Middle East And Africa Tax It Software Market

Market Size in USD Million

CAGR :

%

USD

855.75 Million

USD

1,386.00 Million

2024

2032

USD

855.75 Million

USD

1,386.00 Million

2024

2032

| 2025 –2032 | |

| USD 855.75 Million | |

| USD 1,386.00 Million | |

|

|

|

Middle East and Africa Tax IT Software Market Analysis

The Middle East and Africa tax IT software market is growing rapidly, driven by the increasing complexity of Middle East and Africa tax regulations and the need for businesses to ensure compliance across multiple jurisdictions. This market encompasses solutions that automate tax calculations, reporting, and filing processes while integrating with enterprise systems to reduce manual efforts and minimize errors. Advancements in technologies like AI and cloud computing are enhancing software capabilities, offering real-time updates, scalability, and improved accuracy. The market is further bolstered by rising adoption among SMEs and large enterprises seeking operational efficiency.

Middle East and Africa Tax IT Software Market Size

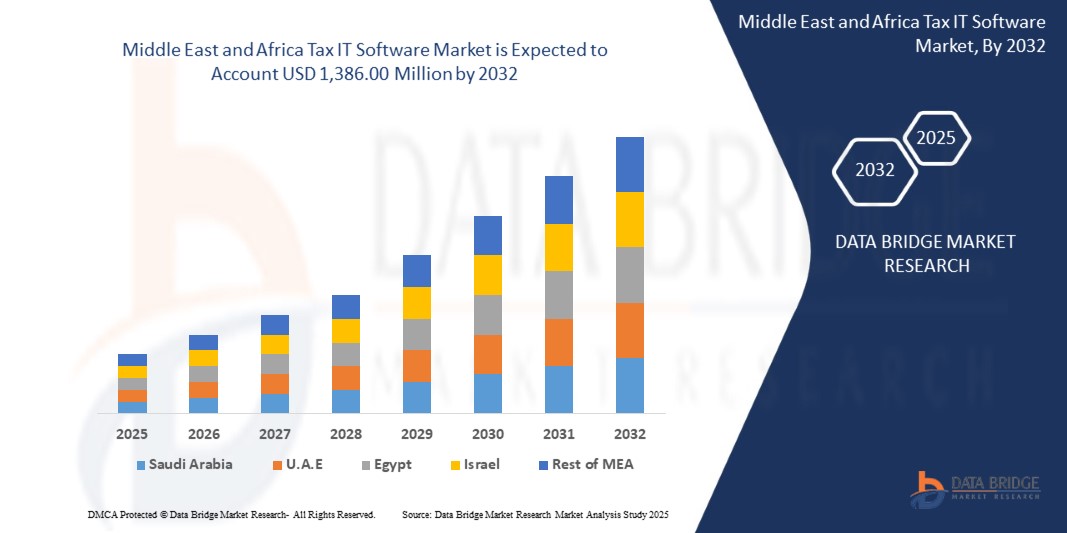

Data Bridge Market Research analyses that the tax the Middle East and Africa tax IT software market is expected to reach USD 1,386.00 million by 2032 from USD 855.75 million in 2024 growing with a CAGR of 8.1% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Middle East and Africa Tax IT Software Market Trends

“Increased Financial Crimes Detection Efforts”

Increased financial crimes detection efforts have intensified scrutiny on anti-money laundering (AML) measures, focusing on enhancing compliance and monitoring systems. Financial institutions are implementing more rigorous procedures to identify suspicious transactions and patterns indicative of money laundering. These measures include strengthening internal controls, improving transaction reporting practices, and enhancing collaboration with regulatory bodies. The push for greater transparency and accountability aims to disrupt financial crime networks and reduce illicit financial flows. By adopting comprehensive AML frameworks, organizations seek to mitigate risks and protect the integrity of the financial system. This proactive approach reflects a broader commitment to combatting financial crime and maintaining regulatory compliance.

Report Scope and Middle East and Africa Tax IT Software Market Segmentation

|

Report Metric |

Middle East and Africa Tax IT Software Market Insights |

|

Segments Covered |

IT & Telecommunications, Manufacturing, Retail & Consumer Goods, Healthcare, Energy & Utilities, and Media & Entertainment |

|

Countries Covered |

U.A.E, Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

Microsoft (U.S.), ADP, Inc. (U.S.), Yayoi Co., Ltd. (Japan), Wolters Kluwer N.V (Netherland), Stripe (U.S.), SAP (U.S.), Thomson Reuters (U.S.), Oracle (U.S.), NTT data (Japan), QUICKBOOKS (INTUIT INC.) (U.S.), SAGE GROUP PLC (U.K.), Vertex (U.S.), TKC Corporation (Japan), SOVOS Compliance, LLC (U.S.), Avalara (U.S.), Money Forward, Inc.(Japan), freee K.K (Japan), TaxDiva (India), Esker (France), PCA Corporation (Japan), and Epicor Software Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Middle East and Africa Tax IT Software Market Definition

The tax IT software refers to specialized technology solutions designed to automate and streamline tax management processes, including tax calculation, compliance, reporting, and filing. These systems integrate with enterprise platforms to ensure accurate handling of sales tax, use tax, VAT, and other tax types across multiple jurisdictions. By leveraging advanced features such as real-time rate updates, exemption certificate management, and detailed reporting, Tax IT Software reduces manual workloads, minimizes compliance risks, and enhances operational efficiency for businesses navigating complex tax regulations.

Middle East and Africa Tax IT Software Market Dynamics

Drivers

- Increasing Adoption of Tax IT Software among Small and Medium-Sized Businesses

As SMBs face increasing complexities in managing tax compliance, they are turning to automated solutions that simplify processes, reduce errors, and ensure accuracy. The need for these businesses to navigate varying tax regulations, including sales tax, VAT, and other local tax laws, has led to a surge in the use of tax IT software. These solutions streamline tax calculations and also integrate seamlessly with financial systems, offering a more efficient way to manage taxes while staying compliant with ever-evolving regulations.

Moreover, the growing shift toward digitalization and cloud-based solutions is accelerating the adoption of tax IT software in the SMB sector. These businesses are increasingly seeking scalable, cost-effective solutions that allow them to manage tax operations without the need for extensive in-house resources. By automating routine tax tasks such as reporting, filing, and compliance monitoring, SMBs can reduce administrative burdens, save time, and focus on strategic growth initiatives. This trend is expected to continue as tax IT software becomes more accessible, user-friendly, and integrated into broader financial management platforms, making it an essential tool for SMBs worldwide.

For instance,

In November 2024, according to an article published by The Indian Express, a Deloitte India survey shows that 81% of small organizations plan to digitize their tax operations within the next five years, highlighting a shift toward technology-driven tax functions. Despite challenges such as integration issues and a shortage of tax tech professionals, there is a strong push for adopting tax IT solutions supported by government digitalization initiatives. This growing interest among small businesses to modernize their tax processes signals an increasing demand for tax IT software, driving market growth and innovation to meet the specific needs of smaller organizations.

- AI and Machine Learning Integration in Tax and Accounting Software

The integration of AI and machine learning (ML) into tax and accounting software is transforming the tax IT software market by automating complex processes and enhancing decision-making capabilities. AI-powered tools simplify tasks such as data extraction, tax calculation, and compliance monitoring, reducing the reliance on manual intervention. ML algorithms improve the accuracy of tax audits and fraud detection by analyzing large datasets and identifying anomalies in real-time. These advancements help businesses ensure compliance with ever-changing tax regulations while streamlining their operations and saving time.

The adoption of AI and ML in tax software is particularly advantageous for addressing regulatory complexities faced by businesses of all sizes. Small and medium-sized businesses (SMBs) benefit from intelligent features such as predictive analytics and adaptive tax planning, enabling them to make informed decisions and optimize their financial strategies. This shift toward smarter, AI-driven tax solutions is driving the market's growth as companies increasingly prioritize efficiency, accuracy, and scalability in their tax management processes.

For instance,

In May 2024, according to an article published by Arizent, Wolters Kluwer has introduced an AI-powered corporate performance management platform, CCH Tagetik. The platform includes features such as Ask AI, AI Automapping, AI Anomaly Detection, and AI Driver-Based Analysis to improve reporting, data governance, and financial analysis. This marks a significant shift towards AI and machine learning in tax and accounting software, enhancing automation, data integrity, and analytical efficiency, which aligns with the growing demand for AI-driven solutions in the Tax IT Software industry.

Opportunities

- Expansion of Cloud Services for Business

As businesses continue to embrace digital transformation, the demand for scalable, flexible, and cost-effective solutions has driven the growth of cloud-based platforms. Cloud services allow tax professionals and businesses to access advanced tools and software without the need for heavy infrastructure investments. This flexibility enables companies to quickly adapt to changing regulatory requirements, streamline operations, and improve overall efficiency. Furthermore, cloud platforms offer real-time data access, collaboration, and seamless integration with other enterprise systems, making them increasingly attractive to firms seeking to enhance their tax and accounting functions.

The rise of cloud-based tax IT solutions also addresses critical concerns such as data security, compliance, and scalability. Cloud service providers invest heavily in robust security measures, ensuring that sensitive tax data is protected while complying with local and international data privacy regulations. This makes cloud services a viable option for businesses looking to mitigate risks and focus on their core operations. As more businesses transition to the cloud, the Tax IT Software Market is likely to witness increased adoption, with providers continuing to innovate and offer specialized solutions tailored to the evolving needs of the industry.

For instance,

In October 2020, according to an article published by the Economic Times, cloud computing and Everything-as-a-Service (XaaS) are reshaping the tax landscape, introducing complexities for businesses in terms of taxation and compliance with evolving regulations. This shift opens up opportunities for the expansion of cloud services for businesses in the tax IT software market, as companies require advanced tax software solutions to manage the unique challenges of cloud-based services and ensure compliance with Middle East and Africa tax laws.

- Rising Government Initiatives to Promote Digital Compliance Software Adoption Across Businesses

Governments worldwide are increasingly promoting the use of digital compliance software, with policies encouraging businesses to adopt digital tools for tax reporting and compliance. These initiatives often include incentives, subsidies, or mandates for businesses to transition from manual processes to digital platforms. The push for digital transformation is particularly strong in industries with complex regulatory requirements, where businesses must manage taxes across multiple jurisdictions.

This growing governmental support presents a significant opportunity for the tax IT software market, as businesses seek software solutions to comply with new regulations and standards. As governments implement stricter tax compliance and reporting rules, businesses are increasingly adopting digital tools to ensure accurate, timely, and efficient tax processes. This shift toward digital compliance software is expected to drive demand for innovative solutions, benefiting software providers and increasing the overall market potential.

For instance,

According to an article published by PKF Smith Cooper, The UK's Making Tax Digital (MTD) initiative requires businesses, self-employed individuals, and landlords to maintain digital records and use third-party software for tax submissions. MTD for Income Tax Self-Assessments (ITSA) will be phased in by 2026, with income thresholds for compliance. This initiative creates an opportunity for Tax IT Software providers, as businesses will need digital solutions to meet the evolving tax regulations.

Restraints/Challenges

- High Costs and Initial Investment Restrictions for the Use of Advanced Tax and Accounting Software

Although modern tax and accounting software has many advantages, the high costs of obtaining, deploying, and maintaining these systems can be a substantial obstacle, especially for small and medium-sized businesses (SMEs). As organizations seek to streamline their financial operations and remain competitive, the initial investment necessary for such software might dissuade many, particularly when extra customization and integration fees are included.

For SMEs, the large initial expenditure necessary to acquire and deploy complex tax and accounting software is frequently a substantial barrier. These systems, which are built to perform complicated financial activities, are often quite expensive. Furthermore, modification to fit individual company demands, as well as connection with current enterprise resource planning (ERP) or customer relationship management (CRM) systems, might increase expenses. For many smaller organizations, these costs might be prohibitively expensive, restricting their capacity to implement complex solutions and impeding their development potential. This difficulty is especially acute for businesses with limited resources, which may choose less expensive, off-the-shelf solutions over extensive, custom-built systems.

For instance,

In May 2024, according to an article published by Attract Group, ERP software development costs, ranging from USD 25,000 to USD 350,000, play a crucial role in modern business efficiency by streamlining operations. These costs are shaped by factors such as complexity, customization, deployment models, and integration requirements. In contrast, ERP systems provide long-term operational advantages, but their high development and implementation expenses present challenges, particularly for small and medium-sized enterprises (SMEs). The significant initial investments, along with ongoing costs for customization, integration, maintenance, upgrades, and licensing, create financial hurdles. These barriers are a notable restraint for the adoption of advanced tax and accounting software, especially among budget-sensitive businesses.

- Cybersecurity and Data Privacy Concerns Hinder Adoption of Tax and Accounting Software

As firms digitize their financial operations, cybersecurity concerns have become a major impediment to the use of modern tax and accounting software. Businesses face increased risks of data breaches, cyberattacks, and privacy violations as they rely more heavily on digital platforms to manage sensitive financial data. These issues frequently prevent businesses from completely adopting digital financial management systems.

In addition, the rising digitalization of financial data, although providing speed and convenience, raises severe issues about data privacy and security. Businesses must safeguard sensitive financial information, such as tax records, employee payroll data, and other secret information, against potential cyber-attacks. Data breaches and cyberattacks may result in significant financial losses, reputational harm, and legal ramifications for companies that fail to comply with data security requirements. As a result, businesses may be hesitant to use tax and accounting software that does not fulfill high security standards, limiting the widespread adoption of digital financial solutions. Furthermore, the absence of proper security measures, such as encryption and safe authentication procedures, might erode trust in the software.

For instance,

- In March 2024, according to an article published by the Association of International Certified Professional Accountants, the growing challenges faced by CPAs and businesses in protecting client data are exacerbated by increasing cybersecurity threats, regulatory changes, and evolving privacy standards. These concerns, including the complexity of maintaining compliance with global data privacy laws and the risks of cyberattacks, highlight the restraint "Cybersecurity and data privacy concerns hinder adoption of tax and accounting software" in the Tax IT Software Market, as firms hesitate to adopt new technologies due to fears of data breaches, compliance costs, and maintaining trust

Middle East and Africa Tax IT Software Market Scope

The tax IT software market is segmented six notable segments on the basis of offering, tax type, deployment mode, organization size, revenue model, and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Software

- Services

- Type

- Training and Consulting

- Support

Tax Type

- Income Tax

- Corporate Tax

- Property Tax

- Others

Deployment Mode

- Cloud

- On-Premises

Organization Size

- Large Enterprises

- Small-and Medium-Sized Enterprises

Revenue Model

- Subscription Based

- One-Time Purchase

Industry

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunications

- Manufacturing

- Retail and Consumer Goods

- Healthcare

- Media and Entertainment

- Energy and Utilities

- Others

Middle East and Africa Tax IT Software Market Regional Analysis

The tax IT software market is segmented six notable segments on the basis of country, offering, tax type, deployment mode, organization size, revenue model, and industry.

The countries covered in the tax IT software market report as U.A.E, Saudi Arabia, South Africa, Egypt, Israel, and rest of Middle East and Africa.

Saudi Arabia dominates the Tax IT software market in the Middle East & Africa region due to its rapid digital transformation, implementation of VAT, and strong government initiatives like e-invoicing regulations. The country's efforts to modernize tax compliance frameworks have driven high adoption rates. Additionally, the fastest growth is fueled by increasing demand for automated tax solutions among businesses adapting to regulatory changes.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Tax It Software Market Share

Tax IT software market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Middle East and Africa tax IT software market .

Middle East and Africa Tax IT Software Market Leaders Operating in the Market are:

- Microsoft (U.S.)

- ADP, Inc. (U.S.)

- Yayoi Co., Ltd. (Japan)

- Wolters Kluwer N.V (Netherland)

- Stripe (U.S.)

- SAP (U.S.)

- Thomson Reuters (U.S.)

- Oracle (U.S.)

- NTT data (Japan)

- QUICKBOOKS (INTUIT INC.) (U.S.)

- SAGE GROUP PLC (U.K.)

- Vertex (U.S.)

- TKC Corporation (Japan)

- SOVOS Compliance, LLC (U.S.)

- Avalara (U.S.)

- Money Forward, Inc.(Japan)

- freee K.K (Japan)

- TaxDiva (India)

- Esker (France)

- PCA Corporation (Japan)

- Epicor Software Corporation (U.S.)

Latest Developments in Middle East and Africa Tax IT Software Market

- In September 2024, Wolters Kluwer has partnered with OneTeam Services Group to enhance CCH Integrator. The collaboration will expand tax compliance, data management, and collaborative workflows, improving efficiency for tax firms and corporations across multiple tax domains

- In October, ADP has acquired Workforce Software, a leading provider of workforce management solutions for global enterprises. This acquisition expands ADP's offerings, enhancing global workforce management capabilities and driving future innovation to meet evolving business needs

- In June, Stripe appears to be signaling preparations for an IPO, despite non-committal statements from its co-founders. Actions such as publishing financial performance reports and conducting tender offers have fueled speculation. These developments drive Stripe to enhance transparency and financial reporting, bolstering trust in its Tax and Accounting Software solutions and aligning with its mission to help businesses streamline compliance, potentially attracting a broader user base

- In June, Avalara has enhanced its presence in India to support the country’s export ambitions by providing cloud-based tax compliance solutions that simplify cross-border tax processes. This move bolsters Avalara’s position in the tax and accounting software market by expanding its footprint in a rapidly growing region, catering to diverse industries, and demonstrating its proficiency in automating global indirect tax compliance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY STANDARDS

4.2 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2.1 INDUSTRY ANALYSIS

4.2.2 FUTURISTIC SCENARIO

4.2.3 COMPETITIVE LANDSCAPE

4.3 PENETRATION AND GROWTH PROSPECT MAPPING

4.4 TECHNOLOGY ANALYSIS

4.5 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF TAX IT SOFTWARE AMONG SMALL AND MEDIUM-SIZED BUSINESSES

5.1.2 AI AND MACHINE LEARNING INTEGRATION IN TAX AND ACCOUNTING SOFTWARE

5.1.3 GROWING NEED FOR STREAMLINING ACCOUNTING OPERATIONS TO REDUCE MANUAL ERRORS

5.1.4 RISING DEMAND FOR REAL-TIME FINANCIAL INSIGHTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS AND INITIAL INVESTMENT RESTRICTIONS FOR THE USE OF ADVANCED TAX AND ACCOUNTING SOFTWARE

5.2.2 CYBERSECURITY AND DATA PRIVACY CONCERNS HINDER ADOPTION OF TAX AND ACCOUNTING SOFTWARE

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF CLOUD SERVICES FOR BUSINESS

5.3.2 RISING GOVERNMENT INITIATIVES TO PROMOTE DIGITAL COMPLIANCE SOFTWARE ADOPTION ACROSS BUSINESSES

5.4 CHALLENGES

5.4.1 FREQUENT TAX UPDATES CREATE CHALLENGES FOR SOFTWARE

5.4.2 CHALLENGES IN INTEGRATING LEGACY SYSTEMS FOR BUSINESSES MIDDLE EAST AND AFRICA LY

6 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.3 SERVICES

6.3.1 SERVICE, BY TYPE

6.4 TRAINING AND CONSULTING

6.5 SUPPORT

7 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY TAX TYPE

7.1 OVERVIEW

7.2 INCOME TAX

7.3 CORPORATE TAX

7.4 PROPERTY TAX

7.5 OTHERS

8 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISES

9 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

10 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL

10.1 OVERVIEW

10.2 SUBSCRIPTION-BASED

10.3 ONE-TIME PURCHASE

11 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.3 IT AND TELECOMMUNICATIONS

11.4 MANUFACTURING

11.5 RETAIL AND CONSUMER GOODS

11.6 HEALTHCARE

11.7 MEDIA AND ENTERTAINMENT

11.8 ENERGY AND UTILITIES

11.9 OTHERS

12 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E

12.1.3 SOUTH AFRICA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 ADP,INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 YAYOI CO., LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 WOLTERS KLUWER N.V.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 STRIPE, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 SERVICE PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AVALARA, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 EPICOR SOFTWARE CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ESKER

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SOLUTION PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 FREEE KK

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 INTUIT INC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MONEY FORWARD, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 NTT DATA GROUP CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SERVICE PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 ORACLE

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 SERVICE PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 PCA CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 SAGE GROUP PLC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SAP SE

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SOVOS COMPLIANCE, LLC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TAXDIVA

15.18.1 COMPANY SNAPSHOT

15.18.2 SERVICE PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 THOMSON REUTERS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 SERVICE PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TKC CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 VERTEX, INC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 SERVICE PORTFOLIO

15.21.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATIONS AND STANDARDS FOR MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET

TABLE 2 AWI TAX CONSULTING TAX SOFTWARE PRICE (IN USD)

TABLE 3 TRENDS IN THE TOTAL SALES OF THE MANUFACTURING INDUSTRY (IN USD BILLION)

TABLE 4 TECHNOLOGY MATRIX

TABLE 5 COMPARATIVE ANALYSIS

TABLE 6 THE OVERALL ERP IMPLEMENTATION PRICING

TABLE 7 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA SOFTWARE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA SERVICES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA INCOME TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CORPORATE TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA PROPERTY TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA OTHERS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA CLOUD IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA ON-PREMISE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA LARGE ENTERPRISES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA SMALL AND MEDIUM-SIZED ENTERPRISES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SUBSCRIPTION BASED IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ONE-TIME PURCHASE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI), BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA IT AND TELECOMMUNICATIONS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MANUFACTURING IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA RETAIL AND CONSUMER GOODS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA HEALTHCARE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA MEDIA AND ENTERTAINMENT IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ENERGY AND UTILITIES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA OTHERS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 42 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 43 SAUDI ARABIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 46 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 47 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 48 SAUDI ARABIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 49 U.A.E. TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 50 U.A.E. SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 U.A.E. TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.A.E. TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 53 U.A.E. TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 54 U.A.E. TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 55 U.A.E. TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 56 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH AFRICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH AFRICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 63 EGYPT TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 64 EGYPT SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EGYPT TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EGYPT TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 67 EGYPT TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 68 EGYPT TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 69 EGYPT TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 70 ISRAEL TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 71 ISRAEL SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 ISRAEL TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 ISRAEL TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 74 ISRAEL TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 75 ISRAEL TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 76 ISRAEL TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 77 REST OF MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: MULTIVARIATE MODELING

FIGURE 9 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: OFFERING TIMELINE CURVE

FIGURE 10 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 12 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET:

FIGURE 14 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: STRATEGIC DECISIONS

FIGURE 15 INCREASING ADOPTION OF TAX IT SOFTWARE AMONG SMALL AND MEDIUM-SIZED BUSINESSES IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET IN 2025 & 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET

FIGURE 18 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: BY OFFERING, 2024

FIGURE 19 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: BY TAX TYPE, 2024

FIGURE 20 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 21 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: BY REVENUE MODEL, 2024

FIGURE 23 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: BY INDUSTRY, 2024

FIGURE 24 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: SNAPSHOT (2024)

FIGURE 25 MIDDLE EAST AND AFRICA TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.