Middle East And Africa Water Dispensers Market

Market Size in USD Million

CAGR :

%

USD

185.02 Million

USD

347.58 Million

2024

2032

USD

185.02 Million

USD

347.58 Million

2024

2032

| 2025 –2032 | |

| USD 185.02 Million | |

| USD 347.58 Million | |

|

|

|

|

What is the Middle East and Africa Water Dispensers Market Size and Growth Rate?

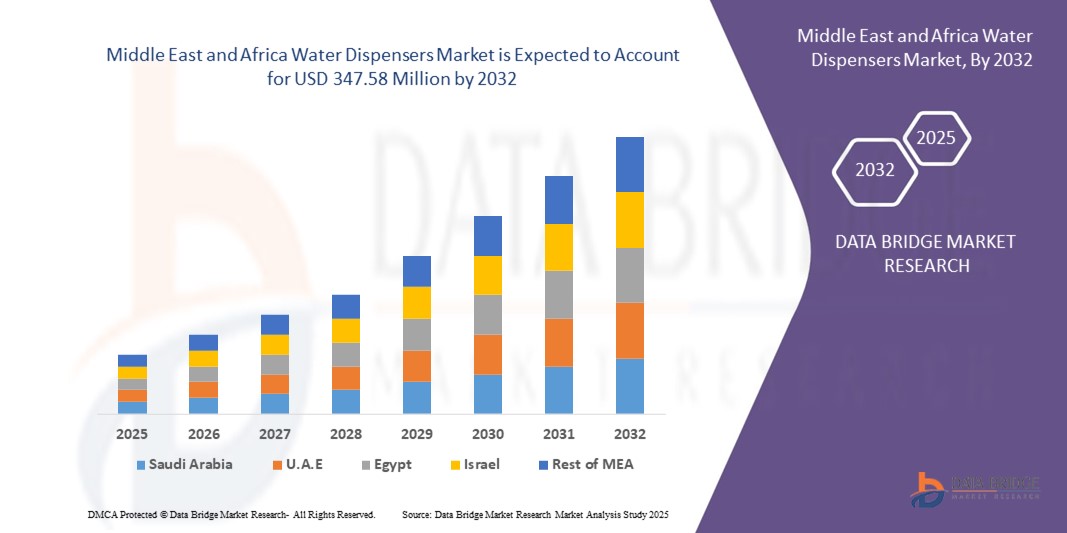

- The Middle East and Africa water dispensers market size was valued at USD 185.02 Million in 2024 and is expected to reach USD 347.58 Million by 2032, at a CAGR of 8.20% during the forecast period

- The water dispensers market presents a range of color options, such as black, silver, white, and others, ensuring diverse consumer choices. In contemporary kitchens, individuals may favor stylish silver dispensers, exemplified by brands such as Whirlpool or Avalon

- Conversely, for more conventional settings, classic white models such as those offered by Primo Water might be the preferred choice. Black dispensers, exemplified by brands such as Honeywell, add a modern touch, appealing to different design preferences

What are the Major Takeaways of Water Dispensers Market?

- In the urban landscape, compact and space-saving water dispensers have become increasingly popular due to evolving lifestyle preferences. The demand is fueled by the need for efficient, convenient hydration solutions that fit seamlessly into smaller living spaces

- Compact water dispensers address spatial constraints align with the modern urban dweller's desire for practical, minimalist appliances that contribute to a more streamlined and functional home environment

- U.A.E. is projected to dominate the Middle East and Africa water dispensers market with the largest revenue share of 44.6% in 2024, driven by high adoption in residential, corporate, and hospitality sectors, along with strong awareness of hydration and health benefits

- Saudi Arabia water dispensers market is anticipated to grow at the fastest CAGR through 2032, backed by increasing demand from commercial offices, educational institutions, and the healthcare sector

- The Bottled Water Dispensers segment dominated the market with the largest revenue share of 63.2% in 2024, owing to its portability, ease of installation, and high demand across residential and commercial setups

Report Scope and Water Dispensers Market Segmentation

|

Attributes |

Water Dispensers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Water Dispensers Market?

“Smart Technology Integration and Touchless Dispensing”

- A major trend in the Middle East and Africa water dispensers market is the increasing adoption of smart and touchless dispensing systems to promote hygiene and convenience in both residential and commercial spaces.

- For example, in 2024, Clover Industries introduced IoT-enabled water dispensers with motion sensors and app-based controls across premium office spaces in the U.A.E.

- Rising health awareness post-pandemic is accelerating the demand for sensor-activated, contactless hydration systems in hospitals, educational institutions, and public facilities.

- The trend is also backed by government health and safety regulations, promoting innovations like UV sterilization, self-cleaning mechanisms, and filter-monitoring displays.

- Ultimately, smart dispensers are transforming user experience and driving long-term product innovation and replacement cycles across the region

What are the Key Drivers of Water Dispensers Market?

- Rising demand for clean and safe drinking water, especially in arid climates and water-scarce areas of the Middle East and parts of Africa, is a primary growth driver

- For instance, in 2023, Blue Star International expanded its distribution network across Saudi Arabia and the U.A.E., offering advanced multi-stage filtration dispensers

- Urbanization and increasing commercial infrastructure such as corporate offices, schools, and retail spaces are boosting product adoption

- Government initiatives and awareness campaigns around water hygiene are influencing institutional buyers to upgrade to certified, energy-efficient water dispensing solutions

- Additionally, growth in disposable incomes and demand for lifestyle-enhancing appliances are increasing residential purchases across urban and suburban areas

Which Factor is challenging the Growth of the Water Dispensers Market?

- One of the key challenges is the high initial cost and maintenance requirements of advanced dispensers, which can deter adoption in price-sensitive markets

- For example, low penetration in rural parts of Africa is attributed to limited electricity access, high import duties, and lack of awareness about modern dispensers

- Counterfeit and substandard products flooding the market are undermining consumer trust and brand reputation, particularly in unorganized retail segments

- Variability in water quality and pressure levels across regions also hampers consistent product performance, leading to increased service calls and user dissatisfaction

- Addressing these challenges through local manufacturing, solar-powered dispensers, and robust after-sales service networks will be key to unlocking the market’s full potential in the region

How is the Water Dispensers Market Segmented?

The market is segmented on the basis of type, cooling capacity, storage capacity, dimension, water type, color, compartment-type water cooler, distribution channel, and application.

- By Type

On the basis of type, the water dispensers market is segmented into Direct Piping/Point of Use (POU) and Bottled Water Dispensers. The Bottled water dispensers segment dominated the market with the largest revenue share of 63.2% in 2024, owing to its portability, ease of installation, and high demand across residential and commercial setups.

The POU segment is projected to grow at the fastest CAGR through 2032, supported by rising concerns over bottled water waste and increasing adoption of filtration-based solutions.

- By Cooling Capacity

On the basis of cooling capacity, the market is segmented into 2 Ltr/Hr, 3 Ltr/Hr, 5 Ltr/Hr, and More than 5 Ltr/Hr. The 3 Ltr/Hr segment led the market with a share of 34.7% in 2024, being ideal for small-to-mid-sized office and residential settings.

The More than 5 Ltr/Hr category is expected to grow fastest due to its suitability for large-scale industrial or institutional environments with high water demand.

- By Storage Capacity

On the basis of storage capacity, the market is categorized into 20 Liters, 40 Liters, 80 Liters, 120 Liters, 150 Liters, 380 Liters, and Others. The 40 Liters segment held the dominant market share of 27.9% in 2024, favored for balanced capacity and compact size.

The 80 Liters segment is anticipated to exhibit strong growth owing to expanding demand in educational institutions and mid-sized commercial premises.

- By Dimension

On the basis of dimensions, the market includes 315x330x490 mm, 310x345x996 mm, 370x380x1000 mm, 400x400x1060 mm, 440x440x1185 mm, 665x485x1210 mm, 755x575x1240 mm, 812x612x1210 mm, and Others. The 310x345x996 mm size emerged as the leading segment with a share of 21.3% in 2024, offering space efficiency for urban and office installations.

Larger sizes like 755x575x1240 mm are expected to grow swiftly due to their suitability in high-footfall areas like malls and hospitals.

- By Water Type

On the basis of water type, the market is segmented into With Combination, Hot Water, Cold Water, and Normal Water. The Hot Water segment held the largest share of 36.4% in 2024, driven by tea/coffee culture and usage in offices and institutions.

With Combination (hot & cold) dispensers are gaining momentum as the fastest-growing category, offering temperature flexibility in a single unit.

- By Color

On the basis of color, the market is segmented into Black, Silver, White, and Others. The White segment accounted for the highest market share of 38.1% in 2024, due to its aesthetic compatibility with most interior designs.

The Black segment is expected to grow at the fastest pace owing to its sleek, premium appearance gaining popularity in modern commercial spaces.

- By Compartment-Type Water Cooler

On the basis of Compartment-Type Water Cooler, The market is segmented into With Refrigerated Compartment and Without Refrigerated Compartment. The Without Refrigerated Compartment segment dominated with a share of 58.7% in 2024, due to affordability and suitability in standard usage.

However, With Refrigerated Compartment units are projected to grow rapidly as multipurpose hydration-cooling units gain traction in commercial and mixed-use areas.

- By Distribution Channel

On the basis of distribution channel, the market includes Direct, Supermarkets/Hypermarkets, Specialty Stores, E-Commerce, and Others. Supermarkets/Hypermarkets held the largest market share of 33.8% in 2024, benefiting from strong consumer trust and product visibility.

The E-Commerce segment is expected to register the fastest growth, supported by increasing online shopping behavior and doorstep installation services.

- By Application

On the basis of application, the market is segmented into Residential, Industrial, Commercial, and Others. The Commercial segment led with a market share of 41.6% in 2024, owing to widespread adoption across offices, retail stores, and educational institutions.

The Residential application segment is projected to grow at the fastest rate, driven by rising urbanization and increased focus on home hydration solutions.

Which Region Holds the Largest Share of the Water Dispensers Market?

- U.A.E. is projected to dominate the Middle East and Africa water dispensers market with the largest revenue share of 44.6% in 2024, driven by high adoption in residential, corporate, and hospitality sectors, along with strong awareness of hydration and health benefits

- The country’s well-established infrastructure, preference for advanced appliances, and high rate of urbanization are contributing to the widespread installation of bottled and point-of-use water dispensers

- Additionally, supportive government initiatives promoting sustainable water use and energy-efficient appliances are reinforcing market growth in both commercial and institutional segments

Saudi Arabia Water Dispensers Market Insight

The Saudi Arabia water dispensers market is anticipated to grow at the fastest CAGR through 2032, backed by increasing demand from commercial offices, educational institutions, and the healthcare sector. The Kingdom's Vision 2030 focus on infrastructure development and public health is accelerating the installation of modern water dispensing systems. Demand is also being driven by harsh climatic conditions, rising disposable incomes, and growing consumer awareness about safe and clean drinking water.

South Africa Water Dispensers Market Insight

The South Africa water dispensers market is set to expand steadily, fueled by a growing middle-income population, water scarcity concerns, and increasing preference for convenient, purified drinking solutions. Urban areas such as Johannesburg, Cape Town, and Durban are witnessing rising adoption across homes, retail outlets, and public institutions. Government efforts to promote access to clean water and growing health consciousness are encouraging investments in both bottled and direct piping water dispensers.

Which are the Top Companies in Water Dispensers Market?

The water dispensers industry is primarily led by well-established companies, including:

- Blue Star Limited (India)

- Whirlpool (U.S.)

- Honeywell International Inc. (U.S.)

- Voltas Limited (India)

- Midea Group (China)

- Merck KGaA (Germany)

- Emerson Electric Co. (U.S.)

- BRITA (Germany)

- SUPER GENERAL (U.A.E.)

- Al Kawther (U.A.E.)

- Pentair (U.K.)

- Primo Water Corporation (U.S.)

- Clover Co.,Ltd. (South Korea)

- Haier Inc. (China)

- Culligan Water (U.S.)

- Ebac.com (U.K.)

- Waterlogic Holdings Ltd. (U.S.)

What are the Recent Developments in Middle East and Africa Water Dispensers Market?

- In November 2023, Primo Water Corporation disclosed an agreement with Culligan International to sell a significant part of its international operations for a valuation of up to USD 575 million. This strategic move reflects Primo Water's focus on reshaping its portfolio and optimizing resources in alignment with its business objectives and market dynamics

- In November 2022, Whirlpool Corporation acquired InSinkErator from Emerson. This strategic acquisition enhances Whirlpool's product portfolio, incorporating InSinkErator's expertise in food waste disposers and instant hot water dispensers for residential and commercial applications. The move aligns with Whirlpool's commitment to expanding its offerings and catering to diverse consumer needs in the home appliances market

- In November 2022, Culligan International and Waterlogic Group Holdings entered a merger agreement to collaborate in delivering environmentally friendly drinking water solutions and services. This strategic alliance combines the strengths of both companies, aiming to enhance their offerings and capabilities to meet the growing demand for sustainable and innovative water solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.