North America And Europe Celiac Disease Market

Market Size in USD Million

CAGR :

%

USD

103.57 Million

USD

218.81 Million

2024

2032

USD

103.57 Million

USD

218.81 Million

2024

2032

| 2025 –2032 | |

| USD 103.57 Million | |

| USD 218.81 Million | |

|

|

|

|

North America and Europe Celiac Disease Market Size

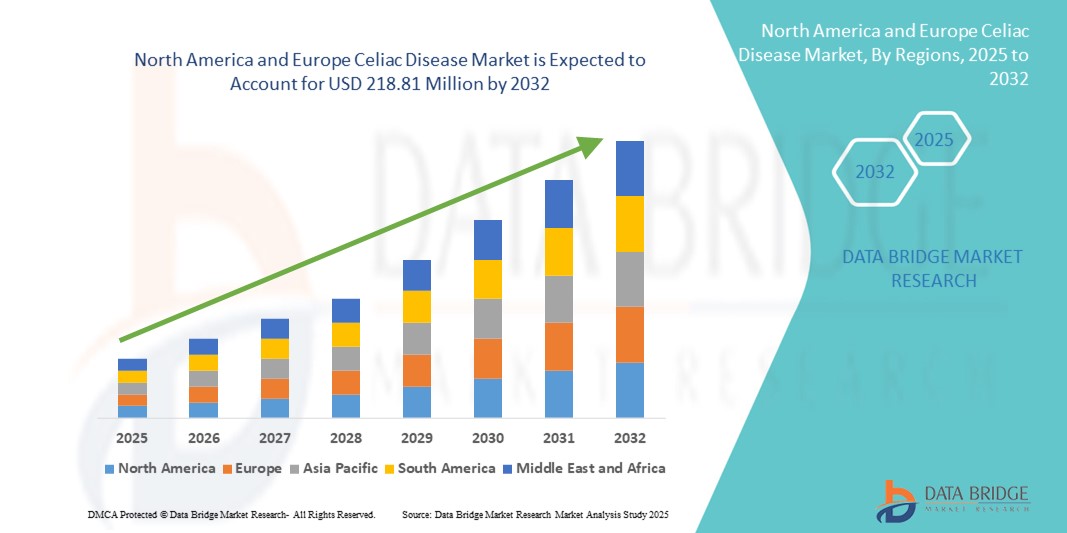

- The North America and Europe celiac disease market size was valued at USD 103.57 million in 2024 and is expected to reach USD 218.81 million by 2032, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within diagnostic techniques, gluten-free product formulations, and digital health tools for chronic disease management, leading to enhanced diagnosis and monitoring of celiac disease in both clinical and homecare settings

- Furthermore, rising consumer demand for gluten-free, user-friendly, and nutritionally balanced food options is establishing such dietary solutions as the primary intervention for managing celiac disease. These converging factors are accelerating the uptake of North America and Europe celiac disease solutions, thereby significantly boosting the industry's growth

North America and Europe Celiac Disease Market Analysis

- Celiac disease, an autoimmune disorder triggered by the ingestion of gluten, is witnessing increasing diagnosis rates and public awareness across North America and Europe, driven by advancements in diagnostic technologies and rising consumer consciousness regarding gluten intolerance

- The demand for celiac disease diagnostics and gluten-free therapeutic solutions is surging, primarily due to the expansion of gluten-free food product lines, improved access to specialized healthcare, and supportive regulatory frameworks across these regions

- North America dominated the North America and Europe celiac disease market with the largest revenue share of 42.6% in 2024, attributed to growing awareness, robust healthcare infrastructure, and an increasing number of individuals adopting gluten-free diets either due to medical necessity or lifestyle preference. The U.S. has witnessed significant growth, driven by widespread screening programs, strong advocacy by celiac associations, and innovation in gluten-free product development

- Europe is projected to be the fastest-growing region in the North America and Europe celiac disease market during the forecast period, owing to improved diagnostic protocols, increasing prevalence of autoimmune disorders, and expanding availability of gluten-free food and pharmaceutical offerings. Countries such as the U.K., Germany, and Italy are at the forefront due to proactive healthcare policies and awareness campaigns promoting early testing and dietary compliance

- Prescription medications dominated the North America and Europe celiac disease market with a market share of 63.4% in 2024, reflecting physician-supervised treatment for moderate to severe cases

Report Scope and North America and Europe Celiac Disease Market Segmentation

|

Attributes |

North America and Europe Celiac Disease Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America and Europe Celiac Disease Market Trends

“Evolving Diagnostic and Dietary Trends in Celiac Disease Management”

- A significant and accelerating trend in the North America and Europe Celiac Disease market is the widespread adoption of advanced diagnostic technologies and increasing demand for gluten-free therapeutic solutions. This evolution is enhancing patient outcomes through earlier detection and improved disease management strategies

- For instance, novel diagnostic kits and point-of-care testing platforms are gaining prominence across the U.S., Germany, and the U.K., enabling more accurate and faster identification of celiac disease. Innovations in blood-based serological tests and non-invasive genetic screening have substantially improved the detection rates

- Technology integration in diagnostic tools allows for patient history tracking, digital symptom mapping, and AI-assisted pattern recognition, which help healthcare professionals provide personalized dietary and therapeutic guidance. In addition, mobile health apps are assisting patients in maintaining gluten-free diets through barcode scanning and real-time alerts for gluten-containing ingredients

- North American and European markets are witnessing strong collaborations between healthcare institutions and food manufacturers to certify and expand the range of gluten-free products. This not only improves adherence to treatment regimens but also elevates quality of life for individuals with celiac disease

- Moreover, leading companies in the space are developing cloud-based platforms and connected health solutions that allow remote patient monitoring, digital dietary coaching, and access to support groups. These platforms are especially impactful in rural or underserved areas where specialist care is limited

- The demand for user-centric, integrated, and proactive solutions is reshaping the North America and Europe Celiac Disease market, fostering innovation across diagnostics, dietary tools, and long-term management systems

North America and Europe Celiac Disease Market Dynamics

Driver

“Growing Need Due to Rising Awareness and Rising Disease Incidence”

- The increasing prevalence of celiac disease across North America and Europe, along with improved awareness and screening efforts, is significantly boosting demand for more effective diagnostics and treatment solutions

- For instance, in April 2024, ImmunogenX, a clinical-stage biopharmaceutical company, reported continued progress in Phase 2 trials of latiglutenase, an oral therapy intended to help celiac patients manage gluten exposure—highlighting a trend of innovation beyond traditional gluten-free diets

- As patients become more aware of potential triggers and long-term complications of untreated celiac disease (e.g., osteoporosis, infertility, and cancer), they are seeking enhanced diagnostic and treatment options from healthcare providers

- Furthermore, the growing popularity of gluten-free diets, even among undiagnosed individuals, is making the public more conscious of gluten sensitivity and autoimmune reactions—positioning the market for sustained growth

- The availability of over-the-counter gluten detection kits, improved genetic testing, and more accessible gluten-free pharmaceutical formulations is further contributing to the expansion of the North America and Europe celiac disease industry

Restraint/Challenge

“Lack of Curative Therapies and High Cost of Long-term Management”

- A major limitation to the growth of the celiac disease market is the absence of a definitive cure, with the current standard of care being a lifelong adherence to a strict gluten-free diet, which is often difficult to manage and costly

- Inconsistent labeling, cross-contamination, and lack of gluten-free options in some regions or institutions make it hard for patients to comply fully—leading to persistent symptoms and associated comorbidities

- Moreover, gluten-free products and medications can be 30–242% more expensive than their gluten-containing counterparts, presenting a significant economic burden—especially for low-income or underserved populations

- Reimbursement policies for gluten-free medical foods and celiac-specific medications vary significantly across countries and insurers, hindering patient access to adequate long-term care

- Overcoming these challenges will require broader insurance coverage, regulatory support for therapeutic innovations, and increased investment in disease-modifying drug development to ensure affordability and compliance in treatment regimens

North America and Europe Celiac Disease Market Scope

The market is segmented on the basis of treatment type, disease type, drug type, prescription type, dosage form, route of administration, population type, end user, and distribution channel.

- By Treatment Type

On the basis of treatment type, the celiac disease market is segmented into corticosteroids, immunosuppressants, and others. Corticosteroids dominated the market with a 45.8% revenue share in 2024, driven by their widespread use in managing inflammation during acute flare-ups and refractory cases.

Immunosuppressants are expected to witness the fastest CAGR of 9.1% from 2025 to 2032, especially for patients unresponsive to conventional therapies.

- By Disease Type

On the basis of disease type, the celiac disease market is segmented into classical celiac disease, non-classical celiac disease, refractory celiac disease, potential celiac disease, and dermatitis herpetiformis. Classical celiac disease accounted for the 38.6% revenue share in 2024, due to its well-established diagnostic criteria and high prevalence.

Refractory celiac disease is projected to grow at a CAGR of 10.4% owing to the increasing identification of cases unresponsive to gluten-free diets.

- By Drug Type

On the basis of drug type, the celiac disease market is segmented into generics and branded. Generic drugs led the segment with a 56.2% market share in 2024, fueled by affordability and wide availability.

The branded segment is expected to register the fastest CAGR of 8.7% during the forecast period, driven by new drug launches and biologic therapies.

- By Prescription Type

On the basis of prescription type, the celiac disease market is segmented into prescription and over-the-counter (OTC) products. Prescription medications held the largest market share of 63.4% in 2024, reflecting physician-supervised treatment for moderate to severe cases.

The OTC segment is anticipated to grow at a CAGR of 9.8% during the forecast period, due to consumer interest in symptom-relief products and digestive enzyme supplements.

- By Dosage Form

On the basis of dosage form, the celiac disease market is segmented into tablet, capsules, injection, and others. Tablet formulations held the largest revenue share of 41.5% in 2024, due to ease of use and patient preference.

Injections are expected to grow at the fastest CAGR of 10.1% during the forecast period, supported by the rising adoption of intravenous biologics.

- By Route of Administration

On the basis of route of administration, the celiac disease market is segmented into oral, intravenous, and topical. Oral administration dominated with a 68.3% share in 2024, driven by its convenience and acceptance.

Intravenous therapy is projected to grow at a CAGR of 9.4% during the forecast period, owing to emerging intravenous immune therapies for refractory cases.

- By Population Type

On the basis of population type, the celiac disease market is segmented into children, adults, and geriatric. Adults accounted for the largest share of 54.6% in 2024, due to rising diagnoses and gluten sensitivity among working-age individuals.

The children segment is expected to grow fastest with a CAGR of 10.2% during the forecast period, driven by school-based screening programs and parental awareness.

- By End User

On the basis of end user, the celiac disease market is segmented into hospitals, clinics, diagnostic centres, home care settings, and others. Hospitals led with a 36.9% market share in 2024, owing to their access to advanced diagnostics and treatment.

Home care settings are expected to register the fastest growth at a CAGR of 9.9% during the forecast period, supported by personalized diet support and telemedicine expansion.

- By Distribution Channel

On the basis of distribution channel, the celiac disease market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. Retail pharmacies dominated with a 48.7% share in 2024, due to wide availability of gluten-free products and medications.

Online pharmacies are expected to grow at the highest CAGR of 11.3% during the forecast period, due to increased digital purchasing behavior and gluten-free product variety.

North America and Europe Celiac Disease Market Regional Analysis

- North America dominated the North America and Europe celiac disease market with the largest revenue share of 42.6% in 2024. This stronghold is attributed to a high prevalence of celiac disease, increasing public awareness, and advanced healthcare infrastructure across the region. The rising demand for gluten-free food products, supported by robust diagnostics and pharmaceutical development, is significantly boosting market revenue

- Consumers across North America are highly proactive in managing autoimmune and digestive disorders. Health insurance coverage for celiac diagnostics and consultations, coupled with active patient advocacy groups such as the Celiac Disease Foundation (CDF), further enhance diagnosis and treatment rates

- Major pharmaceutical companies and startups are focusing on non-dietary therapeutics, including enzymatic therapies, immune modulators, and microbiome-targeted interventions

U.S. North America and Europe Celiac Disease Market Insight

The U.S. North America and Europe celiac disease market accounted for 77% of the North American market share in 2024, positioning it as the largest single-country contributor. This is driven by an estimated 3 million Americans living with celiac disease, many of whom are undiagnosed. A growing emphasis on screening at-risk populations, including those with Type 1 diabetes, autoimmune thyroid disease, and family history. Expansion in research initiatives such as the NIH-funded Celiac Disease Genomic, Environmental, Microbiome, and Metabolomic Study (CDGEMM). Strong market support from retail brands like Whole Foods, Trader Joe’s, and others offering extensive gluten-free aisles.

Canada North America and Europe Celiac Disease Market Insight

Canada North America and Europe celiac disease market is witnessing stable growth in the celiac disease market, aided by National guidelines from Health Canada that support proper food labeling and dietary education. The presence of specialized clinics and gluten-free food manufacturing units in provinces like Ontario and British Columbia. The Canadian Celiac Association is instrumental in increasing awareness through public education, gluten-free food certifications, and support networks.

Mexico North America and Europe Celiac Disease Market Insight

Mexico’s North America and Europe celiac disease market market is in an early growth phase, characterized by increasing diagnosis rates in urban areas, though still relatively low compared to the U.S. and Canada. A growing number of gastroenterologists and public awareness campaigns initiated by local healthcare providers. Rising gluten-free product imports and a budding local production market, especially in tourist-heavy regions such as Cancun and Mexico City.

Europe Celiac Disease Market Overview

Europe North America and Europe celiac disease market is projected to grow at a significant CAGR through the forecast period, supported by the EU’s comprehensive food safety and labeling policies, strong diagnosis infrastructure, and rising consumer health consciousness. The European Society for Paediatric Gastroenterology Hepatology and Nutrition (ESPGHAN) guidelines have streamlined early diagnosis, especially in children. Government reimbursements for gluten-free products in countries like Italy, Spain, and the U.K. help reduce the burden on patients.

Germany North America and Europe Celiac Disease Market Insight

Germany North America and Europe celiac disease market holds a major share in Europe due to High public awareness and availability of gluten-free foods in mainstream retail. Investments in biotech and pharmaceutical R&D focused on autoimmune diseases. Insurance-funded diagnostic tests, regular screenings, and patient-centered clinical trials. Germany-based companies like Dr. Schär are playing a pivotal role in gluten-free innovation.

France North America and Europe Celiac Disease Market Insight

France is experiencing growing demand in both diagnosis and gluten-free food markets. Public healthcare (Sécurité Sociale) supports screenings for celiac and other autoimmune disorders. Popular gluten-free brands and dedicated cafés are expanding in cities like Paris and Lyon. The French Association of Gluten Intolerants (AFDIAG) is active in-patient advocacy and regulatory discussions.

U.K. North America and Europe Celiac Disease Market Insight

The U.K. North America and Europe celiac disease market offers one of the most patient-friendly ecosystems in Europe the NHS offers gluten-free food prescriptions, reducing out-of-pocket costs. Widespread access to blood tests and biopsy diagnostics. Market growth is also driven by gluten-free product offerings from top brands like Tesco, Sainsbury’s, and Co-op. The Coeliac UK charity leads in research, awareness campaigns, and annual gluten-free food fairs.

North America and Europe Celiac Disease Market Share

The North America and Europe Celiac Disease industry is primarily led by well-established companies, including:

- Takeda Pharmaceutical Company Limited (Japan)

- Tillotts Pharma AG (Switzerland)

- GSK plc. (U.K.)

- ImmunogenX, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Pfizer Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Amgen Inc. (U.S.)

- AstraZeneca (U.K.)

- Novartis AG (Switzerland)

- AdvaCare Pharma (U.S.)

- ANOKION (Switzerland)

- Topas Therapeutics (Germany)

- Immunic Therapeutics (Germany)

- Equillium Bio (U.S.)

Latest Developments in North America and Europe Celiac Disease Market

- In May 2025 – The European Commission’s Joint Research Centre released the first-ever certified reference material (CRM) for anti-tTG antibodies, providing a universal benchmark for celiac disease diagnostic tests. This development aims to harmonize results across laboratories, enhancing diagnostic accuracy across Europe

- In June 2025 – The Celiac Disease Foundation announced the completion of a multi-national patient survey conducted across North America and Europe. With over 17,000 participants, the study gathered valuable insights into barriers faced during clinical trial recruitment, aiming to shape more patient-centred research and improve trial accessibility across the UK, Germany, Italy, and Spain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.