North America Cell Counting Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.56 Billion

USD

6.30 Billion

2024

2032

USD

3.56 Billion

USD

6.30 Billion

2024

2032

| 2025 –2032 | |

| USD 3.56 Billion | |

| USD 6.30 Billion | |

|

|

|

|

Cell Counting Devices Market Size

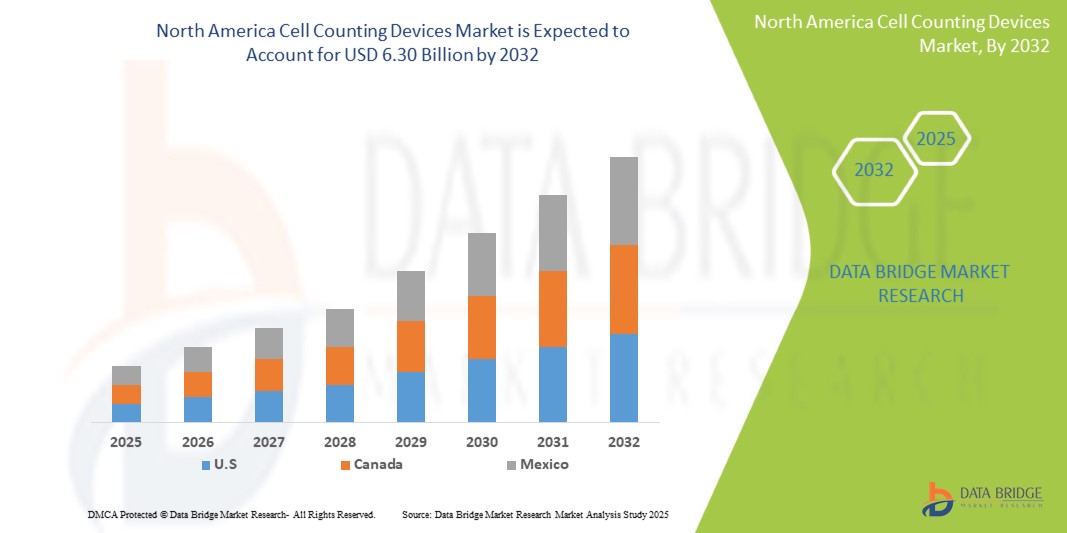

- The North America Cell Counting Devices market size was valued at USD 3.56 billion in 2024 and is expected to reach USD 6.30 billion by 2032, at a CAGR of 7.4% during the forecast period

- The market growth is largely fueled by the rising adoption of cell-based therapies, increasing investments in life science research and development, and the growing demand for automated cell counting solutions.

- Furthermore, technological advancements in cell counting devices, such as the development of image-based cytometers and flow cytometers with enhanced capabilities, are driving market expansion. These converging factors are accelerating the uptake of cell counting devices across various medical and research applications, thereby significantly boosting the industry's growth.

Cell Counting Devices Market Analysis

- Cell Counting Devices market encompasses instruments and consumables used for quantifying and analyzing cells in various biological samples. These devices are essential across a wide range of applications, including research, diagnostics, drug discovery, and quality control in biopharmaceutical manufacturing. The market is driven by advancements in cell-based research, the increasing prevalence of chronic diseases, and the growing demand for accurate and high-throughput cell analysis.

- The escalating demand for cell counting devices is primarily fueled by the increasing number of cell-based assays, the growing need for precise cell enumeration in clinical diagnostics, and the rising focus on quality control in biopharmaceutical production.

- The U.S. dominates the Cell Counting Devices market in North America, holding the largest revenue share of 84.6% in 2025, attributed to its well-established laboratory infrastructure, high adoption of automated and digital cell counting technologies, and increased investment in life sciences research and development. The presence of leading biotechnology and pharmaceutical companies further supports the strong market positioning of the U.S.

- The U.S. is projected to be the fastest-growing country in the North America Cell Counting Devices market during the forecast period, fueled by the rising prevalence of chronic diseases, growing demand for personalized medicine, and the increasing volume of cell-based research activities. The market is also driven by the widespread implementation of high-throughput screening methods and the development of user-friendly, portable cell counters.

- Automated Cell Counters are expected to dominate the North America Cell Counting Devices market with a market share of 52.6% in 2025, due to their superior accuracy, time efficiency, and expanding usage in clinical diagnostics, research laboratories, and biopharmaceutical production processes. The integration of AI and image analysis capabilities is further enhancing the appeal and functionality of automated systems.

Report Scope and Cell Counting Devices Market Segmentation

|

Attributes |

Cell Counting Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cell Counting Devices Market Trends

“Growing demand for high-throughput screening”

- Shift towards Automated and High-Throughput Systems: A significant and accelerating trend in the North America cell counting devices market is the increasing shift towards automated and high-throughput cell counting systems. This evolution is significantly enhancing laboratory efficiency, reducing manual errors, and enabling the processing of a larger number of samples in less time.

- For instance, automated cell counters utilize advanced imaging and algorithms to quickly and accurately quantify cells, assess viability, and even differentiate cell types, minimizing human intervention. This is particularly crucial in drug discovery, clinical trials, and biopharmaceutical manufacturing where large-scale cell analysis is required.

- The integration of robotics and liquid handling systems with cell counters further streamlines workflows, allowing for walk-away operation and improved reproducibility. Digitalization also facilitates the seamless transfer of cell counting data to Laboratory Information Management Systems (LIMS), improving data integrity and accessibility for downstream analysis.

- This trend towards more intelligent, automated, and data-integrated cell counting solutions is fundamentally reshaping laboratory operations and quality control practices. Consequently, companies are investing heavily in R&D to develop next-generation automated systems with enhanced features and connectivity.

- The demand for cell counting devices that offer seamless automation and high-throughput capabilities is growing rapidly across academic research, pharmaceutical companies, and diagnostic centers, as users increasingly prioritize efficiency, accuracy, and scalability in their cell-based applications

Cell Counting Devices Market Dynamics

Driver

“Rising investments in life science R&D”

- Increasing Investments in Cell-Based Research and Drug Discovery: The rising global investments in cell-based research, including genomics, proteomics, and cell biology, coupled with the escalating demand for cell-based assays in drug discovery and development, are significant drivers for the heightened demand for cell counting devices.

- For instance, cell counting is a fundamental step in almost all cell-based experiments, from cell culture maintenance and transfection efficiency assessment to cytotoxicity assays and cell proliferation studies. In drug discovery, accurate cell counts are essential for dose-response studies, high-throughput screening, and cell line development.

- The growing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is fueling research into cell-based therapies and diagnostics, further driving the need for precise cell enumeration and analysis.

- Furthermore, advancements in cell culture techniques, including 3D cell culture and organoid models, require sophisticated cell counting solutions for accurate characterization and monitoring

Restraint/Challenge

“High initial investment costs”

- High Cost of Advanced Cell Counting Devices and Technical Expertise Requirements: The high initial cost of advanced automated cell counting devices and the need for specialized technical expertise to operate and maintain them pose a significant challenge to widespread market adoption, particularly for smaller laboratories and academic institutions with limited budgets.

- For instance, high-end flow cytometers or image-based cytometers can represent a substantial capital investment. Additionally, the complexity of these instruments often requires trained personnel for proper operation, calibration, and data interpretation, adding to operational costs.

- The variability in cell samples and the need for consistent results across different experiments can also be challenging. Ensuring accurate and reproducible cell counts requires careful sample preparation, proper instrument calibration, and robust data analysis methods.

- Furthermore, competition from alternative cell analysis techniques and the availability of manual cell counting methods (e.g., hemocytometers) can limit the adoption of automated devices, especially in settings where cost-effectiveness is a primary concern

Cell Counting Devices Market Scope

The market is segmented on the basis product, application and end user.

- By Product

On the basis of Product, the Cell Counting Devices market is segmented into Automated Cell Counters and Manual Cell Counters. Automated Cell Counters dominate the market with the largest revenue share of 52.6% in 2025, driven by their speed, precision, and integration with modern laboratory workflows. These devices minimize human error, offer high-throughput capabilities, and are essential in research, clinical diagnostics, and biopharmaceutical production. Innovations such as AI-enabled image analysis and compact, user-friendly designs further enhance their utility across various settings.

The Manual Cell Counters segment is anticipated to witness the fastest growth rate of 5.8% from 2025 to 2032 remains relevant in low-resource settings and academic environments due to their affordability and simplicity. However, their use is gradually declining as automation becomes the standard in high-volume laboratories.

- By Application

On the basis of application, the Cell Counting Devices market is segmented into into Research Applications, Clinical and Diagnostic Applications, and Industrial Applications. The Research Applications held the largest market revenue share in 2025 owing to the growing volume of cellular and molecular biology research, particularly in cancer, immunology, and stem cells. The increasing number of clinical trials and drug discovery programs across North America further contributes to the segment's dominance.

The Clinical and Diagnostic Applications is expected to witness the fastest CAGR from 2025 to 2032fueled by the increasing prevalence of chronic diseases, demand for early diagnosis, and the shift toward personalized medicine. Automated hematology analyzers and flow cytometry systems are widely used in diagnosing infections, blood disorders, and cancers.

- By End users

On the basis of end users, the Cell Counting Devices market is segmented into Research Institutes, Pharmaceutical and Biotechnology Companies, Hospitals, Clinical Laboratories, and Other. The Pharmaceutical and Biotechnology Companies segment accounted for the largest market revenue share in 2025 due to their extensive use of cell counting in R&D, production, and quality assurance. The increasing demand for biologics and cell-based therapies continues to drive equipment upgrades and adoption of advanced counting technologies.

The Clinical Laboratories segment is expected to witness the fastest CAGR from 2025 to 2032, as they handle large volumes of patient samples for hematology and diagnostic testing. The adoption of high-throughput and automated cell counters enables efficient and accurate sample processing.

Cell Counting Devices Market Regional Analysis

- U.S. dominates the Cell Counting Devices market with the largest revenue share of 84.6% in 2025, driven by the country’s strong presence in biomedical research, advanced clinical laboratory infrastructure, and the rapid adoption of automated technologies in healthcare and pharmaceutical sectors.

- Robust funding for life sciences research from government agencies like the NIH, as well as private investments in biotechnology and drug development, significantly support the demand for high-throughput and precision cell counting systems in research and clinical diagnostics.

- Additionally, the presence of leading cell counting device manufacturers such as Thermo Fisher Scientific, Bio-Rad Laboratories, and Beckman Coulter facilitates continuous innovation, faster product launches, and widespread market penetration.

- The increasing need for efficient cell analysis in cancer diagnostics, stem cell research, and immunology, along with the growing preference for user-friendly, AI-integrated cell counters in both clinical and research labs, is propelling market growth.

Canada Cell Counting Devices Market Insight

The Canada Cell Counting Devices market is projected to grow at a steady CAGR during the forecast period, supported by a strong public healthcare system and ongoing investments in health research and clinical laboratory infrastructure. National initiatives like the Canadian Institutes of Health Research (CIHR) promote extensive research in life sciences, contributing to rising demand for sophisticated cell analysis technologies in academic and diagnostic settings. Moreover, Canada's expanding biopharmaceutical sector and increasing emphasis on precision medicine and immunotherapy are fostering the adoption of automated cell counters and flow cytometry systems. Collaborations between Canadian research institutions and U.S.-based device manufacturers are also enhancing the availability and accessibility of next-generation cell counting devices across the country.

Mexico Cell Counting Devices Market Insight

The Mexico Cell Counting Devices market is expected to grow at a notable CAGR, driven by improvements in healthcare access, the expansion of diagnostic laboratories, and rising investment in public health technologies. Urbanization and increasing healthcare awareness are boosting the demand for clinical diagnostic tools, including hematology analyzers and manual/automated cell counters, especially in hospitals and regional labs. Government efforts to strengthen health services and diagnostic capabilities—especially for infectious and chronic diseases—are fueling the market. Campaigns to modernize public hospitals and diagnostic centers are opening up new opportunities for automated cell counting systems. While the adoption of advanced cell analysis technologies is still limited outside major cities, international partnerships and medical training programs are gradually improving both the availability and usage of modern cell counting devices across the country.

Cell Counting Devices Market Share

The Cell Counting Devices industry is primarily led by well-established companies, including:

- Danaher Corporation (U.S.)

- Thermo Fisher Scientific (U.S.)

- Bio-Rad Laboratories (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Merck KGaA (Germany)

- PerkinElmer (U.S.)

- Sysmex Corporation (Japan)

- Abbott Laboratories (U.S.)

- Becton, Dickinson and Company (U.S.)

- GE Healthcare (U.S.)

- Olympus Corporation (Japan)

- Promega Corporation (U.S.)

- Corning Incorporated (U.S.)

- Sartorius AG (Germany)

Latest Developments in North America Cell Counting Devices Market

- In March 2024, Danaher Corporation's Beckman Coulter Life Sciences launched a new automated cell counter with enhanced image analysis capabilities and a user-friendly interface, designed to improve efficiency in cell culture laboratories.

- In February 2024, Thermo Fisher Scientific introduced a novel flow cytometer with increased multiplexing capabilities and improved sensitivity for detailed cell population analysis in immunology and oncology research.

- In January 2024, Bio-Rad Laboratories announced a partnership with a leading biotechnology company to develop a high-throughput cell viability assay integrated with their automated cell counting platform, streamlining drug screening workflows.

- In December 2023, Agilent Technologies, Inc. launched a new image-based cytometer with advanced algorithms for label-free cell counting and morphology analysis, providing a non-invasive solution for cell characterization.

- In November 2023, Merck KGaA expanded its portfolio of cell counting consumables with the introduction of new pre-sterilized counting slides and optimized reagents, aiming to improve reproducibility and reduce contamination risks in cell-based assays.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.