Middle East And Africa Snack Pellets Market

Market Size in USD Million

CAGR :

%

USD

660.08 Million

USD

1,020.73 Million

2024

2032

USD

660.08 Million

USD

1,020.73 Million

2024

2032

| 2025 –2032 | |

| USD 660.08 Million | |

| USD 1,020.73 Million | |

|

|

|

|

Snack Pellets Market Size

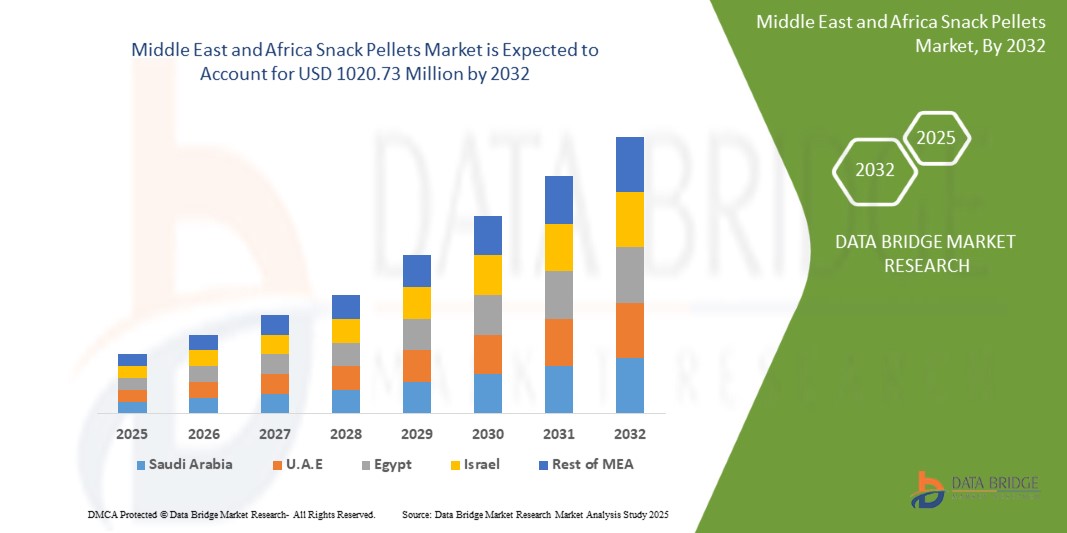

- The Middle East and Africa snack pellets market size was valued at USD 660.08 million in 2024 and is expected to reach USD 1020.73 million by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is largely fueled by increasing consumer demand for convenient, ready-to-eat snacks and evolving dietary preferences toward processed, flavored, and fun-shaped products, particularly among children and young adults. Rapid urbanization, expanding retail infrastructure, and busy lifestyles are contributing to the surging popularity of snack pellets across both developed and emerging markets

- Furthermore, advancements in extrusion and drying technologies are enabling manufacturers to produce diverse snack pellet forms using healthier ingredients such as multigrain, rice, and legumes. These innovations, coupled with rising investments in regional manufacturing and product customization, are significantly boosting the industry's growth

Snack Pellets Market Analysis

- Snack pellets are semi-finished, intermediate snack products that require further processing such as frying or baking before consumption. They come in various shapes, flavors, and ingredient bases, and are widely used by commercial snack producers and household consumers seeking customizable snack options

- The growing demand for snack pellets is driven by rising health consciousness, increased availability of multigrain and non-greasy options, and manufacturers' focus on delivering innovation through unique shapes, textures, and flavors that align with changing consumer preferences

- South Africa dominated the snack pellets market in 2024, due to growing demand for affordable, ready-to-eat snacks and the rapid expansion of the retail sector

- U.A.E. is expected to be the fastest growing region in the snack pellets market during the forecast period due to increasing demand for premium, multigrain, and organic snack options among health-conscious consumers

- Conventional segment dominated the market with a market share of 83.6% in 2024, due to its affordability, wider availability, and established distribution networks. Most consumers in price-sensitive markets still prefer conventionally produced snack pellets

Report Scope and Snack Pellets Market Segmentation

|

Attributes |

Snack Pellets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Snack Pellets Market Trends

Growing Demand for Convenience and Ready-To-Eat Food Products

- The Middle East and Africa snack pellets market is expanding due to rising consumer preference for convenient, ready-to-eat (RTE) snacks that fit busy lifestyles and on-the-go consumption habits

- For instance, companies such as Bach Snacks SAL and Crunchy Food FZE are supplying high-quality snack pellets used by regional manufacturers to produce a variety of savory and fried snacks catering to changing dietary preferences

- Increasing urbanization, rising disposable incomes, and a youthful population in countries such as Saudi Arabia, UAE, and Egypt contribute to higher demand for packaged snacks incorporating snack pellets

- Innovation in snack pellet formulations with multigrain, vegetable-based, and healthier ingredients aligns with the growing health-consciousness among consumers in the Middle East and Africa region

- The surge in foodservice, hospitality, and e-commerce channels supports extensive distribution and accessibility of RTE snack products made from snack pellets

- Manufacturers are leveraging advanced extrusion and processing technologies to develop diverse shapes, textures, and flavors, enhancing product appeal and shelf life

Snack Pellets Market Dynamics

Driver

Increase In Demand for Savory Snacks

- The rising popularity of savory snack products strongly drives demand for snack pellets, as they form the base ingredient for many fried, baked, and flavored snack varieties widely consumed in the Middle East and Africa region

- For instance, regional players such as Societe Cooperative Agricole Limagrain and SOLINO Ltd Corp SaRL have expanded production of corn- and potato-based pellets tailored for popular savory snacks, responding to consumer appetite for bold flavors and varied textures

- Changing dietary habits and increasing snacking occasions—especially among millennials and urban dwellers—fuel growth in savory snack consumption over traditional meals or sweet snacks

- The demand for convenient, portion-controlled savory snacks in retail and foodservice channels continues to rise, boosting production volumes of snack pellets by manufacturers catering to these segments

- Expansion of retail modern trade, supermarkets, and online grocery platforms across Middle East and Africa facilitates greater availability and variety of savory snack products, increasing consumer reach

Restraint/Challenge

Fluctuating Prices of Raw Materials

- Volatility in raw material costs—such as corn, potato, rice, and wheat—poses a significant challenge in the Middle East and Africa snack pellets market, affecting manufacturing costs and pricing stability for snack producers

- For instance, fluctuations in global commodity prices, supply chain disruptions, and climatic factors impacting crop yields have led companies such as GHANEM ALMOUNAJED MD and Quality Pellets AS to face cost pressures and procurement uncertainties

- Sudden increases in raw material prices can constrain margin expansion or force price hikes, potentially limiting demand among price-sensitive consumers in the region

- Dependence on imports for some raw materials exposes manufacturers to foreign exchange risks and supply chain vulnerabilities, especially in countries facing economic instability

- Cost volatility can delay new product launches or capacity expansion plans, as manufacturers seek to manage financial risks and maintain competitive pricing

Snack Pellets Market Scope

The market is segmented on the basis of type, form, shape, ingredients, processing method, nature, technique, brand, flavor, application, and distribution channel.

• By Type

On the basis of type, the snack pellets market is segmented into crackers, chips, puffs, and others. The puffs segment dominated the largest market revenue share in 2024, owing to its high consumer appeal for light, airy textures and its versatility in flavoring. Snack manufacturers often favor puffs due to their broad market acceptance among children and adults alike, as well as their compatibility with healthy ingredients such as multigrain and vegetable blends. Puffs also benefit from ease of packaging and long shelf-life, making them a staple in both retail and vending channels.

The crackers segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by increasing demand for crunchy, baked alternatives to fried snacks. Crackers are gaining traction due to rising health awareness, and the category’s adaptability to incorporate functional ingredients such as seeds, legumes, and whole grains. Their premium positioning and suitability for both savory and sweet flavor profiles contribute to expanding consumer bases across age groups and geographic regions.

• By Form

On the basis of form, the snack pellets market is segmented into laminated, die faced, gelatinized, punched, die distance, tridimensional, and two dimensional. The two-dimensional segment accounted for the largest market share in 2024, owing to its cost-effectiveness in manufacturing and visual familiarity to consumers. These shapes are easy to mass-produce and customize, providing scalability for large snack producers.

The tridimensional form segment is projected to grow at the fastest pace through 2032, driven by growing demand for visually appealing, premium snacks. Consumers are increasingly seeking unique snacking experiences, and 3D pellet designs offer differentiation on retail shelves. These pellets allow manufacturers to experiment with innovative flavors and textures, especially in gourmet and specialty snack lines.

• By Shape

On the basis of shape, the market is segmented into round, oval, ring, triangular, square, star, and others. The ring shape dominated the market in 2024, primarily due to its established popularity across traditional and modern snack formats and its efficient frying behavior, which allows uniform texture and flavor coating.

The star-shaped segment is expected to witness the fastest growth through 2032, fueled by its strong visual appeal to children and its increasing use in themed and branded snack products. Star shapes often feature in kid-focused packaging and marketing campaigns, enhancing product visibility and emotional resonance with young consumers.

• By Ingredients

On the basis of ingredients, the snack pellets market is segmented into potato, corn, rice, tapioca, multigrain, and others. The potato segment held the largest revenue share in 2024, supported by the widespread consumption of potato-based snacks and their ease of flavor absorption and frying.

The multigrain segment is poised to grow at the fastest CAGR from 2025 to 2032, as health-conscious consumers increasingly favor snacks made with diverse grains such as quinoa, millet, and oats. The trend toward functional foods and fiber-rich options is driving innovation in multigrain pellet formulations, making them highly attractive to both manufacturers and consumers.

• By Processing Method

On the basis of processing method, the market is segmented into greasy and non-greasy snack pellets. The greasy segment held the largest share in 2024, driven by its traditional appeal and widespread use in deep-fried snacks. These pellets deliver intense flavor and crunch, which remain popular in mass-market snacks.

The non-greasy segment is expected to grow at the fastest rate, driven by the rising trend of baked and air-popped snacks. Health-conscious consumers are seeking options with lower fat content, and non-greasy pellets cater to this demand while still offering indulgent taste experiences.

• By Nature

On the basis of nature, the market is segmented into organic and conventional. The conventional segment dominated the market with a share of 83.6% in 2024 due to its affordability, wider availability, and established distribution networks. Most consumers in price-sensitive markets still prefer conventionally produced snack pellets.

The organic segment is projected to experience the fastest growth from 2025 to 2032, supported by the rising preference for clean-label products and transparency in sourcing. Increasing organic certification and consumer trust in natural ingredients are enabling the segment’s expansion in premium retail channels.

• By Technique

On the basis of technique, the market is segmented into single-screw extruder and twin-screw extruder. The twin-screw extruder segment captured the highest revenue share in 2024 due to its superior processing flexibility, consistent output quality, and suitability for complex snack pellet formulations.

The single-screw extruder segment is expected to grow fastest, mainly among small- and medium-sized enterprises (SMEs) due to its cost-effectiveness, ease of maintenance, and adequacy for simple product lines. It provides an accessible entry point for regional producers in emerging markets.

• By Brand

On the basis of brand, the market is divided into branded and private label. The branded segment accounted for the highest share in 2024, supported by strong marketing campaigns, trust in established names, and consumer loyalty. Branded snack pellets are often associated with consistent quality and broad flavor variety.

The private label segment is anticipated to register the fastest growth through 2032, as retailers increasingly develop in-house snack pellet lines that offer competitive pricing without compromising on taste or packaging. Consumer acceptance of store brands is rising, especially in North America and Europe.

• By Flavor

On the basis of flavor, the market is segmented into flavored and plain. The flavored segment led the market in 2024, driven by consumer preference for bold, ethnic, and regionally inspired tastes. Flavored snack pellets also support brand differentiation and repeat purchases.

The plain segment is expected to grow rapidly, especially among consumers looking for customizable or lower-sodium options. Plain pellets serve as a base for do-it-yourself flavoring or pairing with dips, aligning with trends in personalization and minimal processing.

• By Application

On the basis of application, the market is segmented into commercial and household. The commercial segment dominated in 2024 due to high-volume purchases by snack manufacturers who use pellets as intermediates in finished snack production. This segment benefits from large-scale contracts and B2B distribution.

The household segment is projected to grow fastest from 2025 to 2032, supported by growing consumer interest in home preparation and customized snacking. Rising availability of snack pellets in retail stores and e-commerce platforms is encouraging at-home experimentation and consumption.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and indirect. The indirect channel dominated the market in 2024, encompassing supermarkets, hypermarkets, convenience stores, and online platforms that offer broad reach and convenience to end users.

The direct channel is expected to witness the fastest growth, particularly in B2B transactions where manufacturers purchase pellets directly from processors. Growth in direct-to-customer (DTC) models and subscription-based services is also contributing to this segment’s momentum.

Snack Pellets Market Regional Analysis

- South Africa dominated the snack pellets market with the largest revenue share in 2024, driven by growing demand for affordable, ready-to-eat snacks and the rapid expansion of the retail sector. The country's increasing urbanization, coupled with shifting dietary preferences toward convenient and processed food options, has made snack pellets a staple in both modern trade and informal retail

- Demand is particularly strong for potato- and corn-based snack pellets in a variety of shapes and flavors, as manufacturers cater to both children and adult consumers seeking indulgent yet low-cost snack alternatives. South Africa’s robust local manufacturing base and growing private label segment continue to drive consistent market supply

- The market is further supported by rising investments in food processing technologies, improved cold chain logistics, and government efforts to boost domestic food production and reduce reliance on imports, thereby enhancing the competitiveness of locally produced snack pellet products

U.A.E. Snack Pellets Market Insight

The U.A.E. is projected to register the fastest CAGR in the Middle East and Africa snack pellets market from 2025 to 2032, fueled by increasing demand for premium, multigrain, and organic snack options among health-conscious consumers. The country’s high per capita income and preference for international snack brands have led to greater innovation in pellet formats and flavor offerings. The growing presence of convenience stores, supermarkets, and e-commerce platforms is also expanding product accessibility and variety across the urban population.

Saudi Arabia Snack Pellets Market Insight

Saudi Arabia is expected to witness steady growth in the snack pellets market between 2025 and 2032, supported by rising consumer expenditure on packaged foods, an expanding youth population, and growing adoption of Western-style snacking habits. National initiatives promoting food manufacturing localization, coupled with the development of new food parks and logistics hubs under Vision 2030, are accelerating domestic pellet production. Strong demand from both commercial processors and household consumers is reinforcing market momentum across major cities and emerging urban centers.

Snack Pellets Market Share

The snack pellets industry is primarily led by well-established companies, including:

- Almounajed (Saudi Arabia)

- Universal Robina Corporation (Philippines)

- The Lorenz Bahlsen Snack-World GmbH & Co KG (Germany)

- BACH SNACKS SAL (Lebanon)

- Crunchy Food FZE (U.A.E.)

- Chhajed Foods (India)

- SOLINO GROUP (Egypt)

- Mahmood Saeed (Saudi Arabia)

- Nasma Food Co. Ltd (Saudi Arabia)

- Al-Tayebat Foodstuff Manufacturing Company (Saudi Arabia)

- JLM Global Foods (U.K.)

- Imbazo Foods (South Africa)

- Al-Qasrawi (Jordan)

- Quality Pellets (Egypt)

- Leng-d'Or (Spain)

Latest Developments in Middle East and Africa Snack Pellets Market

- In March 2024, KP Snacks launched a new Spicy Tomato flavor for its popular Wheat Crunchies line, available in both 70g packs priced at £1.25 and 45g Grab Bags. This strategic product introduction is aimed at tapping into the rising consumer preference for bold and spicy flavor profiles within the savory snacks segment. By diversifying its flavor offerings, KP Snacks is catering to evolving taste trends and also reinforcing its market presence in the competitive pellet-based snacks category. The move is expected to attract new customers, increase shelf visibility, and contribute to sustained revenue growth across retail and convenience channels

- In August 2023, Golden Wonder expanded its value-driven product portfolio by introducing Mega Rings in two variants—Mega Onion Rings and Mega Spicy Rings—within its £1 price-marked pack range. This initiative addresses the growing demand for affordable yet flavorful snacks, particularly in price-sensitive markets. By maintaining a low price point while delivering distinctive taste and large pack sizes, Golden Wonder enhances accessibility for consumers and supports profit margins for retailers. The launch strengthens the brand’s position in the mid-range snack pellets category and reinforces the significance of value-tier offerings in maintaining customer loyalty

- In 2023, Crunchy Food FZE unveiled a new bear-shaped snack pellet made from premium ingredients and featuring a unique, appealing recipe. This product innovation reflects the company’s commitment to differentiation through fun formats and high-quality inputs, targeting both children and health-conscious snackers. The new launch has enabled Crunchy Food FZE to scale its production capacity and capture greater consumer interest, ultimately driving higher revenues. By focusing on creative product design and ingredient quality, the company is reinforcing its brand identity and expanding its footprint in niche snack pellet segments

- In January 2023, Lorenz Bahlsen Snack-World GmbH & Co KG expanded its operational reach into North Africa by establishing a manufacturing facility in Egypt’s Port Said industrial zone. This strategic investment has significantly increased the company’s production capabilities while providing direct access to a growing regional market. The expansion supports supply chain optimization, reduces export-related costs, and enables faster delivery timelines for local consumers. Moreover, it reflects Lorenz Bahlsen’s long-term commitment to regional growth and positions the company competitively in the Middle East and Africa snack pellets market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Snack Pellets Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Snack Pellets Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Snack Pellets Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.