Middle East And Africa Third Generation Advanced High Strength Steel Market

Market Size in USD Million

CAGR :

%

USD

967.02 Million

USD

492.50 Million

2024

2032

USD

967.02 Million

USD

492.50 Million

2024

2032

| 2025 –2032 | |

| USD 967.02 Million | |

| USD 492.50 Million | |

|

|

|

|

Third Generation Advanced High-Strength Steel Market Size

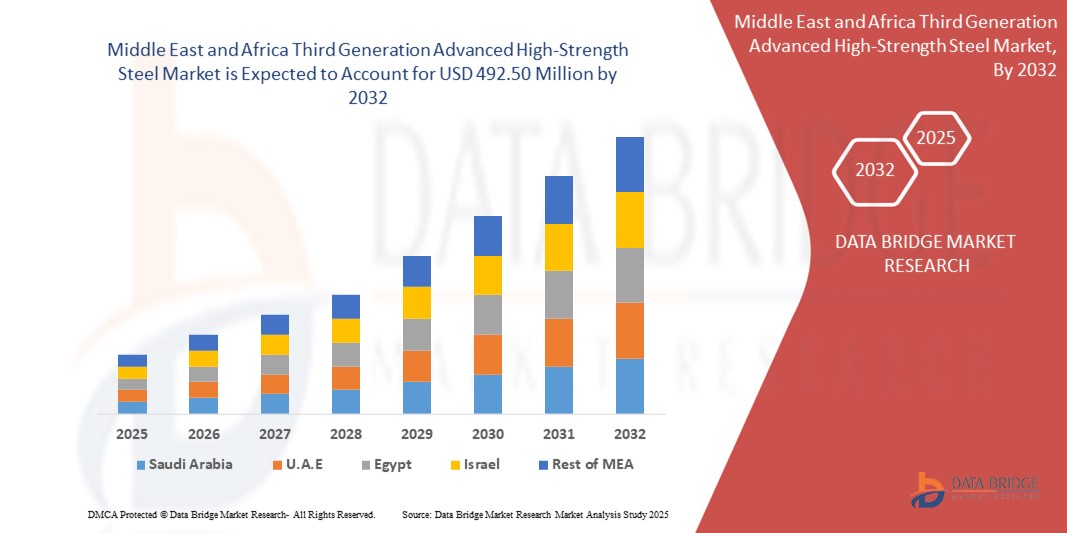

- The Middle East and Africa Third Generation Advanced High-Strength Steel Market size was valued at USD 967.02 million in 2024 and is expected to reach USD 492.50 million by 2032, at a CAGR of 12.0% during the forecast period

- The market growth is largely fueled by growing urbanization and industrialization, expansion of automotive sector

- Furthermore, the increasing demand for high strength and efficient materials from automakers, are further anticipated to propel the growth of the Third Generation Advanced High-Strength Steel Market

Third Generation Advanced High-Strength Steel Market Analysis

- The third generation advanced high-strength steel (AHSS) is an excellent combination of strength and ductility which has high tensile strength property that further provides the safety to the consumers and vehicles.

- The different types of third generation advanced high-strength steel are dual-phase (DP), martensitic (MS), transformation-induced plasticity (TRIP), twinning-induced plasticity (TWIP) and others

- Saudi Arabia dominates the Third Generation Advanced High-Strength Steel Market with the largest revenue share of 68.3% in 2024, characterized by its massive automotive production capacity, increasing adoption of lightweight, fuel-efficient vehicles.

- U.A.E is expected to be the fastest growing region in the Third Generation Advanced High-Strength Steel Market during the forecast period due to the country’s expanding automotive manufacturing base, rising demand for safer vehicles, and infrastructure development

- The dual-phase (DP) segment is expected to dominate the Third Generation Advanced High-Strength Steel Market with a market share of 37.2% in 2024, driven by its excellent balance of strength and ductility, making it suitable for structural and crash-relevant components

Report Scope and Third Generation Advanced High-Strength Steel Market Segmentation

|

Attributes |

Glass Fiber Reinforced Plastics Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Third Generation Advanced High-Strength Steel Market Trends

“Integration of Advanced AHSS in Electric Vehicle (EV) Manufacturing for Lightweighting and Enhanced Safety”

- A prominent and accelerating trend in the Middle East and Africa Third Generation Advanced High-Strength Steel (AHSS) Market is the integration of advanced AHSS grades into electric vehicle (EV) manufacturing. This integration aims to achieve vehicle lightweighting, thereby enhancing fuel efficiency and meeting stringent safety standards.

- For instance, in 2023, Saudi Arabia EV registrations surged by 35% compared to 2022, with 8.1 million new electric vehicles registered. This significant growth underscores the increasing demand for materials like third-generation AHSS, which offer superior strength-to-weight ratios essential for EV structural components.

- Automakers across the region are adopting third-generation AHSS to reduce vehicle weight without compromising safety, thereby extending driving range and improving crashworthiness. This trend aligns with the broader industry shift towards sustainable and efficient transportation solutions.

- The adoption of advanced AHSS in EV manufacturing reflects the region's commitment to innovation and sustainability, positioning Middle East and Africa as a leader in the global transition to electric mobility

Third Generation Advanced High-Strength Steel Market Dynamics

Driver

“Surging Automotive Production and Emphasis on Vehicle Lightweighting”

- The Middle East and Africa region's rapid industrialization and urbanization have led to a significant increase in automotive production, particularly in countries like Saudi Arabia, U.A.E, south Africa. This surge is a primary driver for the demand for third-generation AHSS, which is essential for manufacturing lighter and more fuel-efficient vehicles.

- For example, in 2023, Saudi Arabia car output exceeded 30.16 million units, marking an 11.6% year-on-year growth. This substantial production volume necessitates materials that can meet the dual demands of strength and weight reduction, making third-generation AHSS an ideal choice.

- The push for vehicle lightweighting is further amplified by stringent emission regulations and the global shift towards electric vehicles, both of which require materials that can deliver high performance without adding excessive weight.

- Consequently, the automotive industry's growth, coupled with the emphasis on sustainability and efficiency, propels the demand for third-generation AHSS in the Middle East and Africa market.

Restraint/Challenge

“High Production Costs and Technological Barriers in AHSS Manufacturing”

- Despite the advantages of third-generation AHSS, the high production costs associated with its manufacturing pose a significant challenge. These costs stem from the need for advanced processing technologies and specialized equipment, which can be capital-intensive.

- Small and medium-sized enterprises (SMEs) in the region may find it difficult to invest in the necessary infrastructure and technology, limiting their ability to adopt and produce third-generation AHSS. This financial barrier can hinder market expansion and the widespread adoption of these advanced materials.

- Additionally, the complex manufacturing processes required for third-generation AHSS, including precise control over microstructures and compositions, present technological challenges. These complexities can lead to longer development times and increased costs, further restraining market growth.

- Addressing these challenges requires collaborative efforts between industry stakeholders and government bodies to provide financial support, invest in research and development, and facilitate technology transfer to lower the barriers to entry and promote the adoption of third-generation AHSS.

Third Generation Advanced High-Strength Steel Market Scope

The market is segmented on the basis of type, tensile strength, hot rolled product type, process, technology, application, and end user.

- By Type

On the basis of type, the Middle East and Africa Third Generation AHSS Market is segmented into Dual-phase (DP), Martensitic (MS), Transformation-induced plasticity (TRIP), Twinning-induced plasticity (TWIP), and Others. The Dual-phase (DP) segment dominates the largest market revenue share of 37.2% in 2025, driven by its excellent balance of strength and ductility, making it suitable for structural and crash-relevant components. Its widespread adoption in automotive lightweighting strategies and enhanced energy absorption capabilities supports its leadership.

The TRIP segment is anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032, fueled by its superior formability and high strength. TRIP steels provide enhanced strain hardening during deformation, making them ideal for complex geometries in safety-critical vehicle components. Growing usage in electric vehicles and energy-efficient design also supports demand.

- By Tensile Strength

On the basis of tensile strength, the market is segmented into 700 MPA – 900 MPA (Class 1), 900 MPA –1200 MPA (Class 2), 1200 MPA – 1600 MPA (Class 3), and Above 1600 MPA. The 900 MPA–1200 MPA segment held the largest market revenue share in 2025, driven by its wide applicability across safety and structural components. These materials offer an optimal trade-off between cost, strength, and manufacturability.

The Above 1600 MPA segment is expected to witness the fastest CAGR from 2025 to 2032, driven by demand for ultra-high strength applications, particularly in chassis reinforcements and intrusion-resistant structures. Advancements in alloy design and processing techniques support this segment's expansion.

- By Hot Rolled Product Type

On the basis of hot rolled product type, the market is segmented into Strip and Quarto Plate. The Strip segment dominates the largest market revenue share of 64.1% in 2025, driven by its wide use in automotive and construction industries. Strips offer high dimensional accuracy and superior surface quality, essential for downstream forming operations.

The Quarto Plate segment is anticipated to witness the fastest growth rate of 8.5% from 2025 to 2032, fueled by increasing demand in heavy vehicle chassis, shipbuilding, and industrial equipment. Plates offer superior thickness and load-bearing properties, essential for structural reliability.

- By Process

On the basis of process, the market is segmented into Enhanced Dual-Phase (DP), Modified TRIP, Ultrafine Bainite, Quenching and Partitioning (Q&P), Lower MN TRIP/TWIP, and Higher MN TRIP. The Enhanced DP segment held the largest market revenue share in 2025, driven by its compatibility with conventional processing lines and ability to meet OEM performance standards. It is widely used in automotive crash structures and body panels.

The Quenching and Partitioning (Q&P) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by superior strength-ductility combinations and the ability to tailor microstructures for specific requirements. Growth is supported by high-performance applications in next-generation mobility solutions.

- By Technology

On the basis of technology, the market is segmented into Thick Monolithic Technology, Thin Monolithic Technology, and Surface Technology. The Thin Monolithic Technology segment dominates the largest market revenue share in 2025, driven by its integration in high-speed stamping and forming operations. It offers weight reduction and increased part complexity, suitable for electric and hybrid vehicle design.

The Surface Technology segment is anticipated to witness the fastest growth rate of 9.1% from 2025 to 2032, driven by increased need for corrosion resistance and coating compatibility. This technology enhances product lifespan and supports functional integration in automotive components.

- By Application

On the basis of application, the market is segmented into Structural Details, Car Seats, Bumpers, Chassis, Wheels and Power Train, Side Impact Beams, and Others. The Chassis segment dominates the largest market revenue share of 28.3% in 2025, driven by high demand for lightweight, high-strength materials to improve fuel efficiency and crashworthiness. AHSS enables thinner gauges and better load absorption.

The Side Impact Beams segment is expected to witness the fastest growth rate of 9.6% from 2025 to 2032, fueled by stricter safety regulations and demand for reinforced safety structures. These beams require high tensile strength and energy absorption, aligning with AHSS capabilities.

- By End User

On the basis of end user, the market is segmented into Passenger Car and Commercial Vehicle. The Passenger Car segment dominates the largest market revenue share of 71.4% in 2025, driven by large-scale production volumes and growing emphasis on vehicle weight reduction. OEMs are integrating Third Generation AHSS to meet emissions and safety norms.

The Commercial Vehicle segment is anticipated to witness the fastest growth rate of 8.7% from 2025 to 2032, fueled by rising demand for durable and cost-effective structural materials. Adoption is growing in light commercial vans and heavy trucks due to performance, safety, and longevity benefits.

Third Generation Advanced High-Strength Steel Market Regional Analysis

- Saudi Arabia dominates the Third Generation Advanced High-Strength Steel Market with the largest revenue share of 68.3% in 2024, driven by its massive automotive production capacity, increasing adoption of lightweight, fuel-efficient vehicles, and strong investment in advanced metallurgical research.

- Major domestic steelmakers like Baosteel and HBIS are ramping up production capabilities.

- Additionally, government initiatives supporting low-emission mobility and industrial upgrading continue to drive demand for high-performance steel in transportation and infrastructure sectors.

U.A.E Third Generation Advanced High-Strength Steel Market Insight

U.A.E Third Generation Advanced High-Strength Steel Market is growing rapidly with the highest CAGR of 6.7%, driven by the country’s expanding automotive manufacturing base, rising demand for safer vehicles, and infrastructure development. With government policies and vehicle safety norms becoming stricter, automakers are increasingly turning to advanced high-strength steels. Domestic producers are partnering with global firms to enhance metallurgical capabilities. Continued growth in construction and renewable energy projects also supports rising demand for lightweight, high-strength steel across sectors.

South Africa Third Generation Advanced High-Strength Steel Market Insight

South Africa Third Generation Advanced High-Strength Steel Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by major steel manufacturers and automotive companies driving innovation and adoption of 3rd Gen AHSS in vehicle design and production.

Third Generation Advanced High-Strength Steel Market Share

The Glass Fiber Reinforced Plastics Composites Industry is primarily led by well-established companies, including:

- SSAB AB (Sweden)

- ArcelorMittal (Luxembourg)

- voestalpine AG (Austria)

- Cleveland-Cliffs Inc. (U.S.)

- POSCO (South Korea)

- U.S. Steel Corporation (U.S.)

- thyssenkrupp AG (Germany)

- JFE Steel Corporation (Japan)

- NIPPON STEEL CORPORATION (Japan)

- Anyang Iron and Steel Group Inc (China)

- KOBE STEEL LTD (Japan)

- Benxi Steel Group (China)

- SAIL (Steel Authority of India Limited) (India)

- Shougang Group (China)

- NUCOR (U.S.)

- Baosteel Group (China)

- JSW Steel (India)

- Tata Steel (India)

Latest Developments in Middle East and Africa Third Generation Advanced High-Strength Steel Market

- In 2024, Saudi Arabia Nippon Steel Corporation commenced operations of a new Advanced High-Strength Steel production line in Wakayama, boasting an annual capacity of 1.2 million metric tons. This facility aims to cater to the growing demand in the electric vehicle and construction markets.

- In 2024, ArcelorMittal entered into a joint development agreement with a European automaker to co-design high-strength steel structural modules utilizing third-generation AHSS. This collaboration aims to enhance vehicle performance and safety through innovative steel solutions.

- In 2023, South Africa POSCO introduced a nano-structured martensitic steel with a tensile strength of 1,800 MPa. This advanced steel has been adopted in over 3,000 electric SUVs across Asia, highlighting its suitability for lightweight and high-strength applications in the electric vehicle sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Third Generation Advanced High Strength Steel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Third Generation Advanced High Strength Steel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Third Generation Advanced High Strength Steel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.