North America Circuit Breaker Market

Market Size in USD Billion

CAGR :

%

USD

5.11 Billion

USD

8.53 Billion

2024

2032

USD

5.11 Billion

USD

8.53 Billion

2024

2032

| 2025 –2032 | |

| USD 5.11 Billion | |

| USD 8.53 Billion | |

|

|

|

|

Circuit Breaker Market Size

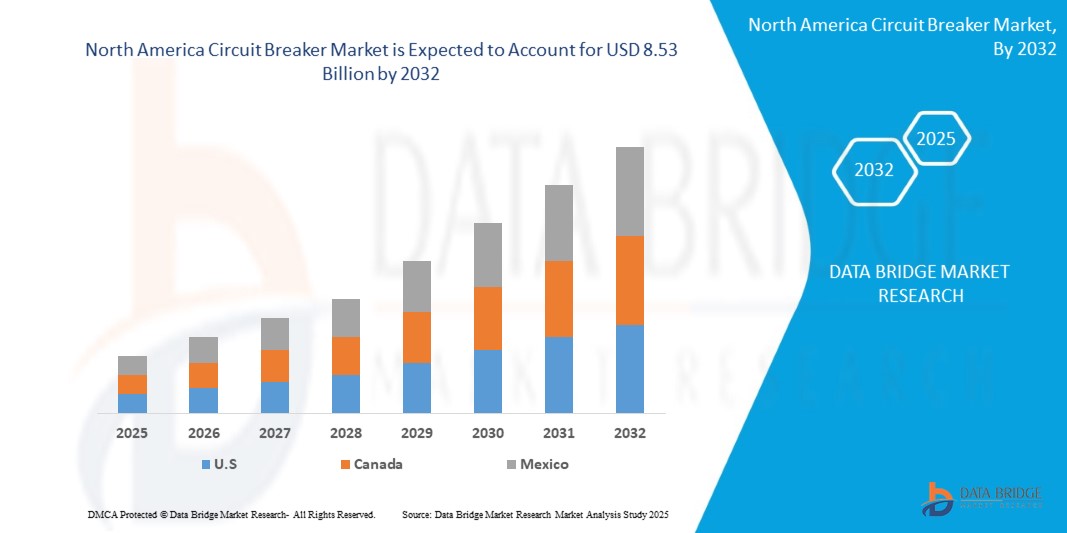

- The North America Circuit Breaker Market size was valued at USD 5.11 billion in 2024 and is expected to reach USD 8.53 billion by 2032, at a CAGR of 6.61% during the forecast period

- The market growth is largely driven by the region's commitment to upgrading aging electrical infrastructure and transitioning towards renewable energy systems. The North America focus on enhancing grid stability, increasing energy efficiency, and reducing carbon emissions has led to increased investments in smart grid technologies and renewable energy integration, which in turn is fueling the demand for advanced circuit breakers.

- Additionally, the rising adoption of electric vehicles (EVs), along with supportive government policies promoting sustainable transportation and electrification of infrastructure, is creating new growth avenues for circuit breaker manufacturers. These developments necessitate robust protection systems for EV charging networks, substations, and renewable energy plants.

Circuit Breaker Market Analysis

- Circuit breakers are the electrochemical switches that breaks the circuit in both ways automatically or manually for the protection and controlling of electrical power system. The major purpose of circuit breakers is to detect a fault function by interrupting continually and instantly discontinue electric flow. They are used in various applications like residential, industrial, commercial, automotive and other applications and it depends on the basis of the voltage class, current rating and type of the circuit breaker.

- Major factors that are expected to boost the growth of the circuit breaker market in the forecast period are the rising electricity consumption across the globe and increasing demand for advanced equipment in electronics, automotive and telecommunication segments.

- Germany captured the largest revenue share of 24.6% within the North America Circuit Breaker Market in 2025, owing to its aggressive expansion in renewable energy infrastructure and smart grid upgrades. The country’s “Energiewende” policy, which aims to decarbonize the energy sector, is leading to heavy investments in transmission and distribution (T&D) networks.

- France is expected to witness the fastest growth rate in the North America Circuit Breaker Market from 2025 to 2032, supported by large-scale renewable projects and modernization of its aging power grid.

- The low voltage circuit breaker segment dominated the market with the largest revenue share in 2024, driven by increasing applications in residential, commercial, and light industrial environments. The growing deployment of smart buildings, energy-efficient solutions, and demand for reliable protection in low-voltage systems are key contributors to this segment’s dominance.

Report Scope and Circuit Breaker Market Segmentation

|

Attributes |

Circuit Breaker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Circuit Breaker Market Trends

“Rising Demand Driven by Power Grid Modernization and Industrial Expansion”

- The growing need to upgrade aging electrical infrastructure, alongside substantial investments in transmission and distribution (T&D) networks, is a major catalyst for the Circuit Breaker Market.

- For instance, Siemens committed €1 billion in 2023 to enhance its North America manufacturing footprint, including increased production of grid components like circuit breakers to support renewable integration.

- With many regions focused on improving power system reliability and accommodating decentralized energy sources such as solar and wind, circuit breakers are becoming essential for protecting these upgraded networks.

- Additionally, the expansion of industrial facilities and the push for automation are generating significant demand for circuit breakers to ensure system safety and prevent equipment failures in high-load environments.

Circuit Breaker Market Dynamics

Driver

“Growing Emphasis on Sustainable and SF6-Free Technologies”

- The push for environmental sustainability and regulatory pressure to reduce greenhouse gas emissions have created a surge in demand for SF6-free and eco-friendly circuit breakers.

- For instance, in January 2024, Schneider Electric launched a new range of medium-voltage switchgear free from SF6 gas, aligning with EU climate targets and sustainable practices.

- Manufacturers are now investing in solid-state and vacuum interrupter technologies to replace traditional SF6-based breakers, which are potent contributors to global warming.

- This shift presents lucrative opportunities for product innovation and market entry, especially in regions with strict environmental policies such as North America and parts of North America.

Restraint/Challenge

“High Initial Costs and Complex Installation in Retrofitting Existing Systems”

- A major challenge for the Circuit Breaker Market is the high upfront cost and complexity involved in replacing or upgrading legacy systems with modern circuit breakers.

- Many older facilities, especially in developing regions, face difficulties in adopting advanced circuit breakers due to infrastructure incompatibility and a lack of technical expertise.

- These constraints are more pronounced in retrofit projects, where space limitations and wiring issues complicate integration.

- Moreover, the requirement for professional installation and calibration increases labor costs, discouraging small-scale users and slowing down adoption in cost-sensitive markets.

Circuit Breaker Market Scope

The market is segmented on the basis of product type, insulation type, external design, location, voltage range, rated current, operating mechanism, and end user.

- By Product Type

On the basis of product type, the Circuit Breaker Market is segmented into low voltage circuit breaker and high voltage circuit breaker.

The low voltage circuit breaker segment dominated the market with the largest revenue share in 2024, driven by increasing applications in residential, commercial, and light industrial environments. The growing deployment of smart buildings, energy-efficient solutions, and demand for reliable protection in low-voltage systems are key contributors to this segment’s dominance.

The high voltage circuit breaker segment is expected to witness the fastest growth from 2025 to 2032, fueled by the expansion of power transmission networks, renewable energy integration, and grid modernization initiatives across North America. Utility-scale renewable projects and interconnectors require robust high-voltage protection systems to ensure operational stability and safety.

- By Insulation Type

On the basis of insulation type, the market is segmented into vacuum, air, gas, SF6, and oil. SF6 circuit breakers accounted for the largest market share in 2024, known for their superior arc-quenching capabilities and performance in high-voltage applications. They are widely used across substations and power transmission systems across North America.

The vacuum insulation segment is expected to experience the fastest CAGR from 2025 to 2032, as utilities and manufacturers increasingly prefer vacuum-based technologies due to their environmental advantages and growing restrictions on SF6 use in the EU, aligning with climate-conscious policies.

- By External Design

On the basis of external design, the Circuit Breaker Market is segmented into live tank and dead tank. Dead tank circuit breakers held the dominant share in 2024, primarily due to their compact structure and safety benefits, particularly in high-voltage outdoor applications. They offer enhanced grounding and fault containment features, making them suitable for North America substations and grid installations.

Live tank circuit breakers are projected to grow steadily, particularly in applications where cost-efficiency and lighter infrastructure are prioritized.

- By Location

On the basis of location, the market is segregated into indoor and outdoor. The outdoor segment held the largest market share in 2024, driven by large-scale grid installations, renewable energy sites, and transmission infrastructure that require robust, weather-resistant circuit protection.

Indoor circuit breakers are expected to see steady demand in commercial buildings, data centers, and manufacturing plants where environmental control and space efficiency are key concerns.

- By Voltage Range

On the basis of voltage range, the market is segmented into less than 500V, 500V to 1KV, 1KV to 15KV, 15KV to 50KV, 50KV to 150KV, 150KV to 300KV, 300KV to 800KV, and >800KV. 1KV to 15KV segment dominated the market in 2024, supported by its broad applicability in utilities, commercial spaces, and small-to-medium industrial units.

The 300KV to 800KV segment is expected to grow rapidly as cross-border energy transfer and high-capacity grid expansion projects progress across North America, particularly in Northern and Central regions.

- By Rated Current

On the basis of rated current, the market is segmented into less than 500 A, 500 A to 1500 A, 1500 A to 2500 A, 2500 A to 4500 A, and >4500 A. The 500 A to 1500 A segment held the leading market share in 2024 due to its widespread use in medium-voltage applications and compact commercial systems.

The >4500 A segment is anticipated to see strong growth as demand increases for ultra-high-capacity systems used in heavy industries, data centers, and utility-grade switchgear.

- By Operating Mechanism

On the basis of operating mechanism, the market is segmented into spring operated circuit breaker, hydraulic circuit breaker, pneumatic circuit breaker, and others. Spring-operated circuit breakers led the market in 2024, thanks to their reliability, minimal maintenance requirements, and wide application across both low and medium voltage systems.

Hydraulic circuit breakers are anticipated to register notable growth, particularly in heavy industrial operations that require robust, high-force actuation systems under demanding load conditions.

- By End User

On the basis of end user, the market is bifurcated into industrial, utility, commercial, automotive, residential, and others. The utility segment accounted for the largest market revenue share in 2024, driven by grid modernization, renewable integration, and substation upgrades across North America.

The industrial segment is expected to witness the fastest CAGR from 2025 to 2032, supported by growing automation, electrification of manufacturing processes, and rising safety regulations.

Additionally, the residential segment is seeing increasing traction due to the rise in smart homes and decentralized energy systems such as rooftop solar and battery storage, necessitating compact and intelligent circuit breakers.

Circuit Breaker Market Regional Analysis

- North America is one of the prominent regions in the global Circuit Breaker Market, accounting for a significant revenue share of 27.4% in 2024, driven by the modernization of power infrastructure, the shift toward renewable energy, and stringent regulatory frameworks focused on energy efficiency and safety.

- Consumers and utilities across the region are rapidly adopting advanced circuit breaker systems to support smart grid development, manage increasing electricity loads, and ensure uninterrupted power distribution. Additionally, the integration of automation and digital monitoring features into circuit breakers is enhancing operational efficiency and system reliability, contributing to widespread market adoption.

- North America’s commitment to achieving climate neutrality and investing in sustainable energy sources is accelerating the deployment of high-voltage and medium-voltage circuit breakers in solar, wind, and hydro power installations.

Germany Circuit Breaker Market Insight

Germany captured the largest revenue share of 24.6% within the North America Circuit Breaker Market in 2025, owing to its aggressive expansion in renewable energy infrastructure and smart grid upgrades. The country’s “Energiewende” policy, which aims to decarbonize the energy sector, is leading to heavy investments in transmission and distribution (T&D) networks. This is creating a strong demand for technologically advanced circuit breakers that can efficiently handle load fluctuations and grid stability.

France Circuit Breaker Market Insight

France is expected to witness the fastest growth rate in the North America Circuit Breaker Market from 2025 to 2032, supported by large-scale renewable projects and modernization of its aging power grid. With nuclear power playing a key role in the country’s energy mix, France is emphasizing enhanced grid protection and reliability, which is fostering demand for high-performance circuit breaker systems across utility and industrial applications.

Circuit Breaker Market Share

The Circuit Breaker industry is primarily led by well-established companies, including:

- ABB(Switzerland)

- Siemens(Germany)

- Schneider Electric(France)

- Mitsubishi Electric Corporation(Japan)

- Efacec(Portugal)

- Eaton(Ireland)

- TOSHIBA INTERNATIONAL CORPORATION(Japan)

- Fuji Electric Co Ltd(Japan)

- TE Connectivity (Switzerland)

- Honeywell International, Inc.(United States)

- Panasonic Corporation (Japan)

- Powell Industries(United States)

- CGglobal (Crompton Greaves)(India)

- LARSEN & TOUBRO LIMITED(India)

- MAXWELL TECHNOLOGIES, INC. (United States)

- Brush Group(United Kingdom)

- INDUSTRIAL ELECTRIC MFG(United States)

- E-T-A Circuit Breakers(Germany)

- Andeli Group Co., Ltd(China)

- Hitachi Industrial Equipment Systems Co., Ltd(Japan)

- Tavrida Electric (Switzerland (operations global, origin Russia))

- Terasaki Electric Co., Ltd(Japan)

- Yueqing Feeo Electric Co., Ltd(China)

Latest Developments in North America Circuit Breaker Market

- In September 2024, Hitachi Energy collaborated with Tirreno Power to install Italy's first eco-efficient 420-kilovolt (kV) SF6-free circuit breaker. Manufactured at Hitachi Energy's facility in Lodi, this pioneering equipment is scheduled for installation in 2025. This initiative marks a significant step towards enhancing the sustainability of Italy's electricity network.

- In August 2024, Mitsubishi Electric Corporation and Siemens Energy Global GmbH & Co. KG signed an agreement to co-develop Direct Current (DC) Switching Stations and DC Circuit Breaker requirement specifications. This collaboration aims to realize Multi-terminal High Voltage DC (HVDC) systems, facilitating the efficient operation of large-scale renewable energy resources and contributing to global decarbonization efforts.

- In July 2024, Siemens Energy, GE Vernova, and Hitachi Energy partnered with German transmission system operators TenneT, Amprion, 50Hertz, and TransnetBW to develop multi-terminal hubs equipped with DC circuit breakers. These hubs are designed to efficiently connect newly developed extra-high voltage direct current (HVDC) transmission lines, enhancing the integration of renewable energy sources into the grid.

- In 2024, Siemens expanded its smart circuit breaker offerings by integrating Internet of Things (IoT) capabilities and AI-driven predictive analytics for real-time fault detection and grid management. These advanced circuit breakers are tailored for smart grid applications and residential smart homes, reflecting Siemens' commitment to innovation in electrical protection solutions.

- In 2024, Eaton introduced a new series of IoT-enabled circuit breakers designed for integration with energy management systems in commercial and industrial applications. These devices collect real-time data and offer insights for system optimization, aligning with the growing demand for smart, connected solutions to improve operational efficiency.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Circuit Breaker Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Circuit Breaker Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Circuit Breaker Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.