North America Anti Nuclear Antibody Test Market

Market Size in USD Billion

CAGR :

%

USD

1.63 Billion

USD

4.42 Billion

2025

2033

USD

1.63 Billion

USD

4.42 Billion

2025

2033

| 2026 –2033 | |

| USD 1.63 Billion | |

| USD 4.42 Billion | |

|

|

|

|

North America Anti-Nuclear Antibody Test Market Size

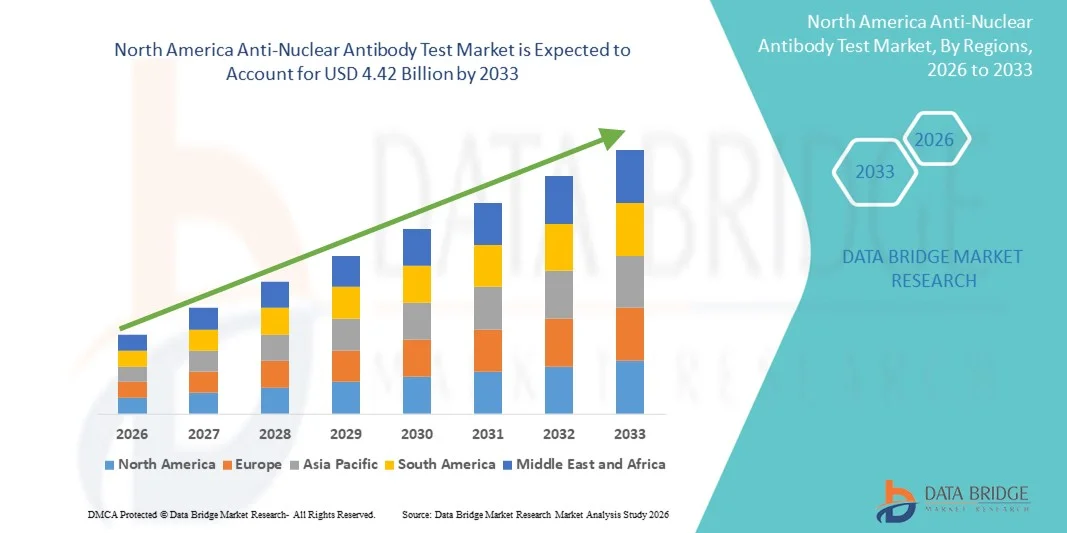

- The North America anti-nuclear antibody test market size was valued at USD 1.63 billion in 2025 and is expected to reach USD 4.42 billion by 2033, at a CAGR of 13.30% during the forecast period

- The market growth is largely fueled by the rising prevalence of autoimmune disorders, increasing awareness about early and accurate diagnosis, and continuous advancements in laboratory testing technologies, leading to greater adoption of Anti-Nuclear Antibody (ANA) tests across hospitals, diagnostic laboratories, and specialty clinics

- Furthermore, growing demand for cost-effective, reliable, and rapid diagnostic solutions for autoimmune diseases such as lupus, rheumatoid arthritis, and scleroderma is establishing the Anti-Nuclear Antibody test as a critical first-line screening tool in routine and specialized healthcare settings. These converging factors are accelerating the uptake of Anti-Nuclear Antibody Test solutions, thereby significantly boosting the industry’s growth

North America Anti-Nuclear Antibody Test Market Analysis

- Anti-Nuclear Antibody (ANA) tests, which are used to detect autoantibodies associated with autoimmune diseases, are becoming increasingly essential tools in modern diagnostics across both hospitals and specialized laboratories due to their critical role in the early identification and monitoring of systemic autoimmune disorders

- The escalating demand for ANA testing is primarily driven by the rising global prevalence of conditions such as systemic lupus erythematosus, rheumatoid arthritis, and scleroderma, along with increased awareness among healthcare professionals and patients about the importance of early and accurate autoimmune disease screening

- The U.S. dominated the anti-nuclear antibody test market with the largest revenue share of 34.6% in 2025, supported by advanced healthcare infrastructure, high diagnostic testing rates, strong reimbursement frameworks, and the presence of major diagnostic companies

- Canada is expected to be the fastest-growing country in the anti-nuclear antibody test market during the forecast period, recording a CAGR of 11.8%, driven by improving healthcare access, expansion of diagnostic laboratory networks, increasing awareness of autoimmune diseases, and rising government investments in healthcare infrastructure

- The Autoimmune Diseases segment accounted for the largest market revenue share of about 58.9% in 2025, driven by the increasing global prevalence of conditions such as systemic lupus erythematosus, rheumatoid arthritis, Sjögren’s syndrome, and scleroderma

Report Scope and Anti-Nuclear Antibody Test Market Segmentation

|

Attributes |

Anti-Nuclear Antibody Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Anti-Nuclear Antibody Test Market Trends

Rising Emphasis on Early Autoimmune Disease Detection and Advanced Diagnostic Adoption

- A significant and accelerating trend in the North America anti-nuclear antibody test market is the increasing emphasis on early detection of autoimmune and systemic inflammatory disorders such as systemic lupus erythematosus, rheumatoid arthritis, and scleroderma. This growing clinical focus is significantly enhancing the demand for reliable and high-precision ANA testing in diagnostic and research environments

- For instance, a growing number of hospitals and diagnostic laboratories across North America are incorporating advanced immunofluorescence and enzyme-linked immunosorbent assay (ELISA)–based ANA testing platforms to improve detection sensitivity and reduce diagnostic turnaround time. This widespread integration is strengthening the role of ANA tests in routine autoimmune disease screening and early diagnosis

- The adoption of improved laboratory automation and high-throughput testing systems is also enabling laboratories to manage higher testing volumes while maintaining consistent result accuracy. Some advanced platforms are now capable of detecting multiple autoantibody patterns simultaneously, providing more comprehensive insights into underlying autoimmune activity and supporting more targeted clinical decisions

- The growing collaboration between clinical laboratories, research institutes, and pharmaceutical companies is further promoting the development and adoption of advanced ANA testing kits. Through such collaborations, healthcare providers can enhance disease monitoring, analyze treatment response more effectively, and improve overall patient management in autoimmune disorders

- This shift towards more efficient, sensitive, and reliable autoimmune diagnostic tools is reshaping expectations for early disease detection and long-term disease management. Consequently, companies specializing in immunodiagnostics are increasingly developing enhanced ANA test kits designed to deliver consistent, reproducible, and clinically accurate results in both hospital and reference laboratory settings

- The demand for advanced ANA testing solutions continues to rise across hospitals, diagnostic centers, and specialty clinics, as healthcare systems prioritize accurate diagnosis, improved patient outcomes, and effective long-term management of autoimmune conditions

North America Anti-Nuclear Antibody Test Market Dynamics

Driver

Growing Prevalence of Autoimmune Diseases and Expanding Diagnostic Awareness

- The increasing prevalence of autoimmune diseases, combined with rising awareness regarding early diagnosis and disease management, is a major driver of the Anti-Nuclear Antibody Test market. More individuals are undergoing rheumatology evaluations, driving demand for ANA testing as a primary diagnostic tool

- For instance, in recent years, healthcare authorities and medical associations have emphasized the importance of early screening for autoimmune disorders, encouraging primary care physicians and specialists to include ANA testing in diagnostic protocols for patients presenting with unexplained chronic symptoms such as fatigue, joint pain, and inflammation. Such initiatives are expected to support steady market growth during the forecast period

- As patients become more conscious of chronic and long-term health conditions, there is a growing preference for comprehensive blood testing that can identify underlying immune system abnormalities. ANA tests offer a crucial first step in identifying autoimmune activity, making them an essential component of diagnostic pathways

- Furthermore, the expansion of specialized rheumatology clinics and diagnostic laboratories is improving access to ANA testing services. Increased investment in healthcare infrastructure and laboratory capabilities is enabling wider availability of these tests in both urban and semi-urban regions

- The rising use of ANA testing in clinical research, drug development, and autoimmune disease monitoring is also contributing to sustained market growth. Pharmaceutical companies increasingly rely on these tests during clinical trials to assess patient eligibility and treatment effectiveness in immune-related studies.

Restraint/Challenge

Concerns Regarding Test Interpretation and High Diagnostic Costs

- Concerns related to the interpretation of ANA test results pose a significant challenge to broader market adoption. As positive ANA results can sometimes appear in healthy individuals, misinterpretation may lead to unnecessary anxiety, misdiagnosis, or additional testing, creating hesitation among clinicians and patients regarding overreliance on this test alone

- For instance, variability in test outcomes based on laboratory techniques, reagent quality, and subjective interpretation in immunofluorescence testing has caused inconsistency in results in some cases. This variability can complicate clinical decision-making and reduce confidence in the sole use of ANA tests without supportive diagnostic evidence

- Addressing these challenges through standardized testing protocols, improved training for laboratory professionals, and enhanced assay accuracy is essential for strengthening trust among healthcare providers. In addition, the relatively high cost of advanced ANA testing methods, particularly for multiplex or automated systems, can limit accessibility for smaller clinics and cost-sensitive healthcare facilities, especially in developing regions. While basic testing options are available, more comprehensive and highly sensitive platforms often remain financially out of reach for many institutions

- Although technological advancements and competition among manufacturers are gradually reducing costs, budget limitations in public healthcare systems and reimbursement challenges can still restrict widespread use. Many healthcare providers must carefully balance affordability with diagnostic accuracy when choosing ANA testing solutions for routine use

- Overcoming these challenges through better standardization, cost-effective product development, increased clinician training, and improved healthcare funding will be essential for the sustained expansion of the Anti-Nuclear Antibody Test market globally

North America Anti-Nuclear Antibody Test Market Scope

The market is segmented on the basis of antibody type, product, technique, application, end user, and distribution channel.

- By Antibody Type

On the basis of antibody type, the Anti-Nuclear Antibody Test market is segmented into Extractable Nuclear Antigens (ENA), Anti-dsDNA & Histones, Anti-DFS70 Antibodies, Anti-PM-SCL, Anti-Centromere Antibodies, Anti-SP100, and Others. The Anti-dsDNA & Histones segment dominated the largest market revenue share of approximately 36.8% in 2025, driven by its critical role in diagnosing systemic autoimmune disorders such as systemic lupus erythematosus (SLE). These antibodies are widely utilized in hospital and diagnostic laboratory settings due to their high specificity and clinical significance. Increased physician awareness, high test accuracy, and routine inclusion in autoimmune panels have further supported the dominance of this segment. Growing global prevalence of lupus and rheumatoid arthritis is also contributing to higher adoption rates. In addition, improvements in assay sensitivity and standardization have increased confidence in results, encouraging broader clinical usage.

The Anti-ENA segment is anticipated to witness the fastest CAGR of around 10.7% from 2026 to 2033, owing to its expanding applications in detecting multiple connective tissue diseases such as Sjögren’s syndrome, scleroderma, and polymyositis. ENA panels allow early-stage detection and differentiation of complex autoimmune conditions, making them highly valuable in advanced diagnostics. Increasing adoption of multiplex platforms and the availability of comprehensive ENA test panels is driving growth. Furthermore, rising healthcare investments, expanding diagnostic infrastructure, and increased screening programs in developing economies are accelerating the demand. The integration of ENA tests with automated platforms is also improving efficiency, further contributing to its rapid growth trajectory.

- By Product

On the basis of product, the market is segmented into Instruments, Consumables & Reagents, and Services. The Consumables & Reagents segment held the largest revenue share of approximately 47.3% in 2025, as these products are required for every single test performed. The recurring requirement for reagents, buffers, antibodies, and assay kits makes this segment a consistent revenue generator for manufacturers. Increased test volumes, rising autoimmune disease prevalence, and expansion of laboratory networks have significantly boosted demand. In addition, continuous advancements in reagent formulations and kit reliability have strengthened their usage in routine diagnostics. The shift toward in-house testing by hospitals and labs further supports long-term growth in this segment.

The Services segment is projected to register the fastest CAGR of about 11.2% from 2026 to 2033, driven by the growing trend of outsourcing diagnostic testing to specialized laboratories. Limited in-house infrastructure in smaller hospitals and clinics is encouraging reliance on third-party service providers. Expansion of diagnostic service chains and investments in high-throughput laboratories are fueling rapid growth. Moreover, the rise of personalized medicine and increasing demand for advanced test interpretation services are playing a critical role. Digital integration and remote testing models are also enhancing the accessibility and expansion of this segment.

- By Technique

On the basis of technique, the market is segmented into ELISA, Indirect Immunofluorescence (IIF), Blotting Test, Antigen Microarray, Gel Based Techniques, Multiplex Assay, Flow Cytometry, Passive Haemagglutination (PHA), and Others. The Indirect Immunofluorescence (IIF) segment dominated the market with a revenue share of nearly 41.5% in 2025, as it remains the gold standard for ANA testing worldwide. IIF provides high sensitivity for detecting a wide range of autoantibodies and offers clear pattern visualization, which is crucial for diagnostic interpretation. Most clinical guidelines continue to recommend IIF as the primary screening method. Its widespread adoption in hospital laboratories and strong reimbursement support further reinforce its dominance.

The Multiplex Assay segment is expected to witness the fastest CAGR of approximately 12.4% from 2026 to 2033, due to its ability to detect multiple antibodies simultaneously. This technique significantly reduces turnaround time, improves workflow efficiency, and lowers overall testing costs. The increasing adoption of automated platforms and rising demand for high-throughput testing in large laboratories is accelerating its growth. Furthermore, technological advancements and integration with AI-based analysis tools are enhancing accuracy and boosting acceptance among clinicians.

- By Application

On the basis of application, the Anti-Nuclear Antibody Test market is segmented into Autoimmune Diseases and Infectious Diseases. The Autoimmune Diseases segment accounted for the largest market revenue share of about 58.9% in 2025, driven by the increasing global prevalence of conditions such as systemic lupus erythematosus, rheumatoid arthritis, Sjögren’s syndrome, and scleroderma. ANA testing plays a critical role in the diagnosis and clinical monitoring of these disorders, and is therefore routinely prescribed in hospitals and specialized clinics. Growing awareness among patients and physicians, improved access to early screening programs, and stronger emphasis on prompt disease identification are significantly boosting demand. Furthermore, continuous advancements in biomarker discovery and ongoing research in autoimmune pathologies have expanded the clinical value of ANA tests in disease progression tracking, treatment response evaluation, and long-term patient management.

The Infectious Diseases segment is projected to grow at the fastest CAGR of roughly 9.6% from 2026 to 2033, as emerging research continues to highlight the complex relationship between infections and immune system dysregulation. Greater focus on understanding immune responses, particularly following widespread viral outbreaks and post-infection complications, has broadened the clinical relevance of ANA testing. In addition, the integration of ANA tests into comprehensive immunological and diagnostic panels, along with increased global investment in infectious disease research and surveillance programs, is contributing to the rapid expansion of this segment.

- By End User

On the basis of end user, the market is segmented into Hospitals, Laboratories, Diagnostic Centers, Research Institutes, and Others. The Hospitals segment dominated the market with a share of approximately 39.4% in 2025, supported by high patient footfall and the availability of integrated diagnostic setups within hospital settings. ANA tests are commonly performed as part of routine clinical evaluations for autoimmune and chronic inflammatory conditions. The presence of skilled healthcare professionals, advanced laboratory capabilities, and multidisciplinary care environments ensures accurate testing and interpretation of results. In addition, continued government investments in healthcare infrastructure, hospital modernization, and the expansion of specialty departments are further reinforcing the leadership of this segment.

The Diagnostic Centers segment is expected to register the fastest CAGR of about 10.9% from 2026 to 2033, driven by the expanding demand for specialized, reliable, and cost-efficient diagnostic services. These centers focus on delivering faster turnaround times through the use of automated technologies and advanced testing platforms. Their growing presence in urban, semi-urban, and even underserved regions is significantly improving access to ANA testing. Moreover, strategic collaborations with hospitals, clinics, and research institutions are strengthening their market position and accelerating growth across this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender, Retail Sales, Third-Party Distributor, and Others. The Direct Tender segment held the largest market share of approximately 44.6% in 2025, driven by bulk procurement by government hospitals, public health organizations, and large healthcare groups. This channel ensures cost efficiency, long-term supply contracts, and consistent product availability. Manufacturers benefit from stable demand, while healthcare institutions gain better pricing and quality assurance. In addition, direct tenders reduce intermediary margins, helping institutions allocate resources more effectively. The increasing number of government-funded diagnostic programs and national disease screening initiatives is further strengthening the dominance of this segment.

The Third-Party Distributor segment is anticipated to grow at the fastest CAGR of around 11.5% from 2026 to 2033, as distributors continue to expand their regional reach and improve overall supply chain efficiency. Their well-established local networks enable faster product availability and improved service in rural and underdeveloped areas, which were previously underserved by direct manufacturers. Increasing reliance on distributors for inventory management, cold-chain maintenance, and last-mile delivery is significantly strengthening their role in the ANA test market. Moreover, third-party distributors often provide bundled solutions including technical support, training, and after-sales service, which enhances customer satisfaction and retention. The growing number of small and mid-sized diagnostic laboratories that lack direct procurement capabilities is also driving dependence on these distributors.

North America Anti-Nuclear Antibody Test Market Regional Analysis

- North America dominated the anti-nuclear antibody test market with the largest revenue share of 41.8% in 2025, supported by advanced healthcare infrastructure, a high volume of diagnostic testing, strong reimbursement frameworks, and the presence of major diagnostic companies

- The region benefits from widespread adoption of advanced ANA testing methods, including indirect immunofluorescence (IIF) and ELISA-based assays. Rising prevalence of autoimmune disorders such as lupus, rheumatoid arthritis, and Sjögren’s syndrome has further increased demand for routine and early-stage ANA screening

- The region’s leadership is also reinforced by high awareness levels among both physicians and patients, well-established laboratory networks, and continuous technological advancements in immunology testing. North America’s integrated hospital and diagnostic laboratory systems ensure rapid test access and accurate disease monitoring, making ANA testing a routine component of autoimmune disease management

U.S. Anti-Nuclear Antibody Test Market Insight

The U.S. anti-nuclear antibody test market captured the largest revenue share in 2025, driven by the growing burden of autoimmune diseases and the strong presence of advanced diagnostic facilities. The extensive use of immunofluorescence and ELISA technologies, combined with high healthcare expenditure and favorable reimbursement policies, continues to support widespread ANA test adoption. In addition, ongoing research into autoimmune biomarkers, increased focus on early diagnosis, and the expansion of personalized medicine approaches are contributing significantly to sustained market growth in the U.S.

Canada Anti-Nuclear Antibody Test Market Insight

Canada anti-nuclear antibody test market is expected to be the fastest-growing country in the Anti-Nuclear Antibody Test market during the forecast period, recording a CAGR of 11.8%. This growth is attributed to improving healthcare access, expansion of diagnostic laboratory infrastructure, rising awareness of autoimmune diseases, and increasing government investments in healthcare development. The country’s growing emphasis on early disease detection, along with expanding research activities and greater availability of advanced immunodiagnostic technologies, is accelerating the adoption of ANA testing across hospitals, diagnostic centers, and research institutions.

North America Anti-Nuclear Antibody Test Market Share

The Anti-Nuclear Antibody Test industry is primarily led by well-established companies, including:

• F. Hoffmann-La Roche Ltd. (Switzerland)

• Abbott (U.S.)

• Siemens Healthineers (Germany)

• Danaher Corporation (U.S.)

• bioMérieux SA (France)

• Thermo Fisher Scientific Inc. (U.S.)

• Becton, Dickinson and Company (U.S.)

• QuidelOrtho Corporation (U.S.)

• Werfen (Spain)

• EUROIMMUN AG (Germany)

• Bio-Rad Laboratories, Inc. (U.S.)

• Inova Diagnostics (U.S.)

• Trinity Biotech (Ireland)

• Genway Biotech, Inc. (U.S.)

• Arlington Scientific, Inc. (U.S.)

• Erba Diagnostics (Germany)

• Hycor Biomedical LLC (U.S.)

• Diagnostic Automation, Inc. (U.S.)

• Creative Diagnostics (U.S.)

• Snibe Diagnostic (China)

Latest Developments in North America Anti-Nuclear Antibody Test Market

- In March 2021, the global ANA test market saw increased adoption of automated ELISA and indirect immunofluorescence (IIF) platforms in hospitals and diagnostic laboratories, improving accuracy and reducing human error in autoimmune disease screening

- In July 2022, several leading diagnostic companies expanded production capacities for ANA test kits, driven by rising awareness of autoimmune diseases such as systemic lupus erythematosus, rheumatoid arthritis, and scleroderma, particularly in North America and Europe

- In April 2023, EUROIMMUN introduced enhanced ANA testing profiles, allowing laboratories to detect a broader spectrum of autoantibodies with greater precision, thereby supporting earlier diagnosis and improved patient management in autoimmune disorders

- In August 2024, Thermo Fisher Scientific launched upgraded automated ANA testing platforms, featuring improved sensitivity and streamlined laboratory workflows, enabling faster turnaround times for high-volume testing centers

- In January 2025, industry analysts reported a continued increase in ANA test adoption, driven by the growing prevalence of autoimmune diseases globally and the rising emphasis on early diagnosis and disease monitoring

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.