North America Cheese Sauce Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

2.28 Billion

2024

2032

USD

1.68 Billion

USD

2.28 Billion

2024

2032

| 2025 –2032 | |

| USD 1.68 Billion | |

| USD 2.28 Billion | |

|

|

|

|

North America Cheese Sauce Market Size

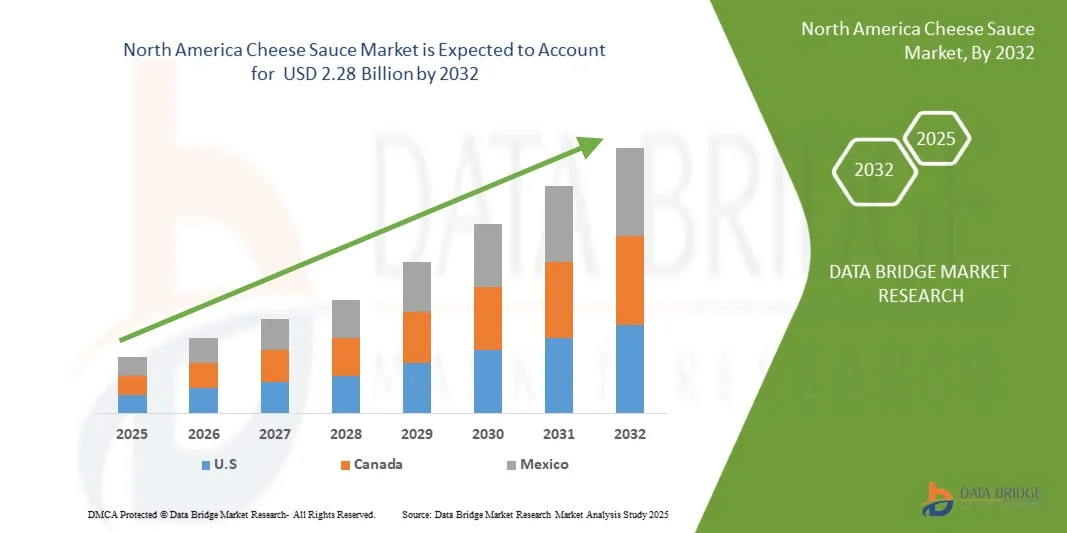

- The North America cheese sauce market size was valued at USD 1.68 billion in 2024 and is expected to reach USD 2.28 billion by 2032, at a CAGR of 3.90% during the forecast period

- Market growth is primarily driven by increasing consumer preference for convenience foods, rising demand in foodservice sectors such as quick-service restaurants (QSRs), and the growing popularity of ready-to-eat and snack-based meals

- Additionally, product innovation, including clean-label, organic, and plant-based cheese sauce variants, is catering to evolving dietary preferences and health-conscious consumers, further fueling demand across retail and commercial segments

North America Cheese Sauce Market Analysis

-

- Cheese sauce, a creamy and flavorful condiment used in a wide range of culinary applications, is becoming an increasingly popular component in both retail and foodservice sectors across North America due to its versatility, ease of use, and alignment with consumer demand for indulgent, convenient food options

- The rising demand for cheese sauce is primarily driven by growing consumption of processed and ready-to-eat foods, increasing popularity of fast-casual dining, and the expanding use of cheese-based sauces in snacks, pasta, and ethnic cuisines

- The U.S. dominated the cheese sauce market with the largest revenue share of 48.5% in 2024, supported by a mature processed food industry, high per capita cheese consumption, and strong demand from restaurant chains and institutional food providers, particularly in the U.S. where product innovation and flavor diversity continue to drive consumer interest

- Canada Cheese Sauce Market is anticipated to grow steadily over the forecast period, supported by increasing demand for convenience foods and growing consumer interest in international cuisines, particularly American and European cheese-based dishes

- The Animal-Based segment led the North America market with a market share of 38.7% in 2024, fueled by its widespread use in snacks, appetizers, and QSR menus, as well as its growing popularity among younger demographics seeking bold and indulgent flavors

Report Scope and North America Cheese Sauce Market Segmentation

|

Attributes |

North America Cheese Sauce Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Cheese Sauce Market Trends

“Flavor Innovation and Clean Label Demand Drive Convenience”

- A significant and accelerating trend in the North America Cheese Sauce Market is the rising demand for flavor innovation and clean label products that enhance convenience without compromising quality. This trend is reshaping consumer preferences and product development strategies across both retail and foodservice sectors.

- For instance, major players such as Kraft Heinz and Nestlé have introduced cheese sauces with bold flavors like jalapeño, chipotle, and truffle to appeal to evolving taste preferences. These products cater to consumers seeking gourmet-style experiences in ready-to-use formats that require minimal preparation.

- Clean label trends are also influencing the market, with a growing number of products now boasting “no artificial preservatives,” “non-GMO,” or “organic” claims. Brands like Gehl Foods and Berner Food & Beverage are expanding their portfolios to include options with simplified ingredient lists, targeting health-conscious consumers who still demand the ease of ready-made sauces.

- Convenience remains central, with packaging innovations such as squeezable pouches, microwaveable cups, and shelf-stable formulations enabling on-the-go consumption and quick meal prep. These solutions are particularly popular in fast-paced foodservice environments and among busy households.

- The integration of cheese sauces into broader culinary experiences is also on the rise, with their use expanding beyond traditional nachos to include pastas, burgers, breakfast items, and ethnic fusion dishes. This versatility is driving demand across various demographics and meal occasions.

- As consumers increasingly seek products that deliver both indulgence and functionality, manufacturers are focusing on developing cheese sauces that balance bold flavor profiles with health-conscious formulations. This dual emphasis is expected to continue shaping the competitive landscape and fueling growth in the North America Cheese Sauce Market.

North America Cheese Sauce Market Dynamics

Driver

“Growing Demand Driven by Changing Consumer Lifestyles and Foodservice Expansion”

- The increasing demand for convenience foods and the rapid expansion of foodservice channels such as quick-service restaurants (QSRs), fast-casual dining, and institutional catering are significant drivers for the growing adoption of cheese sauce across North America

- For instance, in early 2024, Campbell Soup Company expanded its foodservice offerings by introducing new cheese sauce formulations tailored for QSRs and school cafeterias, highlighting the growing institutional demand for versatile, heat-and-serve solutions

- As consumer lifestyles become more fast-paced and preferences shift toward ready-to-eat and indulgent meal options, cheese sauces are increasingly seen as essential ingredients in a wide range of applications—from nachos and burgers to pasta dishes and dipping sauces

- Additionally, the rise of comfort food consumption, particularly during and post-pandemic, has boosted demand for rich, flavorful, and satisfying sauces, with cheese-based varieties leading the way in both home kitchens and commercial food prep

- Cheese sauces are also gaining popularity due to their versatility, long shelf life, and minimal preparation requirements. The ability to enhance taste and texture across multiple cuisines, combined with easy storage and portion control, makes them attractive to restaurants and home cooks alike. Furthermore, innovations in packaging—such as portion-sized cups and bulk dispensers—are supporting broader adoption across diverse consumption settings

Restraint/Challenge

“Health Concerns and Clean Label Expectations”

- Rising health consciousness among consumers presents a notable challenge to the cheese sauce market, as many traditional formulations are perceived to be high in sodium, fat, and artificial additives. This perception can deter health-focused shoppers from including cheese sauce in their diets

- For instance, nutrition advocates and clean eating trends have prompted increased scrutiny of processed cheese products, leading some consumers to avoid cheese sauces due to concerns over artificial preservatives, colorings, and stabilizers commonly used in mass-market options

- In response, companies such as Nestlé and Kraft Heinz are investing in reformulation strategies, aiming to offer cleaner, more natural cheese sauces made with real cheese, fewer additives, and clearly labeled ingredients. However, balancing clean label demands with shelf stability and affordability remains a significant R&D and production challenge

- Furthermore, plant-based and lactose-free alternatives—while growing in popularity—often struggle to replicate the flavor, texture, and melt characteristics of dairy-based cheese sauces, limiting their appeal to broader audiences

North America Cheese Sauce Market Scope

The market is segmented on the basis of cheese sauce type, product type, flavor, nature, brand category, packaging type, packaging size, and end user, and distribution channel.

• By Cheese Sauce Type

On the basis of cheese sauce type, the market is segmented into Cheddar Cheese Sauce, Mozzarella Cheese Sauce, Parmesan Cheese Sauce, Gouda Cheese Sauce, Multiple Cheese Sauce, Pecorino Cheese Sauce, Emmental Cheese Sauce, Havarti Cheese Sauce, Ricotta Cheese Sauce, Edam Cheese Sauce, and Others. The Cheddar Cheese Sauce segment dominated the market with the largest revenue share of 28.6% in 2024, driven by its widespread application in nachos, burgers, fries, and pasta dishes. Its sharp, creamy flavor profile makes it a preferred option in both foodservice and household settings.

The Multiple Cheese Sauce segment is projected to witness the fastest CAGR of 7.9% from 2025 to 2032, owing to increasing consumer interest in gourmet and premium blends. These combinations offer layered taste experiences and are becoming popular in upscale restaurants and ready-to-eat meal kits.

• By Product Type

On the basis of cheese sauce type , the market is segmented into Animal-Based Cheese Sauce and Plant-Based Cheese Sauce. The Animal-Based segment held the largest market revenue share of 38.7% in 2024, attributed to the traditional consumer preference for dairy cheese, superior meltability, and established presence in foodservice. It remains the mainstream choice for sauces due to its authentic flavor and texture.

The Plant-Based segment is expected to grow at the fastest CAGR of 9.6% from 2025 to 2032, driven by increasing veganism, lactose intolerance, and demand for allergen-free products. Innovation in ingredients like cashew, soy, and oat-based cheese sauces is making these options more acceptable to mainstream consumers.

• By Flavor

The flavor segmentation includes Garlic, Spicy, Smoky, Jalapeño, Chipotle, Tangy, and Others. The Spicy segment dominated the market with a revenue share of 24.3% in 2024, supported by consumer preference for bold and intense flavors, particularly among younger demographics. Spicy cheese sauces, including jalapeño and chipotle variants, are common in fast food and casual dining menus.

The Smoky segment is expected to grow at the fastest CAGR of 8.1% from 2025 to 2032, as smoky flavors are increasingly associated with gourmet offerings and BBQ-inspired dishes. Their rising use in sandwich chains and food trucks also contributes to their growth.

• By Nature

By nature, the market is segmented into Organic and Conventional. The Conventional segment led the market with the highest revenue share of 91.5% in 2024, due to its wide availability, lower price points, and preference in foodservice. It continues to dominate due to scalability and established supply chains.

The Organic segment is expected to witness the fastest CAGR of 10.2% from 2025 to 2032, driven by growing health consciousness, clean-label demand, and increasing availability of certified organic cheese sauce products in retail stores.

• By Brand Category

The brand category includes Branded and Private Label cheese sauces. The Branded segment held the dominant share of 63.8% in 2024, supported by strong brand recognition, consumer trust, and national distribution networks. Brands like Kraft Heinz and Gehl Foods continue to lead through innovation and marketing.

The Private Label segment is projected to grow at the fastest CAGR of 8.4% from 2025 to 2032, due to the rising popularity of store brands, especially among budget-conscious consumers and in warehouse club formats.

• By Packaging Type

Packaging types include Jars, Cans, Pouches, Bottles, Tubes, and Others. The Pouches segment dominated with a market share of 35.7% in 2024, favored for their convenience, light weight, and extended shelf life. Pouches are widely used in foodservice and are increasingly adopted in retail for easy dispensing and portability.

The Bottles segment is forecasted to grow at the fastest CAGR of 7.2% from 2025 to 2032, driven by consumer preference for resealable and squeezable formats in household use.

• By Packaging Size

The market by packaging size includes Less Than 100 Grams, 101–200 Grams, 201–300 Grams, 301–400 Grams, 401–500 Grams, and More Than 500 Grams. The More Than 500 Grams segment led the market with the largest share of 32.1% in 2024, largely consumed in bulk by foodservice operators like QSRs and institutional caterers.

The 101–200 Grams segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2032, driven by the rising demand for single-use and household-sized cheese sauce packs offering portion control and reduced waste.

• By End User

The end-user segment is categorized into Food Service Sector and Household/Retail. The Food Service Sector dominated the market with a share of 68.4% in 2024, driven by high-volume demand from QSRs, cafes, casual dining chains, and caterers. Cheese sauces are essential in mass food production due to ease of storage, versatility, and speed of use.

The Household/Retail segment is expected to witness the highest CAGR of 7.7% from 2025 to 2032, driven by growing home cooking trends, increased availability of retail cheese sauces, and interest in DIY comfort foods.

• By Distribution Channel

Distribution is segmented into Store-Based Retailers and Non-Store Retailers (e-commerce platforms). The Store-Based Retailers segment dominated the market with a share of 76.2% in 2024, attributed to consumer preference for physical grocery stores, supermarkets, and club stores where cheese sauces are typically displayed in both refrigerated and shelf-stable formats.

The Non-Store Retailers segment is forecasted to grow at the fastest CAGR of 9.3% from 2025 to 2032, supported by the rapid expansion of online grocery platforms and changing buying habits favoring home delivery and subscription models.

North America Cheese Sauce Market Regional Analysis

- The U.S. dominated in the region with the North America cheese sauce market wiith largest revenue share of 83% in 2024, driven by a well-established fast-food culture and high consumer demand for convenient, flavorful food options

- The growing popularity of cheese-based dishes such as mac & cheese, nachos, and cheeseburgers in both foodservice and retail sectors supports sustained market growth

- Additionally, innovation in product formats, including ready-to-use cheese sauces and flavored variants, caters to busy lifestyles and evolving taste preferences. The country’s mature retail infrastructure, combined with strong brand presence and marketing efforts, further bolsters market expansion.

Canada Cheese Sauce Market Insight

The Canada Cheese Sauce Market is anticipated to grow steadily over the forecast period, supported by increasing demand for convenience foods and growing consumer interest in international cuisines, particularly American and European cheese-based dishes. Rising household incomes and expanding foodservice outlets, including quick-service restaurants and catering services, contribute significantly to cheese sauce consumption. Canadian consumers are also showing a rising preference for premium and organic cheese sauce varieties, driving innovation in product offerings. Retail channels such as supermarkets and online platforms play an important role in market accessibility.

Mexico Cheese Sauce Market Insight

The Mexico Cheese Sauce Market is expected to register notable growth, fueled by the country’s expanding foodservice industry and increasing penetration of Western-style fast food. Cheese sauces are becoming increasingly popular in Mexican cuisine fusion dishes, snacks, and street food, reflecting a growing trend toward indulgent and convenient eating options. Rising urbanization and improving cold chain logistics facilitate wider distribution and availability of cheese sauces across retail and foodservice channels. Furthermore, growing consumer exposure to international brands and flavors supports market diversification and increased demand.

North America Cheese Sauce Market Share

Cheese Sauce Market Leaders Operating in the Market Are:

- The Kraft Heinz Company (U.S.)

- Nestlé (Switzerland)

- Unilever (U.K.)

- Bay Valley Foods, LLC (U.S.)

- Gehl Foods, LLC. (U.S.)

- Berner Food & Beverage

- Campbell Soup Company (U.S.)

- Tatua Co-operative Dairy Company Limited (New Zealand)

- SAVENCIA SA (France)

- AFP advanced food products llc. (U.S.)

- Mizkan America Inc.(U.S.)

- FUNacho (U.S.)

- Kewpie Malaysia Sdn Bhd (Japan)

- RICOS (U.S.)

What are the Recent Developments in The North America Cheese Sauce Market?

- In April 2024, Kraft Heinz Company launched an innovative line of keto-friendly cheese sauces in North America, catering to the growing low-carb diet trend. This new product range combines rich flavors with reduced sugar and carbs, targeting health-conscious consumers seeking indulgent yet diet-compatible options. Kraft Heinz’s move highlights its focus on expanding into niche dietary segments to capture evolving consumer preferences.

- In March 2024, ConAgra Brands expanded its portfolio by introducing a new organic, plant-based cheese sauce under its Earth Balance brand. The product launch aims to tap into rising veganism and flexitarian lifestyles in North America. The cheese sauce is made with sustainably sourced ingredients and features bold flavors such as chipotle and garlic, responding to consumer demand for both taste and environmental responsibility.

- In February 2024, Dairy Farmers of America (DFA) announced a strategic partnership with major foodservice distributors to supply high-quality cheese sauces tailored for the fast-casual restaurant segment. This collaboration focuses on delivering consistent product quality with innovative flavors that appeal to younger demographics. DFA’s initiative underscores the rising role of foodservice channels in driving cheese sauce market growth.

- In January 2024, TreeHouse Foods introduced eco-friendly packaging solutions for its cheese sauces, including recyclable pouches and biodegradable tubs. This sustainability-focused update is part of the company’s broader environmental commitment and aims to attract eco-conscious consumers while reducing packaging waste in the North America market.

- In December 2023, Tillamook County Creamery Association expanded distribution of its artisanal multiple cheese sauce varieties across key U.S. retail chains. The launch leverages the growing consumer appetite for premium, craft-style cheese sauces made with natural ingredients and traditional recipes. Tillamook’s success highlights a broader trend towards gourmet and authentic cheese sauce offerings in North America.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Cheese Sauce Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Cheese Sauce Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Cheese Sauce Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.