North America Bullet Proof Glass Market

Market Size in USD Billion

CAGR :

%

USD

12.37 Billion

USD

42.26 Billion

2024

2032

USD

12.37 Billion

USD

42.26 Billion

2024

2032

| 2025 –2032 | |

| USD 12.37 Billion | |

| USD 42.26 Billion | |

|

|

|

|

Bullet Proof Glass Market Size

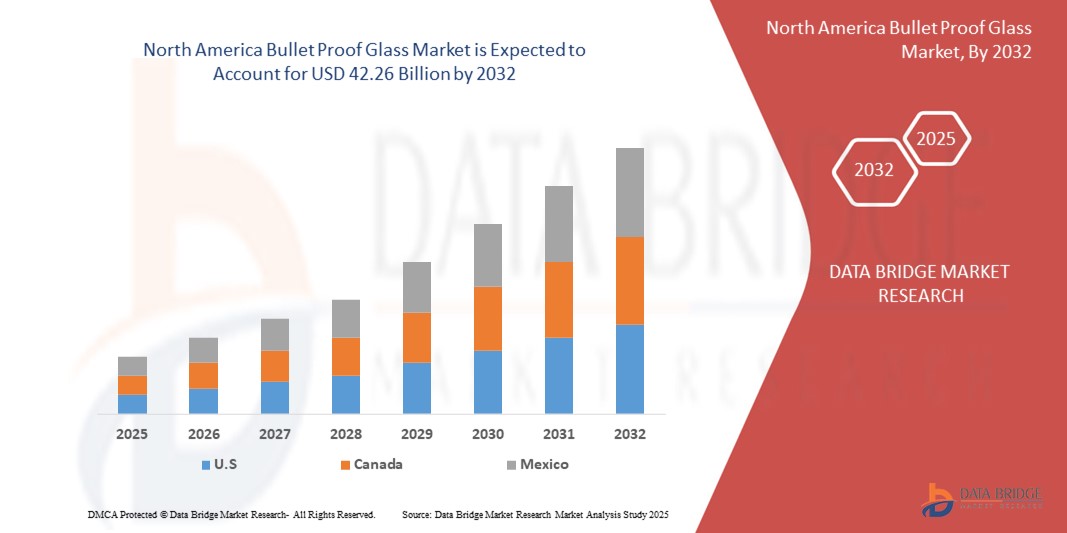

- The North America bullet proof glass market size was valued at USD 12.37 billion in 2024 and is expected to reach USD 42.26 billion by 2032, at a CAGR of 16.60% during the forecast period

- The market growth is largely fueled by increasing global security concerns, rising incidences of armed attacks, and the growing need for enhanced protection across military, banking, and high-value commercial infrastructures

- Furthermore, continuous advancements in ballistic glass materials, such as multi-layer laminates and lightweight polycarbonates, are enabling higher protection levels with improved design flexibility, thus accelerating the adoption of bulletproof glass across diverse applications and significantly boosting market expansion

Bullet Proof Glass Market Analysis

- Bulletproof glass is a specialized type of glass designed to withstand high-impact forces and provide protection against ballistic threats. It is commonly used in applications such as armored vehicles, ATM booths, government buildings, and high-security locations to safeguard individuals and assets

- The bulletproof glass market is experiencing significant growth, driven by rising security concerns, increasing military and defense investments, growing demand for armored vehicles, advancements in material technologies, and the expanding need for personal and property protection in urban and emerging markets

- U.S. dominated the bullet proof glass market with a share of 81.8% in 2024, due to increasing threats from firearm-related incidents and a rising demand for enhanced security across public, commercial, and government infrastructures

- Mexico is expected to be the fastest growing region in the bullet proof glass market during the forecast period due to escalating concerns over organized crime, political unrest, and rising personal security needs

- Laminated glass segment dominated the market with a market share of 39.4% in 2024, due to its strong penetration resistance and widespread use in high-risk environments such as banks, embassies, and armored vehicles. Its multi-layered composition of glass and polymer interlayers absorbs impact energy effectively and also prevents spalling, where glass shards could harm occupants. Laminated glass is also cost-effective and compatible with various architectural designs, supporting its dominance in commercial infrastructure and transport security

Report Scope and Bullet Proof Glass Market Segmentation

|

Attributes |

Bullet Proof Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bullet Proof Glass Market Trends

“Increasing Military and Defense Spending”

- A significant and accelerating trend in the bullet proof glass market is the rising military and defense spending by governments worldwide, aimed at enhancing national security and upgrading protective infrastructure. This surge in expenditure is driving the demand for advanced ballistic-resistant materials across defense vehicles, watchtowers, bunkers, and protective gear

- For instance, companies such as Saint-Gobain Sekurit and AGC Inc. are supplying high-performance bulletproof glass to defense agencies for use in armored personnel carriers and tactical vehicles. Similarly, PPG Industries provides lightweight ballistic glass for military aviation and ground combat systems

- Military applications increasingly require bulletproof glass solutions that meet stringent standards for multi-hit resistance, optical clarity, and environmental durability. For example, Saint-Gobain’s Vetrotech division has developed advanced laminated solutions capable of withstanding high-caliber rounds while minimizing spall formation, making them suitable for armored vehicles operating in hostile environments

- The growing emphasis on troop protection, counter-terrorism measures, and modern warfare preparedness is fueling innovation in materials such as glass-clad polycarbonate and ballistic insulated glass. These materials offer a combination of strength and reduced weight, critical for vehicle mobility and personnel safety

- This trend toward modernizing defense systems with advanced protective glass is fundamentally reshaping procurement strategies and performance expectations across the defense sector. Consequently, leading manufacturers are expanding their military-grade product portfolios to cater to government contracts and international defense collaborations

- The demand for bulletproof glass in military and defense applications is projected to grow significantly as geopolitical tensions rise and countries such as the U.S., China, and India increase their defense budgets, placing ballistic protection as a top priority in national security strategies

Bullet Proof Glass Market Dynamics

Driver

“Expanding Technological Advancements”

- The expanding technological advancements in material science and manufacturing techniques are a significant driver for the growing demand in the bullet proof glass market

- For instance, AGC Inc. and Saint-Gobain Sekurit have been investing heavily in the development of lightweight, multi-hit resistant, and optically clear ballistic glass using advanced lamination and hybrid composite technologies. These innovations aim to improve protection and also visibility and energy efficiency in applications such as armored vehicles and secure buildings

- As end-users such as military forces, banks, and government agencies demand higher performance without compromising design flexibility, bullet proof glass is increasingly being engineered with advanced materials such as glass-clad polycarbonate and ballistic insulated glass. These solutions deliver superior impact resistance while reducing overall weight, which is essential for improving vehicle efficiency and structural integration

- Furthermore, the development of smart bulletproof solutions, such as electrochromic ballistic glass and blast-resistant transparent barriers, is expanding the functional scope of bulletproof materials beyond traditional protection. Companies such as Total Security Solutions and Guardian Glass are incorporating adaptive and intelligent features that enhance occupant safety during active threats

- The growing emphasis on innovation is encouraging collaborations between glass manufacturers and defense contractors to produce next-generation transparent armor systems. This ongoing technological evolution is strengthening the bullet proof glass value proposition across high-security sectors including defense, law enforcement, finance, and critical infrastructure

- The ability to deliver stronger, lighter, and more multifunctional glass products is fueling market growth, as customers increasingly prioritize performance-driven materials that meet evolving security and structural demands

Restraint/Challenge

“Growing Installation Complexity”

- Growing installation complexity of bullet proof glass systems poses a significant challenge to broader market adoption, particularly in retrofitting existing structures or vehicles. Unlike standard glazing materials, bulletproof glass requires specialized framing, structural reinforcements, and precise handling during installation, which can increase project costs and timelines

- For instance, companies such as Total Security Solutions and Guardian Glass often highlight the importance of expert consultation and custom fabrication for bullet resistant installations in banks, government buildings, and transportation fleets. This level of technical involvement can be a deterrent for smaller institutions or contractors lacking specialized expertise

- Addressing this challenge involves developing modular, lighter-weight solutions that can be more easily integrated into existing architectures without significant structural changes. However, achieving this without compromising ballistic performance remains a key engineering hurdle. In sectors such as construction and retail, where downtime must be minimized, the need for complex reinforcement can delay deployment and increase labor dependency

- The challenge is further compounded when working with higher-grade security levels, such as Level-4 to Level-8, where increased thickness and weight demand stronger anchoring systems and may affect design aesthetics or vehicle dynamics

- Overcoming these installation-related constraints through pre-engineered solutions, simplified mounting systems, and enhanced contractor training will be essential to improve scalability and market penetration, particularly in cost-sensitive regions or rapid deployment scenarios

Bullet Proof Glass Market Scope

The market is segmented on the basis of material, end-user, application, and security levels.

• By Material

On the basis of material, the bulletproof glass market is segmented into acrylic, laminated glass, polycarbonate, glass clad polycarbonate, ballistic insulated glass, and others. The laminated glass segment accounted for the largest market revenue share 39.4% in 2024 due to its strong penetration resistance and widespread use in high-risk environments such as banks, embassies, and armored vehicles. Its multi-layered composition of glass and polymer interlayers absorbs impact energy effectively and also prevents spalling, where glass shards could harm occupants. Laminated glass is also cost-effective and compatible with various architectural designs, supporting its dominance in commercial infrastructure and transport security.

The polycarbonate segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its lightweight and high-impact resistance properties, which make it especially suitable for mobile security applications. Unlike glass, polycarbonate is significantly lighter and can be easily molded into complex shapes, offering design flexibility for vehicles and aerospace components. Its increasing use in V.I.P. vehicles and riot control barriers, where reduced weight improves maneuverability and fuel efficiency, is accelerating demand across defense and executive protection sectors.

• By End-User

On the basis of end-user, the market is segmented into automotive, military, construction, banking and finance, and others. The banking and finance segment captured the largest market revenue share in 2024, as these institutions face a high frequency of armed robberies and attempted break-ins. Bulletproof glass is a critical component in teller windows, ATM enclosures, vaults, and transaction counters to ensure the safety of personnel and assets. As banks increasingly operate in semi-urban and high-crime areas, the demand for transparent yet secure architectural solutions has risen substantially.

The military segment is projected to register the fastest CAGR from 2025 to 2032, supported by continuous defense modernization efforts and rising geopolitical tensions globally. Governments are investing heavily in ballistic protection systems for armored vehicles, bunkers, portable command centers, and watchtowers. Bulletproof glass used in these applications is engineered to withstand high-caliber ammunition, explosive fragments, and extreme environmental conditions, thereby playing a pivotal role in enhancing troop safety and operational resilience.

• By Application

On the basis of application, the market is segmented into defense and V.I.P. vehicles, government and law enforcement, cash-in-transit vehicles, commercial buildings, ATM booths and teller stations, and others. The ATM booths and teller stations segment led the market in revenue share in 2024, as these sites remain vulnerable to frequent thefts and armed assaults, particularly in emerging economies. The need to protect both currency and personnel during transactions has prompted widespread installation of bullet-resistant panels and windows, especially in standalone kiosks and high-traffic banking outlets.

The defense and V.I.P. vehicles segment is anticipated to grow at the highest CAGR from 2025 to 2032, due to rising concerns around executive safety, terrorism, and targeted attacks. Heads of state, diplomats, business leaders, and military officials require specialized armored vehicles equipped with multi-layered bulletproof glass to protect against high-velocity projectiles and explosive devices. Demand is further bolstered by growing procurement of tactical vehicles and luxury armored sedans in regions facing political unrest or civil conflict.

• By Security Levels

On the basis of security levels, the bulletproof glass market is segmented into level-1, level-2, level-3, level-4 to 8, and others. The level-3 segment held the largest revenue share in 2024, as it offers an optimal balance of cost, weight, and protection against commonly encountered firearms, including 0.44 Magnum handguns. This level is widely implemented across retail storefronts, law enforcement facilities, and high-traffic public areas that face moderate ballistic threats. Its affordability and ease of integration make it the preferred option for institutions seeking essential ballistic protection without the added weight or cost of military-grade materials.

The level-4 to 8 segment is projected to record the fastest CAGR from 2025 to 2032, driven by increasing demand for high-level ballistic resistance in critical government infrastructure, embassies, and military zones. These higher levels can withstand multiple rounds from assault rifles, armor-piercing ammunition, and sniper fire. Global defense agencies and security contractors are deploying this grade of bulletproof glass in conflict zones, high-risk consulates, and anti-terrorism units, aligning with strict international security protocols and growing threat levels.

Bullet Proof Glass Market Regional Analysis

- U.S. dominated the bullet proof glass market with the largest revenue share of 81.8% in 2024, driven by increasing threats from firearm-related incidents and a rising demand for enhanced security across public, commercial, and government infrastructures

- The surge in active shooter incidents, bank heists, and school safety concerns is prompting widespread adoption of ballistic-resistant materials in transit systems, schools, law enforcement vehicles, and financial institutions. Leading companies such as Total Security Solutions, Armortex, and PPG Industries are expanding their product portfolios and manufacturing capacities to meet growing domestic demand

- In addition, ongoing public transportation upgrades, federal safety funding, and advanced glass innovation are further solidifying the U.S. as the dominant market in the region

Canada Bullet Proof Glass Market Insight

The Canadian bullet proof glass market is experiencing steady growth, supported by government initiatives to strengthen critical infrastructure and improve public safety standards. Rising investments in commercial and defense construction projects are fueling demand for ballistic-resistant materials in airports, embassies, banks, and government buildings. The country is also witnessing increased adoption in luxury residential developments and high-risk urban zones. Local and regional manufacturers are working closely with regulatory authorities to ensure compliance with evolving safety standards, which continues to drive innovation and deployment of certified, lightweight, and multi-hit resistant glass solutions across the country.

Mexico Bullet Proof Glass Market Insight

Mexico represents the fastest-growing market for bullet proof glass in North America from 2025 to 2032, propelled by escalating concerns over organized crime, political unrest, and rising personal security needs. The country is witnessing surging demand for armored vehicles, secure facilities, and high-protection banking and retail environments. Wealthier urban residents and businesses are increasingly investing in bulletproof glass for homes, offices, and vehicles to mitigate kidnapping and robbery risks. Strategic proximity to the U.S. further supports cross-border trade of security products, while domestic manufacturers scale up operations to meet both public and private sector requirements.

Bullet Proof Glass Market Share

The bullet proof glass industry is primarily led by well-established companies, including:

- Saint-Gobain Glass (France)

- PPG Industries, Inc. (U.S.)

- AGC Inc. (Japan)

- TAIWAN GLASS IND. CORP.(Taiwan)

- Nippon Sheet Glass Co., Ltd. (Japan)

- Armortex (U.S.)

- Apogee Enterprises, Inc. (U.S.)

- Binswanger Glass (U.S.)

- Schott AG (Germany)

- Centigon (U.S.)

- armass glass (Turkey)

- Stec Armour Glass (Malaysia)

- Total Security Solution (U.S.)

- Smartglass International (Ireland)

Latest Developments in North America Bullet Proof Glass Market

- In January 2023, Asahi India Glass Limited collaborated with Enormous Brands to create brand films for its AIS Windows range, signaling a strategic effort to bolster its position in the doors and windows market. This move aligns with the broader trends in the bulletproof glass market, as companies seek innovative marketing strategies to differentiate their products and appeal to consumers' safety concerns

- In January 2023, Guardian Glass acquired Vortex Glass, a Miami-based fabrication business, to strengthen its presence in the tempered glass segment, which is crucial for applications such as office partitions, shower doors, and glass railings. This acquisition reflects the growing demand for diversified offerings within the bulletproof glass market, as companies aim to cater to diverse architectural needs while ensuring robust security features

- In February 2022, MIT chemical engineers developed a groundbreaking material through a novel polymerization process. This material, more potent than steel yet as light as plastic, boasts an elastic modulus four to six times greater than traditional bulletproof glass, potentially revolutionizing industries requiring lightweight, high-strength materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Bullet Proof Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Bullet Proof Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Bullet Proof Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.