North America Cleanroom Technology Market

Market Size in USD Million

CAGR :

%

USD

116.27 Million

USD

178.44 Million

2024

2032

USD

116.27 Million

USD

178.44 Million

2024

2032

| 2025 –2032 | |

| USD 116.27 Million | |

| USD 178.44 Million | |

|

|

|

|

North America Cleanroom Technology Market Size

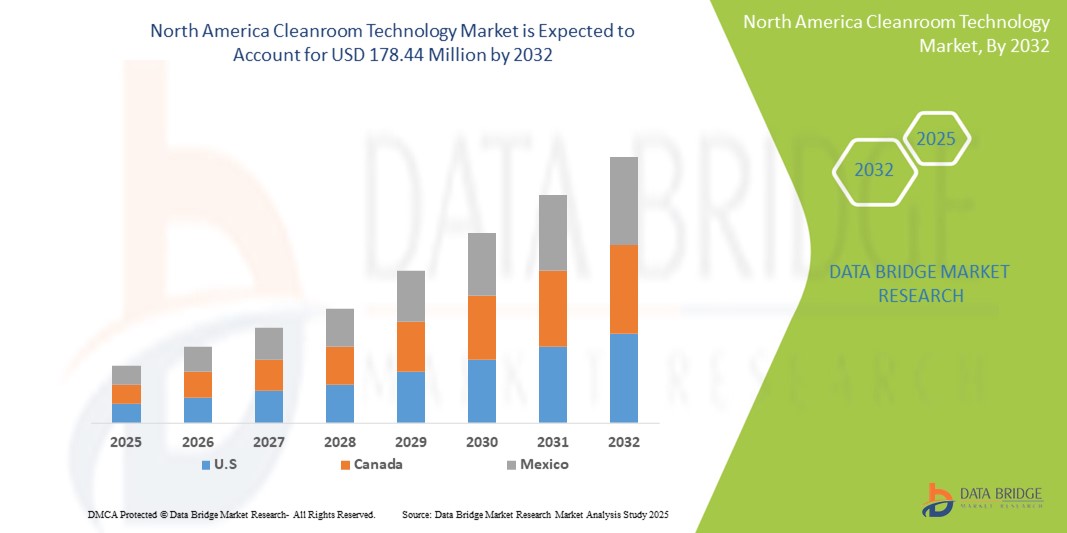

- The North America cleanroom technology market size was valued at USD 116.27 Million in 2024 and is expected to reach USD 178.44 Million by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the increasing demand for contamination-free environments across industries such as pharmaceuticals, biotechnology, medical devices, and electronics manufacturing, driving widespread adoption of advanced Cleanroom Technology solutions in North America. Technological progress in modular cleanrooms, HEPA filtration systems, and automation tools is further enhancing operational efficiency and cleanliness standards

- Furthermore, rising regulatory compliance requirements and the growing need for product quality assurance in high-precision manufacturing are positioning North America cleanroom technology systems as essential infrastructure in modern industrial and healthcare settings. These converging factors are accelerating the uptake of cleanroom solutions across the region, thereby significantly boosting the industry's growth

North America Cleanroom Technology Market Analysis

- North America Cleanroom Technologies, including modular cleanrooms, HVAC systems, cleanroom consumables, and air filtration units, are increasingly vital components across pharmaceutical, biotechnology, semiconductor, and medical device manufacturing due to rising regulatory standards and contamination control requirements

- The escalating demand for cleanroom technologies in the region is primarily driven by the growing biologics and pharmaceutical manufacturing base, stringent FDA guidelines, and the increasing prevalence of chronic diseases that require sterile drug production environments

- U.S. dominated the North America cleanroom technology market, with a market share of 77.8% in 2024, supported by a strong pharmaceutical pipeline, increasing adoption of personalized medicine, and significant expansion in biotech and life science facilities

- Canada is expected to be the fastest growing country in the North America cleanroom technology market is expected to grow at a CAGR of 10.5% from 2025 to 2032, driven by advancements in biotechnology and support from federal funding programs

- Volatile corrosion inhibiting film segment accounted for the largest revenue share of 32.6% in the North America cleanroom technology market in 2024, owing to its essential role in protecting sensitive components in electronics and pharmaceutical packaging. The segment’s growth is driven by rising demand for corrosion prevention solutions that ensure product integrity during storage and transit, especially in high-value sectors such as semiconductors and biopharmaceuticals

Report Scope and North America Cleanroom Technology Market Segmentation

|

Attributes |

North America Cleanroom Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Cleanroom Technology Market Trends

“Increasing Focus on Regulatory Compliance and Sterility Standards”

- A significant and accelerating trend in the North America cleanroom technology Market is the rising emphasis on compliance with stringent regulatory frameworks such as cGMP, ISO cleanroom classifications, and FDA guidelines. This focus is compelling pharmaceutical, biotech, and medical device manufacturers to adopt advanced cleanroom technologies that ensure particle control, sterility, and operational efficiency

- For instance, the introduction of modular cleanroom systems by key players such as DuPont and Clean Air Products allows companies to customize cleanroom environments to meet specific sterility levels while maintaining flexibility in facility expansion or reconfiguration

- The integration of HEPA and ULPA filtration systems in cleanroom environments is becoming more prevalent to meet Class 100 or ISO 5 cleanliness standards. In addition, automated airflow control and pressure balancing systems are gaining traction to minimize contamination risks and ensure constant environmental integrity

- As sterility assurance becomes a non-negotiable priority across pharmaceutical manufacturing and clinical research, cleanroom providers are enhancing their offerings with antimicrobial surfaces, hands-free entry systems, and integrated air monitoring technology to meet evolving standards

- This growing trend is fundamentally reshaping facility design and operational strategies in North America. Consequently, firms such as Terra Universal and Labconco are innovating new modular cleanroom solutions with built-in environmental monitoring and quick-deployment capabilities to address urgent market demand

- The rising adoption of these compliant, customizable, and scalable cleanroom technologies is significantly contributing to the growth of the North America Cleanroom Technology Market, particularly across the healthcare, semiconductor, and R&D sectors

North America Cleanroom Technology Market Dynamics

Driver

“Growing Need Due to Rising Contamination Control and Regulatory Compliance”

- The increasing prevalence of contamination risks in pharmaceutical, biotechnology, and semiconductor industries—coupled with stringent regulatory frameworks such as FDA, ISO 14644, and cGMP—is significantly driving the demand for North America Cleanroom Technology solutions

- For instance, in April 2024, DuPont announced the expansion of its cleanroom apparel product line to meet rising demands from pharmaceutical manufacturers across the U.S. and Canada. Such initiatives reflect the region’s emphasis on maintaining sterile and controlled environments, particularly in advanced manufacturing settings

- As companies strive for higher product integrity, the adoption of advanced cleanroom technologies—including modular cleanroom systems, HEPA filtration, and automated monitoring—provides a compelling upgrade over traditional HVAC and containment methods

- Furthermore, the growing investment in biologics, personalized medicine, and microelectronics production is making cleanrooms an integral part of facility planning and operations across North America. These solutions ensure optimal air quality, pressure differentials, and particulate control, contributing to process efficiency and compliance

- The demand is further bolstered by the integration of cleanroom systems with environmental monitoring, energy-efficient HVAC units, and user-friendly modular designs, offering scalability and quicker installation timelines. As companies increasingly seek flexible yet compliant infrastructure, North America emerges as a major hub for cleanroom technology deployment

Restraint/Challenge

“High Capital Investment and Operational Complexity”

- The North America cleanroom technology market faces notable restraints due to the high initial setup cost and operational challenges, particularly in small- and mid-sized enterprises. The complexity of integrating HVAC systems, filtration units, monitoring software, and modular construction often requires significant capital expenditure and specialized expertise

- For instance, constructing an ISO Class 5 cleanroom can cost up to five times more than conventional workspace environments, including maintenance and validation procedures. These costs can deter startups or budget-constrained healthcare providers from investing in advanced cleanroom systems

- In addition, maintaining cleanrooms to regulatory standards demands continuous environmental monitoring, frequent cleaning, and employee training—all contributing to elevated operational expenses

- Further, retrofitting existing facilities into compliant cleanroom environments can be complex due to design limitations, outdated infrastructure, or spatial constraints, especially in legacy pharmaceutical plants and hospitals

- Overcoming these barriers will require manufacturers to offer cost-effective, scalable solutions and modular units that reduce installation time, training, and maintenance needs. Continued innovation and government incentives can also ease adoption among smaller players in the life sciences and electronics sectors

North America Cleanroom Technology Market Scope

The market is segmented on the basis of product, component, buyer category and end user.

• By Product

On the basis of product, the North America cleanroom technology market is segmented into volatile corrosion inhibiting film, clean bags, lamination sealant films, clean containers, and ultra clean packaging. Volatile corrosion inhibiting film segment accounted for the largest revenue share of 32.6% in 2024, owing to its essential role in protecting sensitive components in electronics and pharmaceutical packaging.

Ultra clean packaging segment is projected to grow at the fastest CAGR of 10.9% from 2025 to 2032, fueled by increasing demand in high-purity applications such as biotechnology and semiconductor manufacturing.

• By Component

On the basis of component, the North America cleanroom technology market is segmented into Equipment and Consumables. Consumables dominated the market with a revenue share of 61.3% in 2024, driven by their frequent usage and continuous replenishment in sterile environments.

Equipment is expected to expand at a CAGR of 9.5% from 2025 to 2032, supported by rising investments in cleanroom construction and upgrades across pharmaceutical and electronics sectors.

• By Buyer Category

On the basis of buyer category, the North America cleanroom technology market is segmented into Semiconductor related companies, pharmaceutical companies, chemical companies, and analytical equipment providers. Semiconductor related companies held the largest share at 34.2% in 2024, driven by increasing chip fabrication activities and investment in contamination-free manufacturing environments.

Pharmaceutical companies are projected to grow at the fastest CAGR of 11.4% from 2025 to 2032, propelled by expanding drug development pipelines, regulatory stringency, and pandemic-driven cleanroom expansions.

• By End-User

On the basis of end-user, the North America cleanroom technology market is segmented into pharmaceutical, biotechnology, medical devices, hospitals, semiconductor manufacturing, and others. Semiconductor manufacturing accounted for the largest revenue share of 29.8% in 2024, as the region remains a key player in advanced microelectronics production requiring ultra-clean facilities.

Biotechnology is anticipated to grow at the highest CAGR of 12.1% from 2025 to 2032, attributed to increased research activities in cell therapy, biologics, and vaccine production.

North America Cleanroom Technology Market Regional Analysis

- North America dominated the global cleanroom technology market with the largest revenue share of 40.01% in 2024, driven by advanced manufacturing capabilities in pharmaceuticals, semiconductors, and biotechnology

- Stringent regulatory environments, particularly in the U.S., and increasing investments in R&D across life sciences and electronics are propelling the adoption of cleanroom technologies across the region

- The region benefits from a well-established industrial base, strong research and development capabilities, and widespread implementation of good manufacturing practices (GMP), particularly in the pharmaceutical and life sciences sectors. These factors collectively support the expansion of cleanroom technology throughout North America

U.S. North America Cleanroom Technology Market Insight

The U.S. cleanroom technology market accounted for the largest share of 77.8% in 2024, owing to its strong pharmaceutical, medical device, and semiconductor manufacturing base. The presence of leading cleanroom solution providers, compliance with stringent FDA and GMP regulations, and increasing biologics and vaccine production are key drivers. The U.S. market is projected to grow at a CAGR of 9.8% from 2025 to 2032, supported by expanding biotechnology research and investment in advanced therapies.

Canada North America Cleanroom Technology Market Insight

The Canada cleanroom technology market contributed 11.3% to the North America cleanroom technology market in 2024, driven by growing investments in pharmaceutical production and life sciences R&D. The country’s emphasis on building resilient drug supply chains and increasing demand for modular cleanroom installations in academic research institutions are key growth enablers. The Canadian market is expected to grow at a CAGR of 10.5% from 2025 to 2032, driven by advancements in biotechnology and support from federal funding programs.

Mexico North America Cleanroom Technology Market Insight

The Mexico cleanroom technology market held a 7.7% revenue share of the North America cleanroom technology market in 2024, fueled by rapid expansion in pharmaceutical and medical device manufacturing and growing foreign direct investments. Proximity to the U.S., cost-efficient labor, and increasing cleanroom adoption in contract manufacturing and packaging are enhancing market attractiveness.

North America Cleanroom Technology Market Share

The North America cleanroom technology industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Clean Air Products (U.S.)

- Clean Room Depot (U.S.)

- Colandis (Germany)

- Nicos Group, Inc. (U.S.)

- Ardmac (Ireland)

- Azbil Corporation (Japan)

- KCWW (U.S.)

- Camfil (Sweden)

- Labconco (U.S.)

- Taikisha Ltd (Japan)

- Terra Universal Inc. (U.S.)

Latest Developments in North America Cleanroom Technology Market

- In December 2024, Germfree, a leading innovator in modular and mobile cleanroom infrastructure and solutions, announced the launch of Smarthood, the world’s first software-agnostic, fully integrated IV workflow hardware platform. Designed to address ongoing challenges in sterile compounding, Smarthood combines advanced technologies into a unified system that enhances contamination control, minimizes workflow errors, and optimizes operational efficiency for pharmacists and technicians

- In April 2024, Germfree, a prominent innovator in modular cleanroom infrastructure and services, entered into an asset purchase agreement and strategic partnership with Orgenesis Inc., a global leader in decentralized cell and gene therapies (CGTs). The collaboration aims to accelerate the advancement of Orgenesis’ therapeutic programs and enhance its portfolio of product development and GMP cell processing services

- In August 2023, Labconco Corporation announced the launch of the Nexus Horizontal Clean Bench, the first laminar flow hood to feature fully integrated onboard intelligence. This groundbreaking workstation redefines industry standards by providing exceptional contamination control for non-hazardous samples and procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF NORTH AMERICA CLEANROOM TECHNOLOGY MARKET

- CURRENCY AND PRICING

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- GEOGRAPHICAL SCOPE

- YEARS CONSIDERED FOR THE STUDY

- DBMR TRIPOD DATA VALIDATION MODEL

- PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

- MULTIVARIATE MODELLING

- TYPE LIFELINE CURVE

- DBMR MARKET POSITION GRID

- MARKET APPLICATION COVERAGE GRID

- VENDOR SHARE ANALYSIS

- SECONDARY SOURCES

- ASSUMPTIONS

- EXECUTIVE SUMMARY

- Market Overview

- drIvErs

- Introduction of Technological advanced products

- Stringent REGULATORY standards OF FDA & WHO

- High adoption of cleanroom technology in manufacturing units

- rising demand for sterilized pharmaceutical formulations

- Upsurge in development and use of new biologics

- Restraints

- high installation and maintenance cost associated with modular cleanroom technology

- Lack of experienced professionals

- OPPORTUNITIES

- Increasing preference toward safety and quality of products

- Extensive R&D activities in the healthcare industry

- Emergence of COVID-19

- CHALLENGES

- Customized design of cleanrooms as per facility requirements

- Financial inputs required for the establishment with constant pressure on manufacturers to reduce costs

- IMPACT OF COVID-19 ON NORTH AMERICA CLEANROOM TECHNOLOGY MARKET

- IMPACT ON DEMAND

- IMPACT ON PRICE

- IMPACT ON SUPPLY CHAIN

- STRATEGIC INITIATIVES BY KEY PLAYERS

- CONCLUSION

- NORTH AMERICA CLEANROOM TECHNOLOGY market, BY PRODUCT

- overview

- volatile corrosion inhibiting film

- CLEAN BAGS

- LAMINATION SEALANT FILMS

- ULTRA CLEAN PACKAGING

- CLEAN CONTAINERS

- NORTH AMERICA CLEANROOM TECHNOLOGY market, BY BUYER CATEGORY

- overview

- semiconductor related companies

- pharmaceutical companies

- chemical companies

- analytical equipment provider companies

- NORTH AMERICA cleanroom technology market, BY Country

- North America

- U.S.

- CANADA

- MEXICO

- North America Cleanroom Technology Market: COMPANY landscape

- company share analysis: North America

- SWOT

- company profiles

- CORTEC CORPORATION

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AICELLO CORPORATION

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- northern technologies international corporation

- COMPANY SNAPSHOT

- 3.2 REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTs

- AERO PACKAGING, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- branopac

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTs

- ARMOR PROTECTIVE PACKAGING

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BRENTWOOD PLASTICS, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- DAUBERT CROMWELL, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Edco supply corporation

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- PROTECTIVE PACKAGING CORPORATION

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

List of Table

TABLE 1 COMPARISON OF COST OF SMALL & LARGE CLEANROOM SETUPS

TABLE 2 NORTH AMERICA CLEANROOM TECHNOLOGY market, By PRODUCT, 2019-2028 (USD Million)

TABLE 3 NORTH AMERICA CLEANROOM TECHNOLOGY market, BY BUYER CATEGORY, 2019-2028 (USD Million)

TABLE 4 North America CLEANROOM TECHNOLOGY Market, By COUNTRY, 2019-2028 (USD million)

TABLE 5 U.S. CLEANROOM TECHNOLOGY Market, By PRODUCT, 2019-2028 (USD million)

TABLE 6 U.S. CLEANROOM TECHNOLOGY Market, By BUYER CATEGORY, 2019-2028 (USD million)

TABLE 7 CANADA cleanroom technology Market, By product, 2019-2028 (USD million)

TABLE 8 CANADA CLEANROOM TECHNOLOGY Market, By BUYER CATEGORY, 2019-2028 (USD million)

TABLE 9 MEXICO cleanroom technology Market, By product, 2019-2028 (USD million)

TABLE 10 MEXICO cleanroom technology Market, By buyer category, 2019-2028 (USD million)

List of Figure

FIGURE 1 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: segmentation

FIGURE 2 NoRTH AMERICA CLEANROOM TECHNOLOGY MARKET: data triangulation

FIGURE 3 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: REGIONAL VS Country MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CLEANROOM TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CLEANROOM TECHNOLOGY Market: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA cleanroom technology Market: vendor share analysis

FIGURE 10 north america CLEANROOM TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 Stringent regulatory standards are expected to drive Growth of the NORTH AMERICA CLEANROOM TECHNOLOGY MARKET in the forecast period of 2021 to 2028

FIGURE 12 volatile corrosion INHIBITING FILM is expected to account for the largest share of the NORTH AMERICA CLEANROOM TECHNOLOGY MARKET in 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF North America Cleanroom Technology Market

FIGURE 14 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY PRODUCT, 2020

FIGURE 15 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY PRODUCT, 2021-2028 (USD Million)

FIGURE 16 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY PRODUCT, CAGR (2021-2028)

FIGURE 17 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY BUYER CATEGORY, 2020

FIGURE 19 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY BUYER CATEGORY, 2021-2028 (USD Million)

FIGURE 20 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY BUYER CATEGORY, CAGR (2021-2028)

FIGURE 21 NORTH AMERICA CLEANROOM TECHNOLOGY market : BY BUYER CATEGORY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA CLEANROOM TECHNOLOGY market: SNAPSHOT (2020)

FIGURE 23 NORTH AMERICA CLEANROOM TECHNOLOGY market: BY COUNTRY (2020)

FIGURE 24 NORTH AMERICA CLEANROOM TECHNOLOGY market: BY COUNTRY (2021 & 2028)

FIGURE 25 NORTH AMERICA CLEANROOM TECHNOLOGY market: BY COUNTRY (2020 & 2028)

FIGURE 26 NORTH AMERICA CLEANROOM TECHNOLOGY market: BY Product (2021-2028)

FIGURE 27 North America cleanroom technology market: company share 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.