North America Amino Acid In Dietary Supplements Market

Market Size in USD Million

CAGR :

%

USD

826.78 Million

USD

1,268.85 Million

2024

2032

USD

826.78 Million

USD

1,268.85 Million

2024

2032

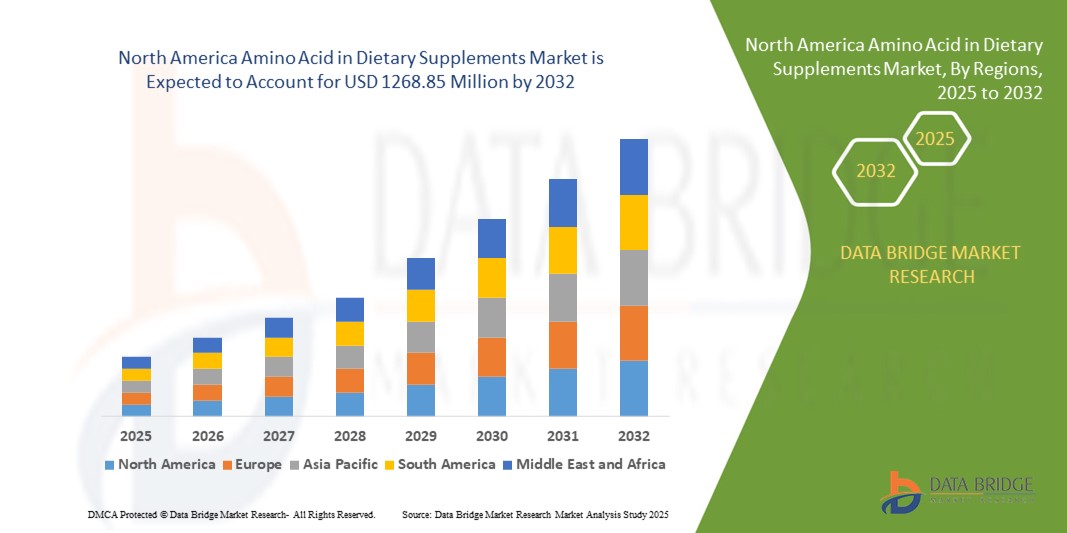

| 2025 –2032 | |

| USD 826.78 Million | |

| USD 1,268.85 Million | |

|

|

|

|

North America Amino Acid in Dietary Supplements Market Size

- The North America amino acid in dietary supplements market size was valued at USD 826.78 million in 2024 and is expected to reach USD 1268.85 million by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of health and wellness, rising demand for fitness and performance-enhancing supplements, and growing adoption of amino acid supplements for preventive healthcare

- The surge in demand for plant-based and vegan-friendly amino acid supplements, along with rising health consciousness among aging populations, is further propelling market growth across both retail and e-commerce channels

North America Amino Acid in Dietary Supplements Market Analysis

- The North America amino acid in dietary supplements market is experiencing robust growth due to increasing consumer focus on fitness, immunity, and overall well-being, coupled with rising demand for personalized nutrition solutions

- Growing interest in sports nutrition and weight management is encouraging manufacturers to innovate with high-quality, bioavailable amino acid formulations tailored to diverse consumer needs

- The U.S. dominates the North America amino acid in dietary supplements market with the largest revenue share of 75.2% in 2024, driven by a well-established health and wellness industry and high consumer spending on dietary supplements

- Canada is expected to be the fastest-growing country in the North America amino acid in dietary supplements market during the forecast period, fueled by increasing health awareness, rising fitness trends, and growing adoption of dietary supplements among millennials and Gen Z populations

- The glutamic acid segment held the largest market revenue share of 43.4% in 2024, driven by its widespread use as a flavor enhancer and its role in supporting neurotransmitter synthesis and overall health

Report Scope and North America Amino Acid in Dietary Supplements Market Segmentation

|

Attributes |

North America Amino Acid in Dietary Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Amino Acid in Dietary Supplements Market Trends

Increasing Integration of Personalized Nutrition and Data Analytics

- The North America amino acid in dietary supplements market is experiencing a significant trend toward the integration of personalized nutrition and advanced data analytics

- These technologies enable tailored supplement recommendations by analyzing individual health data, dietary habits, and genetic profiles to optimize health outcomes

- AI-driven platforms are being developed to provide personalized amino acid supplement plans, such as those targeting specific fitness goals, immune support, or cognitive health based on user-specific data

- For instance, companies are leveraging data analytics to recommend precise dosages of amino acids such as lysine or methionine for muscle recovery or energy management, customized to individual consumer needs

- This trend enhances the appeal of amino acid supplements by offering targeted solutions, making them more attractive to health-conscious consumers, athletes, and aging populations

- Data analytics also tracks consumer supplement usage patterns, enabling manufacturers to optimize product formulations and marketing strategies

North America Amino Acid in Dietary Supplements Market Dynamics

Driver

Rising Demand for Health and Wellness Products and Preventive Healthcare

- Growing consumer awareness of health and wellness, particularly in the U.S. and Canada, is a major driver for the North America amino acid in dietary supplements market

- Amino acid supplements, such as glutamic acid for cognitive health and tryptophan for mood regulation, are increasingly sought after for their role in supporting immunity, muscle recovery, and overall well-being

- The rise in fitness culture and sports nutrition, especially among adults and athletes, is boosting demand for amino acids such as methionine and phenylalanine for muscle growth and performance enhancement

- Government initiatives and healthcare campaigns promoting preventive care, particularly in the U.S., which dominates the market, are encouraging the adoption of dietary supplements to address nutritional deficiencies

- The expansion of e-commerce platforms and improved accessibility to over-the-counter (OTC) supplements are further driving market growth, particularly in Canada, the fastest-growing country in the region

- Advancements in supplement delivery forms, such as gummies and liquids, are catering to diverse consumer preferences, enhancing market penetration

Restraint/Challenge

High Production Costs and Regulatory Compliance Concerns

- The high cost of producing and formulating amino acid supplements, including raw material sourcing and advanced delivery forms such as soft gels and powders, can be a significant barrier, particularly for smaller manufacturers in emerging markets

- Developing specialized formulations, such as those for infants or pregnant women, requires significant investment in research and quality control, increasing overall costs

- Regulatory compliance and safety concerns pose a major challenge. Amino acid supplements involve the collection and analysis of consumer health data for personalized nutrition, raising concerns about data privacy and compliance with regulations such as the U.S. Health Insurance Portability and Accountability Act (HIPAA) and Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA)

- The complex regulatory landscape across the U.S. and Canada regarding supplement safety, labeling, and health claims can complicate operations for manufacturers and limit market expansion

- Potential side effects, such as gastrointestinal discomfort from high doses of certain amino acids such as glutamic acid, may deter consumers, particularly in regions with high awareness of supplement safety

North America Amino Acid in Dietary Supplements market Scope

The market is segmented on the basis of type, form, application, end user, and distribution channel.

- By Type

On the basis of type, the North America amino acid in dietary supplements market is segmented into glutamic acid, lysine, tryptophan, methionine, phenylalanine, and others. The glutamic acid segment held the largest market revenue share of 43.4% in 2024, driven by its widespread use as a flavor enhancer and its role in supporting neurotransmitter synthesis and overall health. Its high demand in dietary supplements is fueled by consumer awareness of its benefits in muscle repair and cognitive function.

The lysine segment is expected to witness the fastest growth rate of 8.7% from 2025 to 2032, driven by its increasing use in sports nutrition and its role in muscle development, immune function, and hormone production. Growing demand for plant-based lysine supplements, particularly among vegetarian and vegan consumers, further accelerates adoption.

- By Form

On the basis of form, the North America amino acid in dietary supplements market is segmented into tablets, capsules, soft gels, powders, gummies, liquids, and others. The powders segment held the largest market revenue share of 38.3% in 2024, attributed to its versatility, ease of customization in dosing, and popularity among fitness enthusiasts for mixing with shakes or smoothies.

The liquids segment is anticipated to experience the fastest growth rate of 7.5% from 2025 to 2032, driven by its rapid absorption and ease of consumption, particularly for consumers seeking convenient and fast-acting supplements. The rise in liposomal liquid formulations enhances bioavailability, boosting adoption.

- By Application

On the basis of application, the North America amino acid in dietary supplements market is segmented into energy & weight management, general health, bone & joint health, gastrointestinal health, immunity, cardiac health, diabetes, anti-cancer, and others. The energy & weight management segment dominated with a revenue share of 39.1% in 2024, fueled by the rising demand for amino acid supplements among athletes and fitness enthusiasts for muscle recovery, fatigue reduction, and performance enhancement.

The immunity segment is expected to witness robust growth from 2025 to 2032, driven by heightened consumer focus on preventive healthcare post-COVID-19. Amino acids such as glutamine and arginine are increasingly sought for their role in supporting immune function and overall wellness.

- By End User

On the basis of end user, the North America amino acid in dietary supplements market is segmented into adults, geriatric, pregnant women, children, and infants. The adults segment held the largest market revenue share of 47.3% in 2024, driven by growing awareness of preventive healthcare, fitness trends, and the need to address nutritional gaps among adult consumers.

The geriatric segment is anticipated to experience rapid growth of 6.8% from 2025 to 2032, fueled by the aging population’s increasing demand for supplements targeting bone health, cognitive function, and immunity. Manufacturers are developing tailored amino acid formulations to address the specific needs of older adults.

- By Distribution Channel

On the basis of distribution channel, the North America amino acid in dietary supplements market is segmented into over-the-counter (OTC) and prescribed. The OTC segment dominated with a revenue share of 62.7% in 2024, driven by the widespread availability of amino acid supplements in retail channels, including pharmacies, supermarkets, and e-commerce platforms, catering to health-conscious consumers.

The prescribed segment is expected to witness significant growth from 2025 to 2032, driven by increasing recommendations from healthcare professionals for amino acid supplements to address specific health conditions, such as muscle loss, immune support, and chronic disease management.

North America Amino Acid in Dietary Supplements Market Regional Analysis

- The U.S. dominates the North America amino acid in dietary supplements market with the largest revenue share of 75.2% in 2024, driven by a well-established health and wellness industry and high consumer spending on dietary supplements

- The trend toward fitness and preventive healthcare, coupled with increasing regulations ensuring product safety, further boosts market expansion. Manufacturers’ focus on innovative formulations, such as plant-based and high-potency amino acids, complements both retail and prescribed sales, creating a diverse product ecosystem

Canada Amino Acid in Dietary Supplements Market Insight

Canada is expected to witness the fastest growth rate in the North America amino acid in dietary supplements market, driven by rising demand for health-focused supplements in urban and suburban settings. Consumers seek amino acids for energy and weight management, immunity, and general health. Increased awareness of nutritional benefits and evolving health regulations balancing efficacy and safety influence consumer choices.

North America Amino Acid in Dietary Supplements Market Share

The amino acid in dietary supplements industry is primarily led by well-established companies, including:

- MusclePharm (U.S.)

- True Nutrition (U.S.)

- Reliance Private Label supplements (U.S.)

- NOW Foods (U.S.)

- Solgar Inc. (U.S.)

- BIOVEA (U.S.)

- Jarrow Formulas, Inc (U.S.)

- Optimum Nutrition (U.S.)

- Universal Nutrition (U.S.)

- Evonik Industries AG (Germany)

- Cellucor (U.S.)

- KAGED (U.S.)

- EVLUTION NUTRITION (U.S.)

- ALLMAX (Canada)

- Ajinomoto Co., Inc. (Japan)

- GAT WHP (U.S.)

- ProSupps USA, LLC (U.S.)

- NutraBio Labs, Inc. (U.S.)

- Five Percent Nutrition, LLC. (U.S.)

What are the Recent Developments in North America Amino Acid in Dietary Supplements Market?

- In May 2025, Arla Foods Ingredients (AFI) unveiled a breakthrough solution to enhance juice-style oral nutrition supplements (ONS) for the medical nutrition sector. Using Lacprodan® BLG-100, a pure beta-lactoglobulin rich in essential amino acids such as leucine, AFI successfully increased the protein content to 7% without compromising taste, mouthfeel, or stability. This fat-free formulation offers a palatable alternative to traditional milky ONS, addressing challenges in malnutrition and muscle loss. The innovation reflects AFI’s commitment to clean-label, high-performance nutrition, and supports growing demand for effective, easy-to-consume medical supplement

- In January 2025, Cizzle Brands Corporation launched Spoken Nutrition, a premium nutraceutical brand specifically crafted for the athletic and fitness market. Certified by NSF for Sport®, Spoken Nutrition meets the stringent safety and purity standards required by professional sports organizations. Its product line—developed by elite performance experts including trainers to NBA and NFL stars—includes supplements for sleep, gut health, and muscle recovery. With endorsements from major league teams and a focus on clean, effective formulations, Spoken Nutrition aims to redefine sports nutrition for elite athletes and fitness enthusiasts asuch as

- In September 2024, Agape ATP Corporation launched ATP2, an advanced wellness supplement designed to support holistic health and vitality. The enhanced formula includes 20 amino acids, 76 essential minerals, and plant-based enzymes, all working synergistically with hydrogen acetate, a scientifically backed ingredient known to improve metabolism, reduce inflammation, and combat aging. ATP2 aims to address key health concerns such as chronic disease, energy production, and cellular repair, reflecting a growing trend toward comprehensive nutritional solutions. With its innovative blend, ATP2 represents a major milestone in Agape’s commitment to cutting-edge wellness science

- In October 2023, Vitaquest International strategically acquired Pharmachem’s powder processing facility in Paterson, New Jersey, significantly expanding its manufacturing and product development capabilities. This facility, now branded as VQ Technologies, brings advanced fluid bed processing technologies in-house, enabling Vitaquest to offer specialized services such as granulation, agglomeration, microencapsulation, drying, and blending of powder and liquid ingredients. These processes enhance supplement performance by improving flowability, taste, stability, and dosing accuracy. The acquisition positions Vitaquest as a leader in powder and particle engineering, supporting its mission to deliver high-quality, innovative solutions across the nutraceutical and functional food sectors

- In September 2023, VitaNatural Inc. expanded its portfolio and market presence by acquiring Vitamin Bounty, a well-established dietary supplement brand known for its high-quality wellness products. Founded in 2016, Vitamin Bounty offers a diverse range of supplements—from immune support to weight management—manufactured in GMP-certified facilities and third-party tested for quality. This strategic acquisition allows VitaNatural to leverage Vitamin Bounty’s strong online presence and retail partnerships across North America, enhancing its competitive edge in the growing self-directed wellness market. The move underscores VitaNatural’s commitment to innovation, brand-building, and delivering trusted health solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Amino Acid In Dietary Supplements Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Amino Acid In Dietary Supplements Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Amino Acid In Dietary Supplements Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.