North America Barley Malt Extracts And Kvass Wort Concentrates Market

Market Size in USD Million

CAGR :

%

USD

555.41 Million

USD

1,060.54 Million

2025

2034

USD

555.41 Million

USD

1,060.54 Million

2025

2034

| 2026 –2034 | |

| USD 555.41 Million | |

| USD 1,060.54 Million | |

|

|

|

|

North America Barley Malt Extracts and Kvass Wort Concentrates Market Size

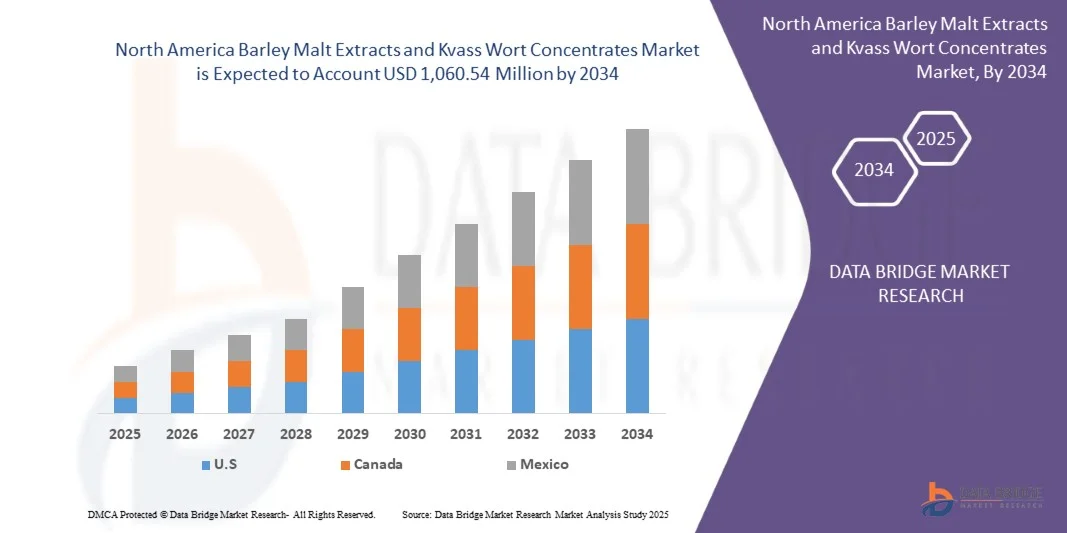

- The North America Barley Malt Extracts and Kvass Wort Concentrates Market size was valued at USD 555.41 Million in 2025 and is expected to reach USD 1,060.54 Million by 2034, at a CAGR of 7.4% during the forecast period

- The growth of the Barley Malt Extracts and Kvass Wort Concentrates Market is primarily driven by the Rising demand in emerging markets, Rising youth and female consumer base and Brand Loyalty & Strong Distribution Networks

North America Barley Malt Extracts and Kvass Wort Concentrates Market Analysis

- North America barley malt extracts and kvass wort concentrates market encompasses the production, processing, and distribution of malt-based ingredients used in beverages, bakery products, confectionery, and health-oriented formulations, driven by evolving consumer tastes, natural ingredient demand, and expanding applications across food and drink sectors.

- The rising adoption of malt extracts and kvass wort concentrates is propelled by product innovation, clean-label trends, and manufacturers’ strategic shift toward functional, nutritious, and craft-inspired formulations to cater to growing demand for natural sweetness, digestive benefits, and premium beverage experiences

- North America is expected to dominate the Global Barley Malt Extracts and Kvass Wort Concentrates Market with the largest market share of 38.88% in 2026 and is also projected to record the highest CAGR during the forecast period, driven by its strong brewing heritage, widespread use of malt-based ingredients, and sustained demand from the bakery, beverage, and nutritional food industries. Additionally, the region benefits from the presence of major malt producers, favorable quality and sourcing standards, and a rising consumer shift toward natural, clean-label, and craft-oriented products—factors that collectively support robust market expansion.

- The barley segment is expected to dominate the North America Barley Malt Extracts and Kvass Wort Concentrates Market with the largest market share of 67.68% in 2026, primarily due to barley’s high suitability for malt production, its widespread cultivation, and its strong demand across brewing, bakery, beverage, and nutritional applications. Additionally, the segment benefits from the presence of established malt producers, favorable raw material availability, and well-developed supply chains, all of which reinforce its sustained leadership in the market

- U.S. is expected to dominate the North America Barley Malt Extracts and Kvass Wort Concentrates Market with the largest market share of 2.4% in 2025 and is also expected to grow with the highest CAGR during the forecast period, primarily due to its large smoking population, strong cultural acceptance of tobacco use, and sustained demand for both conventional and reduced-risk products. In addition, the country benefits from the presence of leading domestic manufacturers, favorable regulatory and pricing conditions, and growing popularity of alternatives such as heated tobacco and e-cigarettes, all contributing to sustained market growth.

Report Scope and North America Barley Malt Extracts and Kvass Wort Concentrates Market Segmentation

|

Attributes |

North Barley Malt Extracts and Kvass Wort Concentrates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Barley Malt Extracts and Kvass Wort Concentrates Market Trends

“Rising Consumer Preference for Plant-Based Beverage Ingredients”

- Rising consumer preference for plant-based beverage ingredients constitutes a clear market driver for the global barley malt extracts and kvass wort concentrates sector, as it redirects product development, procurement, and marketing toward plant-derived solutions for flavor, texture, and functionality. Buyers in retail and foodservice increasingly prioritize ingredients that support perceived health, sustainability, and clean-label claims; this elevates demand for malt-based extracts and wort concentrates that can deliver natural sweetness, body, and functional properties in plant-forward formulations. Consequently, manufacturers and ingredient suppliers gain a commercial incentive to broaden their product portfolios, increase production capacity, and invest in application development for plant-centric beverages, thereby accelerating market expansionAdvances in device miniaturization, ergonomics, and integration with real-time imaging technologies are enabling surgeons to perform complex cardiac interventions through smaller incisions with greater precision. This is particularly beneficial for elderly and high-risk patients who may not tolerate traditional open-heart procedures

- In June 2025, the USDA’s market analysis of China’s beverage sector highlighted the expansion of beverage categories and commercial opportunities. This context supports demand for plant-based ingredient solutions in large consumer markets, such as barley malt extracts

- In May 2024, The Times reported that Britvic's plant-based “Plenish” drinks range experienced “stand-out growth,” with revenues up 168.5% in the six months to the end of March, highlighting strong consumer demand for plant-based beverage formats

- In October 2025, SVZ noted that the Asia–Pacific region’s ingredient market is increasingly oriented toward “natural and functional ingredients” and that plant-based innovations (vegetable purees, fruit-based extracts) are converging with sugar-reduction and clean-label trends in beverage and food development

- The growing consumer inclination toward plant-based beverage ingredients is a defining catalyst for the expansion of the global barley malt extracts and kvass wort concentrates market. As health consciousness, sustainability values, and clean-label expectations continue to shape purchasing decisions, malt-based extracts and wort concentrates gain strategic relevance as natural, functional, and flavour-enhancing solutions. Recent market insights, including Britvic’s surge in plant-based beverage sales to the Asia-Pacific and the region’s focus on natural ingredients, as well as China’s expanding beverage landscape, illustrate a clear, cross-regional momentum. Collectively, these trends highlight the necessity for manufacturers to innovate, scale production, and align product development with the evolving needs of plant-forward beverages, thereby securing long-term growth and a competitive edge in this dynamic sector

North America Barley Malt Extracts and Kvass Wort Concentrates Market Dynamics

Driver

“Growth in Malt-Based Bakery and Confectionery Innovations”

- Growth in malt-based bakery and confectionery innovations serves as a principal market driver for the global barley malt extracts and kvass wort concentrates sector, as it increases demand for malt-derived functional ingredients that provide natural sweetness, color, and textural improvement in baked goods and confections. Manufacturers and product developers are formulating new bakery applications — for example, premixes, improved dough improvers, and clean-label sweeteners that favour malt extracts and wort concentrates as ingredient solutions. This stimulates supplier investment in production capacity, product differentiation, and application development across foodservice and retail channels. Evidence from industry, trade, and government sources confirms that policy support for sustainable grain value chains and multi-stakeholder initiatives in the bakery sector further encourages ingredient innovation and the uptake of malt-based solutions.

- For instance- In July 2024, MPC showcased its enhanced product portfolio of malted‑barley extracts (its “MaltRite” line) and oat extracts (its “OatRite” line) to address growing demand for non‑GMO, plant‑based and nutrient‑rich ingredients. The company emphasised how its extracts serve multiple food & beverage applications from baked goods and breakfast bars to non‑dairy beverages and snack products.

- In February 2024, Rahr Corporation announced the merger of its two business units Rahr Malting Co. and Brewers Supply Group (BSG) to form the new business unit RahrBSG. This integration brings together Rahr Malting’s 177‑year legacy of barley malting and global ingredients supply with BSG’s extensive distribution network supporting craft brewing, distilling, and beverage ingredient markets. The merger is designed to create operational synergies, streamline product distribution, enhance service and value for customers, and enable the newly combined entity to respond more nimbly to changing market conditions and customer needs.

- In June 2025, the Sustainable Wheat Initiative North America launched a manifesto and roadmap, engaging industrial bakers and millers to accelerate the low-carbon wheat supply. The initiative creates a commercial environment that favours ingredient suppliers investing in differentiated grain-based inputs, such as malt extracts.

- The growing demand for malt-based bakery and confectionery products is boosting the global barley malt extracts and kvass wort concentrates market. Malt-derived ingredients provide natural sweetness, enhanced colour, and improved texture, making them essential in modern formulations. Capacity expansions, specialised ingredient development, and sustainability-focused initiatives are collectively driving innovation, supporting clean-label trends, and promoting growth and diversification within the malt ingredient sector

Restraint/Challenge

“Seasonal Dependency Impacting the Continuous Barley Supply Chain”

- Rising seasonal dependency in barley cultivation and harvesting undermines the reliability of continuous supply for malt extraction and wort concentrate production, thereby constituting a significant restraint on the global barley malt extracts and kvass wort concentrates market. Because barley is a winter- or spring-planted cereal in many major producing regions and is subject to weather, planting windows, harvesting schedules, and storage constraints, disruptions in these cycles can reduce availability, elevate raw material risk, and force ingredient manufacturers to either scale back production or source from higher-cost origins. Such supply chain instability places upward pressure on ingredient costs and weakens manufacturers' capacity to commit to long-term contracts, thereby slowing market expansion.

- For instance- In September 2024, the Indian Council of Agricultural Research (ICAR) released its “Progress Report 2023-24” for wheat and barley, highlighting that yield gains in barley remained sensitive to planting and malting-barley cluster demonstration timing, as well as climate variability, underscoring the seasonal risk inherent in barley supply.

- In October 2024, the French daily newspaper Le Monde reported that a “washout winter” with unprecedented rainfall hampered planting and field operations for barley and other cereals in the United Kingdom, thereby increasing risks to supply continuity and crop stability.

- In November 2024, the Grain Industry Association of Western Australia crop report (via GIWA) noted that although yields were in better-than-expected ranges, variability across growing regions remained high due to uneven rainfall during the season, illustrating the seasonal and regional dependency of barley supply within a major export region

- Seasonal dependency in barley cultivation remains a fundamental constraint on the stability and growth of the global barley malt extracts and kvass wort concentrates market. The crop’s vulnerability to climatic variability, planting and harvesting cycles, and regional weather disruptions creates fluctuations in raw material availability and pricing, undermining supply consistency for malt extract producers. Reports from agricultural and industry bodies—from India’s climate-sensitive yield patterns to North America’s rainfall-induced planting delays and Australia’s uneven seasonal performance—underscore the systemic risks tied to barley’s production cycle. Consequently, this seasonality not only constrains production planning and cost control but also limits manufacturers' ability to sustain long-term supply commitments, posing a structural restraint to continuous market expansion

North America Barley Malt Extracts and Kvass Wort Concentrates Market Scope

The North America Barley Malt Extracts and Kvass Wort Concentrates market is categorized into six notable segments based on Source, Nature, Product Type, Grade, Application industries, Distribution Channel.

- By Source

Based on Source, the global barley malt extracts and kvass wort concentrates market is segmented into Barley, Wheat, Rye, Rice, Corn, Soy, Others. In 2026, Barley segment is expected to dominate the North America barley malt extracts and kvass wort concentrates market with 66.49% market share and is expected to reach USD 705.91 million by 2034, growing with the CAGR of 7.4% in the forecast period 2026 to 2034.

- By Nature

Based on Nature, the global barley malt extracts and kvass wort concentrates market is segmented into Conventional and Organic. In 2026, Conventional segment is expected to dominate the North America barley malt extracts and kvass wort concentrates market with 86.41% market share and is expected to reach 923.08 million by 2034, growing with the CAGR of 7.5% in the forecast period 2026 to 2034.

- By Form

Based on Form, the global barley malt extracts and kvass wort concentrates market is segmented into Liquid Powder, Concentrate. In 2026, Liquid segment is expected to dominate the North America barley malt extracts and kvass wort concentrates market with 55.79% market share and is expected to reach 613.30 million by 2034, growing with the CAGR of 7.9% in the forecast period 2026 to 2034.

- By Product Type

Based on Product Type, the global barley malt extracts and kvass wort concentrates market is segmented into Light Extracts, Ambe Extracts, Dark Extracts. In 2026, Light Extracts segment is expected to dominate the North America barley malt extracts and kvass wort concentrates market with 64.93% market share and is expected to reach 698.48 million by 2034, growing with the CAGR of 7.6% in the forecast period 2026 to 2034.

- By Grade

Based on Grade, the global barley malt extracts and kvass wort concentrates market is segmented into Light Extracts, Ambe Extracts, Dark Extracts. In 2026, Standard Malt segment is expected to dominate the North America barley malt extracts and kvass wort concentrates market with 76.46% market share and is expected to reach 798.85 million by 2034, growing with the CAGR of 7.2% in the forecast period 2026 to 2034.

- By Application Industries

On the basis of Application Industries, the global barley malt extracts and kvass wort concentrates market is segmented Beverages, Food Industry, Pharmaceuticals, Others.

In 2026, Beverages segment is projected to dominate in the global barley malt extracts and kvass wort concentrates market with the largest market share of 71.51% and is expected to reach USD 760.89 million by 2034, growing at the CAGR of 7.4% in the forecast period of 2026 to 2034.

- By Distribution Channel

On the basis of Distribution Channel, the Global Barley Malt Extracts and Kvass Wort Concentrates Market is segmented into Direct, Retail. In 2025, Direct segment is projected to dominate in the Global Barley Malt Extracts and Kvass Wort Concentrates Market with the largest market share of 75.55% and is expected to reach USD 807.18 million by 2034, growing at the CAGR of 7.5% in the forecast period of 2026 to 2034.

North America Barley Malt Extracts and Kvass Wort Concentrates Market Regional Analysis

- North America is expected to see U.S. as the highest growing country in the North America barley malt extracts and kvass wort concentrates market. North America barley malt extracts and kvass wort concentrates market is expected to reach USD 1,060.54 Billion by 2034, from USD 555.41 million in 2025, growing at a CAGR of 7.4% in the forecast period of 2026 to 2034

- The country further benefits from the presence of established domestic manufacturers, rising popularity of alternative tobacco formats (such as heated tobacco and e-cigarettes), and relatively favorable regulatory and pricing conditions, all contributing to its sustained market leadership within North America

U.S. Barley Malt Extracts and Kvass Wort Concentrates Market Insight

The U.S. dominates the North American market with 80.14% share in 2026 and the highest CAGR of 7.6%. Its leadership is supported by a large craft beer industry, strong bakery and confectionery sectors, and high adoption of specialty and organic malt extracts. Continuous innovation in functional beverages and premium malt-based ingredients further accelerates growth.

Canada Barley Malt Extracts and Kvass Wort Concentrates Market Insight

Canada holds 12.66% of the market in 2026 and grows at a CAGR of 6.9%, supported by an expanding craft brewing culture and increasing demand for natural and clean-label bakery ingredients. The country’s stable food manufacturing sector and rising trend toward health-focused malt-based beverages contribute to consistent market growth.

North America Barley Malt Extracts and Kvass Wort Concentrates Market Share

The North America tobacco product industry is primarily led by well-established companies, including:

- malt Products (U.S.)

- Country Malt Group (U.S.)

- RahrBSG (U.S.)

- LD Carlson Company (U.S.)

- GW Kent (U.S.)

- Univar Solutions LLC. (U.S.)

Latest Developments in Global North America Barley Malt Extracts and Kvass Wort Concentrates Market

- In February 2024, Rahr Corporation announced that it would combine its business units Rahr Malting Co. and Brewers Supply Group (BSG) into a single new unit named RahrBSG, merging operations and commercial activity to leverage synergies in malting and ingredient distribution

- In July 2024, MPC showcased its enhanced product portfolio of malted‑barley extracts (its “MaltRite” line) and oat extracts (its “OatRite” line) to address growing demand for non‑GMO, plant‑based and nutrient‑rich ingredients. The company emphasised how its extracts serve multiple food & beverage applications from baked goods and breakfast bars to non‑dairy beverages and snack products.

- In June 2024, Bairds Malt entered into a collaboration with Chivas Brothers (the Scotch whisky business of Pernod Ricard) and Scotgrain (an agricultural merchant) to launch the “Dalmunach Growers Pilot Group” programme

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES IN THE NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 BARGAINING POWER OF SUPPLIERS

4.1.5 INTENSITY OF COMPETITIVE RIVALRY (HIGH)

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOR

4.4 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: CLIMATE CHANGE SCENARIO

4.5 INNOVATION TRACKER AND STRATEGIC ANALYSIS — NORTH AMERICA BARLEY MALT EXTRACTS & KVASS WORT CONCENTRATES

4.5.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.5.1.1 JOINT VENTURES

4.5.1.2 MERGERS AND ACQUISITIONS

4.5.1.3 LICENSING AND PARTNERSHIP

4.5.1.4 TECHNOLOGY COLLABORATIONS

4.5.1.5 STRATEGIC DIVESTMENTS

4.5.2 STAGE OF DEVELOPMENT

4.5.3 20.3 INNOVATION STRATEGIES AND METHODOLOGIES

4.5.4 RISK ASSESSMENT AND MITIGATION

4.5.5 FUTURE OUTLOOK

4.6 NEW ENTRANTS AND ENTRY BARRIERS — NORTH AMERICA BARLEY MALT EXTRACTS & KVASS WORT CONCENTRATES MARKET

4.7 PATENT ANALYSIS FOR BARLEY MALT EXTRACTS

4.7.1 PATENT ANALYSIS FOR KVASS WORT CONCENTRATES

4.8 COMPLIANCE LANDSCAPE ACROSS KEY REGIONS

4.8.1 NORTH AMERICA

4.8.1.1 PRODUCT CODES

4.8.1.2 CERTIFIED STANDARDS

4.8.1.3 SAFETY STANDARDS

4.8.1.4 MATERIAL HANDLING & STORAGE

4.8.1.5 TRANSPORT & PRECAUTIONS

4.8.1.6 HAZARD IDENTIFICATION

4.8.2 SOUTH AMERICA

4.8.2.1 PRODUCT CODES

4.8.2.2 CERTIFIED STANDARDS

4.8.2.3 SAFETY STANDARDS (GENERAL)

4.8.2.4 MATERIAL HANDLING & STORAGE

4.8.2.5 TRANSPORT & PRECAUTIONS

4.8.2.6 HAZARD IDENTIFICATION

4.8.3 EUROPE

4.8.3.1 PRODUCT CODES

4.8.3.2 CERTIFIED STANDARDS

4.8.3.3 SAFETY STANDARDS (GENERAL)

4.8.3.4 MATERIAL HANDLING & STORAGE

4.8.3.5 TRANSPORT & PRECAUTIONS

4.8.3.6 HAZARD IDENTIFICATION

4.8.4 ASIA-PACIFIC

4.8.4.1 PRODUCT CODES

4.8.4.2 CERTIFIED STANDARDS

4.8.4.3 SAFETY STANDARDS (GENERAL)

4.8.4.4 MATERIAL HANDLING & STORAGE

4.8.4.5 TRANSPORT & PRECAUTIONS

4.8.4.6 HAZARD IDENTIFICATION

4.8.5 MIDDLE EAST & AFRICA

4.8.5.1 PRODUCT CODES

4.8.5.2 CERTIFIED STANDARDS

4.8.5.3 SAFETY STANDARDS (GENERAL)

4.8.5.4 MATERIAL HANDLING & STORAGE

4.8.5.5 TRANSPORT & PRECAUTIONS

4.8.5.6 HAZARD IDENTIFICATION

4.9 PROFIT MARGIN SCENARIO — NORTH AMERICA BARLEY MALT EXTRACTS & KVASS WORT CONCENTRATES MARKET

4.9.1 CORE DRIVERS OF MARGINS

4.9.2 LOGISTICS, PACKAGING, AND SHELF-STABLE FORMULATIONS

4.9.3 MARKET STRUCTURE AND BARGAINING POWER

4.9.4 COST-CONTROL LEVERS AND MARGIN IMPROVEMENT STRATEGIES

4.9.5 CONCLUSION

4.1 RAW MATERIAL COVERAGE — NORTH AMERICA BARLEY MALT EXTRACTS & KVASS WORT CONCENTRATES MARKET

4.10.1 BARLEY AS THE PRINCIPAL RAW MATERIAL: ROLE AND IMPLICATIONS

4.10.2 VARIETAL SELECTION AND AGRONOMIC CONSIDERATIONS

4.10.3 QUALITY PARAMETERS TO SPECIFY IN CONTRACTS

4.10.4 CONTAMINANTS AND FOOD-SAFETY HAZARDS

4.10.5 STORAGE, HANDLING, AND LOGISTICS THAT PRESERVE RAW MATERIAL QUALITY

4.10.6 PROCESSING INTERACTIONS: HOW MALTING AND CONCENTRATION ALTER RAW-MATERIAL REQUIREMENTS

4.10.7 ADJUNCTS AND ALTERNATIVE CEREALS IN WORT CONCENTRATES

4.11 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET

4.12 VALUE CHAIN ANALYSIS

4.13 PRICING ANALYSIS

4.14 COST ANALYSIS BREAKDOWN

4.15 TECHNOLOGICAL ADVANCEMENT — NORTH AMERICA BARLEY MALT EXTRACTS & KVASS WORT CONCENTRATES MARKET

4.15.1 PROCESS AUTOMATION AND INDUSTRY 4.0 IN MALTING AND EXTRACT PRODUCTION

4.15.2 ADVANCED CONCENTRATION AND SEPARATION TECHNOLOGIES

4.15.3 BIOTECHNOLOGICAL AND ENZYMATIC INNOVATIONS

4.15.4 RAPID QUALITY ASSURANCE AND CONTAMINANT DETECTION

4.15.5 DIGITAL AGRICULTURE, GRAIN-QUALITY ANALYTICS, AND SUPPLY-CHAIN TRACEABILITY

4.15.6 ENERGY EFFICIENCY, HEAT RECOVERY, AND SUSTAINABILITY TECHNOLOGIES

4.15.7 BY-PRODUCT VALORISATION AND CIRCULAR-ECONOMY PROCESSING

4.15.8 PACKAGING, SHELF-STABILITY, AND PRODUCT-FORMAT INNOVATION

4.16 VENDOR SELECTION CRITERIA — NORTH AMERICA BARLEY MALT EXTRACTS & KVASS WORT CONCENTRATES MARKET

5 TARIFF

5.1 CURRENT TARIFF RATE(S)

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF THE MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFTN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 NORTH AMERICA

6.2 SOUTH AMERICA

6.3 EUROPEAN UNION (EU) FRAMEWORK

6.4 ASIA-PACIFIC REGULATORY FRAMEWORK

6.5 MIDDLE EAST AND AFRICA REGULATORY FRAMEWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING CONSUMER PREFERENCE FOR PLANT-BASED BEVERAGE INGREDIENTS

7.1.2 GROWTH IN MALT-BASED BAKERY AND CONFECTIONERY INNOVATIONS

7.1.3 RISING HEALTH AWARENESS IS BOOSTING THE USE OF NATURAL SWEETENERS

7.1.4 DEVELOPMENT OF ADVANCED MALT EXTRACTION AND DRYING TECHNOLOGIES

7.2 RESTRAINTS

7.2.1 SEASONAL DEPENDENCY IMPACTING THE CONTINUOUS BARLEY SUPPLY CHAIN

7.2.2 HIGH INITIAL SETUP COST FOR MALT PRODUCTION FACILITIES

7.3 OPPORTUNITIES

7.3.1 GROWING DEMAND FROM THE NUTRACEUTICAL AND SPORTS NUTRITION SECTORS

7.3.2 EXPANSION INTO READY-TO-DRINK MALT-BASED BEVERAGE MARKETS

7.3.3 INCREASING DEMAND FOR GLUTEN-FREE BARLEY ALTERNATIVES IN MALT EXTRACTS

7.4 CHALLENGES

7.4.1 DEPENDENCY ON LIMITED BARLEY VARIETIES FOR QUALITY MALT OUTPUT

7.4.2 STRINGENT FOOD SAFETY REGULATIONS ACROSS MULTIPLE REGIONS

8 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE

8.1 OVERVIEW

8.2 BARLEY

8.3 WHEAT

8.4 RYE

8.5 RICE

8.6 CORN

8.7 SOY

8.8 OTHERS

9 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY NATURE

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY FORM

10.1 OVERVIEW

10.2 LIQUID

10.3 POWDER

10.4 CONCENTRATE

11 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY PRODUCT TYPE

11.1 OVERVIEW

11.2 LIGHT EXTRACTS

11.3 AMBE EXTRACTS

11.4 DARK EXTR,ACTS

12 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY GRADE

12.1 OVERVIEW

12.2 STANDARD MALT

12.3 SPECIALTY MALT

12.3.1 CRYSTAL

12.3.2 ROASTED

12.3.3 DARK

12.3.4 OTHERS

13 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY APPLICATION INDUSTRIES

13.1 OVERVIEW

13.2 BEVERAGES

13.3 FOOD INDUSTRY

13.4 PHARMACEUTICALS

13.5 OTHERS

14 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.3 RETAIL

15 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 IREKS GMBH

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 MALTEUROP

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 CEREX

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 BRIESS INDUSTRIES, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 BARMALT.

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 ALPHA DELTA FOOD

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 AGRARIA MALTE (DIVISION OF AGRARIA)

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 BAIRDS MALT

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 DIFAL

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 EDME

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 HAFEN-MÜHLEN-WERKE GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 IMPERIAL MALTS LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 MALT PRODUCTS CORPORATION.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MALTEXCO

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 MAHALAXMI.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 MUNTONS PLC

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 NAKODA CORPORATION

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 PSCM FOOD AND DAIRY PRODUCTS

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PUREMALT PRODUCTS LTD

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 PMV MALTINGS PVT. LTD.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 RAHR CORPORATION.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 VINKON S.A.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 COUNTRY MALT GROUP

18.23.1 COMPANY SNAPSHOT

18.23.2 COMPANY SHARE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 UNIVAR SOLUTIONS LLC.

18.24.1 COMPANY SNAPSHOT

18.24.2 COMPANY SHARE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 FOOD TRADE SP. Z O.O.

18.25.1 COMPANY SNAPSHOT

18.25.2 COMPANY SHARE ANALYSIS

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENT

18.26 SANJAY SALES CORPORATION

18.26.1 COMPANY SNAPSHOT

18.26.2 COMPANY SHARE ANALYSIS

18.26.3 PRODUCT PORTFOLIO

18.26.4 RECENT DEVELOPMENT

18.27 BINTANI

18.27.1 COMPANY SNAPSHOT

18.27.2 COMPANY SHARE ANALYSIS

18.27.3 PRODUCT PORTFOLIO

18.27.4 RECENT DEVELOPMENT

18.28 GW KENT

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

18.29 LD CARLSON COMPANY

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

18.3 RAHRBSG

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 RECENT DEVELOPMENT

18.31 RUSSIANFOODS.

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 CONSUMER BUYING BEHAVIOR

TABLE 3 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2034 (USD THOUSAND)

TABLE 4 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (THOUSAND TON)

TABLE 5 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (USD/TON)

TABLE 6 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY NATURE, 2018-2034 (USD THOUSAND)

TABLE 7 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY FORM, 2018-2034 (USD THOUSAND)

TABLE 8 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY PRODUCT TYPE, 2018-2034 (USD THOUSAND)

TABLE 9 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY GRADE, 2018-2034 (USD THOUSAND)

TABLE 10 NORTH AMERICA SPECIALTY MALT IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY APPLICATION INDUSTRIES, 2018-2034 (USD THOUSAND)

TABLE 12 NORTH AMERICA BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA BEER IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA FERMENTED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA DAIRY BASED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA OTHERS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY DISTRIBUTION CHANNEL, 2018-2034 (USD THOUSAND)

TABLE 25 NORTH AMERICA RETAIL IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA IN-STORE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA ONLINE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY COUNTRY, 2018-2032 (THOUSAND TON)

TABLE 30 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2034 (USD THOUSAND)

TABLE 31 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (THOUSAND TON)

TABLE 32 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (USD/TON)

TABLE 33 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY NATURE, 2018-2034 (USD THOUSAND)

TABLE 34 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY FORM, 2018-2034 (USD THOUSAND)

TABLE 35 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY PRODUCT TYPE, 2018-2034 (USD THOUSAND)

TABLE 36 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY GRADE, 2018-2034 (USD THOUSAND)

TABLE 37 NORTH AMERICA SPECIALTY MALT IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY APPLICATION INDUSTRIES, 2018-2034 (USD THOUSAND)

TABLE 39 NORTH AMERICA BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA BEER IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA FERMENTED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA DAIRY BASED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY DISTRIBUTION CHANNEL, 2018-2034 (USD THOUSAND)

TABLE 52 NORTH AMERICA RETAIL IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA IN-STORE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA ONLINE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2034 (USD THOUSAND)

TABLE 56 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (THOUSAND TON)

TABLE 57 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (USD/TON)

TABLE 58 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY NATURE, 2018-2034 (USD THOUSAND)

TABLE 59 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY FORM, 2018-2034 (USD THOUSAND)

TABLE 60 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY PRODUCT TYPE, 2018-2034 (USD THOUSAND)

TABLE 61 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY GRADE, 2018-2034 (USD THOUSAND)

TABLE 62 U.S. SPECIALTY MALT IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY APPLICATION INDUSTRIES, 2018-2034 (USD THOUSAND)

TABLE 64 U.S. BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. BEER IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. NON-ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. FERMENTED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. DAIRY BASED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. OTHERS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY DISTRIBUTION CHANNEL, 2018-2034 (USD THOUSAND)

TABLE 77 U.S. RETAIL IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. IN-STORE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. ONLINE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2034 (USD THOUSAND)

TABLE 81 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (THOUSAND TON)

TABLE 82 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (USD/TON)

TABLE 83 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY NATURE, 2018-2034 (USD THOUSAND)

TABLE 84 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY FORM, 2018-2034 (USD THOUSAND)

TABLE 85 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY PRODUCT TYPE, 2018-2034 (USD THOUSAND)

TABLE 86 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY GRADE, 2018-2034 (USD THOUSAND)

TABLE 87 CANADA SPECIALTY MALT IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY APPLICATION INDUSTRIES, 2018-2034 (USD THOUSAND)

TABLE 89 CANADA BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 CANADA ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CANADA BEER IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CANADA NON-ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CANADA FERMENTED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CANADA DAIRY BASED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CANADA BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 98 CANADA PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CANADA PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA OTHERS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY DISTRIBUTION CHANNEL, 2018-2034 (USD THOUSAND)

TABLE 102 CANADA RETAIL IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA IN-STORE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA ONLINE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2034 (USD THOUSAND)

TABLE 106 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (THOUSAND TON)

TABLE 107 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE, 2018-2032 (USD/TON)

TABLE 108 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY NATURE, 2018-2034 (USD THOUSAND)

TABLE 109 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY FORM, 2018-2034 (USD THOUSAND)

TABLE 110 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY PRODUCT TYPE, 2018-2034 (USD THOUSAND)

TABLE 111 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY GRADE, 2018-2034 (USD THOUSAND)

TABLE 112 MEXICO SPECIALTY MALT IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY APPLICATION INDUSTRIES, 2018-2034 (USD THOUSAND)

TABLE 114 MEXICO BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 MEXICO BEER IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MEXICO NON-ALCOHOLIC BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MEXICO FERMENTED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MEXICO DAIRY BASED BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MEXICO BEVERAGES IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO FOOD INDUSTRY IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 123 MEXICO PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MEXICO PHARMACEUTICALS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO OTHERS IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY MALT SOURCE, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY DISTRIBUTION CHANNEL, 2018-2034 (USD THOUSAND)

TABLE 127 MEXICO RETAIL IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO IN-STORE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO ONLINE IN BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET

FIGURE 2 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DBMR MARKET POSITION GRID DISTRIBUTOR

FIGURE 10 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 SEVEN SEGMENTS COMPRISE THE NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, BY SOURCE (2025)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: SEGMENTATION

FIGURE 15 RISING CONSUMER PREFERENCE FOR PLANT-BASED BEVERAGE INGREDIENTS IS EXPECTED TO DRIVE THE NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET IN THE FORECAST PERIOD OF 2026 TO 2034

FIGURE 16 THE BARLEY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET IN 2026 AND 2033

FIGURE 17 REGIONAL PATENT ANALYSIS

FIGURE 18 PATENT ANALYSIS BY APPLICANTS

FIGURE 19 IPC CODE ANALYSIS

FIGURE 20 PATENT ANALYSIS BY PUBLICATION YEAR

FIGURE 21 PATENT ANALYSIS BY COUNTRIES

FIGURE 22 IPC CODE ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS

FIGURE 25 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, 2023-2034 AVERAGE SELLING PRICE (USD/KG)

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET

FIGURE 27 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: BY SOURCE, 2025

FIGURE 28 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: BY NATURE, 2025

FIGURE 29 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: BY FORM, 2025

FIGURE 30 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: BY PRODUCT TYPE, 2025

FIGURE 31 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: BY GRADE, 2025

FIGURE 32 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: BY APPLICATION INDUSTRIES, 2025

FIGURE 33 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 34 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET, SNAPSHOT (2025)

FIGURE 35 NORTH AMERICA BARLEY MALT EXTRACTS AND KVASS WORT CONCENTRATES MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.