Middle East And Africa Single Use Medical Devices Reprocessing Market

Market Size in USD Million

CAGR :

%

USD

123.37 Million

USD

356.14 Million

2025

2033

USD

123.37 Million

USD

356.14 Million

2025

2033

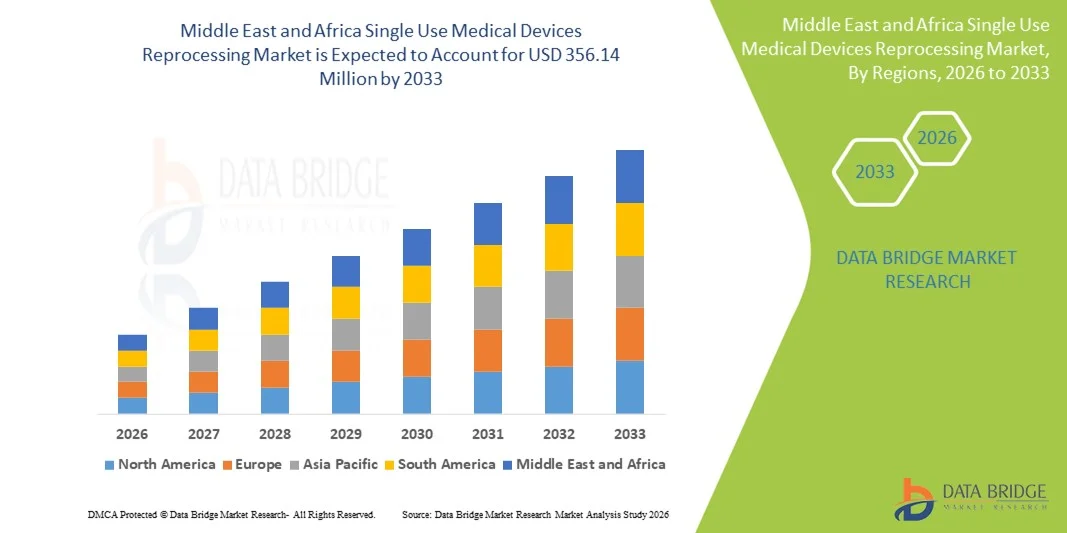

| 2026 –2033 | |

| USD 123.37 Million | |

| USD 356.14 Million | |

|

|

|

|

Middle East and Africa Single Use Medical Devices Reprocessing Market Size

- The Middle East and Africa single use medical devices reprocessing market size was valued at USD 123.37 million in 2025 and is expected to reach USD 356.14 million by 2033, at a CAGR of 14.17% during the forecast period

- The market growth is largely fueled by increasing healthcare cost pressures, rising medical waste concerns, and expanding adoption of reprocessing practices that enable hospitals and surgical centers to reuse selected single‑use devices at lower operational costs while reducing environmental impact

- Furthermore, growing chronic disease burden, rising surgical volumes, and supportive regulatory and waste reduction frameworks across Middle Eastern and African countries are enhancing demand for single use medical device reprocessing as a cost‑effective and sustainable solution in both public and private healthcare settings

Middle East and Africa Single Use Medical Devices Reprocessing Market Analysis

- Single use medical devices reprocessing, which involves the cleaning, sterilization, and safe reuse of selected disposable medical devices, is increasingly becoming a critical practice in healthcare facilities across the Middle East and Africa, enabling hospitals and surgical centers to optimize costs while promoting sustainable medical waste management

- The growing adoption of reprocessing is primarily driven by rising healthcare expenditure pressures, increasing surgical volumes, and the need to reduce medical waste, along with hospitals’ interest in cost-effective and environmentally responsible solutions for single-use device utilization

- Egypt dominated the MEA market with the largest revenue share of 28.4% in 2025, supported by established hospital infrastructure, government initiatives promoting cost reduction, and early adoption of reprocessing protocols, particularly in surgical and cardiac care units, where high-cost single-use devices are frequently employed

- United Arab Emirates (UAE) is expected to be the fastest growing country in the market during the forecast period due to increasing healthcare investments, expanding private hospital networks, and growing awareness about sustainable medical practices

- Cardiology segment dominated the market segment in 2025, with a significant share of 35.7%, driven by the high costs of single-use devices, established safety protocols for reprocessing, and increasing hospital adoption of reprocessed devices for select procedures

Report Scope and Middle East and Africa Single Use Medical Devices Reprocessing Market Segmentation

|

Attributes |

Middle East and Africa Single Use Medical Devices Reprocessing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Single Use Medical Devices Reprocessing Market Trends

Advancements in Sterilization Technologies and Automated Reprocessing Systems

- A significant and accelerating trend in the MEA single use medical devices reprocessing market is the integration of advanced sterilization technologies and automated reprocessing systems, which enhance efficiency, safety, and compliance with international medical standards

- For instance, hospitals in Egypt are adopting automated washer-disinfectors and plasma sterilization systems to reduce manual handling, improve device turnaround time, and maintain sterility for reprocessed surgical instruments

- Technological progress allows reprocessing units to track device usage cycles, perform automated quality checks, and maintain detailed sterilization logs, thereby minimizing human error and ensuring patient safety

- Integration with hospital inventory and management systems facilitates centralized monitoring of device usage and reprocessing, improving operational efficiency and reducing costs associated with device wastage

- This trend towards smarter, automated, and more reliable reprocessing systems is redefining hospital expectations for device safety and operational efficiency. Consequently, companies such as Medline and Stryker are developing reprocessing solutions with automated monitoring and compliance reporting

- The demand for technologically advanced and efficient reprocessing systems is growing rapidly across both private and public healthcare sectors, as facilities increasingly prioritize patient safety and operational cost optimization

- In addition, mobile and IoT-enabled monitoring of reprocessing units is emerging, enabling remote supervision of device sterilization cycles and automated alerts for deviations, improving process reliability

- Hospitals are also exploring AI-driven predictive maintenance for reprocessing equipment to reduce downtime and ensure uninterrupted surgical workflows, supporting both safety and operational efficiency

Middle East and Africa Single Use Medical Devices Reprocessing Market Dynamics

Driver

Rising Need Due to Increasing Surgical Volumes and Cost Pressures

- The increasing number of surgical procedures and rising cost pressures in healthcare facilities are significant drivers for the heightened adoption of single use medical device reprocessing

- For instance, in 2025, El-Sewedy Hospitals in Egypt implemented a reprocessing program for high-cost surgical devices, achieving substantial cost savings while maintaining safety standards

- As hospitals face growing patient loads and limited budgets, reprocessing allows multiple safe uses of expensive single-use devices, offering both economic and environmental benefits

- Furthermore, increasing awareness about medical waste management and sustainable healthcare practices is encouraging facilities to adopt reprocessing as part of their operational strategy

- The cost-effectiveness of reprocessed devices, combined with the ability to comply with safety standards and reduce waste, is driving adoption in both large public hospitals and private surgical centers

- The trend towards standardized protocols, along with staff training and awareness campaigns, further accelerates the uptake of reprocessing practices in MEA healthcare facilities

- In addition, international partnerships and knowledge-sharing initiatives with global medical device manufacturers are helping local hospitals adopt best practices in reprocessing, improving both efficiency and safety

- Expansion of private hospital networks in countries such as UAE and Saudi Arabia is also boosting demand, as reprocessing helps these facilities manage costs while maintaining high-quality care

Restraint/Challenge

Regulatory Compliance Hurdles and Perceived Safety Concerns

- Concerns regarding regulatory compliance and perceived safety risks of reprocessed devices pose significant challenges to broader market adoption

- For instance, hospitals in Saudi Arabia have reported delays in implementing reprocessing programs due to complex approval requirements and strict adherence to regional medical device regulations

- Addressing these compliance challenges requires rigorous validation, quality assurance protocols, and alignment with international reprocessing guidelines to ensure patient safety

- Moreover, skepticism among some healthcare professionals about the safety and efficacy of reprocessed devices can hinder adoption, particularly in facilities unfamiliar with standardized reprocessing methods

- High initial costs for advanced reprocessing equipment and staff training programs can also act as barriers, especially for smaller hospitals with limited budgets

- Overcoming these challenges through regulatory alignment, robust safety protocols, and awareness campaigns will be essential for sustained growth of the reprocessing market in the MEA region

- In addition, inconsistent regulations across countries in the MEA region complicate cross-border adoption of reprocessing practices and slow market expansion

- Limited availability of skilled technicians to operate advanced reprocessing systems can also restrain growth, requiring investment in workforce training and certification programs

Middle East and Africa Single Use Medical Devices Reprocessing Market Scope

The market is segmented on the basis of product type, price range, application, type, end user, and distribution channel.

- By Product Type

On the basis of product type, the MEA market is segmented into Class I Devices and Class II Devices. The Class II Devices segment dominated the market with the largest revenue share of 57.3% in 2025, driven by the higher reprocessing frequency of devices such as surgical instruments, catheters, and high-cost cardiovascular devices. Hospitals often prioritize Class II device reprocessing due to the significant cost savings achieved through multiple safe reuse cycles. Regulatory guidelines and safety protocols for Class II devices are well established, making them more widely accepted for reprocessing. The segment also benefits from the availability of advanced sterilization technologies compatible with Class II devices. Increasing awareness of environmental sustainability further supports demand for Class II reprocessing. Facilities in countries such as Egypt, UAE, and South Africa are actively implementing Class II reprocessing programs in surgical and cardiology departments.

The Class I Devices segment is anticipated to witness the fastest growth, at a CAGR of 18.2% from 2026 to 2033, due to the expanding adoption of low- to mid-cost disposable devices such as basic surgical tools and diagnostic probes in ambulatory surgical centers. Class I devices are easier to reprocess and require less complex sterilization protocols, making them suitable for smaller hospitals and outpatient centers. Rising surgical volumes and cost containment strategies are driving hospitals to incorporate Class I reprocessing programs. The simplicity of Class I device design also allows for faster turnaround and lower labor requirements, further accelerating adoption. The growing penetration of private healthcare facilities in the UAE and Saudi Arabia contributes to faster uptake in this segment.

- By Price Range

On the basis of price range, the market is segmented into high range and low/economy range devices. The High Range segment dominated the market with a revenue share of 61% in 2025, primarily due to the high costs of advanced surgical instruments and cardiology devices that incentivize hospitals to implement reprocessing practices. High-range devices require precise sterilization and compliance with international safety standards, which large hospitals in Egypt, South Africa, and UAE are equipped to handle. Adoption is driven by both economic benefits and regulatory acceptance, as safe reuse reduces operational expenditure while maintaining patient safety. Hospitals often prioritize high-range devices for reprocessing to maximize return on investment. Technological advancements in sterilization equipment also support efficient reprocessing of high-cost devices. Reprocessed high-range devices are increasingly integrated into routine surgical workflows, ensuring consistent availability and cost savings.

The Low/Economy Range segment is expected to witness the fastest growth at a CAGR of 19% from 2026 to 2033, fueled by adoption in smaller hospitals, ambulatory centers, and clinics. Cost-conscious facilities prefer reprocessing economy-range devices to manage budgets effectively. The simple design and lower risk of contamination allow for easier implementation of standardized protocols. Expansion of private healthcare in GCC countries further supports growth in this segment. Reprocessing low-cost devices reduces medical waste, aligning with sustainability initiatives. The segment benefits from training programs and automated reprocessing units that make safe reuse feasible for smaller facilities.

- By Application

On the basis of application, the market is segmented into general surgery, anesthesia, arthroscopy and orthopaedic surgery, cardiology, gastroenterology, urology, gynaecology, and others. The Cardiology segment dominated the market with a market share of 35.7% in 2025, due to the high cost and frequent use of cardiovascular catheters, guidewires, and diagnostic devices in hospitals across the UAE, Egypt, and South Africa. Hospitals prioritize reprocessing of cardiology devices to manage operational costs while maintaining high-quality care. Strict regulatory protocols and advanced sterilization methods ensure safety and compliance, supporting adoption. Cardiovascular procedures are high-volume in major MEA countries, increasing demand for safe, reprocessed devices. Technological support from reprocessing equipment manufacturers ensures quality assurance. Cost efficiency, combined with environmental sustainability, further strengthens the segment’s dominance.

The General Surgery segment is expected to witness the fastest growth with a CAGR of 20.1% from 2026 to 2033, driven by rising surgical procedures in private and public hospitals. Simple surgical instruments, scissors, and clamps are commonly reprocessed, providing substantial cost savings for hospitals in Egypt, Saudi Arabia, and UAE. Increasing investments in healthcare infrastructure and adoption of automated reprocessing units accelerate the segment’s growth. Hospitals and ambulatory centers are standardizing reprocessing protocols to ensure safety and compliance. The segment benefits from increasing awareness about medical waste reduction and environmental sustainability.

- By Type

On the basis of type, the market is segmented into In-House and Outsource reprocessing. The In-House segment dominated the market with a revenue share of 54.5% in 2025, driven by hospitals’ preference for maintaining control over safety, quality, and turnaround times. Large hospitals in UAE, Egypt, and South Africa invest in automated reprocessing units and staff training to ensure consistent quality. Direct oversight of sterilization and quality control reduces operational risks and ensures compliance with regulatory standards. Hospitals also benefit from reduced dependency on third-party providers and faster response to urgent surgical requirements. In-house reprocessing allows customization of workflows to hospital-specific procedures. Increasing capital investment in reprocessing infrastructure supports the continued dominance of this segment.

The Outsource segment is expected to witness the fastest growth at a CAGR of 21% from 2026 to 2033, fueled by smaller hospitals and ambulatory surgical centers outsourcing reprocessing to specialized service providers. Outsourcing allows facilities to reduce upfront investment and leverage specialized expertise for safe device reuse. Growth is particularly strong in Saudi Arabia and UAE, where third-party reprocessing providers are expanding services. Standardized protocols and certifications provided by outsourcing companies increase trust in reprocessed devices. The segment benefits from rising regulatory approvals and cost efficiency. Expansion of outsourcing networks in urban areas further accelerates adoption.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers (ASCs), and others. The Hospitals segment dominated the market with a revenue share of 68% in 2025, due to the large volume of surgeries and high-cost device utilization in tertiary care hospitals. Hospitals in Egypt, UAE, and South Africa implement structured reprocessing programs to achieve cost efficiency and comply with safety regulations. In-house reprocessing units, automated sterilization systems, and trained staff support high-volume operations. The need to reduce operational costs while maintaining high-quality care drives adoption. Hospitals benefit from predictable supply chains for reprocessed devices. Awareness about environmental sustainability also reinforces dominance.

The Ambulatory Surgical Centers segment is expected to witness the fastest growth at a CAGR of 22% from 2026 to 2033, driven by the expansion of private outpatient surgery centers in GCC countries. ASCs prefer reprocessing to manage costs for smaller-scale surgeries without compromising safety. Adoption of automated and outsourced reprocessing solutions makes implementation feasible. Cost efficiency, operational convenience, and regulatory compliance accelerate growth. Increasing surgical volumes and investment in private healthcare infrastructure further support adoption. Patient safety and standardization of protocols are emphasized to gain trust in reprocessed devices.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into B2B and B2C. The B2B segment dominated the market with a revenue share of 75% in 2025, as hospitals, ASCs, and other healthcare facilities procure reprocessing services and equipment directly from manufacturers and certified providers. B2B channels ensure compliance with safety standards, provide bulk solutions, and allow long-term service contracts. Major hospitals in UAE, Egypt, and South Africa rely on B2B distribution for consistent supply of reprocessing units and consumables. Technological support and maintenance services offered through B2B agreements ensure uninterrupted operations. The segment benefits from established vendor relationships and volume-based cost savings.

The B2C segment is expected to witness the fastest growth at a CAGR of 19% from 2026 to 2033, driven by smaller clinics and individual practitioners purchasing low-cost or portable reprocessing equipment directly. B2C adoption is rising in urban areas of GCC countries, where private practitioners increasingly invest in safe, reusable devices. The simplicity of small-scale reprocessing systems and affordability accelerate adoption. Online and direct-sales platforms enhance accessibility for end-users. Training and support provided by manufacturers increase confidence in device safety. Growth is also supported by awareness campaigns on medical waste reduction and sustainability.

Middle East and Africa Single Use Medical Devices Reprocessing Market Regional Analysis

- Egypt dominated the MEA market with the largest revenue share of 28.4% in 2025, supported by established hospital infrastructure, government initiatives promoting cost reduction, and early adoption of reprocessing protocols, particularly in surgical and cardiac care units, where high-cost single-use devices are frequently employed

- Hospitals in Egypt prioritize reprocessing to manage the high costs of surgical and cardiology devices while maintaining patient safety and compliance with international standards. The adoption of automated sterilization systems and trained personnel further enhances operational efficiency

- Widespread awareness of sustainable medical waste management, coupled with increasing private healthcare investments, supports the strong adoption of reprocessing practices in both public and private hospitals

Egypt Single Use Medical Devices Reprocessing Market Insight

The Egypt market captured the largest revenue share of 28.4% in 2025, driven by the high number of tertiary care hospitals, well-established surgical centers, and government initiatives promoting cost-efficient healthcare practices. Hospitals in Egypt are increasingly adopting automated sterilization and in-house reprocessing units to manage high-cost surgical and cardiology devices. Rising awareness of medical waste management and sustainability supports adoption. Furthermore, the integration of reprocessing practices into hospital workflows ensures patient safety and compliance with international standards. Private hospitals and multi-specialty surgical centers are leading the uptake of advanced reprocessing technologies. Increasing surgical volumes and cost pressures are accelerating the implementation of reprocessing programs.

United Arab Emirates (UAE) Single Use Medical Devices Reprocessing Market Insight

The UAE market is projected to grow at the fastest CAGR of 16% during the forecast period, fueled by substantial investments in private healthcare infrastructure and expanding hospital networks. Healthcare facilities in the UAE are increasingly outsourcing or adopting in-house reprocessing solutions to optimize operational costs while maintaining high safety standards. Advanced sterilization equipment and regulatory compliance drive confidence in reprocessed devices. Government support for sustainable medical practices further accelerates adoption. The UAE’s focus on medical tourism and state-of-the-art surgical centers encourages rapid deployment of reprocessing programs. Hospitals in major cities such as Dubai and Abu Dhabi are at the forefront of implementing automated, quality-assured reprocessing workflows.

South Africa Single Use Medical Devices Reprocessing Market Insight

The South Africa market accounted for a significant share in 2025, due to the presence of well-established hospitals and increasing surgical volumes across both public and private sectors. Hospitals prioritize reprocessing high-cost surgical and cardiology devices to reduce operational expenses while complying with safety standards. The availability of skilled personnel and advanced sterilization technologies supports market growth. Private hospital chains are actively implementing both in-house and outsourced reprocessing programs. Growing awareness about environmental sustainability further strengthens adoption. Regulatory frameworks and accreditation programs encourage standardization in device reprocessing practices.

Saudi Arabia Single Use Medical Devices Reprocessing Market Insight

The Saudi Arabia market is expected to witness substantial growth during the forecast period, driven by rising investments in healthcare infrastructure and expansion of private hospitals. Hospitals are increasingly adopting automated sterilization systems and in-house reprocessing protocols for cost management and patient safety. Awareness about medical waste reduction and sustainability is fostering market uptake. The government’s Vision 2030 initiative and healthcare modernization projects provide a supportive environment for reprocessing adoption. Expansion of tertiary care and specialty surgical centers accelerates the use of reprocessed devices. Growing demand for high-quality, cost-effective healthcare solutions further propels market development.

Middle East and Africa Single Use Medical Devices Reprocessing Market Share

The Middle East and Africa Single Use Medical Devices Reprocessing industry is primarily led by well-established companies, including:

- Johnson & Johnson Services, Inc. (U.S.)

- NEScientific, Inc. (U.S.)

- Steris plc (Ireland)

- Stryker (U.S.)

- Medline ReNewal (U.S.)

- Sustainable Technologies (U.S.)

- Innovative Health (U.S.)

- Arjo Group (Sweden)

- Getinge AB (Sweden)

- Medisafe International (U.K.)

- Vanguard AG (Germany)

- SteriPro Canada, Inc. (Canada)

- HYGIA Health Services, Inc. (U.S.)

- SureTek Medical (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- B. Braun SE (Germany)

- Smith & Nephew (U.K.)

- Teleflex Incorporated (U.S.)

- 3M (U.S.)

What are the Recent Developments in Middle East and Africa Single Use Medical Devices Reprocessing Market?

- In November 2025, Egypt’s Strategic Warehouses for Medical Products and Devices signed a memorandum of understanding (MoU) with US‑based EVARA Group to conduct field studies to establish a medical waste transport and treatment company. Although focused on waste management, this initiative supports infrastructure that could enable safer handling and future reprocessing workflows as part of broader healthcare sustainability goals

- In August 2025, SAHPRA published an updated communication on the reprocessing of single‑use medical devices, outlining regulatory expectations and prohibitions for reprocessing and importation of reprocessed devices in South Africa. This step provides clarity and compliance guidance for stakeholders in the region’s largest regulated healthcare market

- In January 2025, the Saudi Investment Recycling Company (SIRC) and global waste specialist SUEZ commenced construction of a hazardous medical waste recycling and treatment plant in Jeddah’s Third Industrial City. The facility will serve healthcare providers across public and private sectors, supporting compliance with environmental and health standards and advancing circular waste solutions

- In December 2024, Egypt’s Ministry of Health and Population and the United Nations Development Programme (UNDP) signed an agreement to build a state‑of‑the‑art hazardous medical waste treatment facility in Suez Governorate. This facility will help process hazardous waste from healthcare settings safely and sustainably, addressing critical gaps in medical waste systems that underpin any future reprocessing initiatives in the region

- In March 2024, the World Bank announced a USD 9.13 million grant via the Global Environment Facility (GEF) to improve healthcare waste management in the Greater Cairo area. This supports safer handling and disposal systems, which are foundational for any future reprocessing or sustainable reuse programs in medical facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.