Market Analysis and Size

Filling technology generally prefers aseptic filling technology in bag-in-box packaging machinery over non-aseptic filling technology. Aseptic filling technology extends the shelf life of the product packed inside and is thus more common in bag-in-box packaging machines than non-aseptic filling technology. Beverages will continue to account for more than half of the worldwide aseptic packaging industry. Beverage aseptic packaging is expected to gain from productivity growth as well as expanding applications.

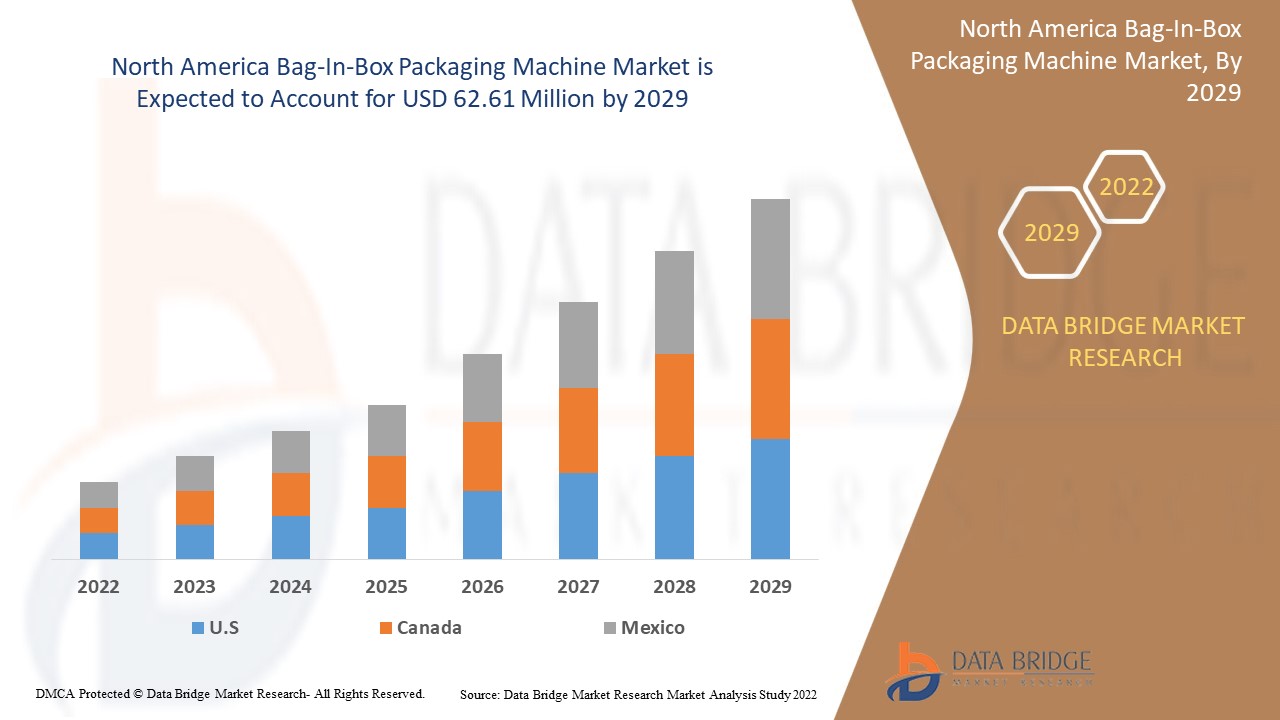

Data Bridge Market Research analyses that the North America bag-in-box packaging machine market was valued at USD 45.4 million in 2021 and is expected to reach USD 62.61 million by 2029, registering a CAGR of 4.10 % during the forecast period of 2022 to 2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Market Definition

Bag-in-box packing machines can fill plastic pillow bags with capacities ranging from 1.5 litres to 25 litres or more. Automatic bag-in-box packaging machines are in high demand since they help boost manufacturing quantity for any type of beverage in order to meet escalating demand. During the aseptic process, bag-in-box packaging is frequently utilised in the packing of processed fruit juice and dairy products. Pasteurized food in bag-in-box packaging are shelf stable and do not require refrigeration.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Machine Type (Standalone, Integrated), Automation Type (Semi-Automatic, Automatic, Manual), Packaging Material (Plastic, Paper & Paperboard, Metal, Others), Output Capacity (10 Bags/min, 11-50 Bags/min, 51-100 Bags/min, Above 100 Bags/min), Filling Technology (Aseptic, Non-Aseptic), End User (Food and Beverages, Paints and Lubricants, Personal Care, Household Products, Healthcare, Others) |

|

Countries Covered |

U.S, Canada, Mexico and Rest of North America |

|

Market Players Covered |

Liquibox (U.S), DS Smith (UK), Robert Bosch GmbH (Germany), Alfa Laval (Sweden), Engi-O (North America), Pattyn (Belgium), SACMI (Italy), Scholle IPN (U.S), Technibag (France), Franz Haniel & Cie (Germany), ProXES GmbH (Germany), Flexifill Ltd (U.K), TORR Industries (U.S), ABCO Automation, Inc (U.S), IC Filling Systems (UK), Kreuzmayr Maschinenbau GmbH (Austria), Gossamer Structures (Pty) Ltd (South Africa), Triangle Package Machinery Co (U.S), voran Maschinen GmbH (Austria), Smurfit Kappa (Ireland) |

|

Market Opportunities |

|

North America Bag-In-Box Packaging Machine Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increase the consumption of alcoholic

The growth of the market for bag-in-box packaging is influenced by rapid industrialization. The rising demand for bag-in-box packaging machines for end-use food and beverage drive the market for bag-in-box packaging machines.

- Low cost packaging with less negotiation

The cost of the purchaser to change a Bag-in-box Packaging Machine product is low and the supplier has less negotiating power. Bag-in-box Packaging Machine products are less varied and the risk of new entrants is increasing. The threat of substitutes increases with low cost change for consumers and the availability of alternative therapies.

Opportunities

- Rise in demand of eco-friendly packaging

Growth of the bag-in-box packaging machine market in the forecast period are the increases in the need for eco-friendly packaging solutions. Furthermore, the increasing requirement for aseptic packaging in food and pharmaceutical industries is further anticipated to boost the bag-in-box packaging machine market. Moreover, the increase in the consumer awareness and the increasing need for packaged food and beverages as a result of rising population is further estimated to cushion the growth of the bag-in-box packaging machine market.

Restraints/ Challenges

The negative impact of COVID-19 the cost of raw materials became high which act as market restraint and further challenge the market growth rate. Non-availability of handle support and high cost of transportation, hindered the growth of bag-in-box packaging machine market and inability to carry heavy goods are the major market restrains that will obstruct the market's growth rate.

North America bag-in-box packaging machine market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the North America bag-in-box packaging machine s market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on North America Bag-In-Box Packaging Machine s Market

The COVID-19 pandemic had a significant impact on the trade segment and Industry. Manufacturers are comprehending approaches to revive from the recent situation by means of reshaping their sales channels as well as product innovation. The period of the virus outbreak remains a key factor in assessing the complete impact of the pandemic. However, bag-in-box packaging machine industry is expected to stabilize after 2021. The liquor industry was not impacted cruelly due to the pandemic.

Recent Development

- In October 2019, Rapak increased the bag-in-box production capacity of its Auckland, New Zealand facility, due to the requirement in the Asia Pacific. It is expected to rise its manufacturing result by over 125% in the upcoming years.

- In September 2019, the Rapak division of DS Smith PLC developed a durable bag-in-box solution for liquid detergents in response to the rise in the e-commerce demand of laundry detergents and other consumer packaged goods. This particularly designed bag-in-box unit is comprised of biaxially-oriented nylon (BON) lamination, given that good barrier and high puncture resistance.

- In March 2019, Liqui-Box Corp. agreed to get DS Smith’s (UK) plastic division. DS Smith is a major provider of corrugated packaging worldwide. Its plastics division includes Rapak and Global Dispensers business. This gaining would provide a worldwide footprint, design capabilities, and service platform that will offer customers the most compelling packaging solutions.

North America Bag-In-Box Packaging Machine Market Scope

North America bag-in-box packaging machine market is segmented on the basis of machine type, automation type, output capacity, filling technology and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Machine

- Standalone

- Integrated

Automation Type

- Semi-Automatic

- Automatic

- Manual

Output Capacity

- 10 Bags/min

- 11-50 Bags/min

- 51-100 Bags/min

- more than 100 Bags/min

Filling Technology

- Aseptic

- Non-Aseptic

End-User

- Food and Beverages

- Paints and Lubricants

- Personal Care

- Household Products

- Healthcare

- Others

North America Bag-In-Box Packaging Machine Market Regional Analysis/Insights

The North America bag-in-box packaging machine market is analysed and market size insights and trends are provided by country, materials, output capacity, automation, filling technology and end-user as referenced above.

The countries covered in the North America bag-in-box packaging machine market report are U.S, Canada, Mexico and Rest of North-America.

U.S has the highest potential in the bag-in-box packaging machine market in terms of market share and revenue during the forecast period. This is due to the rising demand of alcoholic consumption which increase the production of bag-in-box packaging machine in this country. U.S is also leading the way in terms of production and consumption of re-usable and eco-friendly bag-in-box packaging machine. Due of the ease of producing re-usable and eco-friendly machine, the growth rate of this country increases.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Bag-In-Box Packaging Machine Market Share Analysis

North America bag-in-box packaging machine market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America bag-in-box packaging machine market.

Some of the major players operating in the North America Bag-in-Box packaging machine market are:

- Liquibox (U.S)

- DS Smith (UK)

- Robert Bosch GmbH (Germany)

- Alfa Laval (Sweden)

- Engi-O (North America)

- Pattyn (Belgium)

- SACMI (Italy)

- Scholle IPN (U.S)

- Technibag (France)

- Franz Haniel & Cie (Germany)

- ProXES GmbH (Germany)

- Flexifill Ltd (U.K)

- TORR Industries (U.S)

- ABCO Automation, Inc (U.S)

- IC Filling Systems (UK)

- Kreuzmayr Maschinenbau GmbH (Austria)

- Gossamer Structures (Pty) Ltd (South Africa)

- Triangle Package Machinery Co (U.S)

- voran Maschinen GmbH (Austria)

- Smurfit Kappa (Ireland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET : GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 MULTIVARIATE MODELING

2.1 PRODUCTS LIFELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 INCREASED BENEFITS OF BAG-IN-BOX PACKAGING

3.1.2 INCREASED APPLICATION OF BAG-IN-BOX PACKAGING IN VARIOUS INDUSTRIES

3.1.3 GROWTH OF THE NORTH AMERICA RETAIL INDUSTRY

3.1.4 GROWING DEMAND OF BEVERAGE PRODUCTS

3.2 RESTRAINTS

3.2.1 HIGH COST OF EQUIPMENT

3.2.2 STRINGENT REGULATIONS FOR THE MACHINERIES

3.3 OPPORTUNITIES

3.3.1 STRATEGIC INITIATIVES BY THE COMPANIES

3.3.2 GROWING DEMAND OF ASEPTIC PACKAGING

3.3.3 INCREASING DEMAND OF AUTOMATIC PACKAGING MACHINE

3.4 CHALLENGES

3.4.1 LACK OF SKILLED LABOUR FORCE

3.4.2 CHALLENGES IN PACKAGING INDUSTRY

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE

6.1 OVERVIEW

6.2 STANDALONE

6.2.1 FOOD & BEVERAGES

6.2.2 PAINTS & LUBRICANTS

6.2.3 PERSONAL CARE

6.2.4 HOUSEHOLD PRODUCTS

6.2.5 HEALTHCARE

6.2.6 OTHERS

6.3 INTEGRATED

6.3.1 FOOD & BEVERAGES

6.3.2 PAINTS & LUBRICANTS

6.3.3 PERSONAL CARE

6.3.4 HOUSEHOLD PRODUCTS

6.3.5 HEALTHCARE

6.3.6 OTHERS

7 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY AUTOMATION TYPE

7.1 SEMI-AUTOMATIC

7.2 AUTOMATIC

7.3 MANUAL

8 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY PACKAGING MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE

8.2.1.1 LDPE

8.2.1.2 HDPE

8.2.1.3 LLDPE

8.2.2 POLYPROPYLENE

8.2.3 POLYVINYL CHLORIDE

8.2.4 OTHERS

8.3 PAPER & PAPERBOARD

8.4 METAL

8.4.1 ALUMINUM

8.5 OTHERS

9 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY OUTPUT CAPACITY

9.1 OVERVIEW

9.2 BAGS/MIN

9.3 -50 BAGS/MIN

9.4 -100 BAGS/MIN

9.5 ABOVE 100 BAGS/MIN

10 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY FILLING TECHNOLOGY

10.1 OVERVIEW

10.2 ASEPTIC

10.3 NON-ASEPTIC

11 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD & BEVERAGES

11.2.1 BAKERY & CEREALS PACKAGING

11.2.2 BOTTOMS UP PACKAGING

11.2.3 CONFECTIONERY PACKAGING

11.2.4 TRAILBLAZING TRANSPARENCY PACKAGING

11.2.5 HEALTHIER INDULGENCE PACKAGING

11.2.6 FAST-FOOD PACKAGING

11.2.7 OTHERS

11.3 HEALTHCARE

11.3.1 CLINICAL FEEDING

11.3.2 MEDICAL POUCHES

11.3.3 CELL CULTURE MEDIA

11.3.4 VACUUM BAGS

11.3.5 OTHERS

11.4 PERSONAL CARE

11.4.1 LOTION

11.4.2 SHAMPOO & CONDITIONER

11.4.3 HAND SOAP

11.4.4 HAND SANITIZER

11.4.5 BODY WASH

11.4.6 HAIR DYE

11.4.7 HAIR GEL

11.4.8 OTHERS

11.5 PAINTS & LUBRICANTS

11.5.1 CHEMICALS

11.5.2 COATINGS

11.5.3 AUTOMOTIVE OILS

11.5.4 ADHESIVES

11.5.5 LUBRICANTS

11.5.6 PAINTS

11.5.7 PETROLEUM

11.5.8 OTHERS

11.6 HOUSEHOLD PRODUCTS

11.6.1 LIQUID SOAPS

11.6.2 FLOOR CLEANER

11.6.3 OTHERS

11.7 OTHERS

12 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT & DBMR ANALYSIS

14.1 SWOT ANALYSIS

14.2 DATA BRIDGE MARKET RESEARCH ANALYSIS

15 COMPANY PROFILE

15.1 SMURFIT KAPPA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DS SMITH

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ROBERT BOSCH GMBH

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ALFA LAVAL

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 ABCO AUTOMATION, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ENGI-O

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 FLEXIFILL LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 FRANZ HANIEL & CIE. GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 GOSSAMER STRUCTURES (PTY) LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 IC FILLING SYSTEMS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 KREUZMAYR MASCHINENBAU GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LIQUI-BOX

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 PATTYN GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PROXES GMBH

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 QUADRANT EQUIPMENT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SACMI

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SCHOLLE IPN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 TECHNIBAG

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TORR INDUSTRIES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TRIANGLE PACKAGE MACHINERY CO.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 VORAN MASCHINEN GMBH

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NATIONAL RETAIL SALES (2017)

TABLE 2 EU LEGISLATIVE OVERVIEW

TABLE 3 RESEARCH AND DEVELOPMENT (USD MILLION)

TABLE 4 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 5 NORTH AMERICA STANDALONE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 6 NORTH AMERICA STANDALONE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 7 NORTH AMERICA INTEGRATED IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 8 NORTH AMERICA INTEGRATED IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 9 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 10 NORTH AMERICA SEMI-AUTOMATIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 11 NORTH AMERICA AUTOMATIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 12 NORTH AMERICA MANUAL IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 14 NORTH AMERICA PLASTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 15 NORTH AMERICA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 16 NORTH AMERICA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 17 NORTH AMERICA PAPER & PAPERBOARD IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 18 NORTH AMERICA METAL IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 19 NORTH AMERICA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 21 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 22 NORTH AMERICA 10 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 23 NORTH AMERICA 11-50 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 24 NORTH AMERICA 51-100 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 25 NORTH AMERICA ABOVE 100 BAGS/MIN IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 26 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 27 NORTH AMERICA ASEPTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 28 NORTH AMERICA NON-ASEPTIC IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 29 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 30 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 31 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 33 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 34 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 35 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 36 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 37 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 38 NORTH AMERICA HOUSEHOLD PRODUCTS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 39 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN BAG-IN-BOX PACKAGING MACHINE MARKET, BY REGION, 2017-2026 (USD MILLION)

TABLE 41 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY COUNTRY, 2017-2026 (USD MILLION)

TABLE 42 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 43 NORTH AMERICA STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 44 NORTH AMERICA INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 45 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 46 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 47 NORTH AMERICA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 48 NORTH AMERICA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 49 NORTH AMERICA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 50 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 51 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 52 NORTH AMERICA BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 53 NORTH AMERICA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 55 NORTH AMERICA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 56 NORTH AMERICA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 57 NORTH AMERICA HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 58 U.S. BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 59 U.S. STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 60 U.S. INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 61 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 62 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 63 U.S. PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 64 U.S. POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 65 U.S. METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 66 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 67 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 68 U.S. BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 69 U.S. FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 70 U.S. HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 71 U.S. PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 72 U.S. PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 73 U.S. HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 74 CANADA BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 75 CANADA STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 76 CANADA INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 77 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 78 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 79 CANADA PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 80 CANADA POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 81 CANADA METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 82 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 83 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 84 CANADA BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 85 CANADA FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 86 CANADA HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 87 CANADA PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 88 CANADA PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 89 CANADA HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 90 MEXICO BAG-IN-BOX PACKAGING MACHINE MARKET, BY MACHINE TYPE, 2017-2026 (USD MILLION)

TABLE 91 MEXICO STANDALONE MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 92 MEXICO INTEGRATED MACHINES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY APPLICATION, 2017-2026 (USD MILLION)

TABLE 93 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY AUTOMATION TYPE, 2017-2026 (USD MILLION)

TABLE 94 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 95 MEXICO PLASTIC IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 96 MEXICO POLYETHYLENE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 97 MEXICO METAL IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY PACKAGING MATERIAL, 2017-2026 (USD MILLION)

TABLE 98 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY OUTPUT CAPACITY, 2017-2026 (USD MILLION)

TABLE 99 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY FILLING TECHNOLOGY, 2017-2026 (USD MILLION)

TABLE 100 MEXICO BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 101 MEXICO FOOD & BEVERAGES IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 102 MEXICO HEALTHCARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 103 MEXICO PERSONAL CARE IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 104 MEXICO PAINTS & LUBRICANTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

TABLE 105 MEXICO HOUSEHOLD PRODUCTS IN BAG-IN-BOX MACHINE PACKAGING MARKET, BY END USER, 2017-2026 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

FIGURE 2 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: NORTH AMERICA VS REGIONAL

FIGURE 5 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET

FIGURE 10 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: SEGMENTATION

FIGURE 11 INCREASED BENEFITS OF BAG-IN-BOX PACKAGING AND INCREASED APPLICATION OF BAG-IN-BOX PACKAGING IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET IN THE FORECAST PERIOD OF 2019 TO 2026

FIGURE 12 STANDALONE MACHINE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET IN THE FORECAST PERIOD OF 2019 TO 2026

FIGURE 13 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY MACHINE TYPE, 2018

FIGURE 14 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY AUTOMATION TYPE, 2018

FIGURE 15 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY PACKAGING MATERIAL, 2018

FIGURE 16 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY AUTOMATION TYPE, 2018

FIGURE 17 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY FILLING TECHNOLOGY, 2018

FIGURE 18 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY END USER, 2018

FIGURE 19 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: SNAPSHOT (2018)

FIGURE 20 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2018)

FIGURE 21 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2019 & 2026)

FIGURE 22 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY COUNTRY (2018 & 2026)

FIGURE 23 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: BY MACHINE TYPE (2019-2026)

FIGURE 24 NORTH AMERICA BAG-IN-BOX PACKAGING MACHINE MARKET: COMPANY SHARE 2018 (%)

North America Bag In Box Packaging Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Bag In Box Packaging Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Bag In Box Packaging Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.