Middle East Glass Market

Market Size in USD Billion

CAGR :

%

USD

2.56 Billion

USD

4.33 Billion

2024

2032

USD

2.56 Billion

USD

4.33 Billion

2024

2032

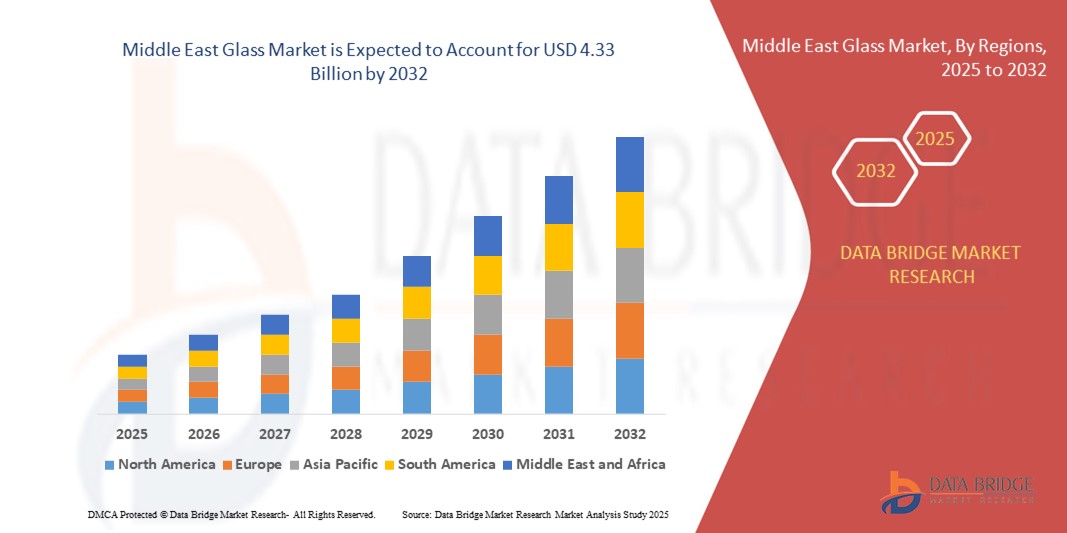

| 2025 –2032 | |

| USD 2.56 Billion | |

| USD 4.33 Billion | |

|

|

|

|

Glass Market Size

- The Middle East glass market size was valued at USD 2.56 billion in 2024 and is expected to reach USD 4.33 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by rapid urbanization, evolving architectural trends, and the increasing emphasis on energy-efficient and sustainable construction materials across residential, commercial, and industrial sectors

- Furthermore, rising demand for advanced glass solutions—such as insulated, coated, and safety glass—driven by modern design preferences and regulatory mandates for thermal performance, is significantly accelerating market expansion and adoption across multiple end-use industries

Glass Market Analysis

- Glass serves as a fundamental material in construction, automotive, electronics, and solar energy applications, offering a combination of structural transparency, insulation, and aesthetic appeal. Innovations in coating technologies, smart glass, and safety features are transforming traditional glass into a high-performance material for modern infrastructure

- The escalating demand for energy-efficient buildings, renewable energy systems, and high-specification automotive components is primarily fueling the adoption of specialized glass types. This shift is supported by green building codes, growing investments in infrastructure, and the push for sustainability across key economic sectors

- Saudi Arabia dominated the glass market in 2024, due to rapid growth in construction and infrastructure projects aligned with Vision 2030, which emphasizes modern architecture and smart urban development

- U.A.E. is expected to be the fastest growing country in the glass market during the forecast period due to a surge in real estate developments, luxury hospitality projects, and smart city initiatives such as Dubai 2040 Urban Master Plan

- Coated segment dominated the market with a market share of 57.9% in 2024, due to growing energy efficiency requirements in buildings and vehicles. Low-emissivity (Low-E) coatings, reflective coatings, and solar control films help manage heat transfer and reduce glare, lowering energy consumption. Coated glass is widely used in architectural glazing, curtain walls, and automotive windows, contributing to thermal insulation and occupant comfort. As sustainability certifications such as LEED and BREEAM become more prominent, demand for coated glass is set to rise. The product is also gaining traction in interior applications where aesthetics and performance intersect

Report Scope and Glass Market Segmentation

|

Attributes |

Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Glass Market Trends

Growing Integration of Smart and Electrochromic Glass Technologies

- The glass market is seeing rapid adoption of smart and electrochromic glass—which can alter transparency, color, or heat transmission via electrical control—driven by energy efficiency goals, green building codes, and consumer demand for comfort and privacy

- For instance, industry leaders such as Saint-Gobain (SageGlass), AGC Glass, and View Inc. are scaling up installation of dynamic glazing in commercial buildings, airports, and premium vehicles, enabling real-time solar control, glare mitigation, and personalized environmental experiences

- The trend is supported by stronger R&D investments in IoT-integrated glass, self-cleaning coatings, voice-activated window systems, and data-enabled building envelopes that optimize lighting and climate in response to occupancy and weather

- As governments set stricter mandates on energy consumption, electrochromic and switchable glass are increasingly chosen for façades, skylights, partitions, and public transport, providing architectural freedom alongside sustainability

- Rapid growth of smart cities and the need for digitally connected infrastructure spur collaborative projects between technology firms, glass manufacturers, and construction companies

- In automotive and mobility sectors, electrochromic glass applications are expanding for sunroofs, rearview mirrors, and windows, enhancing luxury features, occupant comfort, and safety through adaptive tinting

Glass Market Dynamics

Driver

Rising Construction and Infrastructure Development

- Sustained urbanization and the surge in infrastructure megaprojects significantly increase demand for high-performance glass across residential, commercial, transport, and public infrastructure sectors

- For instance, major projects in Asia-Pacific, the Middle East, and North America are sourcing advanced architectural glass—supplied by Guardian Glass, Schott AG, and regionally by Saint-Gobain—for skyscrapers, hospitals, educational institutes, and sustainable housing, where daylighting, insulation, and safety performance are critical

- Construction of transportation hubs, smart office buildings, eco-hospitals, and shopping complexes all require specialized glass—such as insulated, fire-rated, and soundproof variants—supporting continual market growth and innovation

- Increasing need for aesthetically pleasing, lightweight, and energy-saving materials positions glass as a preferred option for developers and architects responding to higher living standards and stricter efficiency regulations

- Refurbishment and retrofitting of existing infrastructure, coupled with international events (expos, sports) and public investment, bolster glass demand for both new and renovated built environments

Restraint/Challenge

Competition from Alternative Materials

- Growing availability and market penetration of high-strength plastics, composites, and polycarbonates challenge the glass industry, offering lower weight, better impact resistance, and sometimes improved cost performance in applications such as automotive, electronics, packaging, and construction

- For instance, consumer goods manufacturers and automakers increasingly utilize PET and bioplastics in bottles and car parts, and advanced polymers for lightweight windows—impacting demand for glass in these segments

- Transparency and strength offered by acrylics, engineered polymers, and transparent ceramics attract electronics, medical device, and specialty sectors seeking options beyond traditional glass

- Lower cost of innovation, easier molding, and lighter weight maintain competitive pressure, especially where recycling infrastructure for glass lags behind that of plastics and composites

- The challenge is exacerbated by rising raw material costs and the need for significant R&D to further improve glass recyclability, smart functionalities, and cost-effective production to maintain its share in evolving high-tech and consumer-driven markets

Glass Market Scope

The market is segmented on the basis of type, product, function, thickness, and application.

- By Type

On the basis of type, the glass market is segmented into float glass, architectural glass, cast glass, blown glass, clear glass, tinted glass, patterned or textured glass, wired glass, extra clear glass, special glass, security glass, glass containers, and others. The float glass segment dominated the market share in 2024 due to its uniform thickness, clarity, and cost-effective mass production process. It serves as the base material for numerous downstream applications, including coated glass, laminated glass, and insulating glass units. The construction industry heavily relies on float glass for windows, facades, and partitions. Its widespread availability and adaptability to additional treatments such as tempering and frosting further extend its use. The segment also benefits from continuous innovations in float line automation and sustainability improvements.

The security glass segment is expected to register the fastest growth from 2025 to 2032, propelled by increasing demand for impact-resistant and intrusion-proof materials in commercial and public infrastructure. This category includes laminated and toughened glass, which offer multi-layered protection against forced entry, fire, and ballistics. Rising concerns about vandalism, theft, and terrorism have made such glass essential for banks, airports, embassies, and retail stores. Its rising incorporation in luxury vehicles and smart homes also adds to demand. Advancements in glass interlayer technology are enhancing transparency while maintaining high safety standards.

- By Product

On the basis of product, the market is segmented into coated and uncoated glass. The coated glass segment accounted for the highest revenue share of 57.9% in 2024, primarily driven by growing energy efficiency requirements in buildings and vehicles. Low-emissivity (Low-E) coatings, reflective coatings, and solar control films help manage heat transfer and reduce glare, lowering energy consumption. Coated glass is widely used in architectural glazing, curtain walls, and automotive windows, contributing to thermal insulation and occupant comfort. As sustainability certifications such as LEED and BREEAM become more prominent, demand for coated glass is set to rise. The product is also gaining traction in interior applications where aesthetics and performance intersect.

The uncoated glass segment, though more traditional, continues to hold a significant share due to its essential role in internal glazing, mirrors, tabletops, and furniture. It is preferred in applications that prioritize cost-effectiveness and basic transparency without the need for energy-saving or light-filtering properties. Uncoated glass also acts as a base for further processing—such as tempering, acid-etching, or screen printing—offering design flexibility. Its relevance in sectors such as interior design, signage, and small-scale construction remains strong, especially in cost-sensitive emerging markets.

- By Function

On the basis of function, the glass market is segmented into UV filter glass, heat insulation glass, safety glazing, soundproofed glazing, self-cleaning glass, ion exchange glass, and others. The safety glazing segment led the market in 2024, driven by increased safety regulations in construction and transport industries. This segment includes both toughened and laminated glass, which are engineered to prevent shattering and reduce injury risk during impact or breakage. Governments and safety organizations across the globe have made safety glazing mandatory in schools, hospitals, elevators, and automotive windshields. Its durability, thermal resistance, and enhanced load-bearing capacity also support broader use in high-rise construction and infrastructure.

The self-cleaning glass segment is projected to grow at the highest rate through 2032, driven by urbanization and the adoption of low-maintenance materials in commercial and residential spaces. This type features a hydrophilic or photocatalytic coating that breaks down organic dirt and allows rainwater to rinse it off. It is highly valued in high-rise buildings, skylights, solar panels, and greenhouses where manual cleaning is labor-intensive or dangerous. Its combination of functionality, hygiene, and long-term cost savings appeals to architects, facility managers, and sustainability advocates alike. Increasing awareness of environmental cleanliness is also boosting its popularity in healthcare and hospitality settings.

- By Thickness

On the basis of thickness, the market is segmented into 2 mm, 3 mm, 4 mm, 5 mm, 6 mm, 8 mm, 10 mm, 12 mm, and more than 12 mm. The 6 mm segment accounted for the highest revenue in 2024 due to its optimal balance of strength, clarity, and affordability, making it ideal for mainstream architectural uses. It is commonly used in residential and commercial window glazing, glass doors, display panels, and internal partitions. The segment is bolstered by wide availability and compatibility with safety and thermal treatments such as tempering, lamination, and double-glazing. Manufacturers favor this thickness for standardization, ease of transport, and reduced material waste during processing.

The more than 12 mm segment is forecasted to grow the fastest, supported by increased demand for structurally strong glass in load-bearing and architectural applications. These include glass flooring, stair treads, structural balustrades, aquarium walls, and high-security installations. With the rise of transparent architectural elements and frameless designs, thicker glass is being adopted to ensure safety without compromising aesthetics. Technological advancements now allow thicker sheets to maintain optical clarity while withstanding extreme pressure and environmental exposure. The growing emphasis on modern, open-space architecture will continue to drive demand for ultra-thick glass solutions.

- By Application

On the basis of application, the market is segmented into building and construction, automotive, aerospace, electronic appliances, solar energy, packaging, furniture, and others. The building and construction segment led the market in 2024, supported by surging urbanization, infrastructure development, and demand for energy-efficient materials. Glass plays a pivotal role in enhancing natural light penetration, thermal insulation, and aesthetics in buildings. From facades and canopies to partitions and railings, glass is integral to green buildings and smart infrastructure. Government mandates for sustainable construction, especially in Europe and Asia, are also accelerating segment growth. Decorative and specialty glasses are gaining traction in interior design, adding further momentum.

The solar energy segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by global investments in renewable energy and declining solar panel costs. Glass is essential in solar modules—specifically in front covers, backsheets, and concentrators—where it must offer high light transmittance, durability, and low iron content. As solar energy capacity expands across both developed and developing nations, the demand for high-performance solar glass is increasing. Technological advancements in anti-reflective and self-cleaning coatings are also enhancing the efficiency and reliability of solar installations. Favorable government subsidies and net metering policies are further driving market acceleration in this segment.

Glass Market Regional Analysis

- Saudi Arabia dominated the glass market with the largest revenue share in 2024, driven by rapid growth in construction and infrastructure projects aligned with Vision 2030, which emphasizes modern architecture and smart urban development

- Demand is particularly strong for float glass, coated glass, and safety glazing used in high-rise buildings, commercial complexes, and government-led megaprojects such as NEOM and the Red Sea Project

- The market is further supported by domestic manufacturing expansion, rising investments in energy-efficient building materials, and regulatory support for sustainable construction practices using advanced glass solutions

Oman Glass Market Insight

Oman’s glass market is projected to grow steadily through 2032, supported by a rise in residential and tourism-based construction projects across Muscat, Duqm, and Salalah. The government’s infrastructure diversification under Vision 2040, along with increased demand for clear and tinted architectural glass in hospitality and retail sectors, is boosting the country’s glass consumption. Import reliance and a focus on quality performance glass are further shaping market trends.

U.A.E. Glass Market Insight

The U.A.E. is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by a surge in real estate developments, luxury hospitality projects, and smart city initiatives such as Dubai 2040 Urban Master Plan. Strong demand for high-performance glass types—such as solar control, UV-filter, and double-glazed units—is reinforced by green building regulations and the country’s goal of net-zero emissions. Major investments in sustainable architecture and advanced facade engineering are accelerating market momentum.

Glass Market Share

The glass industry is primarily led by well-established companies, including:

- Şişecam (Turkey)

- Guardian Industries Holdings (U.S.)

- IKKGlass (Saudi Arabia)

- AGC Inc. (Japan)

- Dubai Investments (U.A.E.)

- Alma (Saudi Arabia)

- Arabian Processing Glass Co. (Saudi Arabia)

- Glas Trösch Holding AG (Switzerland)

- Obeikan Glass Company (Saudi Arabia)

- QGI – Qatar German Gasket Factory (Qatar)

- REGIONGLASS (Russia)

- Saint-Gobain (France)

- Zoujaj – National Company for Glass Industries (Saudi Arabia)

Latest Developments in Middle East Glass Market

- In October 2023, In the first half of the year, Şişecam signed a letter of intent to invest in ICRON, a Turkish firm that provides operational and strategic decision optimization services. Şişecam is now taking this approach further. Şişecam and ICRON have a collaboration arrangement. As part of the deal, Şişecam's initial involvement in ICRON will be 15.7%, with an eventual partnership rate of 33.1% through progressive investments. With this agreement, Şişecam hopes to expand with ICRON and elevate its operational excellence and optimization approach to the next level, marking its first investment in the sector of software innovations

- In September 2023, Şişecam is accelerating investments to support its growth. In response to increased worldwide competitiveness and the rising demand for automotive glass, Sisecam launched a new automotive glass line worth about TRY 4 billion (USD 190 million) with additional capital expenditures at its manufacturing location in Luleburgaz. The new line will have an annual capacity of 200,000 tons and will create an extra 114 jobs. This will be exclusively devoted to architectural glass, increasing capacity and efficiency

- In August 2023, SABIC, Home of Innovation Solar control glass supports a first for residential buildings in the Middle East gained LEED Platinum Certification. In this construction, all windows and some doors are glazed in Guardian SunGuard SuperNeutral 30T, a double silver coated solar control glass that selectively transmits natural light while limiting solar heat gain and the requirement for energy-intensive air conditioning. This helps the firm to obtain more recognition for its environmental efforts

- In February 2023, AGC Inc. and Saint-Gobain, two of the world's leading flat glass producers in terms of sustainability, announced a collaboration on the design of a prototype breakthrough flat glass line that is projected to considerably cut direct CO2 emissions.

- In September 2022, Guardian Glass presented Guardian Clarity Neutral, a revolutionary anti-reflective coated glass that offers the maximum transparency of any Guardian Glass product to date, allowing for truer, more natural views through the glass. Guardian Clarity Neutral lowers reflections and glare in special-purpose applications such as shop storefronts, museum exhibits, picture frames, and commercial refrigerator doors, making the glass nearly invisible and enabling clearer, uninterrupted, more natural views through the glass. This helps the organization enhance its productivity and revenue

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.