North America Artificial Turf Market

Market Size in USD Billion

CAGR :

%

USD

1.40 Billion

USD

5.90 Billion

2024

2032

USD

1.40 Billion

USD

5.90 Billion

2024

2032

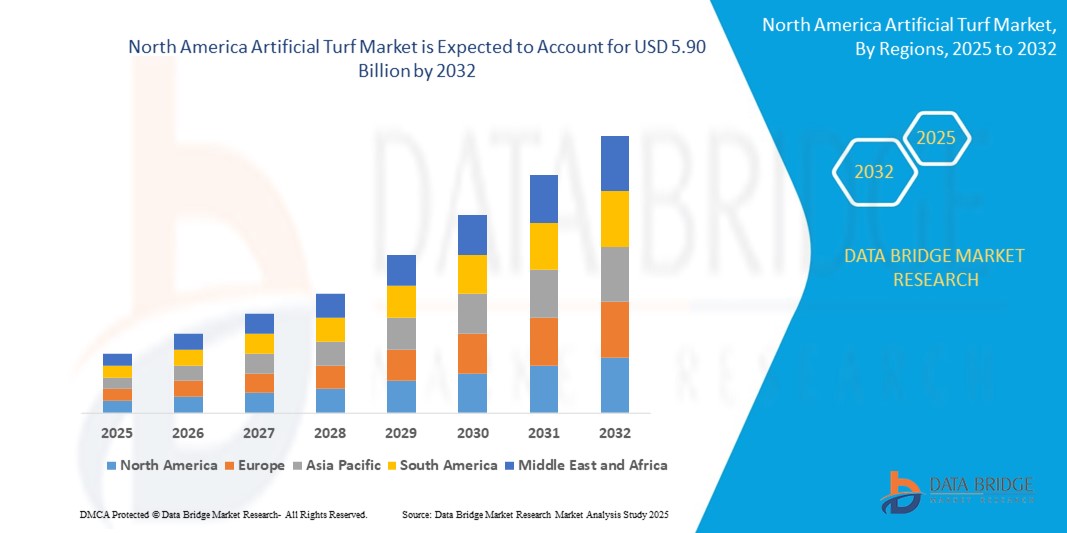

| 2025 –2032 | |

| USD 1.40 Billion | |

| USD 5.90 Billion | |

|

|

|

|

North America Artificial Turf Market Size

- The North America artificial turf market size was valued at USD 1.40 billion in 2024 and is expected to reach USD 5.90 billion by 2032, at a CAGR of 19.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for low-maintenance landscaping solutions across sports facilities, residential lawns, and commercial spaces

- Rising environmental concerns and water conservation efforts are encouraging the shift from natural grass to artificial turf, especially in regions facing water scarcity and high maintenance costs

North America Artificial Turf Market Analysis

- The North America artificial turf market is experiencing consistent growth as sports facilities and schools increasingly adopt synthetic surfaces for durability and lower upkeep. This shift reflects a broader trend toward cost-effective, all-weather playing fields across various applications

- Innovation in fiber technology and infill materials is improving turf performance, offering more realistic textures and better safety features. These advancements are helping manufacturers meet the expectations of professional and recreational users alike

- U.S. artificial turf market held the largest revenue share in North America in 2024, driven by high demand across residential lawns, commercial landscapes, and sports facilities

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America artificial turf market due to rising investments in urban development, growing emphasis on eco-friendly alternatives, and increased application of artificial turf in public recreational spaces, schools, and municipal playgrounds

- Polyethylene holds the largest market revenue share in 2024, driven by its excellent durability, softness, and UV resistance, making it a preferred choice for residential lawns and sports fields

Report Scope and North America Artificial Turf Market Segmentation

|

Attributes |

North America Artificial Turf Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

North America Artificial Turf Market Trends

“Rising Preference for Sustainable and Eco-Friendly Turf Solutions”

- Manufacturers are focusing on recyclable materials and non-toxic infills to meet growing consumer preference for sustainable solutions, as seen in brands offering lead-free and fully recyclable turf products in the U.S.

- Artificial turf is being adopted in drought-prone areas such as California and parts of Australia, where public parks and residential landscapes are replacing natural grass to conserve water resources

- Sports facilities, including major European football stadiums and school athletic fields in Japan, are increasingly installing bio-based or partially recycled turf systems to reduce environmental impact

- The rise in green building certifications, such as LEED and BREEAM, is encouraging the use of eco-friendly landscaping solutions, pushing real estate developers to choose artificial turf that aligns with sustainability goals

North America Artificial Turf Market Dynamics

Driver

“Increasing Demand for Low-Maintenance Landscaping Solutions”

- The artificial turf market is growing due to the increasing demand for landscaping options that require minimal maintenance and upkeep

- Unlike natural grass, artificial turf eliminates the need for regular watering, mowing, and chemical treatments, saving both time and resources

- It provides a long-lasting, visually consistent solution that suits residential, commercial, institutional, and sports environments

- Water-scarce regions are increasingly adopting synthetic turf to reduce water consumption and maintenance expenses

- For instance, the Los Angeles Department of Water and Power offers a rebate of $5 per square foot to customers who replace their lawns with sustainable landscaping, encouraging the adoption of artificial turf as a water-saving measure

Restraint/Challenge

“Environmental and Health Concerns Related to Synthetic Materials”

- Environmental and health concerns are becoming a major challenge in the artificial turf market due to the presence of chemicals and microplastics in traditional turf materials

- Synthetic turfs made with crumb rubber infill, often sourced from recycled tires, may release harmful substances into soil and air over time

- Safety concerns are growing, especially for children and athletes regularly exposed to these surfaces in playgrounds, schools, and sports arenas

- Limited recyclability and landfill accumulation from worn-out artificial turf are prompting regulatory and public scrutiny in many regions

- For instance, municipalities in the Netherlands and the U.S. such as Montgomery County, Maryland, have introduced regulations or proposed bans on crumb rubber infill to address health and contamination concerns from synthetic turf systems

North America Artificial Turf Market Scope

The North America artificial turf market is segmented on the basis of raw material, infill materials, pile height, distribution channel, and end-user.

- By Raw Material

On the basis of raw material, the North America artificial turf market is segmented into nylon, polypropylene, polyethylene, polyamides, jute, rubber, and others. Polyethylene holds the largest market revenue share in 2024, driven by its excellent durability, softness, and UV resistance, making it a preferred choice for residential lawns and sports fields.

Nylon is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, due to its high resilience and ability to retain shape under heavy foot traffic, making it suitable for commercial and sports applications.

- By Infill Materials

On the basis of infill material, the North America artificial turf market is segmented into petroleum-based, organic infill, sand (silica) infill, and others based on infill materials. Petroleum-based infill dominates the market in 2024 because of its affordability and shock-absorbing properties, enhancing safety on sports surfaces.

Organic infill is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, fuelled by increasing demand for eco-friendly and non-toxic alternatives in environmentally conscious regions.

- By Pile Height

On the basis of pile height, the North America artificial turf market is categorized into less than 10 mm, 10-30 mm, 30-50 mm, 50-70 mm, 70-100 mm, and more than 100 mm. The 30-50 mm segment held the largest revenue share in 2024, favored for its natural appearance and balance between comfort and durability, widely used in residential and commercial landscapes.

Longer pile heights above 70 mm is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, especially for sports and leisure applications requiring enhanced cushioning.

- By Distribution Channel

On the basis of distribution channel, the North America artificial turf market is divided into direct sales/B2B, e-commerce, specialty stores, convenience stores, and others. Direct sales/B2B segment dominated in 2024, driven by bulk purchases from sports organizations and commercial projects.

E-commerce is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, as consumers increasingly prefer online shopping for convenience and access to a wide product range.

- By End-User

On the basis of end-user, the North America artificial turf market is segmented by end-user into households, sports and leisure, restaurants, hotels, airports, commercial offices, pet areas, and others. Households accounted for the largest revenue share in 2024, attributed to rising adoption of artificial turf for low-maintenance landscaping.

The sports and leisure segment is expected to witness the fastest growth rate during the forecast period from 2025 to 2032, with expanding investments in sports infrastructure and increasing popularity of synthetic turf fields worldwide.

North America Artificial Turf Market Regional Analysis

- The U.S. artificial turf market held the largest revenue share in North America in 2024, driven by high demand across residential lawns, commercial landscapes, and sports facilities

- Increasing water conservation efforts in states such as California and Arizona are accelerating the shift from natural to synthetic grass solutions

- The sports sector plays a vital role, with artificial turf widely adopted in stadiums and training grounds due to its low maintenance and all-weather usability

- Technological advancements in fiber quality and infill materials are enhancing durability, safety, and aesthetics, further supporting market expansion across the country

Canada Artificial Turf Market Insight

Canada is expected to witness the fastest growth rate during the forecast period from 2025 to 2032. This growth is primarily driven by rising urbanization and increased investments in public parks, school playgrounds, and recreational infrastructure. Additionally, growing environmental awareness and government initiatives promoting water conservation are encouraging both residential and commercial users to adopt artificial turf solutions. The country’s cold climate further supports this trend, as artificial turf offers a durable, green, and low-maintenance landscaping option that remains functional throughout the year.

North America Artificial Turf Market Share

The North America Artificial Turf industry is primarily led by well-established companies, including:

- Dow (U.S.)

- Act Global (Subsidiary of BIG) (U.S.)

- SpectraTurf, Inc. (U.S.)

- EnvyLawn (U.S.)

- XGrass (U.S.)

- Matrix Turf (U.S.)

- Shawgrass (U.S.)

- Synthetic Turf International (U.S.)

Latest Developments in North America Artificial Turf Market

- In February 2024, Act North America celebrates 20 years of innovation, impacting 90+ countries with inclusive, sustainable solutions. With recognition from NFL to FIFA, Act North America remains committed to enhancing performance, safety, and community well-being. As it looks ahead, Act North America reaffirms its dedication to addressing current challenges and building a sustainable future

- In October 2021, Sport Group and BASF teamed up to introduce eco-friendly outdoor flooring made with Infinergy. This material is durable and environmentally friendly. Sport Group will install it in playgrounds and sports facilities worldwide. It is a part of their efforts to make safer and more sustainable places for people to play and exercise

- In June 2021, Victoria PLC acquired Cali. This acquisition will expand Cali's product offerings, provide access to new markets, and ensure financial support and operational infrastructure. Cali will continue to operate autonomously, maintaining its commitment to excellence, sustainability, and customer satisfaction

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Artificial Turf Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Artificial Turf Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Artificial Turf Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.