North America Acrylic Monomers Market

Market Size in USD Thousand

CAGR :

%

USD

1,107,202.15 Thousand

USD

1,608,199.90 Thousand

2022

2030

USD

1,107,202.15 Thousand

USD

1,608,199.90 Thousand

2022

2030

| 2023 –2030 | |

| USD 1,107,202.15 Thousand | |

| USD 1,608,199.90 Thousand | |

|

|

|

North America Acrylic Monomers Market Analysis and Size

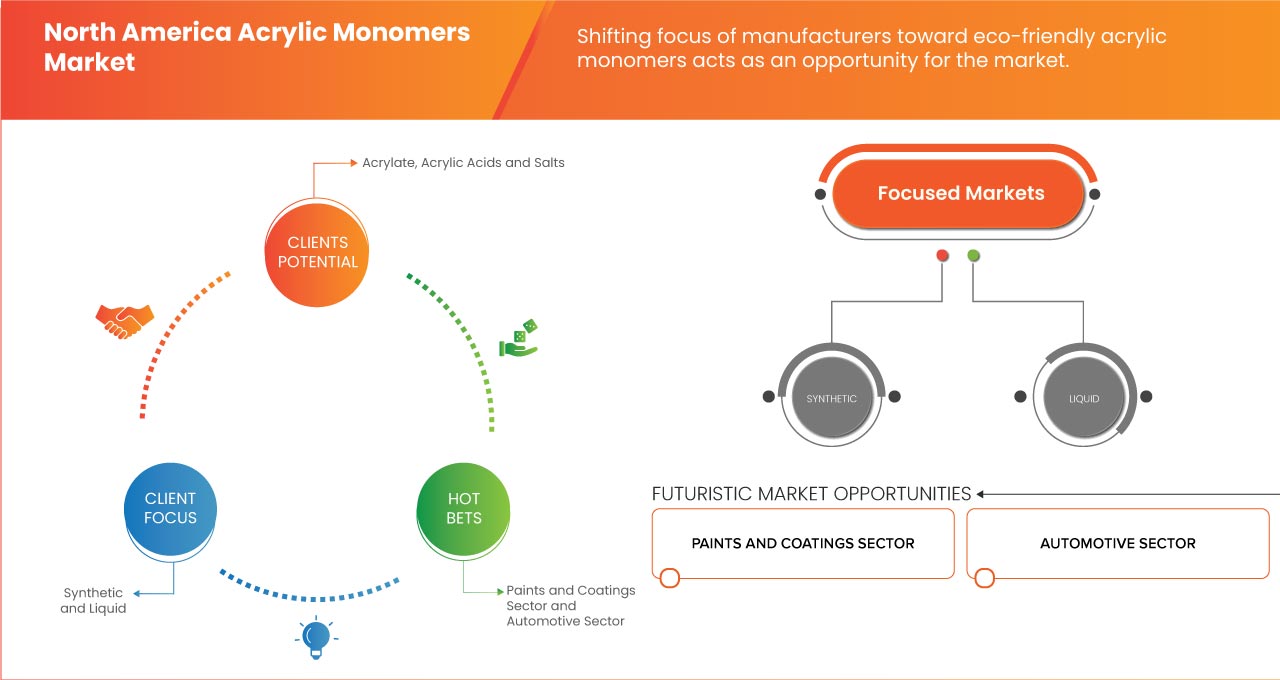

The North America acrylic monomers market is driven by increasing spending in the construction sector. In addition, a positive outlook toward the paints and coating industry is an important driver for the market. Moreover, the shifting focus of manufacturers toward eco-friendly acrylic monomers is expected to boost market growth. However, meeting complex and evolving regulatory standards is expected to restrain market growth.

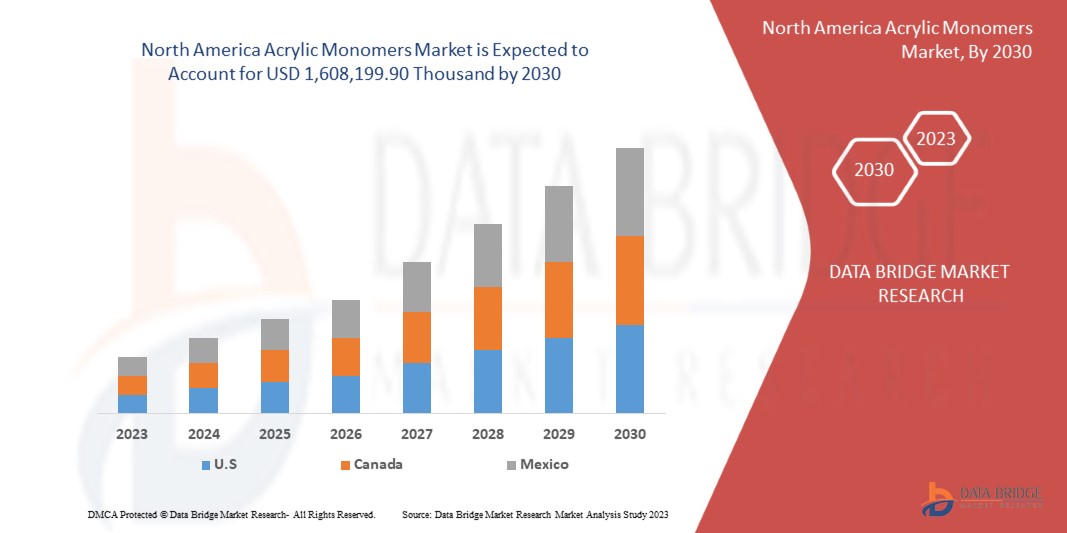

Data Bridge Market Research analyzes that the North America acrylic monomers market is expected to reach USD 1,608,199.90 thousand by 2030 from USD 1,107,202.15 thousand in 2022, growing with a CAGR of 4.9% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Volume in Thousand Liters |

|

Segments Covered |

Product (Acrylate, Acrylic Acids and Salts, Polyfunctional Acrylics, Bisphenol Acrylics, Fluorinated Acrylics, Acrylonitrile, Acrylamide and Methacrylamide, Carbohydrate Monomers, Malemide, and Others), Application (Plastic, Adhesives and Sealants, Synthetic Resins, Acrylic Fibers, Building Materials, Fabrics, Acrylic Rubber, and Others), End-Use (Paints and Coatings, Building and Construction, Automotive, Consumer Goods, Packaging, Water Treatment, Marine, Aerospace, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

BASF SE, Arkema, Mitsubishi Chemical Group Corporation, Dow, LG Chem, Evonik Industries AG, NIPPON SHOKUBAI CO., LTD., LobaChemie Pvt Ltd., Solventis, and Tokyo Chemical Industries CO., Ltd. |

Market Definition

Acrylic monomers consist of compounds that encompass acrylic acid and its associated acrylates. These compounds primarily constitute acrylates, acrylic acid, or polymers. Acrylic monomers are known for their high reactivity. They are commonly combined with polymer powder in the creation of durable acrylic nails. Ethyl methacrylate (EMA) is a typical component in acrylic monomers due to its exceptional strength, rapid curing, and excellent adhesion properties.

North America Acrylic Monomers Market Dynamics

This section deals with understanding the market drivers, restraints, opportunities, and challenges. All of these are discussed in detail below:

Drivers

- Positive Outlook toward the Paints and Coating Industry

The paints and coatings industry holds a positive outlook with respect to the acrylic monomers market, driven by various factors and applications that contribute to its growth. One of the primary drivers behind the positive outlook for the paints and coatings industry is the extensive use of acrylic monomers, specifically N-butyl acrylate. These monomers serve as essential building blocks for copolymers used in the formulation of paints and coatings. These properties include the ability to form hydrophobic polymers, which are crucial for creating coatings that provide protection and durability. This property makes them particularly valuable in the formulation of coatings, where water resistance and durability are essential. Methacrylate, another essential acrylic monomer derived from methacrylic acid, enjoys widespread usage in diverse applications, including computer screens and paints.

The demand for high-performance coatings with exceptional durability, weather resistance, and clarity has been on the rise. Acrylic monomers, with their hydrophobic nature and ability to form tough polymers, meet these demands effectively. Manufacturers in the paints and coatings industry increasingly turn to acrylic copolymers to enhance the quality and longevity of their products. The expansion of construction and infrastructure projects worldwide has generated significant demand for paints and coatings, which is driving the market growth.

- Increasing Expenditure in the Construction Sector

The construction sector stands as a vital pillar of North America economic development, shaping the skylines of cities and laying the foundation for infrastructure growth. The surge in construction spending is primarily attributed to the growing urbanization and population expansion. With more people moving to cities, there is an escalating demand for residential, commercial, and infrastructure development. Governments and private investors are pouring substantial funds into construction projects to meet these demands. This surge in construction activity serves as a catalyst for the acrylic monomers market.

Acrylic monomers, with their ability to fortify concrete, are the ideal solution. They reinforce the concrete matrix, reducing the risk of cracks and fractures. This increased durability ensures that structures can withstand the test of time, aligning perfectly with the long-term goals of construction projects. Acrylic monomers play a pivotal role in this endeavor by improving the workability and flowability of concrete. With optimized water-cement ratios and enhanced fluidity, construction teams can efficiently pour and consolidate concrete, enabling the realization of intricate and daring designs. This not only saves time but also reduces labor costs, making it an economically attractive choice for construction projects. Acrylic monomers provide the required adhesion, water resistance, and durability, making them an indispensable component in the construction of these monumental structures, which is propelling the market growth.

Opportunities

- Shifting Focus of Manufacturers toward Eco-friendly Acrylic Monomers

The acrylic monomers market is currently witnessing a significant shift in focus with manufacturers increasingly turning their attention towards eco-friendly acrylic monomers. One key driver behind this shift is the increasing concern for the environment. In recent years, there has been a growing awareness of the environmental impact of traditional acrylic monomers, which are often derived from fossil fuels and can release harmful emissions during their production. This has led to a heightened demand for more environmentally friendly alternatives. Manufacturers are now investing in research and development to create acrylic monomers that are derived from renewable resources and have a reduced environmental impact.

Furthermore, stringent government regulations and policies aimed at reducing greenhouse gas emissions are pushing manufacturers to adopt more sustainable practices. This regulatory pressure is driving the development and adoption of eco-friendly acrylic monomers as a means to comply with environmental standards. As a result, manufacturers who embrace this shift in focus are likely to gain a competitive edge in the market. The shift towards eco-friendly acrylic monomers also aligns with changing consumer preferences. Today's consumers are more environmentally conscious and are increasingly seeking products that are produced using sustainable and eco-friendly processes, thus providing the opportunity for market growth.

- Immense Potential in the Water Treatment Industry

The water treatment industry is currently witnessing immense potential, creating a promising opportunity for the acrylic monomer market. In recent years, concerns about water pollution and scarcity have grown significantly, driving the need for effective water treatment solutions. Acrylic monomers, particularly glacial acrylic acid, play a crucial role in this industry as they are used as flocculent polymers. These polymers aid in the removal of impurities and contaminants from water, making it safer and more suitable for various applications.

One of the key applications of acrylic monomers, such as glacial acrylic acid, is their role as flocculent polymers. In water treatment processes, flocculants are substances that help in the agglomeration and precipitation of suspended particles. Glacial acrylic acid can serve as a monomer for the production of these flocculent polymers. When added to water, these polymers bind to impurities and contaminants, causing them to form agglomerated flakes. This process is critical in the removal of pollutants, including organic matter, chemicals, and heavy metals, from water sources. The agglomerated flakes formed with the help of acrylic monomers can be easily filtered out, resulting in cleaner water. This is particularly valuable in industries where the quality of water is of utmost importance, such as municipal water treatment plants, industrial processes, and even in the production of drinking water. The ability of acrylic monomers to enhance the efficiency of water treatment processes by facilitating the removal of impurities is a significant factor contributing to their relevance in the water treatment industry.

Restraints/ Challenges

- Fluctuations in the Prices of Raw Materials

Acrylic monomers are made using ingredients such as propylene and isobutylene. When the prices of these raw materials suddenly rise, it makes the production of acrylic monomers more expensive. Manufacturers might have to charge more for their products or see their profits shrink.

The businesses that use acrylic monomers to make paints, adhesives, or coatings rely on a stable supply and cost of these monomers to plan their budgets and prices. When raw material prices jump, it disrupts these plans, causing uncertainty in the market.

In addition, these price fluctuations can affect smaller companies and start-ups more, as they might not have the resources to handle sudden cost increases. It can make it harder for them to compete in the market.

Moreover, industries that use acrylic monomers, such as construction, automotive, and paints and coatings, also feel the impact. Unpredictable costs can affect their projects and budgets, potentially leading to delays or increased expenses.

- Meeting Complex and Evolving Regulatory Standards

In the acrylic monomers industry, there are rules set by governments and environmental agencies around the globe. These rules are there to ensure the safety of workers, consumers, and the environment. They might include limits on the use of certain chemicals or guidelines on how waste should be managed.

Complying with these regulations often requires significant investments in research and development. Companies may need to reformulate their products, change their production processes, or invest in new equipment to meet these standards. The paperwork and documentation required for compliance can also be overwhelming. This can slow down product development and increase costs.

Moreover, non-compliance can lead to fines, legal troubles, and damage to a company's reputation, which is expected to challenge market growth.

Recent Developments

- In September 2023, BASF SE expanded its growing portfolio of 14C bio-based monomers with a proprietary process for the production of 2-Octyl Acrylate (2-OA). The new product underlines BASF’s strong commitment to innovation for a sustainable future with 73% 14C-tracable bio-based content according to ISO 16620. Besides the regular 14C bio-based 2-Octyl Acrylate, BASF also launched a new product 2-Octyl Acrylate BMB ISCC Plus.

- In April 2023, Evonik received DIN CERTCO certification for its VISIOMER Terra biobased methacrylate monomers, confirming a bio-content of up to 85%. This certification, based on the C14 radiocarbon method and ASTM D 6866:2021 protocol, highlights Evonik's commitment to sustainability and climate mitigation.

- In January 2023, Mitsubishi Chemical Group Corporation and Mitsui Chemicals initiated collaborative research to standardize and optimize chemical logistics, which underlie both society and industry. The corporations want to gradually roll out activities across a variety of key subjects, with those that can be immediately executed expected to begin this fiscal year. The companies will work together to develop stronger and more sustainable chemical logistics.

- In September 2019, Archer Daniels Midland and LG Chem formed a partnership to develop biobased acrylic acid, a key component in superabsorbent polymers used in products such as diapers. This joint effort is focused on providing sustainable alternatives to the petrochemical-based acrylic acid currently in use.

North America Acrylic Monomers Market Scope

The North America acrylic monomers market is segmented into three segments based on product, application, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Acrylate

- Acrylic Acids and Salts

- Polyfunctional Acrylics

- Bisphenol Acrylics

- Fluorinated Acrylics

- Acrylonitrile

- Acrylamide and Methacrylamide

- Carbohydrate Monomers

- Malemide

- Others

On the basis of product, the market is segmented into acrylamide and methacrylamide, acrylate, acrylic acids and salts, acrylonitrile, bisphenol acrylics, carbohydrate monomers, fluorinated acrylics, malemide, polyfunctional acrylics, and others.

Application

- Plastic

- Adhesives and Sealants

- Synthetic Resins

- Acrylic Fibers

- Building Materials

- Fabrics

- Acrylic Rubber

- Others

On the basis of application, the market is segmented into plastic, adhesives and sealants, synthetic resins, acrylic fibers, building materials, fabrics, acrylic rubber, and others.

End-Use

- Paints and Coatings

- Building and Construction

- Automotive

- Consumer Goods

- Packaging

- Aerospace

- Marine

- Water Treatment

- Others

On the basis of end-use, the market is segmented into paints and coatings, building and construction, automotive, consumer goods, packaging, water treatment, marine, aerospace, and others.

North America Acrylic Monomers Market Regional Analysis/Insights

The North America acrylic monomers market is analyzed and market size information is provided based on product, application, and end-use.

The countries covered in this market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America acrylic monomers market due to the rising demand for acrylic monomers in the construction industry in the country.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Acrylic Monomers Market Share Analysis

The North America acrylic monomers market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major market players operating in the North America acrylic monomers market are BASF SE, Arkema, Mitsubishi Chemical Group Corporation, Dow, LG Chem, Evonik Industries AG, NIPPON SHOKUBAI CO., LTD., LobaChemie Pv.t Ltd., Solventis, and Tokyo Chemical Industries CO., Ltd. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 MARKET END-USE COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR MARKET POSITION GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 VENDOR SELECTION CRITERIA

4.4 RAW MATERIAL COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 POSITIVE OUTLOOK TOWARD PAINTS AND COATINGS INDUSTRY

5.1.2 INCREASING SPENDING IN THE CONSTRUCTION SECTOR

5.1.3 HIGH ADOPTION OF ADHESIVES AND SEALANTS

5.2 RESTRAINTS

5.2.1 FLUCTUATIONS IN THE PRICES OF RAW MATERIALS

5.2.2 AVAILABILITY OF ALTERNATIVE MATERIALS AND TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 SHIFTING FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY ACRYLIC MONOMERS

5.3.2 IMMENSE POTENTIAL IN THE WATER TREATMENT INDUSTRY

5.4 CHALLENGES

5.4.1 MEETING COMPLEX AND CHANGING REGULATORY STANDARDS

5.4.2 INTERNAL COMPETITION IN THE MARKET

6 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 ACRYLATE

6.2.1 BUTYL ACRYLATE MONOMER

6.2.2 METHYL ACRYLATE MONOMER

6.2.3 METHYL METHACRYLATE MONOMER

6.2.4 ETHYL HEXYL ACRYLATE MONOMER

6.2.5 ETHYL ACRYLATE MONOMER

6.2.6 OTHERS

6.3 ACRYLIC ACIDS AND SALTS

6.4 POLYFUNCTIONAL ACRYLICS

6.5 BISPHENOL ACRYLICS

6.6 FLUORINATED ACRYLICS

6.7 ACRYLONITRILE

6.8 ACRYLAMIDE AND METHACRYLAMIDE

6.9 CARBOHYDRATE MONOMERS

6.1 MALEMIDE

6.11 OTHERS

7 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 PLASTIC

7.2.1 PLASTIC MANUFACTURING

7.2.2 PLASTIC ADDITIVES

7.3 ADHESIVES AND SEALANTS

7.4 SYNTHETIC RESINS

7.5 ACRYLIC FIBERS

7.6 BUILDING MATERIALS

7.7 FABRICS

7.7.1 KNITTED

7.7.2 WOVEN

7.7.3 NONWOVEN

7.7.4 OTHERS

7.8 ACRYLIC RUBBER

7.9 OTHERS

8 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY END-USE

8.1 OVERVIEW

8.2 PAINTS AND COATINGS

8.2.1 ACRYLIC ACIDS AND SALTS

8.2.2 BISPHENOL ACRYLICS

8.2.3 POLYFUNCTIONAL ACRYLICS

8.2.4 FLUORINATED ACRYLICS

8.2.5 ACRYLONITRILE

8.2.6 ACRYLAMIDE AND METHACRYLAMIDE

8.2.7 MALEMIDE

8.2.8 CARBOHYDRATE MONOMERS

8.2.9 OTHERS

8.3 BUILDING AND CONSTRUCTION

8.3.1 ACRYLATE

8.3.2 POLYFUNCTIONAL ACRYLICS

8.3.3 ACRYLIC ACIDS AND SALTS

8.3.4 BISPHENOL ACRYLICS

8.3.5 ACRYLONITRILE

8.3.6 CARBOHYDRATE MONOMERS

8.3.7 FLUORINATED ACRYLICS

8.3.8 ACRYLAMIDE AND METHACRYLAMIDE

8.3.9 MALEMIDE

8.3.10 OTHERS

8.4 AUTOMOTIVE

8.4.1 ACRYLATE

8.4.2 POLYFUNCTIONAL ACRYLICS

8.4.3 ACRYLONITRILE

8.4.4 ACRYLIC ACIDS AND SALTS

8.4.5 BISPHENOL ACRYLICS

8.4.6 FLUORINATED ACRYLICS

8.4.7 ACRYLAMIDE AND METHACRYLAMIDE

8.4.8 MALEMIDE

8.4.9 CARBOHYDRATE MONOMERS

8.4.10 OTHERS

8.5 CONSUMER GOODS

8.5.1 ACRYLATE

8.5.2 ACRYLIC ACIDS AND SALTS

8.5.3 POLYFUNCTIONAL ACRYLICS

8.5.4 BISPHENOL ACRYLICS

8.5.5 FLUORINATED ACRYLICS

8.5.6 CARBOHYDRATE MONOMERS

8.5.7 ACRYLAMIDE AND METHACRYLAMIDE

8.5.8 ACRYLONITRILE

8.5.9 MALEMIDE

8.5.10 OTHERS

8.6 PACKAGING

8.6.1 ACRYLATE

8.6.2 POLYFUNCTIONAL ACRYLICS

8.6.3 ACRYLIC ACIDS AND SALTS

8.6.4 BISPHENOL ACRYLICS

8.6.5 FLUORINATED ACRYLICS

8.6.6 CARBOHYDRATE MONOMERS

8.6.7 ACRYLAMIDE AND METHACRYLAMIDE

8.6.8 MALEMIDE

8.6.9 OTHERS

8.7 AEROSPACE

8.7.1 ACRYLATE

8.7.2 POLYFUNCTIONAL ACRYLICS

8.7.3 FLUORINATED ACRYLICS

8.7.4 BISPHENOL ACRYLICS

8.7.5 ACRYLIC ACIDS AND SALTS

8.7.6 ACRYLAMIDE AND METHACRYLAMIDE

8.7.7 CARBOHYDRATE MONOMERS

8.7.8 ACRYLONITRILE

8.7.9 MALEMIDE

8.7.10 OTHERS

8.8 MARINE

8.8.1 ACRYLATE

8.8.2 POLYFUNCTIONAL ACRYLICS

8.8.3 FLUORINATED ACRYLICS

8.8.4 ACRYLIC ACIDS AND SALTS

8.8.5 BISPHENOL ACRYLICS

8.8.6 ACRYLAMIDE AND METHACRYLAMIDE

8.8.7 CARBOHYDRATE MONOMERS

8.8.8 ACRYLONITRILE

8.8.9 MALEMIDE

8.8.10 OTHERS

8.9 WATER TREATMENT

8.9.1 ACRYLAMIDE AND METHACRYLAMIDE

8.9.2 POLYFUNCTIONAL ACRYLICS

8.9.3 ACRYLIC ACIDS AND SALTS

8.9.4 ACRYLATE

8.9.5 OTHERS

8.1 OTHERS

8.10.1 ACRYLATE

8.10.2 ACRYLIC ACIDS AND SALTS

8.10.3 BISPHENOL ACRYLICS

8.10.4 POLYFUNCTIONAL ACRYLICS

8.10.5 FLUORINATED ACRYLICS

8.10.6 ACRYLONITRILE

8.10.7 ACRYLAMIDE AND METHACRYLAMIDE

8.10.8 MALEMIDE

8.10.9 CARBOHYDRATE MONOMERS

8.10.10 OTHERS

9 NORTH AMERICA ACRYLIC MONOMERS MARKET: BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 DOW

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 BASF SE

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 EVONIK INDUSTRIES AG

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 MITSUBISHI CHEMICAL GROUP CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 ARKEMA

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 LG CHEM

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT

12.7 LOBACHEMIE PVT. LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 NIPPON SHOKUBAI CO., LTD.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 SOLVENTIS

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 TOKYO CHEMICAL INDUSTRY CO., LTD.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 3 NORTH AMERICA ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ACRYLIC MONOMERS MARKET, BY COUNTRY, 2021-2030 (THOUSAND LITERS)

TABLE 19 U.S. ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 21 U.S. ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 23 U.S. PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 U.S. FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 U.S. ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 26 U.S. PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 U.S. BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 28 U.S. AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 29 U.S. CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 U.S. PACKAGING IN ACRYLIC MONOMERS MARKET, PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 U.S. AEROSPACE IN ACRYLIC MONOMERS MARKET, PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 32 U.S. MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 33 U.S. WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 34 U.S. OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 CANADA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 36 CANADA ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 37 CANADA ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 CANADA ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 39 CANADA PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 CANADA FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 CANADA ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 42 CANADA PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 43 CANADA BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 44 CANADA AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 45 CANADA CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 CANADA PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 47 CANADA AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 51 MEXICO ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 MEXICO ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 53 MEXICO ACRYLATE IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MEXICO ACRYLIC MONOMERS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 55 MEXICO PLASTIC IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 MEXICO FABRICS IN ACRYLIC MONOMERS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 MEXICO ACRYLIC MONOMERS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 58 MEXICO PAINTS AND COATINGS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 MEXICO BUILDING AND CONSTRUCTION IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 60 MEXICO AUTOMOTIVE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 61 MEXICO CONSUMER GOODS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 MEXICO PACKAGING IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 63 MEXICO AEROSPACE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 64 MEXICO MARINE IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO WATER TREATMENT IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 MEXICO OTHERS IN ACRYLIC MONOMERS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA ACRYLIC MONOMERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ACRYLIC MONOMERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ACRYLIC MONOMERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ACRYLIC MONOMERS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ACRYLIC MONOMERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ACRYLIC MONOMERS MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ACRYLIC MONOMERS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ACRYLIC MONOMERS MARKET: MARKET END-USE COVERAGE GRID

FIGURE 9 NORTH AMERICA ACRYLIC MONOMERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA ACRYLIC MONOMERS MARKET: DBMR MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA ACRYLIC MONOMERS MARKET: DBMR MARKET POSITION GRID

FIGURE 12 NORTH AMERICA ACRYLIC MONOMERS MARKET: SEGMENTATION

FIGURE 13 INCREASING SPENDING IN THE CONSTRUCTION SECTOR IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA ACRYLIC MONOMERS MARKET IN THE FORECAST PERIOD

FIGURE 14 THE ACRYLATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA ACRYLIC MONOMERS MARKET IN 2023 AND 2030

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ACRYLIC MONOMERS MARKET

FIGURE 17 NORTH AMERICA ACRYLIC MONOMERS MARKET: BY PRODUCT, 2022

FIGURE 18 NORTH AMERICA ACRYLIC MONOMERS MARKET: BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA ACRYLIC MONOMERS MARKET: BY END-USE, 2022

FIGURE 20 NORTH AMERICA ACRYLIC MONOMERS MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA ACRYLIC MONOMERS MARKET: COMPANY SHARE 2022 (%)

North America Acrylic Monomers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Acrylic Monomers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Acrylic Monomers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.