North America Background Check Market

Market Size in USD Billion

CAGR :

%

USD

1.91 Billion

USD

4.90 Billion

2024

2032

USD

1.91 Billion

USD

4.90 Billion

2024

2032

| 2025 –2032 | |

| USD 1.91 Billion | |

| USD 4.90 Billion | |

|

|

|

Background Check Market Analysis

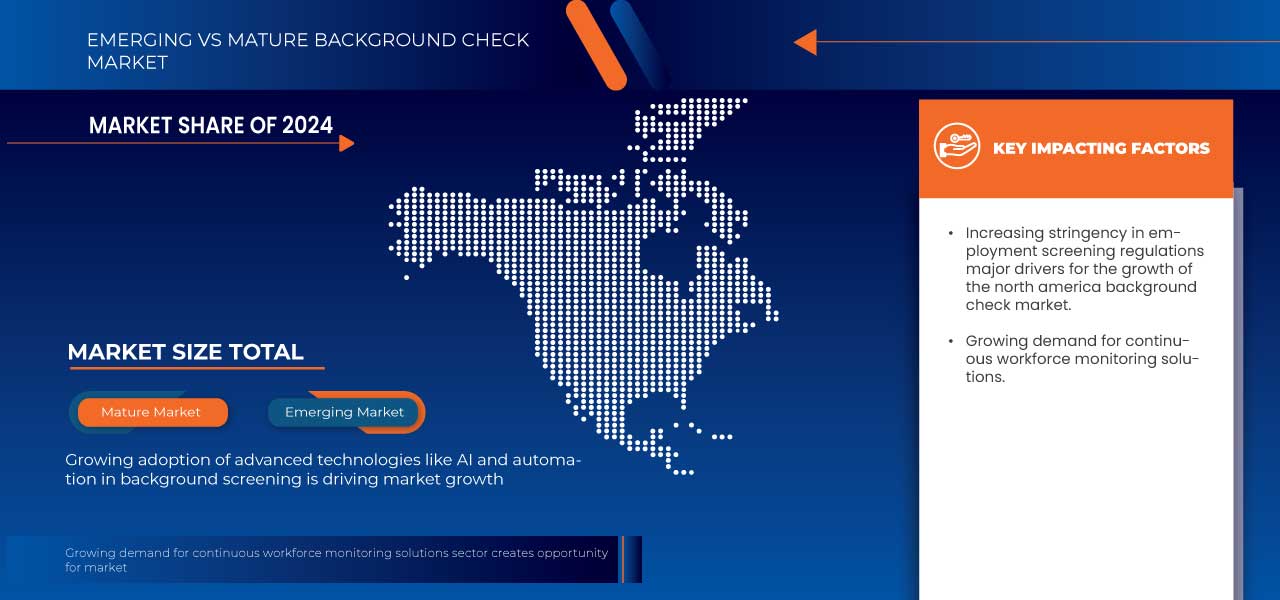

The North America background check market comprises solutions and services designed to verify individual and organizational credentials across industries such as employment, finance, healthcare, and rental housing. These solutions leverage advanced technologies, including artificial intelligence, machine learning, and blockchain, to enhance accuracy, automate processes, and ensure compliance with regulatory frameworks such as the Fair Credit Reporting Act (FCRA) and General Data Protection Regulation (GDPR). The market is driven by increasing concerns over workplace security, fraud prevention, and stringent hiring regulations. The adoption of AI-driven background screening and real-time verification is rising, reflecting the shift towards more efficient and automated solutions. However, challenges such as data privacy concerns, integration complexities, and high compliance costs persist. Opportunities exist in expanding digital identity verification, biometric authentication, and cross-border background screening, supporting the region’s growing demand for secure and transparent verification processes.

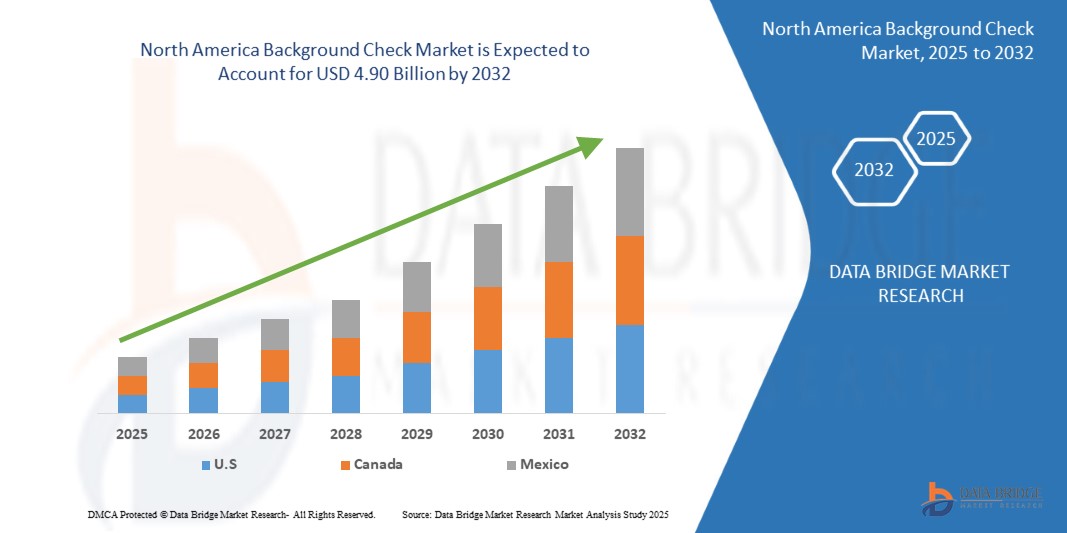

Background Check Market Size

North America background check market size was valued at USD 1.91 billion in 2024 and is projected to reach USD 4.90 billion by 2032, with a CAGR of 12.6% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Background Check Market Trends

“Rising Adoption Of Ai-Driven Background Screening

The North America background check market market is witnessing a significant shift towards AI-driven screening solutions. As organizations prioritize efficiency, accuracy, and compliance, artificial intelligence and machine learning are being integrated into background verification processes to streamline identity verification, criminal record checks, and employment history validation. These technologies help reduce manual errors, accelerate turnaround times, and enhance fraud detection capabilities. Additionally, the increasing need for continuous monitoring and real-time verification in sectors like finance, healthcare, and gig economy platforms is driving demand. As regulatory scrutiny tightens and digital transformation accelerates, AI-powered background checks are poised to become a standard in the industry..

Report Scope and Background Check Market Segmentation

|

Attributes |

Background Check Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico |

|

Key Market Players |

GoodHire (A PART OF CHECKR), Accurate Background, Sterling, a First Advantage company, Paycom Payroll LLC., Rentec Direct, Xref, Certn, Skuad, HireRight, LLC., Spokeo, Inc., TrustID, Kroll, LLC. , MeridianLink, First Advantage, and Ondato among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Background Check Market Definition

A background check is a process used to verify an individual's personal, professional, and criminal history to assess their credibility and trustworthiness. It typically includes identity verification, employment and education history, credit reports, and criminal record checks. Background checks are widely used in employment screening, tenant verification, financial services, government security clearances, and gig economy platforms. Businesses and organizations rely on these checks to ensure compliance with regulatory requirements, mitigate risks, and make informed hiring or partnership decisions. With advancements in digital verification and AI-driven solutions, background checks have become more efficient, accurate, and essential across various industries.

Background Check Market Dynamics

Drivers

Increasing Stringency in Employment Screening Regulations

The North America background check market is driven by the increasing stringency in employment screening regulations, as governments and regulatory bodies enforce stricter compliance standards. Employers across industries must now conduct thorough background screenings to ensure workplace safety, mitigate risks, and adhere to federal, state, and industry-specific regulations. With laws such as the Fair Credit Reporting Act (FCRA) and Ban-the-Box legislation evolving, companies are compelled to adopt more transparent and legally compliant hiring practices, fueling the demand for advanced screening solutions

As regulatory scrutiny intensifies, businesses are leveraging technology-driven background check services to streamline compliance while maintaining efficiency in the hiring process. Automated screening solutions, AI-powered identity verification, and real-time criminal record checks help organizations meet regulatory requirements without delays. The growing emphasis on data security and privacy further reinforces the need for reliable, legally compliant screening providers, positioning the background check market for sustained growth

For instance,

- In September 2024, according to the article published by DISA Global Solutions Inc., state compliance laws for employers are becoming increasingly complex, with stricter regulations on background checks, data privacy, wage transparency, and AI usage in hiring. The article highlights enforcement actions and significant penalties imposed on businesses failing to comply with these evolving laws across various states. The tightening of employment screening regulations is driving the demand for advanced background check solutions. As states introduce more stringent laws and higher fines, businesses are compelled to adopt more comprehensive and compliant screening practices. This trend is accelerating the adoption of automated and AI-driven background check systems, helping organizations navigate evolving legal requirements and fueling market growth

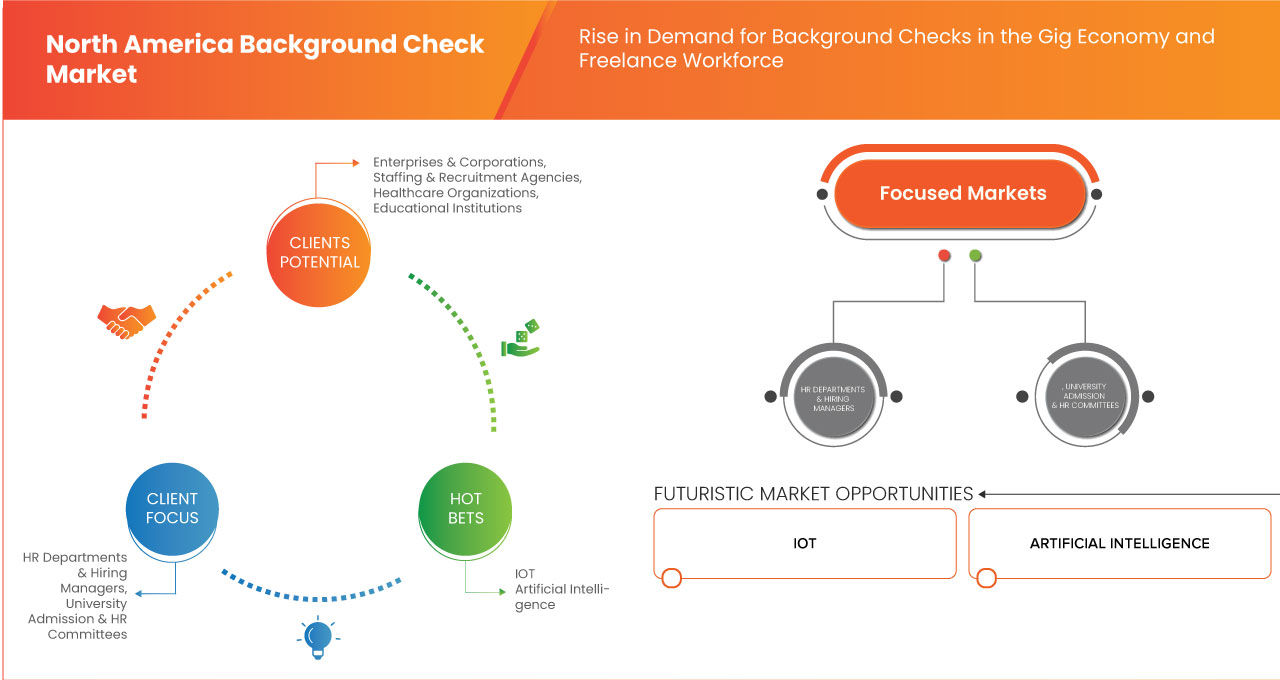

Rise in Demand for Background Checks in the Gig Economy and Freelance Workforce

The rise of the gig economy and freelance workforce is driving increased demand for background checks in North America. As businesses increasingly rely on independent contractors, temporary workers, and remote professionals, ensuring trust and security has become a priority. Companies in industries such as ride-sharing, delivery services, and on-demand platforms require thorough screening to verify credentials, criminal records, and work history. This growing reliance on flexible labor has pushed organizations to adopt comprehensive background check solutions to mitigate risks and maintain a safe work environment

With gig workers often operating outside traditional employment structures, background screening providers are developing faster, more scalable solutions tailored to this workforce. AI-driven verification, real-time database checks, and automated compliance tracking enable businesses to vet large numbers of freelancers efficiently. As concerns over fraud, identity theft, and workplace security rise, the demand for reliable screening processes will continue to fuel growth in the North America background check market

For instance,

- In March 2023, according to the article published by HR Today, the rise of gig work, with 36% of American workers now in independent contracting, is driving demand for efficient background checks. As companies adapt to non-traditional employment, they are investing in automation, identity verification, and seamless hiring workflows to reduce candidate drop-off and attract talent. With 85% of gig workers considering withdrawing from complex hiring processes, businesses must implement streamlined background screening to stay competitive. This shift is shaping the North American background check market, increasing demand for advanced, mobile-friendly, and rapid screening solutions

Opportunities

Growing Demand for Continuous Workforce Monitoring Solutions

The growing demand for continuous workforce monitoring solutions presents a significant opportunity in the North America background check market. Businesses are increasingly shifting from one-time pre-employment screenings to ongoing employee monitoring to mitigate risks, ensure workplace safety, and comply with evolving regulatory requirements. Industries such as healthcare, finance, and transportation, where trust and compliance are critical, are driving the adoption of real-time background checks and continuous criminal record monitoring. Advanced technologies, including AI-powered risk assessments and automated data updates, are enhancing the efficiency and accuracy of workforce monitoring solutions

As organizations focus on maintaining a secure and compliant workforce, background check providers are leveraging automation and data analytics to offer seamless and proactive monitoring. This shift not only helps companies detect potential risks earlier but also strengthens overall workforce integrity. The demand for continuous monitoring is further fueled by remote and hybrid work models, which require ongoing verification of employee credentials and background history. With increasing regulatory scrutiny and a focus on risk mitigation, businesses are prioritizing solutions that offer real-time insights, positioning continuous workforce monitoring as a key growth driver in the background check market

For Instance:

- In April 2021, according to the article published by Recruiting Daily, the demand for continuous workforce monitoring is increasing, driven by the rise of remote work, gig employment, and higher employee turnover since the pandemic. Businesses are prioritizing ongoing screening to mitigate risks related to workplace safety, fraud, and compliance. This growing need presents a significant opportunity for background check providers in North America. As companies focus on real-time risk assessment to enhance workplace security and regulatory compliance, the demand for automated and AI-driven monitoring services is rising. Background check firms can leverage this trend by expanding their offerings to include continuous screening, ensuring businesses have up-to-date insights into employee conduct

Expansion of Background Checks into Social Media and Digital Footprint Analysis

The expansion of background checks into social media and digital footprint analysis presents a significant opportunity for the North America background check market. Employers are increasingly recognizing the value of assessing a candidate’s online presence to identify potential risks, verify credentials, and ensure cultural alignment with the organization. With the rise of remote work and digital interactions, traditional background checks alone may no longer provide a complete picture of an individual’s behavior, making social media screening a crucial addition to hiring and risk management strategies

Advancements in AI and data analytics have made it easier to analyze vast amounts of digital content efficiently while ensuring compliance with privacy laws. Businesses are leveraging automated tools to scan public social media profiles, blogs, and online activity for red flags such as hate speech, violent behavior, or unethical conduct. As companies seek more holistic and real-time insights into candidates and employees, the demand for digital footprint analysis is expected to grow, driving innovation and expansion in the background check industry

For instance-

- In September 2024, according to the article published by Statescoop, Ferretly, a social-media background check startup, is expanding its services to screen election workers ahead of the U.S. presidential election. The platform analyzes social media activity for extremist or offensive content, assisting government agencies and political organizations in maintaining ethical and security standards. This move underscores the rising demand for background checks that incorporate social media and digital footprint analysis in North America. As organizations focus on reputation management and risk mitigation, background check providers can capitalize on AI-driven solutions to enhance screening processes and drive market growth

Restraints/Challenges

Rising Consumer Concerns Over Privacy and Consent

Rising consumer concerns over privacy and consent are becoming a major challenge for the North American background check market. With growing awareness of data security risks, individuals are increasingly questioning how their personal information is collected, stored, and shared by background check companies. High-profile cases of inaccurate reports, misuse of personal data, and lack of proper consent mechanisms have fueled distrust, prompting calls for stronger regulations. Consumers are demanding more control over their data, including clear opt-out options, transparency in data sourcing, and mechanisms to dispute incorrect records. This shift in consumer sentiment is pressuring background check providers to adopt ethical data practices and comply with stricter privacy standards.

In response to these concerns, regulatory bodies such as the FTC are cracking down on non-compliant background check companies, imposing fines and enforcing stricter data accuracy requirements. However, the challenge remains in balancing privacy protections with the need for efficient screening solutions for employers and landlords. Companies must navigate evolving privacy laws while ensuring their background checks remain reliable and compliant. To regain consumer trust, firms will need to implement AI-driven verification systems, enhance data accuracy, and prioritize transparency in their processes. Failure to address these privacy concerns could lead to reputational damage, legal repercussions, and a shrinking customer base as users seek more secure and privacy-conscious alternatives.

For instance

- In September 2023 according to the article published by The Hill, inaccuracies in background checks conducted by unregulated "people search" companies have led to privacy violations and significant personal consequences. The FTC has fined TruthFinder and Instant Checkmate for failing to ensure report accuracy, signaling a move toward stricter industry regulations. Growing awareness of these errors and privacy concerns is driving consumer distrust in the background check sector. As a result, increased regulatory scrutiny, legal challenges, and demands for greater transparency are expected to reshape the North American background check market, compelling companies to implement stringent verification processes and comply with evolving privacy laws

Challenges in Screening International Candidates Due to Varying Global Regulations

The North American background check market faces significant challenges in screening international candidates due to varying global regulations on data privacy, employment verification, and criminal records. Different countries have distinct laws governing background checks, with some imposing strict data protection rules that limit access to candidate information. For example, the European Union's General Data Protection Regulation (GDPR) enforces stringent privacy standards, making it difficult for North American companies to obtain and process background data on European candidates. Similarly, countries like China and North America have restrictive policies on sharing criminal records and employment history, further complicating the verification process. These regulatory differences create inconsistencies in screening practices, leading to delays, incomplete reports, and potential compliance risks for employers.

To navigate these complexities, background check providers must adopt a region-specific approach by partnering with local agencies and legal experts to ensure compliance with international regulations. Leveraging AI-driven data verification systems and blockchain technology can help enhance the security and accuracy of cross-border background checks. Additionally, companies must stay updated on evolving global privacy laws to avoid legal penalties and maintain trust with international candidates. As the demand for global talent increases, businesses that can streamline international screening while ensuring regulatory compliance will gain a competitive advantage in securing a diverse and qualified workforce.

For instance:

- In January 2025, according to the article published by First Advantage, the demand for global tech hiring is increasing due to talent shortages in established markets, the rising need for AI skills, and the growing preference for remote work. However, this expansion brings significant challenges, including fraud risks, compliance complexities, and the need for consistent background screening across different regions. In the North American tech sector, screening international candidates is particularly challenging due to diverse legal and cultural regulations. Varying privacy laws, restrictions on criminal record checks, and differing compliance requirements make it difficult to establish a standardized screening process. To address these issues, companies must stay updated on regional laws, provide multilingual support, and implement digital identity verification tools to ensure compliance and security. Without a strong framework, inconsistencies in screening could result in legal risks, hiring delays, and reputational damage

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Background Check Market Scope

The North America Background Check Market is segmented into five notable segments based on the offering, deployment model, organization size, operating system and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

North America Background Check Market, By Offering

- Service

- Type

- Training And Consulting

- Integration And Implementation

- Support And Maintenance

- Type

- Solution

- Type

- Background Screening

- Type

- Identity Check

- Criminal Background

- Employment Verification

- Education Verification

- Drug And Alcohol Testing

- Professional License Verification

- Credit/Financial

- Driving/Vehicle Record

- Social Media

- Sex Offender Registry

- Others

- Type

- Compliance Management

- Reporting And Statistics

- Others

- Background Screening

- Type

North America Background Check Market, By Deployment Model

- Cloud

- On Premise

North America Background Check Market, By Organization Size

- Large Enterprises

- Type

- Public Organization

- Private Organisation

- Govenrment Organization

- Non-Profit Organization

- Type

- Cloud

- On Premise

- Type

- Small And Medium Size Enterprise (Smes)

- Type

- Public Organization

- Private Organisation

- Government Organization

- Non-Profit Organization

- Type

- Cloud

- On Premise

- Type

North America Background Check Market, By Operating System

- Windows

- Mac

- Mobile

- Type

- Ios

- Android

- Type

- Linux

North America Background Check Market, By Application

- Commerical

- Type

- Banking, Financial Service And Insurance

- Healthcare And Life-Science

- Transportation

- Offices

- Retail

- Education

- Hospitality

- Others

- Type

- Offering

- Services

- Type

- Support And Maintenance

- Integration And Implementation

- Training And Consulting

- Type

- Solution

- Type

- Background Screening

- Type

- Identity Check

- Criminal Background

- Employment Verification

- Education Verification

- Drug And Alcohol Testing

- Professional License Verification

- Credit/Financial

- Driving/Vehicle Record

- Social Media

- Sex Offender Registry

- Others

- Type

- Background Screening

- Compliance Management

- Reporting And Statistics

- Others

- Type

- Services

- Industrial

- Type

- Manufacturing

- It And Bpo

- Construction

- Consumer Goods

- Energy And Utilities

- Gaming

- Media And Entertainment

- Others

- Type

- Offering

- Services

- Type

- Support And Maintenance

- Integration And Implementation

- Training And Consulting

- Type

- Solution

- Type

- Background Screening

- Type

- Identity Check

- Criminal Background

- Employment Verification

- Education Verification

- Drug And Alcohol Testing

- Professional License Verification

- Credit/Financial

- Driving/Vehicle Record

- Social Media

- Sex Offender Registry

- Others

- Type

- Background Screening

- Compliance Management

- Reporting And Statistics

- Others

- Type

- Services

Background Check Market Regional Analysis

The market is analyzed and market size insights and trends are provided by offering, deployment model, organization size, operating system and application as referenced above.

The countries covered in the market are U.S., Canada, Mexico.

U.S. is expected to dominate the North America background check market due to its large workforce, strict employment regulations, and high adoption of background screening services across industries like finance, healthcare, and technology. The presence of major background check providers and advanced verification technologies further strengthens its market leadership. Additionally, stringent compliance requirements, such as FCRA and EEOC guidelines, drive higher demand for thorough screening processes compared to Canada and Mexico.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of South America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Background Check Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, South America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Background Check Market Leaders Operating in the Market Are:

- GoodHire (A PART OF CHECKR),

- Accurate Background,

- Sterling

- Paycom Payroll LLC.,

- Rentec Direct,

- Xref,

- Certn.,

- Skuad,

- HireRight, LLC.,

- Spokeo, Inc.,

- TrustID,

- Kroll, LLC.,

- MeridianLink,

- First Advantage, an

- Ondato

Latest Developments in North America Background Check Market

- In February 2024, Paycom expanded into the United Kingdom by launching Beti, its automated payroll solution that empowers employees to manage their own payroll. The expansion marked Paycom’s first international market outside North America, following its moves into Canada and Mexico. Beti® helped organizations reduce payroll processing time by 90% and consolidate multiple systems into one seamless platform. This move simplified HR tasks and improved efficiency for global employers.

- In November 2022, Sterling, a First Advantage company partnered with Yoti to launch an exclusive portable digital identity solution internationally. The companies integrated a digital identity verification workflow into the hiring process across EMEA and APAC, allowing employers to verify candidate identities quickly and reduce reliance on physical documents. They created a system where candidates could build a secure, reusable digital identity for multiple verification needs. This collaboration simplified pre-employment checks and streamlined onboarding, enhancing overall hiring efficiency and security.

- In November 2023, Sterling, a First Advantage company and Konfir announced a partnership to offer instant employment verifications in the UK. The collaboration aimed to speed up hiring by reducing verification times from days to seconds. Sterling, a First Advantage company combined its background screening expertise with Konfir's API-driven solution that quickly returned payroll, tax, and open banking data. This new service improved the candidate experience and streamlined the hiring process.

- In March 2024, Paycom Software, Inc. earned the Gallup Exceptional Workplace Award for the second consecutive year. It was one of just 60 organizations globally to receive the honor after Gallup workplace scientists evaluated its performance. The company prioritized employee well-being and engagement, which boosted productivity and created a thriving work culture. Paycom’s innovative HR and payroll technology streamlined processes and empowered employees with direct data access. This achievement reinforced its reputation as a leader in cloud-based human capital management solutions.

- In August 2024, Paycom Software, Inc. was named a 2024 Top HR Product by Human Resource Executive magazine for its innovative time-off request tool, GONE®. GONE automated the time-off management process with policy-compliant decisioning that reduced manual reviews and decision fatigue. It approved or denied requests based on preset rules like coverage thresholds and submission times. The tool helped companies cut costs by eliminating the average manual review expense of $30.92 per instance. This award underscored how Paycom’s enhanced automation improved efficiency and delivered stronger ROI for clients worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BACKGROUND CHECK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.1.1 INDUSTRY ANALYSIS

4.1.2 KEY DRIVERS OF GROWTH

4.1.2.1 INCREASING STRINGENCY IN EMPLOYMENT SCREENING REGULATIONS

4.1.2.2 RISE IN DEMAND FOR BACKGROUND CHECKS IN THE GIG ECONOMY AND FREELANCE WORKFORCE

4.1.3 MARKET TRENDS

4.1.4 FUTURISTIC SCENARIO (FORECAST TO 2032)

4.1.5 CONCLUSION

4.2 NEW BUSINESS AND EMERGING BUSINESS REVENUE OPPORTUNITIES

4.2.1 AI-DRIVEN BACKGROUND SCREENING SOLUTIONS

4.2.2 CLOUD-BASED BACKGROUND SCREENING PLATFORMS

4.2.3 ENHANCED DATA SECURITY AND BLOCKCHAIN SOLUTIONS

4.2.4 EMPLOYEE AND WORKFORCE MONITORING SOLUTIONS

4.2.5 CONCLUSION

4.3 PENETRATION AND GROWTH PROSPECTS MAPPING

4.3.1 MARKET PENETRATION

4.3.2 GROWTH PROSPECTS

4.3.3 REGIONAL INSIGHTS

4.3.4 CONCLUSION

4.4 TECHNOLOGY ANALYSIS

4.4.1 KEY TECHNOLOGIES

4.4.2 COMPLEMENTARY TECHNOLOGIES

4.4.3 ADJACENT TECHNOLOGIES

5 REGULATORY STANDARDS

5.1 REGULATIONS

5.2 REGULATORY AGENCIES AND AUTHORITIES

5.3 REGULATORY PROCEDURES

5.4 CLASSIFICATION OF SERVICES

5.5 STANDARD GUIDELINES

5.6 POST MARKET SURVEILLANCE

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING STRINGENCY IN EMPLOYMENT SCREENING REGULATIONS

6.1.2 RISE IN DEMAND FOR BACKGROUND CHECKS IN THE GIG ECONOMY AND FREELANCE WORKFORCE

6.1.3 GROWING ADOPTION OF ADVANCED TECHNOLOGIES LIKE AI AND AUTOMATION IN BACKGROUND SCREENING

6.1.4 INCREASING CROSS-BORDER HIRING AND IMMIGRATION-RELATED SCREENING

6.2 RESTRAINT

6.2.1 DEPENDENCE ON THIRD-PARTY DATA PROVIDERS INCREASING VULNERABILITY TO ERRORS

6.2.2 INCONSISTENCIES IN PUBLIC RECORDS AND DATA AVAILABILITY ACROSS STATES

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR CONTINUOUS WORKFORCE MONITORING SOLUTIONS

6.3.2 EXPANSION OF BACKGROUND CHECKS INTO SOCIAL MEDIA AND DIGITAL FOOTPRINT ANALYSIS

6.3.3 RISING NEED FOR BACKGROUND CHECKS IN TENANT AND RENTAL SCREENINGS

6.4 CHALLENGES

6.4.1 RISING CONSUMER CONCERNS OVER PRIVACY AND CONSENT

6.4.2 CHALLENGES IN SCREENING INTERNATIONAL CANDIDATES DUE TO VARYING GLOBAL REGULATIONS

7 NORTH AMERICA BACKGROUND CHECK MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SERVICE

7.2.1 SOLUTION

7.2.1.1 IDENTITY CHECK

7.2.1.2 CRIMINAL BACKGROUND

7.2.1.3 EMPLOYMENT VERIFICATION

7.2.1.4 DRUG AND ALCOHOL TESTING

7.2.1.5 EDUCATION VERIFICATION

7.2.1.6 PROFESSIONAL LICENSE VERIFICATION

7.2.1.7 CREDIT/FINANCIAL

7.2.1.8 DRIVING/VEHICLE RECORD

7.2.1.9 SOCIAL MEDIA

7.2.1.10 SEX OFFENDER REGISTRY

7.2.1.11 OTHERS

8 NORTH AMERICA BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISE

8.2.1 PUBLIC ORGANIZATION

8.2.2 PRIVATE ORGANIZATION

8.2.3 GOVERNMENT ORGANIZATION

8.2.4 NON-PROFIT ORGANIZATION

8.2.4.1 CLOUD

8.2.4.2 ON PREMISE

8.3 SMALL AND MEDIUM SIZE ENTERPRISES(SMES)

8.3.1 PUBLIC ORGANIZATION

8.3.2 PRIVATE ORGANIZATION

8.3.3 GOVERNMENT ORGANIZATION

8.3.4 NON-PROFIT ORGANIZATION

8.3.4.1 CLOUD

8.3.4.2 ON PREMISE

9 NORTH AMERICA BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISE

10 NORTH AMERICA BACKGROUND CHECK MARKET, BY OPERATING SYSTEM

10.1 OVERVIEW

10.2 WINDOWS

10.3 MAC

10.4 MOBILE

10.4.1 IOS

10.4.2 ANDROID

10.5 LINUX

11 NORTH AMERICA BACKGROUND CHECK MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 COMMERCIAL

11.2.1 BANKING, FINANCIAL SERVICE AND INSURANCE

11.2.2 HEALTHCARE AND LIFE-SCIENCE

11.2.3 TRANSPORTATION

11.2.4 OFFICES

11.2.5 RETAIL

11.2.6 EDUCATION

11.2.7 HOSPITALITY

11.2.8 OTHERS

11.2.9 BY OFFERING

11.2.9.1 SERVICES

11.2.9.1.1 SUPPORT AND MAINTENANCE

11.2.9.1.2 INTEGRATION AND IMPLEMENTATION

11.2.9.1.3 TRAINING AND CONSULTING

11.2.9.2 SOLUTION

11.2.9.2.1 BACKGROUND SCREENING

11.2.9.2.2 COMPLIANCE MANAGEMENT

11.2.9.2.3 REPORTING AND STATISTIC

11.2.9.2.4 OTHERS

11.2.9.2.4.1 IDENTITY CHECK

11.2.9.2.4.2 CRIMINAL BACKGROUND

11.2.9.2.4.3 EMPLOYMENT VERIFICATION

11.2.9.2.4.4 EDUCATION VERIFICATION

11.2.9.2.4.5 DRUG AND ALCOHOL TESTING

11.2.9.2.4.6 PROFESSIONAL LICENSE VERIFICATION

11.2.9.2.4.7 CREDIT/FINANCIAL

11.2.9.2.4.8 DRIVING/VEHICLE RECORD

11.2.9.2.4.9 SOCIAL MEDIA

11.2.9.2.4.10 SEX OFFENDER REGISTRY

11.2.9.2.4.11 OTHERS

11.3 INDUSTRIAL

11.3.1 MANUFACTURING

11.3.2 IT AND BPO

11.3.3 CONSTRUCTION

11.3.4 CONSUMER GOODS

11.3.5 ENERGY AND UTILITIES

11.3.6 GAMING

11.3.7 MEDIA AND ENTERTAINMENT

11.3.8 OTHERS

11.3.9 BY OFFERING

11.3.9.1 SERVICES

11.3.9.1.1 SUPPORT AND MAINTENANCE

11.3.9.1.2 INTEGRATION AND IMPLEMENTATION

11.3.9.1.3 TRAINING AND CONSULTING

11.3.9.2 SOLUTION

11.3.9.2.1 BACKGROUND SCREENING

11.3.9.2.2 COMPLIANCE MANAGEMENT

11.3.9.2.3 REPORTING AND STATISTIC

11.3.9.2.4 OTHERS

11.3.9.2.4.1 IDENTITY CHECK

11.3.9.2.4.2 CRIMINAL BACKGROUND

11.3.9.2.4.3 EMPLOYMENT VERIFICATION

11.3.9.2.4.4 EDUCATION VERIFICATION

11.3.9.2.4.5 DRUG AND ALCOHOL TESTING

11.3.9.2.4.6 PROFESSIONAL LICENSE VERIFICATION

11.3.9.2.4.7 CREDIT/FINANCIAL

11.3.9.2.4.8 DRIVING/VEHICLE RECORD

11.3.9.2.4.9 SOCIAL MEDIA

11.3.9.2.4.10 SEX OFFENDER REGISTRY

11.3.9.2.4.11 OTHERS

12 NORTH AMERICA BACKGROUND CHECK MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BACKGROUND CHECK MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 STERLING, A FIRST ADVANTAGE COMPANY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 SERVICE PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 FIRST ADVANTAGE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 HIRERIGHT, LLC

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 ACCURATE BACKGROUND

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 KROLL, LLC

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 CERTN.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 GOODHIRE (A PART OF CHECKR)

15.7.1 COMPANY SNAPSHOT

15.7.2 SERVICE PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 MERIDIANLINK

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 ONDATO

15.9.1 COMPANY SNAPSHOT

15.9.2 SERVICE PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 PAYCOM PAYROLL LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SOLUTION PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 RENTEC DIRECT

15.11.1 COMPANY SNAPSHOT

15.11.2 SOLUTION PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 SKUAD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 SPOKEO, INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 TRUSTID

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 XREF

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY ASSOCIATION RELATED TO EMPLOYMENT SCREENING

TABLE 2 NORTH AMERICA BACKGROUND CHECK MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA LARGE ENTERPRISE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA LARGE ENTERPRISE IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA SMALL AND MEDIUM SIZE ENTERPRISE(SMES) IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA SMALL AND MEDIUM SIZE ENTERPRISE(SMES) IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA BACKGROUND CHECK MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA BACKGROUND CHECK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA COMMERCIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA COMMERCIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA INDUSTRIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA INDUSTRIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA BACKGROUND CHECK MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. SERVICE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 U.S. SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 U.S. BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 U.S. BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 32 U.S. LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 U.S. LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. BACKGROUND CHECK MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. MOBILE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. BACKGROUND CHECK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 U.S. COMMERCIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 U.S. COMMERCIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 41 U.S. SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. INDUSTRIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. INDUSTRIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 CANADA BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 50 CANADA SERVICE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 CANADA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA BACKGROUND CHECK MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA MOBILE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA BACKGROUND CHECK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA COMMERCIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA COMMERCIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA INDUSTRIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA INDUSTRIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 CANADA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO SERVICE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MEXICO SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 82 MEXICO BACKGROUND CHECK MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 83 MEXICO MOBILE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MEXICO BACKGROUND CHECK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 MEXICO COMMERCIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MEXICO COMMERCIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MEXICO BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MEXICO INDUSTRIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO INDUSTRIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA BACKGROUND CHECK MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BACKGROUND CHECK MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BACKGROUND CHECK MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BACKGROUND CHECK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BACKGROUND CHECK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BACKGROUND CHECK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BACKGROUND CHECK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BACKGROUND CHECK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BACKGROUND CHECK MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA BACKGROUND CHECK MARKET: OFFERING TIMELINE CURVE

FIGURE 11 NORTH AMERICA BACKGROUND CHECK MARKET: APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA BACKGROUND CHECK MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA BACKGROUND CHECK MARKET, BY OFFERING (2024)

FIGURE 14 NORTH AMERICA BACKGROUND CHECK MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 INCREASING STRINGENCY IN EMPLOYMENT SCREENING REGULATIONS IS EXPECTED TO DRIVE THE NORTH AMERICA BACKGROUND CHECK MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 BACKGROUND SCREENING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BACKGROUND CHECK MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BACKGROUND CHECK MARKET

FIGURE 19 EXPECTED NUMBER OF FREELANCERS IN U.S. OVER THE YEARS

FIGURE 20 NORTH AMERICA BACKGROUND CHECK MARKET: BY OFFERING, 2024

FIGURE 21 NORTH AMERICA BACKGROUND CHECK MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 22 NORTH AMERICA BACKGROUND CHECK MARKET: BY DEPLOYMENT MODEL, 2024

FIGURE 23 NORTH AMERICA BACKGROUND CHECK MARKET: BY OPERATING SYSTEM, 2024

FIGURE 24 NORTH AMERICA BACKGROUND CHECK MARKET: BY APPLICATION, 2024

FIGURE 25 NORTH AMERICA BACKGROUND CHECK MARKET: SNAPSHOT (2023)

FIGURE 26 NORTH AMERICA BACKGROUND CHECK MARKET:2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.