North America Aluminum Casting Market

Market Size in USD Billion

CAGR :

%

USD

18.13 Billion

USD

32.83 Billion

2024

2032

USD

18.13 Billion

USD

32.83 Billion

2024

2032

| 2025 –2032 | |

| USD 18.13 Billion | |

| USD 32.83 Billion | |

|

|

|

|

North America Aluminum Casting Market Size

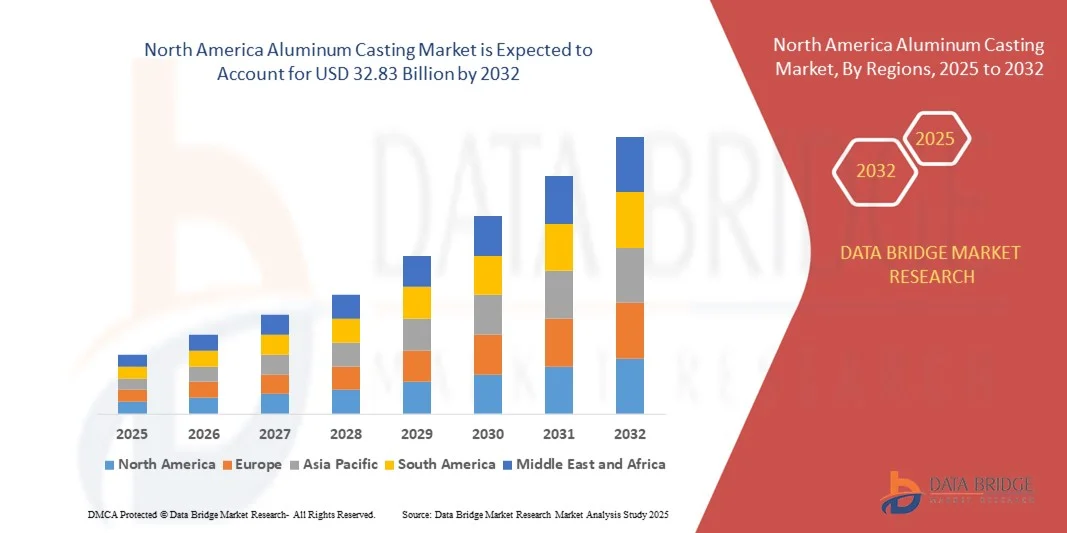

- The North America Aluminum Casting Market size was valued at USD 18.13 billion in 2024 and is expected to reach USD 32.83 billion by 2032, at a CAGR of 7.70% during the forecast period

- The market growth is primarily driven by increasing demand from the automotive and aerospace sectors, where lightweight and durable aluminum components are critical for fuel efficiency and performance

- In addition, advancements in casting technologies, including high-pressure die casting and investment casting, are enhancing production efficiency and component precision, further supporting market expansion. Rising emphasis on sustainable and energy-efficient manufacturing processes is also contributing to the increasing adoption of aluminum castings across industries

North America Aluminum Casting Market Analysis

- Aluminum castings, used for manufacturing lightweight, durable, and corrosion-resistant components, are increasingly vital in automotive, aerospace, and industrial applications due to their strength-to-weight ratio, thermal conductivity, and design flexibility.

- The escalating demand for aluminum castings is primarily fueled by the growing focus on fuel efficiency in vehicles, the rise of electric vehicles (EVs), and increasing adoption of lightweight materials in aerospace and industrial machinery.

- U.S. dominated the North America Aluminum Casting Market with the largest revenue share of 34.4% in 2024, characterized by well-established automotive and aerospace industries, advanced manufacturing infrastructure, and a strong presence of key casting companies, with the U.S. experiencing substantial growth in high-precision castings for EV components and industrial machinery, driven by innovations in die casting and additive manufacturing technologies.

- Canada is expected to be the fastest-growing region in the North America Aluminum Casting Market during the forecast period due to increasing industrialization, growing automotive production, and rising investments in aerospace manufacturing.

- The expendable mold casting segment dominated the market with the largest revenue share of 52.4% in 2024, owing to its ability to produce complex and intricate geometries required for automotive and aerospace components.

Report Scope and North America Aluminum Casting Market Segmentation

|

Attributes |

Aluminum Casting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

• Constellium (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Aluminum Casting Market Trends

Enhanced Performance Through Advanced Casting Technologies

- A significant and accelerating trend in the North America Aluminum Casting Market is the adoption of advanced casting technologies, including high-pressure die casting, low-pressure casting, and investment casting, which are improving component precision, efficiency, and performance across automotive, aerospace, and industrial applications.

- For instance, high-pressure die casting enables the production of complex aluminum parts with tight tolerances for electric vehicle battery housings and lightweight structural components. Similarly, investment casting allows for the creation of intricate aerospace components with excellent dimensional accuracy and surface finish.

- Advancements in casting technologies also enable improved material properties, such as enhanced strength-to-weight ratios, corrosion resistance, and thermal conductivity. For example, some automotive manufacturers are utilizing precision-cast aluminum engine blocks that optimize both durability and fuel efficiency.

- The integration of digital design and simulation tools with casting processes facilitates predictive modeling and defect minimization, allowing manufacturers to produce high-quality components while reducing waste and production time.

- This trend toward more precise, lightweight, and durable aluminum castings is fundamentally transforming manufacturing standards in the automotive and aerospace industries. Consequently, companies such as Alcoa, Kaiser Aluminum, and Novelis are investing in AI-driven casting simulations and automation to enhance quality, reduce costs, and meet the growing demand for lightweight materials.

- The demand for aluminum castings with advanced performance characteristics is growing rapidly across both industrial and commercial sectors, as manufacturers increasingly prioritize efficiency, sustainability, and high-performance material solutions.

North America Aluminum Casting Market Dynamics

Driver

Growing Demand Driven by Automotive and Aerospace Applications

- The increasing focus on fuel efficiency, lightweight materials, and high-performance components in the automotive and aerospace industries is a significant driver for the heightened demand for aluminum castings.

- For instance, in 2024, several leading automakers, including Tesla and Ford, expanded the use of precision aluminum castings in electric vehicle battery housings and chassis components, reflecting the growing need for lightweight and durable materials. Such initiatives by key manufacturers are expected to drive the North America Aluminum Casting Market growth during the forecast period.

- As manufacturers prioritize reducing vehicle weight and improving energy efficiency, aluminum castings offer advanced properties such as high strength-to-weight ratios, corrosion resistance, and thermal conductivity, providing a compelling alternative to traditional steel components.

- Furthermore, the growing adoption of aluminum components in aerospace structures and industrial machinery is making aluminum castings an integral part of modern manufacturing, offering better performance and reduced maintenance costs.

- The demand for complex, precision-engineered parts, coupled with innovations in die casting, investment casting, and additive manufacturing, is propelling market growth in both automotive and aerospace sectors. Increasing emphasis on sustainability and regulatory pressures for fuel-efficient vehicles further reinforce this trend.

Restraint/Challenge

High Production Costs and Technical Complexity

- The relatively high production costs associated with advanced aluminum casting techniques, including die casting and investment casting, pose a significant challenge to broader market adoption. High-quality castings require sophisticated equipment, skilled labor, and precise process control, increasing overall production expenses.

- For instance, the implementation of low-pressure die casting for EV battery housings or aerospace components involves substantial capital investment in machinery and tooling, which can be a barrier for smaller manufacturers.

- Addressing these cost and complexity challenges through process optimization, automation, and material recycling is crucial for enhancing competitiveness. Companies such as Alcoa, Kaiser Aluminum, and Novelis are investing in advanced casting simulations, AI-driven quality control, and lean manufacturing practices to reduce defects and production costs.

- Additionally, technical challenges such as porosity, shrinkage, and dimensional inconsistencies require continuous R&D and skilled labor to overcome, which can limit production efficiency and scalability.

- Overcoming these challenges through technological innovation, process standardization, and cost-effective solutions will be vital for sustained growth of the North America Aluminum Casting Market.

North America Aluminum Casting Market Scope

North America aluminum casting market is segmented based on process, source, application, and end-user.

- By Process

On the basis of process, the North America Aluminum Casting Market is segmented into expendable mold casting and non-expendable mold casting. The expendable mold casting segment dominated the market with the largest revenue share of 52.4% in 2024, owing to its ability to produce complex and intricate geometries required for automotive and aerospace components. Techniques such as sand casting and investment casting allow manufacturers to deliver high-precision, lightweight, and corrosion-resistant parts with reduced tooling costs.

The non-expendable mold casting segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by the rising adoption of die casting for high-volume production of structural and chassis components. Non-expendable mold methods offer shorter production cycles, high repeatability, and superior dimensional accuracy, making them ideal for industrial-scale applications. Growing demand for lightweight and fuel-efficient components across automotive and industrial sectors is propelling the uptake of both casting processes.

- By Source

On the basis of source, the North America Aluminum Casting Market is segmented into primary (fresh aluminum) and secondary (recycled aluminum). The primary aluminum segment dominated the market with a revenue share of 58.3% in 2024, supported by consistent quality, high purity, and suitability for critical automotive, aerospace, and industrial components. Primary aluminum ensures better mechanical properties, corrosion resistance, and structural integrity, making it ideal for engine blocks, transmission parts, and aerospace applications.

The secondary aluminum segment is anticipated to witness the fastest CAGR of 21.2% from 2025 to 2032, fueled by growing sustainability initiatives, cost efficiency, and environmental regulations promoting recycled materials. Secondary aluminum offers energy savings of up to 95% compared to primary aluminum production and is increasingly being adopted in automotive chassis, structural parts, and consumer appliances. Rising emphasis on circular economy practices and the shift towards eco-friendly manufacturing is expected to accelerate secondary aluminum adoption in North America.

- By Application

On the basis of application, the North America Aluminum Casting Market is segmented into intake manifolds, oil pan housings, structural parts, chassis parts, cylinder heads, engine blocks, transmissions, wheels and brakes, heat transfers, and others. The structural parts segment dominated the market with a revenue share of 47.1% in 2024, driven by strong demand from automotive and aerospace industries requiring lightweight yet durable frameworks. Structural castings provide enhanced strength-to-weight ratios and contribute to fuel efficiency and performance optimization.

The intake manifolds segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, fueled by the increasing adoption of lightweight aluminum in engine components for electric and conventional vehicles. Advanced casting methods allow precise airflow control and heat dissipation, enhancing engine efficiency. Growing automotive production, rising EV adoption, and demand for high-performance engines are key factors propelling the uptake of aluminum casting applications across multiple vehicle systems.

- By End-User

On the basis of end-user, the North America Aluminum Casting Market is segmented into automotive, building and construction, industrial, household appliances, aerospace, electronics and electrical, engineering tools, and others. The automotive segment dominated the market with a revenue share of 55.6% in 2024, driven by increasing adoption of aluminum castings in engine components, chassis, wheels, and EV battery housings to meet stringent fuel efficiency and emission standards. Aluminum castings offer lightweight, durable, and corrosion-resistant solutions essential for modern vehicle manufacturing.

The aerospace segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by rising aircraft production, the demand for fuel-efficient components, and adoption of high-precision aluminum castings for structural and engine parts. Expanding defense and commercial aviation activities, coupled with technological advancements in lightweight materials, are driving the demand for aerospace-grade aluminum castings in North America.

North America Aluminum Casting Market Regional Analysis

- U.S. dominated the North America Aluminum Casting Market with the largest revenue share of 34.4% in 2024, driven by strong demand from the automotive, aerospace, and industrial sectors, as well as increasing adoption of lightweight and high-performance aluminum components.

- Manufacturers and end-users in the region highly value aluminum castings for their superior strength-to-weight ratio, corrosion resistance, and versatility in producing complex geometries for engine components, structural parts, and chassis systems.

- This widespread adoption is further supported by advanced manufacturing capabilities, well-established supply chains, and the presence of key industry players investing in innovative casting technologies, establishing aluminum castings as a preferred material choice across automotive, aerospace, industrial, and construction applications in North America.

U.S. Aluminum Casting Market Insight

The U.S. aluminum casting market captured the largest revenue share of 81% in 2024 within North America, driven by strong demand from automotive, aerospace, and industrial machinery sectors. The increasing focus on lightweight and high-performance components, particularly for electric vehicles, is accelerating adoption. Advanced casting technologies, including die casting, sand casting, and investment casting, are being widely implemented to improve precision and efficiency. Furthermore, stringent regulations on fuel efficiency and emissions are encouraging the use of aluminum castings in engine blocks, structural parts, and chassis components. The presence of key manufacturers and a robust industrial infrastructure further supports market growth, making the U.S. the dominant contributor in North America.

Canada Aluminum Casting Market Insight

The Canada aluminum casting market is expected to grow steadily during the forecast period, supported by rising demand in the automotive, construction, and industrial machinery segments. Lightweight aluminum components are increasingly used for structural parts, engine blocks, and transmission housings to improve energy efficiency and reduce emissions. Canada’s focus on sustainable manufacturing practices, along with investments in modern foundries and high-precision casting technologies, is fostering growth. Additionally, government initiatives promoting industrial innovation and the adoption of eco-friendly production methods are further driving the market expansion.

Mexico Aluminum Casting Market Insight

The Mexico aluminum casting market is projected to expand at a notable CAGR throughout the forecast period, driven by its growing automotive and industrial manufacturing base. Proximity to the U.S. market and integration into North American supply chains boost demand for engine components, chassis parts, and structural castings. Competitive labor costs and increasing investments in advanced die casting and sand casting technologies are enabling manufacturers to produce high-quality, cost-efficient aluminum castings. Additionally, rising exports of automotive and industrial components to the U.S. and other regions are contributing significantly to market growth in Mexico.

North America Aluminum Casting Market Share

The Aluminum Casting industry is primarily led by well-established companies, including:

• Constellium (U.S.)

• Alcoa Corporation (U.S.)

• Kaiser Aluminum (U.S.)

• Novelis (Canada)

• Hill & Smith Holdings (U.S.)

• Shiloh Industries (U.S.)

• China Aluminum International Engineering (China)

• Magnus Metalworks (U.S.)

• Gränges (U.S.)

• Aleris (China)

• Magna International (U.S.)

• Teksid Aluminum (U.S.)

• Sapa Group (U.S.)

• Wheels India Limited (U.S.)

• Arconic Corporation (U.S.)

• Castwell Manufacturing (U.S.)

• Universal Aluminum Castings (U.S.)

• Garland Manufacturing (U.S.)

• Milwaukee Aluminum Foundry (U.S.)

• Shandong Aluminum Casting Co., Ltd. (China)

What are the Recent Developments in North America Aluminum Casting Market?

- In April 2023, Alcoa Corporation, a global leader in aluminum production, inaugurated a state-of-the-art aluminum casting facility in Kentucky, U.S., aimed at producing high-precision die-cast components for the automotive and aerospace sectors. This facility underscores the company’s commitment to innovation and advanced manufacturing techniques, enabling the production of lightweight, durable components while enhancing energy efficiency and sustainability in North American supply chains.

- In March 2023, Nemak, S.A.B. de C.V., a leading automotive aluminum casting manufacturer headquartered in Mexico, launched its new high-pressure die-casting line for engine blocks and chassis components. The initiative targets the growing demand for lightweight materials in electric vehicles and fuel-efficient cars, demonstrating Nemak’s focus on supporting automotive innovation through advanced aluminum casting technologies.

- In March 2023, Kaiser Aluminum Corporation successfully expanded its aluminum casting operations in California, U.S., to meet the increasing industrial demand for structural parts and heat-transfer components. This expansion highlights the company’s dedication to providing high-quality, precision-cast solutions for diverse industries, including automotive, aerospace, and heavy machinery.

- In February 2023, Constellium SE, a European-based aluminum solutions provider with operations in North America, partnered with a major U.S. automotive OEM to supply lightweight, high-strength aluminum castings for electric vehicle chassis and body components. The collaboration emphasizes Constellium’s focus on sustainability and technological advancement in aluminum casting processes, supporting the shift toward greener transportation solutions.

- In January 2023, Shiloh Industries, Inc., a North American manufacturer of aluminum die-cast components, unveiled its new line of lightweight transmission housings and engine blocks at the North American International Auto Show. The initiative showcases Shiloh’s commitment to delivering advanced, precision-engineered aluminum castings that improve vehicle efficiency and performance while meeting stringent environmental and safety regulations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Aluminum Casting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Aluminum Casting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Aluminum Casting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.