Middle East And Africa Usage Based Insurance Market

Market Size in USD Billion

CAGR :

%

USD

2.12 Billion

USD

6.01 Billion

2024

2032

USD

2.12 Billion

USD

6.01 Billion

2024

2032

| 2025 –2032 | |

| USD 2.12 Billion | |

| USD 6.01 Billion | |

|

|

|

|

Middle East and Africa Usage-Based Insurance Market Size

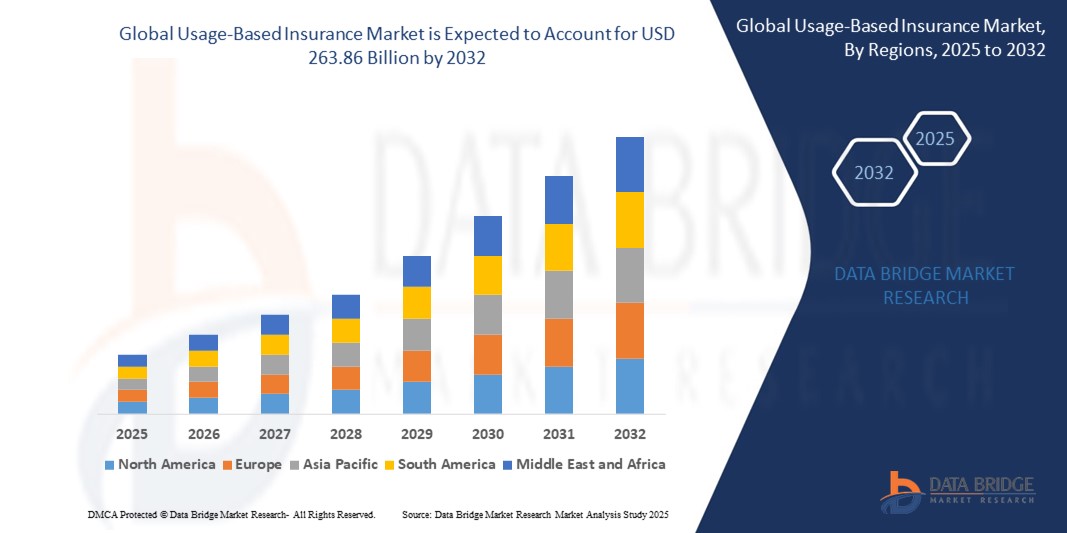

- The Middle East and Africa Usage-Based Insurance Market size was valued at USD 2.12 billion in 2024 and is expected to reach USD 6.01 billion by 2032, at a CAGR of 13.90% during the forecast period

- This growth is driven by factors such as the cheap insurance premium in comparison to the regular insurance premiums and stringent government regulations on telematics

Middle East and Africa Usage-Based Insurance Market Analysis

- Usage-Based Insurance (UBI) is transforming the auto insurance landscape by leveraging telematics, GPS tracking, and real time driving data to offer personalized premiums based on actual driving behavior. This model promotes safer driving habits, improves risk assessment for insurers, and provides cost-saving opportunities for consumers.

- Market growth in Middle East and Africa is driven by the widespread adoption of telematics devices, increasing penetration of connected vehicles, and growing consumer demand for fair and transparent insurance pricing. Rising concerns about reckless driving and accident reduction have further encouraged UBI adoption.

- UAE is expected to dominate the Middle East and Africa Usage-Based Insurance market, supported by mature automotive and insurance sectors, favorable regulatory frameworks, and strong partnerships between insurers and telematics providers.

- Saudi Arabia is emerging as a fast-growing UBI market, fueled by insurance innovation, increasing interest in pay-as-you-drive and pay-how-you-drive models, and government support for connected vehicle infrastructure.

- The Pay-How-You-Drive (PHYD) segment holds the largest market share of 46.87%, driven by insurers’ emphasis on behavioural-based pricing and increasing consumer acceptance of sharing driving data for premium discounts and safety feedback.

Report Scope and Middle East and Africa Usage-Based Insurance Market Segmentation

|

Attributes |

Middle East and Africa Usage-Based Insurance Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Usage-Based Insurance Market Trends

“Integration of AI, Telematics, and Vehicle Connectivity in UBI Programs”

- A major trend reshaping the Middle East and African UBI market is the growing integration of artificial intelligence (AI), telematics, and advanced vehicle connectivity to deliver real-time insights into driver behavior, risk assessment, and personalized pricing.

- These technologies enable insurers to offer dynamic policies such as Pay-How-You-Drive (PHYD) and Pay-As-You-Drive (PAYD), which reward safer driving habits and help reduce accident rates.

For Instance:

- In December 2024, Allstate enhanced its Drive wise program by integrating AI-powered crash detection and personalized driving tips via mobile apps, significantly improving user engagement and policyholder retention.

- The trend toward connected vehicles and smartphone-based telematics is expanding UBI accessibility, especially among younger, tech-savvy drivers.

Usage-Based Insurance Market Dynamics

Driver

“Rising Demand for Fair and Personalized Auto Insurance Premiums”

- One of the main drivers of UBI growth in Middle East and Africa is the rising consumer demand for insurance products that reflect actual driving behavior rather than static demographic risk profiles.

- UBI allows policyholders to lower their premiums by demonstrating safe driving, making it especially attractive for young drivers, urban commuters, and low-mileage users.

For instance:

- In July 2024, Progressive Insurance reported a 20% increase in enrollment in its Snapshot program, driven by consumer demand for data-driven, cost effective auto insurance solutions.

- Insurers are leveraging UBI to improve risk modeling, reduce fraudulent claims, and enhance customer retention through transparent pricing.

Opportunity

“Expansion of UBI Through Smartphone-Based Telematics and Embedded OEM Platforms”

- The increasing use of smartphone sensors and embedded OEM telematics systems presents a major opportunity for UBI program expansion across Middle East and Africa.

- These platforms lower the barriers to entry for both insurers and consumers, eliminating the need for plug-in devices and enabling real-time driver feedback.

For instance:

- In January 2025, Liberty Mutual partnered with Ford Motor Company to integrate UBI features directly into Ford’s connected vehicle platform, allowing drivers to opt in to usage based discounts seamlessly through their infotainment system.

- As automakers continue to roll out connected vehicle models, insurers can scale UBI programs more efficiently and enhance underwriting accuracy.

Restraint/Challenge

“Privacy Concerns and Regulatory Ambiguity in Telematics Data Use”

- A significant challenge in the Middle East and Africa UBI market is the ongoing concern around user data privacy, transparency, and consent in telematics-based policies.

- Consumers often hesitate to enroll in UBI programs due to fears of constant surveillance, unclear data ownership, or potential misuse of driving data.

For Instance:

- In October 2024, a class action lawsuit was filed in California against a regional insurer over alleged unauthorized use of telematics data for non-pricing decisions, sparking debate on telematics regulation.

- Additionally, the lack of standardized data privacy laws across UAE states and Saudi Arabia complicates insurer compliance and hinders broader adoption of UBI offerings. While not halting growth, these factors create barriers to trust and user participation

Usage-Based Insurance Market Scope

The market is segmented on the basis of Vehicle Type, Package Type, Device Offering, Technology, Vehicle Age, Electric and Hybrid Vehicle Type

|

Segmentation |

Sub-Segmentation |

|

By Vehicle Type |

|

|

By Package Type

|

|

|

By Device Offering

|

|

|

By Technology

|

|

|

By Vehicle Age

|

|

|

By Electric and Hybrid Vehicle Type

|

|

In 2025, the Pay-How-You-Drive (PHYD) is projected to dominate the market with a largest share in Package Type segment

The Pay-How-You-Drive (PHYD) segment is expected to dominate the Middle East and Africa UBI market with 46.87% in 2025, owing to its ability to provide highly personalized premiums based on individual driving behavior. Insurers favor PHYD models for their accuracy in risk assessment, while consumers benefit from lower premiums by demonstrating safe driving habits. The increasing adoption of telematics-enabled vehicles and mobile-based monitoring solutions is accelerating this segment’s growth, especially among younger and urban drivers looking for flexible insurance options.

The passenger car is expected to account for the largest share during the forecast period in Vehicle Type segment

In 2025, the passenger car segment is expected to dominate the market with the largest market share of 45.33% due to the high penetration of private car ownership and increasing consumer awareness of personalized insurance plans. The rise in smartphone-based UBI applications and connected car features is making it easier for individual drivers to participate in usage based policies, leading to greater adoption in this segment compared to commercial vehicles or heavy-duty fleets.

Usage-Based Insurance Market Regional Analysis

“UAE Holds the Largest Share in the Usage-Based Insurance Market”

- The UAE is the dominant country within Middle East and Africa, accounting for the largest share due to its well established automotive and insurance industries.

- Major insurers such as Progressive, Allstate, and State Farm have significantly expanded their UBI offerings through smartphone-based apps and plug in devices. The growing use of IoT, AI, and real-time driving analytics is enabling insurers to offer dynamic pricing models, improve risk assessment, and enhance customer engagement.

- Additionally, UAE drivers have shown strong interest in pay-as-you-drive and pay-how-you-drive policies, especially among tech savvy millennials and cost-conscious consumers seeking lower premiums through safe driving behavior.

“Saudi Arabia is Projected to Register the Highest CAGR in the Usage-Based Insurance Market”

- Saudi Arabia is also witnessing steady growth in UBI adoption, supported by increasing consumer awareness, expansion of connected car services, and insurer initiatives targeting younger drivers. Saudi Arabia insurers are piloting incentive-based programs and leveraging smartphone telematics to gain a competitive edge.

- The region's overall growth is reinforced by the expanding use of data analytics, rising vehicle connectivity, and a shift toward digital insurance models, positioning Middle East and Africa as a global leader in usage based insurance innovation.

Usage-Based Insurance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cambridge Mobile Telematics (U.S.)

- insurethebox (U.K.)

- Progressive Casualty Insurance Company (U.S.)

- Modus Group, LLC.(U.S.)

- Inseego Corp. (U.S.)

- Lemonade Inc. Metromile (U.S.)

- The Floow Limited (U.K.)

- Allstate Insurance Company (U.S.)

- Octo Group S.p.A (Italy)

- TomTom International BV. (Netherlands)

- UNIPOLSAI ASSICURAZIONI S.P.A. (Italy)

- Liberty Mutual Insurance (U.S.)

- Equitable Holdings, Inc.(Italy)

- MAPFRE (Spain)

- Sierra Wireless (Canada)

- Verizon (U.S.)

- Allianz Partners (Germany)

Latest Developments in Middle East and Africa Usage-Based Insurance Market

- In March 2025, Progressive Corporation launched Snapshot Pro, a UBI program tailored for small and medium-sized commercial fleets in Middle East and Africa. This program leverages telematics to monitor driving behaviors such as speed, braking patterns, and idle times. Fleet operators receive real-time feedback and potential premium discounts based on driving performance. Snapshot Pro aims to enhance safety, reduce operational costs, and provide more personalized insurance solutions for commercial vehicle operators.

- In March 2025, Munich Re, through its primary insurance arm Ergo, announced the acquisition of the remaining 71% stake in Next Insurance, valuing the U.S.-based digital insurer at USD 2.6 billion. Next Insurance specializes in providing tailored insurance solutions for small businesses, utilizing data analytics and digital platforms. This acquisition strengthens Munich Re's presence in the U.S. market and underscores the growing importance of digital and usage-based insurance models in the small business sector.

- In February 2025, Inmarsat, a global satellite communication provider, entered into a strategic partnership with Petrofac, a leading oilfield services company, to deliver advanced communication solutions for remote oilfield operations. The collaboration focuses on deploying Inmarsat's Global Xpress (GX) network to enable high-speed, secure communications in offshore and onshore oilfields. This partnership aims to improve real-time collaboration, asset management, and operational efficiency for Petrofac’s oil and gas projects.

- In April 2025, Octo Telematics announced significant enhancements to its UBI analytics platform, incorporating advanced machine learning algorithms to better assess driver behavior and risk profiles. The updated platform offers insurers more accurate risk assessments, enabling more personalized premium pricing. These innovations aim to improve customer engagement and retention by providing drivers with detailed feedback and incentives for safe driving habits.

- In May 2025, Hub International, a leading insurance brokerage, secured a USD 1.6 billion minority investment, elevating its valuation to USD 29 billion. This capital infusion is intended to support Hub's strategic acquisitions and expansion into emerging insurance markets, including usage based insurance. The investment reflects growing investor confidence in the scalability and profitability of UBI models within the broader insurance industry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY FRAMEWORK

5.3 TECHNOLOGICAL TRENDS

5.4 CASE STUDY

5.5 VALUE CHAIN ANALYSIS

5.6 COMPANY COMPARITIVE ANALYSIS

5.7 PATENT ANALYSIS

5.8 TOP WINNING STRATEGIES

6 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 EMBEDDED SYSTEM

6.3 ON-BOARD DIAGNOSTICS (OBD-II)

6.4 SMARTPHONE

6.5 BLACK BOX

6.6 OTHERS

7 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY PACKAGE TYPE

7.1 OVERVIEW

7.2 PAY-HOW-YOU-DRIVE (PHYD)

7.3 PAY-AS-YOU-DRIVE (PAYD)

7.4 MANAGE-HOW-YOU-DRIVE (MHYD)

8 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY VEHICLE AGE

8.1 OVERVIEW

8.2 NEW VEHICLES

8.3 OLD VEHICLES

9 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 SMALL SCALE ORGANIZATIONS

9.3 MEDIUM SCALE ORGANIZATIONS

9.4 LARGE SCALE ORGANIZATIONS

10 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY FUNCTIONALITY

10.1 OVERVIEW

10.2 DISCOUNTED PREMIUMS/REWARDS

10.3 GEOFENCING

10.4 ACCIDENT INVESTIGATIONS

10.5 FRAUD REDUCTION

10.6 AUTOMATED CLAIMS MANAGEMENT

10.7 CLAIM COST MINIMIZATION

11 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY DEVICE OFFERING

11.1 OVERVIEW

11.2 BRING YOUR OWN DEVICE (BYOD)

11.3 COMPANY PROVIDED

12 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY END-USER

12.1 OVERVIEW

12.2 PASSENGER CARS

12.2.1 COMPACT CARS

12.2.1.1. .BY TECHNOLOGY

12.2.1.1.1. .EMBEDDED SYSTEM

12.2.1.1.2. .OBD-II

12.2.1.1.3. .SMARTPHONE

12.2.1.1.4. .BLACK BOX

12.2.1.1.5. .OTHERS

12.2.2 SEDAN CARS

12.2.2.1. .BY TECHNOLOGY

12.2.2.1.1. .EMBEDDED SYSTEM

12.2.2.1.2. .OBD-II

12.2.2.1.3. .SMARTPHONE

12.2.2.1.4. .BLACK BOX

12.2.2.1.5. .OTHERS

12.2.3 SUVS

12.2.3.1. .BY TECHNOLOGY

12.2.3.1.1. .EMBEDDED SYSTEM

12.2.3.1.2. .OBD-II

12.2.3.1.3. .SMARTPHONE

12.2.3.1.4. .BLACK BOX

12.2.3.1.5. .OTHERS

12.3 LIGHT-DUTY COMMERCIAL VEHICLES

12.3.1 PICK UP TRUCKS

12.3.1.1. .BY TECHNOLOGY

12.3.1.1.1. .EMBEDDED SYSTEM

12.3.1.1.2. .OBD-II

12.3.1.1.3. .SMARTPHONE

12.3.1.1.4. .BLACK BOX

12.3.1.1.5. .OTHERS

12.3.2 VANS/MINIVANS

12.3.2.1. .BY TECHNOLOGY

12.3.2.1.1. .EMBEDDED SYSTEM

12.3.2.1.2. .OBD-II

12.3.2.1.3. .SMARTPHONE

12.3.2.1.4. .BLACK BOX

12.3.2.1.5. .OTHERS

12.3.3 AUTORICKSHAWS

12.3.3.1. .BY TECHNOLOGY

12.3.3.1.1. .EMBEDDED SYSTEM

12.3.3.1.2. .OBD-II

12.3.3.1.3. .SMARTPHONE

12.3.3.1.4. .BLACK BOX

12.3.3.1.5. .OTHERS

12.4 HEAVY-DUTY COMMERCIAL VEHICLES

12.4.1 BUSES

12.4.1.1. .BY TECHNOLOGY

12.4.1.1.1. .EMBEDDED SYSTEM

12.4.1.1.2. .OBD-II

12.4.1.1.3. .SMARTPHONE

12.4.1.1.4. .BLACK BOX

12.4.1.1.5. .OTHERS

12.4.2 TRUCKS

12.4.2.1. .BY TECHNOLOGY

12.4.2.1.1. .EMBEDDED SYSTEM

12.4.2.1.2. .OBD-II

12.4.2.1.3. .SMARTPHONE

12.4.2.1.4. .BLACK BOX

12.4.2.1.5. .OTHERS

12.4.3 TRIPPER

12.4.3.1. .BY TECHNOLOGY

12.4.3.1.1. .EMBEDDED SYSTEM

12.4.3.1.2. .OBD-II

12.4.3.1.3. .SMARTPHONE

12.4.3.1.4. .BLACK BOX

12.4.3.1.5. .OTHERS

12.4.4 OTHERS

12.4.4.1. .BY TECHNOLOGY

12.4.4.1.1. .EMBEDDED SYSTEM

12.4.4.1.2. .OBD-II

12.4.4.1.3. .SMARTPHONE

12.4.4.1.4. .BLACK BOX

12.4.4.1.5. .OTHERS

13 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY ELECTRIC VEHICLE TYPE

13.1 OVERVIEW

13.2 BATTERY ELECTRIC VEHICLES (BEVS)

13.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

13.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

14 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, BY REGION

MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 UAE

14.1.3 KUWAIT

14.1.4 QATAR

14.1.5 BAHRAIN

14.1.6 SOUTH AFRICA

14.1.7 EGYPT

14.1.8 ISRAEL

14.1.9 OMAN

14.1.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15.2 MERGERS & ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.4 EXPANSIONS

15.5 REGULATORY CHANGES

15.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, SWOT AND DBMR ANALYSIS

17 MIDDLE EAST AND AFRICA USAGE BASED INSURANCE MARKET, COMPANY PROFILE

17.1 AXA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 ASSICURAZIONI GENERALI S.P.A.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 ALLIANZ SE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 IMS

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 CAMBRIDGE MOBILE TELEMATICS

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 VODAFONE AUTOMOTIVE

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 VERIZON

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 OLD MUTUAL INSURE

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 SCG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 BEEMA

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.