Middle East And Africa Surface Analysis Market

Market Size in USD Million

CAGR :

%

USD

266.45 Million

USD

402.90 Million

2024

2032

USD

266.45 Million

USD

402.90 Million

2024

2032

| 2025 –2032 | |

| USD 266.45 Million | |

| USD 402.90 Million | |

|

|

|

|

Surface Analysis Market Analysis

The Middle East and Africa surface analysis market is experiencing significant growth, driven by increasing demand for precise material characterization across industries such as semiconductors, pharmaceuticals, and aerospace. This market includes advanced techniques such as X-ray photoelectron spectroscopy (XPS), atomic force microscopy (AFM), and secondary ion mass spectrometry (SIMS), which enable detailed surface composition and structural analysis. Technological advancements, including AI-driven data interpretation, hybrid analysis techniques, and automation, are enhancing accuracy and efficiency. The market is further propelled by rising investments in R&D, expanding applications in nanotechnology, and growing regulatory requirements for material quality and safety.

Surface Analysis Market Size

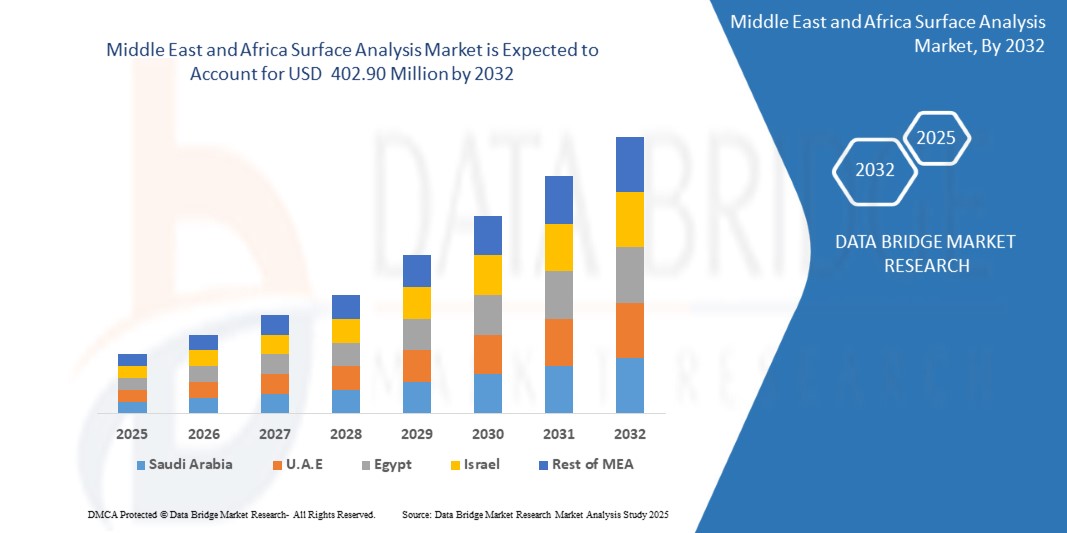

Middle East and Africa surface analysis market size was valued at USD 266.45 million in 2024 and is projected to reach USD 402.90 million by 2032, with a CAGR of 5.4% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Surface Analysis Market Trends

“Rising Demand for High-Precision Material Characterization”

The increasing need for high-precision material characterization is driving advancements in the surface analysis market. Industries such as semiconductors, pharmaceuticals, and aerospace are demanding more accurate and reliable surface assessment techniques to ensure product quality and performance. Innovations in spectroscopy, microscopy, and mass spectrometry are enhancing analytical capabilities, enabling real-time, in-depth surface evaluations. In addition, automation and AI-driven data processing are improving efficiency, reducing errors, and accelerating research and development processes. As regulatory standards for material integrity and safety tighten, the adoption of advanced surface analysis technologies is expected to grow, reinforcing their critical role across various high-tech sectors.

Report Scope and Surface Analysis Market Segmentation

|

Attributes |

Surface Analysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E, Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

SERMA GROUP (France), Shimadzu Corporation (Japan), Eurofins Scientific (Luxembourg), Thermo Fisher Scientific Inc (U.S.), S A I Ltd (U.K.), SPECS GmbH (Germany), Physical Electronics, Inc. (PHI) (U.S.), Staib Instruments (Germany), Hiden Analytical (U.K.), Bruker (U.S.), HORIBA Group (Japan), JEOL Ltd (Japan), Carl Zeiss AG (Germany), TESCAN GROUP, a.s. (Czech Republic), TSI (U.S.), and Nikon Instruments Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Surface Analysis Market Definition

Surface analysis is the study of a material’s outermost layer to determine its composition, structure, roughness, and chemical properties. It involves advanced techniques such as X-ray photoelectron spectroscopy (XPS), atomic force microscopy (AFM), and secondary ion mass spectrometry (SIMS) to analyze surfaces at microscopic and atomic levels. Surface analysis is essential in industries like semiconductors, pharmaceuticals, aerospace, and nanotechnology, where material properties significantly impact performance and reliability. By providing detailed insights into surface characteristics, this analysis helps improve product quality, optimize manufacturing processes, and ensure compliance with regulatory standards.

Surface Analysis Market Dynamics

Drivers

- Increase in the R&D Expenditure in Medical and Pharmaceutical Companies

As these industries focus on developing innovative drugs and medical devices, precise surface characterization is essential for ensuring product quality and regulatory compliance. This surge in R&D spending accelerates innovation in surface analysis, broadening its application in critical healthcare sectors. Moreover, increased funding has led to the development of state-of-the-art analytical instruments that offer higher resolution and sensitivity. These advancements enable companies to meet stringent regulatory standards while fostering breakthrough research in product development.

For instance,

- In April 2024, according to the article published by Deloitte, Middle East and Africa pharmaceutical companies increased their return on R&D investment to 4.1% in 2023, recovering from a record low. The top 20 pharma companies spent USD 145 billion on R&D, driven by complex trials and regulatory changes. This boost in innovation led to higher investments in quality control and process optimization. As a result, advanced analytical techniques, including surface analysis, gained importance for ensuring drug safety and performance, helping grow the surface analysis market

Growing Utilization of Surface Analysis Methods

The integration of surface analysis methods optimizes manufacturing processes by accurately detecting surface defects and ensuring consistency. This widespread use highlights the versatility of surface analysis tools and drives their market growth across diverse industrial applications. In addition, technological improvements have reduced operational costs, making these techniques more accessible to a broader range of industries. The continual evolution of user-friendly software further enhances data interpretation and process control, boosting overall efficiency

For instance,

In March 2025, according to the article published by Elsevier Inc., researchers used AI-enhanced X-ray microscopy to non-destructively detect and quantify crystalline miconazole in amorphous solid dispersions. They combined advanced imaging with AI-assisted segmentation to obtain detailed particle size distributions and reduce human error. This technology improved quality control in drug manufacturing and demonstrated a clear benefit for precise surface analysis, which is expected to drive growth in the Middle East and Africa surface analysis market.

Opportunities

- Emerging Nanotechnology Offers Breakthrough Techniques in Analysis

Emerging nanotechnology drives innovation by enabling analysis at the atomic and molecular levels, providing unprecedented resolution and accuracy. This advancement allows for the detection and characterization of minute surface features that were previously inaccessible with conventional methods. As these nanotech-based techniques continue to evolve, they unlock new possibilities for material science and quality control, fueling the growth of surface analysis applications across various industries.

For Instance: -

- In June 2024, according to article published by, Springer Nature Limited, researchers used advanced environmental scanning electron microscopy (A-ESEM) to reveal the natural nano-morphology of condensed mitotic chromosomes. They applied machine learning to optimize conditions, allowing high-resolution imaging of sensitive, wet samples without damage. This breakthrough enabled the discovery of previously unobserved structural details on chromosome surfaces. The study demonstrated that nanotechnology offers significant opportunities to advance the surface analysis market

Strategic Partnerships and Mergers Accelerate Market Expansion

Strategic partnerships and mergers combine complementary expertise and resources, creating synergistic benefits that drive market growth. These collaborations streamline the development and deployment of advanced surface analysis technologies by leveraging shared technologies, customer networks, and market insights. As a result, companies can reduce time-to-market, expand their Middle East and Africa footprint, and address evolving industry challenges more effectively, ultimately accelerating the overall expansion of the surface analysis market.

For instance,

In February 2025, according to article published by Cision US Inc., Nanovis announced that Medtronic acquired certain nano surface technology assets, including intellectual property related to OsteoSync titanium pads, for use in its next-generation PEEK interbody fusion devices. The FDA-cleared nanotechnology improved osseointegration, enhancing implant fixation in spine surgery. This strategic acquisition underscored how partnerships and mergers accelerate market expansion in surface analysis by integrating advanced nano-scale innovations with leading medical device designs. The collaboration promised to deliver best-in-class devices to surgeons, further driving innovation and market growth in the medical implant sector.

Restraints/Challenges

- Sensitivity to Surface Contaminants Affecting Accuracy

Techniques such as X-ray Photoelectron Spectroscopy (XPS), Auger Electron Spectroscopy (AES), and Time-of-Flight Secondary Ion Mass Spectrometry (ToF-SIMS) are highly surface-sensitive, meaning contamination from the environment, handling, or sample preparation can introduce errors. This challenge is particularly critical in industries like semiconductors, pharmaceuticals, and advanced materials, where precise surface composition analysis is essential for quality control and regulatory compliance. Addressing these issues requires stringent sample handling protocols, controlled environments, and advanced cleaning techniques to minimize unwanted surface alterations.

Furthermore, the growing demand for high-resolution and quantitative surface analysis in nanotechnology and biomaterials research amplifies the need for improved contamination control measures. Innovative solutions such as ultra-high vacuum (UHV) conditions, in situ cleaning techniques like ion sputtering, and advanced data correction algorithms are being explored to mitigate the impact of contaminants. However, these approaches can add complexity and cost to the analysis process, posing challenges for widespread adoption, particularly for smaller research labs and emerging industries. As surface analysis technologies evolve, advancements in automation, real-time contamination detection, and machine learning-driven correction techniques will be key to enhancing accuracy and reliability in diverse applications.

For instance

According to XPS Metrology, surface contamination impacts material properties, coatings, and adhesion, often leading to corrosion and degradation. Contaminants like oils, salts, and atmospheric pollutants distort surface analysis results, especially in XPS, where even nanometer-thick layers affect accuracy. Handling practices, gloves, and cleaning sprays further compromise measurement reliability in industries like aerospace and semiconductor manufacturing.

- Limited Skilled Workforce for Advanced Surface Analysis Techniques

Techniques like XPS, SIMS, and AFM require specialized knowledge in instrumentation, data interpretation, and sample preparation, which are essential for obtaining precise and reliable results. The shortage of trained professionals can lead to inefficiencies, inconsistent data quality, and prolonged analysis times, ultimately impacting research, quality control, and industrial applications reliant on surface characterization.

For instance:

In January 2020, according to the National Library of Medicine, X-ray photoelectron spectroscopy (XPS) has become the most widely used surface analysis technique, but its rapid adoption has led to frequent misapplications due to a shortage of skilled professionals. Many inexperienced users struggle with accurate measurements and data interpretation, resulting in errors and inconsistencies. Variations in instrument calibration further complicate the process, making the lack of trained specialists a key challenge for the surface analysis market, affecting result reliability and reproducibility

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Surface Analysis Market Scope

The Middle East and Africa Surface Analysis Market is segmented into five notable segments based on the offering, deployment model, organization size, operating system and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Microscopy

- By Method

- Electron Microscopy

- Optical Microscopy

- Confocal Microscopy

- Probe Microscopy

- By Technique

- Scanning Electron Microscopy (Sem)

- Transmission Electron Microscopy (Tem)

- Scanning Probe Microscopy (Spm)

- Image Analysis

- Cryo-Electron Microscopy (Cryo-Em)

- Others

- By Method

- Spectroscopy

- X-Ray Diffraction (Xrd)

- Surface Analyzers

Type

- Xps (X-Ray Photoelectron Spectroscopy)

- Tof-Sims (Time-Of-Flight Secondary Ion Mass Spectrometry)

- Aes (Auger Electron Spectroscopy)

- Raman (Raman Spectroscopy)

- Ups (Uv Photoelectron Spectroscopy)

- Iss (Ion Scattering Spectroscopy)

- Others

Method Type

- Spectroscopic Method

- Microscopic Method

- Classical Method

Equipment Type

- Scanning Probe Microscopes (Spm)/Atomic Force Microscopes (Afm)

- By Operation

- Automatic

- Manual

- By Noise Level

- Low

- Extremely Low

- Standard

- By Operation

- Electron Probe Micro-Analyzers (Epma)

- X-Ray Photoelectron Spectrometers (Xps)/Electron Spectroscopy For Chemical Analysis (Esca)

- Others

Application

- Material Composition

- Surface Roughness And Topography

- Thin Film Analysis

- Surface Contamination

- Failure Analysis

- Corrosion Analysis

- Surface Modification

End User

- Industries

- By Type

- Semiconductor

- Life Sciences & Pharmaceuticals

- Polymers

- Energy

- Metallurgy And Minerals

- Automotive

- Food And Beverages

- Textile

- Paper And Packaging

- Others

- By Technology

- Microscopy

- Spectroscopy

- X-Ray Diffraction (Xrd)

- Surface Analyzers

- By Type

- Research Organization

- Microscopy

- Spectroscopy

- X-Ray Diffraction (Xrd)

- Surface Analyzers

- Academic Institutes

- Microscopy

- Spectroscopy

- X-Ray Diffraction (XRD)

- Surface Analyzers

Surface Analysis Market Regional Analysis

The market is analyzed and market size insights and trends are provided by technology, type, method type, equipment type, application and end user.

The countries covered in the market are U.A.E, Saudi Arabia, South Africa, Egypt, Israel, and rest of Middle East and Africa.

Saudi Arabia is the fastest dominating and fastest-growing country in the Middle East & Africa for the surface analysis market due to rapid industrialization, strong government support, and increasing R&D investments. The country’s growth is driven by expanding applications in healthcare, energy, and materials science sectors. In addition, Vision 2030 initiatives and rising demand for advanced analytical technologies fuel market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of South America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Surface Analysis Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, South America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Surface Analysis Market Leaders Operating in the Market Are:

- SERMA GROUP (France)

- Shimadzu Corporation (Japan)

- Eurofins Scientific (Luxembourg)

- Thermo Fisher Scientific Inc (U.S.)

- S A I Ltd (U.K.)

- SPECS GmbH (Germany)

- Physical Electronics, Inc. (PHI) (U.S.)

- Staib Instruments (Germany)

- Hiden Analytical (U.K.)

- Bruker (U.S.)

- HORIBA Group (Japan)

- JEOL Ltd (Japan)

- Carl Zeiss AG (Germany)

- TESCAN GROUP, a.s. (Czech Republic)

- TSI (U.S.)

- Nikon Instruments Inc. (U.S.)

Latest Developments in Middle East and Africa Surface Analysis Market

- In January 2025, Eurofins Environment Testing Eaton Analytical has developed a cutting-edge method to detect chloronitramide anion, a newly discovered disinfection byproduct in drinking water, improving water quality analysis and safety. This advancement enhances Eurofins Scientific’s expertise in surface and chemical analysis by refining its ability to identify and evaluate contaminants, further solidifying its leadership in analytical testing for water and environmental safety

- In July 2022, ULVAC-PHI has launched the PHI GENESIS, a fully automated XPS/HAXPES system designed for high-speed, high-sensitivity surface and interface analysis. This advancement strengthens Physical Electronics, Inc.'s position by enhancing automation, sensitivity, and analytical capabilities for metals, semiconductors, ceramics, and organic materials

- In July 2024, Shimadzu Corporation has joined forces with TESCAN Group to launch TESCAN's scanning electron microscopes in Japan this autumn, expanding its analytical measurement offerings. This partnership enhances Shimadzu’s surface analysis capabilities by combining TESCAN’s cutting-edge SEM technology with its existing instruments, enabling more precise and comprehensive material characterization

- In July 2024, FOCUS GmbH and SPECS Surface Nano Analysis GmbH, both under LAB14 GmbH, have merged as SPECS Surface Nano Analysis GmbH while maintaining their brand identities. This merger enhances SPECS GmbH’s surface analysis capabilities by integrating FOCUS GmbH’s expertise in momentum microscopes and electron spectroscopy, enabling more precise and comprehensive research solutions

- In February 2025, Thermo Fisher Scientific is acquiring Solventum’s Purification & Filtration business for USD 4.1 billion, reinforcing its presence in the expanding bioprocessing market. This acquisition boosts Thermo Fisher’s filtration and purification capabilities, enhancing sample preparation for surface analysis techniques such as XPS and spectroscopy, resulting in greater precision and efficiency in material characterization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 THECNOLOGY TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.1.1 SURFACE ANALYSIS IN THE SEMICONDUCTOR INDUSTRY

4.1.2 SURFACE ANALYSIS IN THE ACADEMIC INSTITUTES

4.1.3 SURFACE ANALYSIS IN THE RESEARCH ORGANIZATIONS

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.2.1 GROWTH PROSPECT

4.3 COMPETITOR KEY PRICING STRATEGIES

4.4 KEY TECHNOLOGIES

4.4.1 COMPLEMENTARY TECHNOLOGIES

4.4.2 ADJACENT TECHNOLOGIES

4.4.3 CHALLENGES

4.4.4 TECHNOLOGY SPEND OF COMPANY

4.5 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE R&D EXPENDITURE IN MEDICAL AND PHARMACEUTICAL COMPANIES

5.1.2 GROWING UTILIZATION OF SURFACE ANALYSIS METHODS IS EXPANDING ACROSS SECTORS LIKE ELECTRONICS, AUTOMOTIVE, AEROSPACE, AND ADVANCED MATERIALS

5.1.3 INCREASING QUALITY CONTROL DEMANDS ARE DRIVING THE EXPANSION OF SURFACE ANALYSIS.

5.1.4 GROWING RESEARCH COLLABORATION AMONG ACADEMIA, INDUSTRY, AND GOVERNMENT BOOST MARKET AWARENESS

5.2 RESTRAINTS

5.2.1 HIGH INSTRUMENT COSTS RESTRICT MIDDLE EAST AND AFRICA SURFACE ANALYSIS EXPANSION

5.2.2 REGULATORY COMPLIANCE ISSUES HINDER RAPID TECHNOLOGY DEPLOYMENT

5.3 OPPORTUNITIES

5.3.1 EMERGING NANOTECHNOLOGY OFFERS BREAKTHROUGH TECHNIQUES IN ANALYSIS

5.3.2 STRATEGIC PARTNERSHIPS AND MERGERS ACCELERATE MARKET EXPANSION IN SURFACE ANALYSIS

5.4 CHALLENGES

5.4.1 SENSITIVITY TO SURFACE CONTAMINANTS AFFECTING ACCURACY

5.4.2 LIMITED SKILLED WORKFORCE FOR ADVANCED SURFACE ANALYSIS TECHNIQUES

6 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 MICROSCOPY

6.2.1 MICROSCOPY, BY METHOD

6.2.1.1 ELECTRON MICROSCOPY

6.2.1.2 OPTICAL MICROSCOPY

6.2.1.3 CONFOCAL MICROSCOPY

6.2.1.4 PROBE MICROSCOPY

6.2.2 MICROSCOPY, BY TECHNIQUE

6.2.2.1 SCANNING ELECTRON MICROSCOPY (SEM)

6.2.2.2 TRANSMISSION ELECTRON MICROSCOPY (TEM)

6.2.2.3 SCANNING PROBE MICROSCOPY (SPM)

6.2.2.4 IMAGE ANALYSIS

6.2.2.5 CRYO-ELECTRON MICROSCOPY (CRYO-EM)

6.2.2.6 OTHERS

6.3 SPECTROSCOPY

6.4 X-RAY DIFFRACTION (XRD)

6.5 SURFACE ANALYZERS

7 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY TYPE

7.1 OVERVIEW

7.2 XPS (X-RAY PHOTOELECTRON SPECTROSCOPY)

7.3 TOF-SIMS (TIME-OF-FLIGHT SECONDARY ION MASS SPECTROMETRY)

7.4 AES (AUGER ELECTRON SPECTROSCOPY)

7.5 RAMAN (RAMAN SPECTROSCOPY)

7.6 UPS (UV PHOTOELECTRON SPECTROSCOPY)

7.7 ISS (ION SCATTERING SPECTROSCOPY)

7.8 OTHERS

8 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY METHOD TYPE

8.1 OVERVIEW

8.2 SPECTROSCOPIC METHOD

8.3 MICROSCOPIC METHOD

8.4 CLASSICAL METHOD

9 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE

9.1 OVERVIEW

9.2 SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM)

9.2.1 SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM), BY OPERATION

9.2.1.1 AUTOMATIC

9.2.1.2 MANUAL

9.2.2 SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM), BY NOISE LEVEL

9.2.2.1 LOW

9.2.2.2 EXTREMELY LOW

9.2.2.3 STANDARD

9.3 ELECTRON PROBE MICRO-ANALYZERS (EPMA)

9.4 X-RAY PHOTOELECTRON SPECTROMETERS (XPS)/ELECTRON SPECTROSCOPY FOR CHEMICAL ANALYSIS (ESCA)

9.5 OTHERS

10 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 MATERIAL COMPOSITION

10.3 SURFACE ROUGHNESS AND TOPOGRAPHY

10.4 THIN FILM ANALYSIS

10.5 SURFACE CONTAMINATION

10.6 FAILURE ANALYSIS

10.7 CORROSION ANALYSIS

10.8 SURFACE MODIFICATION

11 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY END USER

11.1 OVERVIEW

11.2 INDUSTRIES

11.2.1 INDUSTRIES, BY TYPE

11.2.1.1 LIFE SCIENCES & PHARMACEUTICALS

11.2.1.2 SEMICONDUCTOR

11.2.1.3 METALLURGY AND MINERALS

11.2.1.4 AUTOMOTIVE

11.2.1.5 ENERGY

11.2.1.6 FOOD AND BEVERAGES

11.2.1.7 POLYMERS

11.2.1.8 TEXTILE

11.2.1.9 PAPER AND PACKAGING

11.2.1.10 OTHERS

11.2.2 INDUSTRIES, BY TECHNOLOGY

11.2.2.1 MICROSCOPY

11.2.2.2 SPECTROSCOPY

11.2.2.3 X-RAY DIFFRACTION (XRD)

11.2.2.4 SURFACE ANALYZERS

11.3 RESEARCH ORGANIZATION

11.3.1 RESEARCH ORGANIZATION, BY TECHNOLOGY

11.3.1.1 MICROSCOPY

11.3.1.2 SPECTROSCOPY

11.3.1.3 X-RAY DIFFRACTION (XRD)

11.3.1.4 SURFACE ANALYZERS

11.4 ACADEMIC INSTITUTES

11.4.1 ACADEMIC INSTITUTES, BY TECHNOLOGY

11.4.1.1 MICROSCOPY

11.4.1.2 SPECTROSCOPY

11.4.1.3 X-RAY DIFFRACTION (XRD)

11.4.1.4 SURFACE ANALYZERS

12 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 SOUTH AFRICA

12.1.3 U.A.E.

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 THERMO FISHER SCIENTIFIC INC.

15.1.1 COMPANY SNAPSHOTS

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 CARL ZEISS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS/NEWS

15.3 BRUKER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT/ NEWS

15.4 HORIBA GROUP

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 EUROFINS SCIENTIFIC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SERVICE PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 HIDDEN ANALYTICAL

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 JEOL LTD.

15.7.1 COMPANY SNAPSHOTS

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS/NEWS

15.8 NIKON INSTRUMENTS INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 PHYSICAL ELECTRONICS, INC. (AS A PART OF ULVAC-PHI)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 S A I LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 SERMA GROUP

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT / NEWS

15.12 SHIMADZU CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SPECS GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 STAIB INSTRUMENTS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 TESCAN

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT/NEWS

15.16 TSI

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT/NEWS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 MARKET PENETRATION ANALYSIS

TABLE 2 PRICING

TABLE 3 COMPANY COMPARATIVE ANALYSIS

TABLE 4 SEVERAL SOURCES OF SUBSTRATE SURFACE CONTAMINATION

TABLE 5 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SPECTROSCOPY IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA X-RAY DIFFRACTION (XRD) IN SURFACE ANALYSIS MARKET, BY RGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA SURFACE ANALYZERS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA XPS (X-RAY PHOTOELECTRON SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA TOF-SIMS (TIME-OF-FLIGHT SECONDARY ION MASS SPECTROMETRY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA AES (AUGER ELECTRON SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA RAMAN (RAMAN SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA UPS (UV PHOTOELECTRON SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ISS (ION SCATTERING SPECTROSCOPY) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA OTHERS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA SPECTROSCOPIC METHOD IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA MICROSCOPIC METHOD IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA CLASSICAL METHOD IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA ELECTRON PROBE MICRO-ANALYZERS (EPMA) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA X-RAY PHOTOELECTRON SPECTROMETERS (XPS)/ELECTRON SPECTROSCOPY FOR CHEMICAL ANALYSIS (ESCA) IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA OTHERS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA MATERIAL COMPOSITION IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA SURFACE ROUGHNESS AND TOPOGRAPHY IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA THIN FILM ANALYSIS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA SURFACE CONTAMINATION IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA FAILURE ANALYSIS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA CORROSION ANALYSIS IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA SURFACE MODIFICATION IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 SAUDI ARABIA SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 74 SAUDI ARABIA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 75 SAUDI ARABIA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH AFRICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH AFRICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH AFRICA MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH AFRICA SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 SOUTH AFRICA SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH AFRICA SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SOUTH AFRICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 83 SOUTH AFRICA SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 84 SOUTH AFRICA SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH AFRICA SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 88 SOUTH AFRICA RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 90 U.A.E. SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 91 U.A.E. MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 92 U.A.E. MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 93 U.A.E. SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.A.E. SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.A.E. SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 U.A.E. SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 97 U.A.E. SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 98 U.A.E. SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 U.A.E. SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 100 U.A.E. INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 U.A.E. INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 102 U.A.E. RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 103 U.A.E. ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 104 EGYPT SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 105 EGYPT MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 106 EGYPT MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 107 EGYPT SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 EGYPT SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 EGYPT SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 EGYPT SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 111 EGYPT SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 112 EGYPT SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 113 EGYPT SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 114 EGYPT INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 EGYPT INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 116 EGYPT RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 117 EGYPT ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 118 ISRAEL SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 119 ISRAEL MICROSCOPY IN SURFACE ANALYSIS MARKET, BY METHOD, 2018-2032 (USD THOUSAND)

TABLE 120 ISRAEL MICROSCOPY IN SURFACE ANALYSIS MARKET, BY TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 121 ISRAEL SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 ISRAEL SURFACE ANALYSIS MARKET, BY METHOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 ISRAEL SURFACE ANALYSIS MARKET, BY EQUIPMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 ISRAEL SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 125 ISRAEL SCANNING PROBE MICROSCOPES (SPM)/ATOMIC FORCE MICROSCOPES (AFM) IN SURFACE ANALYSIS MARKET, BY NOISE LEVEL, 2018-2032 (USD THOUSAND)

TABLE 126 ISRAEL SURFACE ANALYSIS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 ISRAEL SURFACE ANALYSIS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 128 ISRAEL INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 ISRAEL INDUSTRIES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 130 ISRAEL RESEARCH ORGANIZATION IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 131 ISRAEL ACADEMIC INSTITUTES IN SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 132 REST OF MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 5 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: DBMR MARKET POSITION GRID

FIGURE 6 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: MULTIVARIATE MODELING

FIGURE 7 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: TECHNOLOGY TIMELINE CURVE

FIGURE 8 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: SEGMENTATION

FIGURE 10 SEMICONDUCTOR: MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET EXECUTIVE SUMMARY

FIGURE 11 FOUR SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET, BY TECHNOLOGY (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASE IN THE R&D EXPENDITURE IN MEDICAL AND PHARMACEUTICAL COMPANIES THE MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 14 TECHNOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET IN 2025 & 2032

FIGURE 15 BIGGEST MANUFACTURING ECONOMIES

FIGURE 16 DROC ANALYSIS

FIGURE 17 R&D INVESTMENTS BY INDIAN PHARMA COMPANIES

FIGURE 18 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: BY TECHNOLOGY, 2024

FIGURE 19 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: BY TYPE, 2024

FIGURE 20 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: BY METHOD TYPE, 2024

FIGURE 21 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: BY EQUIPMENT TYPE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: BY APPLICATION, 2024

FIGURE 23 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: BY END USER, 2024

FIGURE 24 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: SNAPSHOT (2024)

FIGURE 25 MIDDLE EAST AND AFRICA SURFACE ANALYSIS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.