North America Artificial Intelligence Ai In Drug Discovery Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

54.93 Billion

2024

2032

USD

1.65 Billion

USD

54.93 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 54.93 Billion | |

|

|

|

|

North America Artificial Intelligence (AI) in Drug Discovery Market Size

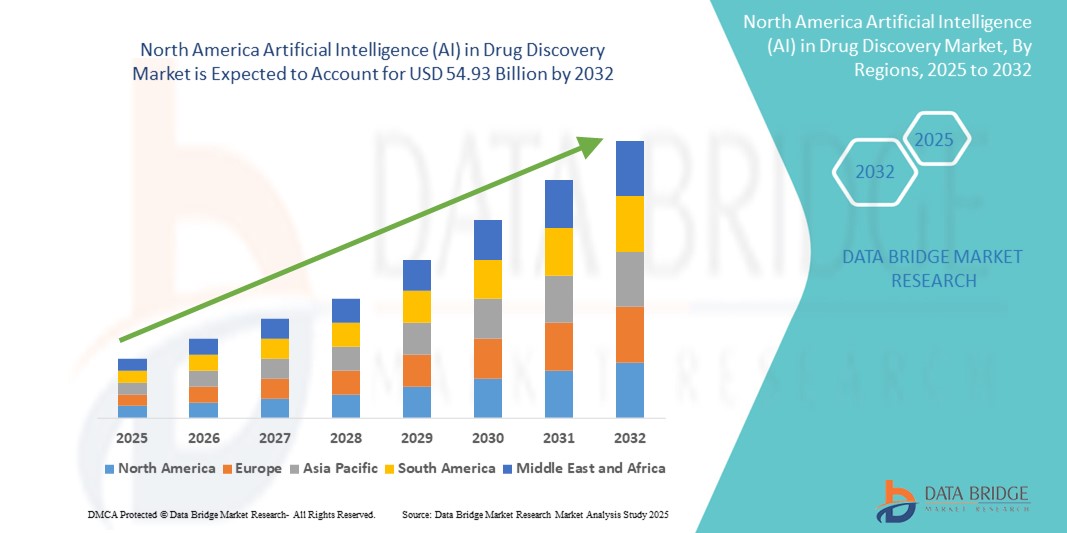

- The North America artificial intelligence (AI) in drug discovery market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 54.93 billion by 2032, at a CAGR of 54.90% during the forecast period

- The market growth is largely fueled by the increasing integration of AI technologies to accelerate drug target identification, compound screening, and clinical trial design, significantly reducing time and R&D costs

- Furthermore, rising demand for precision medicine and personalized therapeutics, alongside collaborations between AI vendors and pharmaceutical companies, is positioning AI as a core enabler of innovation in the drug development pipeline. These converging factors are driving adoption across the region

North America Artificial Intelligence (AI) in Drug Discovery Market Analysis

- AI in drug discovery, utilizing machine learning, deep learning, and data-driven modeling, is becoming a critical enabler in transforming the pharmaceutical R&D landscape across North America by improving the efficiency and accuracy of early-stage drug development processes such as target identification, hit discovery, and molecule optimization

- The escalating demand for AI in drug discovery is primarily fueled by increasing healthcare R&D investments, growing prevalence of chronic and rare diseases, and a rising need to reduce the time and cost associated with traditional drug development cycles

- U.S. dominated the North America artificial intelligence (AI) in drug discovery market with the largest revenue share of 48.7% in 2024, characterized by advanced healthcare infrastructure, early adoption of AI technologies, and strong collaborations between pharmaceutical companies and AI-focused tech firms

- Canada is expected to be the fastest growing country in the North America artificial intelligence (AI) in drug discovery market during the forecast period, driven by increasing government support for AI in healthcare, a growing biotechnology sector, and rising collaborations between Canadian research institutions and pharmaceutical companies to apply AI in drug development

- Small Molecule segment dominated the Nor North America artificial intelligence (AI) in drug discovery market with a market share of 64% in 2024, driven by its ease of modeling, scalability in screening, and widespread use in targeted therapies

Report Scope and North America Artificial Intelligence (AI) in Drug Discovery Market Segmentation

|

Attributes |

North America Artificial Intelligence (AI) in Drug Discovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Artificial Intelligence (AI) in Drug Discovery Market Trends

“AI-Driven Drug Discovery Platforms for Personalized Medicine”

- A major and accelerating trend in the North America AI in drug discovery market is the growing integration of AI-driven platforms to support personalized medicine, enabling pharmaceutical companies to tailor therapies based on individual genetic profiles and disease characteristics. This trend is transforming how drugs are discovered, developed, and matched to specific patient populations

- For instance, companies such as Insilico Medicine and Recursion Pharmaceuticals are leveraging AI to identify drug candidates for genetically defined subpopulations, enhancing the precision and efficiency of drug development. These platforms use AI to analyze omics data, predict patient-specific responses, and accelerate the selection of optimal compounds

- AI technologies, including machine learning and deep learning, are being used to mine vast datasets to uncover previously hidden associations between genetic mutations and disease pathways. This capability is especially valuable in oncology and rare diseases, where individualized treatments are essential

- The use of AI in modeling disease mechanisms and drug interactions contributes to the development of targeted therapies, reducing trial-and-error phases in clinical testing. Moreover, AI platforms integrated with patient EHRs, clinical trial databases, and genomic data enhance the personalization of treatment plans

- Companies such as BioXcel Therapeutics and Atomwise are developing AI solutions that automate hypothesis generation and lead identification, reducing both the cost and duration of drug discovery. These intelligent systems are fostering a shift from traditional broad-spectrum drug development to highly personalized therapeutic strategies

- This trend toward AI-powered precision medicine is reshaping expectations in the drug discovery sector. As a result, North American pharmaceutical and biotech firms are rapidly investing in AI capabilities to remain competitive and deliver more effective, patient-centered treatments

North America Artificial Intelligence (AI) in Drug Discovery Market Dynamics

Driver

“Rising R&D Investments and Demand for Accelerated Drug Development”

- The Increasing investments in healthcare R&D, alongside the growing demand to shorten drug discovery timelines and reduce associated costs, are key drivers fueling the adoption of AI in drug development across North America

- For instance, in May 2024, Pfizer announced a partnership with Tempus to use AI-driven analytics for real-time clinical trial optimization, underscoring the industry's shift toward data-centric drug discovery strategies

- AI applications enable researchers to screen vast chemical libraries, predict drug-such asness, and simulate drug-target interactions in silico, thereby minimizing the reliance on costly and time-consuming lab trials

- The urgent need for novel therapeutics, particularly in areas such as oncology and neurodegenerative diseases, is prompting pharmaceutical companies to leverage AI to accelerate candidate identification and enhance pipeline productivity

- In addition, AI enables better drug repurposing, reducing development risk by identifying new indications for already-approved compounds. These factors collectively contribute to stronger R&D ROI and faster innovation cycles, making AI indispensable to the modern pharmaceutical landscape in North America

Restraint/Challenge

“Data Privacy Concerns and Regulatory Complexity”

- Despite its transformative potential, the adoption of AI in drug discovery faces notable hurdles, including concerns over data privacy and regulatory compliance. As AI systems rely heavily on sensitive health and genomic data, ensuring data security and meeting regulatory standards are paramount challenges

- High-profile incidents of healthcare data breaches and growing scrutiny over AI decision-making transparency have raised concerns among stakeholders regarding the ethical and legal implications of AI applications in life sciences

- For instance, the use of patient genetic data in AI algorithms must comply with frameworks such as HIPAA and GDPR, which impose strict controls over data access and sharing, often slowing AI deployment

- Furthermore, the lack of standardized guidelines for AI validation in drug development complicates regulatory approval. While agencies such as the FDA are working on adaptive pathways for digital tools, many AI models still face challenges in proving clinical relevance and reproducibility

- Addressing these barriers through robust data governance, explainable AI frameworks, and industry-wide regulatory alignment will be crucial for ensuring sustained adoption and trust in AI-driven drug discovery solutions

North America Artificial Intelligence (AI) in Drug Discovery Market Scope

The market is segmented on the basis of application, technology, drug type, offering, indication, and end use.

- By Application

On the basis of application, the North America artificial intelligence (AI) in drug discovery market is segmented into novel drug candidates, drug optimization and repurposing, preclinical testing and approval, drug monitoring, finding new diseases-associated targets and pathways, understanding disease mechanisms, aggregating and synthesizing information, formation and qualification of hypotheses, de novo drug design, finding drug targets of an old drug, and others. The novel drug candidates segment dominated the market with the largest market revenue share of 26.3% in 2024, driven by its ability to streamline early-stage discovery through predictive algorithms that generate new compounds with therapeutic potential

The de novo drug design segment is anticipated to witness the fastest growth rate of 20.8% from 2025 to 2032, fueled by the advancement of generative AI models capable of designing novel molecular structures. This application allows for the rapid creation of drug candidates that meet specific biological and chemical criteria, driving innovation in personalized and targeted therapies.

- By Technology

On the basis of technology, the North America artificial intelligence (AI) in drug discovery market is segmented into machine learning, deep learning, natural language processing (NLP), and others. The machine learning segment held the largest market revenue share of 38.7% in 2024, driven by its widespread use in predictive modeling, compound–target interaction mapping, and optimizing lead identification processes. Machine learning algorithms form the foundation of most AI platforms used in modern drug discovery.

The deep learning segment is expected to witness the fastest CAGR of 21.4% from 2025 to 2032, supported by its superior performance in recognizing complex biological patterns and analyzing high-dimensional datasets. Deep learning is increasingly used in imaging, omics data interpretation, and disease mechanism modeling, driving its rapid adoption across biotech and pharma R&D.

- By Drug Type

On the basis of drug type, the North America artificial intelligence (AI) in drug discovery market is segmented into small molecule and large molecule. The small molecule segment dominated the market with the largest market revenue share of 64% in 2024, driven by its ease of synthesis, scalability, and suitability for AI-based virtual screening. Small molecules are widely used due to their ability to penetrate cells and modulate intracellular targets, making them ideal candidates for AI-guided optimization and discovery.

The large molecule segment is expected to witness the fastest CAGR from 2025 to 2032, particularly in therapeutic areas such as oncology and immunology, where AI is being used to design complex biologics and monoclonal antibodies with high specificity and potency.

- By Offering

On the basis of offering, the North America artificial intelligence (AI) in drug discovery market is segmented into software and services. The software segment held the largest market revenue share of 59.4% in 2024, driven by the increasing demand for AI-powered platforms that assist in data integration, molecule prediction, and workflow automation. These platforms play a critical role in accelerating R&D timelines and reducing drug development costs.

The services segment is expected to witness the fastest CAGR from 2025 to 2032, as pharmaceutical companies increasingly outsource AI-based discovery and analytics tasks to specialized providers. This trend is particularly strong among small- to mid-sized biotechs lacking in-house computational capabilities.

- By Indication

On the basis of indication, the North America artificial intelligence (AI) in drug discovery market is segmented into immuno-oncology, neurodegenerative diseases, cardiovascular diseases, metabolic diseases, and others. The immuno-oncology segment dominated the market with the largest market revenue share of 31.8% in 2024, driven by the growing demand for targeted cancer therapies and AI's capability to model immune responses and optimize checkpoint inhibitor development.

The neurodegenerative diseases segment is expected to witness the fastest growth rate of 22.6% from 2025 to 2032, fueled by the increasing prevalence of conditions such as Alzheimer's and Parkinson’s disease. AI is playing a vital role in understanding complex neurological pathways, identifying biomarkers, and predicting patient-specific responses to treatments.

- By End Use

On the basis of end use, the North America artificial intelligence (AI) in drug discovery market is segmented into contract research organizations (CROs), pharmaceutical and biotechnology companies, research centers and academic institutes, and others. The pharmaceutical and biotechnology companies segment dominated the market with the largest market revenue share of 47.1% in 2024, driven by high adoption of AI technologies to enhance R&D productivity, improve target identification, and reduce clinical trial failures. These companies are investing heavily in proprietary AI tools and collaborative platforms to gain competitive advantages in drug development.

The contract research organizations (CROs) segment is anticipated to witness the fastest growth rate of 21.3% from 2025 to 2032, owing to the growing trend of outsourcing AI-enabled drug discovery services. CROs are increasingly integrating AI into their offerings to provide cost-effective and scalable discovery solutions to pharmaceutical clients.

North America Artificial Intelligence (AI) in Drug Discovery Market Regional Analysis

- The U.S. dominated the North America artificial intelligence (AI) in drug discovery market with the largest revenue share of 48.7% in 2024, characterized by advanced healthcare infrastructure, early adoption of AI technologies, and strong collaborations between pharmaceutical companies and AI-focused tech firms

- Companies in the U.S. are leveraging AI to accelerate drug discovery processes, optimize compound screening, and develop personalized therapies, benefiting from access to extensive clinical and genomic datasets and collaborative research environments

- This dominance is further supported by favorable regulatory initiatives, significant venture capital funding, and a large pool of AI and biomedical talent, reinforcing the U.S. position as the primary engine of innovation in AI-driven drug discovery across the North America region

U.S. Artificial Intelligence (AI) in Drug Discovery Market Insight

The U.S. artificial intelligence (AI) in drug discovery market captured the largest revenue share in 2024 within North America, driven by high R&D spending, strong adoption of advanced technologies, and a robust pharmaceutical and biotech landscape. U.S.-based companies are leading in leveraging AI for target identification, lead optimization, and personalized drug development. Collaborations between AI tech firms and life sciences companies, along with access to large clinical and genomic datasets, further propel the market. Regulatory support, including adaptive frameworks by the FDA for AI tools, also contributes to sustained innovation and market dominance.

Canada Artificial Intelligence (AI) in Drug Discovery Market Insight

The Canada artificial intelligence (AI) in drug discovery market is projected to grow at a significant CAGR throughout the forecast period, fueled by increasing government support for AI research, growth in life sciences, and a rising number of academic-industry collaborations. Canadian institutions are at the forefront of AI innovation, applying advanced machine learning and natural language processing tools to accelerate drug discovery. The country’s focus on personalized healthcare and innovation-friendly regulatory policies is expected to boost adoption across pharmaceutical, biotech, and research sectors.

Mexico Artificial Intelligence (AI) in Drug Discovery Market Insight

The Mexico artificial intelligence (AI) in drug discovery market is expected to expand steadily over the forecast period, driven by improving healthcare infrastructure, increased digitization, and rising investments in medical research. Though at a nascent stage compared to the U.S. and Canada, Mexico is gradually embracing AI technologies in drug development through partnerships with global firms and research institutions. Government initiatives to strengthen the biotech sector and enhance technological capabilities are such asly to support long-term market growth, particularly in early-stage discovery and drug repurposing efforts

North America Artificial Intelligence (AI) in Drug Discovery Market Share

The North America Artificial Intelligence (AI) in Drug Discovery industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Insilico Medicine, Inc. (U.S.)

- Atomwise Inc. (U.S.)

- Recursion Pharmaceuticals, Inc. (U.S.)

- Schrödinger, Inc. (U.S.)

- BenevolentAI Ltd. (U.K.)

- Exscientia Ltd. (U.K.)

- XtalPi Inc. (U.S.)

- Cloud Pharmaceuticals, Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- IBM Corporation (U.S.)

- PathAI, Inc. (U.S.)

- Deep Genomics Inc. (Canada)

- BioAge Labs, Inc. (U.S.)

- Cyclica Inc. (Canada)

- Valo Health, Inc. (U.S.)

- Verge Genomics, Inc. (U.S.)

- BenchSci Analytics Inc. (Canada)

- Roivant Sciences Ltd. (Bermuda)

- AbCellera Biologics Inc. (Canada)

What are the Recent Developments in North America Artificial Intelligence (AI) in Drug Discovery Market?

- In May 2024, Pfizer Inc. announced an expanded partnership with Tempus, a leader in AI and precision medicine, to integrate real-time AI-driven analytics into its oncology clinical trials. This collaboration aims to accelerate patient identification and optimize trial protocols, reinforcing Pfizer’s commitment to AI-enabled drug development and personalized medicine initiatives across the U.S.

- In April 2024, Insilico Medicine, a U.S.-based biotech company utilizing AI for drug discovery, revealed the initiation of a Phase I clinical trial for a novel AI-designed drug targeting idiopathic pulmonary fibrosis. This milestone marks one of the first AI-generated drug candidates to reach human trials, highlighting the growing maturity and potential of AI platforms in transforming early-stage discovery into viable therapies

- In February 2024, Atomwise Inc., headquartered in California, entered into a multi-target drug discovery collaboration with Sanofi. This partnership leverages Atomwise’s AI-based structure-based drug design capabilities to identify novel small molecule candidates. The agreement emphasizes the pharmaceutical industry’s increasing reliance on AI to address complex therapeutic targets more efficiently

- In January 2024, XtalPi Inc., a U.S.-China dual-headquartered AI drug discovery company, announced the launch of its North America Innovation Center in Boston, Massachusetts. The new center will focus on quantum physics-based molecular modeling and generative AI for novel drug design, further positioning Boston as a hub for biotech innovation and expanding XtalPi’s capabilities in AI-powered R&D

- In December 2023, Recursion Pharmaceuticals, a Salt Lake City-based clinical-stage biotechnology company, secured a partnership with NVIDIA to integrate high-performance computing and AI to accelerate the discovery of therapeutics across rare diseases. This collaboration reflects the convergence of AI, large-scale biology, and computational platforms to unlock faster and more scalable drug discovery pipelines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.