North America And Europe Corporate Wellness Market

Market Size in USD Billion

CAGR :

%

USD

32.35 Billion

USD

44.65 Billion

2024

2032

USD

32.35 Billion

USD

44.65 Billion

2024

2032

| 2025 –2032 | |

| USD 32.35 Billion | |

| USD 44.65 Billion | |

|

|

|

|

North America and Europe Corporate Wellness Market Size

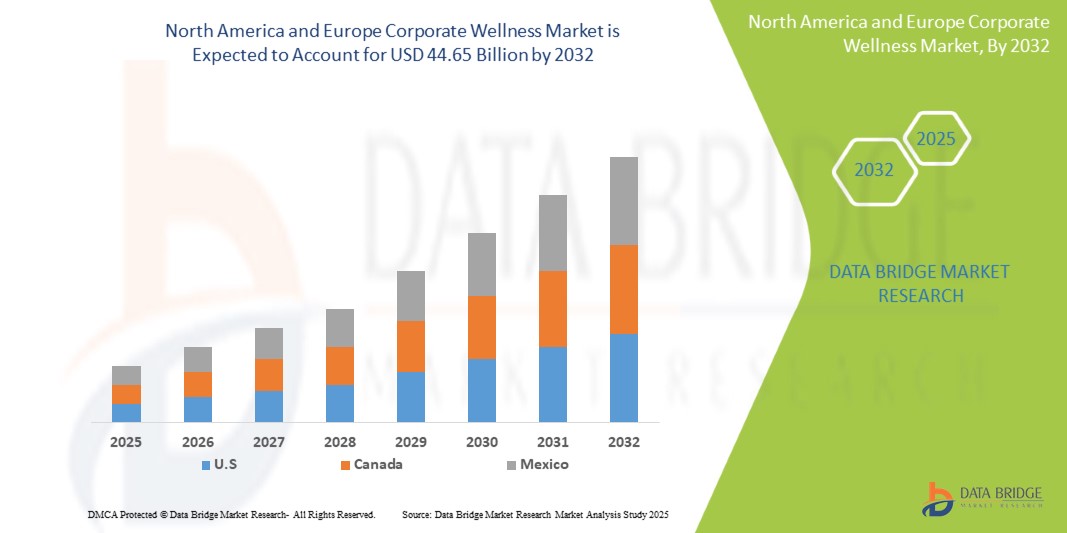

- The North America and Europe Corporate Wellness Market was valued at USD 32.35 billion in 2024 and is expected to reach approximately USD 44.65 billion by 2032

- During the forecast period of 2025 to 2032, the market is anticipated to grow at a CAGR of 4.3%, primarily fueled by rising awareness of mental health, chronic disease prevention, and the increasing adoption of wellness solutions by employers

- This growth is driven by the increasing need to reduce employee healthcare costs, enhance productivity, and provide holistic wellness programs addressing physical, mental, and financial well-being.

North America and Europe Corporate Wellness Market Analysis

- The North America and Europe Corporate Wellness Market comprises a broad range of services aimed at improving employee health and wellbeing across organizations. These include health risk assessments, fitness programs, mental health support, nutritional counseling, and digital wellness solutions

- The market’s expansion is closely tied to the growing focus on preventive healthcare, corporate investments in employee wellbeing, and integration of digital health tools such as wearables and virtual consultations

- The North American remains the dominant country in the corporate wellness market due to high corporate healthcare spending, government support for mental health initiatives, and the widespread adoption of wellness programs among large enterprises. The presence of key players and health tech startups also contributes to market dominance

- According to a report published by Market Data Forecast, U.S. corporations are increasingly adopting integrated platforms that combine physical health tracking with mental wellness features. For instance, in 2024, Virgin Pulse launched a new AI-powered employee wellness app with real-time behavioral nudges and personalized goal tracking, widely adopted by Fortune 500 firms

- Corporate wellness solutions are becoming vital components of organizational strategy, playing a pivotal role in improving workforce engagement, reducing burnout, enhancing work-life balance, and driving long-term healthcare cost savings

Report Scope and Corporate Wellness Market Segmentation

|

Attributes |

Corporate Wellness Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Corporate Wellness Market Trends

“Rising Emphasis on Mental Health and Holistic Wellbeing”

- The growing prevalence of workplace stress, burnout, and mental health disorders—exacerbated by remote work and economic uncertainty—is driving strong demand for corporate wellness programs focused on psychological wellbeing

- Services like mindfulness training, virtual counseling, and Employee Assistance Programs (EAPs) are witnessing increased uptake as employers prioritize mental resilience and emotional support

- For instance, in January 2025, ComPsych Corporation launched an AI-powered virtual mental health assistant that offers on-demand stress management coaching and connects users to licensed therapists, helping companies address mental health at scale across hybrid teams

- The shift toward holistic wellness—which includes physical, mental, social, and financial wellbeing—is becoming a cornerstone of workforce strategy. Employers are moving beyond traditional fitness programs to include financial literacy workshops, sleep coaching, and caregiving support

- Additionally, the integration of digital health tools such as wearables, biometric tracking, and gamified mobile platforms is transforming how employees engage with wellness. These technologies enable real-time feedback, personalized coaching, and continuous engagement, aligning with the preferences of tech-savvy, distributed workforces

Corporate Wellness Market Dynamics

Driver

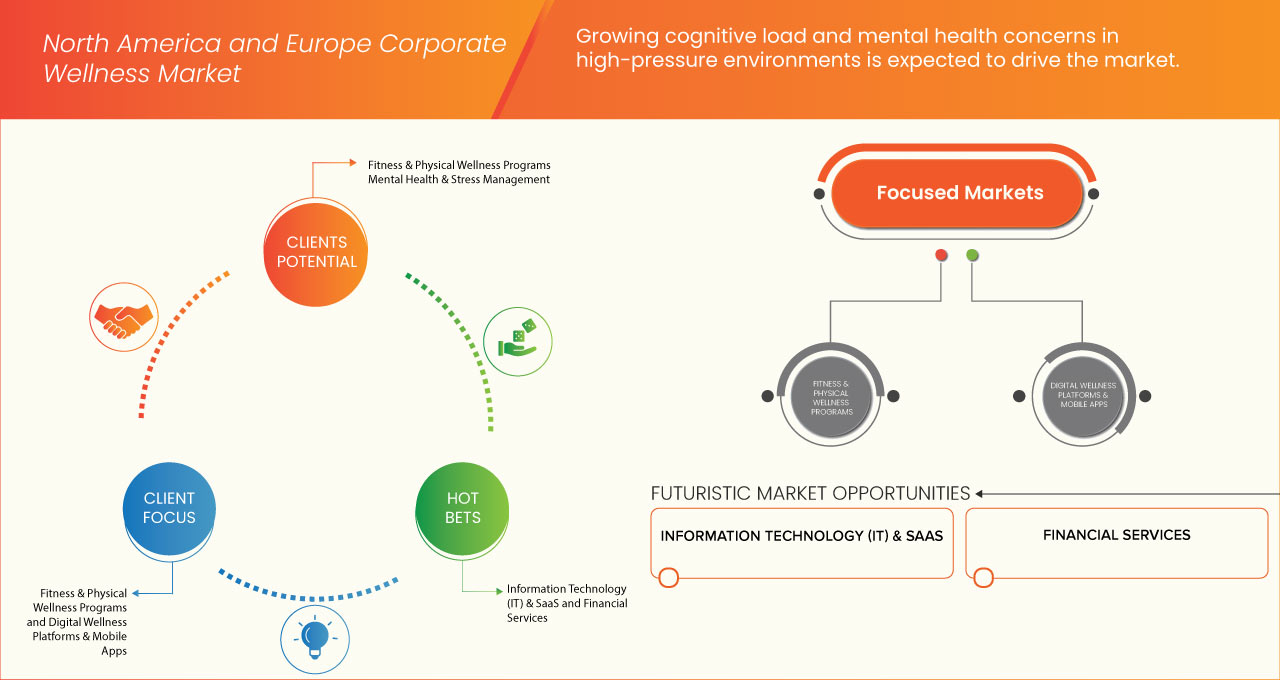

“Growing Cognitive Load and Mental Health Concerns in High-Pressure Environments”

- In response to rising cognitive demands and stress, organizations are expanding wellness programs aimed at reducing absenteeism, enhancing employee retention, and addressing chronic illnesses and mental health conditions

- With productivity and job satisfaction becoming critical in high-pressure and talent-scarce environments, wellness initiatives are increasingly viewed as strategic tools for attracting and retaining talent

- A 2024 report by the American Institute for Preventive Medicine highlights that structured wellness programs led to a 25–28% decline in sick leave and delivered a 3:1 ROI in health insurance savings—underscoring the financial and operational value of addressing mental health concerns

- Employers are increasingly adopting integrated wellness platforms that leverage predictive analytics, track health outcomes, and deliver personalized interventions to mitigate employee burnout and mental strain

- The ongoing emphasis on Diversity, Equity, and Inclusion (DEI) is prompting companies to design wellness initiatives that support culturally aware, multigenerational, and multilingual employee needs—further reducing stress and cognitive overload in diverse workforces

Opportunities

“Integration with Health Insurance and Benefit Plans”

- Employers are increasingly embedding wellness initiatives—such as biometric screenings, mental health support, and fitness incentives—into health insurance and benefit plans to manage rising healthcare costs and promote preventive care.

- Insurance providers are incentivizing wellness adoption by offering premium discounts or shared savings models to companies that implement structured wellness programs, driving mutual value.

- Wellness vendors partnering with insurers and benefits administrators can offer integrated, value-added services that align with healthcare regulations and enhance organizational ROI.

- Real-world partnerships, such as Wellhub with U.S. and Brazilian insurers, and Wellx with Fit On Click in the UAE, showcase how wellness-insurance integration boosts preventive care access while reducing claims.

- Technology-driven solutions like Innovatech’s HRMS integration demonstrate measurable gains in employee engagement and productivity, reinforcing the benefits of merging wellness with core HR and insurance infrastructure.

Restraint/Challenge

“Lack of Unified Standards and ROI Metrics”

- Many organizations struggle to evaluate the effectiveness of wellness programs due to the lack of standardized KPIs like absenteeism reduction, productivity improvement, or mental health outcomes

- Without a clear ROI framework, wellness initiatives often remain in pilot stages and fail to secure long-term investment from executive leadership

- A 2023 ResearchGate meta-analysis found that only 35% of employers had defined ROI tracking mechanisms, with most lacking consistent outcome metrics across programs

- According to a 2023 Harvard Business Review report, despite positive employee feedback, many U.S. firms offering digital wellness tools were unable to scale them due to insufficient data on financial impact and business outcomes

Corporate Wellness Market Scope

The market is segmented on the basis of service and industry.

• By Service

On the basis of service, the North America and Europe Corporate Wellness Market is segmented into fitness & physical wellness programs, mental health & stress management, nutrition & weight management, health risk assessment & screening, smoking & substance abuse programs, financial wellness services, preventive & primary healthcare services, Employee Assistance Programs (EAPS), digital wellness platforms & mobile apps, and others. The fitness & physical wellness programs segment is expected to dominate the market in 2025 with the market share of 22.65% in North America and 25.11% in Europe due to increasing employer focus on reducing sedentary lifestyles, improving workforce productivity, and lowering healthcare costs through preventive fitness initiatives.

The fitness & physical wellness programs is expected to witness the fastest CAGR from 2025 to 2032. This is driven by rising awareness of workplace anxiety, burnout, and depression, particularly in hybrid and remote work settings. The demand for virtual counseling, mindfulness tools, and on-demand therapy apps has surged, prompting employers to invest in holistic mental wellness initiatives that directly impact productivity and employee retention.

• By Industry

On the basis of industry, the North America and Europe Corporate Wellness Market is segmented into Telecom, Information Technology (IT) & SaaS, pharmaceuticals & life sciences, automotive, tourism & hospitality, construction, logistics & transportation, financial services, maritime & offshore, startups & scaleups, media & entertainment, energy & utilities, and education. The Information Technology (IT) & SaaS segment is expected to dominate the market in 2025 with the market share of 20.36% in North America and 19.83% in Europe due to the high prevalence of sedentary workstyles, increasing stress levels among tech professionals, and a strong emphasis on employee retention and productivity enhancement through wellness programs in the sector.

The Information Technology (IT) & SaaS segment accounted for the largest market revenue share in 2025 and is expected to maintain the fastest growth rate through 2032. The segment's rapid adoption of digital wellness tools, remote-first policies, and demand for personalized mental and physical health support solutions make it a major contributor to market expansion. IT companies are leading in offering full-spectrum wellness programs, integrating AI-driven coaching, biometric screenings, and 24/7 EAP access to retain top talent and support global distributed teams.

North America and Europe Corporate Wellness Market Regional Analysis

- North America dominates the corporate wellness market due to high healthcare costs, growing awareness of employee well-being, and strong adoption of digital wellness technologies across large enterprises.

- The region benefits from the presence of established corporate structures, government health mandates, and rising focus on mental health and preventative care programs in the workplace

- North American organizations are integrating AI-powered platforms, wearables, and real-time health monitoring systems to deliver personalized wellness solutions and improve program engagement

- In addition, the region’s advanced HR infrastructure and emphasis on DEI (Diversity, Equity, and Inclusion) support widespread deployment of inclusive and culturally relevant wellness initiatives

U.S. Corporate Wellness Market Insight

The U.S. is the largest and most mature market in North America for corporate wellness, driven by increasing employer investments in employee retention, productivity, and cost management. Expanding hybrid work models have also accelerated the demand for virtual mental health solutions and stress management services. Key players like ComPsych, Virgin Pulse, and Limeade are continuously innovating to meet evolving corporate wellness needs across industries.

Canada Corporate Wellness Market Insight

Canada is witnessing steady growth in corporate wellness adoption, supported by rising employee demand for work-life balance and psychological safety. Government-backed mental health campaigns and partnerships with health-tech startups are creating a favorable environment for wellness service providers. Canadian organizations are increasingly embracing holistic wellness frameworks that combine digital coaching, virtual fitness, and financial wellness programs, particularly in the post-pandemic recovery phase.

Northern & Western Europe Corporate Wellness Market Insight

Northern & Western Europe is a progressive hub for corporate wellness, propelled by a strong regulatory framework supporting employee well-being and mental health. Countries such as the UK, Germany, and the Netherlands are leading with employer-funded wellness initiatives, driven by ESG commitments and rising awareness of burnout. Tech-enabled wellness platforms, flexible working policies, and personalized mental health solutions are gaining rapid traction, especially in knowledge-intensive sectors.

Central Europe (CE) Corporate Wellness Market Insight

Central Europe is experiencing growing momentum in the corporate wellness space, fueled by increasing employer focus on health-driven productivity and talent retention. Countries like Poland, Czech Republic, and Hungary are adopting integrated wellness programs that align with local health policies and workforce needs. Demand is rising for on-site health screenings, mental resilience training, and financial wellness support, especially among manufacturing and service-oriented industries undergoing digital transformation.

Corporate Wellness Market Share

The corporate wellness is primarily led by well-established companies, including:

- Unmind Ltd (U.K.)

- Headspace Inc. (U.S.)

- Spring Care, Inc. (U.S.)

- HeiaHeia (Finland)

- Bluecrest Health (U.K.)

- Grokker, Inc (U.S.)

- Healthscreen UK (U.K.)

- Work Unlocked (Germany)

- Sumondo (Denmark)

- Echelon Health (U.K.)

- Lyra Health, Inc (U.S.)

- Mindgram (Poland)

- BigHealth (U.K.)

- Modern Life, Inc (U.S.)

- Carebook Technologies (Canada)

- TELUS Health (Canada)

- Thrive Global (U.S.)

- TALKSPACE, INC. (U.S.)

- MantraCare (India)

- Wellhub (Brazil)

- FITCOMPANY GmbH (Germany)

- Meditopia for Work (Germany)

- One on One (Brazil)

- BetterUp (U.S.)

- MeQuilibrium (U.S.)

- Keeper Security, Inc. (U.S.)

- Calm Health (U.S.)

- Wellable (U.S.)

Latest Developments in Corporate Wellness Market

- In March 2025, Unmind Ltd launched “Nova,” an AI-powered digital coach offering on-demand emotional support across 40+ languages. Integrated into its wellbeing platform, Nova is designed to deliver proactive mental health guidance and resilience training for global hybrid teams

- In May 2025, Headspace Inc. introduced “Ebb,” a conversational AI companion that supports stress reduction and emotional regulation. Simultaneously, the company expanded its U.S. operations by launching insurance-covered therapy services, increasing access to care for over 90 million individuals

- In March 2025, Wellhub (formerly Gympass) partnered with Headspace to launch 1:1 mental health coaching across its wellbeing platform. The collaboration contributed to a 48% year-on-year increase in mental health engagement, especially among remote employees in the U.S. and Canada

- In April 2025, Lyra Health also unveiled Lyra Empower, an AI-enhanced platform offering real-time analytics on mental health engagement, ROI tracking, and personalized interventions for benefit managers. It integrates connection, engagement, and care modules for comprehensive workforce support

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET INDUSTRY COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 WORKPLACE WELLNESS METRICS

4.2 INDUSTRY-SPECIFIC BURNOUT RATES

4.3 YEAR-OVER-YEAR TRENDS

4.4 REMOTE WORK TRANSITION

4.5 CAUSES AND TRIGGERS

4.6 COST IMPACT ANALYSIS

4.6.1 BURNOUT-RELATED COSTS BY INDUSTRY

4.6.2 EMPLOYEE TURNOVER COST

4.6.3 PRESENTEEISM AND ABSENTEEISM METRICS

4.6.4 STRESS & ANXIETY HEALTHCARE COSTS

4.6.5 PRODUCTIVITY AND REVENUE IMPACT

4.7 OPPORTUNITY MAPPING BY REGION & SECTOR

4.8 STRATEGIC ENTRY RECOMMENDATIONS FOR ZEN2FIT

4.8.1 PLATFORM AS A MODULAR ECOSYSTEM

4.8.2 SEAMLESS HR/PAYROLL TECH INTEGRATION

4.8.3 OUTCOME-BASED VALUE PROPOSITION

4.8.4 INCLUSIVE AND MULTILINGUAL DESIGN

4.8.5 AFFORDABLE SME-FOCUSED PRICING MODEL

4.9 LOCALIZATION & CUSTOMIZATION OPPORTUNITIES

4.1 OPPORTUNITY MAPPING BY REGION & SECTOR

4.10.1 CENTRAL EUROPE (CE)

4.10.2 SOUTHEASTERN EUROPE (SEE)

4.10.3 NORTHERN & WESTERN EUROPE

4.10.4 NORTH AMERICA (U.S. & CANADA)

4.11 LOCALIZATION & CUSTOMIZATION OPPORTUNITIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING COGNITIVE LOAD AND MENTAL HEALTH CONCERNS IN HIGH-PRESSURE ENVIRONMENTS

5.1.2 RISING ADOPTION OF REMOTE AND HYBRID WORK MODELS

5.1.3 RISING DEMAND FOR RESILIENT HUMAN CAPITAL IN HIGH-RISK ENVIRONMENTS

5.1.4 CROSS-SECTOR MOMENTUM ACCELERATES HUMAN-CENTRIC DIGITAL TRANSFORMATION AND WORKPLACE WELLNESS INITIATIVES

5.2 RESTRAINTS

5.2.1 DATA PRIVACY AND CULTURAL RESISTANCE TO MONITORING

5.2.2 LACK OF UNIFIED STANDARDS AND ROI METRICS

5.3 OPPORTUNITIES

5.3.1 INTEGRATION WITH HEALTH INSURANCE AND BENEFIT PLANS

5.3.2 INTEGRATING FINANCIAL, SOCIAL, AND NUTRITIONAL COMPONENTS INTO WELLNESS PROGRAMS

5.3.3 WORKFORCE GLOBALIZATION CREATING DEMAND FOR CULTURALLY CUSTOMIZED WELLNESS SOLUTIONS

5.4 CHALLENGES

5.4.1 INCONSISTENT GOVERNMENT POLICIES AND LACK OF STANDARDIZED INSTITUTIONAL SUPPORT FOR CORPORATE WELLNESS INITIATIVES

5.4.2 GROWING DATA PRIVACY AND CYBERSECURITY RISKS IN CORPORATE WELLNESS TECHNOLOGY AND PLATFORMS

6 NORTH AMERICA AND EUROPE CORPORATE WELLNESS MARKET, BY SERVICES

6.1 OVERVIEW

6.2 FITNESS & PHYSICAL WELLNESS PROGRAMS

6.3 MENTAL HEALTH & STRESS MANAGEMENT

6.4 EMPLOYEE ASSISTANCE PROGRAMS (EAPS)

6.5 HEALTH RISK ASSESSMENT & SCREENING

6.6 DIGITAL WELLNESS PLATFORMS & MOBILE APPS

6.7 NUTRITION & WEIGHT MANAGEMENT

6.8 PREVENTIVE & PRIMARY HEALTHCARE SERVICES

6.9 SMOKING & SUBSTANCE ABUSE PROGRAMS

6.1 FINANCIAL WELLNESS SERVICES

6.11 OTHERS

7 NORTH AMERICA AND EUROPE CORPORATE WELLNESS MARKET, BY INDUSTRY

7.1 OVERVIEW

7.2 INFORMATION TECHNOLOGY (IT) & SAAS

7.3 FINANCIAL SERVICES

7.4 PHARMACEUTICALS & LIFE SCIENCES

7.5 TELECOM

7.6 AUTOMOTIVE

7.7 CONSTRUCTION

7.8 LOGISTICS & TRANSPORTATION

7.9 TOURISM & HOSPITALITY

7.1 EDUCATION

7.11 ENERGY & UTILITIES

7.12 STARTUPS & SCALEUPS

7.13 MEDIA & ENTERTAINMENT

7.14 MARITIME & OFFSHORE

8 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET, BY REGION

8.1 NORTH AMERICA

8.1.1 U.S.

8.1.2 CANADA

8.2 EUROPE

8.2.1 NORTHERN & WESTERN

8.2.2 CENTRAL EUROPE (CE)

8.2.3 SOUTHEASTERN EUROPE (SEE)

8.2.4 UNITED KINGDOM

8.2.5 FRANCE

8.2.6 NETHERLANDS

8.2.7 SWEDEN

8.2.8 IRELAND

8.2.9 NORWAY

8.2.10 DENMARK

8.2.11 BELGIUM

8.2.12 FINLAND

8.2.13 LUXEMBOURG

8.2.14 ICELAND

8.2.15 OTHER NORTHERN & WESTERN EUROPE

8.2.16 GERMANY

8.2.17 ITALY

8.2.18 SWITZERLAND

8.2.19 AUSTRIA

8.2.20 POLAND

8.2.21 CZECH REPUBLIC

8.2.22 HUNGARY

8.2.23 SLOVAKIA

8.2.24 SLOVENIA

8.2.25 TURKEY

8.2.26 GREECE

8.2.27 ROMANIA

8.2.28 BULGARIA

8.2.29 SERBIA

8.2.30 CROATIA

8.2.31 NORTH MACEDONIA

8.2.32 BOSNIA & HERZEGOVINA

8.2.33 ALBANIA

8.2.34 MONTENEGRO

8.2.35 KOSOVO

9 CORPORATE WELLNESS MARKET

9.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

9.2 COMPANY SHARE ANALYSIS: EUROPE

10 COMPANY PROFILES

10.1 TELUS

10.1.1 COMPANY SNAPSHOT

10.1.2 SERVICE PORTFOLIO

10.1.3 RECENT DEVELOPMENTS/NEWS

10.1.4 SWOT ANALYSIS

10.2 WELLABLE, LLC

10.2.1 COMPANY SNAPSHOT

10.2.2 SERVICE PORTFOLIO

10.2.3 RECENT DEVELOPMENTS

10.2.4 SWOT ANALYSIS

10.3 GYMPASS US, LLC (WELLHUB), LLC

10.3.1 COMPANY SNAPSHOT

10.3.2 SERVICE PORTFOLIO

10.3.3 RECENT DEVELOPMENTS

10.3.4 SWOT

10.4 LYRA HEALTH, INC.

10.4.1 COMPANY SNAPSHOT

10.4.2 SERVICE PORTFOLIO

10.4.3 RECENT DEVELOPMENTS/NEWS

10.4.4 SWOT

10.5 HEADSPACE INC.

10.5.1 COMPANY SNAPSHOT

10.5.2 SERVICE PORTFOLIO

10.5.3 RECENT DEVELOPMENTS/NEWS

10.5.4 SWOT ANALYSIS

10.6 BETTERUP

10.6.1 COMPANY SNAPSHOT

10.6.2 SERVICE PORTFOLIO

10.6.3 RECENT DEVELOPMENTS/NEWS

10.6.4 SWOT ANALYSIS

10.7 BIGHEALTH

10.7.1 COMPANY SNAPSHOT

10.7.2 SERVICE PORTFOLIO

10.7.3 RECENT DEVELOPMENTS/NEWS

10.7.4 SWOT

10.8 BLUECREST HEALTH

10.8.1 COMPANY SNAPSHOT

10.8.2 SERVICE PORTFOLIO

10.8.3 RECENT DEVELOPMENTS/NEWS

10.8.4 SWOT ANALYSIS

10.9 CALM HEALTH, INC

10.9.1 COMPANY SNAPSHOT

10.9.2 SERVICE PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.9.4 SWOT ANALYSIS

10.1 CAREBOOK TECHNOLOGIES, INC.

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 SERVICE PORTFOLIO

10.10.4 RECENT DEVELOPMENTS/NEWS

10.10.5 SWOT ANALYSIS

10.11 ECHELON HEALTH

10.11.1 COMPANY SNAPSHOT

10.11.2 SERVICE PORTFOLIO

10.11.3 RECENT DEVELOPMENTS/NEWS

10.11.4 SWOT

10.12 FITCOMPANY

10.12.1 COMPANY SNAPSHOT

10.12.2 SERVICE PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.12.4 SWOT ANALYSIS

10.13 GROKKER, INC.

10.13.1 COMPANY SNAPSHOT

10.13.2 SERVICE PORTFOLIO

10.13.3 RECENT DEVELOPMENTS/NEWS

10.13.4 SWOT ANALYSIS

10.14 HEALTHSCREEN UK

10.14.1 COMPANY SNAPSHOT

10.14.2 SERVICE PORTFOLIO

10.14.3 RECENT DEVELOPMENTS/NEWS

10.14.4 SWOT ANALYSIS

10.15 HEIAHEIA

10.15.1 COMPANY SNAPSHOT

10.15.2 SERVICE PORTFOLIO

10.15.3 RECENT DEVELOPMENTS/NEWS

10.15.4 SWOT ANALYSIS

10.16 MEDIKEEPER

10.16.1 COMPANY SNAPSHOT

10.16.2 SERVICE PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.16.4 SWOT ANALYSIS

10.17 MANTRACARE INTERNATIONAL, LLC

10.17.1 COMPANY SNAPSHOT

10.17.2 SERVICE PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.17.4 SWOT ANALYSIS

10.18 MEDITOPIA

10.18.1 COMPANY SNAPSHOT

10.18.2 SERVICE PORTFOLIO

10.18.3 RECENT DEVELOPMENTS/NEWS

10.18.4 SWOT ANALYSIS

10.19 MINDGRAM

10.19.1 COMPANY SNAPSHOT

10.19.2 SERVICE PORTFOLIO

10.19.3 RECENT DEVELOPMENTS/NEWS

10.19.4 SWOT ANALYSIS

10.2 MODERN LIFE, INC

10.20.1 COMPANY SNAPSHOT

10.20.2 SERVICE PORTFOLIO

10.20.3 RECENT DEVELOPMENTS/NEWS

10.20.4 SWOT

10.21 NEW LIFE SOLUTION, INC.

10.21.1 COMPANY SNAPSHOT

10.21.2 SERVICE PORTFOLIO

10.21.3 RECENT DEVELOPMENTS

10.21.4 SWOT ANALYSIS

10.22 ONE ON ONE S.R.L.

10.22.1 COMPANY SNAPSHOT

10.22.2 SERVICE PORTFOLIO

10.22.3 RECENT DEVELOPMENTS

10.22.4 SWOT ANALYSIS

10.23 SPRING CARE, INC.

10.23.1 COMPANY SNAPSHOT

10.23.2 SERVICE PORTFOLIO

10.23.3 RECENT DEVELOPMENTS/NEWS

10.23.4 SWOT ANALYSIS

10.24 SUMONDO

10.24.1 COMPANY SNAPSHOT

10.24.2 SERVICE PORTFOLIO

10.24.3 RECENT DEVELOPMENTS/NEWS

10.24.4 SWOT

10.25 TALKSPACE, INC.

10.25.1 COMPANY SNAPSHOT

10.25.2 REVENUE ANALYSIS

10.25.3 SERVICE PORTFOLIO

10.25.4 RECENT DEVELOPMENTS/NEWS

10.25.5 SWOT ANALYSIS

10.26 THRIVE GLOBAL

10.26.1 COMPANY SNAPSHOT

10.26.2 SERVICE PORTFOLIO

10.26.3 RECENT DEVELOPMENTS/NEWS

10.26.4 SWOT ANALYSIS

10.27 UNMIND LTD

10.27.1 COMPANY SNAPSHOT

10.27.2 SERVICE PORTFOLIO

10.27.3 RECENT DEVELOPMENTS/NEWS

10.27.4 SWOT ANALYSIS

10.28 WORK UNLOCKED

10.28.1 COMPANY SNAPSHOT

10.28.2 SERVICE PORTFOLIO

10.28.3 RECENT DEVELOPMENTS/NEWS

10.28.4 SWOT

11 QUESTIONNAIRE

12 RELATED REPORTS

List of Table

TABLE 1 REGION-WISE BURNOUT RATES

TABLE 2 BURNOUT GROWTH RATES BY YEAR (2019–2024)

TABLE 3 SECTORAL BURNOUT COMPARISON (EUROPE, 2019–2024)

TABLE 4 REGIONAL BURNOUT PATTERNS IN EUROPE (2024)

TABLE 5 COVID-19 & HYBRID WORK MODEL IMPACT

TABLE 6 VISUAL SUMMARY: BURNOUT PROGRESSION BY SECTOR (2019–2024)

TABLE 7 WORKPLACE MENTAL HEALTH SURVEY FINDINGS

TABLE 8 INDUSTRY WISE ANNUAL LOSSES

TABLE 9 TURNOVER METRICS BY INDUSTRY & REGION

TABLE 10 PRESENTEEISM & ABSENTEEISM METRICS (PER EMPLOYEE IMPACT)

TABLE 11 REGIONAL ANNUAL PER CAPITA STRESS-LINKED HEALTHCARE EXPENDITURE

TABLE 12 ANNUAL PER CAPITA STRESS-LINKED HEALTHCARE EXPENDITURE

TABLE 13 INDUSTRY IMPACT ASSESSMENT: COMPARATIVE USE CASES

TABLE 14 NORTH AMERICA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA CORPORATE WELLNESS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 21 CANADA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 22 CANADA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE CORPORATE WELLNESS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTHERN & WESTERN EUROPE CORPORATE WELLNESS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 25 CENTRAL EUROPE CORPORATE WELLNESS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 26 SOUTHEASTERN EUROPE (SEE) CORPORATE WELLNESS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 27 NORTHERN & WESTERN EUROPE CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 28 NORTHERN & WESTERN EUROPE CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 29 CENTRAL EUROPE (CE) CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 30 CENTRAL EUROPE (CE) CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 31 SOUTHEASTERN EUROPE (SEE) CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 32 SOUTHEASTERN EUROPE (SEE) CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 33 UNITED KINGDOM CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 34 UNITED KINGDOM CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 35 FRANCE CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 36 FRANCE CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 37 NETHERLANDS CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 38 NETHERLANDS CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 39 SWEDEN CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 40 SWEDEN CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 41 IRELAND CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 42 IRELAND CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 43 NORWAY CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 44 NORWAY CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 45 DENMARK CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 46 DENMARK CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 47 BELGIUM CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 48 BELGIUM CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 49 FINLAND CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 50 FINLAND CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 51 LUXEMBOURG CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 52 LUXEMBOURG CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 53 ICELAND CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 54 ICELAND CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 55 OTHER NORTHERN & WESTERN EUROPE NATIONS CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 56 OTHER NORTHERN & WESTERN EUROPE NATIONS CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 57 GERMANY CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 58 GERMANY CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 59 ITALY CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 60 ITALY CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 61 SWITZERLAND CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 62 SWITZERLAND CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 63 AUSTRIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 64 AUSTRIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 65 POLAND CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 66 POLAND CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 67 CZECH REPUBLIC CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 68 CZECH REPUBLIC CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 69 HUNGARY CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 70 HUNGARY CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 71 SLOVAKIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 72 SLOVAKIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 73 SLOVENIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 74 SLOVENIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 75 TURKEY CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 76 TURKEY CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 77 GREECE CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 78 GREECE CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 79 ROMANIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 80 ROMANIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 81 BULGARIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 82 BULGARIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 83 SERBIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 84 SERBIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 85 CROATIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 86 CROATIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH MACEDONIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH MACEDONIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 89 BOSNIA & HERZEGOVINA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 90 BOSNIA & HERZEGOVINA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 91 ALBANIA CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 92 ALBANIA CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 93 MONTENEGRO CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 94 MONTENEGRO CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 95 KOSOVO CORPORATE WELLNESS MARKET, BY SERVICES, 2018-2032 (USD THOUSAND)

TABLE 96 KOSOVO CORPORATE WELLNESS MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET

FIGURE 2 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CORPORATE WELLNESS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CORPORATE WELLNESS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 6 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA CORPORATE WELLNESS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE CORPORATE WELLNESS MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA CORPORATE WELLNESS MARKET: MARKET INDUSTRY COVERAGE GRID

FIGURE 12 EUROPE CORPORATE WELLNESS MARKET: MARKET INDUSTRY COVERAGE GRID

FIGURE 13 NORTH AMERICA CORPORATE WELLNESS MARKET TIME LINE CURVE

FIGURE 14 EUROPE CORPORATE WELLNESS MARKET TIME LINE CURVE

FIGURE 15 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET: VENDOR SHARE ANALYSIS

FIGURE 16 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET: SEGMENTATION

FIGURE 17 NORTH AMERICA CORPORATE WELLNESS MARKET EXECUTIVE SUMMARY

FIGURE 18 EUROPE CORPORATE WELLNESS MARKET EXECUTIVE SUMMARY

FIGURE 19 TEN SEGMENTS COMPRISE THE NORTH AMERICA CORPORATE WELLNESS MARKET, BY SERVICES (2024)

FIGURE 20 TEN SEGMENTS COMPRISE THE EUROPE CORPORATE WELLNESS MARKET, BY SERVICES (2024)

FIGURE 21 NORTH AMERICA & EUROPE CORPORATE WELLNESS MARKET STRATEGIC DEVELOPMENT

FIGURE 22 GROWING COGNITIVE LOAD AND MENTAL HEALTH CONCERNS IN HIGH-PRESSURE ENVIRONMENTS IS EXPECTED TO DRIVE THE NORTH AMERICA CORPORATE WELLNESS MARKET IN THE FORECAST PERIOD

FIGURE 23 RISING ADOPTION OF REMOTE AND HYBRID WORK MODELS IS EXPECTED TO DRIVE THE EUROPE CORPORATE WELLNESS MARKET IN THE FORECAST PERIOD

FIGURE 24 FITNESS & PHYSICAL WELLNESS PROGRAMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CORPORATE WELLNESS MARKET IN 2025 AND 2032

FIGURE 25 FITNESS & PHYSICAL WELLNESS PROGRAMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CORPORATE WELLNESS MARKET IN 2025 AND 2032

FIGURE 26 U.S. BREAKDOWN OF ANNUAL BURNOUT COSTS

FIGURE 27 U.S. PER-EMPLOYEE BURNOUT COST BY ROLE

FIGURE 28 REVENUE IMPACT DUE TO BURNOUT BY SECTOR

FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA AND EUROPE CORPORATE WELLNESS MARKET

FIGURE 30 NORTH AMERICA CORPORATE WELLNESS MARKET: BY SERVICES, 2024

FIGURE 31 EUROPE CORPORATE WELLNESS MARKET: BY SERVICES, 2024

FIGURE 32 NORTH AMERICA CORPORATE WELLNESS MARKET: BY INDUSTRY, 2024

FIGURE 33 EUROPE CORPORATE WELLNESS MARKET: BY INDUSTRY, 2024

FIGURE 34 NORTH AMERICA CORPORATE WELLNESS MARKET: SNAPSHOT (2024)

FIGURE 35 EUROPE CORPORATE WELLNESS MARKET: SNAPSHOT (2024)

FIGURE 36 NORTH AMERICA CORPORATE WELLNESS MARKET: COMPANY SHARE 2024 (%)

FIGURE 37 EUROPE CORPORATE WELLNESS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.