North America Business Process Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

121.07 Billion

USD

229.98 Billion

2024

2032

USD

121.07 Billion

USD

229.98 Billion

2024

2032

| 2025 –2032 | |

| USD 121.07 Billion | |

| USD 229.98 Billion | |

|

|

|

|

North America Business Process Outsourcing (BPO) Market Size

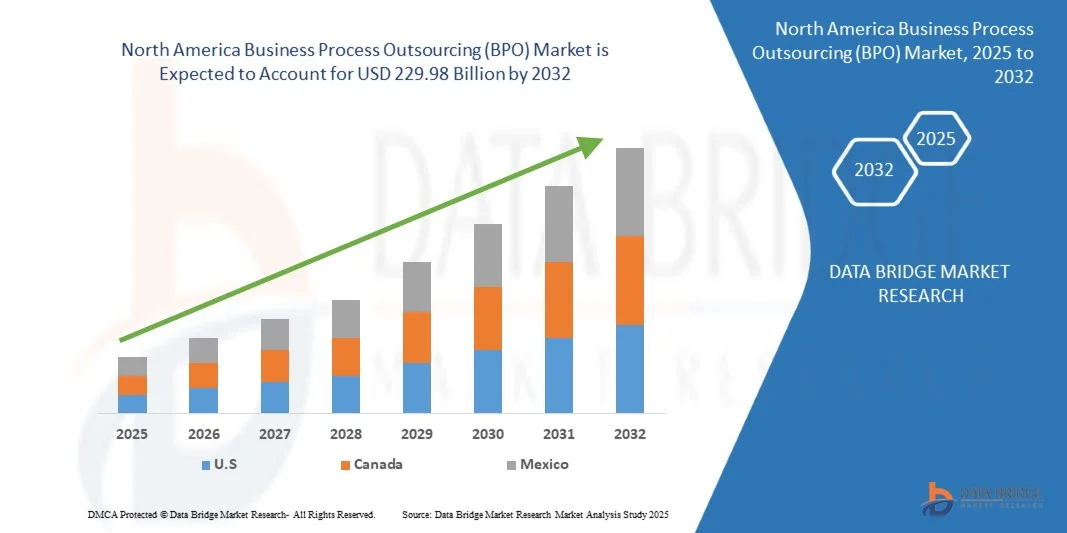

- The North America Business Process Outsourcing (BPO) market is expected to reach USD 229.98 Billion by 2032 from USD 121.07 Billion in 2024 growing with a healthy CAGR of 8.4% in the forecast period of 2025 to 2032.

- The North America BPO market's expansion is propelled by the accelerating demand for cost optimization, operational efficiency, and access to specialized expertise, driven by businesses navigating competitive landscapes and focusing on core competencies.

- This growth is further fueled by the integration of innovative technologies like Robotic Process Automation (RPA) for automating routine tasks, Artificial Intelligence (AI) for enhanced analytics and customer service, and cloud-based solutions for scalable and flexible operations. These advancements, coupled with the increasing need for data security and compliance, are particularly expanding segments in intelligent automation, customer experience management, and knowledge process outsourcing.

North America Business Process Outsourcing (BPO) Market Analysis

- North America Business Process Outsourcing (BPO) is a commercially available service solution designed to manage and optimize non-core business functions, from customer service and human resources to finance and accounting. These services offer essential cost reduction, enhanced efficiency, and access to specialized expertise, and are a staple across diverse sectors such as finance, healthcare, retail, and technology, satisfying enterprise demand for agility, scalability, and strategic focus in a competitive North America landscape.

- The growing demand for North America BPO is driven by the accelerating pace of digital transformation and the increasing complexity of North America business operations and competitive pressures, providing a critical operational backbone for modern enterprises. This demand is further supported by innovations integrated within BPO services, such as Robotic Process Automation (RPA) for automating routine tasks, Artificial Intelligence (AI) for advanced analytics and customer experience management, and cloud-based platforms for flexible service delivery, which enhance efficiency, decision-making, and service quality. The North America push for business resilience and operational agility, driven by increasing economic volatility and the need for scalable solutions, coupled with rising investments in digital transformation initiatives in emerging economies, is significantly boosting the adoption of advanced BPO services worldwide.

- U.S. dominated the North America BPO market with a commanding revenue share of 88.05% in 2024, driven by its early adoption of advanced business services, the high concentration of key end-user industries, and significant investments in digital transformation and customer experience.

- The U.S. region is expected to be the fastest-growing region in the North America BPO market, with a projected CAGR of 8.7% from 2025 to 2032, propelled by its status as a North America hub for talent and services, rapid digital adoption, and increasing government investments in smart city and digital economy initiatives is further driving demand for a diverse range of scalable and agile BPO services.

- The Onshore segment dominated the North America Business Process Outsourcing (BPO) market with a market share of 46.68% in 2024, due to increasing demand for digital transformation, enhanced automation tools, and integration capabilities across diverse enterprise platforms.

Report Scope and North America Business Process Outsourcing (BPO) Market Segmentation

|

Attributes |

North America Business Process Outsourcing (BPO) Key Market Insights |

|

Segments Covered |

By Outsourcing Type: Offshore, Nearshore, Onshore |

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Business Process Outsourcing (BPO) Market Trends

“Increase in the Establishment of Service Centers and the it Sector Spending.”

The IT industry has grown exponentially, undergoing rapid evolution across software development, management, consultancies, online services, and Business Process Outsourcing (BPO). With the cost advantages of outsourcing, countries such as China, India, and Malaysia have been positioned to capture a greater share of the BPO market. IT outsourcing has been adopted as an effective means of delivering IT-enabled business processes, infrastructure solutions, and application services.

In contrast, outsourcing models including SaaS, utility services, and cloud-enabled solutions have been utilized to enhance sourcing strategies, optimize contracts, and build sustainable provider relationships.

Technological advancements such as cloud computing, IoT, blockchain, and machine learning have been integrated to improve efficiency and save employee time, with major IT providers actively deploying these technologies to support BPO operations.

For instance,

- As reported by Reuters in September 2024, India’s North America Capability Centres (GCCs) market is projected to grow from USD 64.6 billion in FY2024 to USD 99–105 billion by 2030, with companies like Chevron and Sanofi investing around USD 1.4 billion, creating 2.5–2.8 million jobs

- As reported by The Times of India in August 2024, India is emerging as a North America hub for GCCs, attracting investments due to its skilled talent pool and operational maturity. The sector is expected to surpass USD 100 billion and generate over 2.5 million jobs by 2030

- As reported by the Financial Times in August 2024, multinational firms like McDonald’s, Bupa, and Tesco are leveraging India’s GCCs for AI operations, analytics, and automation, marking a shift from cost-focused support to high-value innovation roles.

Thus, on concluding, all these facts indicate that every sector has been attracted by Business Process Outsourcing (BPO) services and is using outsourcing services for any of its business functions. Large, small & medium enterprises have increased their budgets for IT services outsourcing, creating opportunities for the North America Business Process Outsourcing (BPO) market.

North America Business Process Outsourcing (BPO) Market Dynamics

Driver

“Increasing Need for Business Agility”

As markets become more dynamic and competitive, organizations are under pressure to adapt quickly, innovate, and improve operational efficiency. BPO enables firms to achieve these goals by providing flexible, scalable solutions that reduce risks and costs while enhancing responsiveness to change.

At the same time, cultural transformation and customer-centric strategies, often led by top leadership, are reinforcing the shift toward outsourcing as a means of supporting collaboration and innovation. This growing focus on agility positions BPO as a strategic tool for businesses seeking to remain competitive in a disruptive North America environment.

For instance,

- In June 2020, there was an increase in the number of companies employing digital marketing in Japan, as one such company, namely Dai Nippon Printing Co., Ltd. (DNP), had announced establishment of two new Business Process Outsourcing (BPO) centers in Tokyo and Fukuoka, southern Japan to deliver a wide range of BPO services to clients, including digital marketing operations

- In 2020, according to the Outsource Asia report, China accounted for USD 223.7 billion worth of outsourcing contracts with 600 outsourcing service providers for foreign clients. Moreover, the Chinese government has eased up on foreign access restrictions to boost the country’s economic growth and the BPO market

- In September 2022, a peer-reviewed article titled Business Process Outsourcing (BPO): Current and Future Trends published in International Research in Economics and Finance highlighted a surge in BPO adoption across Australia and Southeast Asia. The study emphasized how companies were increasingly outsourcing HR, finance, and customer service functions to access new markets and improve operational efficiency

- In July 2023, The Economic Times highlighted how Indian BPO firms were increasingly adopting cloud-based platforms and AI-driven automation to enhance service delivery. The article noted a rise in demand for intelligent customer support and finance operations, especially from clients in North America and Europe

A growing reliance has accompanied the increasing shift toward agile methodologies on business process outsourcing. As BPO firms continue to lead in adopting innovative practices, their role in enabling organizational agility has been reinforced. This evolution in operational strategy has been recognized as a key contributor to the sustained growth of the North America BPO market.

Restraint/Challenge

“Growing Concerns Regarding Data Security and Privacy Concern”

In today’s digital landscape, heightened attention has been placed on data security, especially as business process outsourcing (BPO) continues to gain traction. Concerns have been raised by organizations regarding the risks of entrusting sensitive information to third-party providers.

Although safeguards such as encryption, access controls, and data masking are routinely implemented, these measures have not always been sufficient to prevent breaches.

Over the past decade, cyberattacks and internal lapses have increasingly compromised enterprise data, with risks ranging from tampering and theft to identity manipulation. While BPaaS solutions powered by cloud technologies have offered operational advantages, their expanded threat surface has also exposed businesses to vulnerabilities. In some cases, significant financial losses have been incurred due to both external intrusions and internal errorswhether intentional or accidental.

As a result, rising concerns around data protection have continued to restrain the growth trajectory of the North America BPO market, underscoring the need for more resilient and transparent security frameworks.

For instance,

- In June 2020, Cyware Social reported that Oracle’s BlueKai exposed sensitive data online worth billions due to a security lapse. The incident involved an unsecured database containing personal information such as names, email addresses, home addresses, and web browsing activity. This exposure highlighted the critical importance of securing sensitive data, raised concerns about transparency in data handling, and emphasized the need for robust data protection measures in outsourcing and digital operations

- In June 2020, Oodaloop reported that IT giant Cognizant was the victim of a Maze Ransomware attack, where unencrypted data was accessed and stolen. This incident highlighted vulnerabilities in corporate cybersecurity frameworks and underscored the importance of implementing robust data protection and incident response measures

- In June 2025, according to “Times of India” two India-based employees of U.S. BPO firm TaskUs illegally accessed sensitive Coinbase customer data. The breach, revealed in a May 2025 SEC filing, involved names, contact details, partially masked SSNs, ID images, and transaction history. Coinbase estimated remediation costs of USD 180–400 million, while TaskUs terminated the employees and halted Coinbase operations in Indore

- In September 2020, WIRED UK reported that London-based outsourcing company Virtual Mail Room suffered a major privacy breach, exposing over 50,000 confidential letters—including sensitive communications from banks, local councils, and government agencies—online due to lax security measures. The incident raised serious GDPR compliance concerns and highlighted the risks associated with inadequate data protection in outsourcing operations

Rising concerns around data security—driven by both external cyber threats and internal vulnerabilities—have placed increased pressure on BPO providers to implement robust safeguards. While technological advancements have enabled more agile and scalable outsourcing solutions, they have also expanded the risk landscape. As businesses continue to rely on cloud-based platforms and third-party service providers, the need for resilient, transparent, and secure data management practices remains critical to sustaining trust and supporting the growth of the North America BPO market.

North America Business Process Outsourcing (BPO) Market Scope

North America Business Process Outsourcing (BPO) market is segmented into five notable segments which are based on outsourcing type, application, organization size, outsourcing approach and end-use.

• By Outsourcing Type

On the basis of outsourcing type, the global market is segmented into Offshore, Nearshore, and Onshore. In 2025, the Offshore segment is expected to dominate the market due to its significant cost advantages and access to a vast global talent pool, making it a primary choice for businesses looking to reduce operational expenses.

However, the Offshore segment is projected to be the fastest-growing due to its benefits of geographical proximity, cultural alignment, and closer time zones, which facilitate better communication and collaboration for businesses seeking a balance between cost savings and operational seamlessness.

• By Application

On the basis of application, the global market is segmented into Human Resource, Sales & Marketing, IT Services, Finance & Accounting, Procurement & Supply Chain, Facilities & Administrations, Customer Care, Training, and Product Engineering. In 2025, the Customer Care segment is expected to dominate the market, primarily due to the critical importance of customer satisfaction and the high volume of interactions managed by outsourced call centers and support services.

The Human Resource segment is expected to experience the highest growth, driven by the increasing complexity of global HR regulations, the demand for specialized talent acquisition, and the need for efficient payroll and benefits administration.

• By Organization Size

On the basis of organization size, the global market is segmented into Large Enterprises and SMEs. In 2025, the Large Enterprises segment is expected to dominate the market, driven by their extensive operational needs, substantial budgets for outsourcing, and complex global footprints that require comprehensive service solutions.

The Large Enterprises segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising availability of cost-effective and scalable BPO solutions that allow smaller companies to access specialized expertise and achieve operational efficiencies previously exclusive to larger corporations.

• By Outsourcing Approach

On the basis of outsourcing approach, the global market is segmented into Best Shore, Bundled Services, Contract Based, and Fee for Service. In 2025, the Contract Based segment is expected to dominate the market, as it provides clear terms, defined scope, and predictable costs, which are preferred by businesses for long-term strategic partnerships.

The Bundled Services segment is projected to be the fastest-growing, driven by the increasing demand for integrated solutions that offer multiple services under a single vendor, simplifying management and often leading to greater cost efficiencies and operational synergy.

• By End-User

On the basis of end-user, the global market is segmented into IT, Telecommunication, Manufacturing, BFSI, Government, Defense, Transportation, Logistics, Retail, Healthcare, E-Commerce, Travel, Hospitality, Energy, Education, Utilities and Others. The BFSI (Banking, Financial Services, and Insurance) sector is anticipated to dominate the market in 2025 due to its stringent regulatory requirements, high volume of transactions, and critical need for secure and efficient back-office operations.

In 2025, the IT & Telecommunication segment is projected to be the fastest-growing. This is driven by rapid technological advancements, the increasing need for specialized technical support, and the demand for scalable solutions to manage complex digital infrastructures and evolving customer expectations.

North America Business Process Outsourcing (BPO) Market Regional Analysis

- North America is projected to be a dominant market, driven by its position as a global innovation hub, advanced technological infrastructure, and a strong emphasis on digital transformation across various industries.

- The increasing need for specialized expertise, enhanced customer experience, and efficient management of complex operations is accelerating the adoption of sophisticated BPO services. Countries like the United States and Canada are at the forefront of this expansion.

- The market in this region is characterized by a strong focus on digital transformation, the integration of advanced technologies like AI and RPA into BPO services, and the need to manage complex, globally distributed operations while maintaining high service quality.

North America BPO Market Insight

The North America Business Process Outsourcing (BPO) market is expected to reach USD 229.98 Billion by 2032 from USD 121.07 Billion in 2024 growing with a healthy CAGR of 8.4% in the forecast period of 2025 to 2032. This growth is primarily driven by the region's strong focus on digital transformation, the high concentration of technology-driven industries like BFSI, healthcare, and IT, and the widespread adoption of outsourcing to enhance operational efficiency and reduce costs. The region benefits from the presence of major BPO vendors and a mature service infrastructure, which accelerates the adoption of advanced BPO solutions. A key trend is the integration of advanced technologies such as Robotic Process Automation (RPA) for automating routine tasks and Artificial Intelligence (AI) for enhanced customer experience within BPO services.

• U.S. BPO Market Insight

The U.S. BPO market commands the dominant share in North America, reflecting its leadership in technological innovation and its vast service-oriented economy. Growth is propelled by significant investments in intelligent automation, the need to manage increasingly complex North America operations, and the rapid adoption of cloud-based BPO solutions by small and medium-sized enterprises (SMEs). Leading financial, healthcare, and retail companies are actively leveraging BPO to enhance customer service, accelerate digital transformation, and improve operational efficiency. The modernization of business processes and the rising demand for scalable, flexible, and outcome-based service solutions further stimulate market expansion.

• Canada BPO Market Insight

The Canada BPO market holds a significant and steadily growing share in North America, supported by its strong service sector, particularly in telecommunications and finance, and a growing focus on digital transformation. Growth is driven by government initiatives promoting business innovation, the necessity for Canadian companies to integrate seamlessly into complex North American supply chains, and the increasing adoption of BPO solutions by a vibrant ecosystem of small and medium-sized enterprises (SMEs). Companies across various sectors are actively leveraging BPO to improve cross-border collaboration, enhance service quality, and boost North America competitiveness. The push to modernize customer interaction and back-office processes, coupled with the rising demand for accessible and scalable BPO solutions, continues to fuel market growth.

North America Business Process Outsourcing (BPO) Market Share

The Business Process Outsourcing (BPO) industry is primarily led by well-established companies, including:

- Accenture (U.S.)

- Infosys Limited (India)

- IBM Corporation (U.S.)

- Capgemini (France)

- Tata Consultancy Services Limited (India)

- Cognizant (U.S.)

- NTT DATA Corporation (U.S.)

- Concentrix Corporation (U.S.)

- Wipro Limited (India)

- ADP, Inc. (U.S.)

- Genpact (U.S.)

- HCL Technologies Limited (India)

- robert half inc (U.S.)

- Sodexo (France)

- NCR Voyix Corporation (U.S.)

- Amdocs (U.S.)

- TTEC (U.S.)

- Intetics Inc. (U.S.)

- Plaxonic Technologies (India)

- IBT (U.A.E.)

- ALTECiSyS (U.S.)

Latest Developments in North America Business Process Outsourcing (BPO) Market

- In 2025, Finance consulting helps organizations build a resilient financial future amid market disruptions and business volatility. It supports CFOs and CROs in managing complex transformations while maintaining performance, profitability, and long-term stability. By integrating generative AI, it enables smarter, faster decision-making and advanced risk management. This service provides tailored strategies to enhance financial resilience, optimize capital allocation, and ensure sustainable growth in an increasingly uncertain and competitive North America environment.

- In July 2025, Infosys Foundation launched the Infosys Springboard Livelihood Program with an aspiration to create half a million jobs in India by 2030. The program focuses on job creation for both graduate and undergraduate youth across STEM and non-STEM industries, providing industry-relevant curricula in cutting-edge technologies like artificial intelligence and machine learning.

- In June 2023, IBM announced the acquisition of Apptio, a software firm, for USD 4.6 billion. This move strengthens IBM’s position in hybrid cloud and AI-driven digital transformation by integrating Apptio’s financial and operational IT management solutions with IBM’s existing portfolio. The acquisition enhances IBM’s ability to provide enterprises with deeper cost optimization, IT spend visibility, and improved business decision-making across cloud and technology investments.

- In August 2025, Capgemini signed an agreement to acquire Cloud4C, a specialist in automation-driven managed services for hybrid and sovereign cloud environments. Founded in 2014, Cloud4C employs about 1,600 staff and offers a low-code, AI-ready platform with vertical-specific frameworks. The acquisition is set to enhance Capgemini’s cloud managed services leadership, enable industry-specific packaged frameworks, and unlock cross-selling opportunities. The transaction is expected to close in the coming months, subject to regulatory approvals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 NORTH AMERICA APPLICATION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 EVOLUTION OF BUSINESS PROCESS OUTSOURCING

4.2 PORTER'S FIVE FORCES

4.3 PESTEL ANALYSIS

4.4 CONTRACT DATA OR BPO DEALS BY THE U.A.E. GOVERNMENT AND MARKET PARTICIPANTS

4.5 NUMBER OF FTES/ CONTACT CENTER AGENTS IN THE U.A.E.

4.6 TRANSACTION/ VOLUME DATA FOR BOTH INBOUND AND OUTBOUND CALLS IN THE U.A.E.

4.7 LIST OF THE UAE COMPANIES WITH CAPTIVE CONTACT CENTER OPERATIONS IN THE U.A.E.

4.8 COMPANY LANDSCAPE IN THE U.A.E. ON APPLICATION BASIS

4.8.1 COMPANY SHARE ANALYSIS: TALENT AND HR SERVICES

4.8.2 COMPANY SHARE ANALYSIS: SALES AND MARKETING

4.8.3 COMPANY SHARE ANALYSIS: FINANCE AND ACCOUNTING

4.8.4 COMPANY SHARE ANALYSIS: SOURCING, PROCUREMENT, AND SUPPLY CHAIN

4.8.5 COMPANY SHARE ANALYSIS: TRAINING

4.8.6 COMPANY SHARE ANALYSIS: FACILITIES AND ADMINISTRATION

4.8.7 COMPANY SHARE ANALYSIS: CUSTOMER CARE

4.8.8 COMPANY SHARE ANALYSIS: PRODUCT ENGINEERING

4.9 TECHNOLOGICAL ROADMAP

4.9.1 OVERVIEW

4.9.2 SHIFT FROM RPA TO INTELLIGENT PROCESS AUTOMATION (IPA)

4.9.3 GENERATIVE AI AND CONVERSATIONAL AUTOMATION

4.9.4 PREDICTIVE AND PRESCRIPTIVE ANALYTICS

4.9.5 CLOUD-NATIVE INFRASTRUCTURE AND OMNICHANNEL DELIVERY

4.9.6 CYBERSECURITY AND COMPLIANCE BY DESIGN

4.9.7 STRATEGIC RECOMMENDATIONS FOR CLIENTS AND INVESTORS

4.9.8 FUTURE OUTLOOK

4.1 CLIENT-SIDE BUSINESS PROCESS OUTSOURCING (BPO) MARKET OVERVIEW

4.10.1 MARKET OUTLOOK AND GROWTH TRAJECTORY

4.10.2 KEY DEMAND DRIVERS FROM THE CLIENT PERSPECTIVE

4.10.3 REGIONAL DEMAND HIGHLIGHTS

4.10.4 STRATEGIC INITIATIVES BY LEADING BPO PROVIDERS

4.10.5 CHALLENGES IMPACTING CLIENT-SIDE DECISIONS

4.10.6 STRATEGIC OUTLOOK FOR ENTERPRISES

4.11 COUNTRY-TO-COUNTRY OUTSOURCING FLOWS

4.11.1 OVERVIEW

4.11.2 DELIVERY MODELS & REGIONAL STRUCTURE

4.11.3 KEY INFLUENCING FACTORS ON OUTSOURCING FLOW

4.11.4 CONCLUSION

4.12 COMPANY COMPARATIVE ANALYSIS

4.12.1 TELEPERFORMANCE

4.12.2 CONCENTRIX

4.12.3 ACCENTURE (BPO DIVISION)

4.12.4 GENPACT

4.12.5 TTEC

4.12.6 COMPARATIVE INSIGHTS

4.12.7 CONCLUSION

4.13 NORTH AMERICA OUTSOURCING AND DELIVERY STRUCTURE

4.14 OUTSOURCING FLOW – DRIVERS & RESTRAINING FACTORS

4.14.1 OVERVIEW

4.14.2 COST OPTIMIZATION AND TALENT AVAILABILITY

4.14.3 TECHNOLOGICAL ADVANCEMENTS AND REGULATORY COMPLIANCE

4.14.4 GEOPOLITICAL STABILITY AND REMOTE WORK ENABLEMENT

4.14.5 WAGE INFLATION AND GOVERNMENT POLICIES

4.14.6 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING NEED FOR BUSINESS AGILITY

6.1.2 RISING CUSTOMER FOCUS TOWARDS ENHANCED EFFICIENCY, TIME EFFECTIVENESS, AND COST EFFICIENCY

6.1.3 GROWING PREFERENCE OF CLOUD TECHNOLOGY AND ITS SIGNIFICANCE IN PROCESS AUTOMATION

6.1.4 TECHNOLOGICAL ADVANCEMENTS (AI, RPA, ANALYTICS)

6.2 RESTRAINTS

6.2.1 GROWING CONCERNS REGARDING DATA SECURITY AND PRIVACY CONCERN

6.2.2 STRINGENT GOVERNMENT REGULATIONS

6.3 OPPORTUNITIES

6.3.1 FOCUS ON MULTI-WORKFLOW SCHEDULING OF BUSINESS

6.3.2 EMERGENCE OF DIGITAL TECHNOLOGIES, NAMELY AI, IOT, AND CLOUD COMPUTING

6.3.3 INCREASE IN THE ESTABLISHMENT OF SERVICE CENTERS AND THE IT SECTOR SPENDING

6.4 CHALLENGES

6.4.1 LACK OF SKILLED WORKFORCE AND HIGH ATTRITION RATE

6.4.2 FREQUENT DISRUPTION AFFECTS OPERATIONAL EFFICIENCY OF BUSINESS PROCESS OUTSOURCING (BPO)

7 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING TYPE

7.1 OVERVIEW

7.2 OFFSHORE

7.3 ONSHORE

7.4 NEARSHORE

8 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CUSTOMER CARE

8.3 FINANCE AND ACCOUNTING

8.3.1 FINANCE AND ACCOUNTING, BY APPLICATION

8.3.2 ORDER TO CASH

8.3.3 PROCURE TO PAY

8.3.4 RECORD TO REPORT

8.3.5 FINANCIAL PLANNING & ANALYSIS

8.4 IT SERVICES

8.5 TALENT AND HR SERVICES

8.5.1 TALENT AND HR SERVICES, BY TYPE

8.5.2 EMPLOYEE AND HR OPERATIONS

8.5.2.1 Employee and HR Operations, By Application

8.5.3 PAYROLL AND PENSION

8.5.4 EMPLOYEE SERVICES

8.5.5 GOVERNMENT RELATION SERVICES

8.5.6 WORKFORCE DATA ADMINISTRATION

8.5.7 MASTER DATA MANAGEMENT

8.5.8 TALENT ACQUISITION AND DEVELOPMENT

8.5.8.1 Talent Acquisition and Development, by Application

8.5.9 TALENT DEVELOPMENT

8.5.9.1 Talent Development, By Application

8.5.10 ORGANIZATION AND CHANGE MANAGEMENT

8.5.11 COMPETENCY AND DEVELOPMENT MANAGEMENT

8.5.12 LEARNING CONTENT DEVELOPMENT & LEARNING DELIVERY

8.5.13 CURRICULUM AND CAMPAIGN DESIGN

8.5.14 COLLABORATION AND KNOWLEDGE MANAGEMENT

8.5.15 COMPENSATION PLANNING

8.5.16 OTHERS

8.5.17 TALENT ACQUISITION

8.5.17.1 Talent Acquisition, by Application

8.5.18 WORKFORCE PLANNING

8.5.19 CANDIDATE SOURCING SCREENING AND SELECTION

8.5.20 NEW JOINER OFFER AND ONBOARDING

8.5.21 HIRING CLEARANCES

8.5.22 RELOCATION ASSISTANCE, INTER COMPANY AND NORTH AMERICA MOBILITY

8.5.23 OTHERS

8.6 SALES AND MARKETING

8.7 SOURCING, PROCUREMENT & SUPPLY CHAIN

8.7.1 SOURCING, PROCUREMENT & SUPPLY CHAIN, BY APPLICATION

8.7.2 PROCUREMENT ADMIN SUPPORT

8.7.3 SOURCE TO CONTRACT

8.7.4 PROCUREMENT CONSULTING

8.8 PRODUCT ENGINEERING

8.9 FACILITIES AND ADMINISTRATION

8.1 TRAINING

9 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMES

10 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING APPROACH

10.1 OVERVIEW

10.2 CONTRACT BASED

10.3 BUNDLED SERVICES

10.4 BEST-SHORE

10.5 FEE FOR SERVICE

11 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY END USER

11.1 OVERVIEW

11.2 IT

11.2.1 IT, BY APPLICATION

11.2.1.1 IT SERVICES

11.2.1.2 CUSTOMER CARE

11.2.1.3 PRODUCT ENGINEERING

11.2.1.4 SALES AND MARKETING

11.2.1.5 FINANCE AND ACCOUNTING

11.2.1.6 TALENT AND HR SERVICES

11.2.1.7 TRAINING

11.2.1.8 PROCUREMENT & SUPPLY CHAIN

11.2.1.9 FACILITIES AND ADMINISTRATION

11.3 TELECOMMUNICATION

11.3.1 TELECOMMUNICATION, BY APPLICATION

11.3.1.1 CUSTOMER CARE

11.3.1.2 IT SERVICES

11.3.1.3 FINANCE AND ACCOUNTING

11.3.1.4 SALES AND MARKETING

11.3.1.5 TALENT AND HR

11.3.1.6 TRAINING

11.3.1.7 FACILITIES AND ADMINISTRATION

11.3.1.8 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.3.1.9 PRODUCT ENGINEERING

11.4 MANUFACTURING

11.4.1 MANUFACTURING, BY TYPE

11.4.1.1 AUTOMOTIVE

11.4.1.1.1 AUTOMOTIVE, BY APPLICATION

11.4.1.1.1.1 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.4.1.1.1.2 PRODUCT ENGINEERING

11.4.1.1.1.3 IT SERVICES

11.4.1.1.1.4 FINANCE AND ACCOUNTING

11.4.1.1.1.5 CUSTOMER CARE

11.4.1.1.1.6 TALENT AND HR

11.4.1.1.1.7 TRAINING

11.4.1.1.1.8 SALES AND MARKETING

11.4.1.1.1.9 FACILITIES AND ADMINISTRATION

11.4.1.2 ELECTRONIC MACHINERIES

11.4.1.2.1 ELECTRONIC MACHINERIES, BY APPLICATION

11.4.1.2.1.1 PRODUCT ENGINEERING

11.4.1.2.1.2 IT SERVICES

11.4.1.2.1.3 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.4.1.2.1.4 FINANCE AND ACCOUNTING

11.4.1.2.1.5 CUSTOMER CARE

11.4.1.2.1.6 TALENT AND HR

11.4.1.2.1.7 TRAINING

11.4.1.2.1.8 FACILITIES AND ADMINISTRATION

11.4.1.2.1.9 SALES AND MARKETING

11.4.1.3 CHEMICAL & MATERIALS

11.4.1.3.1 CHEMICAL & MATERIALS, BY APPLICATION

11.4.1.3.1.1 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.4.1.3.1.2 FINANCE AND ACCOUNTING

11.4.1.3.1.3 CUSTOMER CARE

11.4.1.3.1.4 TALENT AND HR SERVICES

11.4.1.3.1.5 PRODUCT ENGINEERING

11.4.1.3.1.6 SALES AND MARKETING

11.4.1.3.1.7 TRAINING

11.4.1.3.1.8 FACILITIES AND ADMINISTRATION

11.4.1.3.1.9 IT SERVICES

11.4.1.4 ICT EQUIPMENTS

11.4.1.4.1 ICT EQUIPMENTS, BY APPLICATION

11.4.1.4.1.1 PRODUCT ENGINEERING

11.4.1.4.1.2 IT SERVICES

11.4.1.4.1.3 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.4.1.4.1.4 CUSTOMER CARE

11.4.1.4.1.5 FINANCE AND ACCOUNTING

11.4.1.4.1.6 TALENT AND HR SERVICES

11.4.1.4.1.7 TRAINING

11.4.1.4.1.8 SALES & MARKETING SUPPORT

11.4.1.4.1.9 FACILITIES AND ADMINISTRATION

11.4.1.5 FOOD & BEVERAGE

11.4.1.5.1 FOOD & BEVERAGE, BY APPLICATION

11.4.1.5.1.1 CUSTOMER CARE

11.4.1.5.1.2 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.4.1.5.1.3 FINANCE AND ACCOUNTING

11.4.1.5.1.4 SALES & MARKETING SUPPORT

11.4.1.5.1.5 TALENT AND HR SERVICES

11.4.1.5.1.6 IT SERVICES

11.4.1.5.1.7 FACILITIES AND ADMINISTRATION

11.4.1.5.1.8 TRAINING

11.4.1.5.1.9 PRODUCT ENGINEERING

11.4.1.6 ARCHITECTURE & HOUSING

11.4.1.6.1 ARCHITECTURE & HOUSING, BY APPLICATION

11.4.1.6.1.1 FINANCE AND ACCOUNTING

11.4.1.6.1.2 PRODUCT ENGINEERING

11.4.1.6.1.3 IT SERVICES

11.4.1.6.1.4 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.4.1.6.1.5 TALENT AND HR SERVICES

11.4.1.6.1.6 CUSTOMER CARE

11.4.1.6.1.7 FACILITIES AND ADMINISTRATION

11.4.1.6.1.8 SALES & MARKETING SUPPORT

11.4.1.6.1.9 TRAINING (SAFETY, COMPLIANCE, DESIGN)

11.4.1.6.1.10 OTHERS

11.5 BFSI

11.5.1 BFSI, BY TYPE

11.5.1.1 BANKING

11.5.1.1.1 BANKING, BY APPLICATION

11.5.1.1.1.1 CUSTOMER CARE

11.5.1.1.1.2 FINANCE AND ACCOUNTING

11.5.1.1.1.3 TALENT AND HR SERVICES

11.5.1.1.1.4 IT SERVICES

11.5.1.1.1.5 SALES & MARKETING SUPPORT

11.5.1.1.1.6 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.5.1.1.1.7 TRAINING

11.5.1.1.1.8 FACILITIES AND ADMINISTRATION

11.5.1.1.2 ‘PRODUCT ENGINEERING

11.5.1.2 FINANCIAL SERVICES

11.5.1.2.1 FINANCIAL SERVICES, BY APPLICATION

11.5.1.2.1.1 FINANCE AND ACCOUNTING

11.5.1.2.1.2 CUSTOMER CARE

11.5.1.2.1.3 IT SERVICES

11.5.1.2.1.4 TALENT AND HR SERVICES

11.5.1.2.1.5 SALES AND MARKETING

11.5.1.2.1.6 PRODUCT ENGINEERING

11.5.1.2.1.7 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.5.1.2.1.8 TRAINING

11.5.1.2.1.9 FACILITIES AND ADMINISTRATION

11.5.1.3 INSURANCE

11.5.1.3.1 INSURANCE, BY APPLICATION

11.5.1.3.1.1 CUSTOMER CARE

11.5.1.3.1.2 FINANCE AND ACCOUNTING

11.5.1.3.1.3 SALES AND MARKETING

11.5.1.3.1.4 TALENT AND HR SERVICES

11.5.1.3.1.5 IT SERVICES

11.5.1.3.1.6 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.5.1.3.1.7 TRAINING

11.5.1.3.1.8 PRODUCT ENGINEERING

11.5.1.3.1.9 FACILITIES AND ADMINISTRATION

11.6 GOVERNMENT

11.6.1 GOVERNMENT, BY APPLICATION

11.6.1.1 IT SERVICES

11.6.1.2 CUSTOMER CARE

11.6.1.3 FINANCE AND ACCOUNTING

11.6.1.4 TALENT AND HR

11.6.1.5 FACILITIES AND ADMINISTRATION

11.6.1.6 TRAINING

11.6.1.7 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.6.1.8 SALES AND MARKETING

11.6.1.9 PRODUCT ENGINEERING

11.7 DEFENSE

11.7.1 DEFENSE, BY APPLICATION

11.7.1.1 IT SERVICES

11.7.1.2 TRAINING

11.7.1.3 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.7.1.4 FINANCE AND ACCOUNTING

11.7.1.5 FACILITIES AND ADMINISTRATION

11.7.1.6 TALENT AND HR

11.7.1.7 CUSTOMER CARE

11.7.1.8 PRODUCT ENGINEERING

11.7.1.9 SALES AND MARKETING

11.8 TRANSPORTATION

11.8.1 TRANSPORTATION, BY APPLICATION

11.8.1.1 CUSTOMER CARE

11.8.1.2 IT SERVICES

11.8.1.3 FINANCE AND ACCOUNTING

11.8.1.4 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.8.1.5 TALENT AND HR

11.8.1.6 TRAINING

11.8.1.7 FACILITIES AND ADMINISTRATION

11.8.1.8 SALES AND MARKETING

11.8.1.9 PRODUCT ENGINEERING

11.9 LOGISTICS

11.9.1 LOGISTICS, BY APPLICATION

11.9.1.1 IT SERVICES

11.9.1.2 CUSTOMER CARE

11.9.1.3 FINANCE AND ACCOUNTING

11.9.1.4 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.9.1.5 TALENT AND HR

11.9.1.6 TRAINING

11.9.1.7 FACILITIES AND ADMINISTRATION

11.9.1.8 SALES AND MARKETING

11.9.1.9 PRODUCT ENGINEERING

11.1 RETAIL

11.10.1 RETAIL, BY APPLICATION

11.10.1.1 CUSTOMER CARE

11.10.1.2 IT SERVICES

11.10.1.3 FINANCE AND ACCOUNTING

11.10.1.4 SALES AND MARKETING

11.10.1.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.10.1.6 TALENT AND HR

11.10.1.7 FACILITIES AND ADMINISTRATION

11.10.1.8 TRAINING

11.10.1.9 PRODUCT ENGINEERING

11.11 HEALTHCARE

11.11.1 HEALTHCARE, BY APPLICATION

11.11.1.1 CUSTOMER CARE

11.11.1.2 IT SERVICES

11.11.1.3 FINANCE AND ACCOUNTING

11.11.1.4 TRAINING

11.11.1.5 TALENT AND HR

11.11.1.6 FACILITIES AND ADMINISTRATION

11.11.1.7 SALES AND MARKETING

11.11.1.8 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.11.1.9 PRODUCT ENGINEERING

11.12 E-COMMERCE

11.12.1 E-COMMERCE, BY APPLICATION

11.12.1.1 CUSTOMER CARE

11.12.1.2 IT SERVICES

11.12.1.3 SALES AND MARKETING

11.12.1.4 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.12.1.5 FINANCE AND ACCOUNTING

11.12.1.6 TALENT AND HR

11.12.1.7 FACILITIES AND ADMINISTRATION

11.12.1.8 TRAINING

11.12.1.9 PRODUCT ENGINEERING

11.13 TRAVEL

11.13.1 TRAVEL, BY APPLICATION

11.13.1.1 CUSTOMER CARE

11.13.1.2 FINANCE AND ACCOUNTING

11.13.1.3 TALENT AND HR SERVICES

11.13.1.4 SALES AND MARKETING

11.13.1.5 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.13.1.6 FACILITIES AND ADMINISTRATION

11.13.1.7 PRODUCT ENGINEERING

11.13.1.8 TRAINING

11.13.1.9 IT SERVICES

11.14 HOSPITALITY

11.14.1 HOSPITALITY, BY APPLICATION

11.14.1.1 CUSTOMER CARE

11.14.1.2 SALES AND MARKETING

11.14.1.3 IT SERVICES

11.14.1.4 FINANCE AND ACCOUNTING

11.14.1.5 TALENT AND HR

11.14.1.6 TRAINING

11.14.1.7 FACILITIES AND ADMINISTRATION

11.14.1.8 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.14.1.9 PRODUCT ENGINEERING

11.15 ENERGY

11.15.1 ENERGY, BY APPLICATION

11.15.1.1 IT SERVICES

11.15.1.2 FINANCE AND ACCOUNTING

11.15.1.3 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.15.1.4 CUSTOMER CARE

11.15.1.5 FACILITIES AND ADMINISTRATION

11.15.1.6 TALENT AND HR

11.15.1.7 TRAINING

11.15.1.8 PRODUCT ENGINEERING

11.15.1.9 SALES AND MARKETING

11.16 EDUCATION

11.16.1 EDUCATION, BY APPLICATION

11.16.1.1 TRAINING

11.16.1.2 IT SERVICES

11.16.1.3 CUSTOMER CARE

11.16.1.4 FINANCE AND ACCOUNTING

11.16.1.5 TALENT AND HR

11.16.1.6 SALES AND MARKETING

11.16.1.7 FACILITIES AND ADMINISTRATION

11.16.1.8 PRODUCT ENGINEERING

11.16.1.9 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.17 UTILITIES

11.17.1 UTILITIES, BY APPLICATION

11.17.1.1 IT SERVICES

11.17.1.2 CUSTOMER CARE

11.17.1.3 FINANCE AND ACCOUNTING

11.17.1.4 SOURCING, PROCUREMENT & SUPPLY CHAIN

11.17.1.5 FACILITIES AND ADMINISTRATION

11.17.1.6 TALENT AND HR

11.17.1.7 TRAINING

11.17.1.8 PRODUCT ENGINEERING

11.17.1.9 SALES AND MARKETING

11.18 OTHERS

12 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ACCENTURE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 INFOSYS LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SERVICE PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 IBM CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SERVICE PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CAPGEMINI

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SERVICE PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 TATA CONSULTANCY SERVICES LIMITED

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SERVICE PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ADP, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SERVICE PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 AMDOCS

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 SERVICE PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 ALTECISYS

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 COGNIZANT

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 SERVICE PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 CONCENTRIX CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SERVICE PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 GENPACT

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SERVICE PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 HCL TECHNOLOGIES LIMITED

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SERVICE PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 INTETICS INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 SERVICE PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 IBT

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 NTT DATA GROUP CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 SERVICE PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 NCR VOYIX CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 SERVICE PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 PLAXONIC.

15.17.1 COMPANY SNAPSHOT

15.17.2 SERVICE PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ROBERT HALF INC (SUBSIDARY OF PROVITI)

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 SERVICE PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 SODEXO

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 SERVICE PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TTEC

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 SERVICE PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 WIPRO

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 SERVICE PORTFOLIO

15.21.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 CONTACT CENTER AGENTS IN U.A.E.

TABLE 2 LIST OF THE UAE COMPANIES WITH CAPTIVE CONTACT CENTER OPERATIONS IN THE U.A.E.

TABLE 3 OUTSOURCING FLOW – FROM CLIENT COUNTRY TO PROVIDER COUNTRY | SERVICES AND REASONS

TABLE 4 DELIVERY MODELS & OUTSOURCING BUDGET DISTRIBUTION BY FUNCTION

TABLE 5 LEADING NORTH AMERICA BPO COMPANIES – FY2024 OVERVIEW

TABLE 6 REGIONAL DELIVERY HUBS IN NORTH AMERICA BPO MARKET

TABLE 7 DELIVERY MODELS & REGIONAL STRUCTURE

TABLE 8 REGULATORY COVERAGE

TABLE 9 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA OFFSHORE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA ONSHORE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA NEARSHORE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CUSTOMER CARE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA FINANCE AND ACCOUNTING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA FINANCE AND ACCOUNTING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA IT SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA TALENT AND HR SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA TALENT AND HR SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA EMPLOYEE AND HR OPERATIONS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA TALENT ACQUISITION AND DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA TALENT DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA TALENT ACQUISITION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA SALES AND MARKETING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA SOURCING, PROCUREMENT & SUPPLY CHAIN IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA SOURCING, PROCUREMENT & SUPPLY CHAIN IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA PRODUCT ENGINEERING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA FACILITIES AND ADMINISTRATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA TRAINING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA LARGE ENTERPRISES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA SMES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING APPROACH, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA CONTRACT BASED IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA BUNDLED SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA BEST-SHORE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA FEE FOR SERVICE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA IT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA IT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA TELECOMMUNICATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA TELECOMMUNICATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA MANUFACTURING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA MANUFACTURING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA AUTOMOTIVE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTRONIC MACHINERIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA CHEMICAL & MATERIALS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA ICT EQUIPMENTS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA FOOD & BEVERAGE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA ARCHITECTURE & HOUSING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA BFSI IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA BFSI IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA BANKING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA FINANCIAL SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA INSURANCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA GOVERNMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA GOVERNMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA DEFENSE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA DEFENSE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA TRANSPORTATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA TRANSPORTATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA LOGISTICS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA LOGISTICS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA RETAIL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA RETAIL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA HEALTHCARE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA HEALTHCARE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA E-COMMERCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA E-COMMERCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA TRAVEL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA TRAVEL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA HOSPITALITY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA HOSPITALITY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA ENERGY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA ENERGY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA EDUCATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA EDUCATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA UTILITIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA UTILITIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA OTHERS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA FINANCE AND ACCOUNTING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA TALENT AND HR SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA EMPLOYEE AND HR OPERATIONS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA TALENT ACQUISITION AND DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA TALENT DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA TALENT ACQUISITION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA SOURCING, PROCUREMENT & SUPPLY CHAIN IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING APPROACH, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA IT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA TELECOMMUNICATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA MANUFACTURING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA AUTOMOTIVE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA ELECTRONIC MACHINERIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA CHEMICAL & MATERIALS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA ICT EQUIPMENTS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA FOOD & BEVERAGE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA ARCHITECTURE & HOUSING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA BFSI IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA BANKING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA FINANCIAL SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA INSURANCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA GOVERNMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA DEFENSE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA TRANSPORTATION S IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA LOGISTICS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA RETAIL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA HEALTHCARE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA E-COMMERCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA TRAVEL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 NORTH AMERICA HOSPITALITY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 116 NORTH AMERICA ENERGY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 NORTH AMERICA EDUCATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 118 NORTH AMERICA UTILITIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 U.S. BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 U.S. FINANCE AND ACCOUNTING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 U.S. TALENT AND HR SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 U.S. EMPLOYEE AND HR OPERATIONS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 U.S. TALENT ACQUISITION AND DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. TALENT DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. TALENT ACQUISITION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. SOURCING, PROCUREMENT & SUPPLY CHAIN IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 U.S. BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OWNERSHIP, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING APPROACH, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. IT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. TELECOMMUNICATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. MANUFACTURING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. AUTOMOTIVE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. ELECTRONIC MACHINERIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 138 U.S. CHEMICAL & MATERIALS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. ICT EQUIPMENTS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. FOOD & BEVERAGE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 U.S. ARCHITECTURE & HOUSING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 142 U.S. BFSI IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. BANKING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 144 U.S. FINANCIAL SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 U.S. INSURANCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. GOVERNMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 U.S. DEFENSE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 148 U.S. TRANSPORTATION S IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 U.S. LOGISTICS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. RETAIL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. HEALTHCARE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. E-COMMERCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. TRAVEL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. HOSPITALITY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. ENERGY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. EDUCATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. UTILITIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA FINANCE AND ACCOUNTING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA TALENT AND HR SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA EMPLOYEE AND HR OPERATIONS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 163 CANADA TALENT ACQUISITION AND DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA TALENT DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA TALENT ACQUISITION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA SOURCING, PROCUREMENT & SUPPLY CHAIN IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING APPROACH, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA IT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA TELECOMMUNICATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA MANUFACTURING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA AUTOMOTIVE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA ELECTRONIC MACHINERIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA CHEMICAL & MATERIALS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA ICT EQUIPMENTS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA FOOD & BEVERAGE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 178 CANADA ARCHITECTURE & HOUSING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA BFSI IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA BANKING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 181 CANADA FINANCIAL SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA INSURANCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 183 CANADA GOVERNMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 CANADA DEFENSE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA TRANSPORTATION S IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 186 CANADA LOGISTICS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 CANADA RETAIL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 188 CANADA HEALTHCARE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 189 CANADA E-COMMERCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 190 CANADA TRAVEL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 191 CANADA HOSPITALITY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 192 CANADA ENERGY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 193 CANADA EDUCATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 194 CANADA UTILITIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 195 MEXICO BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 MEXICO BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 197 MEXICO FINANCE AND ACCOUNTING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 198 MEXICO TALENT AND HR SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 MEXICO EMPLOYEE AND HR OPERATIONS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 200 MEXICO TALENT ACQUISITION AND DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO TALENT DEVELOPMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 202 MEXICO TALENT ACQUISITION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 MEXICO SOURCING, PROCUREMENT & SUPPLY CHAIN IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 MEXICO BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING APPROACH, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 207 MEXICO IT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO TELECOMMUNICATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO MANUFACTURING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 MEXICO AUTOMOTIVE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO ELECTRONIC MACHINERIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO CHEMICAL & MATERIALS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 213 MEXICO ICT EQUIPMENTS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO FOOD & BEVERAGE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO ARCHITECTURE & HOUSING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO BFSI IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO BANKING IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO FINANCIAL SERVICES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO INSURANCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO GOVERNMENT IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO DEFENSE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO TRANSPORTATION S IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 223 MEXICO LOGISTICS IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO RETAIL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO HEALTHCARE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO E-COMMERCE IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO TRAVEL IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 228 MEXICO HOSPITALITY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO ENERGY IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 MEXICO EDUCATION IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 231 MEXICO UTILITIES IN BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET TIME LINE CURVE

FIGURE 7 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 THREE SEGMENTS COMPRISE THE NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET, BY OUTSOURCING TYPE (2024)

FIGURE 13 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET STRATEGIC DEVELOPMET

FIGURE 14 INCREASING NEED FOR BUSINESS AGILITY IS EXPECTED TO DRIVE NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 OFFSHORE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET IN 2025 & 2032

FIGURE 16 U.A.E. BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2023 (%)

FIGURE 17 U.A.E. BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2023 (%)

FIGURE 18 U.A.E. BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2023 (%)

FIGURE 19 U.A.E. BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2023 (%)

FIGURE 20 U.A.E. BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2023 (%)

FIGURE 21 U.A.E. BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2023 (%)

FIGURE 22 U.A.E. BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2023 (%)

FIGURE 23 U.A.E. BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2023 (%)

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET

FIGURE 25 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY OUTSOURCING TYPE, 2024

FIGURE 26 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY APPLICATION, 2024

FIGURE 27 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 28 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY OUTSOURCING APPROACH, 2024

FIGURE 29 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: BY END USER, 2024

FIGURE 30 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: SNAPSHOT (2024)

FIGURE 31 NORTH AMERICA BUSINESS PROCESS OUTSOURCING (BPO) MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.