Middle East And Africa Unmanned Marine Vehicles Market

Market Size in USD Million

CAGR :

%

USD

238.96 Million

USD

528.63 Million

2025

2033

USD

238.96 Million

USD

528.63 Million

2025

2033

| 2026 –2033 | |

| USD 238.96 Million | |

| USD 528.63 Million | |

|

|

|

|

Middle East and Africa Unmanned Marine Vehicles Market Size

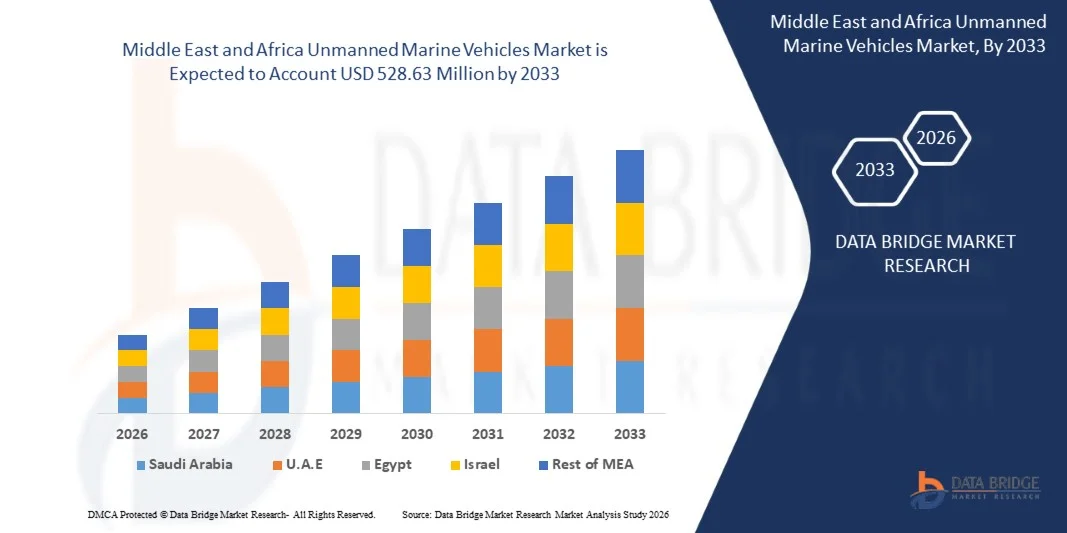

- The Middle East and Africa Unmanned Marine Vehicles Market is expected to reach USD 528.63 Million by 2033 from USD 238.96 Million in 2025, growing with a substantial CAGR of 10.5% in the forecast period of 2026 to 2033

- The Middle East and Africa Unmanned Marine Vehicles Market is witnessing robust growth, driven by increasing industrial operations, rising environmental concerns, and heightened emphasis on worker safety across sectors such as manufacturing, construction, mining, and chemical processing. Additionally, the growing population and intensified focus on disaster preparedness and environmental monitoring continue to accelerate the adoption of unmanned marine solutions for inspection, surveillance, and operational efficiency.

- Market growth is further bolstered by supportive government policies, increased funding for maritime infrastructure, and rising demand from industries requiring precision monitoring and autonomous marine operations. Moreover, cost-efficient production capabilities in countries like Saudi Arabia, U.A.E., Israel, South Africa, Egypt, Qatar, Oman, Kuwait, Bahrain, Rest of Middle East and Africa, along with the expanding presence of regional manufacturers, strengthen the Middle East & Africa region’s competitive position in the global market. Continuous innovation in vehicle autonomy, navigation systems, and sensor technology is also sustaining long-term growth prospects across the region.

Middle East and Africa Unmanned Marine Vehicles Market Analysis

- Unmanned marine vehicles are increasingly critical for operations in challenging and high-risk maritime environments, providing autonomous solutions for inspection, monitoring, and data collection across sectors such as offshore energy, shipping, defense, and environmental research. Their advanced navigation and sensor technologies enable safer, more efficient, and sustainable marine operations.

- Expanding industrial activities, rapid urban development, and stricter workplace safety standards across the Asia-Pacific region are fueling strong demand for unmanned marine vehicles. Sectors such as offshore energy, shipping, defense, and environmental monitoring increasingly depend on these autonomous systems for precise, safe, and efficient maritime operations.

- Additionally, growing emphasis on regulatory compliance, environmental monitoring, and operational safety continues to drive market adoption, particularly for advanced unmanned marine vehicles that offer superior navigation, data collection, and endurance capabilities compared to conventional manned systems.

- Saudi Arabia is projected to lead the Middle East and Africa Unmanned Marine Vehicles Market in 2025, holding a commanding 22.33% market share. This leadership is driven by robust industrial activity, growing construction projects, and increased adoption of safety measures in factories and high-risk work environments. Supportive government initiatives aimed at enhancing workplace safety and reducing environmental impact further strengthen the region’s dominant position.

- The surface unmanned marine vehicles (USV) segment is expected to dominate the Middle East and Africa Unmanned Marine Vehicles Market in 2025, holding a commanding 62.89% market share due to its cost-effectiveness, high bandwidth capability over short distances, and increasing deployment in offshore oil & gas operations, subsea construction, marine research, and underwater inspection tasks where real-time control and high-quality video transmission are critical.

Report Scope and Middle East and Africa Unmanned Marine Vehicles Market Segmentation

|

Attributes |

Middle East and Africa Unmanned Marine Vehicles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East & Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Unmanned Marine Vehicles Market Trends

“Growing Adoption of Unmanned Marine Vehicles Across Global Maritime Operations”

- The rapid expansion of maritime, offshore, and naval activities worldwide is a major factor driving the adoption of unmanned marine vehicles (UMVs). As shipping, offshore exploration, and marine research operations scale up, organizations increasingly rely on UMVs for safe, efficient, and cost-effective deployment in hazardous or hard-to-access marine environments.

- UMVs play a critical role in safeguarding human resources and operational continuity. By performing underwater inspections, surveillance, mapping, and maintenance tasks, these vehicles minimize the risks to personnel while ensuring uninterrupted operations across ports, offshore platforms, naval missions, and scientific research expeditions.

- The increasing use of advanced marine operations such as deep-sea exploration, underwater pipeline monitoring, mine detection, and offshore construction has fueled demand for sophisticated UMVs equipped with high-precision sensors, autonomous navigation systems, and robust communication capabilities. These vehicles enhance operational efficiency, safety, and data accuracy in challenging maritime conditions.

- Countries heavily investing in maritime infrastructure, naval modernization, and offshore development—such as the United States, China, and European nations—are driving UMV deployment. Labor-intensive and high-risk marine operations in these regions increasingly depend on unmanned systems to comply with safety regulations, reduce operational costs, and improve mission reliability.

- Overall, the growing scale of global maritime, offshore, and naval operations positions unmanned marine vehicles as an essential component of modern marine strategy. UMVs support personnel safety, operational efficiency, regulatory compliance, and sustainable expansion of maritime and offshore activities worldwide.

Middle East and Africa Unmanned Marine Vehicles Market Dynamics

Driver

“Increasing Defense Modernization & Naval Surveillance Needs”

- Defense forces across the globe are accelerating programs to modernize naval fleets, strengthen coastal security, and enhance maritime domain awareness. Unmanned Marine Vehicles (UMVs), including Unmanned Surface Vehicles (USVs) and Autonomous Underwater Vehicles (AUVs), are now central to these modernization plans due to their ability to conduct long-endurance missions without risking human life. They support a wide range of tactical and strategic applications, such as intelligence gathering, mine detection, anti-submarine warfare, and persistent surveillance of territorial waters. Rising geopolitical tensions and increasing maritime boundary disputes have further intensified the need for systems that offer real-time situational awareness and rapid threat detection.

- UMVs equipped with advanced sonar, radar, and electro-optical sensors enable militaries to perform complex reconnaissance operations with high precision and minimal operational cost. Their ability to remain undetected, operate in denied environments, and execute missions autonomously is pushing governments to allocate significant budgets toward unmanned maritime systems. Strategic naval collaborations, defense alliances, and increasing investments in indigenous defense technologies are further promoting their adoption. As emerging threats evolve, navies seek technologically advanced platforms capable of adapting quickly to dynamic maritime landscapes

For instance,

- In February 2025, , according to the Naval Sea Systems Command article, the U.S. Navy awarded contracts to expand deployment of advanced Mine Countermeasures Unmanned Surface Vehicles (USVs), ensuring these platforms are more capable in naval operations like minehunting and mine neutralization. This award reflects the Navy’s strategic emphasis on unmanned systems that enhance maritime domain awareness, coastal security, and fleet protection — key aspects of defense modernization.

- As of January 11, 2024, article published by the Naval Sea Systems Command states that the U.S. Navy announced the launch of the Vanguard Unmanned Surface Vessel (OUSV3), built from the keel up for autonomous operation. Vanguard reflects the Pentagon’s investment in unmanned maritime technologies to advance autonomous surveillance, reconnaissance, and integrated naval operations — a key modernization milestone.

- On December 18, 2024, press release published in America’s Navy, the U.S. Navy reported successful completion of a 720-hour propulsion test demonstrating that unmanned surface vessels can operate autonomously and continuously for at least 30 days. This milestone highlights defense efforts to validate endurance and resilience of unmanned platforms, enabling persistent surveillance and extended maritime missions.

- According to the article published on May 20, 2024 in NAVALNEWS, the U.S. Pacific Fleet established Unmanned Surface Vessel Squadron Three (USVRON 3) to expand unmanned platform operations with Global Autonomous Reconnaissance Crafts (GARCs). This initiative reflects organizational and capability expansion within naval forces to integrate unmanned systems into defense operations.

- In conclusion, growing emphasis on defense modernization and maritime security will remain one of the strongest drivers for UMV adoption. Their capability to enhance surveillance, reduce operational risk, and improve mission efficiency makes them indispensable for future naval operations. As countries continue to strengthen their maritime defense posture, demand for autonomous marine vehicles is expected to accelerate, ensuring long-term market growth and sustained strategic relevance in global naval ecosystems.

Restraint/Challenge

“High Procurement and Maintenance Costs”

- UMVs incorporate advanced components such as pressure-resistant hulls, high-powered sonar, autonomy modules, and marine-grade materials, making initial procurement costs relatively high. Their specialized manufacturing processes, rigorous testing, and integration of state-of-the-art electronics significantly increase capital expenditure for end users. These costs are often prohibitive for smaller research institutions, academic organizations, and developing economies, creating disparities in global adoption rates.

- Maintenance expenses also contribute heavily to total ownership costs. Regular system upgrades, battery replacements, corrosion management, sensor recalibration, and mission-specific payload maintenance all require specialized facilities and skilled technicians. Operational logistics like launch and retrieval equipment further add to cost burdens. Without substantial budgets or access to shared infrastructure, stakeholders may limit UMV procurement or rely on less capable alternatives.

For instance,

- As per the news article published on Congress.gov in March 2025, The U.S. Congress Research Service (CRS) report on Large Unmanned Surface and Undersea Vehicles (LUSV/LDUUV) highlights concerns about cost escalation and affordability of unmanned maritime systems. Senior Navy leadership has questioned the “exquisite, expensive” designs of current USV fleets, emphasizing a need to simplify and reduce procurement costs so that mass production becomes feasible underscoring how high unit costs are a barrier to large-scale deployment.

- In September 2025, as per the press releases by SAAB AB, the National Oceanic and Atmospheric Administration (NOAA) awarded Saab a contract worth ~USD 1.7 million for development of a long-range autonomous underwater vehicle (AUV). While this is a smaller research contract, it demonstrates that even government science programs must allocate significant funds for procurement of specialized UMVs due to advanced sensor integration and robust design requirements — reflecting how capital costs for even modest UMV deployments remain high.

- In conclusion, high procurement and lifecycle maintenance costs remain critical barriers to widespread UMV adoption. While technological advancements continue to improve performance, affordability challenges slow market penetration—particularly in cost-sensitive sectors. Reducing manufacturing expenses and expanding leasing or service-based models will be essential for enabling broader global usage.

Middle East and Africa Unmanned Marine Vehicles Market Scope

The Middle East and Africa Unmanned Marine Vehicles Market is segmented into seven notable segments based on the vehicle type, system component, propulsion, application, end user, distribution channel and operation.

By Vehicle type

On the basis of Vehicle type, the Middle East and Africa Unmanned Marine Vehicles Market is segmented into autonomous underwater vehicles (AUV), remotely operated vehicles (ROV), surface unmanned marine vehicles (USV), autonomous surface vehicles (ASV), hybrid systems and others. In 2026 the remotely operated vehicles (ROV) segment is expected to dominate the Middle East and Africa Unmanned Marine Vehicles Market with the market share of 48.06%due to its cost-effectiveness, high bandwidth capability over short distances, and increasing deployment in offshore oil & gas operations, subsea construction, marine research, and underwater inspection tasks where real-time control and high-quality video transmission are critical.

The autonomous surface vehicles (ASV) segment is the fastest growing segment to register a CAGR of 11.2% driven by stricter industrial safety regulations, escalating environmental pollution, expanding construction and manufacturing operations, and continued demand for advanced respiratory protection in emerging Asia-Pacific markets.

By System Component

On the basis of System component, the Middle East and Africa Unmanned Marine Vehicles Market is segmented into sensors & payloads, control systems, launch & recovery systems and others. In 2026 Sensors & Payloads is expected to dominate the Middle East and Africa Unmanned Marine Vehicles Market with the market share of 45.87% due to rapid advancements in marine sensing technologies, increasing need for high-resolution seabed mapping, growth in naval ISR missions, and rising use of multi-mission sonar and camera systems for oceanographic, environmental, and commercial underwater operations.

The control systems segment is the fastest growing segment to grow at a CAGR of 10.7%, supported by ongoing technological advancements, widespread adoption by key manufacturers, benefits from regulatory compliance, and sustained demand across industrial and healthcare applications.

By Propulsion

On the basis of Propulsion, the Middle East and Africa Unmanned Marine Vehicles Market is segmented into diesel engine systems, electric drive systems, battery modules and fuel cell systems. In 2026, the Diesel engine systems segment is anticipated to dominate the Middle East and Africa Unmanned Marine Vehicles Market with the market Share of 46.59% due to its superior endurance, high power output, operational reliability in long-distance missions, and widespread adoption in large AUVs and USVs requiring extended operational ranges for defense patrols, offshore surveys, and deep-water exploration.

The electric drive systems segment is the fastest growing segment to grow at a CAGR of 10.8%, driven by heightened awareness of occupational respiratory risks, escalating exposure to environmental pollution, and the implementation of stricter workplace health and safety regulations across the Asia-Pacific region.

By Application

On the basis of Application, the Middle East and Africa Unmanned Marine Vehicles Market is segmented into defense & security, oil & gas exploration, oceanographic survey, search & rescue, underwater inspection & maintenance, scientific research, commercial shipping and others. In 2026 the Defense & Security segment is anticipated to dominate the Middle East and Africa Unmanned Marine Vehicles Market with the market share of 54.20% due to surging demand for naval modernization, increased focus on mine countermeasures, anti-submarine warfare, maritime surveillance, and the growing need for unmanned systems capable of enhancing situational awareness and reducing human risk in hostile marine environments.

The commercial shipping segment is projected to grow at a CAGR of 11.7%, driven by rapid industrialization, ongoing infrastructure development, stricter enforcement of occupational safety standards, and rising adoption of personal protective equipment (PPE) across developing Asia-Pacific economies.

By End user

On the basis of End user, the Middle East and Africa Unmanned Marine Vehicles Market is segmented into navy, coast guard, research institutes, oil & gas industry, environmental agencies, maritime security organizations, port authorities, salvage & rescue operations and others. In 2026, the Navy segment is anticipated to dominate the Middle East and Africa Unmanned Marine Vehicles Market with the market Share of 52.20% due to the rising adoption of unmanned platforms for ISR missions, increased investments in autonomous maritime capabilities, and the need for cost-effective solutions for persistent surveillance, underwater threat detection, and extended-range operations.

The maritime security organizations (non-navy, non-coast-guard security agencies) segment is the fastest growing segment to grow at a CAGR of 11.3%, driven by a rising preference for long-term supply agreements, optimized logistics, lower intermediary expenses, and increasing demand from large-scale industrial and institutional clients.

By Distribution channel

On the basis of Distribution channel, the Middle East and Africa Unmanned Marine Vehicles Market is segmented into direct sales, Distributors, online platforms and system integrators. In 2026 the Direct Sales segment is anticipated to dominate the Middle East and Africa Unmanned Marine Vehicles Market with the market share of 57.26% due to large-scale procurement programs by defense forces, oil & gas companies, and research organizations that prefer direct manufacturer agreements for customized UMV configurations, long-term service contracts, and greater control over mission-specific system integration.

The system integrators segment is the fastest growing segment to grow at a CAGR of 10.8%, supported by increasing preference for long-term supply contracts, streamlined logistics, reduced intermediary costs, and growing demand from large-scale industrial and institutional buyers

By Operation

On the basis of operation, the Middle East and Africa Unmanned Marine Vehicles Market is segmented into autonomous and remote controlled. In 2026 the Remote Controlled segment is anticipated to dominate the Middle East and Africa Unmanned Marine Vehicles Market with the market share of 64.59% due to the continued preference for operator-guided missions in subsea inspection, repair, rescue operations, and offshore industrial tasks where real-time maneuverability, precision handling, and immediate human decision-making are essential.

The autonomous segment is the fastest growing segment to grow at a CAGR of 10.8%, fueled by increasing preference for long-term supply agreements, streamlined logistics, reduced intermediary costs, and rising demand from large-scale industrial and institutional buyers.

Middle East and Africa Unmanned Marine Vehicles Market Regional Analysis

- Saudi Arabia represents a significant growth market for unmanned marine vehicles, supported by its expansive maritime geography, increasing offshore activities, and sustained investments in port development and naval modernization. The country’s extensive coastline, busy sea lanes, and growing focus on maritime security and offshore monitoring continue to drive steady demand for UMVs across defense, hydrographic surveying, and offshore infrastructure inspection applications.

- U.A.E. is witnessing rising adoption of unmanned marine vehicles as it accelerates development across shipbuilding, offshore energy, and maritime surveillance operations. Expanding port infrastructure, increased emphasis on coastal monitoring, and growing participation in regional maritime trade are encouraging the use of UMVs to enhance operational efficiency, safety, and data accuracy in complex marine environments.

- Israel growing focus on maritime logistics, offshore resource management, and naval capability enhancement is further supporting UMV demand. Ongoing investments in port expansion, coastal infrastructure, and maritime security initiatives are increasing the need for unmanned systems capable of conducting surveillance, inspection, and monitoring tasks, positioning UMVs as critical enablers of safe and modern maritime operation s

Saudi Arabia Middle East and Africa Unmanned Marine Vehicles Market Insight

Saudi Arabia Middle East and Africa Unmanned Marine Vehicles Market is experiencing strong growth, supported by increasing maritime activity, expanding offshore operations, and sustained investments in port infrastructure and naval capability development. Heightened focus on maritime security, offshore asset monitoring, and hydrographic surveying—combined with Indonesia’s extensive coastline and strategic sea lanes—is driving consistent demand for UMVs across defense, offshore energy, and marine research applications, positioning the country as a key market within the Middle East & Africa region.

U.A.E. Middle East and Africa Unmanned Marine Vehicles Market Insight

Canada Middle East and Africa Unmanned Marine Vehicles Market is expanding steadily, driven by rapid development in shipbuilding, offshore energy, and maritime logistics sectors. Growing emphasis on coastal surveillance, underwater inspection, and port modernization—alongside increasing adoption of advanced maritime technologies—is boosting demand for UMVs. The country’s strong orientation toward maritime trade and export-driven growth further reinforces the need for reliable unmanned systems to support safe, efficient, and data-driven marine operations.

Middle East and Africa Unmanned Marine Vehicles Market Share

The unmanned marine vehicles industry is primarily led by well-established companies, including:

- L3Harris Technologies, Inc. (U.S)

- Kongsberg Discovery (Norway)

- Oceaneering International, Inc. (U.S)

- Subsea 7 (Luxembourg)

- BAE Systems (U Kingdom)

- Thales Group (France)

- Fugro (Netherlands)

- Elbit Systems (Israel)

- QinetiQ (U.K.)

- Saab AB (Sweden)

- Teledyne Marine Technologies Incorporated (U.S)

- Edge Autonomy Operations, LLC (U.S)

- Liquid Robotics (A Boeing Company) (U.S)

- Rovco Ltd. (U.K.)

- Bluefin Robotics (U.S)

- Sea Robotics Corporation (U.S)

- Cellula Robotics Ltd (U.K.)

- Chance Maritime Technologies (U.S)

- Deep Ocean Engineering, Inc. (U.S)

- Sea Machines Robotics, Inc. (U.S)

Latest Developments in the Middle East and Africa Unmanned Marine Vehicles Market

- In May 2022, leading marine technology providers expanded their unmanned marine vehicle portfolios by introducing next-generation autonomous and remotely operated platforms designed to support offshore inspection, seabed mapping, and maritime surveillance missions. These launches strengthened suppliers’ capabilities to serve defense, offshore energy, and research applications across Middle East & Africa.

- In October 2025, regional maritime security assessments highlighted rising surveillance requirements across major shipping corridors in the Indo-Pacific, prompting increased deployment of unmanned surface and underwater vehicles for continuous monitoring, threat detection, and situational awareness in high-traffic maritime zones.

- In November 2023, an environmental and maritime infrastructure analysis by an international research organization emphasized that coastal nations in Southeast Asia—such as Indonesia, Thailand, and Vietnam—are increasingly relying on unmanned marine vehicles during periods of heightened maritime congestion and environmental stress to support coastal monitoring, pollution assessment, and underwater inspection activities.

- In November 2024, a regional maritime authority released updated technical guidance for offshore infrastructure inspection and subsea operations, recommending the use of autonomous and remotely operated marine systems to reduce human exposure in hazardous underwater environments, thereby creating opportunities for advanced UMVs in offshore energy and port maintenance applications.

- In March 2025, maritime safety agencies in Australia published revised operational guidelines encouraging the use of unmanned marine vehicles for post-disaster coastal assessment and underwater inspection following cyclones and extreme weather events, reinforcing the role of UMVs in emergency response, environmental assessment, and recovery operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 VEHICLE TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.3 CASE STUDY ANALYSIS

4.3.1 CASE STUDY 1: KONGSBERG MARITIME & THE DEEP-OCEAN RESEARCH CONSORTIUM

4.3.2 CASE STUDY 2: L3HARRIS & THE COASTAL BORDER SURVEILLANCE AUTHORITY

4.3.3 CASE STUDY 3: TELEDYNE MARINE & THE OFFSHORE ENERGY INFRASTRUCTURE OPERATOR

4.3.4 CASE STUDY 4: SAAB & THE NAVAL ANTI-SUBMARINE WARFARE (ASW) TRAINING PROGRAM

4.3.5 CASE STUDY 5: OCEAN INFINITY & THE FLEET-BASED AUTONOMOUS SURVEY MODEL

4.3.6 CONCLUSION

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 RAW MATERIALS

4.4.3 MANUFACTURING, INTEGRATION & TESTING

4.4.4 DISTRIBUTION & LOGISTICS

4.4.5 END USERS

4.5 IMPORT EXPORT SCENARIO

4.6 REGIONAL GROWTH OPPORTUNITIES IN THE MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET

4.6.1 NORTH AMERICA: OPPORTUNITY SHAPED BY MARITIME MODERNIZATION AND ADVANCED OCEAN RESEARCH

4.6.2 EUROPE: OPPORTUNITY DRIVEN BY SUSTAINABILITY, BLUE-ECONOMY STRATEGIES, AND JOINT MARITIME SECURITY EFFORTS

4.7 ASIA-PACIFIC: OPPORTUNITY FUELED BY MARITIME SURVEILLANCE NEEDS AND OFFSHORE ENERGY EXPANSION

4.7.1 MIDDLE EAST & AFRICA: OPPORTUNITY EMERGING FROM COASTAL SECURITY, PORT EXPANSION, AND MARINE ECOLOGY MONITORING

4.7.2 SOUTH AMERICA: OPPORTUNITY INFLUENCED BY FISHERIES CONTROL, OFFSHORE OIL DEVELOPMENT, AND MARINE RESEARCH

4.8 KEY STRATEGIC INITIATIVES BY OEMS IN THE MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET

4.8.1 ADVANCEMENT OF AUTONOMY AND INTELLIGENT NAVIGATION SYSTEMS

4.8.2 COLLABORATIVE DEVELOPMENT AND CROSS-SECTOR PARTNERSHIPS

4.8.3 MODULAR AND SCALABLE DESIGN PHILOSOPHY

4.8.4 EMPHASIS ON SUSTAINABLE MARINE TECHNOLOGY AND LOW-EMISSION OPERATIONS

4.8.5 STRENGTHENING OF AFTER-SALES SUPPORT AND INTEGRATED SERVICE ECOSYSTEMS

4.9 PATENT ANALYSIS – MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET

4.9.1 EVOLVING PATENT TRENDS IN THE UMV SPACE

4.9.2 CORE TECHNOLOGICAL THEMES REFLECTED IN PATENT FILINGS

4.9.3 REPRESENTATIVE PATENTS AND THEIR STRATEGIC MARKET IMPLICATIONS

4.9.4 GEOGRAPHIC AND INSTITUTIONAL PATENT STRENGTH

4.9.5 LONG-TERM STRATEGIC INTERPRETATION FOR MARKET STAKEHOLDERS

4.1 BRAND COMPARISON

4.11 COMPANY VS BRAND OVERVIEW — UNMANNED MARINE VEHICLES

4.12 CONSUMER BUYING BEHAVIOR IN THE MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET

4.12.1 TECHNOLOGICAL SOPHISTICATION

4.12.2 OPERATIONAL EFFICIENCY AND COST-EFFECTIVENESS

4.12.3 BRAND REPUTATION AND TRUST

4.12.4 VERSATILITY AND CUSTOMIZATION

4.12.5 AFTER-SALES SUPPORT AND REGULATORY COMPLIANCE

4.13 COMPANY COMPARATIVE ANALYSIS

5 TARIFFS & IMPACT ON THE MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET

5.1 TARIFF IMPACT ON MANUFACTURING AND EXPORT

6 REGULATORY STANDARDS OF MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET.

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEFENSE MODERNIZATION & NAVAL SURVEILLANCE NEEDS

7.1.2 GROWING OFFSHORE OIL, GAS, AND RENEWABLE ENERGY EXPLORATION

7.1.3 RISING DEMAND FOR OCEANOGRAPHIC AND ENVIRONMENTAL MONITORING

7.1.4 ADVANCEMENTS IN AUTONOMY, AI, AND SENSOR FUSION TECHNOLOGIES

7.2 RESTRAINTS

7.2.1 HIGH PROCUREMENT AND MAINTENANCE COSTS

7.2.2 COMMUNICATION AND CONTROL LIMITATIONS IN DEEP-SEA ENVIRONMENTS

7.3 OPPORTUNITIES

7.3.1 INTEGRATION WITH SMART PORTS AND DIGITAL MARITIME ECOSYSTEMS

7.3.2 GROWING COMMERCIAL APPLICATIONS BEYOND DEFENSE

7.4 CHALLENGES

7.4.1 NAVIGATIONAL SAFETY AND COLLISION AVOIDANCE IN MIXED TRAFFIC

7.4.2 HARSH OCEAN CONDITIONS AFFECTING RELIABILITY AND ENDURANCE

8 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE,

8.1.1 REMOTELY OPERATED VEHICLES (ROV)

8.1.2 AUTONOMOUS UNDERWATER VEHICLES (AUV)

8.1.3 SURFACE UNMANNED MARINE VEHICLES (USV)

8.1.4 AUTONOMOUS SURFACE VEHICLES (ASV)

8.1.5 HYBRID SYSTEMS

8.1.6 OTHERS

8.2 MIDDLE EAST AND AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.2.1 NORTH AMERICA

8.2.2 EUROPE

8.2.3 ASIA-PACIFIC

8.2.4 SOUTH AMERICA

8.2.5 MIDDLE EAST AND AFRICA

8.3 MIDDLE EAST AND AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

8.3.1 SHALLOW WATER ROV

8.3.2 DEEP-WATER ROV

8.3.3 MID-WATER ROV

8.4 MIDDLE EAST AND AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

8.4.1 WORK-CLASS

8.4.2 OBSERVATION-CLASS

8.5 MIDDLE EAST AND AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.5.1 NORTH AMERICA

8.5.2 EUROPE

8.5.3 ASIA-PACIFIC

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST AND AFRICA

8.6 MIDDLE EAST AND AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

8.6.1 MAN-PORTABLE

8.6.2 LIGHT-WEIGHT

8.6.3 HEAVY-WEIGHT

8.6.4 LARGE

8.6.5 ELECTRIC

8.6.6 DIESEL

8.6.7 HYBRID

8.7 MIDDLE EAST AND AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.7.1 NORTH AMERICA

8.7.2 EUROPE

8.7.3 ASIA-PACIFIC

8.7.4 SOUTH AMERICA

8.7.5 MIDDLE EAST AND AFRICA

8.8 MIDDLE EAST AND AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

8.8.1 REMOTE CONTROLLED

8.8.2 AUTONOMOUS

8.9 MIDDLE EAST AND AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

8.9.1 MONOHULL

8.9.2 MULTIHULL (CATAMARAN/TRIMARAN)

8.1 MIDDLE EAST AND AFRICA AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.10.1 NORTH AMERICA

8.10.2 EUROPE

8.10.3 ASIA-PACIFIC

8.10.4 SOUTH AMERICA

8.10.5 MIDDLE EAST AND AFRICA

8.11 MIDDLE EAST AND AFRICA AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

8.11.1 HYDROGRAPHIC SURVEY

8.11.2 INTELLIGENCE, SURVEILLANCE & RECONNAISSANCE (ISR)

8.11.3 ENVIRONMENTAL MONITORING

8.11.4 ANTI-SUBMARINE WARFARE (ASW)

8.12 MIDDLE EAST AND AFRICA HYBRID SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 NORTH AMERICA

8.12.2 EUROPE

8.12.3 ASIA-PACIFIC

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST AND AFRICA

8.13 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.13.1 NORTH AMERICA

8.13.2 EUROPE

8.13.3 ASIA-PACIFIC

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST AND AFRICA

9 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

9.1 OVERVIEW

9.1.1 SENSORS & PAYLOADS

9.1.2 CONTROL SYSTEMS

9.1.3 LAUNCH & RECOVERY SYSTEMS

9.1.4 OTHERS

9.2 MIDDLE EAST AND AFRICA SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.2.1 NORTH AMERICA

9.2.2 EUROPE

9.2.3 ASIA-PACIFIC

9.2.4 SOUTH AMERICA

9.2.5 MIDDLE EAST AND AFRICA

9.3 MIDDLE EAST AND AFRICA SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 SONAR SYSTEMS

9.3.2 COMMUNICATION SYSTEMS

9.3.3 CAMERA SYSTEMS

9.3.4 GPS & NAVIGATION MODULES

9.4 MIDDLE EAST AND AFRICA SONAR SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 MULTIBEAM SONAR

9.4.2 SIDE-SCAN SONAR

9.4.3 1.21.4 SUB-BOTTOM PROFILERS

9.5 MIDDLE EAST AND AFRICA CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.5.1 NORTH AMERICA

9.5.2 EUROPE

9.5.3 ASIA-PACIFIC

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST AND AFRICA

9.6 MIDDLE EAST AND AFRICA CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.6.1 REMOTE CONTROL MODULES

9.6.2 AUTONOMOUS CONTROL SOFTWARE

9.7 MIDDLE EAST AND AFRICA LAUNCH & RECOVERY SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 NORTH AMERICA

9.7.2 EUROPE

9.7.3 ASIA-PACIFIC

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST AND AFRICA

9.8 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 NORTH AMERICA

9.8.2 EUROPE

9.8.3 ASIA-PACIFIC

9.8.4 SOUTH AMERICA

9.8.5 MIDDLE EAST AND AFRICA

10 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

10.1 OVERVIEW

10.1.1 DIESEL ENGINE SYSTEMS

10.1.2 ELECTRIC DRIVE SYSTEMS

10.1.3 BATTERY MODULES

10.1.4 FUEL CELL SYSTEMS

10.2 MIDDLE EAST AND AFRICA DIESEL ENGINE SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.2.1 NORTH AMERICA

10.2.2 EUROPE

10.2.3 ASIA-PACIFIC

10.2.4 SOUTH AMERICA

10.2.5 MIDDLE EAST AND AFRICA

10.3 MIDDLE EAST AND AFRICA ELECTRIC DRIVE SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.3.1 NORTH AMERICA

10.3.2 EUROPE

10.3.3 ASIA-PACIFIC

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST AND AFRICA

10.4 MIDDLE EAST AND AFRICA BATTERY MODULES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.4.1 NORTH AMERICA

10.4.2 EUROPE

10.4.3 ASIA-PACIFIC

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST AND AFRICA

10.5 MIDDLE EAST AND AFRICA FUEL CELL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.5.1 NORTH AMERICA

10.5.2 EUROPE

10.5.3 ASIA-PACIFIC

10.5.4 SOUTH AMERICA

10.5.5 MIDDLE EAST AND AFRICA

11 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.1 OVERVIEW

11.1.1 DEFENSE & SECURITY

11.1.2 OIL & GAS EXPLORATION

11.1.3 UNDERWATER INSPECTION & MAINTENANCE

11.1.4 OCEANOGRAPHIC SURVEY

11.1.5 SCIENTIFIC RESEARCH

11.1.6 COMMERCIAL SHIPPING

11.1.7 SEARCH & RESCUE

11.1.8 OTHERS

11.2 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.2.1 NORTH AMERICA

11.2.2 EUROPE

11.2.3 ASIA-PACIFIC

11.2.4 SOUTH AMERICA

11.2.5 MIDDLE EAST AND AFRICA

11.3 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 INTELLIGENCE, SURVEILLANCE & RECONNAISSANCE

11.3.2 MINE COUNTERMEASURES

11.3.3 ANTI-SUBMARINE WARFARE

11.3.4 MARITIME PATROL

11.4 MIDDLE EAST AND AFRICA OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.4.1 NORTH AMERICA

11.4.2 EUROPE

11.4.3 ASIA-PACIFIC

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST AND AFRICA

11.5 MIDDLE EAST AND AFRICA OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 PIPELINE INSPECTION

11.5.2 OFFSHORE RIG MONITORING

11.6 MIDDLE EAST AND AFRICA UNDERWATER INSPECTION & MAINTENANCE IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.6.1 NORTH AMERICA

11.6.2 EUROPE

11.6.3 ASIA-PACIFIC

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST AND AFRICA

11.7 MIDDLE EAST AND AFRICA OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.7.1 NORTH AMERICA

11.7.2 EUROPE

11.7.3 ASIA-PACIFIC

11.7.4 SOUTH AMERICA

11.7.5 MIDDLE EAST AND AFRICA

11.8 MIDDLE EAST AND AFRICA OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 HYDROGRAPHIC MAPPING

11.8.2 ENVIRONMENTAL MONITORING

11.9 MIDDLE EAST AND AFRICA SCIENTIFIC RESEARCH IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.9.1 NORTH AMERICA

11.9.2 EUROPE

11.9.3 ASIA-PACIFIC

11.9.4 SOUTH AMERICA

11.9.5 MIDDLE EAST AND AFRICA

11.1 MIDDLE EAST AND AFRICA COMMERCIAL SHIPPING IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 NORTH AMERICA

11.10.2 EUROPE

11.10.3 ASIA-PACIFIC

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST AND AFRICA

11.11 MIDDLE EAST AND AFRICA SEARCH & RESCUE IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.11.1 NORTH AMERICA

11.11.2 EUROPE

11.11.3 ASIA-PACIFIC

11.11.4 SOUTH AMERICA

11.11.5 MIDDLE EAST AND AFRICA

11.12 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 NORTH AMERICA

11.12.2 EUROPE

11.12.3 ASIA-PACIFIC

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

12.1 OVERVIEW

12.1.1 NAVY

12.1.2 OIL & GAS INDUSTRY

12.1.3 RESEARCH INSTITUTES

12.1.4 MARITIME SECURITY ORGANIZATIONS (NON-NAVY, NON-COAST-GUARD SECURITY AGENCIES)

12.1.5 COAST GUARD

12.1.6 ENVIRONMENTAL AGENCIES

12.1.7 PORT AUTHORITIES

12.1.8 SALVAGE & RESCUE OPERATIONS

12.1.9 OTHERS

12.2 MIDDLE EAST AND AFRICA NAVY IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.2.1 NORTH AMERICA

12.2.2 EUROPE

12.2.3 ASIA-PACIFIC

12.2.4 SOUTH AMERICA

12.2.5 MIDDLE EAST AND AFRICA

12.3 MIDDLE EAST AND AFRICA OIL & GAS INDUSTRY IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.3.1 NORTH AMERICA

12.3.2 EUROPE

12.3.3 ASIA-PACIFIC

12.3.4 SOUTH AMERICA

12.3.5 MIDDLE EAST AND AFRICA

12.4 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.4.1 NORTH AMERICA

12.4.2 EUROPE

12.4.3 ASIA-PACIFIC

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST AND AFRICA

12.5 MIDDLE EAST AND AFRICA MARITIME SECURITY ORGANIZATIONS (NON-NAVY, NON-COAST-GUARD SECURITY AGENCIES) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 NORTH AMERICA

12.5.2 EUROPE

12.5.3 ASIA-PACIFIC

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST AND AFRICA

12.6 MIDDLE EAST AND AFRICA COAST GUARD IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.6.1 NORTH AMERICA

12.6.2 EUROPE

12.6.3 ASIA-PACIFIC

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST AND AFRICA

12.7 MIDDLE EAST AND AFRICA ENVIRONMENTAL AGENCIES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 NORTH AMERICA

12.7.2 EUROPE

12.7.3 ASIA-PACIFIC

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST AND AFRICA

12.8 MIDDLE EAST AND AFRICA PORT AUTHORITIES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.8.1 NORTH AMERICA

12.8.2 EUROPE

12.8.3 ASIA-PACIFIC

12.8.4 SOUTH AMERICA

12.8.5 MIDDLE EAST AND AFRICA

12.9 MIDDLE EAST AND AFRICA SALVAGE & RESCUE OPERATIONS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.9.1 NORTH AMERICA

12.9.2 EUROPE

12.9.3 ASIA-PACIFIC

12.9.4 SOUTH AMERICA

12.9.5 MIDDLE EAST AND AFRICA

12.1 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 NORTH AMERICA

12.10.2 EUROPE

12.10.3 ASIA-PACIFIC

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

13.1 OVERVIEW

13.1.1 DIRECT SALES

13.1.2 SYSTEM INTEGRATORS

13.1.3 DISTRIBUTORS

13.1.4 ONLINE PLATFORMS

13.2 MIDDLE EAST AND AFRICA DIRECT SALES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.2.1 NORTH AMERICA

13.2.2 EUROPE

13.2.3 ASIA-PACIFIC

13.2.4 SOUTH AMERICA

13.2.5 MIDDLE EAST AND AFRICA

13.3 MIDDLE EAST AND AFRICA SYSTEM INTEGRATORS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.3.1 NORTH AMERICA

13.3.2 EUROPE

13.3.3 ASIA-PACIFIC

13.3.4 SOUTH AMERICA

13.3.5 MIDDLE EAST AND AFRICA

13.4 MIDDLE EAST AND AFRICA DISTRIBUTORS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 NORTH AMERICA

13.4.2 EUROPE

13.4.3 ASIA-PACIFIC

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST AND AFRICA

13.5 MIDDLE EAST AND AFRICA ONLINE PLATFORMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 NORTH AMERICA

13.5.2 EUROPE

13.5.3 ASIA-PACIFIC

13.5.4 SOUTH AMERICA

13.5.5 MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

14.1 OVERVIEW

14.1.1 REMOTE CONTROLLED

14.1.2 AUTONOMOUS

14.2 MIDDLE EAST AND AFRICA REMOTE CONTROLLED IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.2.1 NORTH AMERICA

14.2.2 EUROPE

14.2.3 ASIA-PACIFIC

14.2.4 SOUTH AMERICA

14.2.5 MIDDLE EAST AND AFRICA

14.3 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

14.3.1 NORTH AMERICA

14.3.2 EUROPE

14.3.3 ASIA-PACIFIC

14.3.4 SOUTH AMERICA

14.3.5 MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SAUDI ARABIA

15.1.2 UNITED ARAB EMIRATES

15.1.3 ISRAEL

15.1.4 SOUTH AFRICA

15.1.5 EGYPT

15.1.6 QATAR

15.1.7 OMAN

15.1.8 KUWAIT

15.1.9 BAHRAIN

15.1.10 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET: COMPANY LANDSCAPE

16.1 MANUFACTURER COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 L3HARRIS TECHNOLOGIES, INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 KONGSBERG DISCOVERY

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 OCEANEERING INTERNATIONAL,INC

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 SERVICE PORTFOLIO

18.3.5 RECENT DEVELOPMENT

18.4 SUBSEA 7

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 SERVICE PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 BAE SYSTEM

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ASV MOG (MARINE OPERATIONS GROUP)

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BLUEFIN ROBOTICS

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT/SERVICE PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 CELLULA ROBOTICS LTD

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 CHANCE MARITIME TECHNOLOGIES

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 DEEP OCEAN ENGINEERING, INC..

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 ELBIT SYSTEMS

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVEOPMEN

18.12 EXIAL TECHNOLOGIES

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT/SERVICE PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 FUGRO

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 GENERAL DYNAMICS MISSION SYSTEMS

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 LIQUID ROBOTICS (A BOEING COMPANY)

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 MAPMARINE TECHNOLOGIES

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MARITIME ROBOTICS

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT/SERVICE PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 OCEANALPHA

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 QINETIQ

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT/SERVICE PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 ROVCO LTD.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SAAB AB

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SEA MACHINES ROBOTICS, INC.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 SONARDYNE INTERNATIONAL LTD.

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT/SERVICE PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 SEA ROBOTICS CORPORATION

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 SEA-KIT INTERNATIONAL

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 SUBSEA TECH

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 TELEDYNE MARINE TECHNOLOGIES INCORPORATED.

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 THALES GROUP

18.28.1 COMPANY SNAPSHOT

18.28.2 REVENUE ANALYSIS

18.28.3 PRODUCT PORTFOLIO

18.28.4 RECENT DEVELOPMENT

18.29 TKMS (ATLAS ELEKTRONIK)

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

18.3 VARD AS

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 REGIONAL GROWTH OPPORTUNITIES IN THE MIDDLE EAST AND AFRICA UMV MARKET

TABLE 2 REGIONAL RESTRAINTS, KEY INITIATIVES, AND FUTURE INVESTMENT HOTSPOTS – MIDDLE EAST AND AFRICA UMV MARKET

TABLE 3 BRAND COMPARISON

TABLE 4 COMPANY VS BRAND OVERVIEW — UNMANNED MARINE VEHICLES

TABLE 5 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 7 MIDDLE EAST AND AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA HYBRID SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 22 MIDDLE EAST AND AFRICA SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA SONAR SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA LAUNCH & RECOVERY SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (UNITS)

TABLE 31 MIDDLE EAST AND AFRICA DIESEL ENGINE SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ELECTRIC DRIVE SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA BATTERY MODULES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA FUEL CELL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 37 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA UNDERWATER INSPECTION & MAINTENANCE IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA SCIENTIFIC RESEARCH IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA COMMERCIAL SHIPPING IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA SEARCH & RESCUE IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 50 MIDDLE EAST AND AFRICA NAVY IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA OIL & GAS INDUSTRY IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA RESEARCH INSTITUTES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA MARITIME SECURITY ORGANIZATIONS (NON-NAVY, NON-COAST-GUARD SECURITY AGENCIES) IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA COAST GUARD IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA ENVIRONMENTAL AGENCIES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PORT AUTHORITIES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA SALVAGE & RESCUE OPERATIONS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA OTHERS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (UNITS)

TABLE 61 MIDDLE EAST AND AFRICA DIRECT SALES IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA SYSTEM INTEGRATORS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA DISTRIBUTORS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA ONLINE PLATFORMS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (UNITS)

TABLE 67 MIDDLE EAST AND AFRICA REMOTE CONTROLLED IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA AUTONOMOUS IN UNMANNED MARINE VEHICLES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 REGION

TABLE 70 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY COUNTRY, 2018-2033 (UNITS)

TABLE 72 USD MILLION

TABLE 73 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 75 MIDDLE EAST AND AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 84 MIDDLE EAST AND AFRICA SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA SONAR SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (UNITS)

TABLE 89 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 91 MIDDLE EAST AND AFRICA DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 MIDDLE EAST AND AFRICA OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 95 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 96 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 97 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (UNITS)

TABLE 98 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 99 MIDDLE EAST AND AFRICA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (UNITS)

TABLE 100 USD MILLION

TABLE 101 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 103 SAUDI ARABIA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

TABLE 104 SAUDI ARABIA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 SAUDI ARABIA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 106 SAUDI ARABIA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 107 SAUDI ARABIA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 108 SAUDI ARABIA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 SAUDI ARABIA AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 110 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 111 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 112 SAUDI ARABIA SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 SAUDI ARABIA SONAR SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 SAUDI ARABIA CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 116 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (UNITS)

TABLE 117 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 118 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 119 SAUDI ARABIA DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 SAUDI ARABIA OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 SAUDI ARABIA OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 123 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 124 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 125 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (UNITS)

TABLE 126 SAUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 127 AUDI ARABIA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (UNITS)

TABLE 128 USD MILLION

TABLE 129 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 131 UNITED ARAB EMIRATES REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

TABLE 132 UNITED ARAB EMIRATES REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 UNITED ARAB EMIRATES AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 134 UNITED ARAB EMIRATES AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 135 UNITED ARAB EMIRATES SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 136 UNITED ARAB EMIRATES SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 UNITED ARAB EMIRATES AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 138 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 139 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 140 UNITED ARAB EMIRATES SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 UNITED ARAB EMIRATES SONAR SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 UNITED ARAB EMIRATES CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 144 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (UNITS)

TABLE 145 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 146 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 147 UNITED ARAB EMIRATES DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 UNITED ARAB EMIRATES OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 UNITED ARAB EMIRATES OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 151 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 152 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 153 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (UNITS)

TABLE 154 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 155 UNITED ARAB EMIRATES UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (UNITS)

TABLE 156 USD MILLION

TABLE 157 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 159 ISRAEL REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

TABLE 160 ISRAEL REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 ISRAEL AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 162 ISRAEL AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 163 ISRAEL SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 164 ISRAEL SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 ISRAEL AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 166 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 167 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 168 ISRAEL SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 ISRAEL SONAR SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 ISRAEL CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 172 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (UNITS)

TABLE 173 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 174 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 175 ISRAEL DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 ISRAEL OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 ISRAEL OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 179 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 180 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 181 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (UNITS)

TABLE 182 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 183 ISRAEL UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (UNITS)

TABLE 184 USD MILLION

TABLE 185 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 187 SOUTH AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

TABLE 188 SOUTH AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 SOUTH AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 190 SOUTH AFRICA AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 191 SOUTH AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 192 SOUTH AFRICA SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 SOUTH AFRICA AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 194 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 195 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 196 SOUTH AFRICA SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 SOUTH AFRICA SONAR SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 SOUTH AFRICA CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 200 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (UNITS)

TABLE 201 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 202 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 203 SOUTH AFRICA DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 SOUTH AFRICA OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 SOUTH AFRICA OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 207 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 208 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 209 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (UNITS)

TABLE 210 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 211 SOUTH AFRICA UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (UNITS)

TABLE 212 USD MILLION

TABLE 213 EGYPT UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 EGYPT UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 215 EGYPT REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

TABLE 216 EGYPT REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 EGYPT AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 218 EGYPT AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 219 EGYPT SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 220 EGYPT SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 EGYPT AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 222 EGYPT UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 223 EGYPT UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)

TABLE 224 EGYPT SENSORS & PAYLOADS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 EGYPT SONAR SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 EGYPT CONTROL SYSTEMS IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 227 EGYPT UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 228 EGYPT UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (UNITS)

TABLE 229 EGYPT UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 230 EGYPT UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (UNITS)

TABLE 231 EGYPT DEFENSE & SECURITY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 EGYPT OIL & GAS EXPLORATION IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 EGYPT OCEANOGRAPHIC SURVEY IN UNMANNED MARINE VEHICLES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 EGYPT UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 235 EGYPT UNMANNED MARINE VEHICLES MARKET, BY END USER, 2018-2033 (UNITS)

TABLE 236 EGYPT UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 237 EGYPT UNMANNED MARINE VEHICLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (UNITS)

TABLE 238 EGYPT UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 239 EGYPT UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (UNITS)

TABLE 240 USD MILLION

TABLE 241 QATAR UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 QATAR UNMANNED MARINE VEHICLES MARKET, BY VEHICLE TYPE, 2018-2033 (UNITS)

TABLE 243 QATAR REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY DEPTH RATING, 2018-2033 (USD THOUSAND)

TABLE 244 QATAR REMOTELY OPERATED VEHICLES (ROV) IN UNMANNED MARINE VEHICLES MARKET, BY TASK TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 QATAR AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 246 QATAR AUTONOMOUS UNDERWATER VEHICLES (AUV) IN UNMANNED MARINE VEHICLES MARKET, BY PROPULSION, 2018-2033 (USD THOUSAND)

TABLE 247 QATAR SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 248 QATAR SURFACE UNMANNED MARINE VEHICLES (USV) IN UNMANNED MARINE VEHICLES MARKET, BY HULL TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 QATAR AUTONOMOUS SURFACE VEHICLES (ASV) IN UNMANNED MARINE VEHICLES MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 250 QATAR UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 251 QATAR UNMANNED MARINE VEHICLES MARKET, BY SYSTEM COMPONENT, 2018-2033 (UNITS)