North America Animal Nutrition Market

Market Size in USD Billion

CAGR :

%

USD

5.31 Billion

USD

8.21 Billion

2024

2032

USD

5.31 Billion

USD

8.21 Billion

2024

2032

| 2025 –2032 | |

| USD 5.31 Billion | |

| USD 8.21 Billion | |

|

|

|

|

Animal Nutrition Market Size

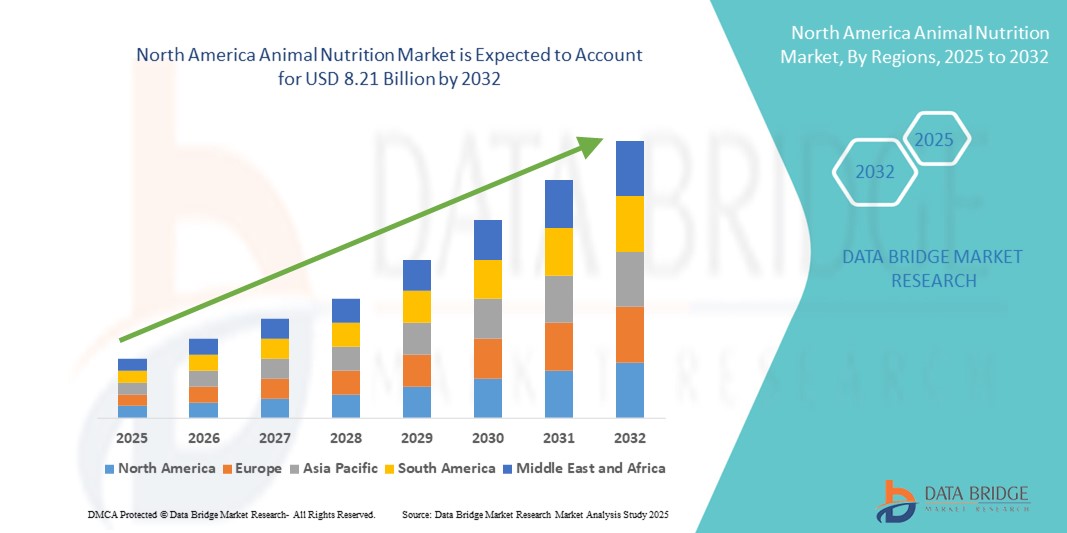

- The North America animal nutrition market size was valued at USD 5.31 billion in 2024 and is expected to reach USD 8.21 billion by 2032, at a CAGR of 5.6% during the forecast period

- The market growth is largely fueled by the increasing demand for high-quality animal protein and the resulting need for efficient livestock production supported by optimized nutritional inputs

- Furthermore, the rising focus on animal health, feed efficiency, and disease prevention is driving the adoption of fortified feed additives, enzymes, and tailored nutrient blends. These converging factors are accelerating the shift toward precision and functional nutrition, thereby significantly boosting the industry's growth

Animal Nutrition Market Analysis

- Animal nutrition involves the provision of balanced dietary formulations to livestock and companion animals to promote growth, reproduction, and health. It includes a wide range of ingredients such as amino acids, enzymes, minerals, vitamins, fatty acids, and medicated feed additives designed to meet species-specific nutritional requirements

- The increasing adoption of advanced feed solutions is driven by growing awareness of animal welfare, regulatory restrictions on antibiotic use, and the need to enhance productivity in a cost-effective and sustainable manner across poultry, swine, cattle, aquaculture, and pet food sectors

- U.S. dominated the animal nutrition market in 2024, due to a robust livestock industry, advanced feed production technologies, and high demand for quality animal-derived products such as meat, milk, and eggs

- Canada is expected to be the fastest growing region in the animal nutrition market during the forecast period due to strong federal support for sustainable animal agriculture and increasing adoption of precision feeding strategies

- Poultry feed segment dominated the market with a market share of 34.9% in 2024, due to the rapid expansion of the global poultry industry and the increasing consumption of poultry meat and eggs. Demand for balanced and cost-effective poultry nutrition solutions continues to rise, especially in Asia-Pacific and Latin America, where poultry is a key source of affordable protein

Report Scope and Animal Nutrition Market Segmentation

|

Attributes |

Animal Nutrition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Animal Nutrition Market Trends

“Precision Nutrition through AI and Data-Driven Feed Formulation”

- The North America animal nutrition market is seeing rapid adoption of precision nutrition, which harnesses artificial intelligence and advanced data analytics to tailor feed formulations for specific species, life stages, and production goals, supporting higher productivity and better animal health

- For instance, Cargill has deployed AI-powered platforms and digital solutions in collaboration with leading dairy and poultry producers, enabling real-time adjustments in feed composition using on-farm data to optimize animal growth, health, and product quality

- Integration of sensor technology and internet-of-things devices within livestock operations allows producers to monitor feed intake, environmental conditions, and animal health, supporting data-driven nutrition strategies with measurable outcomes

- Research advancements are leading to more targeted nutritional additives, such as enzymes and probiotics, that enhance feed efficiency, reduce environmental emissions, and promote animal welfare by addressing specific digestive and health needs

- Demand for sustainable nutrition is increasing, with feed formulators using life cycle assessments and ingredient traceability tools to reduce the environmental footprint of animal feed and align with stricter North American regulations

- Collaborative initiatives between feed manufacturers and biotechnology firms are resulting in innovative products—such as tailored amino acid blends and functional additives—moving precision animal nutrition from concept toward everyday practice across major livestock segments

Animal Nutrition Market Dynamics

Driver

“Rising Consumer Awareness About Food Safety”

- Heightened consumer concern about foodborne illnesses and contaminants in meat, dairy, and eggs is driving producers to invest in nutritionally balanced, traceable feed and higher safety standards throughout the animal nutrition supply chain

- For instance, Land O’Lakes Purina Animal Nutrition has adopted transparency and rigorous ingredient sourcing to provide verifiable assurance to customers and retailers, capitalizing on the growing market for certified and responsible food products

- Regulatory authorities in North America—especially the FDA and CFIA—are increasing scrutiny of feed ingredients, manufacturing, and labeling, pushing feed manufacturers toward stringent compliance with safety and quality requirements

- Retailers and food brands are collaborating with animal nutrition companies to ensure the use of supplements that improve animal health and subsequently reduce antibiotic usage, aligning with consumer demand for “clean label” and residue-free food products

- The rise of “farm to fork” traceability initiatives is fostering investments in digital documentation and blockchain technologies, assuring end consumers about the integrity and safety of animal-derived foods

Restraint/Challenge

“Volatility of Raw Material Prices”

- The animal nutrition sector faces persistent volatility in key raw material prices—such as corn, soybean meal, and minerals—which significantly impacts production costs and complicates budgeting for feed manufacturers

- For instance, Archer Daniels Midland (ADM) has reported operational pressures in its North American feed business during 2022–2025 as extreme weather, supply chain disruptions, and geopolitical conflicts such as the war in Ukraine led to surging grain prices and periods of ingredient shortages

- Sudden increases in feed input costs squeeze producer margins for poultry, cattle, and swine sectors, often resulting in higher consumer prices for meat, dairy, and eggs, and challenging the competitiveness of regional producers

- Fluctuations in material prices are further complicated by regulatory predicaments, trade policy shifts, and logistics bottlenecks, making long-term contracts and innovation planning more difficult for feed companies

- The ongoing push for sustainable and non-GMO ingredients adds layers of complexity and cost variation, requiring flexible procurement strategies and ongoing innovation to maintain profitable and resilient animal nutrition operations

Animal Nutrition Market Scope

The market is segmented on the basis of type, feed type, and end users.

- By Type

On the basis of type, the animal nutrition market is segmented into Amino Acids, Enzymes, Carotenoids, Fiber, Antioxidants, Eubiotics, Lipids, Fatty Acids, Medicated Feed Additives, Minerals, Vitamins, and Others. The Amino Acids segment dominated the animal nutrition market with the largest market revenue share of 27.4% in 2024, owing to their critical role in promoting growth performance, feed efficiency, and protein synthesis in livestock and poultry. Essential amino acids such as lysine, methionine, and threonine are increasingly used in compound feeds to optimize animal productivity and reduce nitrogen excretion, aligning with sustainability goals.

The Enzymes segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for enhanced nutrient digestibility, improved gut health, and cost-effective feed formulations. Enzymatic additives such as phytase, xylanase, and protease are gaining traction for their role in reducing anti-nutritional factors and improving feed conversion ratios.

- By Feed Type

On the basis of feed type, the market is segmented into Poultry Feed, Swine Feed, Ruminant Feed, Pet Food, and Others. The Poultry Feed segment held the largest market revenue share of 34.9% in 2024, fueled by the rapid expansion of the global poultry industry and the increasing consumption of poultry meat and eggs. Demand for balanced and cost-effective poultry nutrition solutions continues to rise, especially in Asia-Pacific and Latin America, where poultry is a key source of affordable protein.

The Pet Food segment is projected to witness the fastest growth rate over the forecast period, supported by rising pet ownership, humanization of pets, and the growing demand for nutritionally tailored pet food products. Functional ingredients such as omega-3s, probiotics, and joint support additives are driving innovation in the pet nutrition space.

- By End Users

On the basis of end users, the animal nutrition market is segmented into Feed Manufacturers, Veterinarians, Pet Food Manufacturers, Livestock Farmers, and Others. The Feed Manufacturers segment dominated the market with a market share in 2024, as they are the primary integrators of nutritional additives into commercial feed formulations. Their role in ensuring feed safety, cost optimization, and performance enhancement makes them key consumers of both macro- and micro-nutrients.

The Pet Food Manufacturers segment is expected to register the fastest CAGR from 2025 to 2032, driven by premiumization trends, innovation in functional pet nutrition, and the surge in demand for breed-specific and age-specific formulations across developed economies.

Animal Nutrition Market Regional Analysis

- U.S. dominated the animal nutrition market with the largest revenue share in 2024, driven by a robust livestock industry, advanced feed production technologies, and high demand for quality animal-derived products such as meat, milk, and eggs

- The country benefits from the presence of major feed manufacturers, established veterinary networks, and strong regulatory frameworks ensuring feed safety and nutritional efficacy. Continued innovation in feed formulations, including tailored micronutrient blends and functional additives, is further enhancing livestock productivity

- Growing consumer preference for sustainable and organic animal products, combined with supportive government policies and funding for research in animal health and nutrition, continues to strengthen market expansion across various livestock sectors

Canada Animal Nutrition Market Insight

Canada is projected to register the fastest CAGR in the North America animal nutrition market from 2025 to 2032, fueled by strong federal support for sustainable animal agriculture and increasing adoption of precision feeding strategies. The country’s dairy, poultry, and beef sectors are increasingly focusing on enhancing feed efficiency, animal health, and environmental sustainability through nutrient-dense and fortified feed formulations. Provinces such as Alberta and Ontario are at the forefront of innovation, supported by public-private research collaborations and funding under Canada’s Agricultural Policy Framework aimed at developing region-specific nutrition solutions and boosting domestic feed production capacity.

Mexico Animal Nutrition Market Insight

Mexico is expected to witness steady growth in the animal nutrition market between 2025 and 2032, supported by rising demand for meat and dairy products, urban expansion, and the growth of commercial poultry and pork production. The country is modernizing its feed manufacturing sector by incorporating high-performance additives, vitamins, and enzymes to improve animal productivity and health. Public initiatives focused on rural livestock development and food security, alongside growing partnerships with U.S. and European feed companies, are facilitating technology transfer, training, and access to quality feed products. These trends are steadily enhancing feed quality and supporting long-term growth in the Mexican animal nutrition market.

Animal Nutrition Market Share

The animal nutrition industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- DSM (Netherlands)

- Kemin Industries, Inc. (U.S.)

- Alltech (U.S.)

- Phibro Animal Health Corporation (U.S.)

- Mercer Milling Company, Inc. (U.S.)

- Rossari Biotech Limited (India)

- ADM (U.S.)

- Aries Agro Limited (India)

- Avitech Nutrition Pvt. Ltd. (India)

- Advanced Enzyme Technologies (India)

- Zoetis Services LLC (U.S.)

- Glanbia PLC (Ireland)

- DuPont (U.S.)

- Zinpro (U.S.)

- Novus International, Inc. (U.S.)

- NORVITE ANIMAL NUTRITION COMPANY LIMITED (U.K.)

- Biovet, S.A (Spain)

- Adisseo (China)

- Balchem Corp. (U.S.)

- Vetoquinol (France)

- EW Nutrition (Germany)

- BASF SE (Germany)

- Chr. Hansen A/S (Denmark)

- SIA Manufacturing Pvt Ltd (Latvia)

- Azelis Group (Belgium)

Latest Developments in North America Animal Nutrition Market

- In April 2023, BASF and Schothorst Feed Research (SFR) signed a deal granting SFR non-exclusive licensing rights to OpteinicsTM, BASF's digital sustainability tool for feed and animal protein. Integrating OpteinicsTM into its consultancy services, SFR aims to enhance its Advanced Feed Package, aiding producers in understanding and mitigating environmental impacts, thereby fostering sustainability in the animal nutrition market

- In March 2023, Evonik is expanding its annual production capacity of MetAMINO (DL-methionine) on Jurong Island, Singapore, by 40,000 metric tons. This investment, expected to reach fruition by the third quarter of 2024, aims to meet growing demand. Additionally, process improvements will yield MetAMINO with a 6% lower carbon footprint, enhancing its appeal in the animal nutrition market

- In March 2023, Trouw Nutrition launched MyFeedPrint, an online environmental footprint service for animal feed products. This innovative program fosters transparency by allowing stakeholders to measure the environmental impact of livestock feed. By promoting sustainability and offering consumers insight into feed sustainability, Trouw Nutrition strengthens its position in the evolving animal nutrition market

- In February 2023, Evonik introduced PhytriCare IM, a plant-based product aimed at promoting the health of dairy cows, sows, and laying hens. Formulated with plant extracts rich in flavonoids known for their anti-inflammatory properties, the product addresses animal wellness needs. Its availability across the EU expands options in the animal nutrition market

- In October 2021, BASF SE introduced trinamiX mobile Near Infrared (NIR) spectroscopy to the animal nutrition market. This innovation enables rapid on-site analysis of animal feed and ingredients, eliminating the need for laboratory testing. By offering convenience and efficiency, BASF attracts more customers and enhances value across the feed industry value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.