Middle East And Africa Solar And Motorcycle Battery Market

Market Size in USD Million

CAGR :

%

USD

519.56 Million

USD

1,012.68 Million

2024

2032

USD

519.56 Million

USD

1,012.68 Million

2024

2032

| 2025 –2032 | |

| USD 519.56 Million | |

| USD 1,012.68 Million | |

|

|

|

|

Solar and Motorcycle Battery Market Size

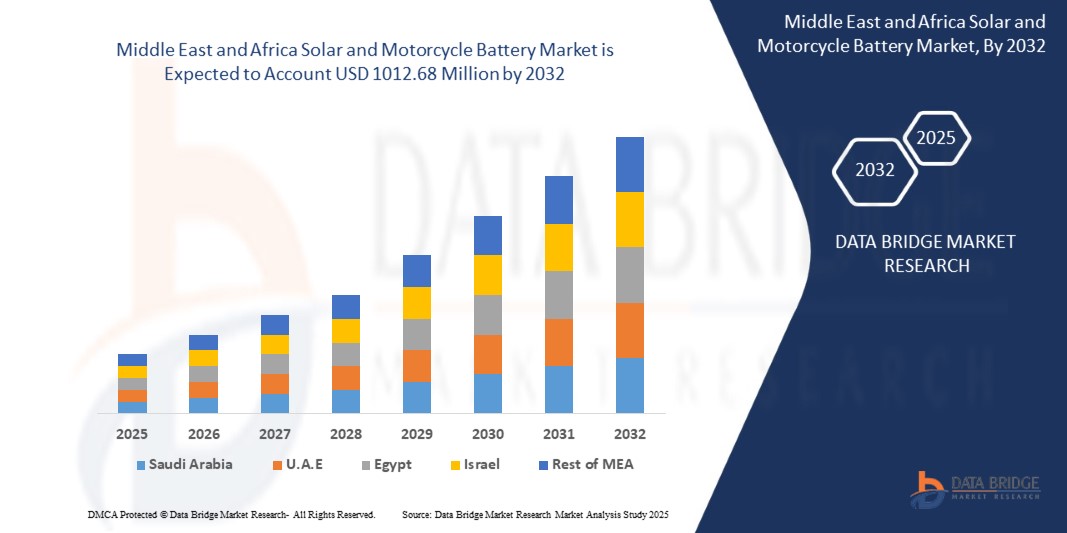

- The Middle East and Africa solar and motorcycle battery market size was valued at USD 519.56 million in 2024 and is expected to reach USD 1012.68 million by 2032, at a CAGR of 8.7% during the forecast period

- The market growth is largely fueled by the rising shift toward clean energy solutions and the integration of solar technology into two-wheeler charging infrastructure, supporting off-grid applications and sustainable transportation, especially in urban and rural areas

- Furthermore, increasing consumer demand for affordable, efficient, and low-emission mobility solutions is driving the adoption of battery-powered motorcycles, while advancements in battery technology and second-life energy storage systems are expanding the viability and performance of both solar and conventional motorcycle batteries, thereby accelerating overall market growth

Solar and Motorcycle Battery Market Analysis

- Solar and motorcycle batteries are essential power sources for electric and hybrid two-wheelers, designed to store and deliver energy for propulsion and auxiliary functions. Solar-powered variants enable off-grid charging and reduce reliance on fossil fuels, while traditional and advanced lithium-ion batteries support a wide range of motorcycles based on capacity and performance requirements

- The market is witnessing strong momentum due to increasing fuel costs, rising urban congestion, and government incentives for electric vehicle adoption. Simultaneously, the development of compact, high-efficiency batteries and solar-charging infrastructure is improving energy accessibility and driving the transition toward sustainable mobility solutions

- U.A.E. dominated the solar and motorcycle battery market in 2024, due to its rising adoption of electric motorcycles, strong governmental focus on clean mobility, and expanding infrastructure for renewable energy integration. The country’s strategic investment in solar-powered transportation and its support for sustainable vehicle technologies have positioned it as a regional leader in green mobility solutions

- South Africa is expected to be the fastest growing region in the solar and motorcycle battery market during the forecast period due to the growing need for cost-effective transportation, increasing urbanization, and rising fuel prices

- Economy segment dominated the market with a market share of 74% in 2024, due to the high penetration of low-cost motorcycles in emerging markets, where affordability and fuel efficiency remain key purchasing factors. Consumers in these regions prioritize functional, cost-effective vehicles for daily commuting, which align with battery systems requiring lower capacity and simpler configurations. The widespread availability of aftermarket batteries and minimal maintenance requirements further support the dominance of this segment

Report Scope and Solar and Motorcycle Battery Market Segmentation

|

Attributes |

Solar and Motorcycle Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Solar and Motorcycle Battery Market Trends

“Increasing Demand for Renewable Energy and Electric Vehicles”

- The Middle East and Africa solar and motorcycle battery market is witnessing significant growth driven by rising demand for renewable energy solutions and increasing adoption of electric motorcycles as eco-friendly, cost-effective transportation alternatives. Solar batteries support the growing deployment of solar power systems by efficiently storing energy for off-grid or backup usage, while motorcycle batteries power a diversified and expanding fleet of electric two-wheelers

- For instance, major companies such as GS Yuasa International Ltd., Exide Technologies, and Amara Raja Batteries Ltd. have captured significant market shares by supplying advanced VRLA and lithium-ion battery technologies suited for solar energy storage and electric motorcycles across MEA. Their investments in the region reflect confidence in the accelerating shift toward sustainable energy and mobility

- Technological improvements in battery energy density, lifespan, and charging speed are enabling market players to meet rising consumer and commercial needs

- Government incentives promoting clean energy and green transport, along with increasing urbanization and concerns about air quality, are resulting in higher acceptance and usage rates

- Expanding charging infrastructure and integration with smart grid projects further entrench battery solutions as key components of Middle East and Africa’s energy and transportation future

Solar and Motorcycle Battery Market Dynamics

Driver

“Rising Solar Energy Adoption”

- Accelerated adoption of solar energy across both residential and commercial sectors in MEA is a primary driver for the solar battery market segment. Solar batteries enable efficient utilization and storage, mitigating reliance on unstable grids and high electricity costs

- For instance, countries such as the U.A.E., Saudi Arabia, and South Africa are leading solar energy installations, supported by government initiatives such as Saudi Vision 2030 and the Dubai Clean Energy Strategy 2050. Major players such as Panasonic and Kokam Company supply advanced battery systems that facilitate grid stability and energy independence

- Increasing investments in off-grid and mini-grid solar projects for underserved or remote areas in Africa expand market potential

- Demand for batteries with higher ampere ranges and greater capacity (exceeding 15 kWh) is growing to support larger installations with extended autonomy

- Integration of battery storage with solar inverter technologies and IoT-based energy management solutions enhances efficiency and operational control, boosting market growth. Rising electricity tariffs and incentives for renewable energy installation also accelerate adoption, encouraging solar battery deployments

Restraint/Challenge

“High Intermittent Energy Production”

- The inherent intermittency and variability of solar energy production pose challenges for consistent energy supply and efficient battery utilization. This intermittency requires larger storage capacities and advanced battery management systems to ensure reliability, impacting costs and system complexity.

- Frequent fluctuations in solar irradiance due to weather conditions across varied MEA geographies require sophisticated integration of solar batteries with grid or backup systems to avoid performance degradation

- For instance, energy storage providers such as Alpha Technologies Inc. and Energy Toolbase work on sophisticated battery control systems to optimize performance despite these fluctuations, but system costs and complexity remain barriers

- The need for frequent and costly battery replacements due to cycling and depth-of-discharge limitations impacts overall system economics

- In regions with underdeveloped grid infrastructure, integrating solar batteries into existing power systems poses technical and financial hurdles

- Addressing intermittency also demands investment in hybrid systems, smart controls, and complementary energy sources, which can slow down adoption pace in price-sensitive markets

Solar and Motorcycle Battery Market Scope

The market is segmented on the basis of motorcycle type, battery type/technology, ampere range, distance covered, vehicle class, battery capacity, and purpose.

• By Motorcycle Type

On the basis of motorcycle type, the market is segmented into standard, cruiser, sports bike, touring, sport touring, dual sport, and off-road. The standard motorcycle segment dominated the largest market revenue share in 2024 due to its widespread usage for daily commuting and affordability. Standard bikes are often favored by urban consumers for their ease of handling, low maintenance requirements, and compatibility with a variety of battery configurations, including solar-enhanced units. Their dominance is further supported by strong sales across emerging economies where two-wheelers remain a primary mode of transport.

The sports bike segment is expected to witness the fastest growth from 2025 to 2032, driven by rising disposable incomes, increased interest in performance riding, and growing youth enthusiasm. These motorcycles require high-powered batteries to meet acceleration and electronic demands, making them a lucrative segment for advanced battery technologies.

• By Battery Type/Technology

On the basis of battery type/technology, the market is segmented into solar power and without solar power. The without solar power segment accounted for the largest market revenue share in 2024, as conventional batteries remain cost-effective and widely adopted in existing vehicle infrastructures. Most motorcycles on the road continue to rely on traditional battery technology due to its mature supply chain and compatibility with older models.

The solar power segment is projected to register the highest growth rate from 2025 to 2032, fueled by the growing emphasis on clean energy solutions and government initiatives promoting green mobility. Solar-powered battery systems are increasingly being adopted in rural and off-grid regions, where access to charging infrastructure is limited. Their ability to harness renewable energy and reduce long-term operational costs is drawing interest from both individual users and fleet operators.

• By Ampere Range

On the basis of ampere range, the market is segmented into less than 2.5 amp and more than 2.5 amp. The less than 2.5 amp segment held the largest revenue share in 2024, driven by its suitability for lightweight and low-powered motorcycles commonly used in urban environments. These batteries offer sufficient performance for short-distance travel while remaining affordable and easy to maintain, making them ideal for cost-sensitive consumers.

The more than 2.5 amp segment is anticipated to experience the fastest CAGR from 2025 to 2032, spurred by the rising demand for high-performance motorcycles and electric models that require greater power output. This category is expected to gain significant traction as manufacturers develop advanced battery systems to support extended range, rapid acceleration, and the integration of auxiliary electronic features.

• By Distance Covered

On the basis of distance covered, the market is segmented into below 75 miles, 75 to 100 miles, and above 100 miles. The below 75 miles segment led the market in 2024 due to its alignment with daily commuting needs, especially in congested urban areas. These batteries are optimized for short-range performance and are popular among users who prioritize affordability and practicality.

The above 100 miles segment is poised for the highest growth during the forecast period, as advancements in battery energy density and efficiency improve the feasibility of long-distance rides. Riders seeking touring or inter-city travel options are increasingly favoring high-capacity batteries capable of supporting extended range on a single charge.

• By Vehicle Class

On the basis of vehicle class, the market is categorized into economy and luxury. The economy segment dominated the market share of 74% in 2024, driven by the high penetration of low-cost motorcycles in emerging markets, where affordability and fuel efficiency remain key purchasing factors. Consumers in these regions prioritize functional, cost-effective vehicles for daily commuting, which align with battery systems requiring lower capacity and simpler configurations. The widespread availability of aftermarket batteries and minimal maintenance requirements further support the dominance of this segment.

The luxury segment is expected to exhibit the fastest growth from 2025 to 2032, driven by the emergence of high-end electric motorcycles that require premium battery systems with enhanced performance, safety, and smart integration. Increasing consumer inclination toward luxury vehicles with cutting-edge features is further propelling this segment.

• By Battery Capacity

On the basis of battery capacity, the market is divided into less than 15 kWh and more than 15 kWh. The less than 15 kWh segment accounted for the largest revenue share in 2024, owing to its dominance in conventional two-wheelers and moderate electric bikes. These batteries are cost-effective, lightweight, and sufficient for most short- to mid-range applications.

The more than 15 kWh segment is projected to record the fastest growth, driven by its relevance to electric sports bikes and long-range motorcycles that demand robust power storage. The proliferation of battery-swapping infrastructure and advances in fast-charging technologies are expected to further support the adoption of this segment.

• By Purpose

On the basis of purpose, the market is segmented into police/military, personal, and other. The personal use segment held the largest market share in 2024, supported by the vast number of individual motorcycle owners using bikes for daily commuting, leisure, and errands. These consumers form the core market for both traditional and solar-integrated battery offerings.

The police/military segment is set to witness the highest growth rate from 2025 to 2032, backed by growing defense modernization programs and increasing deployment of electric motorcycles in patrol operations. Solar-powered and long-range batteries are being adopted to support sustainable mobility initiatives and tactical mobility in remote areas where refueling is challenging.

Solar and Motorcycle Battery Market Regional Analysis

- U.A.E. dominated the solar and motorcycle battery market with the largest revenue share in 2024, driven by its rising adoption of electric motorcycles, strong governmental focus on clean mobility, and expanding infrastructure for renewable energy integration. The country’s strategic investment in solar-powered transportation and its support for sustainable vehicle technologies have positioned it as a regional leader in green mobility solutions

- Demand is particularly strong for high-capacity batteries in premium and electric motorcycles, as well as solar-powered charging systems for two-wheelers used in urban delivery, personal commuting, and government fleets

- The market is further supported by the U.A.E.’s robust transportation ecosystem, favorable regulatory policies, and increasing consumer inclination toward low-emission and tech-enabled two-wheeler options

South Africa Solar and Motorcycle Battery Market Insight

South Africa’s solar and motorcycle battery market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, fueled by the growing need for cost-effective transportation, increasing urbanization, and rising fuel prices. The demand for solar-integrated battery solutions is gaining traction in rural and semi-urban areas where grid access is limited. The market is also supported by the country’s efforts to diversify energy sources, making solar-powered two-wheelers an appealing alternative for last-mile connectivity and delivery applications

Egypt Solar and Motorcycle Battery Market Insight

Egypt is emerging as a promising market for solar and motorcycle batteries, driven by rapid growth in motorcycle usage and government efforts to promote renewable energy. With high solar irradiance and expanding urban centers, there is rising interest in solar-powered battery systems for personal and commercial use. Incentives for clean energy adoption, coupled with increasing awareness of sustainable mobility solutions, are contributing to the market's growth potential through 2032

Solar and Motorcycle Battery Market Share

The solar and motorcycle battery industry is primarily led by well-established companies, including:

- Axitec (U.S.)

- Tesla (U.S.)

- Energy Toolbase (U.S.)

- Kokam Company (South Korea)

- Alpha Technologies Inc. (U.S.)

- Battery Energy Power Solutions Pty (Australia)

- HBL Power Systems Ltd (India)

- East Penn Manufactuting Co Inc. (U.S.)

- System Sunlight SA (Switzerland)

- Panasonic (Japan)

Latest Developments in Middle East and Africa Solar and Motorcycle Battery Market

- In October 2024, Beam Global introduced the BeamBike solar-powered ebike charging station, a move that enhances the solar mobility infrastructure market by providing a scalable, off-grid solution for urban ebike users. With the ability to charge up to 12 ebikes simultaneously, this innovation addresses the growing demand for secure, outdoor ebike charging and parking facilities, thereby promoting wider adoption of sustainable micro-mobility solutions

- In February 2024, MG Motor India and BatX Energies launched an off-grid solar EV charging station powered by repurposed MG EV batteries, marking a significant advancement in second-life battery utilization and decentralized charging infrastructure. This initiative supports the growth of renewable EV charging solutions in India while promoting circular economy practices and extending the life cycle of EV batteries in a sustainable and impactful way

- In June 2021, BS-Battery announced its partnership with French motorcycle manufacturer Sherco. With this partnership, BS-Battery became the official supplier for all motorcycles from Sherco. The duo also signed a three-year contract according to which BS-Battery will support Sherco in its racing events. This partnership reinforced the company’s position as an OEM battery of choice. It also enabled the company to increase its presence in the off-road sector

- In December 2020, ENERSYS teamed up with NAPA AUTO PARTS to offer a premium Absorbed Glass Mat (A.G.M.) ODYSSEY batteries. According to this collaboration, NAPA AUTO PARTS became the approved vendor. This has helped ENERSYS to utilize NAPA AUTO PARTSs' 57 distribution centers and 6,000 stores to increase the sales of their products. This enabled the company to increase the presence of its A.G.M. products in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.