North America Chromatography Columns Market

Market Size in USD Billion

CAGR :

%

USD

6.92 Billion

USD

12.06 Billion

2025

2033

USD

6.92 Billion

USD

12.06 Billion

2025

2033

| 2026 –2033 | |

| USD 6.92 Billion | |

| USD 12.06 Billion | |

|

|

|

|

North America Chromatography Columns Market Size

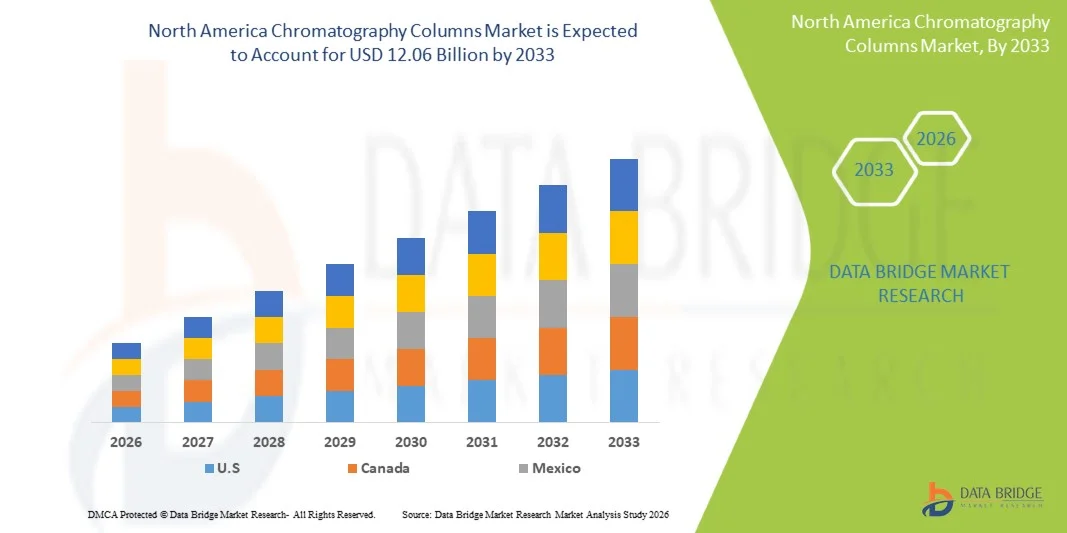

- The North America Chromatography Columns Market size was valued at USD 6.92 billion in 2025 and is expected to reach USD 12.06 billion by 2033, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced separation technologies and continuous innovations in chromatography techniques, leading to increased efficiency, precision, and automation in both research and industrial applications

- Furthermore, rising demand for high-purity compounds, stringent regulatory requirements in pharmaceuticals and biotechnology, and the expanding use of chromatography in food, environmental, and chemical analysis are driving the adoption of chromatography columns. These converging factors are accelerating the uptake of Chromatography Columns solutions, thereby significantly boosting the industry's growth

North America Chromatography Columns Market Analysis

- Chromatography columns, essential components in chemical, pharmaceutical, and biotech laboratories, are increasingly vital for precise separation, purification, and analysis of compounds, due to their high efficiency, reproducibility, and compatibility with advanced analytical systems

- The escalating demand for chromatography columns is primarily fueled by the growing adoption of advanced analytical techniques, increasing R&D activities in life sciences, and stringent regulatory requirements for high-purity compounds

- U.S. dominated the North America Chromatography Columns Market with the largest revenue share of 45.5% in 2025, supported by advanced pharmaceutical and biotechnology infrastructure, substantial R&D investments, and the presence of leading market players driving innovation and adoption of high-performance chromatography columns. The country’s well-established analytical testing ecosystem and strong pharmaceutical manufacturing base further boost market growth

- Canada is expected to be the fastest-growing region in the North America Chromatography Columns Market during the forecast period, driven by increasing life sciences R&D initiatives, expanding pharmaceutical exports, growing adoption of high-throughput analytical techniques, and ongoing laboratory modernization in both academic and industrial settings

- The Pharmaceuticals segment dominated the largest market revenue share of 51.3% in 2025, driven by rising biopharmaceutical and drug development activities in Asia-Pacific. Chromatography columns are critical for quality control, purification, and analytical testing, ensuring safety, efficacy, and regulatory compliance

Report Scope and North America Chromatography Columns Market Segmentation

|

Attributes |

North America Chromatography Columns Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Chromatography Columns Market Trends

“Rising Demand for Advanced Analytical Techniques and High-Throughput Screening”

- A significant trend in the global North America Chromatography Columns Market is the growing adoption of advanced analytical and separation techniques across pharmaceutical, biotechnology, chemical, and food industries. This trend is driven by increasing requirements for high-purity products, precise separation, and accurate quantification of complex mixtures

- For instance, the growing need for high-throughput screening in drug discovery is encouraging the use of specialized columns capable of faster separations and higher resolution

- There is also a rising preference for environmentally friendly and reusable chromatography columns, which support sustainability goals in laboratories and manufacturing facilities

- The market is witnessing innovation in column packing materials, stationary phases, and micro- and nano-scale columns, enabling researchers to achieve higher efficiency and reproducibility in analytical workflows

North America Chromatography Columns Market Dynamics

Driver

“Growing Adoption in Pharmaceutical and Biotech Industries”

- The increasing demand for high-quality biologics, vaccines, and specialty chemicals is driving the adoption of chromatography columns for purification and separation processes

- For instance, in April 2025, a leading chromatography column manufacturer introduced a high-efficiency protein purification column capable of delivering faster throughput and improved purity levels, reflecting the rising focus on advanced column technologies in biopharma applications

- Laboratories and manufacturing units are increasingly using chromatography columns to ensure regulatory compliance, high precision, and reproducibility, making them essential tools in quality control and research environments

- Growing pharmaceutical R&D investments, coupled with expanding biopharmaceutical production, are supporting the increasing utilization of chromatography columns globally

- The convenience of versatile column applications, compatibility with multiple analytical platforms, and support for high-throughput processes are key factors propelling market growth

- Increasing use of chromatography columns in food safety testing, environmental monitoring, and clinical diagnostics is further expanding the market scope

- The trend toward miniaturization and automation in laboratory workflows is promoting adoption of advanced chromatography columns that enable faster analyses with reduced sample volumes

- Strategic collaborations between column manufacturers and research institutions are accelerating product innovation and driving wider market penetration

Restraint/Challenge

“High Costs and Technical Complexity”

- High initial costs of advanced chromatography columns and associated instruments can be a barrier, particularly for small laboratories and academic institutions. Premium columns with specialized stationary phases or high-throughput capabilities often come at significantly higher prices than conventional alternatives

- In addition, the technical complexity associated with column selection, optimization, and maintenance may limit adoption among users lacking specialized expertise

- For instance, incorrect column handling or improper mobile phase selection can affect separation efficiency and reproducibility, making training and technical knowledge critical for effective use

- While prices of standard columns are gradually decreasing, the perceived premium for high-performance columns may slow adoption, especially in cost-sensitive regions

- Limited availability of certain high-performance column types in emerging markets can restrict market expansion

- Variability in column lifetime and performance degradation over repeated use may lead to additional operational costs, deterring some potential users

- Regulatory constraints in pharmaceutical and biotech applications may require extensive validation and compliance checks, delaying adoption of new column technologies

- Overcoming these challenges through improved column durability, simplified operation protocols, and development of more affordable high-performance columns will be crucial for sustained market growth

- Companies are also focusing on providing technical support, training programs, and user-friendly manuals to help mitigate operational complexity and enhance customer confidence.

North America Chromatography Columns Market Scope

The market is segmented on the basis of Column Type, Type, Capacity, Application, Industry, and End User.

• By Column Type

On the basis of column type, the North America Chromatography Columns Market is segmented into Normal Phase Chromatography Columns, Pre-Packed Chromatography Columns, and Automated Chromatography Columns. The Normal Phase Chromatography Columns segment dominated the largest market revenue share of 46.8% in 2025, driven by its widespread adoption in protein separation, small molecule analysis, and laboratory-scale purification processes. Researchers and analytical laboratories favor normal phase columns for their reliability, reproducibility, and ability to handle diverse sample matrices. The segment benefits from high compatibility with existing HPLC and prep chromatography systems, facilitating easy integration into laboratory workflows. Increasing investments in pharmaceutical R&D, nutraceutical analysis, and quality control testing further strengthen adoption. Continuous technological improvements, such as enhanced silica-based stationary phases and improved column packing, enhance separation efficiency. High demand across academic and industrial research institutions in North America also reinforces its dominant market share. Regulatory compliance and standardized performance metrics provide additional credibility, boosting preference among lab users.

The Automated Chromatography Columns segment is expected to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by rising adoption of automation in analytical workflows. Automated columns reduce manual handling errors, improve reproducibility, and enable high-throughput sample processing, making them ideal for pharmaceutical, biotech, and food testing laboratories. Increasing demand for process optimization, time efficiency, and scalable purification solutions accelerates growth. Integration with advanced liquid handling and data management systems further enhances user convenience. Expansion of contract research organizations (CROs) and analytical service providers in the region supports adoption. Rising focus on automation in academic and industrial research applications, combined with continuous R&D in column technologies, is expected to propel rapid market growth through 2033.

• By Type

On the basis of type, the North America Chromatography Columns Market is segmented into Ion Exchange Chromatography, Affinity Chromatography, Multimodal Chromatography, Gel Filtration, and Others. The Ion Exchange Chromatography segment held the largest market revenue share of 39.5% in 2025, driven by its extensive use in protein purification, enzyme isolation, and nucleic acid separation. Its high selectivity, scalability, and reproducibility make it a preferred choice in pharmaceuticals, biotechnology, and academic research. The segment benefits from well-established protocols, robust column chemistries, and compatibility with various buffer systems. Growing pharmaceutical manufacturing, protein therapeutics development, and vaccine research in North America further support dominance. Continuous improvements in resin stability and column performance contribute to reliability. Strong penetration in both large-scale laboratories and small research setups ensures sustained demand. The segment also benefits from growing awareness about reproducible analytical workflows and quality control requirements in regulated industries.

The Multimodal Chromatography segment is projected to grow at the fastest CAGR of 21.4% from 2026 to 2033, owing to its versatility in combining multiple separation mechanisms for complex biomolecule purification. Increasing adoption in biopharmaceutical development, monoclonal antibody purification, and high-value protein processing drives growth. Multimodal columns reduce the number of purification steps, lower operational costs, and improve yield, making them highly attractive for industrial applications. Rising investments in biotechnology research, CRO expansion, and downstream processing optimization further accelerate demand. Continuous advancements in ligand design, column packing, and process integration contribute to rapid market uptake. Adoption is also fueled by the growing requirement for high-purity biomolecules and regulatory compliance in therapeutic manufacturing.

• By Capacity

On the basis of capacity, the North America Chromatography Columns Market is segmented into 1-100 mL, 100-1000 mL, and More Than 1 L. The 1-100 mL segment dominated the market with a revenue share of 42.7% in 2025, driven by its extensive use in laboratory-scale research, method development, and analytical testing. Small-capacity columns are widely preferred for their ease of handling, low sample consumption, and high reproducibility. They are suitable for academic institutions, quality control labs, and small R&D facilities conducting protein purification, sample preparation, and small molecule analysis. The segment benefits from standardization, strong availability, and compatibility with multiple chromatography systems. Increasing research funding in the pharmaceutical and biotechnology sectors further boosts adoption. Technological improvements in column materials, resin quality, and performance consistency enhance their reliability. Laboratories also favor small-capacity columns for faster turnover, cost-effectiveness, and operational flexibility.

The More Than 1 L segment is expected to witness the fastest CAGR of 20.9% from 2026 to 2033, supported by growing demand in large-scale protein production, industrial purification, and biopharmaceutical manufacturing. High-capacity columns enable high-throughput processing, reduced processing time, and efficient downstream operations. Increasing biologics manufacturing, vaccine development, and large-scale nutraceutical production in North America are key growth drivers. Column automation, scalable process design, and enhanced resin performance further fuel adoption. Expansion of industrial R&D facilities and contract manufacturing organizations also supports market growth. Demand is rising for robust, high-capacity solutions capable of handling complex biomolecules while maintaining purity and yield standards.

• By Application

On the basis of application, the North America Chromatography Columns Market is segmented into Sample Preparation, Resin Screening, Protein Purification, Anion and Cation Exchange, and Desalting. The Protein Purification segment accounted for the largest market revenue share of 45.2% in 2025, owing to the increasing biopharmaceutical production and the critical role of chromatography columns in isolating high-purity proteins. Pharmaceutical and biotechnology industries rely on protein purification columns to ensure therapeutic quality, efficacy, and regulatory compliance. The segment benefits from strong R&D activity, established purification protocols, and high reproducibility. Increasing monoclonal antibody development, enzyme production, and vaccine manufacturing further reinforce dominance. Continuous advancements in column chemistry, resin design, and purification efficiency contribute to improved process outcomes. Strong adoption in academic research, CROs, and industrial labs across North America also supports leadership. Protein purification applications remain critical in both laboratory-scale research and industrial-scale manufacturing.

The Sample Preparation segment is expected to witness the fastest CAGR of 21.1% from 2026 to 2033, driven by growing demand for pre-treatment of complex biological, environmental, and food samples before chromatographic analysis. Automated and high-throughput sample preparation is increasingly adopted to improve workflow efficiency, reproducibility, and accuracy. Expansion of analytical laboratories, quality control centers, and research institutions across North America accelerates adoption. Increasing regulatory focus on sample integrity, analytical accuracy, and traceability further supports market growth. Continuous technological advancements in solid-phase extraction, pre-packed columns, and filtration methods contribute to rapid uptake. Rising demand in pharmaceuticals, environmental testing, and nutraceutical analysis further propels the segment’s growth.

• By Industry

On the basis of industry, the North America Chromatography Columns Market is segmented into Nutraceuticals, Academics, Food and Beverages, Pharmaceuticals, Environmental Biotechnology, Cosmetics, and Others. The Pharmaceuticals segment dominated the largest market revenue share of 51.3% in 2025, driven by rising biopharmaceutical and drug development activities in Asia-Pacific. Chromatography columns are critical for quality control, purification, and analytical testing, ensuring safety, efficacy, and regulatory compliance. Pharmaceutical R&D centers, vaccine manufacturers, and biologics producers heavily rely on high-performance columns for complex separations. The segment benefits from strong clinical trial activity, rising government healthcare investment, and increased industrial output. Technological advancements in column chemistries, resin performance, and automation enhance productivity. Growing adoption of protein-based therapeutics, monoclonal antibodies, and vaccines further reinforces dominance. Regulatory compliance requirements for high-purity products also support robust demand.

The Nutraceuticals segment is expected to witness the fastest CAGR of 19.7% from 2026 to 2033, fueled by increasing demand for functional foods, dietary supplements, and plant-based bioactives. Chromatography columns are used extensively in nutraceutical product development, quality testing, and bioactive compound purification. Rising health awareness, clean-label product trends, and expansion of nutraceutical manufacturing facilities drive growth. Continuous innovations in analytical techniques, automated purification, and sample processing accelerate adoption. Growing focus on standardization, safety, and bioavailability testing supports the segment’s rapid expansion. Emerging markets in Asia-Pacific, favorable regulatory policies, and investment in nutraceutical R&D further propel high growth through 2033.

• By End User

On the basis of end user, the North America Chromatography Columns Market is segmented into Analytical Laboratories and Research Institutes. The Analytical Laboratories segment dominated the largest market revenue share of 61.2% in 2025, driven by its central role in pharmaceutical, food, environmental, and biotechnology testing. Analytical laboratories rely on chromatography columns for high-precision separation, quality control, and validation studies. The segment benefits from strong adoption in academic institutions, industrial labs, and contract testing organizations. Expansion of R&D activities, growing regulatory compliance requirements, and high throughput testing needs further reinforce dominance. Continuous improvements in column performance, automated workflows, and standardized protocols enhance efficiency. The increasing complexity of analytical tasks and demand for reproducible results support continued growth. Analytical laboratories remain the primary end users due to their critical role in testing and validation workflows.

The Research Institutes segment is expected to witness the fastest CAGR of 20.3% from 2026 to 2033, fueled by rising investments in biotechnology, life sciences, and academic research. Research institutes are increasingly adopting advanced chromatography columns for method development, purification studies, and protein characterization. Expansion of laboratory infrastructure, collaborative R&D programs, and increasing focus on innovative therapeutics drive growth. High adoption of automated columns, high-throughput screening, and scalable purification methods further supports uptake. Rising awareness of advanced analytical techniques, access to modern equipment, and regulatory-driven research requirements also contribute to segment growth. Research institutes in North America are rapidly adopting cutting-edge chromatographic solutions, making this the fastest-growing end-user segment.

North America Chromatography Columns Market Regional Analysis

- The North America Chromatography Columns Market is poised to grow at a robust CAGR during the forecast period

- Driven by rapid industrialization, increasing R&D infrastructure, rising pharmaceutical exports, and expanding analytical testing in both academic and industrial laboratories

- Countries such as the U.S., Canada, and Mexico are witnessing strong demand for high-performance chromatography columns across pharmaceutical, biotechnology, chemical, and food industries, fueled by increasing investments in life sciences, advanced laboratory infrastructure, and high-throughput analytical workflows

U.S. North America Chromatography Columns Market Insight

U.S. North America Chromatography Columns Market dominated the North America Chromatography Columns Market with the largest revenue share of 45.5% in 2025, supported by advanced pharmaceutical and biotechnology infrastructure, substantial R&D investments, and the presence of leading market players driving innovation and adoption of high-performance chromatography columns. The country’s well-established analytical testing ecosystem and strong pharmaceutical manufacturing base further boost market growth.

Canada North America Chromatography Columns Market Insight

Canada North America Chromatography Columns Market is expected to be the fastest-growing market in North America during the forecast period, driven by increasing life sciences R&D initiatives, expanding pharmaceutical exports, growing adoption of high-throughput analytical techniques, and ongoing laboratory modernization in both academic and industrial settings. Government support for scientific research, along with investments from domestic and multinational companies, is accelerating the adoption of chromatography columns and contributing to rapid market expansion.

North America Chromatography Columns Market Share

The Chromatography Columns industry is primarily led by well-established companies, including:

- Agilent Technologies (U.S.)

- Waters Corporation (U.S.)

- Thermo Fisher Scientific (U.S.)

- Merck KGaA (Germany)

- GE Healthcare (U.S.)

- Shimadzu Corporation (Japan)

- Bio-Rad Laboratories (U.S.)

- Sartorius AG (Germany)

- Phenomenex (U.S.)

- Tosoh Corporation (Japan)

- J.T. Baker (U.S.)

- Hitachi High-Tech (Japan)

- Macherey-Nagel (Germany)

- VWR International (U.S.)

Latest Developments in North America Chromatography Columns Market

- In April 2024, Waters Corporation launched its GTxResolve Premier SEC 1000Å 3 µm Columns, designed to accelerate development of gene‑based therapeutics (mRNA, LNPs, viral vectors) by offering up to 50% higher resolution and improved throughput, while minimizing non‑specific binding and simplifying method development

- In June 2023, Agilent Technologies expanded its GPC/SEC (gel permeation/size‑exclusion chromatography) offerings by integrating the product suite of Polymer Standards Service Ltd. (PSS). The expanded portfolio — including specialized columns, multi-angle light scattering detectors, dedicated thermostats, and software — resulted in the most complete one‑vendor solution for polymer and macromolecule characterization on the market

- In September 2025, Agilent introduced the new Altura Ultra Inert HPLC Columns, tailored for biotherapeutic applications such as peptide, oligonucleotide, and GLP‑1 therapeutic development. The new columns deliver improved sensitivity, better peak shape, faster conditioning, and greater reproducibility — helping biopharma labs meet stringent regulatory and analytical demands for complex biologics

- In January 2025, Bio‑Rad Laboratories launched its 45 cm ID “Foresight Pro” chromatography columns, targeting large‑scale downstream purification of vaccines, antibodies, and proteins in bioprocessing workflows. This step reflects growing market demand for scalable purification solutions

- In January 2025, at the same time, Astrea Bioseparations announced the acquisition of Delta Precision Ltd — broadening its chromatography‑column portfolio with advanced reusable and single‑use formats, enabling expanded offerings for biomanufacturing and separation technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.