North America Biocides Market

Market Size in USD Million

CAGR :

%

USD

4,132.56 Million

USD

6,737.29 Million

2022

2030

USD

4,132.56 Million

USD

6,737.29 Million

2022

2030

| 2023 –2030 | |

| USD 4,132.56 Million | |

| USD 6,737.29 Million | |

|

|

|

North America Biocides Market Analysis and Size

Modern constructions with complex designs adopt polymers and molded glass because of their lightweight and flexible qualities. This has augmented the usage of sealants and adhesives that are more vulnerable to microbial attack in intricately constructed infrastructures made of polymers and glass. As a result, increasing demand for sealants and adhesives in the construction sector is likely to increase the use of biocides in-can preservatives and dry film fungicides and favourably impacting the biocides market size. Moreover, growing innovations by many multinationals to extend their product portfolio and the growing preference for natural biocides enhance market growth in upcoming years.

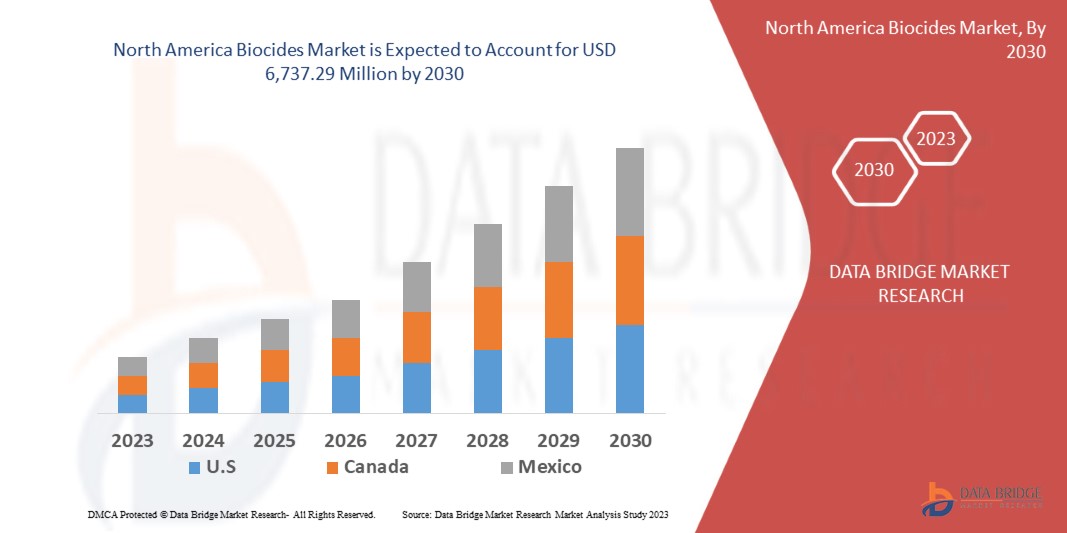

Data Bridge Market Research analyses that the biocides market is expected to reach USD 6,737.29 million by 2030, which is USD 4,132.56 million in 2022, registering a CAGR of 6.30% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Grade (Food, Pharmaceutical, Industrial), Type (Halogen Compounds, Organic Acids, Nitrogen Based Biocides (Quaternary Ammonium Compounds), Metallic Compounds, Organosulfur Compounds, Phenolic Biocides and Others), Product Type (Preservatives, Pest Control and Others), Application (Water Treatment, Food and Beverage, Boilers and Industrial Cooling Towers, Personal Care, Wood Preservation, Paints and Coatings, Heating, Ventilation, and Air Conditioning (HVAC), Boilers, Metal Working Fluids, Marine Industry, Plastics, Leather and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America |

|

Market Players Covered |

BASF SE (U.S.), CLARIANT (Switzerland), Dow (U.S.), Akzo Nobel N.V (Netherlands), Kemira Oyj (Finland), THOR (U.S.), Italmatch AWS (Italy), LANXESS (Germany), Albemarle Corporation (U.S.), Lonza (Switzerland), Ecolab (U.S.), Merck KgaA (Germany), Solvay (Belgium), The Lubrizol Corporation (U.S.), Evonik Industries AG (Germany), Nouryon (Netherland), Ashland (U.S.), Bayer AG (Germany), |

|

Market Opportunities |

|

Market Definition

Biocides are the substances or products which are used to protect against animals, unwanted plants, or microorganisms. They are produced in powder and liquid forms, in ready-to-use formulations, or as concentrates, and are applied by using several techniques. Normally, biocides are divided in to four main groups: preservatives, pest control, disinfectants and general biocidal products and other biocidal products.

Biocides Market Dynamics

Drivers

- Growing demand for clean and potable water and effective wastewater treatment solutions

The biocides market is driven mainly by the rising demand for clean and potable water and the growing demand for effective wastewater treatment solutions. Biocides help to keep algal contamination and bacterial at bay in pool piping, industrial water treatment systems and municipal drinking water systems. Water treatment applications make significant use of biocides, such as hydrogen peroxide, silver, bromine, sodium bromide, hypobromous acid, chlorine tablets, stabilized bromine, sodium hypochlorite, calcium hypochlorite, Bronopol, QACs, and isothiazolinone. Therefore, increasing demand for clean and potable water and effective wastewater treatment solutions boosts the market growth.

- Rising usage of biocides in paint and coating industry

Growing usage of biocides in paint and coating industry is likely to drive the market growth during the forecast period. Paints and coatings are extremely susceptible to airborne and waterborne microbial contaminants because of their exposure to bulk handling. Using biocides in paints and coatings provides various benefits such as microbial growth prevention, dry-film preservation, and in-can preservation in paints and coatings. It also helps to prevent fungal development in paints when the paint dries. All these factors are enhancing the market growth.

Opportunities

- Increasing usage of biocide in household and personal care application

Biocides are widely used in household and personal care applications, as a result the demand for the biocides increases during the forecast period. The major application for the biocide during the forecast period in household and personal care application is due to the rapid growth in the disinfectant demand caused by the pandemic. Furthermore, increasing awareness regarding health hygiene eventually increases the demand for the biocides in household and personal care products such as chloroacetimide bronopol, triclosan, isothiazolinones, and others. Therefore, the increasing usage of biocide in household and personal care applications create lucrative market opportunities.

- Rising mergers acquisition and collaboration between major market players

The surging mergers acquisition and collaboration between major market players further offer ample growth opportunities within the market. For instance, in 2019, Ecolab acquired Chemstar Corporation, a food safety, cleaning, and sanitizing solutions supplier, focusing on food retail and the supermarket markets in the United States. The acquisition was undertaken for the company to increase its sanitizing and cleaning products product lines.

Restraints/ Challenges

- Availability of substitutes

The availability of an alternative to biocides such as inhibitors of High-Performance Driver Education (HPDE) is one of the major factor which is expected to hamper the growth of the biocides market. Some known inhibitors are hydroxylamine and its salts such as sodium thiocyanate.

- Adverse effects associated with biocides

The use of biocides can lead to severe ecological consequences. Anti-fouling paints have compounds such as Tributyltin that adversely affect aquatic ecosystems. Furthermore, biocides pose a particular risk to pregnant women, small children, unborn life, or people with serious chronic illness. As a result of all these factors, hamper the market growth during the forecast period.

This biocides market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the biocides market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In 2022, Bridgnorth Aluminium collaborated with Veolia Water Technologies. With this collaboration, Veolia Water will help Bridgnorth Aluminium in compliance services and water treatment processes at the production site in Shropshire. Veolia Water Technologies deliver servicing chemical supply and Legionella compliance for its water treatment process and cooling towers systems.

- In 2022, Arxada collaborated with Troy Corporation. This collaboration will create an innovative, advanced and comprehensive offering in Arxada’s Microbial Control Solutions (MCS’) business. They will also allow the delivery of value-added solutions and new services to customers.

- In January 2021, Lanxess acquired biocides specialist Intace SAS to reinforce its business. The company is going to extend its biocide technology platform for packaging and labeling and in customer goods industry.

North America Biocides Market Scope

The biocides market is segmented on the basis of type, products and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Halogen Compounds

- Organic Acids

- Nitrogen Based Biocides (Quaternary Ammonium Compounds)

- Metallic Compounds

- Organosulfur Compounds

- Phenolic Biocides

- Others

Product

- Preservatives

- Pest Control

- Others

Application

- Water Treatment

- Oil and Gas

- Municipal Water Treatment

- Power Plants

- Pulp and Paper

- Swimming Pools

- Mining

- Other

- Food and Beverage

- Boilers and Industrial Cooling Towers

- Personal Care

- Wood Preservation

- Paints and Coatings

- Heating, Ventilation, and Air Conditioning. (HVAC)

- Boilers

- Metal Working Fluids

- Marine Industry

- Plastics

- Leather

- Others

Biocides Market Regional Analysis/Insights

The biocides market is analysed and market size insights and trends are provided by country, type, products, and application as referenced above.

The countries covered in the biocides market report are U.S., Canada, and Mexico in North America.

U.S. dominates the North America biocides market due to the growing demand of biocides in the food and beverage preservation sector in this region. Furthermore, the high rate of the geriatric population which demands the preservative food and beverage preservation that can maintain the bone health will further boost the market growth in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Biocides Market Share Analysis

The biocides market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to biocides market.

Some of the major players operating in the biocides market are:

- BASF SE (U.S.)

- CLARIANT (Switzerland)

- Dow (U.S.)

- Akzo Nobel N.V (Netherlands)

- Kemira Oyj (Finland)

- THOR (U.S.)

- Italmatch AWS (Italy)

- LANXESS (Germany)

- Albemarle Corporation (U.S.)

- Lonza (Switzerland), Ecolab (U.S.)

- Merck KgaA (Germany)

- Solvay (Belgium)

- The Lubrizol Corporation (U.S.)

- Evonik Industries AG (Germany)

- Nouryon (Netherland), Ashland (U.S.)

- Bayer AG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Biocides Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Biocides Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Biocides Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.