North America Aesthetic Devices Market

Market Size in USD Billion

CAGR :

%

USD

8.06 Billion

USD

18.71 Billion

2024

2032

USD

8.06 Billion

USD

18.71 Billion

2024

2032

| 2025 –2032 | |

| USD 8.06 Billion | |

| USD 18.71 Billion | |

|

|

|

|

North America Aesthetic Devices Market Size

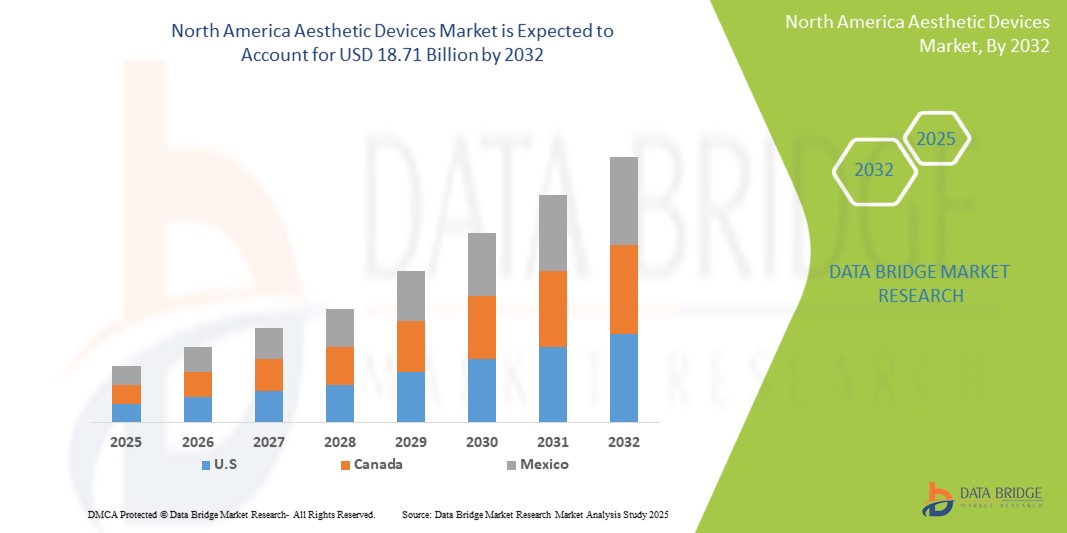

- The North America aesthetic devices market size was valued at USD 8.06 billion in 2024 and is expected to reach USD 18.71 billion by 2032, at a CAGR of 11.10% during the forecast period

- The market growth is primarily driven by the increasing demand for minimally invasive cosmetic procedures and the rising awareness of aesthetic enhancement options among diverse consumer groups. Advances in technology have improved the safety, efficacy, and variety of aesthetic devices available, encouraging wider adoption across both medical clinics and wellness centers

- In addition, growing social media influence and the emphasis on personal appearance are motivating more individuals to seek aesthetic treatments, fueling steady market expansion. Consumers are increasingly looking for non-surgical solutions that offer quicker recovery times and natural-looking results

North America Aesthetic Devices Market Analysis

- Aesthetic devices are witnessing strong adoption across North America, driven by rising demand for minimally invasive and non-invasive cosmetic procedures, growing awareness of personal aesthetics, and increasing disposable incomes

- The growing influence of social media, increased focus on anti-aging treatments, and technological advancements in laser, ultrasound, and radiofrequency devices are fueling demand for aesthetic solutions. Dermatology clinics, medical spas, and hospitals in North America are increasingly investing in multifunctional aesthetic platforms to enhance treatment precision, reduce downtime, and expand their service portfolio

- U.S. dominated the North America aesthetic devices market, accounting for the largest revenue share of 87.6% in 2024. This dominance is attributed to high consumer spending on cosmetic procedures, widespread availability of advanced devices, and the presence of globally recognized aesthetic brands headquartered in the U.S. Continuous innovation, strong marketing campaigns, and a large base of trained practitioners further strengthen the country’s leadership

- Canada is projected to be the fastest-growing country in the North America aesthetic devices market, with an estimated CAGR of 6.8% from 2025 to 2032. Growth in Canada is driven by increasing acceptance of non-surgical cosmetic procedures, expansion of aesthetic service providers in both urban and suburban areas, and supportive regulatory pathways for device approvals. Rising awareness in the aging population and growing medical tourism also contribute to market expansion

- The polymers segment held the largest market share of 47.6% in 2024, owing to the wide application of polymer-based materials in diverse aesthetic devices due to their flexibility, lightweight nature, and biocompatibility. These materials are extensively used in cosmetic implants, dermal fillers, and various skin treatment devices

Report Scope and North America Aesthetic Devices Market Segmentation

|

Attributes |

North America Aesthetic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Aesthetic Devices Market Trends

Advancements in Minimally Invasive Technologies and Patient-Centric Solutions

- A significant and accelerating trend in the North America aesthetic devices market is the continuous innovation in minimally invasive and non-invasive treatment technologies, aimed at improving patient comfort and reducing recovery times. These advancements are driving wider adoption among both clinicians and patients seeking effective yet less intrusive cosmetic solutions

- For instance, cutting-edge laser and ultrasound-based devices are being enhanced to offer targeted treatment with minimal side effects, allowing patients to resume normal activities rapidly. Devices such as the Cynosure Elite+ laser system and Ultherapy ultrasound technology exemplify this shift toward safer and more efficient aesthetic procedures

- Growing focus on patient-centric customization has led manufacturers to develop devices that can be tailored to individual skin types, conditions, and treatment goals. For instance, the use of advanced imaging and diagnostic tools helps practitioners personalize treatment plans, improving outcomes and patient satisfaction

- The integration of multifunctional platforms that combine various treatment modalities—such as radiofrequency, laser, and cryotherapy—in a single device is also gaining traction. This provides enhanced versatility to aesthetic practitioners, enabling comprehensive treatment offerings within a streamlined clinical setting

- These trends are reshaping the aesthetic device landscape by emphasizing safety, efficacy, and personalized care. Companies such as Allergan and Lumenis are at the forefront, continuously innovating their product portfolios to meet evolving consumer demands and clinical requirements

- The demand for advanced, minimally invasive aesthetic devices is growing rapidly across both developed and emerging markets, driven by increasing awareness, expanding aesthetic clinics, and a rising focus on wellness and self-care

North America Aesthetic Devices Market Dynamics

Driver

Growing Demand Driven by Rising Awareness and Expanding Cosmetic Procedures

- The increasing awareness about aesthetic treatments among a broader demographic, including millennials and aging populations, coupled with the rising demand for minimally invasive and non-invasive cosmetic procedures, is a major driving force behind the surge in demand for advanced aesthetic devices

- For instance, in April 2024, Lumenis Ltd. announced the launch of its state-of-the-art laser platform designed to cater to a wide range of applications such as skin resurfacing, wrinkle reduction, and vascular lesion treatments, offering enhanced precision and greater patient comfort. These continuous innovations by leading companies are anticipated to accelerate the growth of the aesthetic devices market throughout the forecast period

- As consumers increasingly seek effective yet low-risk solutions for skin rejuvenation, body contouring, and hair removal, aesthetic devices that offer faster recovery times and fewer side effects are gaining widespread acceptance in dermatology clinics, plastic surgery centers, and medical spas North Americanly

- Furthermore, the growing preference for personalized treatment plans and multi-functional devices capable of addressing various cosmetic concerns in a single session is further propelling market growth. Devices employing technologies such as radiofrequency, ultrasound, cryolipolysis, and fractional lasers are particularly favored for their safety and efficacy

- The expanding number of trained cosmetic practitioners and the rise of medical tourism in emerging economies are also contributing to the increasing adoption of these devices, enabling access to advanced aesthetic treatments across diverse geographical regions

Restraint/Challenge

Concerns Regarding High Initial Costs and Regulatory Compliance

- The high initial capital investment required to procure cutting-edge aesthetic devices remains a significant barrier, particularly for smaller clinics and emerging market players who may face budget constraints. This challenge is compounded by the continuous need for device upgrades and maintenance, which add to the overall expenditure

- For instance, premium aesthetic devices equipped with advanced features like fractional laser technology or high-intensity focused ultrasound (HIFU) typically come with a considerable price premium, limiting their accessibility in price-sensitive markets

- In addition, the stringent and varying regulatory requirements across different countries demand rigorous clinical trials, certifications, and approvals, which can delay product launches and increase compliance-related expenses, thereby impacting market growth

- Although manufacturers are progressively introducing more cost-effective models and flexible financing solutions to alleviate the financial burden on end-users, the perceived premium cost and complex regulatory landscape continue to restrict broader market penetration

- To ensure sustained growth, the industry must focus on developing affordable, innovative solutions, streamlining regulatory pathways, and providing comprehensive training to practitioners to enhance device usability and patient outcomes

North America Aesthetic Devices Market Scope

The market is segmented on the basis of products, raw materials, end user and distribution channel.

- By Products

On the basis of products, the aesthetic devices market is segmented into facial aesthetic products, body contouring devices, cosmetic implants, skin aesthetic devices, hair removal devices, and others. The facial aesthetic products segment held the largest market revenue share of 38.7% in 2024, propelled by an increasing North America emphasis on beauty, wellness, and aging gracefully. The rising popularity of non-invasive and minimally invasive treatments such as chemical peels, microdermabrasion, laser resurfacing, and injectables like botulinum toxin and dermal fillers is significantly driving demand. Technological innovations have enhanced safety profiles, reduced downtime, and improved treatment efficacy, attracting a broader demographic, including younger consumers seeking preventive care.

The body contouring devices segment is forecasted to register the fastest CAGR of 15.8% from 2025 to 2032. This growth is fueled by the escalating prevalence of obesity and sedentary lifestyles, combined with increasing consumer preference for non-surgical fat reduction techniques like cryolipolysis, ultrasound, and radiofrequency therapies. In addition, the rising awareness of body aesthetics and self-image is encouraging adoption in both developed and emerging markets.

- By Raw Materials

On the basis of raw materials, the aesthetic devices market is segmented into polymers, biomaterials, and metals. The polymers segment held the largest market share of 47.6% in 2024, owing to the wide application of polymer-based materials in diverse aesthetic devices due to their flexibility, lightweight nature, and biocompatibility. These materials are extensively used in cosmetic implants, dermal fillers, and various skin treatment devices.

Biomaterials are projected to achieve the fastest growth during the forecast period, with a CAGR of 14.2%, driven by advancements in regenerative medicine and tissue engineering, which utilize naturally derived materials to promote healing and integration within the human body. This segment benefits from increased research and development activities focusing on personalized medicine and implantable devices that mimic biological tissues. Metals such as titanium, stainless steel, and cobalt-chromium alloys continue to play a vital role, particularly in providing structural integrity and durability in cosmetic implants, surgical instruments, and other high-strength applications, holding a market share of 28.3% in 2024, especially where long-term stability and biocompatibility are critical.

- By End User

On the basis of end user, the aesthetic devices market is segmented into hospitals, dermatology clinics, clinics, academic and private research institutes, and others. Hospitals dominated the market in 2024, accounting for 42.5% of revenue, thanks to their well-established infrastructure, access to multidisciplinary specialists, and capability to perform advanced surgical and non-surgical aesthetic procedures. The presence of specialized departments and collaborations with medical device manufacturers enable hospitals to offer cutting-edge treatments, driving patient influx.

Dermatology clinics are expected to experience the fastest CAGR of 14.9% from 2025 to 2032, as these clinics focus increasingly on cosmetic dermatology and outpatient aesthetic procedures. The rise in aesthetic awareness and preference for less invasive treatments has led to more patients opting for dermatology clinics, which often provide personalized care, shorter wait times, and innovative technologies tailored to skin-related concerns. In addition, academic and private research institutes contribute by pioneering new technologies and clinical trials, fostering ongoing innovation in the sector.

- By Distribution Channel

On the basis of distribution channel, the aesthetic devices market is segmented into direct tender and retail sales. The direct tender segment led the market in 2024, with a revenue share of 54.3%, primarily due to bulk procurement contracts from hospitals, government healthcare organizations, and large healthcare providers that ensure consistent supply, negotiate better pricing, and maintain inventory for high-demand devices. This segment benefits from long-term agreements and institutional buying power.

Conversely, the retail sales segment is expected to register the fastest CAGR of 13.6% over the forecast period, driven by the proliferation of e-commerce platforms and online marketplaces, which have expanded product accessibility to smaller clinics, individual practitioners, and end consumers. The growth in retail sales is further supported by rising consumer confidence in purchasing aesthetic devices online, the availability of user-friendly, home-use devices, and increasing marketing efforts targeting direct-to-consumer sales channels, thereby broadening the market reach and encouraging product trial.

North America Aesthetic Devices Market Regional Analysis

- The North America aesthetic devices market accounted for 39.8% of the global market revenue in 2024, driven by rising demand for minimally invasive and non-invasive cosmetic procedures, growing awareness of personal aesthetics, and increasing disposable incomes. The region benefits from a mature healthcare infrastructure, strong presence of specialist clinics, and widespread consumer acceptance of advanced cosmetic treatments. Continuous innovation by leading manufacturers—ranging from multifunctional laser platforms to advanced ultrasound and radiofrequency systems—has positioned North America as a global hub for aesthetic technology adoption

- The growing influence of social media trends, heightened focus on anti-aging treatments, and advancements in device precision and safety are accelerating demand for aesthetic procedures. Dermatology clinics, medical spas, and hospitals in North America are increasingly investing in multifunctional platforms to deliver comprehensive skin rejuvenation, body contouring, and hair removal solutions. The dermatology clinics segment contributed approximately 46.2% of total North America market revenue in 2024, underscoring the pivotal role of specialist-led, targeted treatments in driving patient satisfaction and repeat procedures

- Technological advancements—such as AI-driven skin analysis tools, portable at-home treatment devices, and hybrid systems combining multiple modalities—are further enhancing treatment outcomes, shortening recovery periods, and expanding the range of treatable conditions. North America’s market leadership is also supported by robust practitioner training programs, high regulatory standards ensuring safety and efficacy, and a strong ecosystem of marketing and brand partnerships that amplify consumer engagement

U.S. Aesthetic Devices Market Insight

The U.S. aesthetic devices market dominated the North America aesthetic devices market, commanding the largest revenue share of 87.6% in 2024. This leadership stems from high consumer spending on cosmetic enhancements, early adoption of cutting-edge technologies, and the presence of globally recognized brands such as Allergan Aesthetics, Cynosure, and Cutera. The country’s extensive network of dermatology clinics, medical spas, and cosmetic surgery centers provides broad access to both surgical and non-surgical aesthetic services. Continuous innovation in laser resurfacing, ultrasound-based skin tightening, and minimally invasive body contouring—combined with aggressive marketing strategies and financing options—has significantly expanded the market’s consumer base. The prevalence of celebrity-driven beauty trends and the country’s strong medical tourism sector further reinforce its position as the global leader in aesthetic device adoption.

Canada Aesthetic Devices Market Insight

The Canada aesthetic devices market is poised to be the fastest-growing country in the North America aesthetic devices market, with an estimated CAGR of 6.8% from 2025 to 2032. Market growth is driven by rising acceptance of non-surgical cosmetic procedures among diverse age groups, coupled with increasing accessibility of aesthetic services in both metropolitan and suburban regions. The expansion of dermatology clinics, medspas, and outpatient cosmetic centers-supported by favorable regulatory frameworks for device approvals—is enhancing patient access to advanced technologies such as radiofrequency microneedling, cryolipolysis, and fractional lasers. Canada’s aging population is fueling demand for anti-aging treatments, while growing medical tourism, particularly from the U.S., is further boosting revenue streams. Public awareness campaigns and social media influence are also contributing to a cultural shift toward preventive and maintenance-oriented aesthetic care, accelerating the adoption of advanced devices across the country

North America Aesthetic Devices Market Share

The aesthetic devices industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd (China)

- Bausch Health Companies Inc (Canada)

- Candela Medical (U.S.)

- Cutera (U.S.)

- Cynosure (U.S.)

- LUTRONIC INC (South Korea)

- BTL (Czech Republic)

- Medytox (South Korea)

- SharpLight Technologies Inc (Israel)

- Aerolase Corp (U.S.)

- Suneva Medical (U.S.)

- AirXpanders, Inc. (U.S.)

- Lumenis Be Ltd. (Israel)

- Venus Concept (Canada)

- Sientra, Inc. (U.S.)

- Merz North America, Inc. (U.S.)

- Quanta System (Italy)

- GC Aesthetics (Ireland)

Latest Developments in North America Aesthetic Devices Market

- In January 2021, Candela, a leading North America medical aesthetic device company has announced the availability of the Frax Pro system which is a FDA-cleared, non-ablative fractional device skin resurfacing with both Frax 1550 and the novel Frax 1940 applicators. This helped the company to expand the product portfolio of aesthetics in the market

- In April 2025, LYMA Life Ltd. received FDA clearance for its LYMA Laser PRO, a handheld device designed to provide low-level laser light therapy for the treatment of wrinkles. This clearance marked a significant milestone, as the LYMA Laser PRO is the first device of its kind to receive FDA approval, expanding the availability of advanced at-home aesthetic treatments in the U.S. market

- In August 2025, advancements in non-surgical skin-tightening treatments gained prominence, with devices like Ultherapy, Sofwave, and red light therapy offering less painful and more sophisticated alternatives to traditional facelifts. These energy-based devices are designed to stimulate collagen production and rejuvenate skin, aligning with the growing demand for youthful skin

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.