North America Antibody Drug Conjugates Market

Market Size in USD Billion

CAGR :

%

USD

4.81 Billion

USD

14.62 Billion

2024

2032

USD

4.81 Billion

USD

14.62 Billion

2024

2032

| 2025 –2032 | |

| USD 4.81 Billion | |

| USD 14.62 Billion | |

|

|

|

|

North America Antibody Drug Conjugates (ADC) Market Size

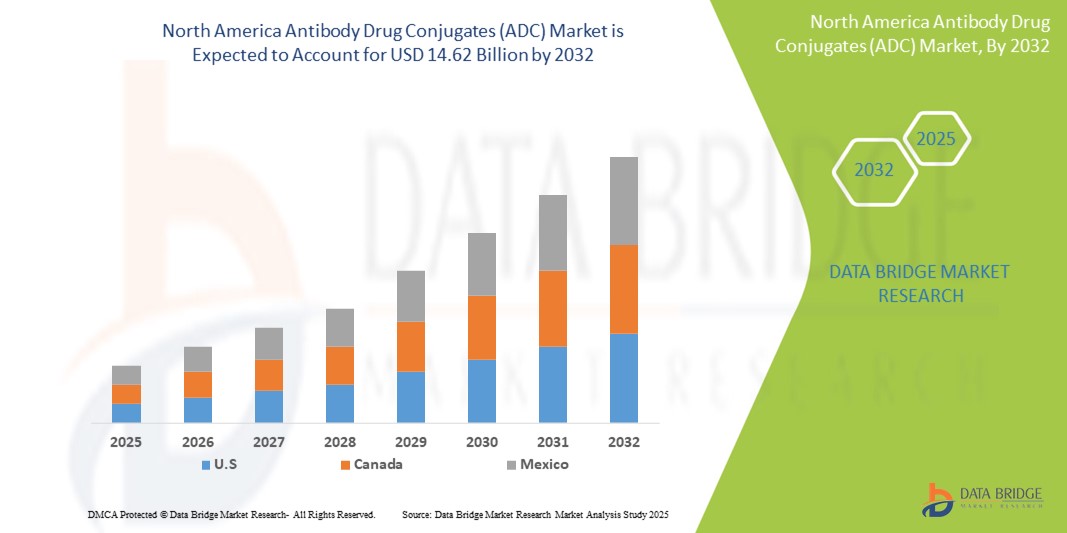

- The North America antibody drug conjugates (ADC) market size was valued at USD 4.81 billion in 2024 and is expected to reach USD 14.62 billion by 2032, at a CAGR of 14.90% during the forecast period

- The market growth is largely fueled by the rising prevalence of cancer and the increasing adoption of targeted therapies that offer enhanced efficacy with reduced toxicity, which is driving the shift toward precision oncology

- Furthermore, growing investments in R&D, robust clinical pipelines, and favorable regulatory initiatives are accelerating ADC development and commercialization. These converging factors are solidifying ADCs as a critical component of the region’s biopharmaceutical landscape, thereby significantly boosting the industry’s growth

North America Antibody Drug Conjugates (ADC) Market Analysis

- Antibody drug conjugates (ADCs), which combine the targeting capability of monoclonal antibodies with the cytotoxic potency of chemotherapeutic agents, are becoming essential in cancer therapy across North America—particularly in the United States, Canada, and Mexico—due to their precision, reduced side effects, and growing clinical success

- The rising demand for ADCs is primarily driven by increasing cancer incidence, heightened focus on personalized medicine, and expanded investments in oncology research and clinical development across the region

- U.S. dominated the North America antibody drug conjugates (ADC) market with the largest revenue share of 82.8% in 2024, supported by a highly advanced healthcare system, strong biopharmaceutical R&D investment, and a high concentration of major pharmaceutical companies actively developing and commercializing ADC therapies

- Canada is expected to witness fastest growth in North America antibody drug conjugates (ADC) market, supported by rising cancer awareness, enhanced healthcare access, and growing collaboration in cross-border clinical research

- The breast cancer segment dominated the antibody drug conjugates (ADC) market in North America with a market share of 40.2% in 2024, led by the clinical success of HER2-targeted ADCs and continued advancements in treatment for aggressive breast cancer subtypes such as triple-negative breast cancer

Report Scope and North America Antibody Drug Conjugates (ADC) Market Segmentation

|

Attributes |

North America Antibody Drug Conjugates (ADC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Antibody Drug Conjugates (ADC) Market Trends

“Advancement of Site-Specific Conjugation and Linker Technologies”

- A significant and accelerating trend in the North America ADC market is the continued evolution of site-specific conjugation methods and next-generation linker technologies, enabling enhanced therapeutic precision, improved safety profiles, and better efficacy across various cancer types

- For instance, Seagen Inc.’s proprietary linker-payload technologies have played a pivotal role in the clinical and commercial success of ADCs such as Adcetris, which targets CD30-positive lymphomas with improved stability and reduced off-target toxicity. Similarly, the HER2-targeting ADC Enhertu, developed by Daiichi Sankyo and AstraZeneca, incorporates a cleavable linker with a high drug-to-antibody ratio, contributing to its approval and growing adoption in HER2-low breast cancer treatment

- These advancements are enabling ADCs to address previously difficult-to-treat solid tumors, expanding their use beyond hematologic malignancies. In addition, integration with biomarker testing is allowing oncologists to better select patient populations, enhancing treatment outcomes

- U.S.-based companies are heavily investing in expanding ADC pipelines targeting a broader array of tumor antigens, with multiple ADCs progressing through late-stage clinical trials

- This trend toward highly specific, stable, and scalable ADC platforms is reshaping the oncology treatment paradigm across North America, with biopharmaceutical firms racing to develop novel ADC candidates with optimized efficacy and tolerability

North America Antibody Drug Conjugates (ADC) Market Dynamics

Driver

“Rising Cancer Prevalence and Strong Biopharmaceutical R&D Pipeline”

- The increasing prevalence of cancer across the United States, Canada, and Mexico, coupled with an aggressive focus on targeted therapies and biologics by pharmaceutical companies, is a major driver of the North America ADC market

- For instance, the American Cancer Society estimated over 1.9 million new cancer cases in the U.S. in 2024, leading to growing demand for more effective and personalized oncology treatments such as ADCs. Companies such as Pfizer, Gilead Sciences, and ImmunoGen are at the forefront of innovation, with multiple ADCs in clinical or commercial stages

- Strategic collaborations and high-value acquisitions are further fueling the market. Notably, Pfizer’s acquisition of Seagen in 2023 reinforced the importance of ADC technology in expanding oncology pipelines

- In addition, the supportive regulatory environment in the U.S., characterized by fast-track approvals and breakthrough designations by the FDA, is accelerating ADC development and commercialization

- With strong investment flows, active clinical research, and increasing awareness among oncologists and patients, ADCs are becoming integral to cancer care strategies across North America, driving sustained market momentum

Restraint/Challenge

“High Development Costs and Regulatory Complexity”

- The high cost of ADC development, driven by complex manufacturing processes and stringent regulatory requirements, presents a significant challenge to widespread market expansion in North America

- For instance, the production of ADCs involves intricate steps including antibody engineering, stable linker design, and precise drug conjugation, all of which require specialized infrastructure and quality control, leading to elevated production costs

- Regulatory bodies such as the U.S. FDA and Health Canada demand rigorous data for approval, particularly around pharmacokinetics, toxicity, and manufacturing consistency. This often results in extended development timelines and higher resource commitments for biopharma firms

- Smaller biotech companies may face hurdles in scaling up production or meeting regulatory expectations without major funding or partnerships. In Canada and Mexico, reimbursement constraints and pricing pressure from public healthcare systems can also limit ADC accessibility

- Overcoming these challenges through process optimization, early regulatory engagement, and innovative pricing and access models will be critical for driving broader adoption and long-term market growth across the North America region

North America Antibody Drug Conjugates (ADC) Market Scope

The market is segmented on the basis of product, antigen component, antibody component, linkers component, cytotoxic payloads, linker technology, conjugation technology, indication, end user, and distribution channel.

- By Product

On the basis of product, the North America antibody drug conjugates (ADC) market is segmented into Enhertu, Kadcyla, Trodelvy, Polivy, Adcetris, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak, and Others. The Enhertu segment dominated the market with the largest revenue share in 2024, driven by its strong clinical efficacy in HER2-low breast cancer and expanding approvals across various solid tumors. Its innovative linker-payload design and high drug-to-antibody ratio provide superior therapeutic outcomes, contributing to widespread adoption.

The Elahere segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by its recent approval for folate receptor alpha–positive ovarian cancer and growing clinical evidence supporting its efficacy. As more gynecologic oncologists adopt Elahere into treatment regimens, its share is expected to expand rapidly within targeted indications.

- By Antigen Component

On the basis of antigen component, the North America antibody drug conjugates (ADC) market is segmented into HER2 Receptor, Trop-2, CD79B, CD30, Nectin 4, CD22, CD19, CD33, Tissue Factors, and Others. The HER2 receptor segment held the largest market share in 2024 due to the high prevalence of HER2-positive and HER2-low breast cancer cases in the U.S. and Canada and the success of HER2-targeting ADCs such as Enhertu and Kadcyla.

The Trop-2 segment is expected to witness the fastest CAGR from 2025 to 2032, owing to increasing development of Trop-2-targeting ADCs such as Trodelvy, which have shown promising results in triple-negative breast and urothelial cancers.

- By Antibody Component

On the basis of antibody component, the North America antibody drug conjugates (ADC) market is segmented into First Generation ADCs, Second Generation ADCs, Third Generation ADCs, and Fourth Generation ADCs. The Third Generation ADCs segment dominated the market in 2024, supported by their improved stability, site-specific conjugation capabilities, and reduced systemic toxicity.

The Fourth Generation ADCs segment is projected to grow at the highest rate during the forecast period due to their innovative payload delivery systems and dual mechanism of action, expanding the treatment potential across multiple solid tumor indications.

- By Linkers Component

On the basis of linkers, the North America antibody drug conjugates (ADC) market is segmented into Cleavable Linkers and Non-Cleavable Linkers. The Cleavable Linkers segment held the largest market revenue share in 2024, driven by their ability to release cytotoxic drugs in targeted cells via enzymatic or pH-sensitive mechanisms, enhancing efficacy with minimal off-target effects.

The Non-Cleavable Linkers segment is anticipated to grow steadily during forecast period, preferred in hematologic cancers where controlled drug release and intracellular stability are vital.

- By Cytotoxic Payloads or Warheads Component

On the basis of cytotoxic payloads, the North America antibody drug conjugates (ADC) market is segmented into DNA Damaging Agents and Microtubule Disrupting Agents. The Microtubule Disrupting Agents segment dominated the market in 2024, led by their widespread use in approved ADCs such as Kadcyla and Adcetris that effectively target dividing tumor cells.

The DNA Damaging Agents segment is projected to grow at the fastest rate during forecast period, supported by innovations in topoisomerase inhibitors and promising outcomes in newer ADCs such as Enhertu and Elahere.

- By Linker Technology

On the basis of linker technology, the North America antibody drug conjugates (ADC) market is segmented into Peptide Linkers, Thioether Linkers, Hydrazone Linkers, and Disulfide Linkers. The Peptide Linkers segment held the highest share in 2024, as they enable enzymatic cleavage in the tumor microenvironment, ensuring drug activation only at the targeted site.

Disulfide Linkers are expected to grow significantly during forecast period, owing to their redox-sensitive properties, which offer a balance between stability in circulation and efficient drug release inside cancer cells.

- By Conjugation Technology

On the basis of conjugation technology, the North America antibody drug conjugates (ADC) market is segmented into Site-Specific Conjugation and Chemical Conjugation. The Site-Specific Conjugation segment dominated the market in 2024 due to its enhanced control over drug-to-antibody ratios and improved consistency in manufacturing.

The Chemical Conjugation segment is expected to witness fastest growth during forecast period, particularly in early-generation ADCs and ongoing development programs that rely on well-established chemical linker-payload methods.

- By Indication

On the basis of indication, the North America antibody drug conjugates (ADC) market is segmented into Breast Cancer, Blood Cancer (Leukemia, Lymphoma), Lung Cancer, Gynecological Cancer, Gastrointestinal Cancer, Genitourinary Cancer, and Others. The Breast Cancer segment dominated the market with the largest revenue share of 40.2% in 2024, owing to the high burden of breast cancer in the U.S. and the clinical success of ADCs such as Enhertu and Kadcyla in HER2-positive and HER2-low cases.

The Lung Cancer segment is projected to witness rapid growth during forecast period, due to expanding clinical trials of ADCs targeting HER3, Trop-2, and other novel antigens specific to non-small cell lung cancer (NSCLC).

- By End User

On the basis of end user, the North America antibody drug conjugates (ADC) market is segmented into Hospitals, Specialty Centers, Clinics, Ambulatory Centers, Home Healthcare, and Others. The Hospitals segment led the market in 2024, supported by the centralized administration of ADC therapies and access to oncology specialists and infusion services.

The Specialty Centers segment is expected to grow fastest from 2025 to 2032, driven by rising demand for outpatient cancer care, personalized medicine, and integrated oncology services.

- By Distribution Channel

On the basis of distribution channel, the North America antibody drug conjugates (ADC) market is segmented into Direct Tenders, Retail Sales, and Others. The Direct Tenders segment accounted for the largest share in 2024, as most ADC therapies are procured directly by hospitals and healthcare institutions via government and institutional tenders.

The Retail Sales segment is anticipated to grow gradually during forecast period, particularly for self-administered or home-infusion-enabled ADCs as part of emerging patient-centric treatment model

North America Antibody Drug Conjugates (ADC) Market Regional Analysis

- U.S. dominated the North America ADC market with the largest revenue share of 82.8% in 2024, supported by a highly advanced healthcare system, strong biopharmaceutical R&D investment, and a high concentration of major pharmaceutical companies actively developing and commercializing ADC therapies

- U.S. healthcare providers increasingly favor ADCs for their ability to deliver targeted treatment with fewer systemic side effects, particularly in hard-to-treat cancers such as HER2-low breast and advanced urothelial cancers

- This dominance is further supported by advanced R&D infrastructure, substantial oncology funding, and favorable FDA pathways for accelerated approvals, positioning the U.S. as the central hub for ADC innovation and clinical deployment in the region

U.S. Antibody Drug Conjugates (ADC) Market Insight

The U.S. North America antibody drug conjugates (ADC) market captured the largest revenue share of 82.3% in 2024 within North America, driven by the country’s high cancer prevalence, strong investment in oncology R&D, and leadership in biopharmaceutical innovation. The U.S. has seen a rapid expansion in clinical trials and FDA approvals for ADCs targeting solid and hematologic tumors. Growing demand for precision medicine and favorable regulatory support for accelerated approvals are accelerating market adoption. Furthermore, strong partnerships between biotech firms and major pharmaceutical companies, such as Pfizer’s acquisition of Seagen, are reinforcing the U.S.’s dominance in ADC development and commercialization.

Canada Antibody Drug Conjugates (ADC) Market Insight

The Canada North America antibody drug conjugates (ADC) market is projected to expand at a steady CAGR throughout the forecast period, supported by increased cancer awareness and access to advanced oncology therapies. Canada's universal healthcare system and proactive reimbursement policies for novel biologics are fostering ADC adoption in hospitals and specialty oncology centers. Moreover, the presence of leading cancer research institutions and growing participation in international clinical trials are contributing to market development. Ongoing collaborations with U.S.-based firms and favorable regulatory frameworks are expected to further stimulate ADC availability and uptake in the Canadian healthcare landscape.

Mexico Antibody Drug Conjugates (ADC) Market Insight

The Mexico North America antibody drug conjugates (ADC) market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising cancer incidence, improved healthcare infrastructure, and increasing access to innovative biologic treatments. The Mexican government’s efforts to modernize cancer care and expand access to targeted therapies are encouraging the adoption of ADCs. Moreover, partnerships between multinational pharmaceutical companies and local distributors are facilitating market penetration. With continued improvements in diagnostics, patient awareness, and treatment availability, Mexico is expected to emerge as a growing contributor to the North America ADC market

North America Antibody Drug Conjugates (ADC) Market Share

The North America antibody drug conjugates (ADC) industry is primarily led by well-established companies, including:

- AstraZeneca (U.K.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- BioNTech SE (Germany)

- ADC Therapeutics SA (Switzerland)

- GSK plc (U.K.)

- Mablink Bioscience SAS (France)

- Synaffix B.V. (Netherlands)

- Seagen Inc. (U.S.)

- Daiichi Sankyo Company, Limited (Japan)

- Pfizer Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- ImmunoGen, Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Pierre Fabre Laboratories (France)

- Philogen S.p.A. (Italy)

- Sobi (Sweden)

- Sartorius AG (Germany)

- Bayer AG (Germany)

What are the Recent Developments in North America Antibody Drug Conjugates (ADC) Market?

- In December 2023, the U.S. Food and Drug Administration (FDA) approved ImmunoGen’s Elahere (mirvetuximab soravtansine-gynx) for the treatment of folate receptor alpha–positive, platinum-resistant epithelial ovarian cancer. This milestone marks a significant expansion in the ADC therapeutic landscape, providing a novel treatment option for a difficult-to-treat cancer subtype. The approval underscores the FDA’s continued support for fast-tracking innovative biologics and reflects the increasing clinical validation of ADCs in solid tumors

- In November 2023, Pfizer Inc. finalized its USD 43 billion acquisition of Seagen Inc., one of the leading ADC innovators. This strategic move bolsters Pfizer’s oncology portfolio by integrating Seagen’s advanced ADC platforms and late-stage pipeline, including products such as Padcev and Tivdak. The acquisition highlights the growing importance of ADCs in cancer treatment and reinforces the trend of large-scale investments by major pharma companies to secure next-generation targeted therapies

- In October 2023, Gilead Sciences, Inc. announced positive Phase III trial results for Trodelvy (sacituzumab govitecan-hziy) in HR-positive, HER2-negative metastatic breast cancer. The data demonstrated a significant improvement in progression-free survival, supporting the broader application of Trop-2–targeted ADCs. The advancement reflects North America’s leading role in clinical research and the expanding indications for ADCs in high-prevalence cancers

- In September 2023, AbbVie Inc. entered into a strategic collaboration with DualityBio, a clinical-stage biotech company, to co-develop multiple ADC candidates using DualityBio’s proprietary conjugation platform. The deal includes up to USD 1.8 billion in milestone payments, highlighting growing interest in novel linker technologies and site-specific conjugation methods to improve efficacy and safety. This partnership reinforces North America's position as a hub for ADC innovation and global biopharma collaboration

- In July 2023, Mersana Therapeutics initiated a Phase II study of UpRi, its lead ADC candidate targeting NaPi2b in ovarian cancer, with U.S.-based trial sites across major academic cancer centers. This development reflects ongoing momentum among North American biotech firms to develop first-in-class ADCs tailored to niche cancer targets, signaling a vibrant and competitive clinical pipeline across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PESTEL ANALYSIS

5 COST STRUCTURE ANALYSIS OF ANTIBODY-DRUG CONJUGATE (ADC) MANUFACTURING

5.1 ANTIBODIES

5.1.1 OVERVIEW OF ANTIBODY PRODUCTION

5.1.1.1 In-house vs. Outsourced:

5.1.2 ANTIBODY PRICING FACTORS

5.2 LINKERS

5.2.1 ROLE AND TYPES OF LINKERS

5.2.1.1 Cost Impact by Linker Type:

5.3 CYTOTOXIC AGENTS

5.3.1 COST CONSIDERATIONS:

5.3.2 BUFFERS AND SOLVENTS

5.4 COST BREAKDOWN BY MANUFACTURING STAGE

5.4.1 PRE-PRODUCTION COSTS

5.4.2 CONJUGATION PROCESS

5.4.3 PURIFICATION AND FILTRATION

5.4.4 QUALITY CONTROL

5.5 COST PROJECTIONS AND PRICING TRENDS (2024–2030)

5.5.1 PROJECTED COST FLUCTUATIONS

5.5.2 COST IMPACT OF SCALABILITY

5.6 SUPPLIER AND GEOGRAPHIC PRICING TRENDS

5.6.1 GEOGRAPHIC COST VARIATIONS

5.6.2 SUPPLIER ANALYSIS

5.6.3 CONCLUSION

6 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CANCER

7.1.2 ADVANCES IN ANTIBODY-DRUG CONJUGATE (ADC) TECHNOLOGY

7.1.3 INCREASING DEMAND FOR TARGETED THERAPIES

7.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS RESEARCH

7.2 RESTRAINTS

7.2.1 HIGH DEVELOPMENT COST & MANUFACTURING COMPLEXITIES

7.2.2 SAFETY AND TOXICITY ISSUES OF ANTIBODY DRUG CONJUGATES

7.3 OPPORTUNITIES

7.3.1 GROWING ONCOLOGY PIPELINE FOR ANTIBODY DRUG CONJUGATES (ADCS)

7.3.2 INCREASING INVESTMENT IN CANCER RESEARCH

7.3.3 INCREASING COLLABORATION WITH RESEARCH INSTITUTIONS FOR ANTIBODY DRUG CONJUGATES

7.4 CHALLENGES

7.4.1 CLINICAL TRIAL FAILURES FOR ANTIBODY DRUG CONJUGATES DEVELOPMENT

7.4.2 LENGTHY CLINICAL TRIALS AND DEVELOPMENT PHASES

8 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ENHERTU

8.3 KADCYLA

8.4 TRODELVY

8.5 POLIVY

8.6 ADCETRIS

8.7 PADCEV

8.8 BESPONSA

8.9 ELAHERE

8.1 ZYLONTA

8.11 MYLOTARG

8.12 TIVDAK

8.13 OTHERS

9 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT

9.1 OVERVIEW

9.2 HER2 RECEPTOR

9.3 TROP-2

9.4 CD79B

9.5 CD30

9.6 NECTIN 4

9.7 CD22

9.8 CD19

9.9 CD33

9.1 TISSUE FACTORS

9.11 OTHERS

10 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT

10.1 OVERVIEW

10.2 THIRD GENERATION ADCS

10.3 SECOND GENERATION ADCS

10.4 FOURTH GENERATION ADCS

10.5 FIRST GENERATION ADCS

11 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT

11.1 OVERVIEW

11.2 CLEAVABLE LINKERS

11.2.1 PEPTIDE BASED

11.2.2 ACID SENSITIVE OR ACID LABILE

11.2.3 GLUTATHIONE SENSITIVE DISULFIDE

11.3 NON CLEAVABLE LINKERS

12 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT

12.1 OVERVIEW

12.2 DNA DAMAGING AGENTS

12.2.1 CAMPTOTHECIN

12.2.2 CALICHEAMICIN

12.2.3 PYRROLOBENZODIAZEPINES

12.3 MICROTUBULE DISRUPTING AGENTS

12.3.1 AURISTATIN

12.3.2 MAYTANSINOIDS

13 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY

13.1 OVERVIEW

13.2 PEPTIDE LINKERS

13.3 THIOETHER LINKERS

13.4 HYDRAZONE LINKERS

13.5 DISULFIDE LINKERS

14 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY

14.1 OVERVIEW

14.2 SITE-SPECIFIC CONJUGATION

14.3 CHEMICAL CONJUGATION

15 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION

15.1 OVERVIEW

15.2 BREAST CANCER

15.3 BLOOD CANCER (LEUKEMIA, LYMPHOMA)

15.4 LUNG CANCER

15.5 GYNECOLOGICAL CANCER

15.6 GASTROINTESTINAL CANCER

15.7 GENITOURINARY CANCER

15.8 OTHERS

16 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.3 SPECIALTY CENTER

16.4 CLINICS

16.5 AMBULATORY CENTERS

16.6 HOME HEALTHCARE

16.7 OTHERS

17 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDERS

17.3 RETAIL SALES

17.3.1 HOSPITAL PHARMACY

17.3.2 RETAIL PHARMACY

17.3.3 ONLINE PHARMACY

17.4 OTHERS

18 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION

18.1 NORTH AMERICA

18.1.1 U.S

18.1.2 CANADA

18.1.3 MEXICO

19 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC): COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 DAIICHI SANKYO, INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 F. HOFFMANN-LA ROCHE LTD

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENT

21.3 GILEAD SCIENCES, INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENT

21.4 ASTELLAS PHARMA INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENT

21.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENT

21.6 ABBVIE INC.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENT

21.7 ADC THERAPEUTICS SA

21.7.1 6.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENT

21.8 AMGEN, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENT

21.9 ASTRAZENECA

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENT

21.1 BAYER

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENT

21.11 BYONDIS

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENT

21.12 EISAI INC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENT

21.13 GSK PLC

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENT

21.14 JOHNSON & JOHNSON SERVICES, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENT

21.15 OXFORD BIOTHERAPEUTICS

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENT

21.16 PFIZER INC.

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT UPDATES

21.17 REMEGEN

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SANOFI

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT DEVELOPMENT

21.19 SUTRO BIOPHARMA, INC.

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT UPDATES

22 QUESTIONNAIRE

23 RELATED REPORTS

List of Table

TABLE 1 PROJECTED PRICE CHANGE (2024–2030)

TABLE 2 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 3 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 4 NORTH AMERICA ENHERTU IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 NORTH AMERICA KADCYLA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA TRODELVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA POLIVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 NORTH AMERICA ADCETRIS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA PADCEV IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 NORTH AMERICA BESPONSA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA ELAHERE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA ZYLONTA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA MYLOTARG IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 NORTH AMERICA TIVDAK IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 17 NORTH AMERICA HER2 RECEPTOR IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA TROP-2 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 NORTH AMERICA CD79B IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 NORTH AMERICA CD30 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 NORTH AMERICA NECTIN 4 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 NORTH AMERICA CD22 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 23 NORTH AMERICA CD19 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 NORTH AMERICA CD33 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 NORTH AMERICA TISSUE FACTORS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 28 NORTH AMERICA THIRD GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 29 NORTH AMERICA SECOND GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 30 NORTH AMERICA FOURTH GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 31 NORTH AMERICA FIRST GENERATION ADCS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 32 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 33 NORTH AMERICA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 34 NORTH AMERICA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 35 NORTH AMERICA NON CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 36 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 37 NORTH AMERICA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 38 NORTH AMERICA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 39 NORTH AMERICA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 40 NORTH AMERICA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 41 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 42 NORTH AMERICA PEPTIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 43 NORTH AMERICA THIOETHER LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 44 NORTH AMERICA HYDRAZONE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 45 NORTH AMERICA DISULFIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 46 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 47 NORTH AMERICA SITE-SPECIFIC CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 48 NORTH AMERICA CHEMICAL CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 49 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 50 NORTH AMERICA BREAST CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 51 NORTH AMERICA BLOOD CANCER (LEUKEMIA, LYMPHOMA) IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 52 NORTH AMERICA LUNG CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 53 NORTH AMERICA GYNECOLOGICAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 54 NORTH AMERICA GASTROINTESTINAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 55 NORTH AMERICA GENITOURINARY CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 57 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 58 NORTH AMERICA HOSPITALS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 59 NORTH AMERICA SPECIALTY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 60 NORTH AMERICA CLINICS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 61 NORTH AMERICA AMBULATORY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 62 NORTH AMERICA HOME HEALTHCARE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 63 NORTH AMERICA OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 64 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 65 NORTH AMERICA DIRECT TENDERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 66 NORTH AMERICA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 67 NORTH AMERICA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 68 NORTH AMERICA OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 69 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 70 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 71 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 72 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 73 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 74 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 75 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 76 NORTH AMERICA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 77 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 78 NORTH AMERICA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 79 NORTH AMERICA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 80 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 81 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 82 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 83 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 84 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 85 NORTH AMERICA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 86 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 87 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 88 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 89 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 90 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 91 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 92 U.S. CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 93 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 94 U.S. DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 95 U.S. MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 96 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 97 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 98 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 99 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 100 U.S. ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 U.S. RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 103 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 104 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 105 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 106 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 107 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 108 CANADA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 109 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 110 CANADA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 111 CANADA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 112 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 113 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 114 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 115 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 116 CANADA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 117 CANADA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 118 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 119 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 120 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 121 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 122 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 123 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 124 MEXICO CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 125 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 126 MEXICO DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 127 MEXICO MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 128 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 129 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 130 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 131 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 132 MEXICO ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 133 MEXICO RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING INCIDENCE OF CANCER IS DRIVING THE GROWTH OF THE NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET FROM 2024 TO 2031

FIGURE 14 THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET IN 2024 AND 2031

FIGURE 15 DROC

FIGURE 16 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2023

FIGURE 17 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2024-2031 (USD MILLION)

FIGURE 18 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 19 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2023

FIGURE 21 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2024-2031 (USD MILLION)

FIGURE 22 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, CAGR (2024-2031)

FIGURE 23 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, LIFELINE CURVE

FIGURE 24 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2023

FIGURE 25 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2024-2031 (USD MILLION)

FIGURE 26 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, CAGR (2024-2031)

FIGURE 27 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, LIFELINE CURVE

FIGURE 28 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2023

FIGURE 29 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 30 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, CAGR (2024-2031)

FIGURE 31 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, LIFELINE CURVE

FIGURE 32 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2023

FIGURE 33 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 34 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, CAGR (2024-2031)

FIGURE 35 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, LIFELINE CURVE

FIGURE 36 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2023

FIGURE 37 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 38 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, CAGR (2024-2031)

FIGURE 39 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, LIFELINE CURVE

FIGURE 40 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2023

FIGURE 41 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 42 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, CAGR (2024-2031)

FIGURE 43 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, LIFELINE CURVE

FIGURE 44 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2023

FIGURE 45 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2024-2031 (USD MILLION)

FIGURE 46 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, CAGR (2024-2031)

FIGURE 47 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 48 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2023

FIGURE 49 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 50 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 51 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, LIFELINE CURVE

FIGURE 52 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 53 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 54 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 55 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 56 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC) MARKET: SNAPSHOT (2023)

FIGURE 57 NORTH AMERICA ANTIBODY DRUG CONJUGATES (ADC): COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.