North America Assisted Living Software Market

Market Size in USD Billion

CAGR :

%

USD

19.19 Billion

USD

36.33 Billion

2024

2032

USD

19.19 Billion

USD

36.33 Billion

2024

2032

| 2025 –2032 | |

| USD 19.19 Billion | |

| USD 36.33 Billion | |

|

|

|

|

North America Assisted Living Software Market Analysis

The increasing elderly population is significantly boosting demand for assisted living solutions, as more seniors require support with daily activities and healthcare needs. This demographic shift is prompting the development and adoption of specialized software designed to efficiently manage care, enhance resident well-being, and streamline facility operations. Assisted living facilities are leveraging technology to improve service delivery, ensure regulatory compliance, and optimize resource allocation. Hence, increasing elderly population boosts demand for assisted living solutions is expected to drive the market growth.

Assisted Living Software Market Size

North America Assisted Living Software Market size was valued at USD 19.19 billion in 2024 and is projected to reach USD 36.33 billion by 2032, with a CAGR of 8.30% during the forecast period of 2025 to 2032.

Assisted Living Software Market Trends

“Integrating Software with Existing EHR and Healthcare Systems”

Integrating software with existing Electronic Health Records (EHR) and healthcare systems is crucial for modernizing health care facilities. This integration allows for seamless data exchange, improving the accuracy and accessibility of patient information. It enhances care coordination by providing caregivers with real-time access to medical histories, treatment plans, and medication records.

In today's market, Seamless integration of EHS software with existing EHR and healthcare systems significantly benefits the North America assisted living software market. It enhances operational efficiency by synchronizing safety protocols with health records, ensuring real-time updates and compliance. This leads to improved care quality and streamlined administrative processes, fostering growth in the market by enabling assisted living facilities to deliver safer, more coordinated care while minimizing administrative overhead.

Report Scope and Market Segmentation

|

Attributes |

Assisted Living Software Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada, Mexico |

|

Key Market Players |

PointClickCare (Canada), MatrixCare (U.S.), ALAdvantage, LLC (U.S.), Senior Insight Inc. (U.S.), Eldermark (U.S.), Medtelligent, Inc. (U.S.), iCareManager, LLC (U.S.), Storii, Inc. (U.S.), CareVoyant Inc. (U.S.), BROOKDALE SENIOR LIVING INC. (U.S.), INTELLICHIEF (U.S.), AUGUST HEALTH (U.S.), ORACLE (U.S.), Smartlinx, LLC (U.S.), and ShiftCare (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Assisted Living Software Market Definition

Assisted living software is a specialized digital tool designed to streamline the management and operational aspects of assisted living facilities, which provide care for elderly or disabled individuals who need assistance with daily activities but do not require the full-time medical care offered by nursing homes. This software integrates various functionalities, such as Electronic Health Records (EHR), medication management, resident monitoring, and compliance tracking, to improve the quality of care, enhance staff efficiency, and ensure regulatory adherence. By automating routine tasks and providing real-time data, assisted living software enables caregivers and administrators to deliver personalized care while optimizing operational processes.

Assisted Living Software Market Dynamics

Drivers

- Increasing Elderly Population Boosts Demand for Assisted Living Solutions

The increasing elderly population is significantly boosting demand for assisted living solutions, as more seniors require support with daily activities and healthcare needs. This demographic shift is prompting the development and adoption of specialized software designed to efficiently manage care, enhance resident well-being, and streamline facility operations. Assisted living facilities are leveraging technology to improve service delivery, ensure regulatory compliance, and optimize resource allocation. As the aging population grows, the need for robust and integrated solutions continues to rise, driving innovation in the industry. These advancements are crucial for meeting the complex needs of elderly residents and supporting caregivers. The trend underscores the importance of investing in technologies that enhance the quality of care and operational efficiency in assisted living environments.

- Integrating Software with Existing EHR and Healthcare Systems

Integrating software with existing Electronic Health Records (EHR) and healthcare systems is crucial for modernizing health care facilities. This integration allows for seamless data exchange, improving the accuracy and accessibility of patient information. It enhances care coordination by providing caregivers with real-time access to medical histories, treatment plans, and medication records. In addition, it streamlines administrative processes, reducing paperwork and minimizing errors. By leveraging this integrated approach, aged care providers can deliver more efficient, personalized care, ensuring better outcomes for residents while optimizing operational efficiency and regulatory compliance.

Opportunities

- Leveraging AI and Machine Learning for Predictive Analytics

Leveraging AI and machine learning for predictive analytics can significantly enhance assisted living software by enabling facilities to anticipate and address residents' needs more proactively. These technologies can analyze vast amounts of data to identify patterns and predict potential health issues, allowing caregivers to intervene early and improve resident outcomes. Additionally, predictive analytics can optimize resource allocation, reduce operational costs, and improve staffing efficiency by forecasting demand and workload. By integrating AI-driven insights, assisted living facilities can deliver more personalized and effective care, ultimately boosting the overall quality of service.

- Partnerships with Healthcare Providers

Partnerships with healthcare providers are increasingly vital for advancing assisted living software, as they facilitate the integration of comprehensive health data and specialized care solutions into digital platforms. Such collaborations enable assisted living software to incorporate real-time medical insights, enhance predictive analytics, and streamline care coordination, ensuring that software solutions are aligned with the latest healthcare practices and regulations. This synergy between technology and healthcare expertise improves the accuracy and effectiveness of care delivery but also fosters a more cohesive approach to managing resident health, ultimately leading to better outcomes and increased satisfaction in assisted living environments.

Restraints/Challenges

- High Initial Costs Affecting Adoption in Smaller Facilities

High initial costs are a significant barrier to the adoption of advanced remote monitoring technologies in smaller assisted living facilities. These facilities often struggle with budget constraints, making it challenging to invest in sophisticated systems that require substantial upfront expenditure. As a result, smaller facilities may delay or forgo the implementation of these technologies, potentially missing out on the benefits of enhanced patient care and operational efficiency. Addressing these cost concerns through scalable solutions or financial incentives could facilitate broader adoption and improve overall care quality in the sector.

- Interoperability Issues with Existing Systems

Interoperability issues with existing systems pose significant challenges for assisted living software. Many facilities use a mix of outdated or disparate systems that do not communicate effectively, leading to fragmented data and inefficient operations. This lack of integration can hinder the seamless exchange of information between various software platforms, impacting care coordination and administrative efficiency. Addressing these interoperability challenges requires advanced software solutions capable of integrating with existing systems, enabling smooth data flow, and enhancing overall functionality.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Assisted Living Software Market Scope

The market is segmented on the basis of solution, facility type, deployment type, platform, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Solution

- Electronic Health Records

- Billing, Invoicing & Scheduling Software

- Clinical Decision Support Systems

- Remote Patient Monitoring Systems

- E-Prescribing

- Real-Time Location Systems

- Others

Facility Type

- Community-Based Residential Facility

- Residential Care Apartment Complex

- Adult Family Home

- Others

Platform

- Mobile

- PC/MAC

Deployment Type

- Cloud-Based

- On Premises

Application

- Appointment Scheduling

- Resource Allocation

- Documentation of Services

Assisted Living Software Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, solution, facility type, deployment type, platform, and application as referenced above.

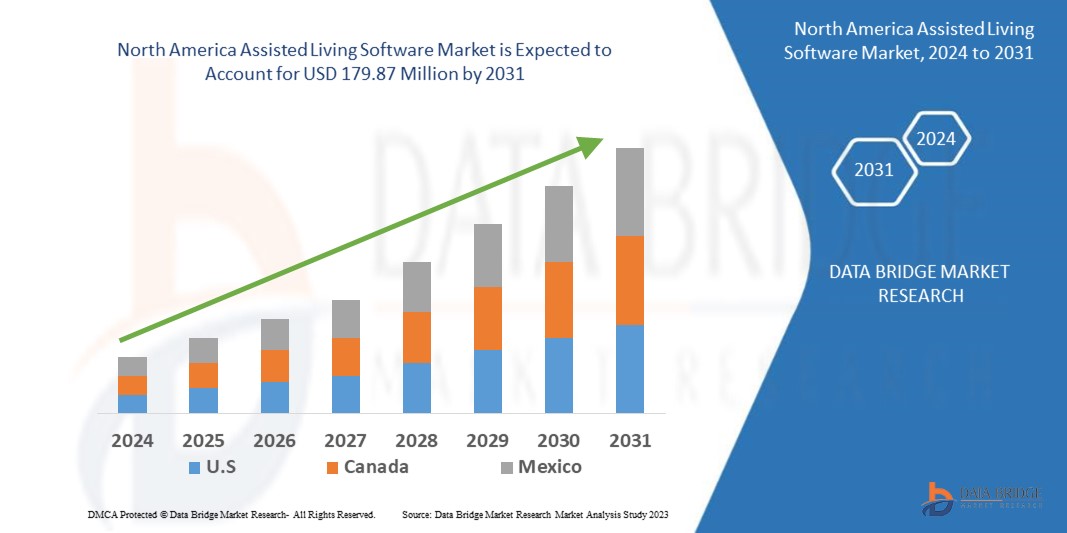

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate the market due to its larger aging population, higher adoption of advanced healthcare technologies, and substantial investment in senior care facilities compared to Canada and Mexico.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Assisted Living Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Assisted Living Software Market Leaders Operating in the Market Are:

- PointClickCare (Canada)

- MatrixCare (U.S.)

- ALAdvantage, LLC (U.S.)

- Senior Insight Inc. (U.S.)

- Eldermark (U.S.)

- Medtelligent, Inc. (U.S.)

- iCareManager, LLC (U.S.)

- Storii, Inc. (U.S.)

- CareVoyant Inc. (U.S.)

- BROOKDALE SENIOR LIVING INC. (U.S.)

- INTELLICHIEF (U.S.)

- AUGUST HEALTH (U.S.)

- ORACLE (U.S.)

- Smartlinx, LLC (U.S.)

- ShiftCare (U.S.)

Latest Developments in Assisted Living Software Market

- In November 2023, Eldermark launched Eldermark Next Academy to provide comprehensive training and support for senior care professionals. The initiative aimed to enhance staff skills and knowledge in using Eldermark’s solutions. This launch improved user proficiency and strengthened the overall effectiveness of company software in senior living communities

- In May 2023, Medtelligent, Inc. has teamed up with TapRoot Interventions & Solutions to incorporate TapRoot’s Ella behavior planning platform into its ALIS eHR software, improving care management in senior living communities with targeted interventions for behavioral reactions. This partnership allows Medtelligent to enhance ALIS with advanced behavior planning features, streamline data management, boost caregiver effectiveness, and support alternative payment models, resulting in better care outcomes and increased operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.