North America Autonomous Forklift Market Analysis and Size

Autonomous forklifts are also known as self-propelled forklifts that lift goods without human assistance. All storage services can be handled individually. This eliminates the need for human labour for warehouse operations. Defects introduced by human intervention in warehouse operations can be conveniently managed with the advent of automated forklifts. The rapid growth of the logistics and construction industries has increased the demand for autonomous devices. The need to handle heavy loads in material handling and supply chains is driving the demand for automated forklifts. Advances in technology have also increased the efficiency of industrial trucks. Automated forklifts make a significant contribution to optimizing intralogistics processes. This ensures that the right part is always in the right place at the right time. This technology helps drivers to avoid potential hazards by calculating the safest maneuver in difficult situations, which will significantly reduce accidents.

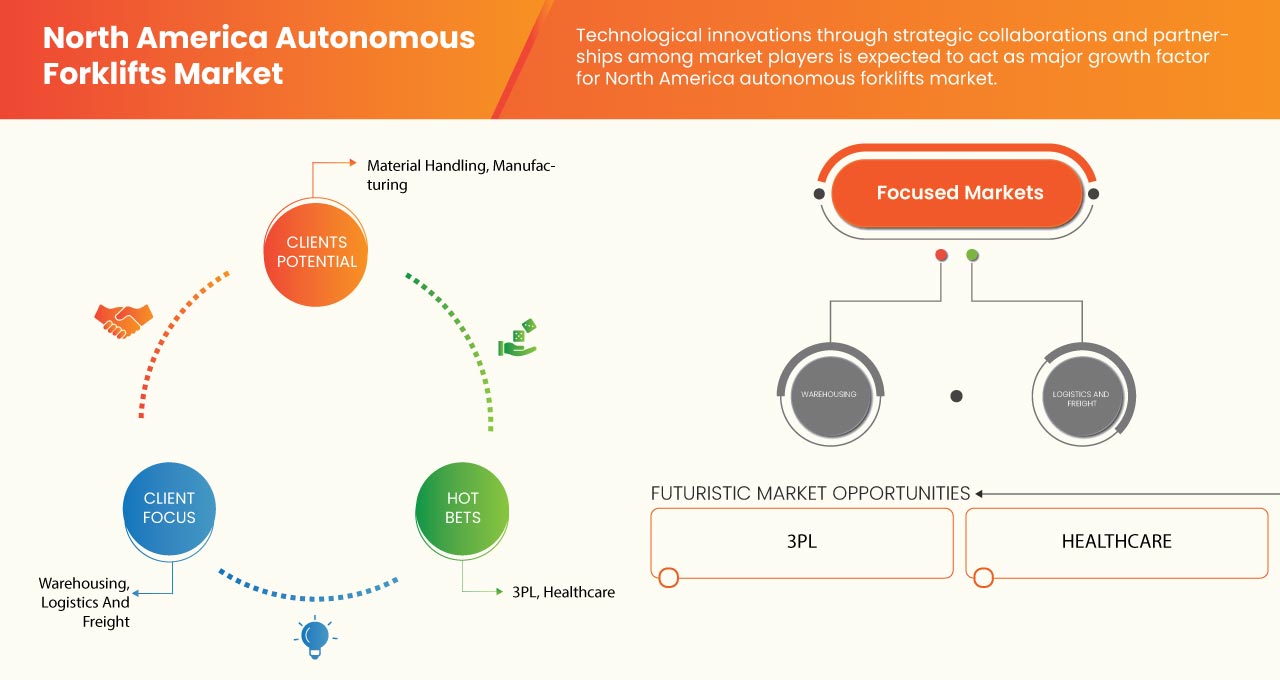

For this, various market players are introducing new products and forming a partnership to expand their business in autonomous forklift market.

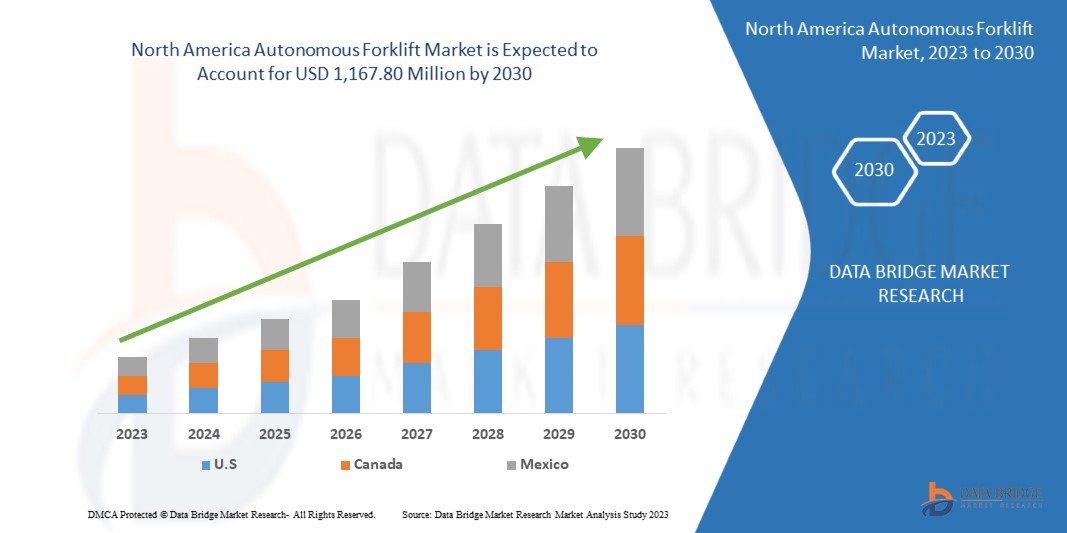

Data Bridge Market Research analyses that the North America autonomous forklift market is expected to reach a value of USD 1,167.80 million by 2030, at a CAGR of 7.2% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Sales Channel (Leasing, In-House Purchase), Application (Material Handling, Warehousing, Logistics & Freight, Manufacturing, and Others), Industry (3PL, E-Commerce, Automotive, Metal & Heavy Machinery, Food and Beverages, Semiconductor & Electronics, Paper & Pulp Industry, Aviation, Healthcare, and Others), Navigation Technology (Laser Guidance, Magnetic Guidance, Inductive Guidance, Vision Guidance, Optical Tape Guidance, and Others) |

|

Country Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Oceaneering International, Inc and Seegrid Corporation |

Market Definition

Autonomous forklifts are the powered machines that are capable of transporting heavy loads from one place to another. These are designed to be capable of carrying maximum loads of weight in the warehouses. These are capable of load and unloading with requiring any human intervention. Therefore, autonomous forklifts help to minimize human errors and reduce the probability of industrial accidents.

Rapid industrialization and growth and expansion of construction industry are the two major factors fostering growth in the demand for autonomous forklifts. Rising demand for machines that can load and unload heavy weights in the warehouses is further inducing growth of autonomous forklifts. Increasing cases of warehouse accidents and human errors is also bolstering the growth of market.

North America Autonomous Forklift Market Dynamics

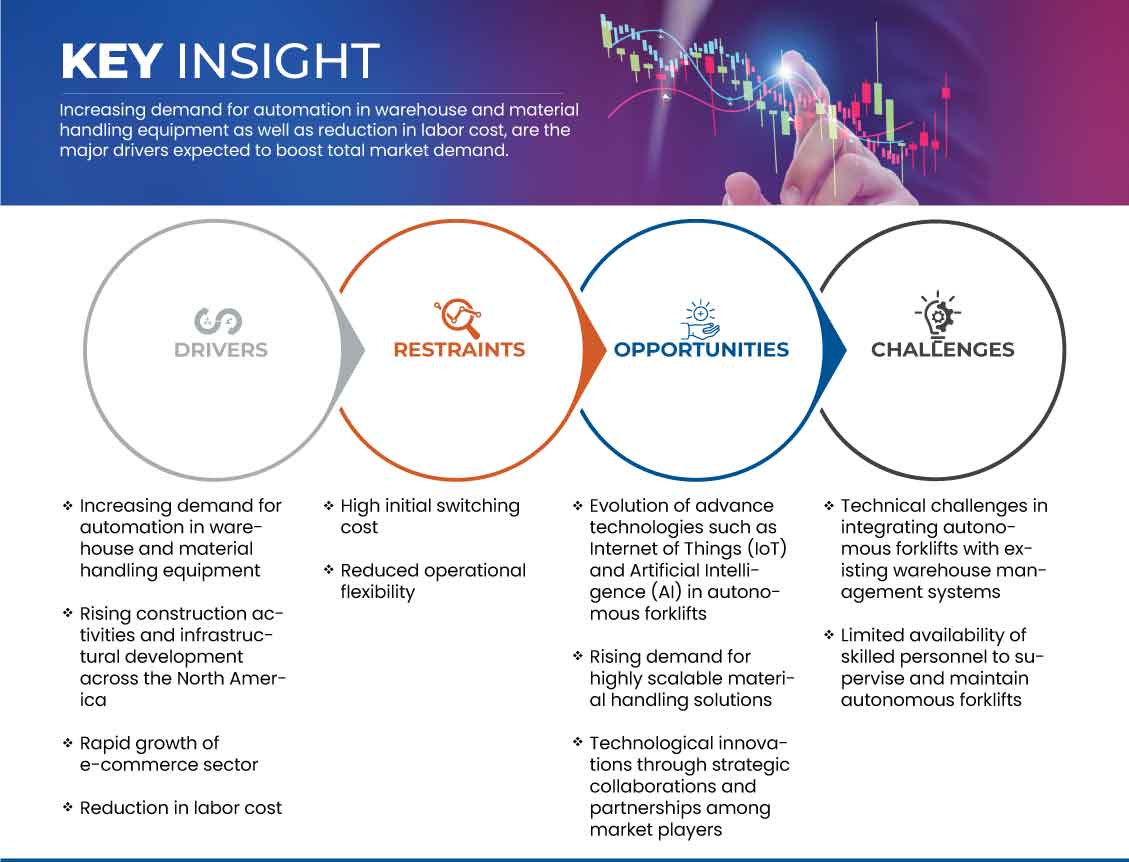

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Increasing demand for automation in warehouse and material handling equipment

Automation forklifts in warehouse and material handling equipment have revolutionized the way these operations are carried due to a growing demand over time. Automation forklifts have become an essential component of modern material handling and logistics operations as a result of technological advancements. This enables businesses to:-

- Increased efficiency and productivity: Automation forklifts can move and store materials faster and with greater precision than human operators, which can save time and labor. The operations of the warehouse and material handling become more productive and efficient as a result of this

- Improved safety: Forklift mishaps are a significant reason for workplace injuries and fatalities, and computerization forklifts can assist with decreasing the risk of accidents by eliminating the need for human operators. They can also be programmed to operate safely at all times by adhering to stringent safety procedures

- Increased flexibility: Programmable automation forklifts can be set up to transport materials, stack and organize inventory, pick and place products, and transport goods. They are ideal for use in a variety of warehouses due to their adaptability

- Improved accuracy: Automation forklifts can be programmed to operate with extreme precision, ensuring that materials are moved and stored appropriately. This can help reduce errors and improve the accuracy of inventory management

Rising construction activities and infrastructural development across north america

The use of autonomous forklifts is one of the main factors behind the significant expansion of the construction and logistics sectors in North America. Advanced sensors and cameras in autonomous forklifts enable them to operate without human intervention, resulting in increased productivity, increased safety, and decreased labour costs. How autonomous forklifts are changing construction and logistics in North America:-

- Improved Productivity: The ability of autonomous forklifts to operate 24/7 without breaks without taking breaks is one of their primary advantages. This prompts expanded efficiency and quicker finish of development projects. Autonomous forklifts are versatile tools for construction and logistics operations because they can load and unload materials, transport materials to various locations, and stack materials. With independent forklifts, development organizations can finish projects quicker and more effectively than any other time

- Increased Safety: Advanced cameras and sensors are included in autonomous forklifts so that they can avoid collisions and detect obstacles. Because of this, they are safer to operate than conventional forklifts, which require a human operator to manoeuvre around obstacles. The sensors and cameras on autonomous forklifts allow them to detect obstacles in real-time and adjust their path to avoid collisions. This reduces the risk of accidents and injuries on construction sites, making them safer for workers

Opportunity

- Rising demand for highly scalable material handling solutions

The need for greater goods movement efficiency, speed, and accuracy has led to a significant shift in the logistics and material handling industries in recent years. The rising demand for highly scalable material handling solutions that are able to adapt to shifting business requirements and keep up with the growing demands of e-commerce is one of the most important trends in this industry.

The number of packages and parcels being shipped around the world has increased as a result of the rise of e-commerce. As a result, warehouse operators and logistics companies are under a lot of pressure to make their operations more efficient and deliver goods faster than ever before. Material handling solutions that are highly scalable, adaptable, and flexible have become increasingly in demand as a result. Scalability is a critical factor in material handling systems because it enables businesses to adjust their operations quickly and efficiently in response to changes in demand. For example, during top peak seasons or sales events, organizations might have to handle altogether higher volumes of packages than expected. These surges in demand can be accommodated by highly scalable material handling solutions without requiring significant alterations to the underlying infrastructure.

Restraint/Challenge

- High initial switching cost

The logistics industry has the potential to be transformed by autonomous forklifts, but widespread adoption may be hindered by the high initial switching costs. Because autonomous navigation requires specialized sensors, cameras, and other equipment, the technology itself can be expensive. Costs may also rise further due to the technology's proprietary nature.

Additionally, significant integration with existing warehouse management systems (WMS), ERP systems, and other logistics software is required for the implementation of autonomous forklifts. This integration can be difficult, expensive, and requires specialized resources and expertise. A significant expense can also be incurred when specialized training and support are required. The autonomous forklifts' continued operation necessitates ongoing support and maintenance, which can drive up costs even further.

Post-COVID-19 Impact on North America Autonomous Forklift Market

The autonomous forklift market noted a gradual decrease in demand due to lockdown and COVID-19 governmental laws, as manufacturing facilities and services were closed. Even private and public development was called off. Moreover, the industry was also affected by halt of supply chain especially of raw materials used in the manufacturing process of autonomous forklift. Stringent government regulations for different industries, restrictions on trade & transportation were some of the top factors that had cause dent towards the growth of the market for autonomous forklift around the world in 2020 and in first two quarters of 2021. As the autonomous forklift production slowed down owing to the restrictions by the governments across the globe, the production was not meeting the demand in the first three quarters of 2020. Thus, this had not only led to the hike in the demand but also increased the cost of the product.

Recent Developments

- In April 2023, Oceaneering International, Inc announces the availability of new supervisory software for its fleet of autonomous mobile robots by its Mobile Robotics division. The software platform can be used for a wide range of things, from assembly lines to intricate logistical flows that span multiple floors in different buildings

- In October 2022, Seegrid Corporation announces strategic partnership with Koops Automation Systems a main frameworks integrator gaining practical experience in modern mechanization for assembling conditions. Koops is able to expand their product offering by introducing their clients to the entire line of autonomous mobile robots known as Seegrid Palion and Fleet Central enterprise software solutions because of the collaboration agreement. Such partnership helps the company to develop according to customer requirements

North America Autonomous Forklift Market Scope

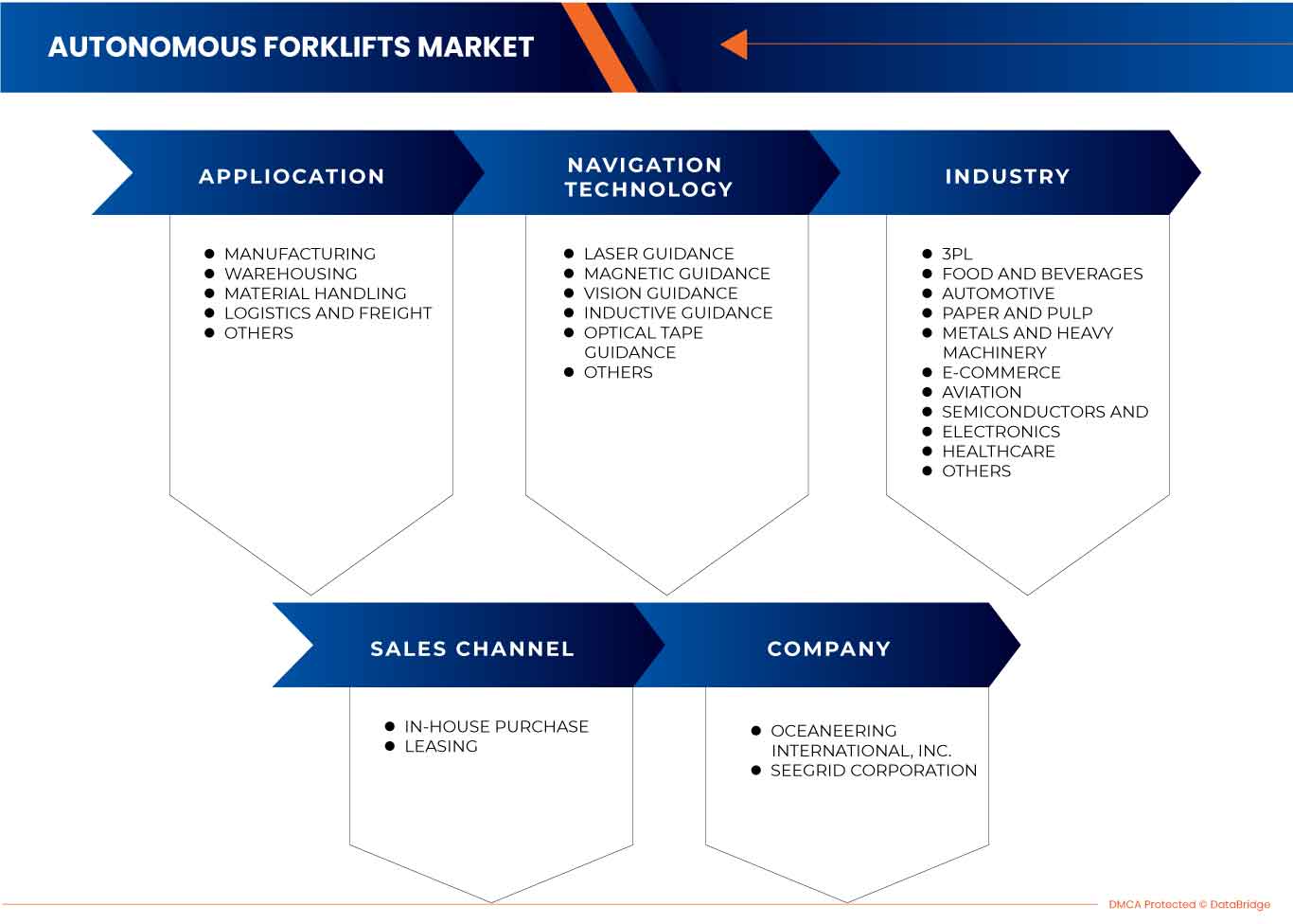

North America autonomous forklift market is analysed, and market size insights and trends are provided by industry, navigation technology, application, and sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

North America Autonomous Forklift Market, By Sales Channel

- Leasing

- In-House Purchase

On the basis of sales channel, the North America autonomous forklift market is segmented into leasing & in-house purchase.

North America Autonomous Forklift Market, By Application

- Material Handling

- Warehousing

- Logistics & Freight

- Manufacturing

- Others

On the basis of application, the North America autonomous forklift market is segmented into material handling, warehousing, logistics & freight, manufacturing, and others.

North America Autonomous Forklift Market, By Industry

- 3PL

- E-Commerce

- Automotive

- Metal & Heavy Machinery

- Food and Beverages

- Semiconductor & Electronics

- Paper & Pulp Industry

- Aviation

- Healthcare

- Others

On the basis of industry, the North America autonomous forklift market is segmented into 3PL, e-commerce, automotive, metal & heavy machinery, food and beverages, semiconductor & electronics, paper & pulp industry, aviation, healthcare, and others.

North America Autonomous Forklift Market, By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Inductive Guidance

- Vision Guidance

- Optical Tape Guidance

- Others

On the basis of navigation technology, the North America autonomous forklift market is segmented into laser guidance, magnetic guidance, inductive guidance, vision guidance, optical tape guidance, and others.

North America Autonomous Forklift Market Regional Analysis/Insights

North America autonomous forklift market is analysed, and market size insights and trends are provided by region, industry, navigation technology, application, and sales channel, as referenced above.

The country covered in the North America autonomous forklift market report are U.S., Canada, & Mexico. U.S. dominates in the region due to high demand of forklifts across the logistic industries.

The region section of the report also provides individual market-impacting factors and changes in market regulation that affect the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and North America Autonomous Forklift Market Share Analysis

North America autonomous forklift market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to autonomous forklift market.

Some of the major players operating in the North America autonomous forklift market are Oceaneering International, Inc, and Seegrid Corporation.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 PREMIUM INSIGHTS

1.1 MARKET DEFINATION

1.2 VALUE CHAIN ANALYSIS

1.3 CASE STUDY

1.3.1 AUTONOMOUS FORKLIFTS STACK CHEESE BOXES USING 3D TIME-OF-FLIGHT

1.3.2 HOBURNE HOLIDAYS CASE STUDY

1.3.3 MILTON CAT ACHIEVES UP TO 50% IMPROVED ORDER FULFILLMENT

1.4 REGULATORY FRAMEWORK

1.4.1 ANSI/ITSDF

1.4.2 ISO STANDARDS

1.5 TECHNOLOGICAL TRENDS

1.6 PRICING ANALYSIS

1.7 SUPPLY CHAIN ANALYSIS

2 MARKET OVERVIEW

2.1 DRIVERS

2.1.1 INCREASING DEMAND FOR AUTONOMOUS IN WAREHOUSE AND MATERIAL HANDLING EQUIPMENT

2.1.2 RISING CONSTRUCTION ACTIVITIES AND INFRASTRUCTURAL DEVELOPMENT ACROSS NORTH AMERICA

2.1.3 RAPID GROWTH OF THE E-COMMERCE SECTOR

2.1.4 REDUCTION IN LABOR COST

2.2 RESTRAINTS

2.2.1 HIGH INITIAL SWITCHING COST

2.2.2 REDUCED OPERATIONAL FLEXIBILITY

2.3 OPPORTUNITIES

2.3.1 EVOLUTION OF ADVANCED TECHNOLOGIES SUCH AS THE INTERNET OF THINGS (IOT) AND ARTIFICIAL INTELLIGENCE (AI) IN AUTONOMOUS FORKLIFTS

2.3.2 RISING DEMAND FOR HIGHLY SCALABLE MATERIAL HANDLING SOLUTIONS

2.3.3 TECHNOLOGICAL INNOVATIONS THROUGH STRATEGIC COLLABORATIONS AND PARTNERSHIPS AMONG MARKET PLAYERS

2.4 CHALLENGES

2.4.1 TECHNICAL CHALLENGES IN INTEGRATING AUTONOMOUS FORKLIFTS WITH EXISTING WAREHOUSE MANAGEMENT SYSTEMS

2.4.2 LIMITED AVAILABILITY OF SKILLED PERSONNEL TO SUPERVISE AND MAINTAIN AUTONOMOUS FORKLIFTS

3 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL

3.1 OVERVIEW

3.2 LEASING

3.3 IN-HOUSE PURCHASE

4 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION

4.1 OVERVIEW

4.2 MATERIAL HANDLING

4.3 WAREHOUSING

4.4 LOGISTICS & FREIGHT

4.5 MANUFACTURING

4.6 OTHERS

5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY

5.1 OVERVIEW

5.2 3PL

5.3 E-COMMERCE

5.4 AUTOMOTIVE

5.5 METAL & HEAVY MACHINERY

5.6 FOOD AND BEVERAGES

5.7 SEMICONDUCTOR & ELECTRONICS

5.8 PAPER & PULP INDUSTRY

5.9 AVIATION

5.1 HEALTHCARE

5.11 OTHERS

6 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY

6.1 OVERVIEW

6.2 LASER GUIDANCE

6.3 MAGNETIC GUIDANCE

6.4 INDUCTIVE GUIDANCE

6.5 VISION GUIDANCE

6.6 OPTICAL TAPE GUIDANCE

6.7 OTHERS

7 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET:BY COUNTRIES

7.1 U.S.

7.2 CANADA

7.3 MEXICO

8 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

9 COMPANY PROFILE

9.1 OCEANEERING INTERNATIONAL, INC

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 SEEGRID CORPORATION

9.2.1 COMPANY SNAPSHOT

9.2.2 PRODUCT PORTFOLIO

9.2.3 RECENT DEVELOPMENTS

List of Table

TABLE 1 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 6 U.S. AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 7 U.S. AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 U.S. AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 9 U.S. AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 10 CANADA AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 11 CANADA AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 12 CANADA AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 13 CANADA AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 14 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 15 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 17 MEXICO AUTONOMOUS FORKLIFTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 TOTAL CONSTRUCTION IN THE UNITED STATES

FIGURE 2 E-COMMERCE RETAIL SALES IN UNITED STATES

FIGURE 3 EMPLOYMENT COST INDEX IN UNITED STATES

FIGURE 4 NEW ORDERS OF MATERIAL HANDLING EQUIPMENT IN THE UNITED STATES

FIGURE 5 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: SNAPSHOT (2022)

FIGURE 6 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2022)

FIGURE 7 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 8 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 9 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: BY SALES CHANNEL (2023-2030)

FIGURE 10 NORTH AMERICA AUTONOMOUS FORKLIFTS MARKET: 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.