North America Aircraft Hangar Market Analysis and Insights

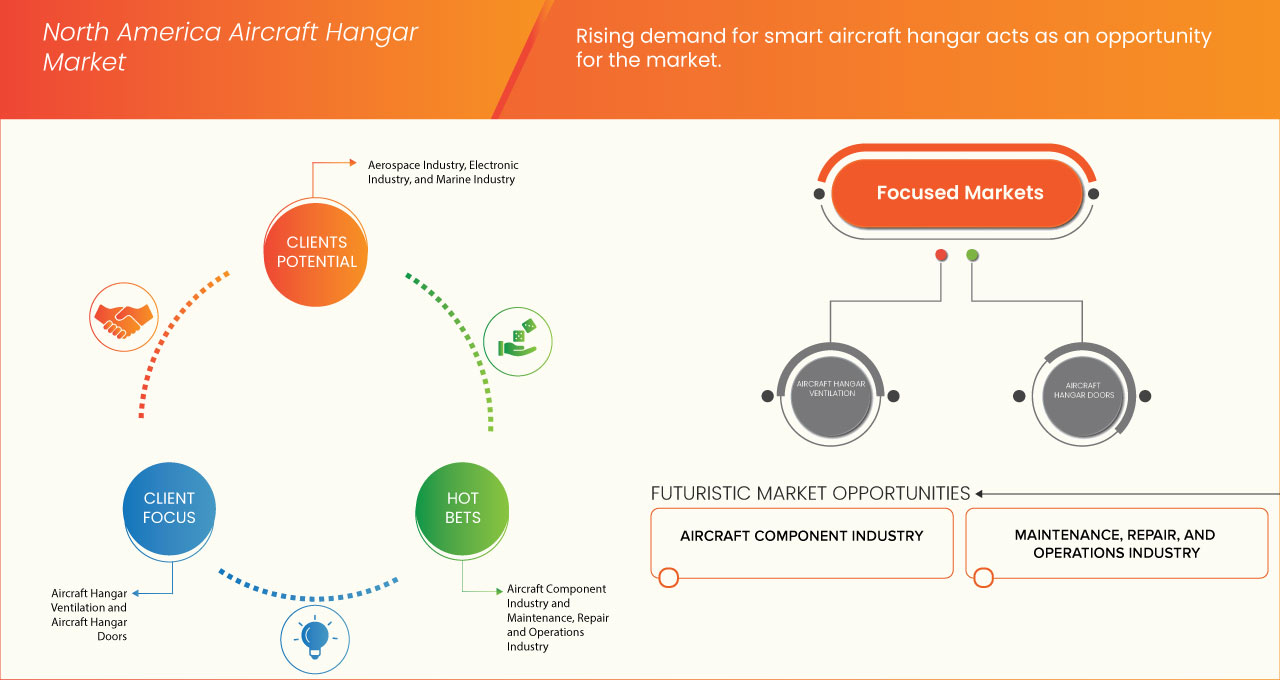

The increase in defense budgets across the globe and growth in commercial aviation sector is expected act as a prime driving factor for the growth of the market. The increase in demand for Maintenance, Repair, and Overhaul (MRO) services is further expected to propel the market growth. However, the high initial investment associated with aircraft hangars and long permitting and approval process are expected to restrain the market. Furthermore, the land availability and zoning regulations is expected to act as challenge the market. However, rising demand of smart aircraft hangar and increase in development and modernization in airport infrastructure is expected to open growth opportunities for the market.

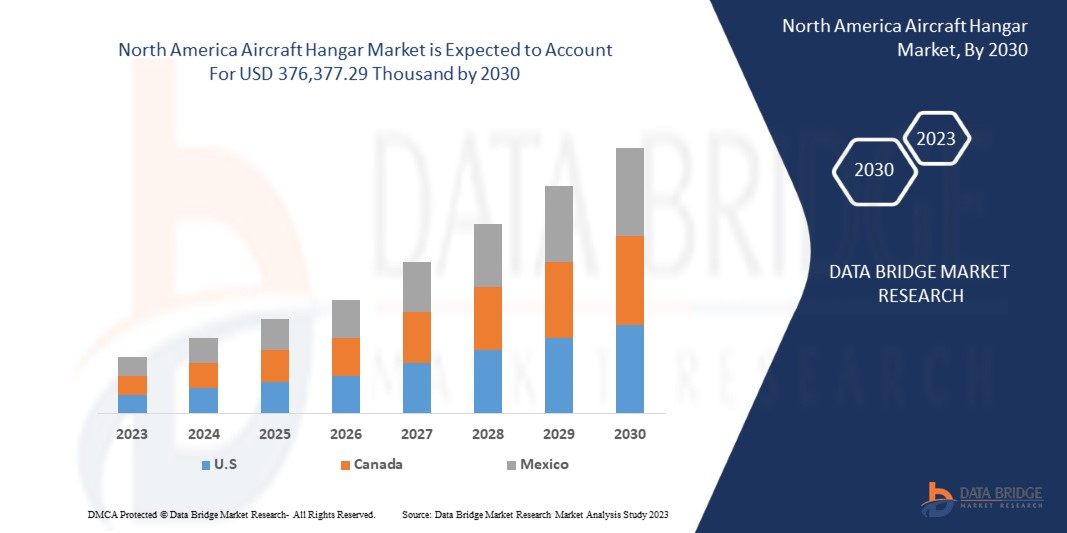

Data Bridge Market Research analyzes that the North America aircraft hangar market is expected to reach a value of USD 376,377.29 thousand by 2030, at a CAGR of 5.5% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Type (Maintenance, Repair, and Overhaul (MRO), Assembly, and Storage), Construction (Fixed and Portable), Aircraft (Wide Body, Narrow Body, Jets, Helicopters, and Others), Component (Aircraft Hangar Canopy, Aircraft Hangar Doors, Aircraft Hangar Ventilation, Aircraft Hangar Lighting, Aircraft Hangar Flooring, and Others), Platform (Commercial, Military, and Others), Material (Steel, Concrete, Fabric, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

AECOM, PFEIFER GROUP, FulFab Inc., BlueScope Building Inc., The Korte Company, HTS TENTIQ GmbH, Rubb Buildings Ltd, Banyan Air Service, ALASKA STRUCTURES, Sunbelt Temporary Structure, Nucor Building Systems, JOHN REID AND SONS STRUCSTEEL LTD., Allied builders, LEGACY BUILDING SOLUTIONS, ERECT-A-TUBE, INC, Premier Building Systems, Inc, ClearSpan Fabric Structures, Inc., SML Group, and Diuk Arches among others |

Market Definition

Aircraft hangars are specialized structures designed to shelter, maintain, and protect airplanes and helicopters. These facilities vary in size and design, accommodating different aircraft types, from small private planes to large commercial jets or military aircraft. Constructed with durable materials like steel, aluminum, or fabric, hangars often feature climate control, security systems, and maintenance equipment to ensure the safety and upkeep of the housed aircraft.

North America Aircraft Hangar Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Increase in Defense Budgets Across the Globe

A defense budget is the allocation of financial resources by a nation's government for military purposes. It represents the total amount of money designated to fund defense-related activities, including the acquisition of military equipment, personnel salaries, research and development, infrastructure, and other defense-related expenditures. A country's defense budget plays a crucial role in ensuring national security, sovereignty, and the ability to respond to potential threats. Adequate funding enables the development and maintenance of armed forces capable of safeguarding territorial integrity and responding effectively to potential aggressors. Moreover, a well-funded defense budget acts as a deterrent against potential adversaries. The existence of a formidable military capability can discourage hostile actions, contributing to regional and the North America stability. This surge in defense spending is expected to have a direct positive impact on the market, which is expected to drive market growth.

Opportunity

- Rising Demand for Smart Aircraft Hangar

The smart aircraft hangar is a technologically advanced facility designed to provide efficient and intelligent solutions for the storage, maintenance, and management of aircraft. These hangars incorporate state-of-the-art technologies and advanced systems to optimize operations, enhance safety, and reduce overall costs. The smart aircraft hangars are equipped with sophisticated monitoring and sensing systems that provide real-time data on aircraft conditions, environmental factors, and potential hazards. These systems enable proactive maintenance and enhance safety by detecting and addressing issues promptly. Moreover, smart aircraft hangars often incorporate energy-efficient designs, using sustainable materials, natural lighting, and smart climate control systems. This results in reduced energy consumption and lower operational costs.

Challenges/ Restraints

-

High Initial Investment Associated with Aircraft Hangars

The importance of aircraft hangar is increasing with the increase in aviation fleet and commercial flights. However, the substantial upfront costs required for land acquisition, hangar construction, and equipping the facility is expected to act as a restraint for many stakeholders, including airlines, airports, and MRO service providers. Building a hangar involves considerable construction costs, especially for large-scale facilities capable of accommodating multiple aircraft. These costs include materials, labor, and specialized engineering expertise. Additionally, compliance with aviation regulations and safety standards can add to the initial investment. Hangars must meet stringent structural and safety requirements, which may necessitate additional expenses.

- Land Availability and Zoning Regulations

The aircraft hangar plays a pivotal role in supporting the aviation industry by providing essential facilities for aircraft storage, maintenance, and protection. However, the market faces significant challenges due to complex land availability and zoning regulations associated with hangar construction. Securing suitable land and adhering to zoning regulations can be daunting and time-consuming, leading to potential delays and obstacles for investors, airports, and MRO providers. Finding suitable land of adequate size and in proximity to airports or MRO facilities can be challenging. Hangars require sufficient space for aircraft maneuvering, maintenance operations, and potential expansion.

Recent Developments

- In June 2023, PFEIFER GROUP was a partner of the "Coalition for Timber Construction," an initiative for sustainable building with wood that aimed to promote wooden buildings as the first choice for construction projects across the board. The coalition served as a knowledge provider for the real estate industry and political discourse, advocating for timber construction's advantages in sustainability and climate protection. It was founded in 2021

- In June 2023, BlueScope Construction, Inc. has successfully conducted the Buildings of the Future North America accelerator, collaborating with BlueScopeX, the ventures arm of BlueScope Steel, to foster innovation in the construction industry. The accelerator resulted in five pilot programs with innovative startups, including GigBridge, a U.K.-based SaaS platform addressing the challenge of finding skilled labor in the construction industry. This initiative showcases BlueScope Construction's commitment to leveraging cutting-edge technologies and solutions, such as AI-powered workplace safety, AI-enabled digital twin for defect prediction in steel production, supply chain-focused SaaS platform and solar energy solution

- In December 2022, JOHN REID & SONS (STRUCSTEEL) LTD got recognition for its outstanding contributions to the North America aircraft hangar market. Their collaboration with the main contractor Civils Contracting Ltd on the dual-cantilever hangar at London Biggin Hill Airport and Bombardier's official opening showcases their expertise in designing, fabricating, and installing complete steel frames and hangar elements

- In July 2022, ALASKA STRUCTURES underwent a strategic renaming and restructuring program, becoming AKS Industries, Inc., and introducing three new corporate divisions: Alaska Defense, Alaska Structures, and BLU-MED Response Systems. This move reflected the company's significant growth, expanded product offerings, and in-house manufacturing capabilities, allowing AKS Industries to offer both soft- and hard-wall building solutions and seamlessly integrate containerized buildings into their product lineup. The strategic renaming and restructuring program marked a significant milestone in AKS Industries' history, allowing the company to align its brand and divisions with its expanded product lines and manufacturing capabilities

- In October 2021, Banyan Air Service announced that the Banyan/Sheltair Complex at Fort Lauderdale Executive Airport has seen substantial demand, with its Banyan North hangars, offering 180,000 sq. ft. of new hangar space, reaching an impressive 85% occupancy within just 14 months of operation. The recent additions of three flight departments, housing Gulfstream IV, Falcon 900, Challenger 604, and Learjet 60 aircraft, have further boosted Banyan North's success, with Hangar H now at full capacity

North America Aircraft Hangar Market Scope

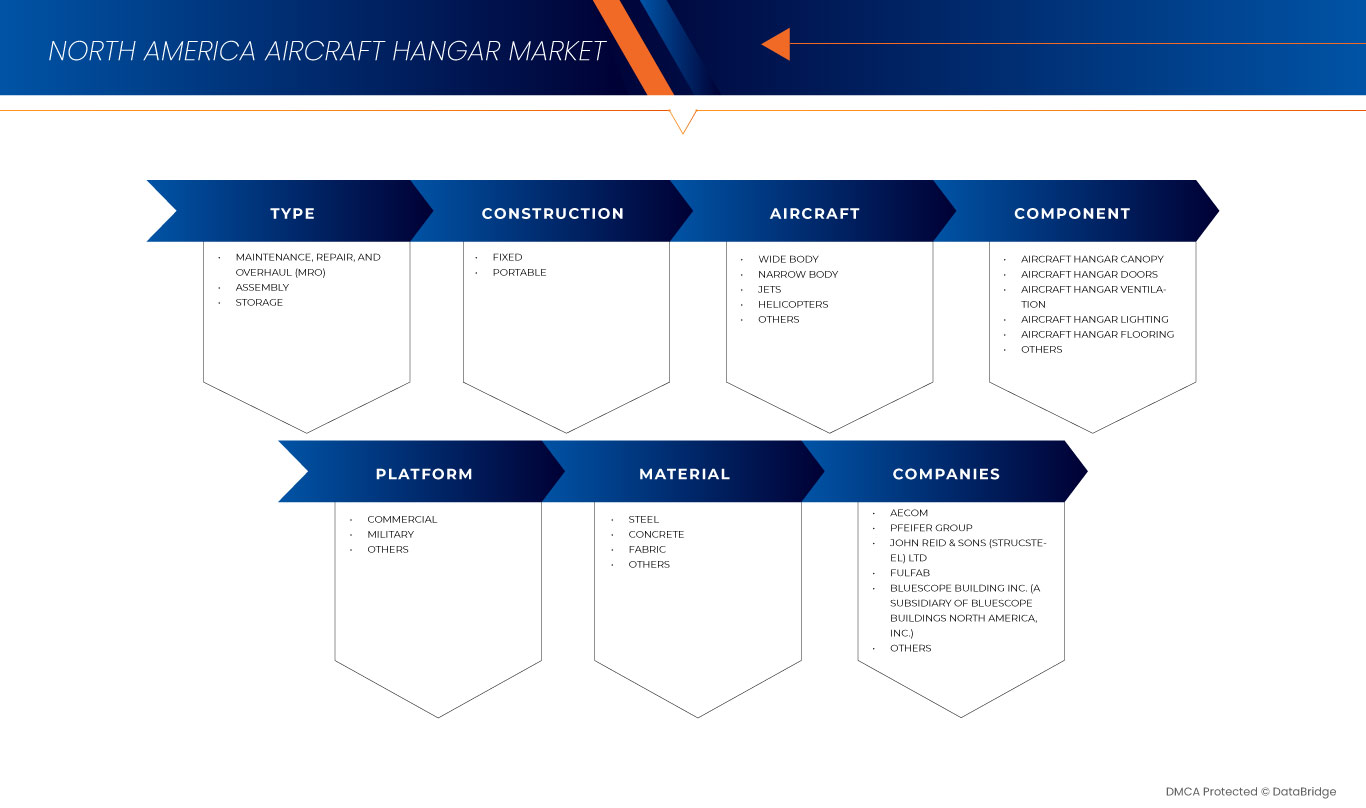

The North America aircraft hangar market is segmented into six notable segments based on type, construction, aircraft, component, platform, and material. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Type

- Maintenance, Repair, and Overhaul (MRO)

- Assembly

- Storage

On the basis of type, the market is segmented into Maintenance, Repair, and Overhaul (MRO), assembly, and storage.

Construction

- Fixed

- Portable

On the basis of construction, the market is segmented into fixed and portable.

Aircraft

- Wide Body

- Narrow Body

- Jets

- Helicopters

- Others

On the basis of aircraft, the market is segmented into wide body, narrow body, jets, helicopters, and others.

Component

- Aircraft Hangar Canopy

- Aircraft Hangar Doors

- Aircraft Hangar Ventilation

- Aircraft Hangar Lighting

- Aircraft Hangar Flooring

- Others

On the basis of component, the market is segmented into aircraft hangar canopy, aircraft hangar doors, aircraft hangar ventilation, aircraft hangar lighting, aircraft hangar flooring, and others.

Platform

- Commercial

- Military

- Others

On the basis of platform, the market is segmented into commercial, military, and others.

Material

- Steel

- Concrete

- Fabric

- Others

On the basis of material, the market is segmented into steel, concrete, fabric, and others.

North America Aircraft Hangar Market Regional Analysis/Insights

The North America aircraft hangar market is segmented into six notable segments which are based on the basis of type, construction, aircraft, component, platform, and material.

The countries covered in this market report are U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America aircraft hangar market due to the presence of key market players in the largest consumer market with higher GDP. The U.S. is expected to grow due to a rise in technological advancement in commercial and military aviation sector.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Aircraft Hangar Market Share Analysis

The North America aircraft hangar market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major players operating in the market are AECOM, PFEIFER GROUP, FulFab Inc., BlueScope Building Inc., The Korte Company, HTS TENTIQ GmbH, Rubb Buildings Ltd, Banyan Air Service, ALASKA STRUCTURES, Sunbelt Temporary Structure, Nucor Building Systems, JOHN REID AND SONS STRUCSTEEL LTD., Allied builders, LEGACY BUILDING SOLUTIONS, ERECT-A-TUBE, INC, Premier Building Systems, Inc, ClearSpan Fabric Structures, Inc., SML Group, and Diuk Arches, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AIRCRAFT HANGAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TYPE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEFENSE BUDGETS ACROSS THE GLOBE

5.1.2 GROWTH IN THE COMMERCIAL AVIATION SECTOR

5.1.3 INCREASE IN DEMAND FOR MRO SERVICES

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENT ASSOCIATED WITH AIRCRAFT HANGARS

5.2.2 LONG PERMITTING AND APPROVAL PROCESS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR SMART AIRCRAFT HANGAR

5.3.2 INCREASE IN DEVELOPMENT AND MODERNIZATION OF AIRPORT INFRASTRUCTURE

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION BY MARKET PLAYERS

5.4 CHALLENGE

5.4.1 LAND AVAILABILITY AND ZONING REGULATIONS

6 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY TYPE

6.1 OVERVIEW

6.2 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)

6.3 ASSEMBLY

6.4 STORAGE

7 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY CONSTRUCTION

7.1 OVERVIEW

7.2 FIXED

7.3 PORTABLE

8 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY AIRCRAFT

8.1 OVERVIEW

8.2 WIDE BODY

8.3 NARROW BODY

8.4 JETS

8.5 HELICOPTERS

8.6 OTHERS

9 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY COMPONENT

9.1 OVERVIEW

9.2 AIRCRAFT HANGAR CANOPY

9.3 AIRCRAFT HANGAR DOORS

9.3.1 ROLL-UP

9.3.2 FOLDING

9.3.3 SLIDING

9.3.4 SECTIONAL

9.3.5 OTHERS

9.4 AIRCRAFT HANGAR VENTILATION

9.5 AIRCRAFT HANGAR LIGHTING

9.6 AIRCRAFT HANGAR FLOORING

9.7 OTHERS

10 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY PLATFORM

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 MILITARY

10.4 OTHERS

11 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY MATERIAL

11.1 OVERVIEW

11.2 STEEL

11.3 CONCRETE

11.4 FABRIC

11.5 OTHERS

12 NORTH AMERICA AIRCRAFT HANGAR MARKET BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA AIRCRAFT HANGAR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILINGS

15.1 AECOM

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 SOLUTION PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 PFEIFER GROUP

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 JOHN REID & SONS (STRUCSTEEL) LTD

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 FULFAB

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 BLUESCOPE CONSTRUCTION, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 SOLUTION PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ALASKA STRUCTURES

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ALLIED BUILDERS

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BANYAN AIR SERVICE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CLEARSPAN FABRIC STRUCTURES, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 DIUK ARCHES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 ERECT-A-TUBE, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 HTS TENTIQ GMBH

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 LEGACY BUILDING SOLUTIONS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 NUCOR BUILDING SYSTEMS

15.14.1 COMPANY SNAPSHOT

15.14.2 SOLUTION PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 PREMIER BUILDING SYSTEMS, INC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 RUBB BUILDINGS LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SML GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SUNBELT TEMPORARY STRUCTURES

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 THE KORTE COMPANY

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA AIRCRAFT HANGAR DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA AIRCRAFT HANGER DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 16 U.S. AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 U.S. AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 18 U.S. AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 19 U.S. AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 20 U.S. AIRCRAFT HANGER DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 U.S. AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 22 U.S. AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 23 CANADA AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 CANADA AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 25 CANADA AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 26 CANADA AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 27 CANADA AIRCRAFT HANGER DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 CANADA AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 29 CANADA AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 30 MEXICO AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MEXICO AIRCRAFT HANGAR MARKET, BY CONSTRUCTION, 2021-2030 (USD THOUSAND)

TABLE 32 MEXICO AIRCRAFT HANGAR MARKET, BY AIRCRAFT, 2021-2030 (USD THOUSAND)

TABLE 33 MEXICO AIRCRAFT HANGAR MARKET, BY COMPONENT, 2021-2030 (USD THOUSAND)

TABLE 34 MEXICO AIRCRAFT HANGER DOORS IN AIRCRAFT HANGAR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MEXICO AIRCRAFT HANGAR MARKET, BY PLATFORM, 2021-2030 (USD THOUSAND)

TABLE 36 MEXICO AIRCRAFT HANGAR MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA AIRCRAFT HANGAR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AIRCRAFT HANGAR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AIRCRAFT HANGAR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AIRCRAFT HANGAR MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AIRCRAFT HANGAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AIRCRAFT HANGAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AIRCRAFT HANGAR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AIRCRAFT HANGAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AIRCRAFT HANGAR MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA AIRCRAFT HANGAR MARKET: TYPE

FIGURE 11 NORTH AMERICA AIRCRAFT HANGAR MARKET: SEGMENTATION

FIGURE 12 INCREASE IN DEMAND FOR MRO SERVICES IS EXPECTED TO BE KEY DRIVERS FOR NORTH AMERICA AIRCRAFT HANGAR MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 MAINTENANCE, REPAIR, AND OVERHAUL (MRO) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AIRCRAFT HANGAR MARKET IN 2023 TO 2030

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA AIRCRAFT HANGAR MARKET

FIGURE 15 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY CONSTRUCTION, 2022

FIGURE 17 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY AIRCRAFT, 2022

FIGURE 18 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY COMPONENT, 2022

FIGURE 19 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY PLATFORM, 2022

FIGURE 20 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY MATERIAL, 2022

FIGURE 21 NORTH AMERICA AIRCRAFT HANGAR MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA AIRCRAFT HANGAR MARKET: BY TYPE (2023-2030)

FIGURE 26 NORTH AMERICA AIRCRAFT HANGAR MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.