Middle East And Africa Trade Surveillance Market

Market Size in USD Million

CAGR :

%

USD

358.36 Million

USD

1,142.83 Million

2024

2032

USD

358.36 Million

USD

1,142.83 Million

2024

2032

| 2025 –2032 | |

| USD 358.36 Million | |

| USD 1,142.83 Million | |

|

|

|

|

Middle East and Africa Trade Surveillance Market Size

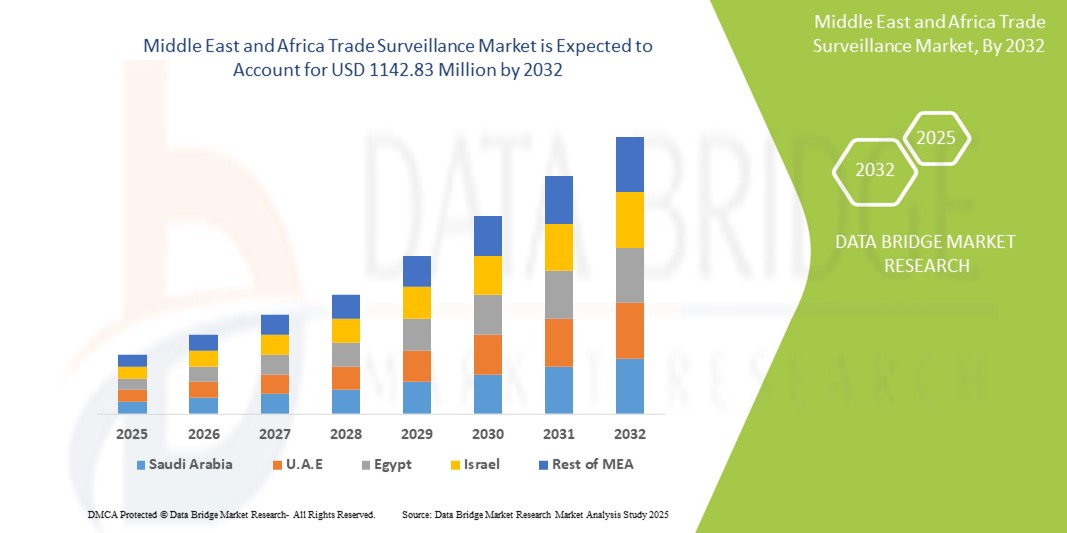

- The Middle East and Africa Trade Surveillance market size was valued at USD 358.36 Million in 2024 and is expected to reach USD 1142.83 Million by 2032, at a CAGR of 15.6% during the forecast period

- The Middle East and Africa Trade Surveillance market is driven by the demand for advanced surveillance tools is rising. The integration of AI, machine learning, and real-time analytics in surveillance systems is improving the detection of market abuse and fraud, enhancing overall market integrity. Additionally, the shift towards digital financial services and the expansion of market's growth.

Middle East and Africa Trade Surveillance Market Analysis

- Trade surveillance systems in the Middle East and Africa region are becoming essential for monitoring, analysing, and detecting suspicious trading activities across diverse financial markets. These systems are replacing manual oversight processes in exchanges, investment firms, and banks, ensuring compliance with increasingly stringent regulatory requirements and maintaining market transparency. These systems are crucial for identifying risks such as market manipulation, insider trading, and fraudulent activities in real-time.

- The Middle East and Africa Trade Surveillance Market is evolving rapidly, driven by several key factors that are reshaping the financial landscape in the region. A surge in digital trading, coupled with the increasing use of algorithmic and high-frequency trading, has amplified the need for robust surveillance systems capable of detecting real-time irregularities and ensuring compliance with global standards.

- Saudi Arabia is expected to emerge as a dominant player in the Middle East and Africa Trade Surveillance market. The advanced financial infrastructure and the government's proactive stance on financial crime prevention. The nation's commitment to enhancing its regulatory environment and implementing innovative technologies such as AI, blockchain, and real-time surveillance tools in monitoring trading activities strengthens its market dominance.

- U.A.E. is predicted to be the fastest-growing region in the Middle East and Africa Trade Surveillance market. The nation’s focus on becoming a global financial hub, coupled with the rise of fintech innovations, is driving the adoption of advanced surveillance systems. As U.A.E. financial institutions integrate more digital platforms, the demand for scalable surveillance systems that can manage high volumes of trades and detect fraudulent or manipulative activities in real time is set to increase, fueling the market's growth.

- The solution segment is expected to dominate the Middle East and Africa Trade Surveillance market, with a market share of 59.6% during the forecast period. The solution component segment is driving growth in the Middle East and Africa Trade Surveillance Market, accounting for a significant market share. Financial institutions are increasingly adopting integrated surveillance solutions that provide real-time monitoring, advanced analytics, automated compliance tracking, and enhanced risk detection, addressing stringent regulatory requirements and improving market transparency.

Report Scope and Middle East and Africa Trade Surveillance Market Segmentation

|

Attributes |

Middle East and Africa Trade Surveillance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Trade Surveillance Market Trends

“Increasing Adoption of Blockchain Technology for Enhanced Transparency”

- Blockchain technology is gaining traction in the Middle East and Africa Trade Surveillance market, offering enhanced transparency, security, and traceability in trade transactions. The decentralized nature of blockchain helps eliminate data manipulation and fraud, improving market integrity and compliance.

- Financial institutions are exploring blockchain to streamline surveillance and ensure more reliable tracking of trading activities, reducing the risk of manipulation or illicit activities.

- For instance, in April 2025, a financial regulator in the UAE began piloting a blockchain-based trade surveillance system to improve transparency and traceability across asset classes.

- Blockchain adoption is helping to enhance surveillance system efficiency and security, providing real-time audit trails and reducing fraud in cross-border trading environments.

Middle East and Africa Trade Surveillance Market Dynamics

Driver

“Increasing Regulatory Pressure and Market Integrity Initiatives”

- Stricter regulatory frameworks and a growing focus on market integrity in the Middle East and Africa are driving demand for advanced trade surveillance solutions. Regulatory bodies in countries such as Saudi Arabia and the UAE are implementing rigorous compliance standards, pushing financial institutions to adopt automated surveillance systems.

- • Financial firms are under pressure to adhere to local and international regulations, including anti-money laundering (AML) and market abuse laws, motivating them to enhance their surveillance systems.

For instance,

- in March 2025, Saudi Arabia’s Capital Market Authority (CMA) introduced new regulations requiring financial firms to use advanced trade surveillance systems for real-time compliance monitoring.

- Increasing regulatory pressure is driving the demand for comprehensive surveillance platforms that can offer real-time analytics, compliance tracking, and robust risk management features.

Opportunity

“Integration of Artificial Intelligence in Compliance Management”

- The growing complexity of financial markets in the Middle East and Africa has led to the integration of AI and machine learning into trade surveillance systems, enhancing compliance management and fraud detection capabilities. AI-driven solutions enable real-time analysis of vast amounts of data, improving the efficiency of surveillance.

- Financial institutions are seeking AI-powered systems to proactively identify irregular trading patterns, detect anomalies, and automate reporting processes to ensure compliance with evolving regulatory frameworks.

For instance,

- In June 2025, a major financial institution in the UAE implemented an AI-based trade surveillance system to improve real-time risk detection and automate compliance reporting, reducing manual intervention.

- AI integration offers significant opportunities for improving market transparency, reducing manual oversight, and ensuring more effective detection of market manipulation and insider trading.

Restraint/Challenge

“Data Privacy Regulations and Compliance Across Multiple Jurisdictions”

- Data privacy concerns and the complexity of managing cross-border data flows pose significant challenges for the implementation of trade surveillance systems in the Middle East and Africa. Diverse regulatory frameworks across countries complicate the deployment of unified solutions.

- Financial institutions face challenges in ensuring that surveillance systems comply with stringent local data privacy regulations, such as the UAE’s Personal Data Protection Law and South Africa’s Protection of Personal Information Act (POPIA), while also adhering to global standards.

For instance,

- In May 2025, a major bank in Egypt faced delays in rolling out a new trade surveillance system due to compliance concerns over cross-border data storage and privacy requirements.

- The need to adhere to various data privacy regulations complicates the deployment of unified trade surveillance systems, creating operational challenges and increasing costs for financial institutions.

Scope

The market is segmented on the basis component, deployment model, organization size and vertical.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Model |

|

|

By Organization Size |

|

|

By Vertical |

|

In 2025, the solution is projected to dominate the market with a largest share in by component segment

The solution segment is expected to dominate the Middle East and Africa Trade Surveillance market, with a market share of 59.6% during the forecast period. Increasing regulatory scrutiny and the need for robust compliance tools. Financial institutions are investing in advanced surveillance software that integrates AI and machine learning to detect suspicious activities, ensuring transparency and preventing market manipulation.

The Cloud is expected to account for the largest share during the forecast period in Middle East and Africa Trade Surveillance market

In 2025, the cloud segment in the Middle East and Africa Trade Surveillance Market is projected to hold the largest share of approximately 52.1%. The cloud segment is a major growth driver in the region’s trade surveillance market, offering scalability, faster deployment, and reduced infrastructure costs. Cloud-based platforms enable real-time monitoring, remote accessibility, and seamless updates, making them ideal for institutions seeking agility and compliance amid evolving regulatory frameworks and digital transformation efforts.

Middle East and Africa Trade Surveillance Market Regional Analysis

Saudi Arabia Holds the Largest Share in the Middle East and Africa Trade Surveillance Market”

- Saudi Arabia continues to hold the largest share in the MEA trade surveillance market due to its Vision 2030 reforms, which focus on diversifying the economy and strengthening the financial sector. The country is investing heavily in the development of smart financial markets and advanced surveillance technologies.

- The Saudi Arabian financial sector is undergoing significant regulatory enhancements, further fueling demand for trade surveillance systems that can provide real-time monitoring and compliance with international standards.

- Strong government initiatives aimed at improving financial market transparency and investor protection are boosting the adoption of surveillance solutions across the Kingdom.

“U.A.E. is Projected to Register the Highest CAGR in the Middle East and Africa Trade Surveillance Market”

- The UAE is projected to experience the highest Compound Annual Growth Rate (CAGR) in the MEA trade surveillance market, driven by its position as a financial hub for the region and increased focus on regulatory compliance.

- The UAE is accelerating the adoption of AI-powered trade surveillance solutions, enhancing real-time monitoring capabilities and addressing the growing complexity of financial transactions in digital market.

- New regulations in the UAE, such as enhanced market oversight and stricter financial reporting standards, are contributing to the rapid growth of the trade surveillance market.

Middle East and Africa Trade Surveillance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Software AG

- FIS

- SIA S.P.A.

- Celent, ACA Group.

- Scila AB

- CINNOBER FINANCIAL TECHNOLOGY

- Trapets AB.

- Abel Noser Holdings LLC

- CRISIL LIMITED

- Cognizant, IPC System, Inc.

- Aquis Exchange

- OneMarketData, LLC.

- b-next

- IBM

- Accenture

- Nasdaq, Inc.

Latest Developments in Middle East and Africa Trade Surveillance Market

- In January 2024, Eventus Systems announced its commitment to redefining trade surveillance with client-driven solutions. The company emphasized the importance of customizable technology to meet the unique needs of financial institutions in the MEA region. Eventus highlighted its robust global growth in 2023 and a strong outlook for 2024, aiming to provide scalable and adaptable surveillance platforms to address the evolving regulatory landscape in the region.

- In January 2024, Eviden published insights into the cybersecurity landscape in the MEA region, discussing opportunities and initiatives to enhance digital security. The company emphasized the growing threat landscape and the need for robust cybersecurity measures. Eviden's initiatives focused on leveraging advanced technologies to address new vulnerabilities, aiming to strengthen the security of financial institutions and support the adoption of trade surveillance systems in the region.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.