North America Aesthetic And Cosmetic Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.62 Billion

USD

2.78 Billion

2025

2033

USD

1.62 Billion

USD

2.78 Billion

2025

2033

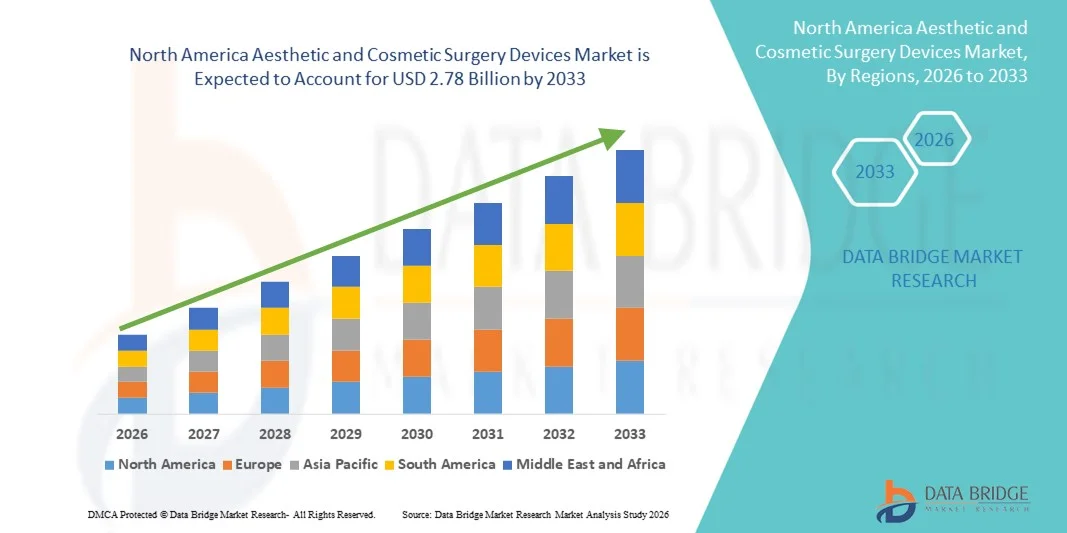

| 2026 –2033 | |

| USD 1.62 Billion | |

| USD 2.78 Billion | |

|

|

|

|

North America Aesthetic and Cosmetic Surgery Devices Market Size

- The North America aesthetic and cosmetic surgery devices market size was valued at USD 1.62 billion in 2025 and is expected to reach USD 2.78 billion by 2033, at a CAGR of 7.0% during the forecast period

- The market growth is largely driven by the rising adoption of minimally invasive and non-invasive aesthetic procedures, along with continuous technological advancements in energy-based and surgical cosmetic devices across the region

- Furthermore, increasing consumer focus on physical appearance, growing acceptance of cosmetic procedures, and strong demand for safe, effective, and clinically advanced solutions in medical spas and hospitals are establishing aesthetic and cosmetic surgery devices as essential tools in modern aesthetic care. These converging factors are accelerating device adoption, thereby significantly boosting the market’s growth

North America Aesthetic and Cosmetic Surgery Devices Market Analysis

- Aesthetic and cosmetic surgery devices, including breast implants, body implants, and custom-made implants, are increasingly vital components of modern cosmetic and reconstructive procedures in clinical and hospital settings in the U.S. due to their precision, safety, and ability to deliver predictable aesthetic outcomes

- The escalating demand for these devices is primarily fueled by growing consumer focus on appearance, rising acceptance of minimally invasive and reconstructive procedures, and technological advancements in implant materials and customization

- The U.S. dominated the North America aesthetic and cosmetic surgery devices market with the largest revenue share of 87.6% in 2025, characterized by high healthcare spending, widespread adoption of cosmetic procedures, and a strong presence of key industry players, with hospitals and clinics experiencing substantial growth in device usage, driven by innovations in polymers, metals, and biomaterials for implants

- Canada is expected to be the fastest-growing country in the North America aesthetic and cosmetic surgery devices market during the forecast period due to increasing disposable incomes, growing awareness of cosmetic procedures, and expanding access to advanced aesthetic treatments in clinics and hospitals

- Breast implants/mammary implants segment dominated the market with a market share of 38.7% in 2025, driven by their established demand in cosmetic and reconstructive surgeries and the growing preference for safe, high-quality implant materials

Report Scope and North America Aesthetic and Cosmetic Surgery Devices Market Segmentation

|

Attributes |

North America Aesthetic and Cosmetic Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Aesthetic and Cosmetic Surgery Devices Market Trends

Rising Adoption of Minimally Invasive and Customized Procedures

- A significant and accelerating trend in the North America aesthetic and cosmetic surgery devices market is the growing preference for minimally invasive and custom-made implant procedures, which enhance patient outcomes while reducing recovery time

- For instance, customized 3D-printed implants for reconstructive surgery allow surgeons to tailor devices to individual patient anatomy, improving fit, safety, and aesthetic results

- Advances in implant materials, such as biocompatible polymers and metals, are enabling safer, longer-lasting, and more versatile cosmetic and reconstructive solutions, driving procedural innovation

- Integration of digital imaging and surgical planning software allows practitioners to simulate procedures preoperatively, enhancing precision and patient satisfaction

- Increasing adoption of outpatient cosmetic clinics and dermatology centers is facilitating easier access to advanced devices for elective and reconstructive procedures

- Growth in medical tourism within North America, particularly for high-quality aesthetic treatments, is expanding the patient base for cosmetic surgery devices

- This trend towards patient-specific, minimally invasive, and technology-enabled devices is reshaping expectations for aesthetic outcomes in clinics and hospitals

- The demand for devices that combine safety, customization, and minimally invasive delivery is growing rapidly across both reconstructive and elective cosmetic procedures

North America Aesthetic and Cosmetic Surgery Devices Market Dynamics

Driver

Increasing Focus on Appearance and Rising Cosmetic Procedure Acceptance

- The growing importance of physical appearance among consumers, combined with increasing acceptance of aesthetic and reconstructive procedures, is a significant driver of market growth

- For instance, rising social media influence and celebrity-driven trends have led to higher demand for breast augmentation, body contouring, and facial implants in the U.S.

- Advances in implant technologies, including safer materials and customizable options, are encouraging both surgeons and patients to opt for more complex aesthetic procedures

- Expansion of outpatient clinics and dermatology centers offering minimally invasive treatments is making cosmetic procedures more accessible to a wider population

- The availability of training programs and specialized surgical devices is enabling more practitioners to perform advanced procedures, further driving device adoption

- Rising disposable incomes and willingness to invest in personal aesthetics are increasing the adoption of implants and other cosmetic surgery devices in North America

- Increased collaborations between device manufacturers and healthcare providers are accelerating adoption and innovation in aesthetic treatments

- Growing awareness of non-surgical and adjunctive procedures, such as fat grafting or tissue engineering, is boosting demand for complementary devices in aesthetic clinics

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The high cost of advanced implants, customized devices, and associated surgical procedures poses a major restraint for broader market adoption among price-sensitive consumers

- For instance, premium breast implants or custom-made body implants can be prohibitively expensive for patients without sufficient insurance coverage or disposable income

- Strict regulatory approvals and compliance requirements by the FDA for device safety and efficacy can delay product launches and increase development costs

- Challenges in ensuring biocompatibility, long-term safety, and surgical precision limit rapid adoption of newer materials and custom implants

- While prices are gradually decreasing for some standard devices, the perceived premium for high-end, technology-enabled implants can hinder uptake in smaller clinics or less affluent patient segments

- Overcoming these challenges through cost optimization, regulatory guidance, and patient education will be vital for sustained market growth in North America

- Limited awareness among patients and some healthcare providers about newer, minimally invasive devices can slow adoption rates in certain regions

- Risks of post-surgical complications or device recalls due to material defects can impact market confidence and restrain growth

North America Aesthetic and Cosmetic Surgery Devices Market Scope

The market is segmented on the basis of type, raw material, end user, and distribution channel.

- By Type

On the basis of type, the North America market is segmented into breast implants/mammary implants, implants for the body, and custom-made implants. The breast implants/mammary implants segment dominated the market with the largest revenue share of 38.7% in 2025, driven by the high demand for cosmetic and reconstructive breast surgeries. These implants are widely preferred due to their established safety profile, availability in diverse sizes and shapes, and compatibility with advanced surgical techniques. Surgeons and patients likely favor breast implants for both aesthetic enhancement and post-mastectomy reconstruction, which ensures consistent market demand. The segment also benefits from continuous product innovations, including textured and high-cohesive gel implants, which enhance safety and patient satisfaction. Marketing campaigns and social media influence further fuel consumer interest, particularly in the U.S., where cosmetic awareness is high. The segment’s dominance is reinforced by the strong presence of leading manufacturers who provide regulatory-approved implants with extensive clinical support.

The custom-made implants segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the rising preference for personalized solutions tailored to individual patient anatomy. These implants are particularly sought after in reconstructive procedures following trauma, congenital defects, or cancer surgeries. Advancements in 3D printing and digital imaging technologies allow precise preoperative planning, resulting in better aesthetic and functional outcomes. The ability to create patient-specific implants enhances surgeon confidence and patient satisfaction, which is driving adoption. Growing awareness among healthcare providers about the benefits of custom implants, coupled with increasing investments in research and development, is further fueling market expansion. The increasing availability of biocompatible materials for custom implants also supports this trend.

- By Raw Material

On the basis of raw material, the market is segmented into polymers, metals, and biomaterials. The polymers segment dominated the market in 2025 due to their biocompatibility, lightweight nature, and versatility in aesthetic and reconstructive applications. Polymers are widely used in breast implants, body implants, and various custom devices, offering durability and minimal risk of adverse reactions. Their ease of molding and adaptability to patient-specific shapes makes them ideal for both standard and custom implant solutions. Surgeons favor polymer-based devices for their long-term stability and compatibility with advanced surgical techniques. In addition, regulatory approvals and clinical data supporting polymer implants increase their acceptance among practitioners. The availability of high-quality, FDA-approved polymer materials also strengthens their market position.

The biomaterials segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for implants that mimic natural tissue properties and improve integration with human tissue. Biomaterials, including collagen-based or hydroxyapatite-enhanced composites, are gaining traction in both reconstructive and cosmetic surgeries. Their ability to reduce post-surgical complications and enhance healing makes them highly attractive for hospitals and specialized clinics. Rising research in tissue engineering and regenerative medicine supports the expansion of biomaterial applications. Surgeons increasingly prefer biomaterials for advanced, minimally invasive procedures where biocompatibility and aesthetic outcomes are critical.

- By End User

On the basis of end user, the market is segmented into clinics, hospitals, dermatology clinics, and others. The clinics segment dominated the market with the largest revenue share in 2025, driven by the high number of outpatient procedures and the growing popularity of minimally invasive aesthetic surgeries. Clinics provide convenient access for elective procedures, shorter recovery periods, and specialized care, attracting a wide patient base. They are often equipped with advanced implant technologies and staffed by trained cosmetic surgeons, ensuring high-quality procedural outcomes. The prevalence of dermatology and aesthetic clinics in urban areas further reinforces this segment’s dominance. Patient preference for personalized care and streamlined treatment processes continues to drive demand. Marketing campaigns and social media awareness programs by clinics also contribute to consistent growth.

The hospitals segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising demand for reconstructive surgeries and more complex aesthetic procedures requiring advanced infrastructure. Hospitals provide comprehensive surgical care, access to high-end imaging, and post-operative support, making them the preferred choice for high-risk or multi-stage procedures. Increasing collaboration between hospitals and device manufacturers ensures the availability of the latest implants and materials. Rising insurance coverage for reconstructive procedures also supports hospital adoption. Growth in medical tourism targeting high-quality hospital care further accelerates this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail pharmacies. The direct tender segment dominated the market in 2025, driven by procurement through hospitals, clinics, and large healthcare institutions. This channel allows bulk purchasing of implants and surgical devices, ensuring consistent supply and cost efficiencies for healthcare providers. Direct tender contracts often include long-term support and warranty services from manufacturers, enhancing trust and reliability. Hospitals and major clinics prefer this channel due to regulatory compliance and inventory management convenience. Manufacturers also benefit from predictable revenue streams and easier market penetration through direct tender agreements.

The retail pharmacies segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing consumer awareness and the rise of minimally invasive procedures that can be facilitated through outpatient care and home-use devices. Retail pharmacies provide convenient access for adjunctive products and support services related to aesthetic procedures. Growing partnerships between device manufacturers and pharmacy chains facilitate distribution of smaller or non-implant devices directly to clinics or patients. The trend of self-managed pre- and post-operative care also supports the growth of this channel. Increasing adoption of e-commerce for healthcare products further accelerates expansion in the retail pharmacy segment.

North America Aesthetic and Cosmetic Surgery Devices Market Regional Analysis

- The U.S. dominated the North America aesthetic and cosmetic surgery devices market with the largest revenue share of 87.6% in 2025, characterized by high healthcare spending, widespread adoption of cosmetic procedures, and a strong presence of key industry players, with hospitals and clinics experiencing substantial growth in device usage, driven by innovations in polymers, metals, and biomaterials for implants

- Patients and practitioners in the region highly value the precision, safety, and customization offered by advanced implants and minimally invasive devices, which enhance aesthetic outcomes and reduce recovery times

- This widespread adoption is further supported by high healthcare spending, a large pool of skilled cosmetic surgeons, and increasing investments in advanced clinics and hospitals, establishing aesthetic and cosmetic surgery devices as essential tools for both elective and reconstructive procedures

The U.S. Aesthetic and Cosmetic Surgery Devices Market Insight

The U.S. aesthetic and cosmetic surgery devices market captured the largest revenue share of 87.6% in 2025 within North America, fueled by rising consumer awareness of aesthetic procedures and the growing demand for minimally invasive and reconstructive surgeries. Patients are increasingly prioritizing personalized and safe implant solutions, including breast implants, body implants, and custom-made devices. The expansion of specialized clinics and dermatology centers, combined with hospitals equipped with advanced surgical technologies, further propels the market. Moreover, innovations in biocompatible polymers, metals, and biomaterials are significantly contributing to improved patient outcomes. Strong healthcare infrastructure, high disposable incomes, and increasing social media influence also play key roles in sustaining market growth.

Canada Aesthetic and Cosmetic Surgery Devices Market Insight

The Canada aesthetic and cosmetic surgery devices market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising disposable incomes, increasing awareness of cosmetic procedures, and growing medical tourism for aesthetic treatments. The adoption of minimally invasive and customized implants, coupled with the expansion of specialized aesthetic clinics, is enhancing accessibility to advanced procedures. Canadian consumers value high-quality, safe, and technologically advanced devices for reconstructive and elective surgeries. The presence of regulatory-compliant, FDA-approved implants and devices further encourages market uptake. Growing investments by manufacturers and healthcare providers in training and infrastructure are expected to accelerate market growth.

Mexico Aesthetic and Cosmetic Surgery Devices Market Insight

The Mexico aesthetic and cosmetic surgery devices market is expected to grow at a significant CAGR during the forecast period, driven by increasing awareness of cosmetic and reconstructive procedures and rising disposable incomes. Patients in Mexico are increasingly opting for minimally invasive treatments and personalized implants, including breast implants, body implants, and custom-made devices. The expansion of aesthetic clinics, dermatology centers, and hospital-based surgical units is enhancing access to advanced procedures. Moreover, the growth of medical tourism, particularly from the U.S. and Canada, is boosting demand for high-quality, cost-effective devices. Government initiatives to improve healthcare infrastructure and regulatory approvals for safe, high-quality implants further support market growth. Social media influence and a growing culture of aesthetic awareness are also key factors propelling adoption across the country.

North America Aesthetic and Cosmetic Surgery Devices Market Share

The North America Aesthetic and Cosmetic Surgery Devices industry is primarily led by well-established companies, including:

- Cutera, Inc. (U.S.)

- Tiger Aesthetics Medical, LLC (U.S.)

- Implantech (U.S.)

- Cynosure LLC (U.S.)

- Apyx Medical Corporation (U.S.)

- AbbVie Inc. (U.S.)

- CANDELA CORPORATION (U.S.)

- BTL Industries, Inc. (U.S.)

- Alma Lasers Ltd. (Israel)

- Lumenis Ltd. (Israel)

- Viora (U.S.)

- AirXpanders, Inc. (U.S.)

- Cartessa Aesthetics (U.S.)

- Aesthetic Management Partners (U.S.)

- Zimmer Biomet (U.S.)

- Solta Medical (U.S.)

- Viora Ltd. (U.S.)

- Cereplas (U.S.)

- PMT Corporation (U.S.)

What are the Recent Developments in North America Aesthetic and Cosmetic Surgery Devices Market?

- In October 2025, Apyx Medical submitted a new 510(k) to expand the AYON system’s indications to include power liposuction, aiming to broaden its procedural applications and further establish AYON as a comprehensive aesthetic surgical platform

- In May 2025, Apyx Medical Corporation received FDA 510(k) clearance for its AYON Body Contouring System, the first all‑in‑one platform combining fat removal, tissue contraction and electrosurgical capabilities for comprehensive aesthetic body sculpting marking a significant product advancement in surgical aesthetic technology

- In January 2025, Apyx Medical submitted its 510(k) premarket notification to the U.S. FDA for the AYON Body Contouring System, signaling regulatory progress for a novel comprehensive body contouring device integrating multiple surgical modalities

- In March 2024, Hugel America, Inc. received FDA approval for Letybo (letibotulinumtoxinA‑wlbg), a new neurotoxin injectable for treating moderate‑to‑severe glabellar (frown) lines in adults, positioning it as a competitive alternative in the aesthetic neuromodulator space

- In April 2023, Apyx Medical’s Renuvion APR Handpiece received FDA 510(k) clearance for soft tissue coagulation post‑liposuction, enhancing device capabilities in skin tightening adjunctive procedures an advance in non‑invasive and surgical aesthetics tech

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.