North America Agricultural Lubricants Market

Market Size in USD Million

CAGR :

%

USD

505.56 Million

USD

640.43 Million

2021

2029

USD

505.56 Million

USD

640.43 Million

2021

2029

| 2022 –2029 | |

| USD 505.56 Million | |

| USD 640.43 Million | |

|

|

|

Market Analysis and Size

The use of modern agricultural equipment is increasing, which is driving demand for agricultural lubricants and even allowing companies to expand globally. Furthermore, the agricultural lubricants industry is expanding as a result of increased farm mechanisation around the world.

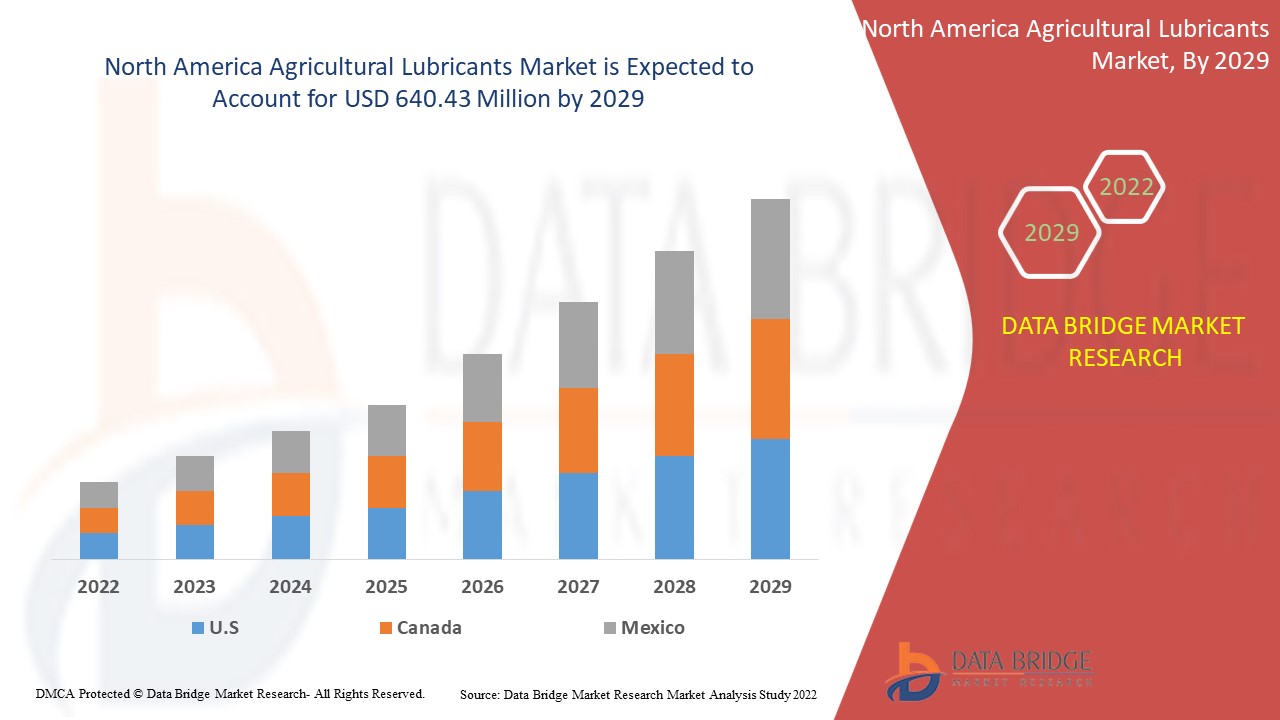

Data Bridge Market Research analyses that the agricultural lubricants market was valued at USD 505.56 million in 2021 and is expected to reach the value of USD 640.43 million by 2029, at a CAGR of 3.0% during the forecast period of 2022 to 2029.

Market Definition

Agricultural lubricants are lubricants used in agricultural equipment to extend the life of machines and equipment. They are used in a variety of machines, including harvesters, tractors, and verge cutters. They are also cost-effective and help to reduce gasoline consumption. They ensure the proper operation of these machines and equipment because it is critical to productivity.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Category (Mineral Oil, Synthetic, Bio-based), Type (Engine Oil, Grease, Hydraulic Oils, Transformer Oil, Crankcase Oils, Bar and Chain Oil, Others), Raw Material (Petroleum Based Lubricants, Bio-Based Lubricants), Application (Engines, Gear and Transmission, Hydraulics, Greasing, Chain, Implements, Others), Agricultural Equipment (Tractors, Harvesters, Corn-Pickers, Balers, Verge Cutters, Circular Spike Harrows, Stone Grinders, Fertilizer Spreaders, Slurry Tankers, Sprayers, Fodder Mixers, Silage Spreaders, Straw Blowers, Mowers and Mower-Conditioners, Hay Tedders, Hay Rakes, Bale Wrappers, Grape Harvesting Machines, Others) |

|

Countries Covered |

U.S., Canada and Mexico |

|

Market Players Covered |

Exxon Mobil Corporation (U.S.), Shell (Netherlands), Chevron Corporation ((U.S.), Total Energies (France), BP plc (UK), FUCHS (Germany), Phillips 66 Company (U.S.), Exol Lubricants Limited (UK), Witham Group (UK), Rymax Lubricants (Netherlands), Repsol (Spain), Cougar Lubricants International Ltd (UK), Schaeffer Manufacturing Co. (U.S.), Pennine Lubricants (UK), Frontier Performance Lubricants, Inc. (U.S.) and UNIL (Belgium) |

|

Opportunities |

|

Agricultural Lubricants Market Dynamics

Drivers

- Implementation of subsidies

Farmers' subsidies are being implemented by government agencies in a number of countries. These subsidies are designed to help farmers buy agricultural equipment such as harvesters, power sprayers, paddy trans planters, threshers, tractors, and other similar items. As a result, more sophisticated agricultural equipment is being adopted, increasing demand for agricultural lubricants. The rising cost of farm labour will accelerate the growth of the agricultural lubricants market. Furthermore, the growing popularity of high-performance synthetic lubricants and rising farm mechanisation rates are expected to drive market growth.

Opportunity

Furthermore, the rising trend of bio-based products, particularly in developed economies, expands profitable opportunities for market participants from 2022 to 2029. Furthermore, the increasing number of various market strategies employed by manufacturers, such as business expansion, joint ventures, and acquisition, will contribute to the agricultural lubricants market's future growth..

Restraints

The high cost of synthetic and bio-based lubricants is expected to stifle the growth of the agricultural lubricants market during the forecasted period. Furthermore, lower agricultural marketing expenditure results in lower awareness of agricultural products such as bio-based agricultural lubricants, which will be a detriment to the agricultural lubricants market over the forecasted period. As a result, the rate of growth in the agricultural lubricants market will be challenged.

This agricultural lubricants market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the agricultural lubricants market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Agricultural Lubricants Market

The recent coronavirus outbreak had a negative impact on the agricultural lubricants market because, due to the implementation of lockdowns in raw material-supplying countries such as China, the COVID-19 pandemic impacted the supply chain in the first half of 2020. COVID-19 had little impact on agricultural lubricant demand because agriculture and agricultural-related activities were regarded as essential services in the majority of countries. In the first half of 2020, raw material procurement was one of the market competitors' challenges. The aforementioned determinants will weigh the market's revenue trajectory during the forecast period. On the plus side, the market is expected to recover as individual regulatory bodies begin to relax these imposed restrictions.

Recent Development

In February 2020, the President of Lukoil and the Governor of the Astrakhan Region signed an agreement between the company and the Astrakhan Region. In this agreement, he stated that he will finance monument restoration as well as purchase a laboratory for the gas and oil institute for research purposes. This investment will assist the company in expanding its operations in the near future.

North America Agricultural Lubricants Market Scope

The agricultural lubricants market is segmented on the basis of category, type, raw material, application and agricultural equipment. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Category

- Mineral Oil

- Synthetic

- Bio-based

Type

- Engine Oil

- Grease

- Hydraulic Oils

- Transformer Oil

- Crankcase Oils

- Bar and Chain Oil

- Others

Raw material

- Petroleum Based Lubricants

- Bio-Based Lubricants

Application

- Engines

- Gear and Transmission

- Hydraulics

- Greasing

- Chain

- Implements

- Others

Agricultural equipment

- Tractors

- Harvesters

- Corn-Pickers

- Balers

- Verge Cutters

- Circular Spike Harrows

- Stone Grinders

- Fertilizer Spreaders

- Slurry Tankers

- Sprayers

- Fodder Mixers

- Silage Spreaders

- Straw Blowers

- Mowers and Mower-Conditioners

- Hay Tedders

- Hay Rakes

- Bale Wrappers

- Grape Harvesting Machines

- Others

Agricultural Lubricants Market Regional Analysis/Insights

The agricultural lubricants market is analysed and market size insights and trends are provided by country, category, type, raw material, application and agricultural equipment as referenced above.

The countries covered in the agricultural lubricants market report are U.S., Canada and Mexico.

In the forecast period of 2022 to 2029, North America is expected to show profitable growth due to increased mechanisation in the agricultural sector and the development of new and innovative products for regional application.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Agricultural Lubricants Market Share Analysis

The agricultural lubricants market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to agricultural lubricants market.

Some of the major players operating in the agricultural lubricants market are:

- Exxon Mobil Corporation (U.S.)

- Shell (Netherlands)

- Chevron Corporation (U.S.)

- Total Energies (France)

- BP plc (UK)

- FUCHS (Germany)

- Phillips 66 Company (U.S.)

- Exol Lubricants Limited (UK)

- Witham Group (UK)

- Rymax Lubricants (Netherlands)

- Repsol (Spain)

- Cougar Lubricants International Ltd (UK)

- Schaeffer Manufacturing Co. (U.S.)

- Pennine Lubricants (UK)

- Frontier Performance Lubricants, Inc. (U.S.)

- UNIL (Belgium)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING MECHANIZATION AND USE OF MACHINERY IN THE AGRICULTURAL INDUSTRY

5.1.2 RISING GOVERNMENT SUBSIDIES FOR AGRICULTURAL EQUIPMENTS

5.1.3 UNIVERSAL LUBE FOR MULTI-BRAND FLEET

5.1.4 GROWING NEED TO INCREASE FOOD PRODUCTIVITY OWING TO INCREASING POPULATION

5.1.5 INCREASING LABOR COST AND LOW AVAILABILITY OF LABOR

5.2 RESTRAINTS

5.2.1 HIGH COST OF SYNTHETIC AND BIO-BASED LUBRICANTS

5.2.2 LOW INCOME OF FARMERS IN DEVELOPING COUNTRIES

5.3 OPPORTUNITIES

5.3.1 INCREASING USE OF BIODEGRADABLE LUBRICANTS IN EQUIPMENT

5.3.2 LEVERAGING E-COMMERCE INDUSTRY TO INCREASE CUSTOMER REACH

5.3.3 INADEQUATE INFRASTRUCTURE IN DEVELOPING COUNTRIES

5.3.4 SKEPTICISM AMONG FARMERS FOR USING ADVANCED AGRICULTURAL EQUIPMENT

5.4 CHALLENGE

5.4.1 VOLATILE CRUDE OIL PRICES ACTS AS A CHALLENGE FOR AGRICULTURAL LUBRICANTS INDUSTRY

6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE

6.1 OVERVIEW

6.2 ENGINE OIL

6.3 HYDRAULIC OILS

6.4 GREASE

6.5 TRANSFORMER OIL

6.6 CRANKCASE OILS

6.7 BAR AND CHAIN OIL

6.8 OTHERS

7 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 PETROLEUM BASED LUBRICANTS

7.3 MINERAL OIL LUBRICANTS

7.4 SYNTHETIC LUBRICANTS

7.5 BIO-BASED LUBRICANTS

7.6 PLANT OIL

7.7 VEGETABLE OIL

7.8 SOYABEAN OIL

7.9 OTHERS

7.1 ANIMAL OIL

8 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ENGINES

8.3 HYDRAULICS

8.4 GREASING

8.5 GEAR & TRANSMISSION

8.6 IMPLEMENTS

8.7 TILLAGE IMPLEMENTS

8.8 SEED BED PREPARATION IMPLEMENTS

8.9 SEEDING IMPLEMENTS

8.1 WEEDING AND INTERCULTURAL

8.11 OTHERS

8.12 CHAIN

8.13 OTHERS

9 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT

9.1 OVERVIEW

9.2 TRACTORS

9.3 HARVESTERS

9.3.1 SILAGE HARVESTERS

9.3.2 POTATO HARVESTERS

9.3.3 BEET HARVESTERS

9.3.4 OTHERS

9.4 VERGE CUTTERS

9.4.1 CIRCULAR SPIKE HARROWS CUTTERS

9.4.2 STONE GRINDERS

9.5 BALERS

9.5.1 ROUND BALERS

9.5.2 BIG BALERS

9.5.3 OTHERS

9.6 HAY TEDDERS

9.7 HAY RAKES

9.8 SPRAYERS

9.9 FERTILISER SPREADERS

9.1 SILAGE SPREADERS

9.11 FODDER MIXERS

9.12 SLURRY TANKERS

9.13 STRAW BLOWERS

9.14 MOWERS AND MOWER CONDITIONERS

9.15 CORN PICKERS

9.16 BALE WRAPPERS

9.17 GRAPE HARVESTING MACHINES

9.18 OTHERS

10 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 COMNPANY PROFILES

12.1 ROYAL DUTCH SHELL PLC,

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 BP P.L.C.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 EXXON MOBIL CORPORATION.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATES

12.4 TOTAL

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATE

12.5 CHEVRON CORPORATION.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYISIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATE

12.6 PHILLIPS 66

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATE

12.7 REPSOL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATE

12.8 LUKOIL

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT UPDATE

12.9 ENI S.P.A.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT UPDATE

12.1 VALVOLINE LLC

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT UPDATE

12.11 FUCHS

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT UPDATE

12.12 GULF OIL INTERNATIONAL

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATE

12.13 MORRIS LUBRICANTS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATE

12.14 LUBRITA EUROPE B.V.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATE

12.15 CONDAT

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT UPDATE

12.16 COUGAR LUBRICANTS INTERNATIONAL LTD

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT UPDATE

12.17 DYADE LUBRICANTS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT UPDATE

12.18 UNIL

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT UPDATE

12.19 THE BAHRAIN PETROLEUM COMPANY B.S.C.

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT UPDATE

12.2 KLONDIKE LUBRICANTS CORPORATION

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT UPDATE

13 SWOT AND DATABRIDGE MARKET RESEARCH ANALYSIS

13.1 STRENGTH: - STRONG GEOGRAPHICAL PRESENCE

13.2 WEAKNESS: - LACK OF INNOVATION DUE TO LESS INVESTMENT IN R&D EXPENDITURE

13.3 OPPORTUNITY: - STRATEGIC EXPANSION, COLLABORATIONS, PARTNERSHIP AND ACQUISITIONS

13.4 THREAT: - FLUCTUATION IN RAW MATERIAL PRICE

13.5 DATA BRIDGE MARKET RESEARCH ANALYSIS

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 IMPORT DATA OF LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST OR ANTI-CORROSION PREPARATIONS AND MOULD-RELEASE PREPARATIONS BASED ON LUBRICANTS; TEXTILE LUBRICANT PREPARATIONS AND PREPARATIONS OF A KIND USED FOR THE OIL OR GREASE TREATMENT OF TEXTILE MATERIALS, LEATHER, FURSKINS OR OTHER MATERIALS (EXCLUDING PREPARATIONS CONTAINING, AS BASIC CONSTITUENTS, >= 70% PETROLEUM OIL OR BITUMINOUS MINERAL OIL BY WEIGHT), N.E.S.; HS CODE: 3403 (USD THOUSAND)

TABLE 2 EXPORT DATA OF LUBRICANT PREPARATIONS, INCL. CUTTING-OIL PREPARATIONS, BOLT OR NUT RELEASE PREPARATIONS, ANTI-RUST OR ANTI-CORROSION PREPARATIONS AND MOULD-RELEASE PREPARATIONS BASED ON LUBRICANTS; TEXTILE LUBRICANT PREPARATIONS AND PREPARATIONS OF A KIND USED FOR THE OIL OR GREASE TREATMENT OF TEXTILE MATERIALS, LEATHER, FURSKINS OR OTHER MATERIALS (EXCLUDING PREPARATIONS CONTAINING, AS BASIC CONSTITUENTS, >= 70% PETROLEUM OIL OR BITUMINOUS MINERAL OIL BY WEIGHT), N.E.S.; HS CODE: 4802 (USD THOUSAND)

TABLE 3 PRODUCTION AND TRADE IN AGRICULTURAL MACHINERY IN EUROPEAN COUNTRY (USD MILLION)

TABLE 4 EUROPEAN PRODUCTION PER TYPE OF AGRICULTURAL MACHINERY, IN 2017 (USD MILLION)

TABLE 5 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 7 NORTH AMERICA ENGINE OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 8 NORTH AMERICA ENGINE OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 9 NORTH AMERICA HYDRAULIC OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 10 NORTH AMERICA HYDRAULIC OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 11 NORTH AMERICA GREASE IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 12 NORTH AMERICA GREASE IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 13 NORTH AMERICA TRANSFORMER OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 14 NORTH AMERICA TRANSFORMER OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 15 NORTH AMERICA CRANKCASE OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 16 NORTH AMERICA CRANKCASE OILS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 17 NORTH AMERICA BAR AND CHAIN OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 18 NORTH AMERICA BAR AND CHAIN OIL IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 20 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 21 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 22 NORTH AMERICA PETROLEUM BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 23 NORTH AMERICA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 24 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 25 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 26 NORTH AMERICA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 27 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 28 NORTH AMERICA ENGINES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 29 NORTH AMERICA HYDRAULICS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 30 NORTH AMERICA GREASING IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 31 NORTH AMERICA GEAR AND TRANSMISSION IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 32 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 33 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 34 NORTH AMERICA CHAIN IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 35 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 36 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 37 NORTH AMERICA TRACTORS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 38 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 39 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 40 NORTH AMERICA VERGE CUTTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 41 NORTH AMERICA CIRCULAR SPIKE HARROWS CUTTERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 42 NORTH AMERICA STONE GRINDERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 43 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 44 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 45 NORTH AMERICA HAY TEDDERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 46 NORTH AMERICA HAY RAKES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 47 EUROPE SPRAYERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 48 NORTH AMERICA FERTILISER SPREADERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 49 NORTH AMERICA SILAGE SPREADERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 50 NORTH AMERICA FODDER MIXERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 51 NORTH AMERICA SLURRY TANKERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 52 NORTH AMERICA STRAW BLOWERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (TONS)

TABLE 53 NORTH AMERICA MOWERS AND MOWER CONDITIONERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 54 NORTH AMERICA CORN PICKERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 55 NORTH AMERICA BALE WRAPPERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 56 NORTH AMERICA GRAPE HARVESTING MACHINES IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 57 NORTH AMERICA OTHERS IN AGRICULTURAL LUBRICANTS MARKET, BY REGION, 2018-2027 (USD THOUSAND)

TABLE 58 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY COUNTRY, 2018-2027 (TONS)

TABLE 59 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY COUNTRY, 2018-2027 (USD THOUSAND)

TABLE 60 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 61 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 62 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 63 NORTH AMERICA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 64 NORTH AMERICA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 65 NORTH AMERICA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 66 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 67 NORTH AMERICA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 68 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 69 NORTH AMERICA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 70 NORTH AMERICA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 71 U.S. AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 72 U.S. AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 73 U.S. AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 74 U.S. PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 75 U.S. BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 76 U.S. PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 77 U.S. AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 78 U.S. IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 79 U.S. AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 80 U.S. HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 81 U.S. BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 82 CANADA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 83 CANADA AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 84 CANADA AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 85 CANADA PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 86 CANADA BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 87 CANADA PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 88 CANADA AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 89 CANADA IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 90 CANADA AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 91 CANADA HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 92 CANADA BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

TABLE 93 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (TONS)

TABLE 94 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY TYPE, 2018-2027 (USD THOUSAND)

TABLE 95 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 96 MEXICO PETROLEUM-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY PETROLEUM-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 97 MEXICO BIO-BASED LUBRICANTS IN AGRICULTURAL LUBRICANTS MARKET, BY BIO-BASED LUBRICANTS RAW MATERIAL, 2018-2027 (USD THOUSAND)

TABLE 98 MEXICO PLANT OIL IN AGRICULTURAL LUBRICANTS MARKET, BY PLANT OIL BIO-BASED LUBRICANTS, 2018-2027 (USD THOUSAND)

TABLE 99 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 100 MEXICO IMPLEMENTS IN AGRICULTURAL LUBRICANTS MARKET, BY IMPLEMENTS APPLICATION, 2018-2027 (USD THOUSAND)

TABLE 101 MEXICO AGRICULTURAL LUBRICANTS MARKET, BY AGRICULTURAL EQUIPMENT, 2018-2027 (USD THOUSAND)

TABLE 102 MEXICO HARVESTERS IN AGRICULTURAL LUBRICANTS MARKET, BY HARVESTERS, 2018-2027 (USD THOUSAND)

TABLE 103 MEXICO BALERS IN AGRICULTURAL LUBRICANTS MARKET, BY BALERS, 2018-2027 (USD THOUSAND)

List of Figure

LIST OF FIGURES

FIGURE 1 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: THE TECHNOLOGY LIFE LINE CURVE

FIGURE 7 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SEGMENTATION

FIGURE 14 INCREASING MECHANIZATION AND USE OF MACHINERY IN THE AGRICULTURAL INDUSTRY IS DRIVING THE NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 15 ENGINE OIL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET IN 2020 & 2027

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET

FIGURE 17 TRACTOR REGISTRATION, BY COUNTRY (2018)

FIGURE 18 NORTH AMERICA POPULATION, IN BILLION (2019 – 2100)

FIGURE 19 AVERAGE INCOME OF FARMERS IN CHINA AND INDIA

FIGURE 20 EUROPEN INTERNET USERS ON MOBILE PHONE, FROM 2011 TO 2016 (IN %)

FIGURE 21 AVERAGE LANDHOLDING SIZE OF A HOUSEHOLD, 2016

FIGURE 22 CRUDE OIL PRICE FLUCTUATION (USD MILLION)

FIGURE 23 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY TYPE, 2019

FIGURE 24 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY RAW MATERIAL, 2019

FIGURE 25 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY APPLICATION, 2019

FIGURE 26 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY AGRICULTURAL EQUIPMENT, 2019

FIGURE 27 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: SNAPSHOT (2019)

FIGURE 28 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2019)

FIGURE 29 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2020 & 2027)

FIGURE 30 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY COUNTRY (2019 & 2027)

FIGURE 31 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: BY TYPE (2020-2027)

FIGURE 32 NORTH AMERICA AGRICULTURAL LUBRICANTS MARKET: COMPANY SHARE 2019 (%)

North America Agricultural Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Agricultural Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Agricultural Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.