North America Cell Culture Media Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

6.57 Billion

2024

2032

USD

2.81 Billion

USD

6.57 Billion

2024

2032

| 2025 –2032 | |

| USD 2.81 Billion | |

| USD 6.57 Billion | |

|

|

|

|

North America Cell Culture Media Market Size

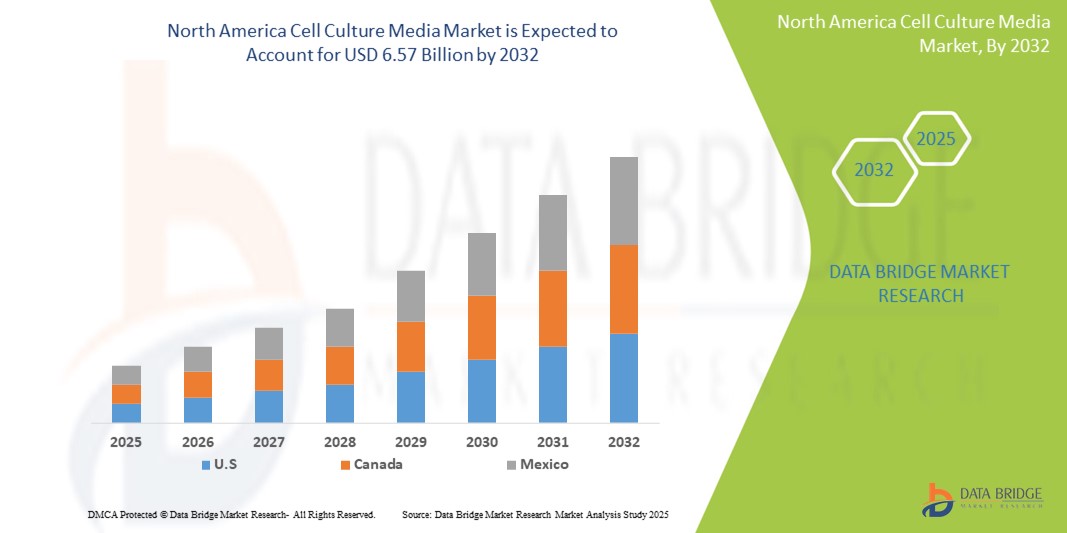

- The North America cell culture media market size was valued at USD 2.81 billion in 2024 and is expected to reach USD 6.57 billion by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is primarily driven by increasing biopharmaceutical research and development activities, alongside expanding investments in biologics manufacturing across the region

- Moreover, rising demand for advanced cell-based therapies and personalized medicine is boosting the need for high-quality, specialized media. These combined drivers are fueling significant advancements and adoption within the cell culture media segment, propelling strong regional market expansion

North America Cell Culture Media Market Analysis

- Cell culture media, providing essential nutrients and growth factors for in vitro cell cultivation, are increasingly vital to biopharmaceutical research, vaccine development, and cell-based therapies in both academic and commercial settings due to their role in enabling consistent and high-yield cell growth

- The accelerating demand for cell culture media is primarily fueled by the rapid expansion of biologics manufacturing, increasing adoption of personalized medicine, and growing reliance on cell-based assays in drug discovery and toxicity testing

- U.S. dominated the North America cell culture media market with the largest revenue share of 41.8% in 2024, driven by strong government funding, a robust biopharmaceutical industry, and early adoption of advanced cell culture technologies, particularly in applications related to monoclonal antibodies and stem cell research

- Canada is expected to be the fastest-growing country in the North America cell culture media market during the forecast period, supported by increased investments in regenerative medicine, rising academic-industry collaborations, and national strategies to expand biotech infrastructure and innovation hubs

- Serum-free media segment dominated the North America cell culture media market with a share of 45.1% in 2024, favored for its consistency, reduced contamination risk, and suitability for scalable biomanufacturing processes in clinical and commercial application

Report Scope and North America Cell Culture Media Market Segmentation

|

Attributes |

North America Cell Culture Media Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Cell Culture Media Market Trends

“Shift Toward Serum-Free and Chemically Defined Media”

- A significant and accelerating trend in the North America cell culture media market is the transition toward serum-free and chemically defined media, driven by the increasing need for consistent, contamination-free, and regulatory-compliant solutions in both research and manufacturing environments

- For instance, Thermo Fisher Scientific offers a wide range of serum-free and xeno-free formulations optimized for specific cell types, while Cytiva has developed chemically defined media supporting high-density cultures for biologics production

- This shift enables improved reproducibility, batch-to-batch consistency, and reduced risk of contamination from animal-derived components. Moreover, regulatory agencies such as the FDA and Health Canada increasingly favor chemically defined formulations for clinical and GMP applications

- Serum-free media provide greater control over cell culture conditions and align with the ethical move away from animal-based ingredients, supporting sustainable and standardized bioproduction

- Companies such as Lonza and Merck are heavily investing in the development of advanced media platforms that offer tailored solutions for stem cells, CAR-T therapies, and vaccine production, reflecting a broader market trend toward specialized, performance-optimized formulations

- The demand for serum-free and chemically defined media is rapidly growing across both the academic and commercial sectors, as institutions aim for scalable, high-efficiency processes compatible with evolving therapeutic and research needs

North America Cell Culture Media Market Dynamics

Driver

“Growth in Biologics and Cell-Based Research Across the U.S. and Canada”

- The rising development of biologics, personalized medicine, and regenerative therapies is a key driver for the increasing demand for advanced cell culture media in North America

- For instance, in May 2024, Thermo Fisher Scientific expanded its production facility in New York to meet growing demand for animal origin-free media used in vaccines and cell therapies, reinforcing regional manufacturing capacity

- The United States, with its robust pharmaceutical ecosystem and high R&D spending, is driving large-scale adoption of serum-free and GMP-grade media for monoclonal antibody production, immunotherapy, and toxicology testing

- Canada is also contributing to growth through increased investment in stem cell research, university-led biotech initiatives, and government-backed funding programs aimed at boosting life sciences innovation

- The compatibility of cell culture media with a wide range of applications including cancer biology, virology, and biologics manufacturing positions it as a foundational tool in both commercial and academic bioprocesses

Restraint/Challenge

“High Cost and Complex Regulatory Requirements”

- The relatively high cost of developing and producing serum-free, chemically defined, or GMP-grade media presents a barrier to adoption, particularly for smaller labs and early-stage biotech companies

- For instance, manufacturers must meet strict regulatory standards set by the FDA and Health Canada, involving rigorous validation, traceability, and documentation that increase operational complexity and production costs

- This challenge is especially relevant for facilities transitioning from research to clinical-grade media, where compliance burdens can limit flexibility and slow scale-up processes

- Smaller institutions may find it difficult to access or afford customized media solutions needed for advanced applications such as CAR-T cell expansion or gene editing workflows

- To overcome these barriers, companies are focusing on improving cost-efficiency through localized production, modular manufacturing, and broader access to validated, scalable media options that meet both scientific and regulatory demands

North America Cell Culture Media Market Scope

The market is segmented on the basis of type, application, end-user, and distribution channel.

- By Type

On the basis of type, the North America cell culture media market is segmented into chemically defined media, classical media, serum-free media, specialty media, stem cell media, lysogeny broth (LB), custom media formulation, and others. The serum-free media segment held the largest revenue share of 45.1% in 2024, driven by its widespread use in clinical and commercial biomanufacturing due to enhanced consistency, reduced contamination risk, and regulatory compliance. The growing demand for animal-origin-free products in biopharmaceutical production has further strengthened the adoption of serum-free formulations.

The chemically defined media segment is expected to witness the fastest growth rate from 2025 to 2032, as research institutions and biopharma companies increasingly require highly consistent and reproducible media for advanced applications, including monoclonal antibody production and cell therapy development. The precision and customizability of chemically defined media enable scalable, high-performance cell cultures, which is fueling its accelerated uptake.

- By Application

On the basis of application, the North America cell culture media market is segmented into biopharmaceutical production, drug screening & development, diagnostics, regenerative medicine & tissue engineering, and others. The biopharmaceutical production segment dominated the market in 2024 owing to the rapidly expanding demand for biologics, including vaccines, monoclonal antibodies, and cell-based therapeutics. The segment benefits from large-scale investments in biosimilar and vaccine production, especially in the U.S., where biologics contribute a significant share to pharmaceutical revenues.

The regenerative medicine & tissue engineering segment is projected to grow at the highest CAGR during the forecast period due to increasing R&D in stem cell therapy and personalized medicine. The growing focus on developing cell-based treatment modalities for chronic and degenerative conditions is driving demand for high-quality, specialized media formulations.

- By End-User

On the basis of end-user, the North America cell culture media market is segmented into biopharmaceutical companies, biotechnology organizations, academic and research laboratories, hospitals, diagnostic centers, cell banks, forensic laboratories, and others. The biopharmaceutical companies segment held the largest share in 2024, as they are the primary consumers of cell culture media for upstream processing and large-scale biologics manufacturing. The increasing number of clinical trials and product pipelines for biologics in the U.S. significantly contributes to this dominance.

The academic and research laboratories segment is expected to exhibit the fastest growth during the forecast period, supported by ongoing research initiatives in universities and publicly funded institutions, especially in Canada. Innovations in regenerative medicine and cancer biology are further fueling media demand in academic settings.

- By Distribution Channel

On the basis of distribution channel, the North America cell culture media market is segmented into direct tenders, third-party distribution, and retail sales. The direct tenders segment held the largest revenue share in 2024, driven by long-term supply agreements between media manufacturers and major biopharmaceutical firms, hospitals, and academic institutions. These contracts offer volume-based procurement and regulatory-grade quality assurance, making them preferred for critical applications.

The third-party distribution segment is anticipated to grow at the fastest pace during forecast period, as smaller biotech firms and research labs rely on distributors for flexible purchasing, technical support, and access to a wider range of products without direct supplier agreements. The increasing penetration of specialized life sciences distributors in North America is further supporting this trend.

North America Cell Culture Media Market Regional Analysis

- U.S. dominated the North America cell culture media with the largest revenue share of 41.8% in 2024, driven by strong government funding, a robust biopharmaceutical industry, and early adoption of advanced cell culture technologies, particularly in applications related to monoclonal antibodies and stem cell research

- Users in the country prioritize high-quality, serum-free, and chemically defined media for applications ranging from vaccine production to regenerative medicine, supported by cutting-edge manufacturing facilities and academic research centers

- This leadership is further reinforced by favorable government funding, robust clinical trial activity, and the presence of major players such as Thermo Fisher Scientific and GE HealthCare, establishing the U.S. as the central hub for innovation and adoption in the cell culture media space

The U.S. Cell Culture Media Market Insight

The U.S. cell culture media market captured the largest revenue share of 41.8% in 2024 within North America, driven by robust demand from the biopharmaceutical sector and expanding research in cell-based therapies. The country’s strong clinical trial ecosystem, academic research capabilities, and government-backed funding initiatives continue to support widespread adoption of serum-free and chemically defined media. In addition, the presence of major players such as Thermo Fisher Scientific and Lonza, along with significant investments in biologics manufacturing infrastructure, fuels consistent growth in both commercial and academic applications.

Canada Cell Culture Media Market Insight

The Canada cell culture media market is projected to grow at a notable CAGR during the forecast period, propelled by increased investment in stem cell research, personalized medicine, and academic-industry collaborations. Government initiatives aimed at boosting life sciences innovation and expanding biomanufacturing capacity are further enhancing market momentum. Canadian institutions are increasingly adopting advanced, GMP-compliant media for regenerative medicine, oncology research, and vaccine development, contributing to the rising demand for high-quality, customized formulations across public and private sectors.

Mexico Cell Culture Media Market Insight

The Mexico cell culture media market is expected to grow at a robust CAGR during the forecast period, driven by the expansion of biotechnology and life sciences activities in the country. Increasing investments in academic research on cancer, infectious diseases, and regenerative medicine—supported by government programs and public–private partnerships—are fostering greater adoption of high-performance cell culture media. Local biopharma and CRO facilities are integrating serum-free and specialty media into their development workflows, while Mexico’s growing role as a manufacturing partner for North American-biologics production underscores demand for reliable, GMP-compliant media formulations.

North America Cell Culture Media Market Share

The North America cell culture media industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Lonza Group AG (Switzerland)

- Cytiva (U.S.)

- HiMedia Laboratories Pvt. Ltd. (India)

- Corning Incorporated (U.S.)

- FUJIFILM Irvine Scientific, Inc. (U.S.)

- Repligen Corporation (U.S.)

- BD (U.S.)

- Eppendorf SE (Germany)

- PromoCell GmbH (Germany)

- PAN-Biotech GmbH (Germany)

- CellGenix GmbH (Germany)

- Danaher Corporation (U.S.)

- GE Healthcare Life Sciences (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- Miltenyi Biotec GmbH (Germany)

- MP Biomedicals, LLC (U.S.)

What are the Recent Developments in North America Cell Culture Media Market?

- In April 2024, Thermo Fisher Scientific announced the expansion of its Grand Island, New York facility to increase the production of animal-origin-free and chemically defined cell culture media. This move aims to meet growing demand from vaccine manufacturers and cell therapy developers, reinforcing Thermo Fisher’s leadership in supplying high-quality, GMP-compliant media solutions across North America and supporting scalability in advanced therapeutic applications

- In March 2024, GE HealthCare’s Cytiva division collaborated with the University of Toronto’s Medicine by Design initiative to co-develop specialized stem cell culture media tailored for regenerative medicine research. This partnership reflects a commitment to innovation in academic-industry collaborations and the advancement of next-generation therapies through optimized, customizable media platforms

- In February 2024, Lonza Group expanded its Portsmouth, New Hampshire bioproduction site to enhance capabilities in producing clinical- and commercial-grade media for biologics manufacturing. The investment focuses on increasing capacity for serum-free and chemically defined formulations, aiming to support growing demand from North American biopharmaceutical clients pursuing monoclonal antibody and cell therapy pipelines

- In January 2024, Avantor, Inc. launched a new line of performance-enhanced classical media designed for cell-based assays and preclinical drug development. The launch, targeting U.S.-based pharmaceutical research labs, emphasizes batch-to-batch consistency and reduced contamination risk, supporting drug discovery and high-throughput screening workflows in regulated environments

- In December 2023, Corning Incorporated announced a strategic initiative with Canadian biotech startups to co-develop media supplements for 3D cell culture and organoid growth. The collaboration aims to advance in vitro disease modeling and drug testing, addressing the increasing demand for complex media systems in cancer biology and personalized medicine applications across Canada

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CELL CULTURE MEDIA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 NORTH AMERICA CELL CULTURE MEDIA MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING FOCUS ON PERSONALIZED MEDICINE

6.1.2 ADVANCES IN CELL THERAPY AND REGENERATIVE MEDICINE

6.1.3 INCREASE IN R&D SPENDING ON BIOPHARMACEUTICAL PROJECTS

6.1.4 GROWING DEMAND FOR VACCINE DEVELOPMENT

6.2 RESTRAINTS

6.2.1 RISKS ASSOCIATED WITH CONTAMINATION

6.2.2 HIGH COST OF PRODUCTION

6.3 OPPORTUNITIES

6.3.1 RISING COLLABORATION AND PARTNERSHIPS

6.3.2 INCREASING DEMAND FOR BIOPHARMACEUTICALS AND VACCINES

6.3.3 INNOVATIONS IN 3D CELL CULTURE

6.4 CHALLENGES

6.4.1 COMPLEXITY OF MEDIA FORMULATION

6.4.2 INTENSE MARKET COMPETITION

7 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE

7.1 OVERVIEW

7.2 CHEMICALLY DEFINED MEDIA CHEMICALLY DEFINED MEDIA

7.3 CLASSICAL MEDIA

7.4 SERUM-FREE MEDIA

7.5 SPECIALTY MEDIA

7.6 STEM CELL MEDIA

7.7 LYSOGENY BROTH (LB)

7.8 CUSTOM MEDIA FORMULATION

7.9 OTHERS

8 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIOPHARMACEUTICAL PRODUCTION

8.3 DRUG SCREENING & DEVELOPMENT

8.4 DIAGNOSTICS

8.5 REGENERATIVE MEDICINE & TISSUE ENGINEERING

8.6 OTHERS

9 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER

9.1 OVERVIEW

9.2 BIOPHARMACEUTICAL COMPANIES

9.3 BIOTECHNOLOGY ORGANIZATIONS

9.4 ACADEMIC AND RESEARCH LABORATORIES

9.5 HOSPITALS

9.6 DIAGNOSTIC CENTERS

9.7 CELL BANKS

9.8 FORENSIC LABORATORIES

9.9 OTHERS

10 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT TENDERS

10.3 THIRD PARTY DISTRIBUTION

10.4 RETAILS SALES

11 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CELL CULTURE MEDIA MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 MERCK KGAA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 DANAHER CORPORATION (CYTIVA)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 SARTORIUS AG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 LONZA

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 CORNING INCORPORATED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 COMPANY SHARE ANALYSIS

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT UPDATES

14.7 AJINOMOTO CO., INC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 AKRON BIOTECH

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 BD

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT UPDATES

14.1 BIO-RAD LABORATORIES, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 CAISSON LABS INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 CELL APPLICATION, INC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 ELEX BIOLOGICAL PRODUCTS (SHANGHAI) CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 FUJIFILM HOLDINGS CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT UPDATES

14.15 HIMEDIA LABORATORIES

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 KOH JIN-BIO CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 PAN-BIOTECH

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 PROMOCELL GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SERA-SCANDIA A/S

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 STEMCELL TECHNOLOGIES

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 TAKARA BIO INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 GMP REQUIREMENTS

TABLE 2 SCOPE OF THE CURRENT DOCUMENT

TABLE 3 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 4 NORTH AMERICA CHEMICALLY DEFINED MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 5 NORTH AMERICA CLASSICAL MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 6 NORTH AMERICA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 7 NORTH AMERICA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 8 NORTH AMERICA SPECIALTY MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 9 NORTH AMERICA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 10 NORTH AMERICA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 11 NORTH AMERICA LYSOGENY BROTH (LB) IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 12 NORTH AMERICA CUSTOM MEDIA FORMULATION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 14 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 15 NORTH AMERICA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 16 NORTH AMERICA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 17 NORTH AMERICA DRUG SCREENING & DEVELOPMENT IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 18 NORTH AMERICA DIAGNOSTICS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 19 NORTH AMERICA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 20 NORTH AMERICA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 22 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 23 NORTH AMERICA BIOPHARMACEUTICAL COMPANIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 24 NORTH AMERICA BIOTECHNOLOGY ORGANIZATIONS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 25 NORTH AMERICA ACADEMIC AND RESEARCH LABORATORIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 27 NORTH AMERICA DIAGNOSTIC CENTERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 28 NORTH AMERICA CELL BANKS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 29 NORTH AMERICA FORENSIC LABORATORIES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 31 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 32 NORTH AMERICA DIRECT TENDERS IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 33 NORTH AMERICA THIRD PARTY DISTRIBUTION IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 34 NORTH AMERICA RETAIL SALES IN CELL CULTURE MEDIA MARKET, BY REGION, 2018-2035 (USD MILLION)

TABLE 35 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY COUNTRY, 2018-2035 (USD MILLION)

TABLE 36 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 37 NORTH AMERICA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 38 NORTH AMERICA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 39 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 40 NORTH AMERICA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 41 NORTH AMERICA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 42 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 43 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 44 U.S. CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 45 U.S. SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 46 U.S. STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 47 U.S. CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 48 U.S. BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 49 U.S. REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 50 U.S. CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 51 U.S. CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 52 CANADA CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 53 CANADA SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 54 CANADA STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 55 CANADA CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 56 CANADA BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 57 CANADA REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 58 CANADA CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 59 CANADA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

TABLE 60 MEXICO CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 61 MEXICO SERUM-FREE MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 62 MEXICO STEM CELL MEDIA IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 63 MEXICO CELL CULTURE MEDIA MARKET, BY APPLICATION, 2018-2035 (USD MILLION)

TABLE 64 MEXICO BIOPHARMACEUTICAL PRODUCTION IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 65 MEXICO REGENERATIVE MEDICINE & TISSUE ENGINEERING IN CELL CULTURE MEDIA MARKET, BY TYPE, 2018-2035 (USD MILLION)

TABLE 66 MEXICO CELL CULTURE MEDIA MARKET, BY END-USER, 2018-2035 (USD MILLION)

TABLE 67 MEXICO CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, 2018-2035 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA CELL CULTURE MEDIA MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CELL CULTURE MEDIA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CELL CULTURE MEDIA MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CELL CULTURE MEDIA MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CELL CULTURE MEDIA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CELL CULTURE MEDIA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CELL CULTURE MEDIA MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA CELL CULTURE MEDIA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA CELL CULTURE MEDIA MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA CELL CULTURE MEDIA MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS BY KEY PLAYERS

FIGURE 13 INCREASING FOCUS ON PERSONALIZED MEDICINE IS DRIVING THE GROWTH OF THE NORTH AMERICA CELL CULTURE MEDIA MARKET FROM 2025 TO 2035

FIGURE 14 THE CHEMICALLY DEFINED MEDIA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CELL CULTURE MEDIA MARKET IN 2025 AND 2035

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CELL CULTURE MEDIA MARKET

FIGURE 16 NORTH AMERICA CELL CULTURE MEDIA MARKET: BY TYPE, 2024

FIGURE 17 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, 2025-2035

FIGURE 18 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, CAGR, 2025-2035

FIGURE 19 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY TYPE, LIFE LINE CURVE

FIGURE 20 NORTH AMERICA CELL CULTURE MEDIA MARKET: BY APPLICATION, 2024

FIGURE 21 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION,2025-2035

FIGURE 22 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION, CAGR (2025-2035)

FIGURE 23 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY APPLICATION, LIFE LINE CURVE

FIGURE 24 NORTH AMERICA CELL CULTURE MEDIA MARKET: BY END-USER, 2024

FIGURE 25 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END USER, (2025-2035)

FIGURE 26 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER, CAGR (2025-2035)

FIGURE 27 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY END-USER, LIFE LINE CURVE

FIGURE 28 NORTH AMERICA CELL CULTURE MEDIA MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 29 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL,2025-2035

FIGURE 30 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, CAGR, (2025-2035)

FIGURE 31 NORTH AMERICA CELL CULTURE MEDIA MARKET, BY DISTRIBUTION CHANNEL, LIFE LINE CURVE

FIGURE 32 NORTH AMERICA CELL CULTURE MEDIA MARKET: SNAPSHOT (2024)

FIGURE 33 NORTH AMERICA CELL CULTURE MEDIA MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.