North America Cardiac Pacemakers Market

Market Size in USD Billion

CAGR :

%

USD

5.14 Billion

USD

7.77 Billion

2024

2032

USD

5.14 Billion

USD

7.77 Billion

2024

2032

| 2025 –2032 | |

| USD 5.14 Billion | |

| USD 7.77 Billion | |

|

|

|

|

Cardiac Pacemakers Market Size

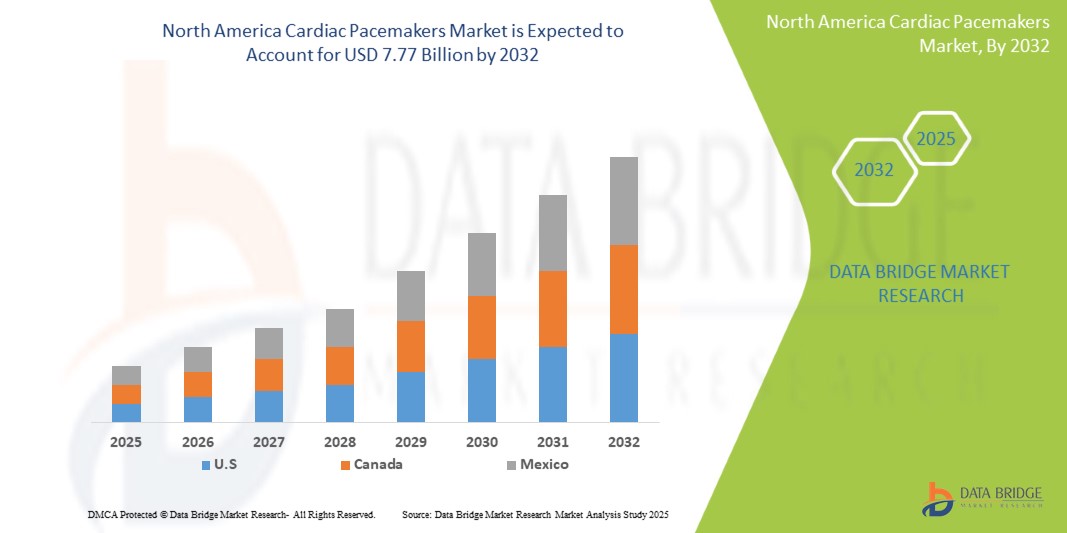

- The North America cardiac pacemakers market size was valued at USD 5.14 billion in 2024 and is expected to reach USD 7.77 billion by 2032, at a CAGR of 5.30% during the forecast period

- This growth is driven by factors such as the increasing aging population, technological advancement, rising cardiovascular disease incidence

Cardiac Pacemakers Market Analysis

- A pacemaker is an electrical device and it is used to treat arrhythmias, which leads to asymmetrical heartbeat. A pacemaker is usually used to help patients suffering from arrhythmias, to lead an active and healthy life style

- Implantable cardiac pacemakers have been observing substantial demand due to growing cases of slow heart rhythm and cardiac failures. Furthermore, technological developments such as the development of MRI companionable pacemakers have additional driven the market's growth

- U.S. is expected to dominate the cardiac pacemakers market with 37.9% due to technological advancements such as leadless pacemakers and AI-integrated devices

- Canada is expected to be the fastest growing region in the cardiac pacemakers market during the forecast period due to emerging markets are witnessing rapid adoption of cardiac devices and with ongoing healthcare reforms and technological advancements

- Implantable segment is expected to dominate the market with a market share with 63.2% due to rise in the adoption of these devices for arrhythmias, treatment of cardiac failure, and ongoing clinical trial processes are the key factors driving this segment's overall growth

Report Scope and Cardiac Pacemakers Market Segmentation

|

Attributes |

Cardiac Pacemakers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Cardiac Pacemakers Market Trends

“Surge in Leadless and AI-Integrated Pacemakers”

- Leadless pacemakers, which eliminate the need for leads and are implanted directly into the heart, offer benefits such as reduced risk of infection and shorter recovery times.

- For instance, Abbott's dual-chamber leadless pacemaker system, AVEIR, received FDA approval in July 2023, marking a significant milestone in minimally invasive cardiac care

- Additionally, the integration of artificial intelligence into pacemakers is enhancing device performance and patient outcomes

- AI algorithms enable real-time monitoring and personalized adjustments to pacing, improving the management of arrhythmias and other cardiac conditions

- These innovations are not only improving patient care but also expanding the market's reach, as they cater to a growing demand for advanced cardiac solutions

Cardiac Pacemakers Market Dynamics

Driver

“Aging Population and Increased Prevalence of Cardiac Diseases”

- The aging population in North America is a significant driver of the cardiac pacemakers market

- As individuals age, the incidence of cardiac conditions such as arrhythmias and heart block increases, leading to a higher demand for pacemaker implants

- According to a report by Technavio, the market is expected to grow substantially due to the growing prevalence of cardiac diseases and an aging population

- Furthermore, unhealthy lifestyle choices, including poor diet, inactivity, and obesity, exacerbate the prevalence of cardiovascular diseases, further driving the need for cardiac interventions

- This demographic shift is prompting healthcare providers to invest in advanced pacemaker technologies to meet the rising demand

Opportunity

“Expansion of Remote Monitoring and Personalized Care”

- The increasing adoption of remote monitoring technologies presents a significant opportunity for the cardiac pacemakers market

- Telemedicine and AI-powered pacemakers enable healthcare providers to monitor patients' heart rhythms and device performance remotely, improving patient convenience and allowing for early detection of potential issues

- This shift towards personalized care is enhancing patient outcomes and reducing the need for in-person clinic visits, thereby expanding access to cardiac care

- As more healthcare facilities integrate these technologies, the demand for remotely monitored pacemakers is expected to rise, offering growth prospects for market players

Restraint/Challenge

“Regulatory Hurdles and Workforce Shortages”

- The approval process for new pacemaker technologies is lengthy and complex, often taking over five years to receive full regulatory clearance. This delay can slow innovation and market entry

- Manufacturers must adhere to rigorous standards set by regulatory agencies, leading to increased production costs. These costs can affect pricing and accessibility of pacemaker devices

- Approximately 5% of pacemakers are recalled annually due to malfunctions or safety concerns, impacting market growth and consumer confidence

- There is a shortage of trained medical professionals capable of performing pacemaker implantations and monitoring patients effectively. This shortage can lead to longer waiting times and increased healthcare costs

- Delays in regulatory approvals can hinder the introduction of advanced pacemaker solutions, affecting the timely availability of innovative treatments

Cardiac Pacemakers Market Scope

The market is segmented on the basis of product, technology, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By End User |

|

In 2025, the implantable cardiac pacemakers is projected to dominate the market with a largest share in product segment

The implantable cardiac pacemakers segment is expected to dominate the Cardiac Pacemakers market with the largest share with 63.2% in 2025 due to its reliability, efficacy, and increased demand for minimally invasive procedures of implantable pacemakers. Implantable types, i.e., dual-chamber or MRI-compatible models, are very popular because of reduced infection rates and better outcomes for patients.

The hospitals is expected to account for the largest share during the forecast period in end user market

In 2025, the hospitals segment is expected to dominate the market with the largest market share with 61.8% due to the increasing demand. The rise of cardiac patient admissions and excellent reimbursement facilities during the surgeries are the factors that are fuelling the growth of this segment.

Cardiac Pacemakers Market Regional Analysis

“U.S. Holds the Largest Share in the Cardiac Pacemakers Market”

- U.S. is projected to hold a significant share of the North America cardiac pacemakers market with 37.9%

- A significant proportion of the population is over 65 years old, leading to increased demand for cardiac devices

- Advanced medical facilities and high healthcare expenditure support the adoption of pacemakers.

- Favorable insurance and reimbursement policies facilitate access to cardiac treatments.

- Early adoption of innovative technologies, such as leadless and MRI-compatible pacemakers, enhances treatment options

- Companies such as Medtronic, Abbott, and Boston Scientific have a strong presence, contributing to the region's dominance

- The market is expected to maintain its leading position due to continuous innovation and a stable healthcare environment

“Canada is Projected to Register the Highest CAGR in the Cardiac Pacemakers Market”

- Rising incidences of heart-related conditions drive the demand for pacemakers

- These are investing heavily in healthcare infrastructure, improving access to treatments

- The adoption of cost-effective pacemaker options makes treatment accessible to a larger population

- Policies aimed at expanding healthcare coverage and facilities contribute to market growth

- Dominates the region with a large patient pool and increasing healthcare expenditure. This shows significant potential due to a vast population and improving healthcare access

- Emerging markets are witnessing rapid adoption of cardiac devices. With ongoing healthcare reforms and technological advancements, the region is set to experience sustained growth in the pacemaker market

Cardiac Pacemakers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Zoll Medical Corporation (U.S.)

- OSCOR Inc. (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- MEDICO (U.S.)

Latest Developments in North America Cardiac Pacemakers Market

- In January 5, 2024, Medtronic received the CE Mark for its next-generation Micra AV2 and Micra VR2 leadless pacemakers. These devices offer approximately 40% more battery life than previous models, with projected lifespans of nearly 16 and 17 years, respectively. Additionally, the Micra AV2 features advanced algorithms to optimize atrioventricular (AV) synchrony and supports higher tracking capabilities for faster heart rates

- On August 2022, Cornell University scientists tested their newly developed pacemaker on mini-donkey suffering from severe cardiac disease to detect its efficacy in managing fatal heart conditions. Veterinarians conducted an EEG/echocardiography & installed an ECG on the donkey to record its heart beating. It showed highly positive results, and within a month or two, the donkey's condition gradually improved. Cornell University announced that its new pacemaker would receive FDA approval within the next month for its launching in the market

- In June 2021, India Medtronic Private Limited launched Micra AV, a miniaturized, fully self-contained pacemaker that delivers advanced pacing technology to atrioventricular (AV) block patients via a minimally invasive approach. The device is the first pacemaker that can sense atrial activity without a lead or device in the upper chamber of the heart

- In January 2021, Boston Scientific Corporation announced its plan to acquire the remote cardiac monitoring developer, Preventice Solutions

- In May 2020, BIOTRONIK launched a home monitoring system for providing safe and cost-effective management for patients with pacemakers

- On January 2020, Medtronic announced FDA approval for its product Micra AV, the world’s smallest 2nd generation wireless pacemaker directly implanted into the heart

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.