North America Ccd Imagers Market

Market Size in USD Billion

CAGR :

%

USD

1.25 Billion

USD

2.91 Billion

2024

2032

USD

1.25 Billion

USD

2.91 Billion

2024

2032

| 2025 –2032 | |

| USD 1.25 Billion | |

| USD 2.91 Billion | |

|

|

|

|

North America Charge-Coupled Device (CCD) Imagers Market Size

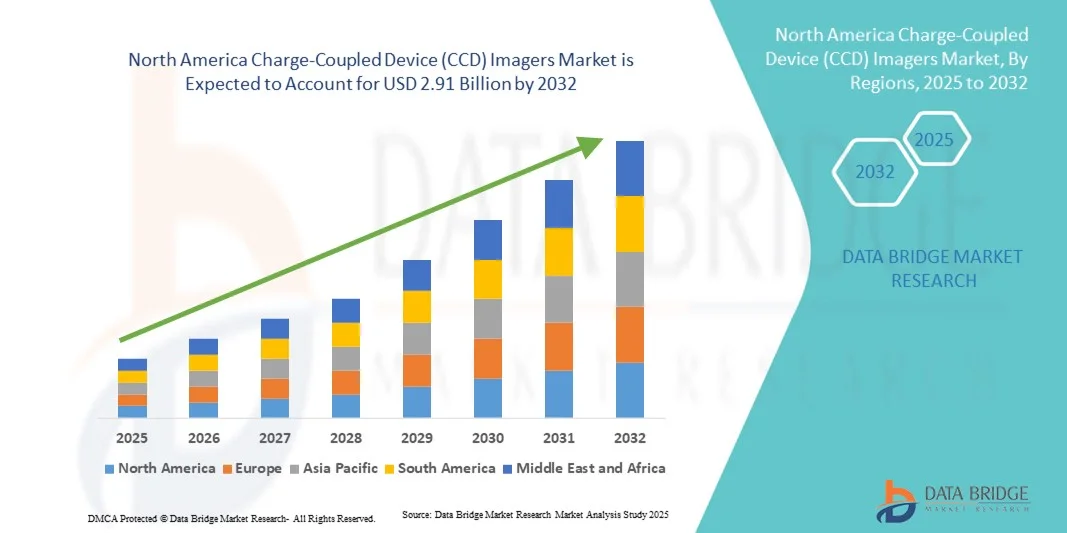

- The North America Charge-Coupled Device (CCD) imagers market size was valued at USD 1.25 billion in 2024 and is expected to reach USD 2.91 billion by 2032, at a CAGR of 11.17% during the forecast period

- The market growth is largely fueled by increasing demand for high-quality imaging in medical diagnostics, industrial automation, and scientific research, where CCD imagers provide superior image clarity and low noise performance

- Furthermore, rising adoption in applications such as endoscopy, X-ray imaging, and other diagnostic tools is driving the demand for CCD imagers, making them the preferred imaging solution in precision-critical environments

North America Charge-Coupled Device (CCD) Imagers Market Analysis

- CCD imagers, providing high-resolution and low-noise imaging, are increasingly vital components of modern medical diagnostics, industrial inspection, and scientific research systems in both healthcare and industrial settings due to their superior image clarity, sensitivity, and reliability

- The escalating demand for CCD imagers is primarily fueled by the growing adoption of advanced imaging technologies, increasing need for precise diagnostics, and a rising preference for imaging solutions that deliver consistent performance under low-light and critical conditions

- U.S, dominated the North America Charge-Coupled Device (CCD) imagers market with the largest revenue share of 69% in 2024, characterized by early adoption of cutting-edge imaging solutions, strong R&D infrastructure, and a strong presence of key industry players, with substantial growth in hospitals, diagnostic centers, and research laboratories, driven by innovations from both established imaging companies and startups focusing on 3D imaging and portable CCD solutions

- Canada is expected to be the fastest-growing country in the North America Charge-Coupled Device (CCD) imagers market during the forecast period due to increasing investments in healthcare infrastructure and industrial automation

- Endoscopy segment dominated the North America Charge-Coupled Device (CCD) imagers market in 2024 with a market share of 39.2%, driven by its critical role in minimally invasive diagnostic procedures requiring high-precision imaging

Report Scope and North America Charge-Coupled Device (CCD) Imagers Market Segmentation

|

Attributes |

North America Charge-Coupled Device (CCD) Imagers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Charge-Coupled Device (CCD) Imagers Market Trends

Advancements in 3D Imaging and High-Resolution Sensors

- A significant and accelerating trend in the North America CCD imagers market is the integration of advanced 3D imaging capabilities and high-resolution sensors into medical, industrial, and research applications, significantly improving image accuracy and detection precision

- For instance, hospitals are increasingly adopting 3D CCD imagers for minimally invasive surgeries, enabling surgeons to visualize complex structures with enhanced depth perception and detail

- High-resolution CCD sensors are also being incorporated into industrial inspection systems to detect microscopic defects in manufacturing lines, while research laboratories are using them for precise microscopy and imaging experiments

- The adoption of CCD imagers with enhanced image processing capabilities allows users to capture clearer, more accurate images in low-light or high-speed conditions, reducing the need for repeated scans and improving operational efficiency

- This trend towards more precise, high-performance, and versatile imaging systems is driving the replacement of older CCD models with next-generation devices capable of supporting both 2D and 3D imaging

- The demand for CCD imagers that offer superior resolution, high sensitivity, and integration with advanced imaging platforms is growing rapidly across hospitals, diagnostic centers, and research institutions

North America Charge-Coupled Device (CCD) Imagers Market Dynamics

Driver

Rising Demand for Precision Imaging in Healthcare and Industry

- The increasing requirement for accurate diagnostics and high-quality imaging across healthcare, industrial, and research sectors is a significant driver for the growing adoption of CCD imagers

- For instance, diagnostic centers are deploying CCD imagers for endoscopy and X-ray imaging to improve image clarity, enhance patient outcomes, and support minimally invasive procedures

- Manufacturing facilities are also leveraging CCD imagers for quality inspection and defect detection, reducing errors and operational costs

- Furthermore, the adoption of 3D imaging and AI-assisted analysis is making CCD imagers integral to advanced medical and industrial workflows, enabling better decision-making and operational efficiency

- The convenience of integrating CCD imagers with existing imaging systems, coupled with reliable low-light performance and high sensitivity, is driving their adoption in hospitals, diagnostic centers, and research laboratories

- The trend towards portable and stationary CCD imagers for diverse end uses is further contributing to market growth and increasing overall revenue generation in North America

Restraint/Challenge

High Costs and Technological Complexity

- The relatively high manufacturing and acquisition costs of CCD imagers pose a significant challenge to broader market penetration, particularly for smaller diagnostic centers and industrial facilities

- For instance, some hospitals and laboratories are hesitant to replace existing imaging systems due to the premium pricing of high-end CCD imagers with 3D and advanced image processing capabilities

- The technical complexity of integrating CCD imagers with AI or 3D imaging platforms may require specialized training and maintenance, limiting adoption in certain facilities

- In addition, competition from alternative imaging technologies such as CMOS sensors, which offer lower costs and simpler integration, can restrain market growth despite CCD advantages in sensitivity and image quality

- While prices are gradually decreasing, the perceived premium and technical requirements can still hinder adoption, especially in smaller diagnostic centers or industrial setups with budget constraints

- Overcoming these challenges through cost optimization, user-friendly integration solutions, and training programs will be vital for sustained growth of the CCD imagers market in North America

North America Charge-Coupled Device (CCD) Imagers Market Scope

The market is segmented on the basis of image processing, application, mobility, and end use

- By Image Processing

On the basis of image processing, the North America Charge-Coupled Device (CCD) imagers market is segmented into 2D and 3D. The 2D segment dominated the market in 2024 with the largest market revenue share of 61.2%, driven by its widespread application in medical diagnostics, industrial inspection, and research laboratories. 2D CCD imagers are preferred for endoscopy, X-ray imaging, and general-purpose imaging applications due to their established performance, ease of integration, and cost-effectiveness. Healthcare institutions and diagnostic centers often prioritize 2D CCD imagers for routine imaging tasks where high precision and reliability are required. Industrial applications, such as quality inspection, also favor 2D imagers for their ability to detect defects and ensure product consistency. The compatibility of 2D CCD imagers with existing imaging systems further reinforces their dominant position in the market. The segment continues to grow steadily due to consistent demand in traditional imaging applications.

The 3D segment is expected to witness the fastest growth from 2025 to 2032 at a CAGR of 18.5%, fueled by increasing demand for enhanced visualization in minimally invasive surgeries, industrial automation, and advanced scientific research. 3D CCD imagers provide depth perception and more detailed imaging, enabling better analysis and precision in complex applications. The integration of AI and image processing algorithms with 3D CCD imagers is accelerating adoption in hospitals and research laboratories for more accurate diagnostics. In addition, growing investments in advanced industrial inspection systems are creating opportunities for 3D CCD imagers to replace conventional 2D imaging solutions. The segment benefits from technological innovations and rising awareness of the advantages of 3D imaging. 3D CCD imagers are particularly favored in applications where precision and spatial analysis are critical.

- By Application

On the basis of application, the North America Charge-Coupled Device (CCD) imagers market is segmented into endoscopy, X-ray, and others. The endoscopy segment dominated the market in 2024 with a market share of 39.2%, driven by the increasing use of minimally invasive diagnostic procedures in hospitals and clinics. CCD imagers in endoscopy provide superior image clarity, low noise, and reliable performance in low-light conditions, making them ideal for precise internal examinations. The high adoption of endoscopic procedures in North America, coupled with continuous technological innovations in imaging sensors, supports the segment’s leading position. Endoscopy applications also benefit from the growing preference for patient-friendly, non-invasive diagnostic techniques. The demand for enhanced visualization and improved surgical outcomes is further strengthening the use of CCD imagers in endoscopy. Hospitals and diagnostic centers continue to invest heavily in advanced endoscopy systems.

The X-ray segment is expected to witness the fastest growth during the forecast period, due to increasing demand for high-resolution X-ray imaging systems in hospitals, diagnostic centers, and research institutions. CCD imagers in X-ray systems enable rapid image capture, superior clarity, and detailed diagnostics, facilitating faster decision-making for medical professionals. Rising healthcare expenditure and the replacement of outdated X-ray systems are driving adoption. X-ray applications are particularly important in emergency care and specialized diagnostics, further boosting demand.

- By Mobility

On the basis of mobility, the North America Charge-Coupled Device (CCD) imagers market is segmented into portable and stationary CCD imagers. The stationary segment dominated the market in 2024 with the largest revenue share of 57.6%, as these systems are widely used in hospitals, diagnostic centers, and research laboratories where stability and high-performance imaging are critical. Stationary CCD imagers provide consistent image quality, support complex imaging workflows, and integrate with other diagnostic equipment seamlessly. Their use in high-throughput environments, such as hospital imaging departments, ensures efficient operations and reliable results. The preference for stationary systems is also influenced by the availability of advanced features, including integration with AI and image processing software, which is easier to implement in fixed setups. Hospitals often prioritize stationary systems for critical and large-scale imaging applications. The segment remains dominant due to reliability, performance, and ease of integration with existing infrastructure.

The portable segment is expected to witness the fastest growth from 2025 to 2032 at a CAGR of 17.2%, driven by increasing demand for mobile diagnostic solutions, point-of-care imaging, and field inspections in industrial applications. Portable CCD imagers enable real-time imaging in remote locations, emergency situations, and smaller diagnostic centers, providing flexibility and convenience without compromising image quality. They are particularly useful in home healthcare, mobile clinics, and on-site industrial inspections. Technological improvements in battery life, compactness, and wireless connectivity are further boosting adoption. Portable CCD imagers allow rapid deployment and easy operation, increasing their appeal for small facilities.

- By End Use

On the basis of end use, the North America Charge-Coupled Device (CCD) imagers market is segmented into hospitals, diagnostic centers, and others. The hospital segment dominated the market in 2024 with a market share of 45.3%, due to the high adoption of CCD imagers for endoscopy, X-ray, and other diagnostic procedures. Hospitals rely on CCD imagers for accurate, high-quality imaging to support patient care, surgical procedures, and research activities. The robust healthcare infrastructure in the U.S. and the adoption of advanced imaging technologies contribute to the segment’s dominance. Hospitals also invest in upgrading imaging systems regularly, reinforcing demand for CCD imagers. The need for reliable, low-noise, and high-resolution imaging supports continuous growth. Hospitals remain the largest end-user segment due to the scale and diversity of diagnostic services offered.

The diagnostic centers segment is expected to witness the fastest growth during the forecast period, driven by the increasing number of standalone diagnostic facilities and outpatient centers across North America. These centers are investing in advanced imaging systems, including portable and 3D CCD imagers, to offer high-quality diagnostic services efficiently and cost-effectively. Growth is fueled by increasing patient demand for specialized diagnostic procedures. Diagnostic centers benefit from compact and high-performance CCD imagers for space-constrained setups. Rising awareness of precision imaging and early disease detection is driving adoption.

North America Charge-Coupled Device (CCD) Imagers Market Regional Analysis

- U.S. dominated the North America Charge-Coupled Device (CCD) imagers market with the largest revenue share of 69% in 2024, characterized by early adoption of cutting-edge imaging solutions, strong R&D infrastructure, and a strong presence of key industry players

- Hospitals, diagnostic centers, and research laboratories in the region highly value the high-resolution, low-noise performance, and reliability offered by CCD imagers for endoscopy, X-ray, and other critical imaging procedures

- This widespread adoption is further supported by strong R&D infrastructure, a technologically advanced healthcare ecosystem, and increasing investments in medical and industrial imaging equipment, establishing CCD imagers as the preferred solution across key applications

U.S. Charge-Coupled Device (CCD) Imagers Market Insight

The U.S. Charge-Coupled Device (CCD) imagers market captured the largest revenue share of 68.9% in 2024 within North America, fueled by the rapid adoption of advanced imaging technologies across healthcare, industrial inspection, and research applications. Hospitals and diagnostic centers are increasingly prioritizing high-resolution, low-noise CCD imagers for endoscopy, X-ray, and other critical imaging procedures. The growing trend of AI-assisted imaging and 3D imaging integration further propels the market. Moreover, the presence of major imaging technology companies and startups focusing on sensor innovation significantly contributes to market expansion. Government support for medical infrastructure upgrades and research initiatives also bolsters the adoption of CCD imagers. Overall, the U.S. remains the dominant market due to technological advancements, strong R&D capabilities, and high demand for precision imaging solutions.

Canada Charge-Coupled Device (CCD) Imagers Market Insight

The Canada Charge-Coupled Device (CCD) imagers market market is projected to expand at a notable CAGR during the forecast period, driven by increasing investments in hospitals, diagnostic centers, and industrial automation facilities. The growing demand for high-quality medical imaging and research-grade imaging solutions is fostering market adoption. Canadian healthcare institutions value CCD imagers for their superior image clarity and reliability, supporting improved diagnostics and patient care. In addition, the rising trend of portable and point-of-care imaging solutions is encouraging broader deployment. Technological collaboration with U.S.-based imaging companies enhances access to advanced CCD systems. Overall, Canada is witnessing steady growth due to rising healthcare expenditure and modernization of imaging infrastructure.

Mexico Charge-Coupled Device (CCD) Imagers Market Insight

The Mexico Charge-Coupled Device (CCD) imagers market is expected to grow steadily during the forecast period, driven by increasing investments in healthcare infrastructure, diagnostic centers, and research institutions. Hospitals and laboratories are adopting CCD imagers to improve diagnostic accuracy and operational efficiency. Industrial applications, such as quality inspection in manufacturing, are also contributing to market demand. Government initiatives aimed at modernizing healthcare facilities and promoting advanced medical technologies are supporting market expansion. In addition, collaborations with international imaging technology providers are enhancing access to high-performance CCD imagers. Mexico presents significant growth opportunities due to rising awareness of advanced imaging solutions and increasing adoption across healthcare and industrial sectors.

North America Charge-Coupled Device (CCD) Imagers Market Share

The North America Charge-Coupled Device (CCD) Imagers industry is primarily led by well-established companies, including:

- Semiconductor Components Industries, LLC (U.S.)

- Canon U.S.A., Inc. (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- STMicroelectronics. (Switzerland)

- Panasonic Holdings Corporation (Japan)

- Teledyne Technologies Inc. (U.S.)

- ON Semiconductor Corporation (U.S.)

- Sony Semiconductor Solutions Corporation (Japan)

- e2v Technologies Ltd. (U.K.)

- Photometrics (U.S.)

- QImaging (U.S.)

- Oxford Instruments. (U.K.)

- Princeton Instruments (U.S.)

- Lumenera Corporation (Canada)

- JAI A/S (Denmark)

- Basler AG (Germany)

- IDS Imaging Development Systems GmbH (Germany)

What are the Recent Developments in North America Charge-Coupled Device (CCD) Imagers Market?

- In August 2025, Toshiba Electronic Devices & Storage Corporation launched the TCD2728DG, a lens-reduction type CCD linear image sensor for A3 multifunction printers. The new sensor, which is a successor to the TCD2726DG, has improved random noise reduction by approximately 40%, enhancing image quality in high-speed, high-resolution scanning applications

- In March 2025, the Government of Canada announced an USD 8 million investment in Teledyne's Bromont, Quebec facility. This funding aims to enhance the development of next-generation image sensors and expand semiconductor capabilities, supporting advancements in medical imaging, aerospace, and industrial applications

- In September 2024, Teledyne DALSA announced the launch of its Linea HS2 TDI line scan camera family, which is designed for ultra-high-speed imaging. The new camera series, which is a significant breakthrough in next-generation TDI (Time Delay and Integration) technology, is targeted at demanding industrial inspection applications. This product development showcases the continuous innovation in CCD-based technologies for the machine vision and industrial automation sectors.

- In June 2024, the National Science Foundation's NOIRLab announced the first-ever on-sky demonstration of a new "skipper CCD" for astronomical data collection. Conducted using the SOAR Telescope, this groundbreaking development allows for extremely low readout noise, enabling the detection of individual photons

- In February 2021, Teledyne Imaging announced that its sensors were part of the NASA Mars 2020 mission, which successfully landed the Perseverance rover on Mars. The sensors from Teledyne would be used to sense, power, and help analyze the chemical composition of minerals and the surface of the red planet

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.