North America Biomarkers Market

Market Size in USD Billion

CAGR :

%

USD

22.40 Billion

USD

37.07 Billion

2024

2032

USD

22.40 Billion

USD

37.07 Billion

2024

2032

| 2025 –2032 | |

| USD 22.40 Billion | |

| USD 37.07 Billion | |

|

|

|

|

North America Biomarkers Market Size

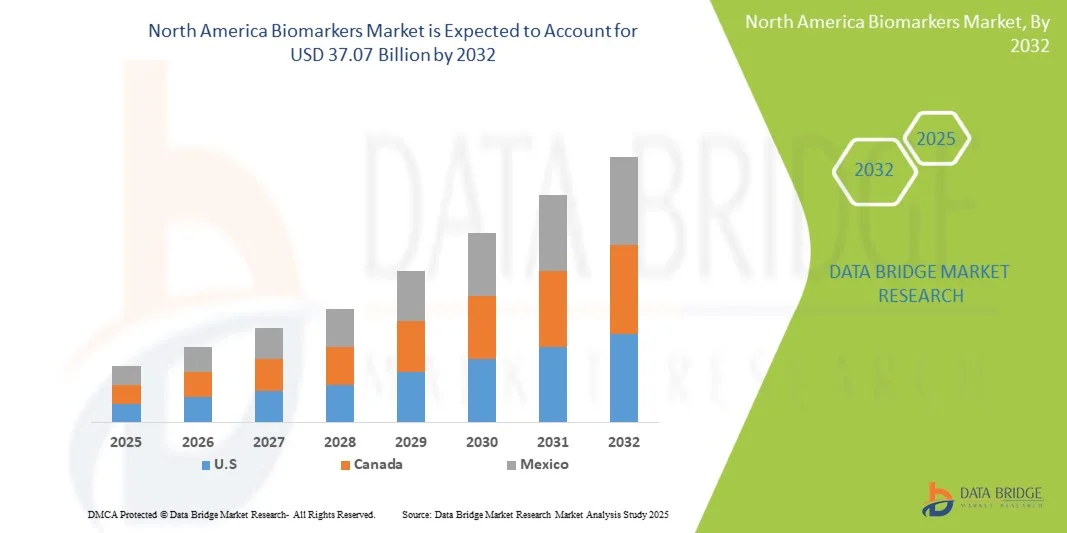

- The North America Biomarkers Market size was valued at USD 22.40 billion in 2024 and is expected to reach USD 37.07 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress in diagnostic and therapeutic applications, leading to increased integration of biomarkers in personalized medicine, drug development, and clinical research

- Furthermore, rising demand for accurate, rapid, and non-invasive diagnostic solutions is establishing biomarkers as essential tools in early disease detection, treatment monitoring, and precision healthcare. These converging factors are accelerating the adoption of biomarker-based solutions, thereby significantly boosting the industry's growth

North America Biomarkers Market Analysis

- Biomarkers, used for disease detection, prognosis, and treatment monitoring, are increasingly vital components of modern healthcare and personalized medicine due to their ability to provide precise, real-time insights into patient conditions, improve therapeutic outcomes, and support drug development pipelines

- The escalating demand for biomarkers is primarily fueled by the growing adoption of precision medicine, increasing prevalence of chronic and infectious diseases, and rising awareness of early diagnostics and personalized healthcare solutions

- U.S. dominated the North America Biomarkers Market with the largest revenue share of 81.5% in 2024, driven by advanced healthcare infrastructure, strong R&D investments, and the presence of leading industry players. Growth is supported by widespread adoption of biomarker-based diagnostics in oncology, cardiovascular, and metabolic disease monitoring, alongside continuous technological advancements in assay development and laboratory automation

- Canada is expected to witness the fastest growth in the North America Biomarkers Market, with a projected CAGR of 8.9% from 2025 to 2032, fueled by increasing adoption of personalized medicine, rising prevalence of chronic diseases, and expanding healthcare infrastructure including hospitals and diagnostic centers

- The Cancer segment dominated the largest market revenue share of 48.6% in 2024, driven by the high prevalence of cancers and the critical role of biomarkers in early detection, prognosis, and therapy monitoring

Report Scope and North America Biomarkers Market Segmentation

|

Attributes |

North America Biomarkers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Biomarkers Market Trends

“Growing Demand Driven by Personalized Medicine and Early Diagnostics”

- A significant and accelerating trend in the North America Biomarkers Market is the increasing adoption of biomarkers for early disease detection, patient monitoring, and personalized treatment planning. This integration of advanced diagnostic tools is significantly enhancing healthcare outcomes and clinical decision-making

- For instance, in 2024, Thermo Fisher Scientific and Bio-Rad Laboratories announced advancements in multiplex biomarker assay panels, enabling more accurate detection of oncology, cardiovascular, and metabolic disorders. Such initiatives by leading companies are expected to drive North America Biomarkers Market growth during the forecast period The use of biomarkers across clinical laboratories, hospitals, and research institutions allows for more precise monitoring of disease progression, patient response to therapy, and identification of high-risk individuals, improving overall healthcare efficiency

- The North America Biomarkers Market continues to expand due to growing awareness among healthcare professionals and patients, increased R&D investment, and the integration of advanced laboratory technologies that enhance throughput and diagnostic accuracy

- This trend towards advanced, reliable, and accessible biomarker solutions is reshaping patient care strategies and accelerating adoption across both clinical and research applications

North America Biomarkers Market Dynamics

Driver

“Growing Need Due to Rising Demand for Precision Medicine and Early Disease Detection”

- The increasing prevalence of chronic diseases and the growing focus on personalized healthcare, coupled with advancements in diagnostic technologies, is a significant driver for the heightened demand for biomarker solutions

- For instance, in April 2024, Bio-Rad Laboratories, Inc. (U.S.) announced the launch of its new multiplex biomarker assay platform, designed to enhance early detection and monitoring of multiple disease pathways simultaneously. Such strategic developments by key companies are expected to drive the Biomarkers industry growth in the forecast period

- As healthcare providers become more aware of the value of early and accurate diagnostics, biomarker solutions offer advanced capabilities such as multi-analyte detection, real-time monitoring, and integration with clinical decision support systems, providing a compelling advantage over conventional diagnostic methods

- Furthermore, the growing adoption of personalized medicine and the increasing use of biomarkers in drug discovery and therapeutic monitoring are making biomarker-based solutions an integral component of modern healthcare, offering seamless integration with electronic health records and laboratory information systems

- The convenience of non-invasive testing, faster turnaround times, and the ability to monitor treatment response in real time are key factors propelling the adoption of biomarker solutions in both clinical and research settings. The trend towards precision healthcare and the increasing availability of user-friendly biomarker platforms further contribute to market growth

Restraint/Challenge

“Concerns Regarding Regulatory Compliance, High Costs, and Data Privacy”

- Challenges surrounding regulatory approvals, data privacy, and standardization of biomarker tests pose significant barriers to broader market penetration. Biomarker solutions often require strict validation and adherence to clinical and regulatory guidelines, which can slow market adoption

- For instance, high costs associated with advanced biomarker assays and proprietary platforms can make some healthcare providers hesitant to implement them widely, particularly in resource-constrained regions or smaller clinics

- Addressing these challenges through robust clinical validation, compliance with FDA and EMA guidelines, and ensuring secure handling of patient data is crucial for building trust among healthcare providers and patients. Companies such as QIAGEN and Meso Scale Diagnostics emphasize their validated, regulatory-compliant biomarker platforms to reassure customers

- In addition, the relatively high initial cost of some advanced biomarker systems compared to conventional diagnostic tests can be a barrier to adoption. While some affordable platforms are emerging, premium solutions with multiplexing capabilities, high sensitivity, or integration with AI-driven analytics often come with a higher price tag

- Overcoming these challenges through enhanced regulatory support, transparent clinical validation, secure data management, and development of more cost-effective biomarker solutions will be vital for sustained market growth

North America Biomarkers Market Scope

The market is segmented on the basis of type, product, mechanism, application, and disease indication

• By Type

On the basis of type, the North America Biomarkers Market is segmented into safety biomarkers, efficacy biomarkers, and validation biomarkers. The safety biomarkers segment dominated the largest market revenue share of 42.7% in 2024, driven by their critical role in evaluating the safety profile of drugs during preclinical and clinical trials. Pharmaceutical companies and research institutions extensively use safety biomarkers to detect potential adverse effects early, ensuring patient safety and regulatory compliance. Their application across multiple therapeutic areas such as oncology, cardiovascular, and neurological disorders reinforces demand. The well-established protocols for safety biomarker assessment, coupled with growing regulatory focus on patient safety, continue to sustain this segment’s dominance. Furthermore, collaborations between academic institutions and biotech firms to develop novel safety biomarkers enhance the segment’s market position. The availability of validated assays and kits for routine safety evaluation also contributes to steady adoption.

The efficacy biomarkers segment is anticipated to witness the fastest growth rate of 19.4% CAGR from 2025 to 2032, fueled by increasing adoption in drug development and personalized therapy. Efficacy biomarkers help determine the therapeutic effect of a treatment, optimize dosing, and monitor patient response, making them essential in precision medicine. Pharmaceutical companies are increasingly integrating efficacy biomarkers into clinical trial designs to reduce time-to-market and improve success rates. The growing focus on targeted therapies, particularly in oncology and immunology, is driving demand. Advances in multiplexing technologies and bioinformatics allow simultaneous monitoring of multiple efficacy biomarkers, improving efficiency. Increasing regulatory support for biomarker-driven trials further accelerates adoption. The rising number of partnerships between diagnostic companies and pharma firms to develop innovative efficacy biomarkers also supports rapid growth in this segment.

• By Product

On the basis of product, the North America Biomarkers Market is segmented into consumables, services, software, and growth hormone therapy. The consumables segment held the largest market revenue share of 47.3% in 2024, driven by the extensive use of kits, reagents, and assay plates in laboratories and clinical settings. Consumables form the backbone of biomarker analysis, enabling reproducible and standardized testing for diagnostics, research, and drug development. The growing number of biomarker-focused research initiatives and clinical trials contributes to sustained demand. Easy availability of off-the-shelf consumables and pre-validated kits further reinforces adoption. In addition, the surge in contract research organizations (CROs) offering biomarker testing services boosts consumable usage. The rise of high-throughput screening and automated platforms also enhances the reliance on consumables.

The services segment is expected to witness the fastest CAGR of 18.6% from 2025 to 2032, fueled by increasing outsourcing of biomarker analysis, validation, and clinical testing. Contract research organizations, clinical laboratories, and academic research facilities are outsourcing biomarker testing to specialized service providers to reduce operational costs and accelerate timelines. Growing demand for custom biomarker panels and personalized testing solutions is a key driver. Services such as bioinformatics support, sample processing, and assay development are becoming critical for pharma and biotech companies. The increasing focus on regulatory compliance and quality assurance in clinical studies further enhances demand. Expansion of specialized biomarker service providers in North America supports rapid segment growth.

• By Mechanism

On the basis of mechanism, the North America Biomarkers Market is segmented into genetic, epigenetic, proteomic, lipidomic, and other mechanisms. The genetic segment dominated the largest market revenue share of 44.5% in 2024, driven by its application in personalized medicine, pharmacogenomics, and disease risk assessment. Genetic biomarkers allow early detection of hereditary conditions and help predict patient responses to therapies. The availability of advanced sequencing technologies and decreasing costs of genetic tests further support adoption. Research in oncology, cardiovascular, and neurological disorders heavily relies on genetic biomarkers for patient stratification and therapy optimization. Regulatory support for genetic testing and increasing patient awareness of personalized healthcare solutions contribute to dominance. Collaborations between biotech firms and academic institutions are accelerating the development of novel genetic biomarker assays.

The Proteomic segment is anticipated to witness the fastest growth rate of 20.1% CAGR from 2025 to 2032, fueled by advancements in mass spectrometry and protein profiling technologies. Proteomic biomarkers help in identifying protein expression patterns associated with disease progression and treatment response, particularly in cancer and immunological disorders. Increasing investment in proteomics research, rising adoption of multiplex protein assays, and integration with bioinformatics platforms drive market growth. Proteomic biomarkers are increasingly used in early diagnosis, therapeutic monitoring, and drug development, enhancing their appeal. Collaborations between diagnostic companies and pharma to develop novel proteomic assays further accelerate growth.

• By Application

On the basis of application, the North America Biomarkers Market is segmented into diagnostics development, drug discovery and development, personalized medicine, disease risk assessment, and others. The drug discovery and development segment accounted for the largest market revenue share of 46.2% in 2024, driven by the critical role of biomarkers in target validation, clinical trial design, and monitoring therapeutic efficacy. Pharmaceutical and biotech companies increasingly integrate biomarkers into clinical programs to reduce attrition rates and optimize patient selection. The growing adoption of biomarker-driven trials, particularly in oncology and immunology, reinforces dominance. Expansion of contract research organizations (CROs) offering biomarker services supports the segment. Regulatory encouragement for biomarker-based drug development further sustains growth.

The personalized medicine segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, fueled by rising demand for precision therapies and patient-specific treatment plans. Biomarkers enable identification of responders and non-responders to therapies, improving efficacy and safety. Increased investment in personalized medicine initiatives, coupled with advances in genomics, proteomics, and AI-driven diagnostics, drives adoption. Collaboration between diagnostic and pharmaceutical companies to develop companion diagnostics strengthens the market. Rising patient awareness and regulatory support further contribute to rapid segment growth.

• By Disease Indication

On the basis of disease indication, the North America Biomarkers Market is segmented into cancer, cardiovascular disorders, neurological disorders, immunological disorders, and others. The cancer segment dominated the largest market revenue share of 48.6% in 2024, driven by the high prevalence of cancers and the critical role of biomarkers in early detection, prognosis, and therapy monitoring. Oncology research heavily relies on genetic, proteomic, and epigenetic biomarkers for patient stratification and personalized treatment planning. Increasing funding for cancer research, rising adoption of companion diagnostics, and regulatory support contribute to dominance.

The neurological disorders segment is expected to witness the fastest CAGR of 22.0% from 2025 to 2032, fueled by rising prevalence of disorders such as Alzheimer’s, Parkinson’s, and multiple sclerosis. Biomarkers aid in early diagnosis, monitoring disease progression, and evaluating therapeutic interventions. Advances in imaging, proteomics, and molecular diagnostics are driving adoption. Growing awareness of neurological diseases, coupled with increasing R&D investment in neurodegenerative therapies, supports segment growth. Moreover, government initiatives and funding for neurological research are further accelerating the development and adoption of biomarker-based solutions in this segment

North America Biomarkers Market Regional Analysis

- U.S. dominated the North America Biomarkers Market with the largest revenue share of 81.5% in 2024, driven by advanced healthcare infrastructure, strong R&D investments, and the presence of leading industry players. Growth is supported by widespread adoption of biomarker-based diagnostics in oncology, cardiovascular, and metabolic disease monitoring, alongside continuous technological advancements in assay development and laboratory automation

- Canada is expected to witness the fastest growth in the North America Biomarkers Market, with a projected CAGR of 8.9% from 2025 to 2032, fueled by increasing adoption of personalized medicine, rising prevalence of chronic diseases, and expanding healthcare infrastructure including hospitals and diagnostic centers

- This widespread adoption is further supported by advanced healthcare infrastructure, strong R&D investments, and a technologically inclined population, establishing biomarker solutions as essential tools in both clinical and research settings

U.S. North America Biomarkers Market Insight

The U.S. biomarkers dominated the North America Biomarkers Market with the largest revenue share of 81.5% in 2024, driven by advanced healthcare infrastructure, strong R&D investments, and the presence of leading industry players. Growth is supported by widespread adoption of biomarker-based diagnostics in oncology, cardiovascular, and metabolic disease monitoring, alongside continuous technological advancements in assay development, high-throughput screening, and laboratory automation. Increasing integration of biomarker platforms into personalized medicine programs and clinical workflows further accelerates adoption, making the U.S. the key revenue contributor within North America.

Canada North America Biomarkers Market Insight

The Canada biomarkers is expected to witness the fastest growth in the North America Biomarkers Market, with a projected CAGR of 8.9% from 2025 to 2032, fueled by rising adoption of personalized medicine, increasing prevalence of chronic diseases, and expanding healthcare infrastructure including hospitals, diagnostic centers, and research laboratories. Growing government initiatives, funding for biomarker research, and collaboration between diagnostic companies and healthcare institutions are also accelerating market expansion in the country.

North America Biomarkers Market Share

The Biomarkers industry is primarily led by well-established companies, including:

- Enzo Biochem, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Merck KGaA (Germany)

- PerkinElmer, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Bruker (U.S.)

- Epigenomics AG (Germany)

- Meso Scale Diagnostics, LLC (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- LifeSign LLC (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

Latest Developments in North America Biomarkers Market

- In December 2024, iXpressGenes, a biotechnology company transforming trauma care, appointed co-founder John Schmitt as Chief Executive Officer (CEO) and announced the nationwide launch of its Trauma Autoimmune Indicator (TAI) test, available by Q2 2025. This cutting-edge advancement represents a paradigm shift in trauma detection and prevention, empowering healthcare providers to identify trauma-induced diseases like PTSD before symptoms emerge

- In March 2025, WellStone, a behavioral health provider, partnered with iXpressGenes and ordered 1,000 Trauma Autoimmune Indicator (TAI) tests to enhance its trauma screening capabilities. This collaboration underscores the growing adoption of innovative biomarker-based diagnostics in mental health care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.