Middle East And Africa Specialty Gas Market

Market Size in USD Billion

CAGR :

%

USD

1.41 Billion

USD

2.08 Billion

2024

2032

USD

1.41 Billion

USD

2.08 Billion

2024

2032

| 2025 –2032 | |

| USD 1.41 Billion | |

| USD 2.08 Billion | |

|

|

|

|

Specialty Gas Market Size

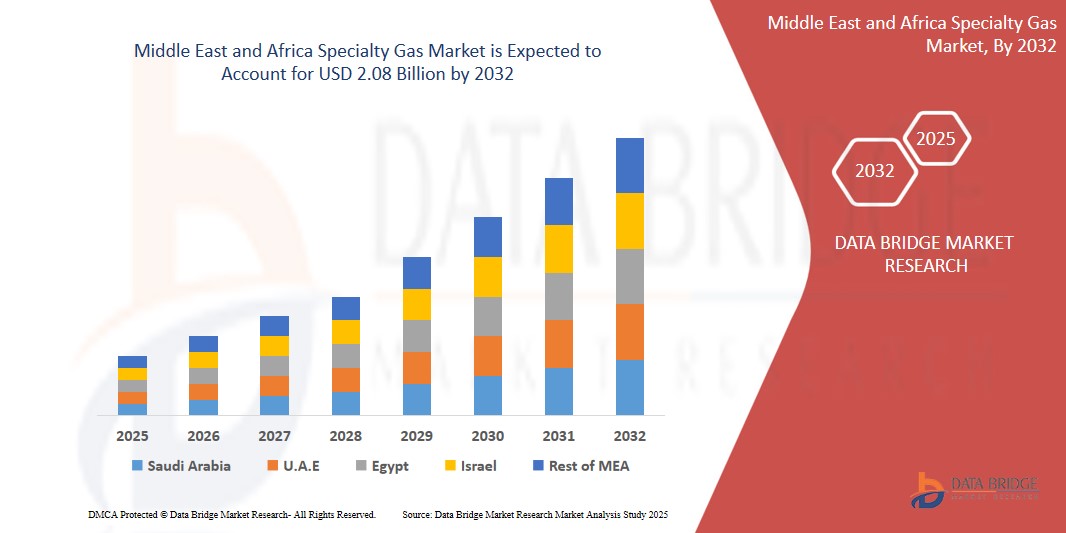

- The Middle East and Africa Specialty Gas market size was valued at USD 1.41 billion in 2024 and is expected to reach USD 2.08 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by rising industrialization across sectors such as oil & gas, healthcare, electronics, and manufacturing, where specialty gases are essential for operations such as calibration, testing, and medical applications

- Furthermore, increased investments in the healthcare sector and technological advancements in electronics manufacturing are expanding the usage scope of high-purity gases, significantly accelerating the uptake of Specialty Gas solutions and driving robust market growth across the region

Specialty Gas Market Analysis

- Specialty Gases, which include high-purity and gas mixtures used for precise applications, are increasingly vital components in industries such as healthcare, electronics, petrochemicals, and manufacturing due to their superior performance, consistency, and regulatory compliance requirements.

- The escalating demand for Specialty Gases is primarily fueled by the rapid industrial growth across the region, rising healthcare investments, and expanding applications in the electronics and energy sectors, particularly for calibration, diagnostics, and controlled manufacturing environments.

- Saudi Arabia dominates the Middle East and Africa Specialty Gas market with the largest revenue share of 40.01% in 2025, driven by significant oil & gas operations, growing industrial base, and strong demand from the healthcare and energy sectors.

- U.A.E. is expected to be the fastest-growing country in the Specialty Gas market during the forecast period due to its increasing investments in medical infrastructure, electronics manufacturing, and renewable energy initiatives.

- The High Purity Gases segment is expected to dominate the Specialty Gas market with a market share of 43.2% in 2025, driven by its critical role in applications requiring ultra-clean processing, especially in semiconductors, laboratories, and medical diagnostics.

Report Scope and Specialty Gas Market Segmentation

|

Attributes |

Specialty Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Specialty Gas Market Trends

“Rising Integration of Specialty Gases in Advanced Manufacturing and Healthcare Applications”

- A significant and accelerating trend in the Middle East and Africa Specialty Gas market is the expanding use of high-purity gases in advanced manufacturing sectors, including electronics, semiconductors, and additive manufacturing (3D printing), due to their critical role in ensuring precise process environments.

- For instance, semiconductor and photovoltaic (solar cell) manufacturing processes increasingly depend on specialty gases like silane, nitrogen trifluoride, and high-purity hydrogen, driving market demand in technologically evolving Gulf economies like the UAE and Saudi Arabia.

- In the healthcare sector, there is a notable surge in demand for specialty medical gases such as nitrous oxide, helium, and medical-grade oxygen due to growing investments in hospitals, diagnostics centers, and pharmaceutical manufacturing.

- Governments across the region are prioritizing local production and storage of medical gases following pandemic-related supply shortages, further supporting market growth.

- Additionally, advancements in gas purification and packaging technologies are enabling safer, more cost-effective distribution of specialty gases, thereby improving regional access and boosting uptake across diverse industries.

- This trend toward high-purity, application-specific gases is shaping procurement preferences and encouraging investments in gas separation and liquefaction plants across the region..

Specialty Gas Market Dynamics

Driver

“Growing Demand from Key End-Use Industries Such as Healthcare, Electronics, and Oil & Gas”

- The Middle East and Africa specialty gas market is witnessing strong momentum driven by the rapid expansion of healthcare infrastructure, the growing footprint of electronics and semiconductor manufacturing, and ongoing oil & gas and petrochemical activities

- For example, Saudi Arabia’s Vision 2030 and UAE’s energy diversification plans are prompting increased investment in industrial gases to support solar panel production, energy storage solutions, and enhanced oil recovery (EOR) techniques that utilize carbon dioxide and other specialty gases.

- Moreover, the rise in analytical and calibration applications across environmental monitoring agencies and research labs has amplified the demand for ultra-high purity gases.

- Industrial players are also increasingly seeking specialty gas solutions that enable compliance with international quality and safety standards, particularly in pharmaceuticals and food processing, which further fuels growth.

Restraint/Challenge

“High Production and Distribution Costs Coupled with Limited Regional Infrastructure”

- The production of specialty gases requires complex, capital-intensive purification and liquefaction processes, often involving sophisticated cryogenic or adsorption technologies. These high operational costs, coupled with the limited number of local manufacturing units in many parts of the Middle East and Africa, restrict scalability and affordability.

- Additionally, challenges in the regional supply chain—including insufficient storage infrastructure, regulatory delays, and the need for specialized handling and transportation—can lead to inconsistent supply and elevated prices.

- Many countries in Africa still rely heavily on imports from Europe or Asia for high-purity gases, which not only increases costs but also creates supply chain vulnerabilities.

- Addressing these issues will require collaborative investment between governments and gas companies to build regional production hubs, improve logistical networks, and encourage technology transfer to boost local capabilities.

Specialty Gas Market Scope

The market is segmented on the basis type, ingredients and application.

- By Type

On the basis of type, the Specialty Gas market is segmented into High Purity Gases, Noble Gases, Carbon Gases, Halogen Gases, Others. The High Purity Gases segment dominates the market with the largest revenue share of 43.2% in 2025, driven by its essential role in critical applications such as semiconductor manufacturing, laboratory research, and medical diagnostics. These gases offer extremely low levels of contaminants, which are crucial in precision-driven industries where even trace impurities can lead to quality issues.

The Noble Gases segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing use of argon, neon, and xenon in medical imaging, lighting, aerospace, and electronics. Rising demand for energy-efficient lighting and high-end electronics further supports this growth.

- By Ingredients

On the basis of Ingredients, the Specialty Gas market is segmented into Argon, Bromine, Nitrogen, Helium, Carbon Monoxide, Xenon, Methane, Krypton, Oxygen, Neon, Hydrogen, Others. Argon held the largest market revenue share in 2025, driven by its extensive use in welding, metal fabrication, and as an inert shielding gas in industrial processes. Its chemical stability makes it ideal for applications where non-reactivity is critical.

Helium is expected to witness the fastest CAGR during the forecast period, owing to its increasing demand in MRI machines, scientific research, cryogenics, and fiber optic manufacturing. With helium shortages becoming a global concern, its strategic importance and value continue to rise in the regional market.

- By Application

On the basis of Application, the Specialty Gas market is segmented into Manufacturing, Electronics, Healthcare, Academics, Analytical & Calibration, Refrigeration, and Others. The Healthcare segment held the largest market revenue share in 2025, attributed to the widespread use of specialty medical gases such as oxygen, nitrous oxide, and helium in anesthesia, respiratory therapy, and medical imaging. The region’s growing investment in hospitals and diagnostic centers has amplified demand.

The Electronics segment is projected to grow at the fastest rate during the forecast period, driven by the emergence of semiconductor and photovoltaic manufacturing in the Gulf region. Specialty gases like silane, nitrogen trifluoride, and high-purity hydrogen are integral to these industries, especially in cleanroom environments.

Specialty Gas Market country Analysis

- Saudi Arabia dominates the Specialty Gas market with the largest revenue share of 40.01% in 2024, driven by surging demand across key industries such as oil & gas, petrochemicals, healthcare, and electronics.

- The country’s industrial development, supported by Vision 2030, has accelerated investment in advanced manufacturing, clean energy, and healthcare infrastructure, all of which are major consumers of specialty gases such as hydrogen, nitrogen, and carbon dioxide.

- High capital spending on megaprojects like NEOM, along with the expansion of refining and gas processing facilities, continues to boost demand for high-purity and calibration gases.

- Saudi Arabia’s favorable regulatory environment, advanced logistics capabilities, and presence of major international gas companies make it a leading hub for specialty gas production and distribution in the region.

U.A.E. Specialty Gas Market Insight

The U.A.E. is expected to be one of the fastest-growing markets in the region, fueled by rapid urbanization, strong industrial diversification, and increasing investments in high-tech and life science sectors. Rising demand from semiconductor, healthcare, and environmental monitoring industries is propelling the use of ultra-high purity gases, calibration gases, and medical-grade gases. Dubai and Abu Dhabi are developing into regional centers for R&D and pharmaceutical manufacturing, increasing the need for reliable specialty gas supply chains. Furthermore, government initiatives promoting clean energy and sustainability (such as the UAE Energy Strategy 2050) are driving the use of specialty gases in renewable energy and green hydrogen projects..

South Africa Specialty Gas Market Insight

South Africa is projected to experience steady growth in the specialty gas market due to its established industrial base, ongoing infrastructure projects, and growing demand in the healthcare and mining sectors. Specialty gases such as oxygen, argon, and carbon dioxide are extensively used in welding, metallurgy, and environmental testing. The expansion of private and public healthcare services, particularly post-pandemic, has also led to increased consumption of medical-grade gases like nitrous oxide and oxygen. Additionally, the development of local specialty gas production capabilities and partnerships with global suppliers are helping to stabilize supply and reduce reliance on imports, making South Africa a growing market for these critical materials.

Specialty Gas Market Share

The Specialty Gas industry is primarily led by well-established companies, including:

- The Linde Group (Germany)

- Air Liquide (France)

- Southern Industrial Gas Sdn Bhd (Malaysia)

- Air Products and Chemicals Inc. (U.S.)

- Praxair Technology, Inc. (U.S.) (Now part of Linde plc)

- Showa Denko K.K. (Japan) (Now part of Resonac Holdings Corporation)

- Messer Group GmbH (Germany)

- Mitsui Chemicals Inc. (Japan)

- TAIYO NIPPON SANSO CORPORATION (Japan)

Latest Developments in Middle East and Africa Specialty Gas Market

- In February 2024, Israel reported a 25% increase in natural gas exports to Egypt and Jordan in 2023, totaling 11.56 billion cubic meters. This growth underscores Israel's role as a regional energy hub, with significant contributions from the Leviathan and Tamar fields operated by Chevron

- In November 2023, Tanzania and Uganda signed agreements to initiate the Tanzania–Uganda Natural Gas Pipeline project. This collaboration aims to transport natural gas from Tanzania to Uganda, supporting industrial applications such as steel manufacturing, electricity generation, and domestic use.

- In March 2023, Sonatrach, Algeria's state-owned energy company, announced plans to increase annual output to 200 million tonnes of oil equivalent, a level not achieved since 2010. The company also plans to sign new agreements with Eni, including electrical supply, and is exploring the development of a new pipeline to transport hydrogen.

- In April 2023, QatarEnergy expanded its North Field East LNG project by partnering with Sinopec, which acquired a 5% stake in an 8 million tonnes per year LNG train. This expansion is part of Qatar's strategy to increase LNG production capacity to 126 million tonnes per year by 2027.

- In December 2023, Taifa Gas Investment SEZ Limited commenced the construction of a 30,000-metric-ton liquefied petroleum gas (LPG) storage facility in Mombasa, Kenya. This USD 130 million investment aims to reduce East Africa's reliance on imported LPG and provide a stable, cost-effective supply for households

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Specialty Gas Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Specialty Gas Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Specialty Gas Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.