North America Cartoning Machines Market

Market Size in USD Billion

CAGR :

%

USD

1.00 Billion

USD

1.73 Billion

2024

2032

USD

1.00 Billion

USD

1.73 Billion

2024

2032

| 2025 –2032 | |

| USD 1.00 Billion | |

| USD 1.73 Billion | |

|

|

|

|

North America Cartoning Machines Market Size

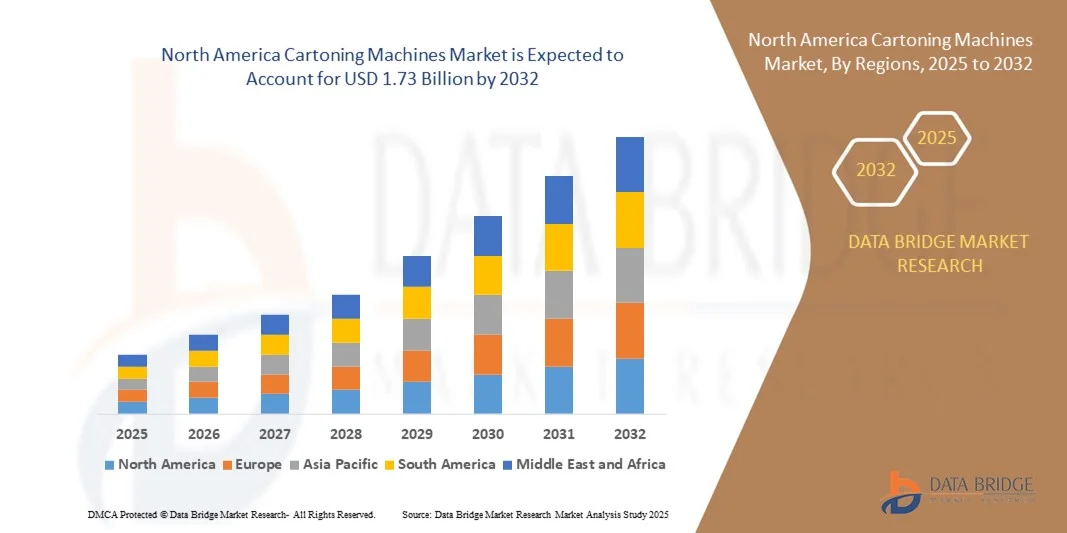

- The North America cartoning machines market size was valued at USD 1.00 billion in 2024 and is expected to reach USD 1.73 billion by 2032, at a CAGR of 7.0% during the forecast period

- The market growth is largely fuelled by the rising demand for automated packaging solutions across industries such as food & beverages, pharmaceuticals, and consumer goods, aimed at enhancing operational efficiency and reducing labor costs

- Increasing adoption of smart and flexible cartoning systems integrated with robotics, IoT, and AI technologies is further supporting market expansion by enabling faster changeovers and improving product handling accuracy

North America Cartoning Machines Market Analysis

- The cartoning machines market is witnessing steady growth as manufacturers shift toward automation to streamline packaging processes and ensure consistent quality. The integration of digital control systems and advanced sensors is enhancing machine precision and reducing downtime

- Increasing demand for high-speed horizontal and vertical cartoners in pharmaceutical and cosmetic sectors is reshaping the competitive landscape, with key players focusing on innovation and customizability

- The U.S. dominated the cartoning machines market with the largest revenue share in North America in 2024, driven by high demand from the food, beverage, healthcare, and personal care industries, coupled with widespread adoption of automation and robotics in packaging operations

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America cartoning machines market due to increasing demand for efficient packaging solutions, growing food and beverage production, and rising adoption of Industry 4.0 technologies. Supportive government initiatives and investments in modern packaging infrastructure are also fueling market growth

- The Horizontal Cartoning Machines segment held the largest market share in 2024, driven by its wide adoption across food, beverage, and pharmaceutical industries for packaging high-speed production lines. These machines are favored for their ability to efficiently handle rectangular cartons and provide superior sealing accuracy, making them ideal for continuous packaging operations

Report Scope and North America Cartoning Machines Market Segmentation

|

Attributes |

North America Cartoning Machines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Cartoning Machines Market Trends

Integration of Robotics and AI in Cartoning Operations

- The growing adoption of robotics and artificial intelligence (AI) is transforming the cartoning machines market by enhancing speed, precision, and flexibility in packaging operations. Automated systems equipped with robotic arms and vision sensors can handle delicate products, minimize human errors, and ensure consistent packaging quality across various industries. These advancements enable manufacturers to meet increasing production demands while maintaining high product integrity and reducing waste

- The demand for smart packaging automation is rising as manufacturers seek to optimize production efficiency and reduce operational costs. AI-driven cartoning systems enable predictive maintenance, real-time error detection, and adaptive performance based on changing product sizes and packaging materials, improving overall productivity. Furthermore, automation helps minimize downtime and human dependency, ensuring consistent output and quality control in large-scale operations

- With the global shift toward Industry 4.0, integration of IoT and machine learning capabilities in cartoning machines allows for data-driven decision-making, energy optimization, and improved throughput. This trend supports scalable automation across food, beverage, and pharmaceutical sectors. The ability to collect and analyze production data in real time enables smarter resource allocation and enhances overall plant efficiency

- For instance, in 2023, a leading packaging equipment manufacturer introduced an AI-enabled robotic cartoning line that reduced downtime by 25% and improved line efficiency by 30% through automated adjustment mechanisms. This innovation showcased how automation can significantly reduce manual intervention, improve consistency, and streamline packaging operations. The move also encouraged smaller manufacturers to explore digital transformation in packaging

- While robotics and AI are revolutionizing the packaging landscape, ensuring interoperability between digital systems, investing in workforce training, and addressing high initial setup costs are key to maximizing adoption and performance outcomes. Overcoming integration challenges and developing a skilled workforce will be essential for long-term success. Continued R&D and government support for smart manufacturing initiatives are expected to accelerate adoption in emerging economies

North America Cartoning Machines Market Dynamics

Driver

Increasing Demand for Automation and Efficiency in Packaging Processes

- The rising need for higher production efficiency and reduced labor dependency is driving the adoption of automated cartoning machines. These systems streamline packaging operations, ensuring consistent output and minimizing wastage, especially in high-volume industries such as food, pharmaceuticals, and personal care. Automation also improves product safety and reduces the likelihood of contamination, supporting global regulatory compliance in packaging standards

- Manufacturers are increasingly focusing on operational flexibility and customization to handle various product sizes and formats. Advanced cartoning machines equipped with servo-driven motors and programmable control systems provide faster changeovers and enhanced precision, meeting the growing demand for dynamic packaging solutions. This adaptability allows manufacturers to quickly respond to shifting consumer preferences and shorter product life cycles

- The push toward automation also aligns with the global trend of smart manufacturing and sustainability, as automated machines optimize material usage and reduce energy consumption. Automated systems are increasingly being designed to handle recyclable materials and eco-friendly packaging formats, contributing to sustainable manufacturing goals. This positions automation as both a productivity and environmental solution

- For instance, in 2023, several companies adopting automated cartoning lines reported significant improvements in packaging speed, production efficiency, and product consistency. The implementation of smart packaging systems also minimized human errors, enhanced overall equipment effectiveness, and boosted profitability, encouraging broader adoption across industries.

- While automation drives productivity and consistency, ongoing innovation, maintenance support, and cost-effective scalability remain essential for sustaining market growth. Manufacturers are focusing on modular system designs and digital twin technology to simplify integration and maintenance. These developments are expected to make automation more accessible and sustainable for SMEs

Restraint/Challenge

High Initial Investment and Maintenance Costs

- The implementation of advanced cartoning machines involves significant upfront capital expenditure, which can be a barrier for small and medium-sized enterprises (SMEs). High-end systems with robotics and automation features require substantial investment in installation, integration, and operator training. The return on investment (ROI) can take several years, making small manufacturers cautious about large-scale upgrades

- Regular maintenance, spare parts replacement, and software updates contribute to long-term operational costs, limiting accessibility for businesses with tight budgets. In addition, compatibility challenges with existing production lines can lead to further customization expenses. This creates operational inefficiencies and delays in system adoption, especially in industries with diverse product portfolios

- The shortage of skilled technicians capable of operating and troubleshooting complex cartoning systems also adds to operational challenges, particularly in developing regions. The lack of training programs and technical support networks limits proper equipment utilization, often resulting in downtime and higher maintenance costs. Building local technical capacity is crucial for overcoming these barriers

- For instance, in 2023, Conversely, some manufacturers faced delays in upgrading to automated systems due to high initial costs and limited access to skilled technical personnel. These challenges led to slower production turnaround, reduced competitiveness, and highlighted the need for financing solutions, leasing models, and workforce training to facilitate wider adoption of automation

- While cost remains a major restraint, market players are focusing on modular designs, leasing models, and cost-effective service packages to enhance affordability and expand adoption among SMEs. Partnerships between automation solution providers and regional governments are also being established to subsidize technology adoption. Such initiatives are expected to bridge the affordability gap and accelerate smart packaging adoption globally

North America Cartoning Machines Market Scope

The global cartoning machines market is segmented on the basis of machine type, carton type, capacity, dimension, process, distribution channel, and application.

- By Machine Type

On the basis of machine type, the market is segmented into Vertical Cartoning Machines (Top Load) and Horizontal Cartoning Machines (End Load). The Horizontal Cartoning Machines segment held the largest market share in 2024, driven by its wide adoption across food, beverage, and pharmaceutical industries for packaging high-speed production lines. These machines are favored for their ability to efficiently handle rectangular cartons and provide superior sealing accuracy, making them ideal for continuous packaging operations.

The Vertical Cartoning Machines segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand in the healthcare and personal care industries. Their compact design, flexibility to handle fragile products, and suitability for short production runs make them highly preferred for space-constrained facilities and diverse product packaging.

- By Carton Type

On the basis of carton type, the market is segmented into Stand-Up Straight, Closed, Folded, Bag-In-Box, Side-Seamed, and Others. The Closed Carton segment dominated the market in 2024, owing to its ability to provide secure, tamper-evident packaging suitable for pharmaceuticals, cosmetics, and high-value consumer goods. Its superior sealing characteristics enhance product protection and shelf appeal.

The Folded Carton segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption in food and beverage applications. Folded cartons offer design versatility, reduced material usage, and easy recyclability, aligning with the growing sustainability trends across industries.

- By Capacity

On the basis of capacity, the market is categorized into Up to 70 CPM, 70 to 150 CPM, 150 to 400 CPM, and Above 400 CPM. The 150 to 400 CPM segment accounted for the largest revenue share in 2024, supported by the growing need for medium-to-high-speed cartoning operations across consumer goods and pharmaceutical industries. These machines offer a balance between performance, flexibility, and cost-effectiveness.

The Above 400 CPM segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the increasing adoption of high-performance systems in large-scale production environments. Advanced models in this category integrate robotics and AI to achieve ultra-high throughput and minimize downtime.

- By Dimension

On the basis of dimension, the market is segmented into Up to 200 CM³, 200 to 1000 CM³, 1000 to 5000 CM³, and Above 5000 CM³. The 200 to 1000 CM³ segment dominated the market in 2024 due to its suitability for packaging mid-sized products such as personal care, processed food, and small pharmaceutical items. These machines offer optimal speed and versatility for standard retail packaging needs.

The 1000 to 5000 CM³ segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in bulk packaging applications. This segment is particularly favored by the beverage and chemical industries, where larger packaging volumes enhance logistics efficiency.

- By Process

On the basis of process, the market is divided into Online Cartoning Machines and Offline Cartoning Machines. The Online Cartoning Machines segment held the dominant market share in 2024, supported by the increasing integration of cartoning machines into automated production lines. These machines enable continuous operation, real-time monitoring, and improved synchronization with upstream and downstream systems.

The Offline Cartoning Machines segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in small and medium enterprises (SMEs) that prefer stand-alone systems for limited production runs. The flexibility and ease of operation of offline machines make them suitable for customized packaging needs.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into B2B, Distributor/Broker, and Others. The B2B segment dominated the market in 2024, as manufacturers prefer direct partnerships with packaging equipment suppliers for large-scale installations, after-sales service, and system customization. This channel ensures cost transparency and efficient project management.

The Distributor/Broker segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of modular and mid-range cartoning machines among SMEs. Distributors help bridge market accessibility by offering localized service support and faster delivery options.

- By Application

On the basis of application, the market is segmented into Food, Beverages, Healthcare, Personal Care, Homecare, Chemical, and Others. The Food segment accounted for the largest revenue share in 2024, driven by the surge in demand for ready-to-eat meals, confectionery, and bakery products. Cartoning machines provide efficient, hygienic, and high-speed packaging solutions suitable for diverse food applications.

The Healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising pharmaceutical production and stringent packaging regulations. Automated cartoning systems ensure precision, traceability, and compliance with safety standards, supporting the sector’s shift toward digitalized packaging processes.

North America Cartoning Machines Market Regional Analysis

- The U.S. dominated the cartoning machines market with the largest revenue share in North America in 2024, driven by high demand from the food, beverage, healthcare, and personal care industries, coupled with widespread adoption of automation and robotics in packaging operations

- Manufacturers are increasingly investing in advanced cartoning machines, including vertical and horizontal systems, to enhance production efficiency, maintain consistent quality, and reduce labor dependency

- This strong market presence is further supported by the U.S.’s well-established industrial infrastructure, technological advancements, and focus on smart manufacturing and Industry 4.0 initiatives, making it a leading market for cartoning machines in North America

Canada Cartoning Machines Market Insight

The Canada cartoning machines market is expected to witness the fastest growth rate from 2025 to 20322, fueled by increasing automation in packaging lines and rising demand for high-speed, flexible packaging solutions. Companies are adopting AI-driven and robotic cartoning systems to optimize productivity, reduce errors, and handle diverse product formats efficiently. The growth is further supported by the expansion of the food and beverage sector, growing e-commerce, and government initiatives promoting smart manufacturing technologies, significantly contributing to the market’s rapid growth in Canada.

North America Cartoning Machines Market Share

The North America cartoning machines industry is primarily led by well-established companies, including:

- WestRock Company (U.S.)

- ProMach, Inc. (U.S.)

- Tetra Pak Inc. (U.S.)

- Barry-Wehmiller Companies, Inc. (U.S.)

- Illinois Tool Works Inc. (U.S.)

- Bosch Packaging Technology (U.S.)

- Matthews Marking Systems, Inc. (U.S.)

- Coesia North America, Inc. (U.S.)

- Honeywell Intelligrated (U.S.)

- Automation Packaging Systems, LLC (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Cartoning Machines Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Cartoning Machines Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Cartoning Machines Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.