North America Api Intermediates Market

Market Size in USD Billion

CAGR :

%

USD

192.65 Billion

USD

314.07 Billion

2024

2032

USD

192.65 Billion

USD

314.07 Billion

2024

2032

| 2025 –2032 | |

| USD 192.65 Billion | |

| USD 314.07 Billion | |

|

|

|

|

North America API Intermediates Market Size

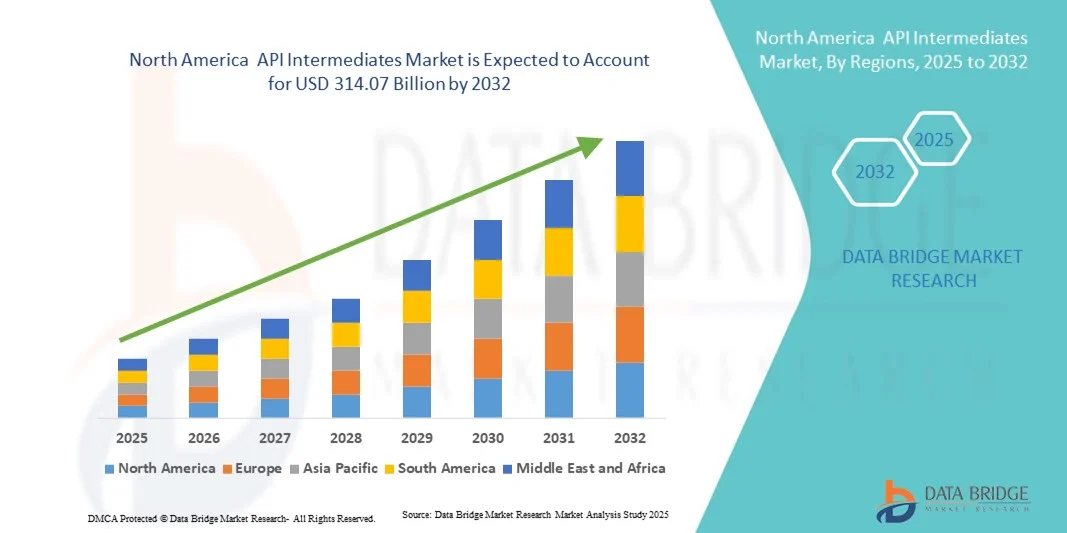

- The North America API intermediates market size was valued at USD 192.65 billion in 2024 and is expected to reach USD 314.07 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by the rising demand for pharmaceutical and biopharmaceutical products, coupled with increasing outsourcing of API manufacturing to specialized producers, which is driving large-scale production and innovation in API intermediates

- Furthermore, advancements in chemical synthesis technologies, growing adoption of green chemistry practices, and the rising prevalence of chronic diseases are accelerating the uptake of API intermediates across multiple therapeutic areas, thereby significantly boosting the industry's growth

North America API Intermediates Market Analysis

- API intermediates, which are specialized chemical compounds serving as essential building blocks in the synthesis of active pharmaceutical ingredients (APIs), play a critical role in the pharmaceutical manufacturing process. Their importance has grown significantly due to the surging demand for both innovative and generic drugs, coupled with the rapid expansion of contract manufacturing services across the globe

- The escalating demand for API intermediates is being driven by several key factors, including the rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer; increased investments in pharmaceutical research and development (R&D); and a pronounced industry shift toward outsourcing API production to cost-effective regions that can maintain high quality standards while reducing manufacturing expenses

- U.S. held the dominant position in the API intermediates market, accounting for the largest revenue share of 38.7% in 2024. This leadership is driven by the country’s advanced pharmaceutical manufacturing infrastructure, strong presence of leading API producers, and well-established regulatory systems such as the FDA. The U.S. continues to lead in the production of high-value and specialty intermediates used in complex therapeutic segments including oncology and cardiovascular treatments

- Canada is projected to be the fastest-growing country in the API intermediates market during the forecast period. This rapid expansion is supported by rising investments in domestic pharmaceutical production, favorable government initiatives to strengthen the local API supply chain, and increasing collaborations with international pharmaceutical companies. Canada’s focus on sustainability and innovation in chemical synthesis also positions it as a key emerging hub in the North American API landscape

- The pharmaceutical/bulk drug intermediates segment dominated the market with the largest revenue share of 68.4% in 2024, driven by their extensive application in large-scale drug manufacturing across therapeutic areas such as oncology, cardiovascular, and infectious diseases. The segment benefits from robust demand from generic and branded drug producers worldwide

Report Scope and API Intermediates Market Segmentation

|

Attributes |

API Intermediates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America API Intermediates Market Trends

Growing Importance of API Intermediates in Modern Pharmaceutical Manufacturing

- A significant and accelerating trend in the North America API Intermediates market is the increasing adoption of advanced manufacturing technologies, automation, and digital process optimization tools. This integration of innovative production methods is enhancing the efficiency, quality, and scalability of API intermediate production

- For instance, leading pharmaceutical manufacturers are implementing continuous manufacturing techniques for API intermediates, enabling consistent product quality, reduced production timelines, and better control over critical process parameters. Similarly, advanced process analytical technologies (PAT) are being used to monitor reactions in real time, ensuring compliance with stringent regulatory requirements

- Automation and data-driven manufacturing allow for predictive maintenance of equipment, optimization of raw material use, and reduced downtime. For example, some facilities now use AI-driven analytics to forecast production bottlenecks and adjust batch scheduling to meet urgent API demands. Furthermore, these advancements help in reducing manufacturing costs and improving yields, making production more competitive in North America

- The integration of Industry 4.0 principles with API intermediate manufacturing is also facilitating centralized control and oversight across multiple production sites. Through a single digital interface, manufacturers can track batch progress, monitor quality metrics, and ensure supply chain transparency from raw materials to final APIs

- This trend toward more precise, efficient, and connected manufacturing processes is fundamentally reshaping pharmaceutical supply chains. Consequently, major players such as Lonza and Cambrex are investing heavily in expanding high-purity intermediate production facilities equipped with modern, automated systems

- The demand for high-quality API intermediates produced using advanced manufacturing methods is rising rapidly across both branded and generic drug segments, as pharmaceutical companies increasingly prioritize consistent quality, cost efficiency, and regulatory compliance

North America API Intermediates Market Dynamics

Driver

Growing Importance of API Intermediates in Modern Pharmaceutical Manufacturing

- The rising demand for efficient, high-quality pharmaceutical production, coupled with the need for faster drug development timelines, is significantly driving the growth of the API intermediates market. These intermediates, which are critical raw materials in the synthesis of active pharmaceutical ingredients (APIs), play an indispensable role in ensuring the efficacy, safety, and stability of final drug formulations

- For instance, in April 2024, Divis Laboratories Ltd. announced the expansion of its API intermediates production capacity in India, aimed at catering to both domestic demand and export markets. The company’s investment in advanced chemical synthesis technologies and green chemistry practices reflects a broader industry shift toward sustainable and scalable API manufacturing. Such strategic expansions are expected to fuel the API intermediates market growth during the forecast period

- As the North America pharmaceutical sector experiences increased demand for generics, biosimilars, and specialty medicines, API intermediates are becoming essential for enabling cost-effective and timely production. Their role in minimizing impurities, improving yield, and supporting complex synthesis processes is making them a cornerstone of pharmaceutical manufacturing

- Furthermore, growing emphasis on supply chain resilience and reducing dependency on single-country sourcing is encouraging manufacturers to diversify their API intermediate production capabilities. This trend is supported by government incentives in multiple countries to boost domestic pharmaceutical ingredient manufacturing

- The integration of continuous manufacturing technologies, advancements in process chemistry, and increased investment in R&D for high-purity intermediates are creating new opportunities in the market. With their adaptability across therapeutic areas—including oncology, cardiovascular diseases, and infectious diseases—API intermediates are witnessing expanding applications that enhance both manufacturing efficiency and product quality

Restraint/Challenge

Concerns Regarding Stringent Regulatory Compliance and High Production Costs

- The API intermediates industry faces challenges related to stringent regulatory requirements in different regions, which can lengthen product approval timelines and increase operational costs. Adhering to Good Manufacturing Practices (GMP) and meeting pharmacopoeia standards requires significant investment in quality control systems, skilled workforce, and compliance infrastructure

- For instance, recent audits by regulatory bodies such as the U.S. FDA and European Medicines Agency (EMA) have resulted in temporary plant shutdowns for some manufacturers failing to meet environmental and safety standards. Such incidents highlight the need for robust compliance frameworks to avoid disruptions in supply

- In addition, the relatively high cost of advanced API intermediates—particularly those requiring multi-step synthesis or specialized catalysts—can be a barrier for smaller pharmaceutical companies or for cost-sensitive markets. Factors such as volatility in raw material prices, dependency on imported precursors, and energy-intensive production processes further contribute to high manufacturing costs

- While process optimization and economies of scale are gradually reducing costs, the perceived premium pricing for high-purity or niche API intermediates can still limit widespread adoption, especially in low- and middle-income regions

- Overcoming these challenges will require not only technological advancements in process chemistry but also greater collaboration between manufacturers, regulatory agencies, and raw material suppliers to create a more cost-efficient and compliant supply ecosystem for API intermediates

North America API Intermediates Market Scope

The North America API Intermediates market is segmented on the basis of type, product, therapeutic type, customers, end user, and distribution channel.

- By Type

On the basis of type, the API Intermediates market is segmented into veterinary drug intermediates and pharmaceutical/bulk drug intermediates. The pharmaceutical/bulk drug intermediates segment dominated the market with the largest revenue share of 68.4% in 2024, driven by their extensive application in large-scale drug manufacturing across therapeutic areas such as oncology, cardiovascular, and infectious diseases. The segment benefits from robust demand from generic and branded drug producers worldwide. Growth is fueled by technological advancements in chemical synthesis and large-scale manufacturing capabilities. Increasing adoption of continuous manufacturing processes improves efficiency and consistency of intermediates. The segment is strengthened by strong regulatory frameworks ensuring high-quality production. Strategic partnerships between global pharmaceutical companies and contract manufacturers further boost capacity. Rising demand for complex small molecules and specialty APIs supports market dominance. The availability of cost-effective production in emerging regions also contributes to growth. Ongoing R&D in novel drug formulations drives consistent intermediate consumption. Increased outsourcing from North America and Europe enhances production demand. Sustainable and green chemistry practices adopted by manufacturers improve productivity and compliance. The segment continues to benefit from high barriers to entry due to capital-intensive processes. Large-scale production capabilities ensure reliable supply for global pharmaceutical needs.

The veterinary drug intermediates segment is projected to witness the fastest CAGR of 9.7% from 2025 to 2032, supported by the rising focus on animal healthcare, the growing livestock industry, and increasing approvals of veterinary pharmaceuticals North America. Growth is driven by increasing awareness of animal health and zoonotic disease prevention. Expanding companion animal care markets contribute to higher demand for veterinary APIs. Government initiatives promoting livestock health encourage domestic production. Technological advancements in veterinary drug synthesis enhance yield and reduce costs. Partnerships between animal health companies and intermediates producers boost supply capacity. Rising exports to emerging markets increase revenue potential. Contract manufacturing for veterinary APIs facilitates accessibility for smaller firms. Regulatory approvals and streamlined processes accelerate market entry. Rising investments in preventive animal healthcare further expand demand. Development of novel formulations for livestock and pets supports sustained growth. Market adoption in North America, Europe, and Asia provides additional opportunities.

- By Product

On the basis of product, the API Intermediates market includes bromo compound, O-benzyl salbutamol, hemisulfate, oxirane, bisoprolol base, chiral PCBHP, pheniramine base, chlorpheniramine base, brompheniramine base, mepyramine/pyrilamine base, 6-amino-1,3-dimethyl uracil, theophylline, acefylline, xanthine, nitriles, and others. The bromo compound segment accounted for the largest market share of 21.3% in 2024, attributed to its wide application in producing active pharmaceutical ingredients for cardiovascular, respiratory, and oncology drugs. The segment’s dominance is supported by high demand from both large-scale and specialty pharmaceutical manufacturers. Bromo compounds are essential for complex chemical synthesis, enabling high-potency formulations. Continuous innovations in bromination and green chemistry improve production efficiency. The availability of cost-effective raw materials enhances profitability. Expansion in oncology, cardiovascular, and respiratory drug pipelines increases consumption. Regulatory compliance and quality standards drive preference for trusted suppliers. Strategic collaborations between CMOs and pharma companies strengthen supply chains. Rising global demand for life-saving drugs sustains market share. Technological advancements reduce production costs and improve yield. Integration with automated production systems ensures consistency. The segment remains critical due to high application versatility and scalability.

The chiral PCBHP segment is anticipated to register the fastest CAGR of 10.8% from 2025 to 2032, driven by the increasing demand for chiral synthesis in high-value therapeutic drugs where enantiopurity is critical for efficacy and safety. Growth is supported by adoption of asymmetric synthesis and stereoselective catalysis. Precision medicine and targeted therapies require high-purity chiral intermediates. Expansion in oncology, neurology, and cardiovascular pipelines drives increased usage. Contract manufacturing organizations cater to growing small- and mid-size pharma demand. Regulatory incentives for enantiomerically pure drugs accelerate market penetration. Biotech and pharma collaborations enhance production capacity. Technological innovations improve yield, reduce waste, and lower production costs. The rise in patent expirations for racemic drugs encourages chiral alternatives. Increased adoption in biosimilars and advanced drug formulations contributes to growth. Sustainability and green chemistry practices attract environmentally conscious clients. Global market expansion in emerging regions further supports revenue growth. Demand from research and development labs for small-batch production also boosts segment growth.

- By Therapeutic Type

On the basis of therapeutic type, the market is segmented into autoimmune diseases, oncology, metabolic diseases, ophthalmology, cardiovascular diseases, infectious diseases, neurology, respiratory disorders, dermatology, urology, and others. The oncology segment led the market in 2024 with a revenue share of 27.9%, owing to the rising prevalence of cancer, increasing approvals of targeted therapies, and the demand for high-purity intermediates for complex formulations. Dominance is supported by global investments in oncology research and drug development. Rising patient population and increasing cancer awareness drive demand. Adoption of biologics, ADCs, and targeted small molecules requires high-quality intermediates. Expansion in clinical trials strengthens market position. Partnerships between pharmaceutical companies and CMOs enhance manufacturing capabilities. Regulatory approvals for novel cancer therapies increase consumption. Continuous innovation in anticancer compounds boosts demand. North America and Europe remain key contributors due to R&D infrastructure. Oncology-focused contract manufacturing supports supply consistency. Growth in specialty oncology drugs fuels intermediate requirements. Integration of advanced manufacturing techniques ensures process efficiency. High value and technical complexity of oncology APIs sustain market leadership.

The autoimmune diseases segment is expected to grow at the fastest CAGR of 11.2% from 2025 to 2032, propelled by the increasing North America incidence of autoimmune disorders and the robust R&D pipeline in biologics and small molecules addressing these conditions. Rising investments in immunomodulatory drugs expand production needs. Biologics and biosimilars drive the requirement for high-quality intermediates. Contract manufacturing for specialty drugs enhances availability. Technological advancements improve efficiency and yield in intermediate synthesis. Expansion of peptide and small molecule therapies increases market opportunity. Regulatory approvals for autoimmune treatments accelerate growth. Rising prevalence of diseases such as lupus, rheumatoid arthritis, and multiple sclerosis drives consumption. Clinical trials and innovative drug formulations further support demand. Collaborations between biotech and pharma firms improve production capabilities. Growing geriatric population increases patient base. Emerging markets adoption creates new revenue streams. Adoption of personalized medicine strategies reinforces intermediate demand. Sustainable manufacturing practices provide additional growth support.

- By Customers

On the basis of customers, the API Intermediates market is categorized into direct users/pharma companies, traders/wholesalers/distributors, and associations/government & private institutions. The direct users/pharma companies segment dominated in 2024 with 62.1% market share, as pharmaceutical manufacturers prefer direct procurement to ensure quality control, traceability, and compliance with regulatory standards. Large companies maintain long-term contracts to secure uninterrupted supply. Regulatory adherence by suppliers ensures safety and compliance. Integration with production schedules optimizes supply chain management. Digital procurement tools improve tracking and efficiency. High-purity intermediates are prioritized for specialty drug formulations. Contract manufacturing and outsourcing strengthen supply consistency. The dominance is reinforced by high demand from generic and branded drug manufacturers. Strategic supplier partnerships improve capacity and scalability. Advanced quality control systems ensure minimal batch variation. Automation in manufacturing enhances productivity and reliability. The segment benefits from a growing pipeline of complex small molecules. Expansion in global pharmaceutical markets sustains market leadership.

The traders/wholesalers/distributors segment is projected to expand at the fastest CAGR of 8.9% from 2025 to 2032, supported by the growing presence of regional suppliers catering to small and mid-sized drug manufacturers. Growth is driven by flexible order quantities and cost-effective distribution. Digital B2B platforms simplify procurement for emerging companies. Regional hubs reduce lead times and improve logistics. CROs increasingly source intermediates through distributors. Partnerships with CMOs expand supply reach. Small-scale manufacturers gain access to high-quality compounds. Increasing pharma R&D creates additional sourcing demand. Regulatory compliance support strengthens trust. Expansion in emerging markets drives market penetration. Retail and online distribution channels enhance accessibility. Contract manufacturing collaborations further improve availability. Distribution networks support both domestic and export requirements. Strengthened logistics ensure timely delivery and continuity of supply.

- By End User

On the basis of end user, the market is segmented into API manufacturers and finished product manufacturers. API manufacturers accounted for the largest market revenue share of 54.7% in 2024, driven by the increasing outsourcing of intermediate production to specialized facilities offering cost-effective and scalable solutions. Growth is supported by demand for high-quality intermediates for generic and specialty APIs. Contract manufacturing enhances production efficiency. Regulatory-compliant GMP facilities maintain product reliability. Technological advancements improve process yield and cost-effectiveness. Large-scale API production meets global supply needs. Continuous manufacturing adoption strengthens capacity. Strong collaborations between pharma and CMOs secure supply. Vertical integration by API manufacturers reduces lead times. Expansion in North America and Europe increases consumption. Process automation enhances quality and consistency. Sustainable production practices attract market preference. Strategic alliances with biotech firms drive further growth.

Finished product manufacturers are expected to post the fastest CAGR of 9.4% from 2025 to 2032, aided by their integration of intermediate production into vertical manufacturing chains for quality assurance and faster time-to-market. Integration enables tighter supply chain control and cost optimization. Adoption of in-house synthesis reduces dependency on external suppliers. Personalized medicine drives custom intermediate production. Expansion in specialty and complex drug formulations increases demand. Regulatory compliance and quality assurance strengthen market position. Advanced technologies improve production efficiency. Collaborative efforts with CMOs enhance technical expertise. Growing global pharmaceutical demand supports faster adoption. Sustainable manufacturing practices reinforce market confidence. Vertical integration reduces production lead times and operational risks. Emerging market adoption of finished products increases intermediate usage. Investments in R&D drive innovation in production processes.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment held the highest share of 48.6% in 2024, attributed to bulk procurement by large pharmaceutical companies and government agencies for high-volume drug production. Direct tender ensures consistent supply, cost-efficiency, and standardized quality. Long-term procurement contracts with governments stabilize revenue. Bulk ordering supports large-scale production needs. Strategic supplier partnerships improve delivery reliability. Regulatory compliance and quality assurance reinforce preference. Global procurement for pandemic preparedness enhances demand. Integration with CMO supply chains strengthens procurement efficiency. Large pharma relies on tenders for uninterrupted API supply. Bulk procurement reduces operational risk and price volatility. Advanced logistics and planning improve tender fulfillment. Sustainability initiatives in supply chains support procurement decisions. Direct tender contracts increase market visibility and business continuity.

Retail sales are forecasted to grow at the fastest CAGR of 8.7% from 2025 to 2032, supported by increasing demand from small-scale manufacturers and contract research organizations procuring intermediates in smaller quantities. Retail channels offer flexible lot sizes and convenient access. Digital B2B platforms simplify ordering and logistics. Small and mid-sized manufacturers benefit from reduced minimum order requirements. CROs increasingly rely on retail channels for specialized intermediates. E-commerce platforms enhance product availability. Regional distribution hubs reduce delivery times. Emerging markets drive additional retail demand. Access to niche and specialty intermediates supports innovation. Retail channels allow faster product turnaround and customization. Contract manufacturing collaborations enhance retail supply efficiency. Growth in R&D activities fuels retail demand. Flexible retail procurement complements tender and direct supply networks.

North America API Intermediates Market Regional Analysis

- North America dominated the API intermediates market with the largest revenue share of 39.5% in 2024, primarily driven by the increasing demand for both innovative and generic pharmaceuticals, as well as the region’s emphasis on advanced manufacturing capabilities

- The market benefits from strong regulatory oversight, extensive research and development initiatives, and the presence of several leading North America API intermediate manufacturers. In addition, strategic collaborations between biotech firms and contract manufacturing organizations (CMOs) are strengthening North America’s competitive position, enabling the production of high-purity and specialty intermediates essential for modern drug development

- The growth is further supported by high healthcare expenditure, a well-established pharmaceutical sector, and a strong pipeline of specialty drugs, including high-potency and complex molecules, which require highly purified intermediates to ensure therapeutic efficacy

U.S. API Intermediates Market Insight

The U.S. API intermediates market held the dominant position in the API Intermediates Market, accounting for the largest revenue share of 38.7% in 2024. This leadership is supported by the country’s advanced pharmaceutical manufacturing infrastructure, the presence of leading API producers, and well-established regulatory frameworks such as the FDA. The U.S. excels in producing high-value and specialty intermediates for complex therapeutic areas including oncology, cardiovascular, and infectious disease treatments. Rapid adoption of continuous manufacturing technologies enhances efficiency, yield, and quality of production. Strong intellectual property protections attract investment in research and development. Outsourcing to domestic CMOs ensures a robust and flexible supply chain. Large-scale production capabilities, coupled with advanced chemical synthesis expertise, reinforce global competitiveness. Expansion of targeted and specialty drug pipelines drives increased intermediate consumption. Strategic partnerships between pharmaceutical companies and CMOs strengthen production capacity. Sustainable and green manufacturing practices improve operational efficiency and reduce environmental impact. High-quality control standards ensure compliance with both domestic and international regulations. Overall, these factors collectively maintain the U.S.’s dominant position in North America.

Canada API Intermediates Market Insight

The Canada API intermediates market is projected to be the fastest-growing country during the forecast period. Growth is driven by rising investments in domestic pharmaceutical production and supportive government initiatives aimed at strengthening the local API supply chain. Canada is emerging as a hub for sustainable and innovative chemical synthesis, attracting international collaborations and technology transfers from global pharmaceutical companies. Expansion in specialty and high-value therapeutic segments such as oncology, cardiovascular, and rare diseases is fueling demand for locally produced intermediates. Modernization of manufacturing facilities and adoption of environmentally friendly practices improve production efficiency. The country benefits from regulatory support and tax incentives that encourage domestic production. Partnerships with CMOs enable access to advanced synthesis techniques and ensure consistent supply. Development of integrated supply chains strengthens reliability and scalability. Export opportunities to North America and global markets contribute to revenue growth. Skilled talent in pharmaceutical sciences supports R&D and process innovation. Canada’s focus on quality, sustainability, and innovation positions it as a key emerging API intermediate hub in the North American market

North America API Intermediates Market Share

The API Intermediates industry is primarily led by well-established companies, including:

- HIKAL Ltd. (India)

- Cambrex Corporation (U.S.)

- Ganesh-Group (India)

- AlzChem Group AG (India)

- Vasudha Pharma (India)

- Anyang General Chemical Co.,Ltd. (China)

- Sarex (India)

- Sandoo Pharmaceuticals and Chemicals Co., Ltd (India)

- Atul Ltd (India)

- Sandoz International GmbH (a subsidiary of Novartis AG) (Germany)

- Aceto (U.S.)

- Supriya Lifescience Ltd. (India)

- LEVACHEM COMPANY LIMITED (China)

- Vertellus (U.S.)

- Dishman Carbogen Amcis Ltd (India)

- Divi's Laboratories Limited (India)

- AARTI INDUSTRIES LIMITED (India)

- Aurobindo Pharma (India)

- BASF SE (Germany)

Latest Developments in North America API Intermediates Market

- In June 2025, The Economic Times reported a significant decline in the prices of active pharmaceutical ingredients (APIs) in India. This drop has provided much-needed relief to the country's pharmaceutical industry, reducing production expenses for drugmakers who have faced pressure from high raw material prices in recent years. The fall in API prices is expected to enhance profitability and stabilize the supply chain within the sector, which is a crucial component of India's healthcare and export economy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.