North America Body Composition Analyzers Market

Market Size in USD Million

CAGR :

%

USD

123.20 Million

USD

231.43 Million

2024

2032

USD

123.20 Million

USD

231.43 Million

2024

2032

| 2025 –2032 | |

| USD 123.20 Million | |

| USD 231.43 Million | |

|

|

|

|

Body Composition Analysers Market Size

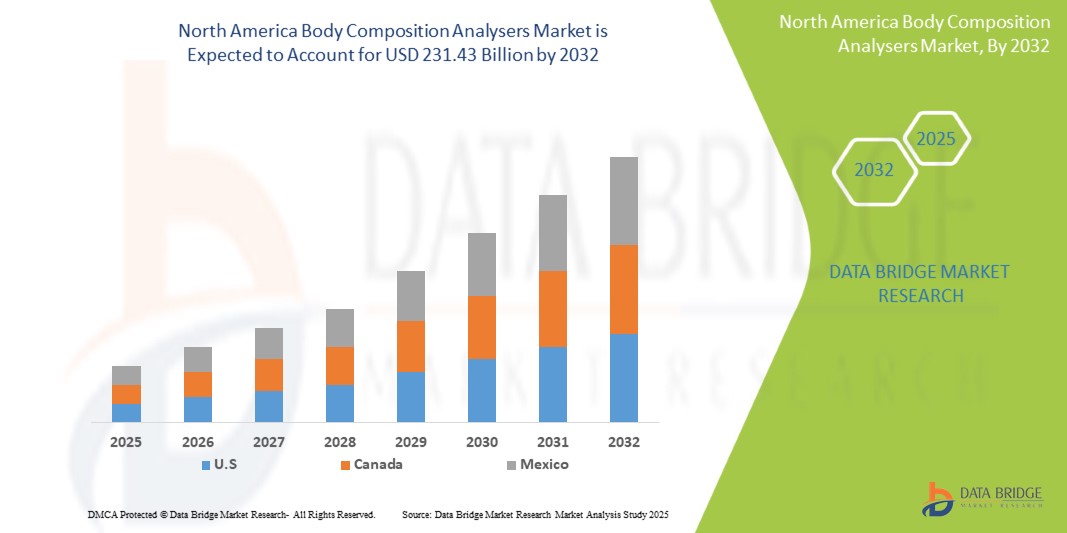

- The North America Body Composition Analysers Market size was valued at USD 123.2 Million in 2024 and is projected to reach USD 231.43 Million by 2032, exhibiting a CAGR of 8.2% during the forecast period.

- The market expansion is primarily fueled by the escalating focus on health and wellness, alongside the increasing prevalence of obesity and related chronic diseases, driving the demand for accurate body composition assessment.

- Furthermore, technological advancements in body composition analysers, such as enhanced accuracy, portability, and integration with digital health platforms, are broadening their applications across various end-user segments, thereby boosting market growth. The rising consumer awareness regarding the importance of body composition analysis in fitness and disease management also significantly contributes to the market's expansion.

Body Composition Analysers Market Analysis

- Body composition analysers, which are devices used to measure the proportions of fat mass, lean mass, water, and bone mineral density in the human body, are becoming increasingly crucial tools in health monitoring, fitness assessments, and clinical diagnostics due to their ability to provide detailed insights beyond just body weight.

- The growing emphasis on personalized health and fitness regimens, where understanding body composition is key to tailoring effective strategies, is a significant factor driving the demand for these analysers.

- U.S. represents a substantial market for body composition analysers, holding the largest revenue share of 38.5% in 2025, characterized by a strong emphasis on health and fitness, high disposable incomes, and a well-established healthcare infrastructure, with the U.S. demonstrating considerable adoption across fitness centers, hospitals, and for personal use, propelled by innovations in user-friendly and accurate devices.

- Canada is anticipated to be the fastest-growing country in the Body Composition Analysers Market during the forecast period, owing to increasing health awareness, rising disposable incomes, and a growing prevalence of lifestyle diseases.

- The Bioelectrical Impedance Analysis (BIA) segment is expected to dominate the Body Composition Analysers Market with a market share of 45.8% in 2025, driven by its non-invasive nature, affordability, and increasing availability in consumer-friendly devices.

Report Scope and Body Composition Analysers Market Segmentation

|

Attributes |

Body Composition Analysers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Body Composition Analysers Market Trends

“Growing Emphasis on Non-Invasive and User-Friendly Technologies”

- A significant trend in the North America Body Composition Analysers Market is the increasing preference for non-invasive and user-friendly technologies. Bioelectrical Impedance Analysis (BIA) devices, known for their ease of use and affordability, are gaining substantial traction in both home and fitness center settings.

- The development of more sophisticated BIA devices with improved accuracy and the ability to segment body composition is further fueling this trend. These devices often come with user-friendly interfaces and smartphone app integration, allowing individuals to track their progress conveniently.

- Furthermore, advancements in wearable body composition analysers are emerging, offering continuous monitoring and integration with daily activity tracking. This focus on convenience and non-invasiveness caters to the growing health-conscious population seeking regular body composition insights without the need for clinical settings or complex procedures.

- The demand for devices that can be easily integrated into daily routines and provide actionable data is shaping the innovation landscape of the body composition analysers market in North America.

Body Composition Analysers Market Dynamics

Driver

“Rising Awareness of Health and Wellness and Increasing Prevalence of Obesity”

- The escalating focus on health and wellness across North America is a significant driver for the Body Composition Analysers Market. As individuals become more proactive about their health, the demand for tools that provide detailed insights into body composition beyond just weight is increasing.

- Furthermore, the rising prevalence of obesity and associated chronic diseases such as diabetes and cardiovascular conditions is driving the need for accurate body composition assessment for diagnosis, monitoring, and management. Healthcare professionals and individuals alike are recognizing the importance of understanding fat mass, lean mass, and other body components in achieving and maintaining optimal health.

- The growing adoption of fitness and wellness programs, coupled with increasing consumer spending on health-related products and services, further contributes to the demand for body composition analysers across various end-user segments, including home use, fitness centers, and healthcare facilities.

Restraint/Challenge

“Accuracy Limitations and Cost of Advanced Technologies”

- While technological advancements are improving the accuracy of body composition analysers, some methods, particularly BIA, can be influenced by hydration levels, food intake, and other factors, leading to potential inaccuracies. This limitation can hinder the reliability of these devices for certain applications, especially in clinical settings where precise measurements are crucial.

- Moreover, advanced technologies like Dual-Energy X-ray Absorptiometry (DXA) and Air Displacement Plethysmography (ADP), while highly accurate, come with a higher cost, limiting their accessibility, particularly for home use and smaller fitness centers. The initial investment and maintenance expenses associated with these sophisticated devices can be a significant barrier to wider adoption.

- Overcoming these challenges requires continuous innovation in technology to enhance accuracy across different methods and efforts to reduce the cost of advanced analysers to make them more accessible to a broader range of consumers and healthcare providers.

Body Composition Analysers Market Scope

The market is segmented on the basis of product type and end user.

By Product Type

- On the basis of product type, the North America Body Composition Analysers Market is segmented into Bioelectrical Impedance Analysis (BIA), Dual-Energy X-ray Absorptiometry (DXA), Air Displacement Plethysmography (ADP), Skinfold Calipers, Hydrostatic Weighing, and Others. The Bioelectrical Impedance Analysis (BIA) segment dominates the largest market revenue share of 45.8% in 2025, driven by its non-invasive nature, affordability, and increasing availability in user-friendly, portable devices for both clinical and home use.

- The Dual-Energy X-ray Absorptiometry (DXA) segment is anticipated to witness the fastest growth rate of 6.7% from 2025 to 2032, fueled by its superior accuracy in measuring bone mineral density and body composition, and its increasing adoption in diagnosing conditions like osteoporosis and sarcopenia.

By End User

- On the basis of end user, the North America Body Composition Analysers Market is segmented into Hospitals & Clinics, Fitness Centers, Research Centers, Home Use, and Others.

- The Hospitals & Clinics segment driven by the increasing use of body composition analysers for patient assessment, nutritional monitoring, and management of various health conditions.

- The Fitness Centers segment is a major contributor to the market, with a growing demand for body composition analysis to personalize training programs and track client progress.

Body Composition Analysers Market Regional Analysis

- U.S. dominates the Body Composition Analysers Market driven by a strong emphasis on health and fitness, high disposable incomes, and a well-established healthcare infrastructure.

- Consumers in the region exhibit a high awareness of the benefits of body composition analysis in managing weight, improving athletic performance, and monitoring overall health, contributing to the significant adoption of these devices across various settings.

- The presence of key market players and continuous technological advancements further solidify North America's leading position in the global body composition analysers market.

U.S. Body Composition Analysers Market Insight

- The U.S. Body Composition Analysers Market captured the largest revenue share of 38.5% within North America in 2025, fueled by a high prevalence of obesity and related chronic diseases, coupled with a strong culture of health and fitness.

- The increasing adoption of body composition analysers in hospitals, clinics, fitness centers, and for personal home use underscores the growing awareness of the importance of detailed body composition data for health management and wellness.

- The market is further propelled by technological innovations leading to more accurate, portable, and user-friendly devices, as well as the integration of these analysers with digital health platforms and wearable technology.

Canada Body Composition Analysers Market Insight

- The Canada North America Body Composition Analysers Market is experiencing steady growth, driven by increasing health awareness and government initiatives promoting healthy lifestyles.

- The adoption of body composition analysers is rising in healthcare facilities, fitness centers, and among health-conscious consumers for personal use.

- Factors such as a growing aging population and the rising prevalence of lifestyle diseases are contributing to the demand for accurate body composition assessment tools.

Body Composition Analysers Market Share

The Body Composition Analysers industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- GE Healthcare (U.S.)

- InBody USA

- Tanita Corporation of America (U.S.)

- RJL Systems(U.S.)

- Omron Healthcare(U.S.)

- Withings (Nokia Health) (U.S.)

- Fitbit (A subsidiary of Google) (U.S.)

- Nutritional BioScience (NBS) (U.S.)

- SECA Corporation(U.S)

Latest Developments in North America Body Composition Analysers Market

- In January 2024, InBody Co., Ltd. launched its latest body composition analyser, the InBody 970, in North America. This advanced device features enhanced accuracy, segmental body composition analysis, and seamless integration with cloud-based data management systems, targeting hospitals, research institutions, and high-end fitness facilities.

- In November 2023, Hologic, Inc. received FDA clearance for its new DXA system, the Horizon DXA Prime, which offers improved precision and faster scan times for body composition assessment, including visceral fat measurement. This advancement aims to enhance clinical utility and patient experience in North American healthcare settings.

- In June 2023, GE Healthcare partnered with a leading telehealth platform in North America to integrate its body composition analysis data into remote patient monitoring programs, aiming to improve the management of chronic conditions such as heart failure and diabetes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.