North America Capillary Blood Collection And Sampling Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.23 Billion

USD

1.91 Billion

2024

2032

USD

1.23 Billion

USD

1.91 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.91 Billion | |

|

|

|

|

North America Capillary Blood Collection and Sampling Devices Market Size

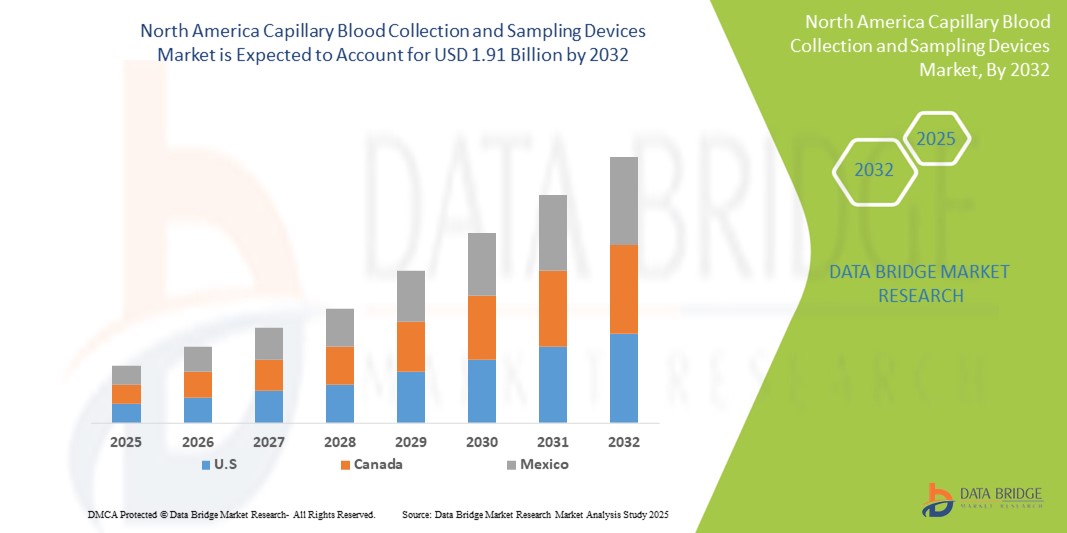

- The North America capillary blood collection and sampling devices market size was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.91 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market expansion is primarily driven by the rising demand for minimally invasive diagnostic procedures and the increasing prevalence of chronic and infectious diseases, prompting the need for efficient point-of-care testing solutions across the region

- In addition, growing investments in diagnostic infrastructure, coupled with technological innovations in microcollection techniques, are bolstering the adoption of capillary blood sampling devices. These trends are reinforcing the market’s growth trajectory across both clinical and home care environments

North America Capillary Blood Collection and Sampling Devices Market Analysis

- Capillary blood collection and sampling devices, essential for minimally invasive diagnostic procedures, are becoming increasingly integral in clinical, homecare, and decentralized healthcare settings due to their ease of use, patient comfort, and suitability for point-of-care testing

- The growing demand for these devices is primarily driven by the rising prevalence of chronic conditions such as diabetes, increased adoption of home-based health monitoring, and the expanding use of self-sampling kits for laboratory testing

- U.S. dominated the North American capillary blood collection and sampling devices market, accounting for the largest revenue share in 2024, owing to its advanced diagnostic infrastructure, high frequency of chronic disease screening, and presence of key manufacturers

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America capillary blood collection and sampling devices market due to increasing healthcare expenditure, rising awareness around preventive health, and the growing need for decentralized testing.

- Capillary blood collection devices segment dominated the North America capillary blood collection and sampling devices market with a market share of 35.3% in 2024, driven by its widespread use in clinical diagnostics and compatibility with multiple testing platforms

Report Scope and North America Capillary Blood Collection and Sampling Devices Market Segmentation

|

Attributes |

North America Capillary Blood Collection and Sampling Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Capillary Blood Collection and Sampling Devices Market Trends

“Rising Demand for At-Home Diagnostic Testing and Microcollection Technologies”

- A key and accelerating trend in the North America capillary blood collection and sampling devices market is the growing adoption of home-based diagnostic testing, driven by rising consumer demand for convenience, cost-efficiency, and accessibility in healthcare delivery. This trend is supported by innovations in microcollection devices that allow accurate sample collection with minimal discomfort and training

- For instance, companies such as Neoteryx and Tasso have introduced user-friendly microsampling devices that enable remote blood collection through volumetric absorptive microsampling (VAMS) and push-button systems, eliminating the need for in-clinic visits. These devices are gaining traction in chronic disease monitoring, pharmacokinetics, and decentralized clinical trials

- In addition, technological advances in sample preservation, such as dried blood spot (DBS) and VAMS, support the stability and transport of specimens for lab analysis, further fueling the demand for remote testing solutions

- Integration with digital health platforms allows seamless transmission of diagnostic data from remote collection sites to laboratories or healthcare providers. This digital-health synergy is enhancing the diagnostic workflow and improving health outcomes

- As healthcare systems shift toward value-based care and personalized medicine, the demand for capillary blood sampling that facilitates early detection and monitoring outside traditional clinical settings is surging. This trend is transforming diagnostic access, especially in underserved and rural populations

- Leading manufacturers are expanding their product lines with devices tailored for both professional and home use, with features such as single-use designs, reduced contamination risk, and compliance with regulatory standards for remote specimen collection

North America Capillary Blood Collection and Sampling Devices Market Dynamics

Driver

“Expanding Use in Chronic Disease Monitoring and Decentralized Testing”

- The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and autoimmune conditions is significantly driving demand for capillary blood collection devices in North America. These devices offer a minimally invasive, fast, and effective method for routine monitoring and diagnostic testing, particularly in outpatient and home settings

- For instance, the widespread use of lancets and microtainers in diabetes management supports frequent blood glucose monitoring, contributing to better disease control and reducing healthcare system burden

- In addition, the rise in decentralized clinical trials and personalized healthcare is fostering the adoption of remote sampling devices. Companies such as Tasso Inc. and Seventh Sense Biosystems have developed compact, pain-minimized sampling tools that enable patient-led blood collection from home

- Government initiatives and favorable reimbursement policies are further reinforcing the uptake of point-of-care and home-based testing solutions. This shift is aligned with healthcare providers’ goals of reducing hospital visits and supporting early intervention

- As healthcare consumers seek greater autonomy, convenience, and efficiency, capillary blood collection technologies are positioned as a vital solution that bridges the gap between traditional diagnostics and remote care delivery

Restraint/Challenge

“Accuracy Concerns and Regulatory Barriers for Remote Testing Devices”

- Despite their advantages, capillary blood sampling devices face challenges related to sample variability, limited sample volume, and potential collection errors, which can affect test accuracy and clinical reliability, particularly in complex or high-precision diagnostics

- For instance, inconsistent blood volume from fingerstick sampling and improper handling in home environments may compromise sample integrity, leading to misinterpretation of results or the need for retesting

- In addition, strict regulatory oversight from agencies such as the FDA and Health Canada requires manufacturers to conduct extensive clinical validations for at-home sampling products. Delays in obtaining regulatory approvals may hinder timely product launches and market expansion

- Some healthcare professionals also express concerns over integrating remote-collected samples into established lab workflows due to traceability and compliance standards

- Educating users on proper collection techniques, investing in training resources, and improving device automation are critical to mitigating user-related errors. Furthermore,

- ongoing innovation in capillary collection technology and collaborative regulatory efforts will be essential to overcoming these barriers and expanding market access

North America Capillary Blood Collection and Sampling Devices Market Scope

The market is segmented on the basis of product, modality, mode of administration, application, platform, age group, test type, technology, material, end user, and distribution channel.

- By Product

On the basis of product, the capillary blood collection and sampling devices market is segmented into blood sampling devices, capillary blood collection devices, rapid test cassette, remote capillary blood collection device, and wearable capillary blood collection device. The capillary blood collection devices segment dominated the market with the largest revenue share of 35.3% in 2024, owing to their broad application in diagnostic labs, hospitals, and home-based care. These devices are favored for their simplicity, low invasiveness, and effectiveness in collecting precise blood volumes for routine analysis.

The wearable capillary blood collection device segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing demand for continuous health monitoring and real-time diagnostics. Wearable solutions enable convenient sample collection without clinic visits, making them ideal for chronic disease management and remote patient monitoring.

- By Modality

On the basis of modality, capillary blood collection and sampling devices market is segmented into manual sampling and automated/autoinjection sampling. The manual sampling segment led with a market share of 61.2% in 2024, largely due to its cost-effectiveness and widespread usage in traditional healthcare settings. These methods remain a staple in diagnostics, particularly in resource-limited or decentralized locations.

The automated/autoinjection sampling segment is expected to grow at a higher rate during the forecast period, driven by technological advancements offering increased consistency, reduced user error, and integration into at-home sampling kits for patient-led testing.

- By Mode Of Administration

On the basis of mode of administration, the capillary blood collection and sampling devices market is segmented into puncture and incision. The puncture method held the leading share of 68.5% in 2024. Puncture-based sampling, especially through fingersticks or heelsticks, is widely adopted for its minimally invasive approach and suitability for frequent diagnostic monitoring in various age groups.

The incision segment is expected to witness fastest growth during forecast period, due to attention for use in specialty applications requiring larger sample volumes or specific analyte testing.

- By Application

On the basis of application, the capillary blood collection and sampling devices market is segmented into cardiovascular disease, infection and infectious disease, respiratory diseases, cancers, rheumatoid arthritis, and others. Cardiovascular disease led the market in 2024 with a 26.9% share, owing to frequent monitoring needs such as lipid profiles and blood glucose levels. The increasing burden of heart-related conditions across North America drives the demand for routine and preventive diagnostics.

The infection and infectious disease segment is anticipated to grow rapidly during forecast period, post-COVID-19, with heightened awareness for early detection and management of communicable illnesses through rapid capillary-based tests.

- By Platform

On the basis of platform, the capillary blood collection and sampling devices market is segmented into enzyme immunoassay platform (ELISA Platform), PCR, lateral flow immunoassay, ELTABA, and others, The enzyme immunoassay platform (ELISA Platform) held the top position with a 32.4% market share in 2024.Its reliability, high sensitivity, and established clinical use make ELISA the preferred platform across many healthcare applications.

The lateral flow immunoassay platform is expected to grow fastest during forecast period, driven by the demand for rapid, user-friendly diagnostics, especially in point-of-care and self-testing formats.

- By Age Group

On the basis of age group, the capillary blood collection and sampling devices market is segmented into geriatrics, infant, pediatric, and adult. The adult segment dominated with 49.1% share in 2024.Adults represent the largest group undergoing regular diagnostic screenings for lifestyle diseases, infections, and wellness assessments.

The geriatric segment is expected to grow rapidly during forecast period, due to rising life expectancy and the need for frequent blood-based monitoring of chronic illnesses in aging populations.

- By Test Type

On the basis of test type, the capillary blood collection and sampling devices market is segmented into whole blood test, dried blood spot tests, plasma/serum protein tests, liver function tests, comprehensive metabolic panel (CMP), and others. Dried blood spot tests accounted for the highest share at 30.7% in 2024, due to their ease of collection, storage, and transport, making them highly suitable for remote and longitudinal testing.

Comprehensive metabolic panel tests are anticipated to rise during forecast period due to, in demand as full-body health checkups gain popularity across employer wellness programs and preventive care.

- By Technology

On the basis of technology, the capillary blood collection and sampling devices market is segmented into volumetric absorptive microsampling, capillary electrophoresis-based chemical analysis, and others. Volumetric absorptive microsampling (VAMS) led the segment with a 35.6% share, providing precise and reproducible small-volume blood collection, ideal for at-home and clinical applications.

Capillary electrophoresis-based analysis is expected to witness fastest growth during forecast period, in specialized labs for its ability to separate biomolecules efficiently, especially in advanced diagnostics.

- By Material

On the basis of material, the is segmented into market is segmented into plastic, glass, stainless steel, and ceramic. Plastic dominated with 58.3% share in 2024, favored for its low cost, safety, and disposability, especially in single-use capillary blood collection devices.

Stainless steel is expected to witness fastest growth during forecast period, preferred in reusable lancets and specialty devices where precision and durability are critical.

- By End User

On the basis of end user, the is segmented into market is segmented into laboratories and home care setting. Laboratories remained the dominant end user with 62.8% of the market share, benefiting from consistent demand in clinical diagnostics and centralized testing facilities.

However, the home care setting segment is growing rapidly during forecast period, driven by increased consumer interest in at-home testing and chronic disease self-monitoring.

- By Distribution Channel

On the basis of distribution channel, the is segmented into market is segmented into direct tender, retail sales, and others. Direct tender led with a 47.5% share in 2024, driven by bulk procurement by public hospitals, diagnostic chains, and government health agencies.

Retail sales, particularly via e-commerce, are expected to witness fastest growth during forecast period, as consumers seek convenience and privacy in accessing diagnostic tools.

North America Capillary Blood Collection and Sampling Devices Market Regional Analysis

- The U.S. dominated the North American market, accounting for the largest revenue share in 2024, owing to its advanced diagnostic infrastructure, high frequency of chronic disease screening, and presence of key manufacturers

- The country’s robust healthcare infrastructure, widespread access to point-of-care testing, and rising preference for home-based and minimally invasive diagnostics are fueling rapid adoption of capillary sampling devices across clinical and home care settings

- In addition, the presence of major diagnostic device manufacturers such as Becton, Dickinson and Company and Thermo Fisher Scientific, coupled with ongoing technological innovation and increased federal support for remote healthcare, continues to strengthen the U.S. market leadership

U.S. North America Capillary Blood Collection and Sampling Devices Market Insight

The U.S. capillary blood collection and sampling devices market held the largest revenue share of 78.6% in North America in 2024, primarily driven by the increasing prevalence of chronic conditions such as diabetes, cardiovascular disorders, and infectious diseases. The growing adoption of remote and point-of-care diagnostics, supported by robust telehealth infrastructure, is fueling demand for minimally invasive blood collection tools. Government support for early disease detection, along with significant R&D investments by U.S.-based diagnostics companies, is further bolstering market growth. In addition, rising demand for home-based testing kits and wearable collection devices is reshaping diagnostic workflows across the country.

Canada North America Capillary Blood Collection and Sampling Devices Market Insight

The Canadian capillary blood collection and sampling devices market is projected to grow steadily over the forecast period, supported by increasing healthcare expenditure, rising awareness around preventive health, and the growing need for decentralized testing. Canada’s strong public healthcare infrastructure and strategic focus on patient-centric diagnostics are driving the adoption of automated and user-friendly sampling technologies. The market is also benefitting from partnerships between diagnostic device companies and health institutions to improve accessibility to early testing solutions in rural and underserved communities.

Mexico North America Capillary Blood Collection and Sampling Devices Market Insight

The Mexico’s capillary blood collection and sampling devices market is gaining momentum, driven by rising incidences of infectious diseases and expanding government initiatives targeting universal healthcare coverage. The adoption of affordable, rapid blood collection tools is critical in improving diagnostic reach, particularly in remote and low-income regions. Growing investment in mobile healthcare units and integration of point-of-care testing in public health campaigns are further boosting the market. Moreover, the country’s increasing collaborations with global diagnostic firms are enabling faster deployment of innovative and portable blood sampling technologies.

North America Capillary Blood Collection and Sampling Devices Market Share

The North America capillary blood collection and sampling devices industry is primarily led by well-established companies, including:

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer (U.S.)

- Danaher Coporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Greiner Bio-One North America, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Neoteryx, LLC (U.S.)

- Tasso, Inc. (U.S.)

- Drawbridge Health, Inc. (U.S.)

- Seventh Sense Biosystems, Inc. (U.S.)

- Owen Mumford Inc. (U.S.)

- Babson Diagnostics, Inc. (U.S.)

- Everlywell, Inc. (U.S.)

- Hemosure, Inc. (U.S.)

- Labcorp (U.S.)

- CerTest Biotec USA, Inc. (U.S.)

- Natera, Inc. (U.S.)

- Biolytical Laboratories Inc. (Canada)

What are the Recent Developments in North America Capillary Blood Collection and Sampling Devices Market?

- In April 2024, Neoteryx LLC, a U.S.-based microsampling innovator, expanded its Mitra microsampling device production capacity to meet growing demand from diagnostic labs and decentralized testing programs across North America. This scale-up reflects the rising preference for volumetric absorptive microsampling in chronic disease monitoring and remote patient care, reinforcing Neoteryx’s position in the capillary blood collection market

- In March 2024, Quest Diagnostics announced the integration of remote capillary blood collection devices into its home testing kits, aimed at enhancing accessibility and convenience for patients managing conditions such as diabetes and thyroid disorders. This move aligns with the growing demand for self-collection and mail-in lab testing services across the U.S., particularly post-pandemic

- In February 2024, BD (Becton, Dickinson and Company) launched a next-generation capillary blood collection system designed to improve ease of use, reduce hemolysis rates, and enhance sample integrity. This innovation supports BD’s focus on optimizing pre-analytical workflows and addresses increasing requirements from clinical labs for high-quality microsamples

- In January 2024, Drawbridge Health, a U.S.-based medtech firm, announced strategic partnerships with Canadian diagnostic networks to distribute its OneDraw blood collection device, which enables simplified blood sample collection at home. This partnership marks a major step toward expanding decentralized diagnostic capabilities in North America, particularly for routine biomarker and metabolic testing

- In December 2023, Tasso, Inc. received additional FDA clearance for its Tasso+ blood collection device, enhancing its applicability for remote clinical trials and personalized medicine initiatives across the U.S. and Canada. The clearance facilitates wider adoption of self-collection technologies and strengthens Tasso’s contribution to home-based healthcare innovation in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.