North America 2D Display for Defense and Aerospace Market Analysis and Size

The 2D display market for aerospace and defense is a specialized market that provides displays for military and commercial aerospace applications. Displays used in this market must meet stringent requirements for reliability, performance, and durability and comply with various regulatory standards. The market for 2D displays for aerospace and defense is expected to experience steady growth in the coming years, driven by increasing demand for advanced display technologies, the growth of the aerospace and defense industry, and the need for improved situational awareness and communication capabilities in military and commercial aviation. The emergence of new technologies, such as high-resolution displays, touch screens, and augmented reality displays, is also expected to drive growth in this market.

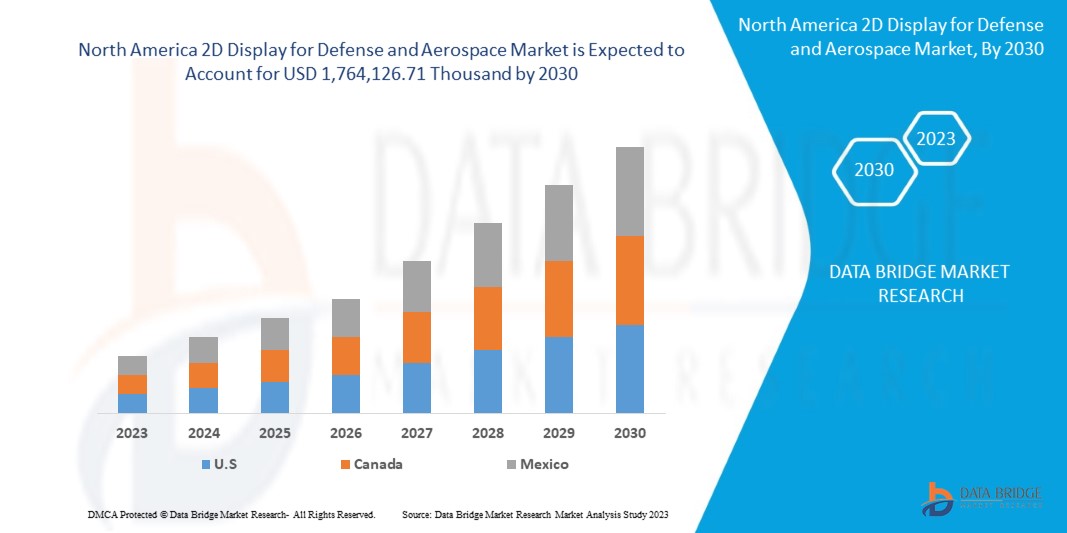

Data Bridge Market Research analyses that North America 2D display for defense and aerospace market is expected to reach a USD 1,764,126.71 thousand by 2030, at a CAGR of 6.6% during the forecast period. North America 2D Display for Defense and Aerospace market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

By Display Technology (Liquid Crystal Displays (LCD), Light Emitting Diode (LED), Organic LED (OLED), Micro-LED, Others), Type (Touch, Non-Touch), Resolution (Full HD, HD, 4K, Others), Panel Size (5 Inches to 10 Inches, Greater Than 10 Inches, Less Than 5 Inches), Display Type (Conventional Display, Smart Display), Sales Channel (OEMS, Retailer), Application (Aerospace, Defense) |

|

Countries Covered |

U.S., Canada and Mexico. |

|

Market Players Covered |

Korry, Astronautics Corporation of America, FDS Avionics Corp., Rosen Aviation, ScioTeq, Excelitas Technologies Corp., DIEHL STIFTUNG & CO. KG, Nighthawk Flight Systems, Inc, Aspen Avionics, Inc., US Micro Products, AvMap s.r.l., Meggitt PLC, Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., WINMATE INC, Collins Aerospace, D&T Inc, and Elbit Systems Ltd. |

Market Definition

A display device is an output device for presenting information in visual or tactile form. When the input information that is supplied has an electrical signal, the display is called an electronic display. A 2D-head-mounted display (HMD) is a display device worn on the head or as part of a helmet that has a small display optic in front of one (monocular HMD) or each eye (binocular HMD). An HMD has many uses, including gaming, aviation, engineering, and medicine. Virtual reality headsets are HMDs combined with IMUs. There is also an optical head-mounted display (OHMD), a wearable display that can reflect projected images and allow a user to see through it.

North America 2D display for defense and aerospace Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVERS

- GROWTH IN THE MILITARY MODERNIZATION PROGRAMS ACROSS THE GLOBE

Military modernization is updating and improving a nation's military capabilities and equipment to meet current, and future security challenges better. It involves acquiring new weapons systems, technologies, and infrastructure, as well as the development of new strategies and doctrines. Military modernization is important for a nation as it helps maintain a credible deterrence capability against potential adversaries, enhances military readiness and effectiveness, and ensures the military can perform its assigned roles and missions. As nations across the globe are increasing their respective defense budgets, the number of military modernization programs is also increasing.

- GROWTH IN THE DEMAND FOR ADVANCED DISPLAY TECHNOLOGIES

The defense of government across the globe and the aerospace industry requires advanced displays that can provide high-resolution images, real-time information, and enhanced situational awareness to pilots and soldiers. As such, there is a growing demand for 2D displays that can meet these requirements.

OPPORTUNITY

- INCREASE IN DEMAND FOR SIMULATION AND TRAINING SYSTEMS

Simulation and training systems in the defense and aerospace industry are tools and technologies used to simulate real-world scenarios and train military personnel and pilots. These systems can simulate various scenarios, from routine operations to complex battlefield scenarios, and allow military personnel to train and hone their skills in a safe, controlled environment. The importance of simulation and training systems in the defense and aerospace industry cannot be overstated. These systems help to ensure that military personnel is well-trained and prepared for any situation they may encounter. In addition, they help reduce the risk of accidents or mishaps during training exercises or missions.

RESTRAINTS/CHALLENGES

- STRINGENT GOVERNMENT REGULATIONS

Stringent government regulations are expected to restrain North America 2d display for the defense and aerospace market by creating obstacles in the procurement and use of certain 2d display technologies. These regulations are put in place to ensure that the technologies being used in the defense and aerospace industry meet certain safety and security standards

- HIGH TECHNOLOGICAL OBSOLESCENCE IN DEFENSEAND AEROSPACE SECTOR

Technological obsolescence refers to the state of being outdated due to technological advancements. This means that technology, product, or service that was once popular and in high demand may become irrelevant and unusable as newer and more advanced technologies are developed and widely available. In the market context, technological obsolescence can occur when the 2d display technology used in defense and aerospace becomes outdated and is replaced by newer and more advanced technologies, leading to a decline in demand for the older technology. This is a challenge in the defense and aerospace industry, where the technology needs to be constantly updated and improved to keep up with the changing needs and requirements of the military. In the case of 2D displays for defense and aerospace, technological obsolescence can limit the market's growth in several ways.

Post-COVID-19 Impact on North America 2D display for defense and aerospace Market

The COVID-19 pandemic has significantly impacted the aerospace and defense industry, including the market for 2D displays. The pandemic has led to a decline in air travel and a reduction in defense spending, which has impacted demand for 2D displays used in aircraft and defense applications. One of the major impacts of the pandemic has been disruptions in North America supply chain, which have led to shortages of raw materials and components used in the manufacturing of 2D displays. This has caused delays in the production and delivery of displays, which has impacted the ability of aerospace and defense companies to complete their projects on time. The pandemic has also resulted in a decline in demand for commercial aircraft, which has affected the demand for 2D displays used in cockpit displays and other applications. Additionally, the reduction in defense spending has led to a slowdown in military procurement, which has impacted the demand for displays used in military applications.

Recent Developments

- In March 2022, Nighthawk Flight Systems, Inc. announced that the company had earned AS9100/ISO9001 certificate. This certification has allowed the company to design and manufacture compact integrated display systems. Which is used for general aviation, business aviation, military, air transport, and regional aircraft under North America 2D display for the defense and aerospace market

- In August 2020, Aspen Avionics, Inc. announced that the company has agreed with the AIRO group of aerospace companies. This step has expanded the company's investments and resources and increased its technologies in not only avionics for general aviation but also to offer avionics products for manned and unmanned flight platforms for commercial, military, robotics, and multi-modal aircraft under the North America 2D display for defense aerospace market

North America 2D Display for Defense and Aerospace Market Scope

North America 2D display for defense and aerospace market is segmented based on display technology, type, resolution, panel size, display type, sales channel, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and insights to help them make strategic decisions for identifying core market applications.

By Display Technology

- Liquid Crystal Displays (LCD)

- Light Emitting Diode (LED)

- Organic LED (OLED)

- Micro-LED

- Others

On the basis of display technology, North America 2D display for defense and aerospace market is segmented into liquid crystal displays (LCD), light emitting diode (LED), organic LED (OLED), micro-LED, and others.

By Type

- Touch

- Non-Touch

On the basis of type, North America 2D display for defense and aerospace market is segmented into touch and non-touch.

By Resolution

- Full HD

- HD

- 4K

- Others

On the basis of resolution, North America 2D display for defense and aerospace market is segmented into full HD, HD, 4K, and others.

By Panel Size

- 5 Inches to 10 Inches

- Greater Than 10 Inches

- Less Than 5 Inches

On the basis of panel size, North America 2D display for defense and aerospace market is segmented into 5 inches to 10 inches, greater than 10 inches, and less than 5 inches.

By Display Type

- Conventional Display

- Smart Display

On the basis of display type, North America 2D display for defense and aerospace market is segmented into conventional display and smart display.

By Sales Channel

- OEMS

- Retailer

On the basis of sales channel, North America 2D display for defense and aerospace market is segmented into OEMS and retailer.

By Application

- Aerospace

- Defense

On the basis of application, North America 2D display for defense and aerospace market is segmented into aerospace and defense.

North America 2D display for defense and aerospace Market Regional Analysis/Insights

North America 2D display for defense and aerospace Market is analyzed. As referenced above, market size insights and trends are provided by display technology, type, resolution, panel size, display type, sales channel, and application.

The countries covered in the North America 2D display for defense and aerospace market report are U.S., Canada, and Mexico.

U.S. dominates in the North America region as the U.S. has a well-developed aerospace and defense industry, with many leading companies involved in designing, developing, and manufacturing 2D displays. This continues to grow and is expected to boost the market growth

The region section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America 2D display for defense and aerospace Market Share Analysis

North America 2D display for defense and aerospace Market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on North America 2D display for defense and aerospace market.

Some of the major players operating in the North America 2D display for defense and aerospace market are Korry, Astronautics Corporation of America, FDS Avionics Corp., Rosen Aviation, ScioTeq, Excelitas Technologies Corp., DIEHL STIFTUNG & CO. KG, Nighthawk Flight Systems, Inc, Aspen Avionics, Inc., US Micro Products, AvMap s.r.l., Meggitt PLC, Honeywell International Inc., Barco, BAE Systems, Thales, Garmin Ltd., WINMATE INC, Collins Aerospace, D&T Inc, and Elbit Systems Ltd.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT CURVE

2.1 MARKET CHALLENGE MATRIX

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 TECHNOLOGICAL TRENDS

4.3 COMPANY COMPARATIVE ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PATENT ANALYSIS

4.6 CASE STUDY

4.7 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MILITARY MODERNIZATION PROGRAMS ACROSS THE GLOBE

5.1.2 GROWING DEMAND FOR ADVANCED DISPLAY TECHNOLOGIES

5.1.3 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS

5.1.4 INCREASE IN TECHNOLOGICAL ADVANCEMENTS IN DISPLAY TECHNOLOGY

5.2 RESTRAINTS

5.2.1 HIGH DEVELOPMENT AND MANUFACTURING COSTS ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.2.2 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN DEMAND FOR SIMULATION AND TRAINING SYSTEMS

5.3.2 INCREASING PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 RISE IN DEMAND FOR HEAD-MOUNTED DISPLAYS (HMDS)

5.3.4 EXPANSION OF THE DEFENSE AND AEROSPACE INDUSTRY ACROSS THE GLOBE

5.4 CHALLENGES

5.4.1 INTEGRATION CHALLENGES ASSOCIATED WITH ADVANCED 2D DISPLAYS

5.4.2 HIGH TECHNOLOGICAL OBSOLESCENCE IN DEFENCE AND AEROSPACE SECTOR

6 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

6.1 OVERVIEW

6.2 LIQUID CRYSTAL DISPLAYS (LCD)

6.3 LIGHT EMITTING DIODE (LED)

6.4 ORGANIC LED (OLED)

6.4.1 RIGID

6.4.2 FLEXIBLE

6.4.3 FOLDABLE

6.5 MICRO-LED

6.6 OTHERS

7 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TOUCH

7.3 NON-TOUCH

8 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION

8.1 OVERVIEW

8.2 FULL HD

8.3 HD

8.4 4K

8.5 OTHERS

9 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE

9.1 OVERVIEW

9.2 5 INCHES TO 10 INCHES

9.3 GREATER THAN 10 INCHES

9.4 LESS THAN 5 INCHES

10 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE

10.1 OVERVIEW

10.2 CONVENTIONAL DISPLAY

10.3 SMART DISPLAY

11 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 OEMS

11.3 RETAIL

12 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 AEROSPACE

12.2.1 BY TYPE

12.2.1.1 PRIMARY FLIGHT DISPLAY

12.2.1.2 MULTI-FUNCTIONAL DISPLAY

12.2.1.3 BACKUP DISPLAY

12.2.1.4 MISSION DISPLAY

12.2.2 BY TYPE

12.2.2.1 AIRCRAFT

12.2.2.2 HELICOPTERS

12.2.2.3 OTHERS

12.3 DEFENCE

12.3.1 BY TYPE

12.3.1.1 LAND

12.3.1.2 AIRBORNE

12.3.1.3 NAVAL

13 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 HONEYWELL INTERNATIONAL INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THALES

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SOLUTION PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 COLLINS AEROSPACE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SOLUTION PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 EXCELITAS TECHNOLOGIES CORP.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCTS PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 BAE SYSTEMS

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCTS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASPEN AVIONICS, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ASTRONAUTICS CORPORATION OF AMERICA

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCTS PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 AVMAP SRL

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCTS PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BARCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SOLUTION PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 DIEHL STIFTUNG & CO. KG

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 D&T INC

16.11.1 COMPANY SNAPSHOT

16.11.2 SOLUTION PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 ELBIT SYSTEMS LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 BUSINESS PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FDS AVIONICS CORP.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCTS PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GARMIN LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KORRY

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MEGGIT PLC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCTS PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NIGHTHAWK FLIGHT SYSTEMS, INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 ROSEN AVIATION.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SCIOTEQ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 US MICRO PRODUCTS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 WINMATE INC.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PATENT ANALYSIS

TABLE 2 REGULATORY STANDARDS

TABLE 3 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA LIQUID CRYSTAL DISPLAYS (LCD) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA LIGHT EMITTING DIODE (LED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA MICRO-LED IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA OTHERS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA NON-TOUCH IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA FULL HD IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA HD IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA 4K IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA OTHERS IN 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA 5 INCHES TO 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA GREATER THAN 10 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA LESS THAN 5 INCHES IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA CONVENTIONAL DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA SMART DISPLAY IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA OEMS IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA RETAIL IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 61 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 CANADA AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 CANADA DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 69 MEXICO ORGANIC LED (OLED) IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY RESOLUTION, 2021-2030 (USD THOUSAND)

TABLE 72 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY PANEL SIZE, 2021-2030 (USD THOUSAND)

TABLE 73 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY DISPLAY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 75 MEXICO 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 76 MEXICO AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 MEXICO AEROSPACE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 MEXICO DEFENSE IN 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA 2D DIPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: DISPLAY TECHNOLOGY CURVE

FIGURE 11 THE MARKET CHALLENGE MATRIX BY DISPLAY TECHNOLOGY

FIGURE 12 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 13 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SEGMENTATION

FIGURE 14 EMERGING REQUIREMENTS OF ENHANCED COMMUNICATION SYSTEMS IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 LIQUID CRYSTAL DISPLAYS (LCD) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET IN 2023 TO 2030

FIGURE 16 TECHNOLOGY TRENDS IN 2D DISPLAY FOR AEROSPACE AND DEFENSE

FIGURE 17 COMPANY COMPARISON

FIGURE 18 VALUE CHAIN FOR THE NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET

FIGURE 20 TOP 7 DEFENSE BUDGET OF NATION ACROSS THE GLOBE OF 2023 (IN USD)

FIGURE 21 MILITARY EXPENDITURE (% OF GDP) OF U.S., U.K., INDIA, CHINA, AND RUSSIA (2013-2021)

FIGURE 22 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TECHNOLOGY, 2022

FIGURE 23 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY TYPE, 2022

FIGURE 24 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY RESOLUTION, 2022

FIGURE 25 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY PANEL SIZE, 2022

FIGURE 26 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY DISPLAY TYPE, 2022

FIGURE 27 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY SALES CHANNEL, 2022

FIGURE 28 NORTH AMERICA 2D DISPLAY FOR DEFENSE & AEROSPACE MARKET: BY APPLICATION, 2022

FIGURE 29 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: SNAPSHOT (2022)

FIGURE 30 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022)

FIGURE 31 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: BY DISPLAY TECHNOLOGY (2023-2030)

FIGURE 34 NORTH AMERICA 2D DISPLAY FOR DEFENSE AND AEROSPACE MARKET: COMPANY SHARE 2022 (%)

North America 2d Display For Defense And Aerospace Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America 2d Display For Defense And Aerospace Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America 2d Display For Defense And Aerospace Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.