North America Blood Screening Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

2.45 Billion

2025

2033

USD

1.08 Billion

USD

2.45 Billion

2025

2033

| 2026 –2033 | |

| USD 1.08 Billion | |

| USD 2.45 Billion | |

|

|

|

|

North America Blood Screening Market Size

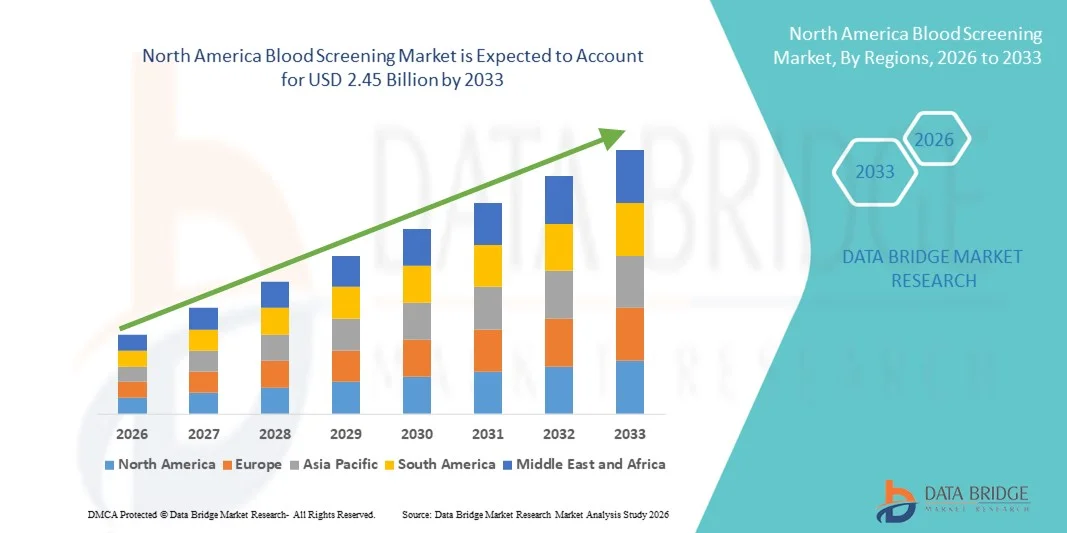

- The North America blood screening market size was valued at USD 1.08 billion in 2025 and is expected to reach USD 2.45 billion by 2033, at a CAGR of 10.80% during the forecast period

- The market growth is largely fueled by increased demand for safe blood donation screening, advanced molecular and immunoassay technologies, and stringent regulatory frameworks that mandate comprehensive blood safety testing, driving adoption of innovative screening solutions across hospitals, blood banks, and diagnostic centers

- Furthermore, rising prevalence of infectious diseases, greater focus on preventive healthcare, and expanding diagnostics infrastructure in the U.S., Canada, and Mexico are encouraging higher uptake of blood screening services as essential components of clinical workflows, thereby significantly boosting industry growth

North America Blood Screening Market Analysis

- Blood screening, encompassing diagnostic tests to detect infectious agents and ensure the safety of blood transfusions, is increasingly vital in healthcare systems in both hospitals and blood banks due to its critical role in preventing transfusion-transmitted infections and supporting public health initiatives

- The escalating demand for blood screening is primarily fueled by growing prevalence of infectious diseases, stringent regulatory requirements for safe blood supply, and the adoption of advanced technologies such as nucleic acid tests (NAT) and enzyme-linked immunosorbent assays (ELISA), which improve accuracy, speed, and reliability of diagnostics

- The United States dominated the North America blood screening market with the largest revenue share of 65.9% in 2025, characterized by early adoption of advanced diagnostic solutions, well-established healthcare infrastructure, high healthcare spending, and a strong presence of key industry players

- Canada is expected to be the fastest growing country in the North America blood screening market during the forecast period due to increasing healthcare infrastructure, rising awareness of blood safety, and adoption of advanced diagnostic technologies across hospitals and blood banks

- The reagents and kits segment dominated the North America blood screening market with the largest share of 50.2% in 2025, driven by frequent use in routine testing workflows and its critical role in ensuring safe transfusions

Report Scope and North America Blood Screening Market Segmentation

|

Attributes |

North America Blood Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Blood Screening Market Trends

Adoption of Advanced Molecular and Automated Screening Technologies

- A significant and accelerating trend in the North America blood screening market is the increasing integration of advanced molecular technologies, automation, and high-throughput platforms, significantly enhancing testing speed, accuracy, and reliability

- For instance, the COBAS® 6800 System by Roche Diagnostics automates nucleic acid testing workflows, enabling large-scale, rapid blood screening with minimal human intervention, reducing errors and turnaround times

- Automation and molecular integration allow laboratories to conduct simultaneous multi-pathogen screening, improve reproducibility, and reduce manual handling, while emerging AI-assisted analytics help identify patterns and optimize testing protocols

- These technologies also facilitate centralized data management, allowing seamless monitoring of blood safety metrics across multiple facilities and ensuring regulatory compliance with minimal manual reporting

- The trend towards high-throughput, automated, and AI-assisted blood screening is reshaping expectations for efficiency and safety, prompting companies such as Grifols and Abbott to develop integrated platforms with rapid, multiplexed testing capabilities

- The demand for automated and molecular blood screening solutions is growing rapidly across hospitals, diagnostic centers, and blood banks as healthcare providers prioritize speed, accuracy, and comprehensive pathogen detection

- Growing collaboration between diagnostic companies and digital health providers is enabling cloud-based monitoring and reporting, streamlining laboratory operations and enhancing traceability of test results

North America Blood Screening Market Dynamics

Driver

Rising Need Due to Increasing Infectious Diseases and Regulatory Standards

- The growing prevalence of infectious diseases, coupled with stringent regulatory requirements for blood safety, is a significant driver for the increased adoption of advanced blood screening solutions

- For instance, in March 2025, Hologic, Inc. launched enhanced NAT screening assays designed for early detection of emerging infectious agents, supporting compliance with U.S. FDA and CDC blood safety guidelines

- As healthcare providers prioritize prevention of transfusion-transmitted infections, blood screening systems offer high sensitivity and specificity, reducing risks associated with contaminated blood products

- Furthermore, expanding healthcare infrastructure and rising patient awareness of safe blood transfusions are driving investments in next-generation screening technologies across hospitals, blood banks, and diagnostic centers

- The convenience of automated workflows, rapid multi-pathogen detection, and integrated software solutions that streamline data management are key factors propelling adoption of blood screening technologies in North America

- Government initiatives and funding programs to enhance blood safety protocols are encouraging healthcare providers to adopt modern screening solutions

- Rising demand for early disease detection and preventive healthcare is further driving investment in advanced blood screening platforms

Restraint/Challenge

High Costs and Technical Expertise Requirement

- The relatively high cost of advanced blood screening instruments and consumables poses a challenge to widespread market adoption, particularly for smaller diagnostic centers and clinics

- For instance, smaller regional blood banks may face budget constraints when implementing fully automated NAT or ELISA platforms, limiting accessibility despite clear clinical benefits

- The need for trained personnel to operate complex molecular systems and maintain quality control adds another barrier, as specialized skills are required to ensure accurate results and compliance with regulatory standards

- In addition, integration with existing laboratory information systems and validation of new technologies can require significant time and resources, potentially delaying adoption

- Overcoming these challenges through cost reduction strategies, simplified automation, training programs, and scalable solutions will be critical to sustaining growth and expanding access to advanced blood screening technologies

- Stringent regulatory compliance and frequent updates in testing protocols can slow adoption and increase operational complexity for laboratories

- Potential supply chain constraints for reagents, kits, and specialized instruments may limit availability and impact timely implementation of advanced screening solutions

North America Blood Screening Market Scope

The market is segmented on the basis of products and services, technology, disease type, and end user.

- By Products and Services

On the basis of products and services, the market is segmented into reagents and kits, instruments, and software and services. Reagents and Kits segment dominated the market with the largest revenue share of 50.2% in 2025. Reagents and kits are critical for routine blood screening workflows and are widely used for NAT, ELISA, and rapid tests in hospitals, blood banks, and diagnostic centers. Their frequent replacement and consistent performance requirements make them essential for reliable testing. Continuous innovation in assay design and multi-pathogen detection kits further supports their dominance. Laboratories also prefer ready-to-use kits to reduce errors and maintain standardization across multiple facilities. In addition, reagents and kits are a primary revenue contributor due to their recurring demand in high-volume screening programs.

Software and Services segment is expected to witness the fastest growth during 2026–2033. The growth is driven by adoption of digital laboratory management systems, cloud-based reporting, and AI-assisted analytics, which streamline workflows, reduce manual errors, and enhance traceability of results. Hospitals and diagnostic centers increasingly invest in software solutions for regulatory compliance and quality control. Integration with automated instruments and high-throughput platforms further accelerates demand. Cloud-based monitoring enables centralized data management and real-time tracking of test results. Emerging AI tools also optimize testing protocols and improve operational efficiency across laboratories.

- By Technology

On the basis of technology, the market is segmented into Nucleic Acid Test (NAT), ELISA, rapid tests, western blot assay, next-generation sequencing (NGS), and others. Nucleic Acid Test (NAT) segment dominated the market in 2025 with the largest revenue share of 40%. NAT is favored for its high sensitivity and specificity, especially for detecting viral pathogens such as HIV, HBV, and HCV. It reduces the window period for infection detection, ensuring safer transfusions. Hospitals and centralized blood banks rely on NAT for large-scale blood screening due to efficiency and reliability. Adoption of automated NAT platforms has further strengthened its market position. NAT also supports compliance with stringent regulatory standards in the U.S., reinforcing its adoption. Multi-pathogen detection capabilities of NAT kits make them indispensable in high-volume screening workflows.

Next-Generation Sequencing (NGS) is expected to witness the fastest growth from 2026 to 2033. NGS enables simultaneous detection of multiple pathogens and genetic variants, making it highly useful in advanced diagnostic centers and research-oriented blood banks. The declining cost of sequencing and improvements in throughput and accuracy accelerate adoption. NGS facilitates predictive analysis and early disease detection, supporting preventive healthcare initiatives. Hospitals and diagnostic labs increasingly integrate NGS with other molecular tests for comprehensive screening. Investment in NGS platforms is rising due to growing demand for multiplexed testing and personalized medicine approaches.

- By Disease Type

On the basis of disease type, the market is segmented into respiratory diseases, diabetes mellitus, oncology, cholesterol, HIV/AIDS, cold and flu, infectious diseases, and others. Infectious Diseases segment dominated the market with the largest revenue share of 55% in 2025. High prevalence of HIV/AIDS, hepatitis, and other viral infections drives demand for routine blood screening. Blood banks and hospitals prioritize infectious disease screening due to regulatory compliance and patient safety. Multiplex testing solutions and NAT platforms strengthen this segment further. Growing awareness about transfusion safety also fuels adoption. The segment benefits from continuous innovation in diagnostic assays that improve sensitivity and throughput. Automated screening systems are increasingly deployed to meet high-volume testing requirements.

Oncology segment is expected to witness the fastest growth from 2026 to 2033. Rising demand for early detection of cancer biomarkers via blood tests drives this growth. Advancements in liquid biopsy technologies and NGS are expanding adoption in hospitals and diagnostic centers. Increasing awareness of preventive healthcare and early cancer detection supports the rapid uptake. Research investments in oncology diagnostics also boost market potential. Oncology screening is increasingly integrated with multi-disease panels, enhancing its relevance in blood screening workflows. Personalized medicine initiatives are further propelling this segment’s expansion.

- By End User

On the basis of end users, the market is segmented into diagnostic centers, blood banks, hospitals, clinics, and ambulatory surgical centers (ASCs). Blood Banks dominated the market with the largest revenue share of 45% in 2025. They handle high-volume blood collection, processing, and transfusion safety, requiring continuous screening for multiple pathogens. Adoption of automated NAT and ELISA platforms has improved operational efficiency. Blood banks face stringent regulatory mandates, which necessitate investment in advanced screening technologies. Their central role in transfusion safety drives recurring demand for reagents, kits, and instruments. Advanced screening ensures reduced risk of transfusion-transmitted infections. Blood banks also lead adoption of multi-pathogen and high-throughput screening systems.

Diagnostic Centers are expected to witness the fastest growth from 2026 to 2033. Increasing preventive healthcare awareness and demand for comprehensive blood testing drive this expansion. Advanced molecular diagnostics, rapid tests, and NGS adoption in diagnostic centers enable early disease detection. Urbanization and rising healthcare spending further support growth. Centers invest in automated systems to increase throughput and reduce turnaround times. Integration of digital reporting and AI-assisted analytics strengthens operational efficiency. Patients increasingly prefer diagnostic centers for routine and specialized blood screening services.

North America Blood Screening Market Regional Analysis

- The United States dominated the North America blood screening market with the largest revenue share of 65.9% in 2025, characterized by early adoption of advanced diagnostic solutions, well-established healthcare infrastructure, high healthcare spending, and a strong presence of key industry players

- Healthcare providers and blood banks in the region highly prioritize accurate and rapid detection of infectious agents, ensuring safe transfusions and compliance with FDA and CDC guidelines. The adoption of automated platforms, nucleic acid testing (NAT), and ELISA-based screening solutions supports widespread usage

- This dominance is further supported by high healthcare spending, a technologically advanced laboratory workforce, and the presence of leading diagnostic companies, establishing the U.S. as the primary hub for blood screening innovations and adoption. Hospitals, diagnostic centers, and centralized blood banks contribute significantly to the market revenue through high-volume testing programs

The U.S. Blood Screening Market Insight

The U.S. blood screening market captured the largest revenue share of 65.9% in 2025 within North America, fueled by early adoption of advanced molecular diagnostics, automated high-throughput screening platforms, and stringent regulatory frameworks. Hospitals, blood banks, and diagnostic centers prioritize rapid and accurate detection of infectious agents to ensure safe transfusions. The growing trend of preventive healthcare, combined with robust demand for multiplexed assays and AI-assisted analytics, further propels the market. Moreover, the widespread use of nucleic acid testing (NAT) and enzyme-linked immunosorbent assays (ELISA) is significantly contributing to market expansion. The presence of leading diagnostic companies and centralized blood screening laboratories also reinforces U.S. dominance.

Canada Blood Screening Market Insight

The Canada blood screening market is expected to grow at the fastest CAGR during the forecast period, driven by increasing investments in healthcare infrastructure, rising awareness of blood safety, and adoption of advanced automated screening platforms. The government’s initiatives to strengthen transfusion safety protocols are promoting modern diagnostic technologies across hospitals and blood banks. Furthermore, growing preventive healthcare programs and expanding laboratory networks support the adoption of high-throughput and multiplexed testing solutions. Diagnostic centers and research-oriented blood banks are increasingly leveraging nucleic acid testing and next-generation sequencing (NGS). The rising number of blood donation programs and centralization of blood testing facilities are further accelerating market growth.

Mexico Blood Screening Market Insight

The Mexico blood screening market is witnessing steady growth due to improvements in healthcare infrastructure and rising adoption of modern diagnostic techniques in urban centers. Blood banks and hospitals are increasingly deploying ELISA and rapid tests to ensure safe blood transfusions and meet local regulatory requirements. Public awareness campaigns on blood donation safety and infectious disease prevention are driving demand for advanced blood screening solutions. The growing number of private diagnostic laboratories offering automated testing services contributes to market expansion. Furthermore, government collaborations with international diagnostic companies are supporting technology transfer and skill development. Affordability of multiplex testing kits is gradually increasing accessibility across regional hospitals and clinics.

North America Blood Screening Market Share

The North America Blood Screening industry is primarily led by well-established companies, including:

- Labcorp (U.S.)

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Abbott (U.S.)

- BIOMÉRIEUX (France)

- Siemens Healthineers AG (Germany)

- Bio Rad Laboratories, Inc. (U.S.)

- Hologic, Inc. (U.S.)

- Danaher (U.S.)

- PerkinElmer, Inc. (U.S.)

- QIAGEN (Netherlands)

- Cepheid (U.S.)

- Grifols, S.A. (Spain)

- Ortho Clinical Diagnostics (U.S.)

- Luminex Corporation (U.S.)

- QuidelOrtho Corporation (U.S.)

- Bio-Techne Corporation (U.S.)

What are the Recent Developments in North America Blood Screening Market?

- In October 2025, Roche Diagnostics and Eli Lilly received FDA approval for the Elecsys blood test that detects Alzheimer’s‑linked pTau181 protein, aimed at supporting initial cognitive decline assessments and speeding up clinical decision‑making

- In October 2025, large‑scale clinical results for the Galleri multi‑cancer early detection test capable of identifying signals from more than 50 cancer types showed effective early detection across U.S. and Canadian participants, pointing to broader blood screening adoption potential

- In August 2025, Freenome entered an exclusive license agreement with Exact Sciences to commercialize its colorectal cancer blood‑based screening test in the U.S., with FDA submission complete and commercial launch

- In June 2025, Quest Diagnostics announced a collaboration with The University of Texas MD Anderson Cancer Center to develop the multi‑cancer stratification (MCaST) blood test, aimed at identifying elevated risk for various cancers using circulating protein biomarkers

- In May 2025, the U.S. Food and Drug Administration (FDA) granted marketing clearance to the first blood test designed to assist in diagnosing Alzheimer’s disease, developed by Fujirebio Diagnostics in Pennsylvania, offering a less invasive and more accessible diagnostic alternative

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.