North America Acerola Extract Market

Market Size in USD Million

CAGR :

%

USD

1,668.74 Million

USD

3,204.99 Million

2021

2029

USD

1,668.74 Million

USD

3,204.99 Million

2021

2029

| 2022 –2029 | |

| USD 1,668.74 Million | |

| USD 3,204.99 Million | |

|

|

|

North America Acerola Extract Market Analysis and Size

Growing awareness of its medicinal and other commercial applications has resulted in its plantation spreading to other parts of the world. The tree is now found as far south as India in Asia Pacific and as far north as Texas in North America. Since the fruit is relatively easy to grow, the North America acerola extract market participants are able to keep manufacturing costs to a minimum. Due to its extremely shallow roots, the tree plantation only requires careful consideration of wind conditions. Cutting, seeding, and other common methods are used to propagate the tree.

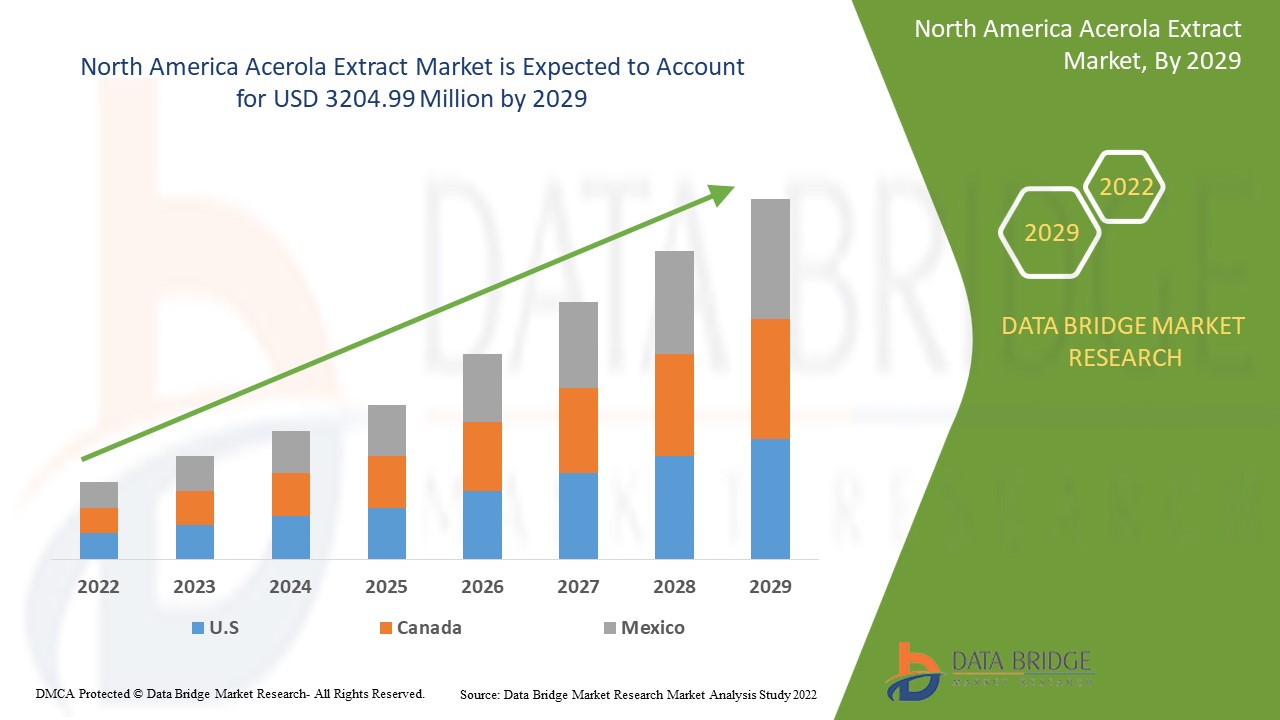

Data Bridge Market Research analyses that the acerola extract market was valued at USD 1668.74 million in 2021 and is expected to reach the value of USD 3204.99 million by 2029, at a CAGR of 8.5% during the forecast period of 2022 to 2029.

Market Definition

Acerola is a tropical fruit-bearing small tree or shrub with the scientific name Malpighia emarginata. The tree belongs to the Malpighiaceae family. It is also known as wild crepe, acerola cherry, seriz, and West Indian cherry. The acerola tree is thought to have originated in South America. Its fruit resembles cherry but is much smaller in size. It contains Vitamin B1, Vitamin A, B3, and B2 as well as Vitamin C, which is extremely nutritious. The fruit is also well-known for its antioxidant properties, bioflavonoids, and carotenoids.

North America Acerola Extract Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Form (Dry/Powder, Liquid/Paste), Type (Conventional, organic), Application (Dietary Supplements, Bakery Products, Beverages, Sports Nutrition, Convenience & Processed Products, Cosmetics & Personal Care, Dairy Products, Confectionery Products, Meat & Poultry Products, Granola & Breakfast Cereals), Distribution Channel (Direct and Indirect), |

|

Countries Covered |

U.S, Canada and Mexico |

|

Market Players Covered |

Kemin Industries, Inc. (U.S), Florida Food Products (U.S), Niagro - Nichirei do Brasil Ag. Ltda (Brazil), Naturex SA (France), Advanced Biotech (India), HANDARY S.A. (Belgium), Bösch Boden Spies (Germany), Optimally Organic (U.S), KINGHERBS (China), Vita Forte Inc. (U.S), The Green Labs LLC. (U.S), DuPONT (U.S), Foodchem International Corporation (China), Ti Tropicals (U.S), Duas Rodas Institucional (Brazil) |

|

Opportunities |

|

Acerola Extract Market Dynamics

Drivers

- Growing demand from the food and beverage industry due to its numerous benefits

Ascorbic acid is a water-soluble vitamin that is essential. Although most plants and animals can synthesise ascorbic acid but humans cannot. As a result, humans require it as a dietary supplement. Acerola is a good source of vitamin C. This property of acerola extract compels food and beverage manufacturers to include it in their products. Along with being a good source of ascorbic acid, acerola is one of the few fruits that contain a good amount of phenolic, flavonoids, anthocyanins, and carotenoids. All of these phytonutrients aid in the treatment of various diseases. For its high antioxidant capacity, acerola promotes the inactivation of free radicals, which are directly related to the ageing process and diseases such as cancer and cardiovascular disorders.

- Rising application from the cosmetic industry

Acerola extracts' widespread use in dietary supplements, beverages, and cosmetics for skin and hair care has accelerated their growth. Acerola has a standard vitamin composition of 17 percent, which is significantly higher than any other citrus fruit such as oranges and cherries. The demands for organic and natural-based vitamins, as well as the high demand for clean labelled products and consumer awareness, have fuelled market growth.

Opportunity

Government organisations have made aggressive efforts to regulate the production and use of environmentally friendly products, such as prohibiting the use of specific chemicals and establishing maximum consumption limits. The growing consumer concern about the health effects of synthetic colours drives the demand for clean label products. The rise in demand for natural ingredients, particularly those used to preserve meat products, can be viewed as an opportunity for acerola extract manufacturers to expand and grow.

Restraints

Adverse effects from excessive use of acerola-based vitamin C products, combined with high acerola-based merchandise costs, may impede business growth in the current forecast timeframe. Many factors influence multifunctional food industry trends, including regulatory structure, consumption patterns, and distribution network connections from farm to fork. This is expected to have an impact on the growth of the acerola extract market.

This acerola extract market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the acerola extract market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Acerola Extract Market

The COVID-19 has had an impact on economies and businesses such as the food and beverage industry in a number of countries due to detentions, travel restrictions, and company closures. The distribution network outage has indeed had an impact on acerola availability. The delay in the distribution network will affect the quality of acerola as well as the volume and cost of deliveries. As more people eat healthier foods, the demand for acerola extract has increased as a result of the outbreak. As a result, COVID had a significant impact on the acerola extract market.

Recent Development

- Duas Rodas Institucional was awarded the Innovation Award in February 2019, recognising the company for developing the most unique functional element in the Food Ingredients industry. The company manufactures various types of ingredients used in the food and beverage industry. As a result of receiving this award for innovation, the company's market standing has improved.

North America Acerola Extract Market Scope

The acerola extract market is segmented on the basis of application, form, type and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Conventional

- Organic

Application

- Dietary Supplements

- Bakery Products

- Beverages

- Sports Nutrition

- Convenience

- Processed Products

- Cosmetics

- Personal Care

- Dairy Products

- Confectionery Products

- Meat & Poultry Products

- Granola

- Breakfast Cereals

Form

- Dry/Powder

- Liquid/Paste

Distribution channel

- Direct

- Indirect

Acerola Extract Market Regional Analysis/Insights

The acerola extract market is analysed and market size insights and trends are provided by country, application, form, type and distribution channel as referenced above.

The countries covered in the acerola extract market report are U.S, Canada and Mexico.

Due to the increased popularity of acerola in Southern States of the United States, which use acerola among healthy foods and nutritional natural beverages as the best source of vitamin C, the United States has occupied the highest market share in North America acerola extract market. To meet the needs of industrialists, companies are taking steps to introduce organic extracts. For example, in 2029, Duas Rodas launched dotNAT natural ingredients, which include botanical extracts, dehydrated super fruits, and acerola, which is widely used in functional foods and supplements in the United States.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Acerola Extract Market Share Analysis

The acerola extract market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to acerola extract market.

Some of the major players operating in the acerola extract market are:

- Kemin Industries, Inc. (U.S)

- Florida Food Products (U.S)

- Niagro - Nichirei do Brasil Ag. Ltda (Brazil)

- Naturex SA (France)

- Advanced Biotech (India)

- HANDARY S.A. (Belgium)

- Bösch Boden Spies (Germany)

- Optimally Organic (U.S)

- KINGHERBS (China)

- Vita Forte Inc. (U.S)

- The Green Labs LLC. (U.S)

- DuPONT (U.S)

- Foodchem International Corporation (China)

- iTi Tropicals (U.S)

- Duas Rodas Institucional (Brazil)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ACEROLA EXTRACT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 FORM LIFELINE CURVE

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 HEALTH CLAIMS

4.2 RAW ACEROLA NUTRITIONAL FACT ANALYSIS PER SERVING

4.3 PATENT ANALYSIS

4.4 DBMR ANALYSIS

4.4.1 COUNTRY LEVEL PATENT ANALYSIS

4.4.2 COMPANY BASED ANALYSIS

4.5 SUPPLY CHAIN OF ACEROLA EXTRACT MARKET

4.6 VALUE CHAIN OF ACEROLA EXTRACT

4.7 NORTH AMERICA ACEROLA EXTRACT MARKET: REGULATORY FRAMEWORK

5 IMPACT OF COVID-19

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSUMPTION OF VITAMIN-RICH PRODUCTS

6.1.2 INCREASING DEMAND FOR CONVENIENCE FOOD & BEVERAGE PRODUCTS

6.1.3 RISING DEMAND FOR NATURAL AND FRESH FRUIT DERIVATIVES

6.1.4 GROWING KNOWLEDGE ABOUT THE ADVANTAGES OF NUTRITION PRODUCTS

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS ASSOCIATED WITH THE EXCESSIVE CONSUMPTION OF ACEROLA BASED VITAMIN C PRODUCTS

6.2.2 HIGH COST OF ACEROLA-BASED PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING USAGES OF ACEROLA IN VARIOUS INDUSTRIES

6.3.2 ACCEPTANCE IN DEVELOPING COUNTRIES

6.4 CHALLENGES

6.4.1 AVAILABILITY OF ACEROLA SUBSTITUTES

6.4.2 STRINGENT GOVERNMENT REGULATIONS

7 NORTH AMERICA ACEROLA EXTRACT MARKET, BY FORM

7.1 OVERVIEW

7.2 DRY/ POWDER

7.3 LIQUID/ PASTE

8 NORTH AMERICA ACEROLA EXTRACT MARKET, BY TYPE

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 ORGANIC

9 NORTH AMERICA ACEROLA EXTRACT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DIETARY SUPPLEMENTS

9.3 BAKERY PRODUCTS

9.3.1 BISCUITS AND COOKIES

9.3.2 CAKES AND PASTRIES

9.3.3 BREAD

9.3.4 DONUTS AND MUFFINS

9.3.5 OTHERS

9.4 BEVERAGES

9.4.1 NON-ALCOHOLIC

9.4.1.1 SMOOTHIES

9.4.1.2 SPORTS & ENERGY DRINKS

9.4.1.3 CARBONATED DRINKS

9.4.1.4 RTD COFFEE & TEA

9.4.1.5 OTHERS

9.4.2 ALCOHOLIC

9.5 SPORTS NUTRITION

9.6 CONVENIENCE & PROCESSED PRODUCTS

9.6.1 SNACKS

9.6.2 RTD MEALS

9.6.3 JAMS, PRESERVES & MARMALADE

9.6.4 SEASONINGS & DRESSINGS

9.6.5 SOUPS & SAUCES

9.6.6 OTHERS

9.7 COSMETICS & PERSONAL CARE

9.7.1 SKIN CARE

9.7.2 HAIR CARE

9.7.3 SOAPS & BODY WASH

9.7.4 OTHERS

9.8 DAIRY PRODUCTS

9.8.1 ICE-CREAM

9.8.2 MILK

9.8.3 SPREADS

9.8.4 YOGURT

9.8.5 PUDDINGS

9.8.6 CHEESE

9.8.7 OTHERS

9.9 CONFECTIONERY PRODUCTS

9.9.1 CHOCOLATES

9.9.2 SOFT AND HARD CANDIES

9.9.3 CREAM FILLINGS

9.9.4 MARZIPAN

9.9.5 FONDANT

9.9.6 OTHERS

9.1 MEAT & POULTRY PRODUCTS

9.11 GRANOLA & BREAKFAST CEREALS

10 NORTH AMERICA ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

10.3.1 STORE-BASED RETAILING

10.3.1.1 WHOLESALERS

10.3.1.2 CONVENIENCE STORES

10.3.1.3 SUPERMARKETS/HYPERMARKETS

10.3.1.4 GROCERY STORES

10.3.1.5 PHARMACIES

10.3.1.6 SPECIALTY STORES/ HEALTH FOOD STORED

10.3.2 NON-STORE RETAILING

10.3.2.1 ONLINE

10.3.2.2 CONVENIENCE STORES

11 NORTH AMERICA ACEROLA EXTRACT MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA ACEROLA EXTRACT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 NATUREX (A SUBSIDIARY OF GIVAUDAN)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 DUAS RODAS INSTITUCIONAL

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 AMWAY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 DUPONT

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 DIANA GROUP (A SUBSIDIARY OF SYMRISE)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 NIAGRO - NICHIREI DO BRASIL AG. LTDA (A SUBSIDIARY OF NICHIREI CORPORATION)

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 ADVANCED BIOTECH

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 BLUE MACAW FLORA

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 BÖSCH BODEN SPIES

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 FOODCHEM INTERNATIONAL CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 FLORIDA FOOD PRODUCTS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 HANDARY S.A.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 ITI TROPICALS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 KINGHERBS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 KEMIN INDUSTRIES, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 NP NUTRA

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 OPTIMALLY ORGANIC

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 THE GREEN LABS LLC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 VITA FORTE INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 VITAL HERBS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 VITAMINS

TABLE 2 MINERALS

TABLE 3 FATS AND FATTY ACIDS

TABLE 4 PROTEINS AND AMINO-ACIDS

TABLE 5 CARBOHYDRATES

TABLE 6 STEROLS

TABLE 7 OTHERS

TABLE 8 NORTH AMERICA ACEROLA EXTRACT MARKET: PATENTS (2018-2020)

TABLE 9 NORTH AMERICA ACEROLA EXTRACT MARKET: REGULATORY FRAMEWORK

TABLE 10 MAIN NUTRIENTS FOUND IN ACEROLA

TABLE 11 COST OF ACEROLA BASED PRODUCTS

TABLE 12 NORTH AMERICA ACEROLA EXTRACT MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICADRY/ POWDER IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA LIQUID/ PASTE IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA ACEROLA EXTRACT MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICACONVENTIONAL IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA ORGANIC IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICADIETARY SUPPLEMENTS IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICABAKERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICABAKERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICABEVERAGES IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICABEVERAGES IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICANON-ALCOHOLIC IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICASPORTS NUTRITION IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICACONVENIENCE & PROCESSED PRODUCTS IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICACONVENIENCE & PROCESSED IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICACOSMETICS & PERSONAL CARE IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICACOSMETICS & PERSONAL CARE IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA DAIRY PRODUCTS IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICADAIRY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA CONFECTIONERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICACONFECTIONERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA MEAT & POULTRY PRODUCTS IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA GRANOLA & BREAKFAST CEREALS IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICADIRECT IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICAINDIRECT IN ACEROLA EXTRACT MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICAINDIRECT IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICASTORE-BASED RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICANON-STORE RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA ACEROLA EXTRACT MARKET,BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICAACEROLA EXTRACT MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 44 NORTH AMERICA ACEROLA EXTRACT MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BAKERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA BEVERAGES IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 48 NORTH AMERICA NON-ALCOHOLIC IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA CONVENIENCE & PROCESSED PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 50 NORTH AMERICA DAIRY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA CONFECTIONERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 52 NORTH AMERICA COSMETICS & PERSONAL CARE IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 53 NORTH AMERICA ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 54 NORTH AMERICA INDIRECT IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 55 NORTH AMERICA STORE-BASED RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 56 NORTH AMERICA NON-STORE RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION))

TABLE 57 U.S.ACEROLA EXTRACT MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 58 U.S. ACEROLA EXTRACT MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 59 U.S. ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 60 U.S. BAKERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 61 U.S. BEVERAGES IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 62 U.S. NON-ALCOHOLIC IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 63 U.S. CONVENIENCE & PROCESSED PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 U.S. DAIRY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 65 U.S. CONFECTIONERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 66 U.S. COSMETICS & PERSONAL CARE IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 67 U.S. ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 68 U.S. INDIRECT IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 69 U.S. STORE-BASED RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 70 U.S. NON-STORE RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION))

TABLE 71 CANADAACEROLA EXTRACT MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 72 CANADA ACEROLA EXTRACT MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 73 CANADA ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 74 CANADA BAKERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 75 CANADA BEVERAGES IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 76 CANADA NON-ALCOHOLIC IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 77 CANADA CONVENIENCE & PROCESSED PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 CANADA DAIRY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 79 CANADA CONFECTIONERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 80 CANADA COSMETICS & PERSONAL CARE IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 81 CANADA ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 82 CANADA INDIRECT IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 83 CANADA STORE-BASED RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 84 CANADA NON-STORE RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION))

TABLE 85 MEXICOACEROLA EXTRACT MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 86 MEXICO ACEROLA EXTRACT MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 87 MEXICO ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 88 MEXICO BAKERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 89 MEXICO BEVERAGES IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 90 MEXICO NON-ALCOHOLIC IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 91 MEXICO CONVENIENCE & PROCESSED PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 92 MEXICO DAIRY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 93 MEXICO CONFECTIONERY PRODUCTS IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 94 MEXICO COSMETICS & PERSONAL CARE IN ACEROLA EXTRACT MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 95 MEXICO ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 96 MEXICO INDIRECT IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 97 MEXICO STORE-BASED RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 98 MEXICO NON-STORE RETAILING IN ACEROLA EXTRACT MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION))

List of Figure

LIST OF FIGURES

FIGURE 1 NORTH AMERICA ACEROLA EXTRACT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ACEROLA EXTRACT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ACEROLA EXTRACT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ACEROLA EXTRACT MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ACEROLA EXTRACT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ACEROLA EXTRACT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 7 NORTH AMERICA ACEROLA EXTRACT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA ACEROLA EXTRACT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA ACEROLA EXTRACT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ACEROLA EXTRACT MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA ACEROLA EXTRACT MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 INCREASING DEMAND FOR CONVENIENCE FOOD & BEVERAGE PRODUCTSAND GROWING CONSUMPTION OF VITAMIN-RICH PRODUCT ARE EXPECTED TO THE DRIVE THE NORTH AMERICA ACEROLA EXTRACT MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 DRY/POWDER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ACEROLA EXTRACT MARKET IN 2020 & 2027

FIGURE 14 VITAMIN C CONTENT OF FRUITS (MG/100G)

FIGURE 15 PATENT REGISTERED FOR ACEROLA, BY COUNTRY

FIGURE 16 PATENT REGISTERED YEAR (1998-2020)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA ACEROLA EXTRACT MARKET

FIGURE 18 U.S. FOOD CONSUMPTION

FIGURE 19 CONSUMPTION OF FOOD IN THE WORLD

FIGURE 20 CONSUMPTION OF FOOD IN CHINA

FIGURE 21 CONSUMPTION OF FOOD IN INDIA

FIGURE 22 NUTRITION IN RAW ACEROLA

FIGURE 23 CALORIES BY SOURCE

FIGURE 24 IMPORT OF SUPERFRUIT JUICES BY COUNTRIES

FIGURE 25 EXPORT OF SUPERFRUIT JUICES BY COUNTRIES

FIGURE 26 IMPORT OF SUPERFRUIT JUICES

FIGURE 27 NORTH AMERICA ACEROLA EXTRACT MARKET: BY FORM, 2019

FIGURE 28 NORTH AMERICA ACEROLA EXTRACT MARKET: BY TYPE, 2019

FIGURE 29 NORTH AMERICA ACEROLA EXTRACT MARKET: BY APPLICATION, 2019

FIGURE 30 NORTH AMERICA ACEROLA EXTRACT MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 31 NORTH AMERICA ACEROLA EXTRACT MARKET: SNAPSHOT (2019)

FIGURE 32 NORTH AMERICA ACEROLA EXTRACT MARKET: BY COUNTRY(2019)

FIGURE 33 NORTH AMERICA ACEROLA EXTRACT MARKET: BY COUNTRY(2020& 2027)

FIGURE 34 NORTH AMERICA ACEROLA EXTRACT MARKET: BY COUNTRY (2019& 2027)

FIGURE 35 NORTH AMERICA ACEROLA EXTRACT MARKET: BY FORM (2020-2027)

FIGURE 36 NORTH AMERICA ACEROLA EXTRACT MARKET: COMPANY SHARE 2019 (%)

North America Acerola Extract Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Acerola Extract Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Acerola Extract Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.